Market Overview

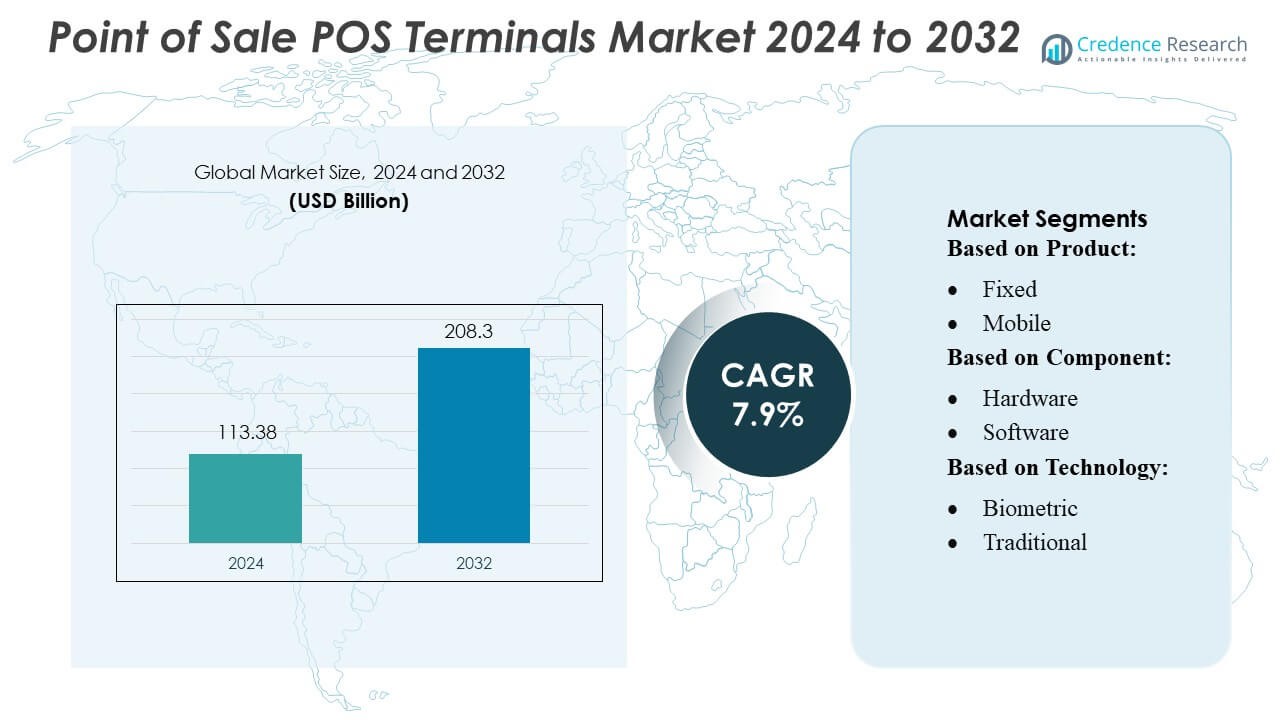

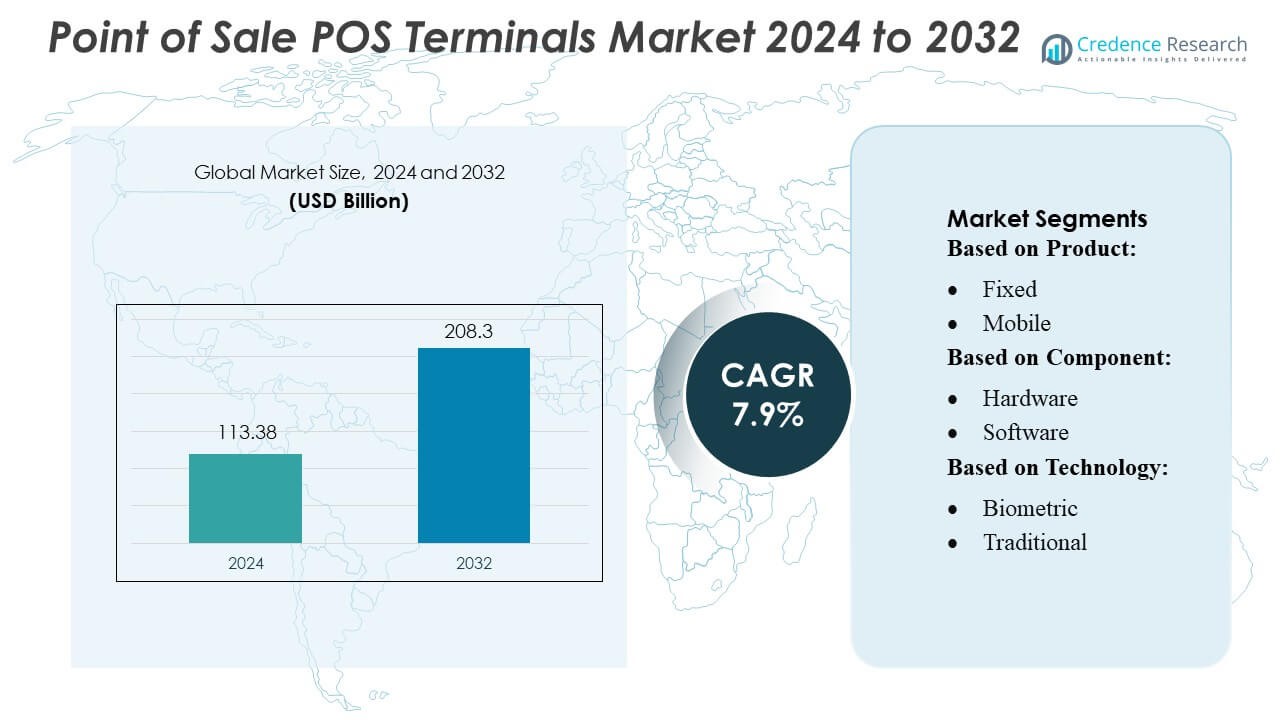

Point of Sale POS Terminals Market size was valued USD 113.38 billion in 2024 and is anticipated to reach USD 208.3 billion by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Point of Sale POS Terminals Market Size 2024 |

USD 113.38 Billion |

| Point of Sale POS Terminals Market, CAGR |

7.9% |

| Point of Sale POS Terminals Market Size 2032 |

USD 208.3 Billion |

The Point of Sale (POS) Terminals Market features strong competition among global providers that continue to expand their hardware, software, and cloud-based payment capabilities. The market is shaped by ongoing innovation in mobility, analytics, and secure payment processing as vendors strengthen their portfolios to meet rising digital-payment demand across retail and hospitality environments. Asia-Pacific remains the leading region, holding approximately 35% of the global market share, driven by rapid adoption of digital wallets, government-led cashless initiatives, and extensive retail expansion supported by mobile and cloud POS deployments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Point of Sale (POS) Terminals Market was valued at USD 113.38 billion in 2024 and is projected to reach USD 208.3 billion by 2032, expanding at a CAGR of 7.9%, supported by rising global demand for digital and contactless payments.

- Market growth is driven by increasing adoption of cloud-based and mobile POS systems, as businesses prioritize flexibility, faster checkout processes, and integrated payment solutions across retail and hospitality sectors.

- The market trends highlight rapid expansion of analytics-enabled, AI-supported POS platforms and strong uptake of biometric and NFC technologies to enhance transaction security and operational efficiency.

- Competition intensifies as vendors invest in software-centric ecosystems, omnichannel capabilities, and secure payment infrastructure, while cost barriers and cybersecurity concerns continue to restrain adoption, especially for SMEs.

- Regionally, Asia-Pacific leads with about 35% market share, while fixed POS systems remain the dominant segment, driven by high transaction volumes and strong demand for reliable, full-featured terminals.

Market Segmentation Analysis:

By Product

Fixed POS terminals hold the dominant share in the product segment, driven by their stability, larger processing capacity, and suitability for high-volume retail and hospitality environments. Their strong presence comes from retailers’ preference for secure, permanent checkout stations that support complex billing, inventory management, and multi-user operations. Mobile POS solutions continue to grow, but fixed units remain the leading sub-segment because businesses rely on their durability and ability to handle continuous transactions effectively.

- For instance, Presto Phoenix Inc. has shipped over 277,000 “Presto Touch” tablet devices to major casual dining chains as of June 2023, demonstrating the scale and adoption of its fixed POS-like solution in high-volume dining environments.

By Component

Hardware remains the largest component sub-segment, supported by ongoing demand for terminals, card readers, scanners, and display systems required for POS upgrades and new installations. Its dominance is driven by the need for reliable physical devices that ensure smooth transaction processing in retail, food service, and hospitality sectors. While software and services are expanding due to cloud adoption and analytics tools, hardware continues to lead because every POS deployment depends on robust, high-performance equipment.

- For instance, NCR Voyix’s PX Series terminals offer dual-core Intel N3350 processors, up to 8 GB RAM, and optional biometric readers for secure PIN verification, as per its technical datasheet.

By Technology

Traditional POS technology remains the dominant sub-segment, mainly because businesses continue to rely on established card- and PIN-based systems that are cost-effective and easy to deploy. Its leadership is driven by broad compatibility, widespread user familiarity, and proven reliability in daily operations. Biometric POS is growing quickly due to rising interest in enhanced security and fraud prevention, but traditional systems still lead the market as most retailers prioritize affordability and seamless integration with existing infrastructure.

Key Growth Drivers

- Rising Adoption of Digital Payments

The POS terminals market expands rapidly as consumers and businesses shift toward cashless transactions. Governments and financial institutions promote digital payment ecosystems, encouraging merchants to upgrade to modern POS systems. Contactless cards, QR payments, and mobile wallets fuel demand for flexible, secure, and fast payment acceptance tools. This transition boosts adoption across retail, hospitality, healthcare, and transportation, where businesses require efficient, compliant, and integrated payment solutions. The widespread push for financial inclusion also accelerates POS penetration in emerging markets.

- For instance, Toast, Inc. reported that its Mobile Order & Pay system — which lets guests scan a QR code, browse a menu, order, and pay from their phone — typically boosts restaurants’ processing volume by up to 10–12%, according to its internal data.

- Expansion of Omni-Channel Retailing

Retailers increasingly deploy POS terminals to unify in-store and online shopping experiences. Omni-channel strategies require systems capable of real-time inventory tracking, centralized billing, CRM integration, and seamless returns or exchanges across platforms. POS terminals serve as critical customer-touch points, helping retailers improve engagement and operational efficiency. As brands prioritize data-driven decision-making and personalized experiences, demand rises for intelligent POS solutions that support analytics, loyalty programs, and cross-channel visibility, strengthening the market’s long-term growth outlook.

- For instance, Revel Systems offers a developer API with close to 140 public endpoints, including Order, Order Item, and Product, enabling real-time synchronization of sales and inventory data across channels.

- Growth of Mobile & Cloud-Based POS Solutions

Mobile and cloud POS solutions act as major catalysts as businesses seek scalable, low-maintenance, and cost-efficient systems. Cloud-based POS platforms reduce upfront hardware investment, enable remote management, and support automatic software updates. Mobile POS devices offer flexibility for line-busting, tableside ordering, and field-based sales, making them popular in restaurants, retail pop-ups, and logistics operations. Their ease of integration with inventory tools, accounting systems, and payment gateways drives rapid adoption, particularly among SMEs targeting operational agility.

Key Trends & Opportunities

- Rising Integration of AI and Data Analytics

AI-enhanced POS systems create new opportunities by enabling predictive insights, personalized recommendations, automated inventory forecasting, and improved fraud detection. Retailers and restaurants use analytics-driven POS platforms to optimize pricing, labor planning, and purchasing decisions. This integration allows businesses to convert transactional data into meaningful intelligence for enhancing customer experience and operational precision. As AI tools become more accessible, vendors can differentiate by offering analytics as a built-in feature, creating significant value-added opportunities across high-growth sectors.

- For instance, ACE (Acumera Consolidated Edge) platform supports LTE failover, API orchestration, and PCI 4.0 readiness at scale — delivering secure compute directly at the edge across thousands of sites.

- Increasing Uptake of Biometric and Contactless Technologies

Biometric authentication and contactless payments continue to shape opportunities in the POS market. Fingerprint, facial recognition, and tap-to-pay capabilities unlock faster, more secure transactions that appeal to both consumers and merchants. Growing security concerns and regulatory push for stronger identity verification accelerate adoption of biometric POS terminals. Meanwhile, contactless payments gain momentum in retail, healthcare, and transportation due to convenience and hygiene benefits. Vendors offering multi-modal authentication and NFC-enabled devices are well-positioned to capture this expanding opportunity.

- For instance, POSaBIT POS 2.0, the company added a more intuitive interface and enhanced analytics, enabling deeper insights into transaction behavior.

Key Challenges

- High Integration and Deployment Costs

Despite growing demand, many businesses hesitate to transition to advanced POS systems due to high initial hardware and software costs. Integration with existing ERP, CRM, and inventory systems may require technical expertise and extended implementation timelines. Smaller retailers and SMEs face budget limitations, making them cautious about recurring subscription fees for cloud-based platforms. These financial barriers slow market penetration, especially in developing regions where cost sensitivity remains a key concern and alternatives like manual billing still persist.

- Rising Cybersecurity Risks and Compliance Pressures

The expansion of digital payments increases exposure to data breaches, hacking, and payment fraud. POS terminals must comply with strict standards like PCI DSS, EMV, and local data-protection regulations to safeguard cardholder information. Constant updates and monitoring are required to prevent vulnerabilities in connected systems, especially cloud-based or mobile POS networks. Small businesses often lack cybersecurity resources, heightening risk and impacting trust in digital transaction ecosystems. Vendors must continuously enhance encryption, authentication, and threat-detection capabilities to address these challenges.

Regional Analysis

North America

North America remains the leading regional market, accounting for 30–35% of global POS terminal revenues. The region benefits from a highly digitized retail ecosystem, early adoption of EMV-compliant devices, and strong consumer preference for contactless and mobile payment methods. Large retailers, restaurants, and quick-service chains continue investing heavily in advanced POS infrastructures that integrate analytics, loyalty programs, and omnichannel capabilities. Cloud POS systems are widely deployed due to their scalability and low operational cost, enabling businesses to streamline operations and enhance customer experience. Significant penetration of fintech services and rapid growth in digital commerce further accelerate demand. Additionally, stringent security standards and data-protection regulations encourage merchants to upgrade legacy terminals to modern, secure solutions. Continuous innovation by U.S. and Canadian payment technology companies sustains North America’s long-term market leadership.

Europe

Europe holds a strong position with a 22–27% share of the global POS terminals market, supported by widespread card usage, robust regulatory frameworks, and accelerated adoption of contactless payments. Retailers across Germany, the U.K., France, and the Nordics rely heavily on POS systems for integrated billing, inventory control, CRM, and secure payment acceptance. The region’s emphasis on data protection and compliance—particularly GDPR and PSD2—drives upgrade cycles toward more secure and intelligent POS platforms. Growth is also propelled by the expansion of self-checkout systems, mobile POS adoption in hospitality, and modernization initiatives across transportation and entertainment sectors. European consumers’ strong preference for digital transactions and rising e-commerce activities encourage merchants to deploy omnichannel POS solutions. Moreover, increasing adoption of biometric and NFC-enabled terminals positions Europe as a technologically progressive market with strong long-term potential.

Asia-Pacific

Asia-Pacific is the fastest-growing region and accounts for 33–36% of global market share, driven by rapid digital transformation, a thriving retail sector, and strong government initiatives promoting cashless transactions. China, India, Japan, and Southeast Asian economies are witnessing massive expansion in digital wallets, QR-code payments, and smartphone-based transactions. SMEs and informal retail sectors increasingly adopt mobile and cloud POS systems due to low cost, easy scalability, and minimal hardware needs. The rise of e-commerce, food delivery, and quick-commerce platforms boosts demand for integrated POS solutions that support multi-channel billing and real-time inventory management. Government policies such as India’s Digital India and China’s cashless society programs significantly accelerate POS penetration. Additionally, increasing foreign investments in retail and hospitality infrastructure create substantial opportunities. APAC’s strong fintech ecosystem and consumer shift toward digital payments continue to make it the most dynamic regional market.

Latin America

Latin America represents 5–9% of the global POS terminals market and is undergoing steady modernization as consumers shift from cash to digital payment methods. Brazil, Mexico, Argentina, and Colombia lead regional demand, driven by fast-growing fintech ecosystems and widespread adoption of mobile POS among micro-retailers and small businesses. The rise of digital banking and payment apps encourages merchants to deploy POS systems that support card-based and wallet-based transactions. Economic reforms and financial-inclusion initiatives help expand electronic payment acceptance, especially in urban areas. Despite challenges such as inconsistent connectivity and cost barriers, cloud-enabled POS systems with subscription-based pricing models are growing rapidly. Retail modernization, expansion of quick-service restaurants, and rising e-commerce penetration further support POS adoption. With ongoing efforts to formalize cash-heavy markets, Latin America presents strong long-term opportunities for POS vendors.

Middle East & Africa (MEA)

The Middle East & Africa region holds 8–12% of global market share and is rapidly expanding due to digital transformation efforts, especially in the Gulf Cooperation Council (GCC) countries. Nations such as the UAE, Saudi Arabia, and South Africa are adopting POS terminals at a fast pace as governments push for cashless payment ecosystems and improved financial transparency. Retail, hospitality, and transportation sectors are investing in both fixed and mobile POS solutions to support growing digital transaction volumes. E-commerce growth and rising smartphone penetration also contribute to higher POS adoption. While certain African markets face infrastructure gaps, the rapid rise of mobile money services stimulates demand for affordable, flexible POS systems. Increasing tourism, modern shopping centers, and supportive regulations further accelerate market expansion, positioning MEA as a high-potential emerging region for POS technology providers.

Market Segmentations:

By Product:

By Component:

By Technology:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Point of Sale (POS) Terminals Market features a diverse mix of global and specialized players, including Presto Phoenix Inc., NCR Voyix, Toast, Inc., Revel Systems, AURES Group, Acumera, Inc., POSaBIT Inc., Oracle Corporation, Ingenico, and HP Development Company, L.P. The Point of Sale (POS) Terminals Market remains intense, with companies focusing on technology upgrades, multi-channel integration, and secure payment capabilities to strengthen their market positions. Vendors increasingly invest in cloud-based and mobile POS solutions that offer flexibility, scalability, and real-time data insights for retail, hospitality, and service-driven environments. Innovations in biometric authentication, AI-enabled analytics, and contactless payment processing further differentiate offerings and enhance user experience. Strategic partnerships with payment processors and software providers expand solution reach, while mergers and acquisitions accelerate product diversification. Additionally, rising demand for industry-specific features and modular platforms drives companies to deliver customizable, high-performance systems that address the evolving needs of both large enterprises and SMEs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Presto Phoenix Inc.

- NCR Voyix

- Toast, Inc.

- Revel Systems

- AURES Group

- Acumera, Inc.

- POSaBIT Inc.

- Oracle Corporation

- Ingenico

- HP Development Company, L.P.

Recent Developments

- In February 2025, NCR Voyix announced a strategic agreement with Worldpay, a UK-based provider of payment technology, to deliver a unified cloud-based software and payment solution tailored for retailers and restaurants.

- In June 2024, Shift4 acquired a majority stake in Vectron Systems AG, a German provider of point-of-sale (POS) systems for the European hospitality sector. This acquisition, along with the earlier acquisition of Revel Systems, expands Shift4’s European customer footprint and distribution network.

- In February 2024, Zoho Corporation launched Zakya, a new brand, to offer a modern retail POS solution in India. Zakya’s cloud-based POS solution is easy to implement and user-friendly, helping small and medium-sized retailers go live and start billing in under an hour.

- In January 2023, VMware, in collaboration with Stratodesk, launched the VMware Retail POS modernization solution to help retailers update their existing point-of-sale systems. This solution combines VMware’s virtual desktop and endpoint management software with Stratodesk’s endpoint operating system, aiming to extend hardware lifecycles, reduce security risks, increase uptime, and enhance the customer.

Report Coverage

The research report offers an in-depth analysis based on Product, Component, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as digital and contactless payments continue to expand across all sectors.

- Cloud-based POS adoption will rise due to its scalability, lower maintenance needs, and easier remote management.

- Mobile POS systems will gain wider acceptance among SMEs seeking flexible and cost-effective transaction solutions.

- Integration of AI and analytics will enhance decision-making, customer engagement, and operational efficiency.

- Biometric and NFC technologies will see accelerated deployment to improve transaction security and speed.

- Omni-channel retail strategies will increase demand for POS systems that unify online and in-store operations.

- Restaurants and hospitality providers will adopt advanced POS platforms to support automation and personalized services.

- Regulatory shifts and data-security requirements will drive upgrades to more compliant and secure POS infrastructures.

- Fintech expansion will support broader POS penetration in emerging markets with rising digital-payment activity.

- Customizable and industry-specific POS solutions will gain traction as businesses prioritize tailored capabilities.