Market overview

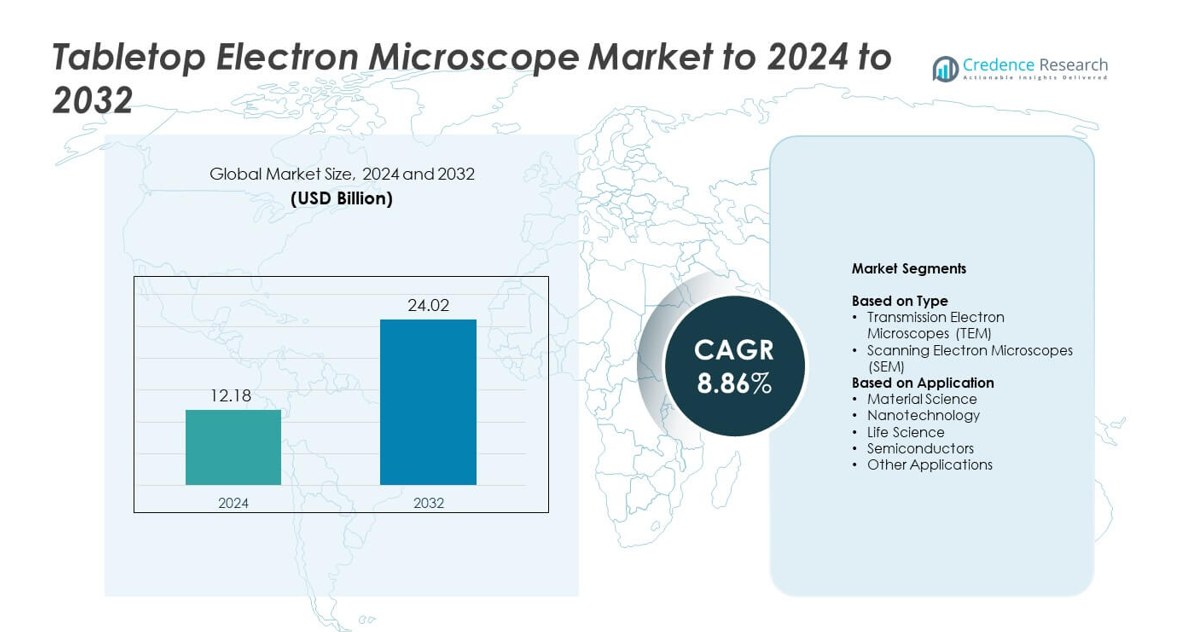

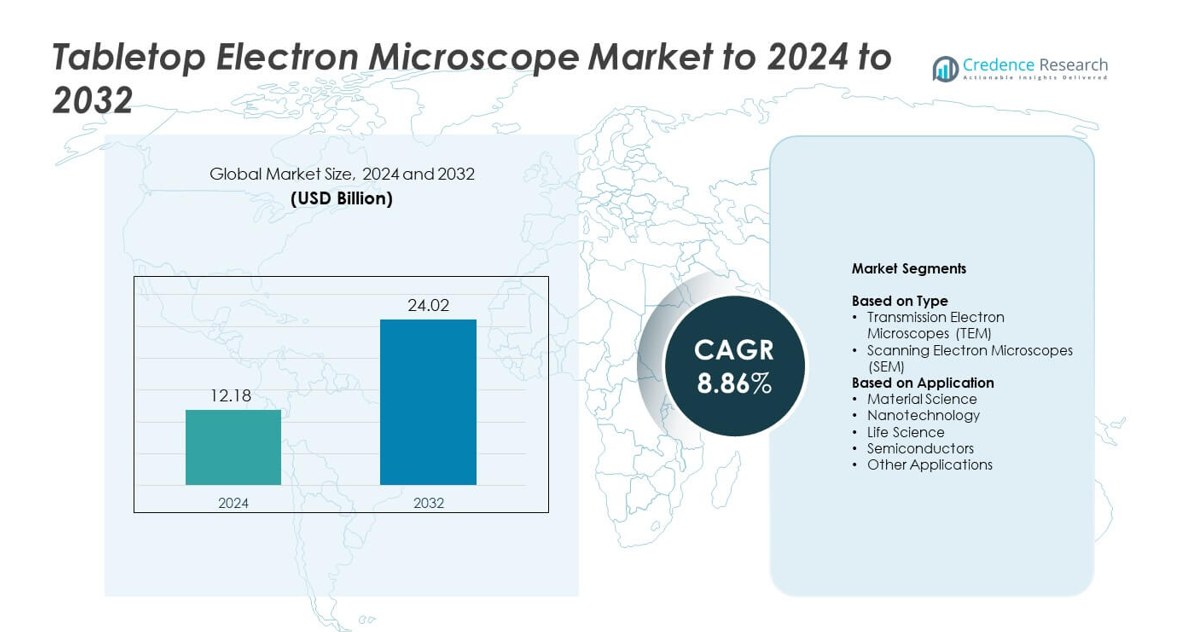

Tabletop electron microscope market size was valued at USD 12.18 billion in 2024 and is anticipated to reach USD 24.02 billion by 2032, at a CAGR of 8.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tabletop Electron Microscope Market Size 2024 |

USD 12.18 billion |

| Tabletop Electron Microscope Market, CAGR |

8.86% |

| Tabletop Electron Microscope Market Size 2032 |

USD 24.02 billion |

The tabletop electron microscope market is shaped by major players including Carl Zeiss AG, Angstrom Advanced Inc., Hitachi High-Tech Corporation, Bruker, Oxford Instruments, Hirox Europe, JEOL Ltd., Thermo Fisher Scientific Inc., ADVANTEST CORPORATION, and Delong Instruments. These companies strengthen the market through advanced imaging systems, improved automation, and compact designs suited for research labs and industrial testing. North America led the global market in 2024 with about 35% share, supported by strong R&D activity and robust semiconductor research. Asia Pacific followed closely with nearly 30% share, driven by expanding electronics manufacturing and rising investment in material science and nanotechnology.

Market Insights

- The tabletop electron microscope market reached USD 12.18 billion in 2024 and is projected to hit USD 24.02 billion by 2032, growing at a CAGR of 8.86%.

- Market growth is driven by rising demand for compact, high-resolution imaging in material science, nanotechnology, and semiconductor research, supported by expanding adoption in universities and industrial QA labs.

- Key trends include rapid integration of AI-enabled image analysis, automation for faster workflows, and advancing resolution capabilities that make tabletop models suitable for routine micro-scale studies and applied research.

- The competitive landscape features strong innovation as manufacturers enhance imaging stability, software precision, and user-friendly operation to meet growing needs across research and manufacturing environments, while service expansion strengthens customer retention.

- North America led the market with about 35% share, followed by Asia Pacific at nearly 30%. Material science held the largest segment share at around 38%, supported by broad industrial and academic usage across metals, polymers, composites, and structural analysis.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Scanning electron microscopes led the tabletop electron microscope market in 2024 with about 62% share. SEM systems remained dominant because they offer high surface-level imaging, simple operation, and rapid analysis for routine lab work. Research labs, quality-control units, and manufacturing teams favored SEM due to strong depth of field and reliable microstructural observation. Transmission electron microscopes grew steadily as users sought advanced nanoscale resolution, yet their higher cost and greater technical complexity kept adoption lower than SEM systems. Rising demand for compact, user-friendly devices continued to support SEM leadership across industrial and academic settings.

- For instance, Thermo Scientific’s Phenom XL G2 desktop SEM offers an electron optical magnification range of 160–200,000x.

By Application

Material science held the largest share in 2024 with nearly 38% of the tabletop electron microscope market. Users in metallurgy, polymers, and composites selected tabletop systems for quick defect checks, surface evaluation, and microstructure mapping. Nanotechnology applications expanded as researchers explored particle size, coatings, and nanoscale behavior in compact setups. Life science labs used these systems for cell and tissue morphology, while the semiconductor sector adopted them for failure studies and process validation. Material science led overall due to broad industrial use, rising R&D spending, and strong need for fast, high-precision imaging.

- For instance, JEOL’s JCM-7000 benchtop SEM provides 10–100,000x magnification for materials analysis. The instrument reaches about 8 nm resolution using selectable accelerating voltages of 5–15 kV.

Key Growth Drivers

Rising demand for compact laboratory imaging

Many research labs prefer small and efficient imaging tools that fit limited workspace. Tabletop electron microscopes meet this need with easy installation, low maintenance, and fast imaging output. Universities, quality-control units, and R&D teams benefit from simplified workflows and reduced training time. The push for decentralized testing encourages institutions to replace bulky systems with compact devices. This shift strengthens adoption across teaching labs, material analysis centers, and industrial testing departments. Growing interest in accessible high-resolution imaging keeps demand strong.

- For instance, COXEM’s EM-30 tabletop SEM measures roughly 400×600×550 mm and weighs 85 kg. That system delivers magnification to 150,000x with spatial resolution specified below 5 nm

Growth in material science and semiconductor research

Material science teams rely on these microscopes to study defects, surface patterns, and structural behavior across metals, alloys, polymers, and composites. Semiconductor firms use them for process checks, failure studies, and precision validation. Rising investment in chip manufacturing boosts adoption across labs involved in thin films, wafers, and micro-components. These microscopes deliver stable results with shorter turnaround time, which supports daily testing cycles. Expanding industrial R&D spending continues to push demand across key sectors.

- For instance, Delong Instruments’ LVEM25E low-voltage electron microscope achieves resolution near 1.0 nm. Researchers use LVEM systems at 5–25 kV to study nanostructured metals and semiconductors.

Advancements in imaging resolution and automation

Recent upgrades in detectors, software, and automated workflows enhance image clarity and process consistency. Labs can now run advanced measurements with fewer manual steps, reducing operator errors. Improved vacuum systems increase stability, while enhanced automation supports repetitive testing in quality-control environments. As performance improves, many users shift from basic optical systems to tabletop electron microscopes for higher detail. Ongoing innovation creates a strong pull from both research and manufacturing sectors seeking reliable micro-scale imaging.

Key Trends and Opportunities

Growing integration of AI-based image analysis

AI-driven software now helps researchers classify structures, detect defects, and measure features more efficiently. Automated pattern recognition reduces interpretation time and improves consistency across large sample sets. Companies benefit from faster decision-making in material validation and product testing. The trend opens opportunities for smart workflow systems that support real-time analytics. As AI matures, more labs adopt tabletop electron microscopes to gain both imaging capability and analytical speed in one platform.

- For instance, Keyence’s EA-300 elemental analyzer adds AI-based suggestions to VHX digital microscopes. The combined VHX-X1 platform includes a 300 mm stage for wafers and automated comparisons.

Expansion in education and training programs

Academic institutions adopt tabletop models to give students hands-on exposure to micro-scale imaging. The compact size and safe operation allow installation in teaching labs without complex infrastructure. More universities introduce microscopy modules for material science, biotechnology, and engineering courses. This shift boosts long-term adoption because trained students enter industry familiar with these tools. The rise of skill-development programs creates a strong market opportunity for vendors targeting education-focused product lines.

- For instance, Hitachi High-Tech Corporation emphasizes social contribution through education, and in its official reporting, it noted that its “science education support activities” reached 62,487 participants in fiscal 2022.

Increasing use in nanotechnology and applied research

Nanotechnology teams need consistent imaging at micro and nano levels for particle studies, coatings, and structural behavior. Tabletop models support these tasks without the high operational load of large microscopes. Expanding research in energy storage, advanced composites, and biomedical materials drives adoption. The trend opens opportunities for vendors offering enhanced nanoscale visualization and analytical add-ons. Growth in multidisciplinary research strengthens the market’s long-term potential.

Key Challenges

Limited resolution compared to full-size systems

Although tabletop models offer strong performance, they still fall short of the resolution achieved by large, high-end electron microscopes. Some advanced semiconductor and nanomaterial studies require ultra-high detail that compact systems cannot deliver. This gap restricts wider adoption in cutting-edge research labs. Users may need hybrid setups, increasing cost and complexity. Balancing compact design with higher resolution remains a major technical challenge for manufacturers.

High upfront cost for academic and small labs

Despite lower costs than full-size systems, many small research centers still find tabletop models expensive. Budget constraints limit adoption, especially in developing regions or smaller universities. Maintenance and service plans add further financial pressure. This challenge slows market expansion in price-sensitive sectors. Vendors must focus on cost-effective models and flexible financing to overcome barriers.

Regional Analysis

North America

North America held the largest share of the tabletop electron microscope market in 2024 with about 35%. Strong demand came from advanced research labs, semiconductor facilities, and material science institutes. Universities and R&D centers invested in compact imaging tools to support high-volume testing and academic programs. Growth in nanotechnology projects and federal research funding helped expand adoption across biotechnology, energy materials, and electronics. The presence of major manufacturers and well-developed laboratory infrastructure supported steady upgrades to modern tabletop systems across the region.

Europe

Europe accounted for nearly 28% share in 2024, driven by strong adoption across industrial quality-control labs, academic institutes, and research organizations. Countries such as Germany, the UK, and France led usage due to high activity in materials testing, automotive components, and electronics research. Laboratories preferred tabletop systems for their compact size, consistent performance, and reduced operational requirements. Growing investment in microstructure analysis and surface characterization supported expansion. Strong collaboration between universities and technology firms continued to encourage uptake across applied research environments.

Asia Pacific

Asia Pacific captured around 30% share in 2024, supported by rapid growth in semiconductor manufacturing, nanotechnology research, and industrial R&D activities. China, Japan, South Korea, and India formed the strongest demand base as companies expanded material science labs and upgraded inspection capabilities. Universities and training centers boosted purchases for skill development and micro-imaging education. Expanding electronics production and increasing focus on advanced materials kept demand strong. Rising government investment in research infrastructure further enhanced regional adoption of tabletop electron microscopes.

Latin America

Latin America held close to 4% share in 2024, with demand led by Brazil and Mexico. Research universities adopted tabletop models to improve access to micro-scale imaging for materials testing and life science applications. Industrial labs in automotive and electronics sectors upgraded systems to support routine inspections. Growth remained steady as institutions focused on modernizing laboratory capabilities. Limited budgets slowed large-scale adoption, yet the region showed rising interest in compact microscopes due to ease of use and lower operating requirements.

Middle East & Africa

Middle East & Africa accounted for about 3% share in 2024, supported by growing investments in academic research, oil and gas material analysis, and emerging semiconductor activities. Countries such as the UAE, Saudi Arabia, and South Africa expanded laboratory infrastructure to enhance local R&D capabilities. Universities incorporated tabletop systems for training and applied science programs. While adoption remained modest, steady development of research hubs and rising interest in materials engineering supported gradual market growth across the region.

Market Segmentations:

By Type

- Transmission Electron Microscopes (TEM)

- Scanning Electron Microscopes (SEM)

By Application

- Material Science

- Nanotechnology

- Life Science

- Semiconductors

- Other Applications

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the tabletop electron microscope market features leading companies such as Carl Zeiss AG, Angstrom Advanced Inc., Hitachi High-Tech Corporation, Bruker, Oxford Instruments, Hirox Europe, JEOL Ltd., Thermo Fisher Scientific Inc., ADVANTEST CORPORATION, and Delong Instruments in the first line only. The market remains highly innovation-driven as manufacturers focus on improving resolution, automation, and user-friendly software to suit both research and industrial workflows. Vendors compete through technology upgrades, compact designs, and advanced imaging features that support material science, semiconductor, and nanotechnology applications. Many companies strengthen their presence through strategic partnerships with universities, research institutes, and industrial QA teams. Product differentiation centers on enhanced imaging stability, AI-assisted analysis, and integration of digital workflow tools. Expanding service networks and training programs also support customer retention. As adoption rises across emerging regions, companies invest in localized distribution and after-sales support to enhance market reach and long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Carl Zeiss AG

- Angstrom Advanced Inc.

- Hitachi High-Tech Corporation

- Bruker

- Oxford Instruments

- Hirox Europe

- JEOL Ltd.

- Thermo Fisher Scientific Inc.

- ADVANTEST CORPORATION

- Delong Instrument

Recent Developments

- In 2025, Hitachi High-Tech Corporation launched the SU9600, an ultrahigh-resolution scanning electron microscope (SEM) with high throughput.

- In 2025, Thermo Fisher Scientific launched two new electron microscopes, the Scios 3 FIB-SEM and Talos 12 TEM, at the Microscopy & Microanalysis (M&M) 2025 conference.

- In 2023, JEOL released the JSM-IT710HR analytical SEM with high resolution and enhanced analytical capabilities, expanding options for labs that pair a benchtop/tabletop SEM with a more powerful instrument.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as more labs shift toward compact and efficient imaging tools.

- Universities will adopt more systems to support hands-on training in advanced microscopy.

- Semiconductor manufacturing will boost demand through expanded process validation needs.

- Material science research will drive steady upgrades for surface and defect analysis.

- Automation and AI-based software will improve accuracy and lower operator dependence.

- Vendors will launch higher-resolution models to reduce performance gaps with full-size systems.

- Adoption will rise in small labs due to improved affordability and simpler installation.

- Nanotechnology projects will expand usage for particle evaluation and coating studies.

- Emerging regions will increase investment in research infrastructure and microscopy tools.

- Collaboration between universities and industry will accelerate innovation and product development.