Market overview

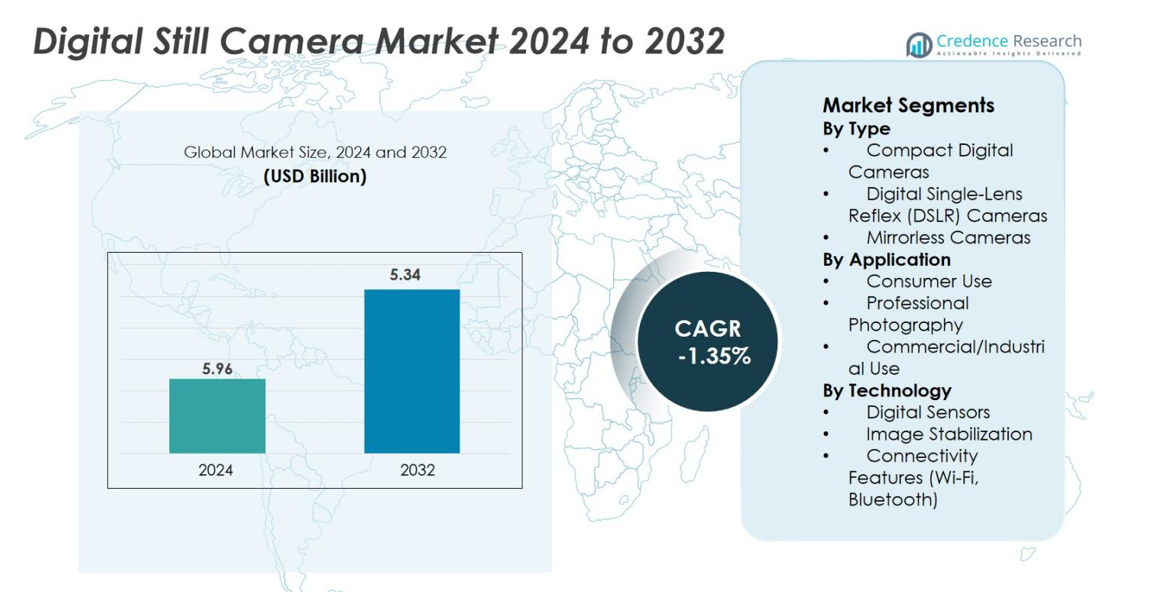

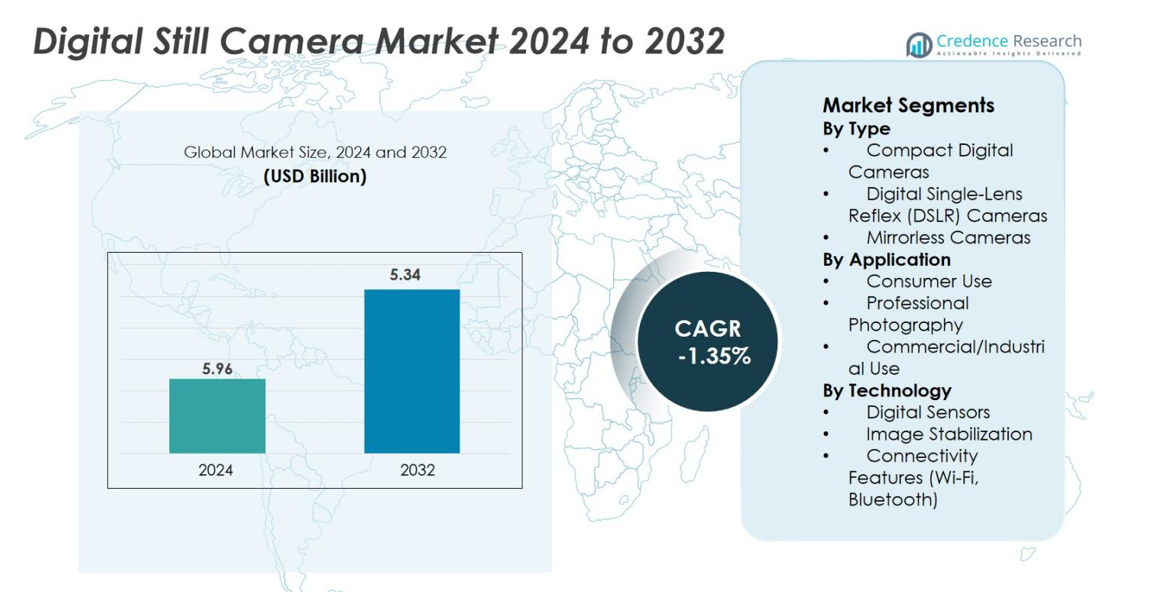

The digital still camera market was valued at USD 5.96 billion in 2024 and is expected to reach USD 5.34 billion by 2032, with a CAGR of -1.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Still Camera Market Size 2024 |

USD 5.96 billion |

| Digital Still Camera Market, CAGR |

1.35% |

| Digital Still Camera Market Size 2032 |

USD 5.34 billion |

The Digital Still Camera Market is dominated by key players such as Canon Inc., Sony Group Corporation, and Nikon Corporation, which together account for a significant portion of the global market share. Canon leads the market with a share of approximately 40%, owing to its strong presence in both consumer and professional segments. Sony follows closely with around 30% market share, driven by its innovative mirrorless camera technology and high-performance sensors. Nikon holds about 20% of the market, maintaining a stronghold in the DSLR segment. The Asia-Pacific region is the largest market, contributing approximately 35% of the global share, largely driven by the high demand in Japan, China, and India. North America and Europe also remain strong markets, with North America holding about 30% and Europe contributing 25% to the global market, supported by high consumer demand and professional applications.

Market Insights

- The digital still camera market was valued at USD 5.96 billion in 2024 and is projected to reach USD 5.34 billion by 2032, growing at a CAGR of -1.35% during the forecast period.

- Key drivers of market growth include advancements in camera technology, increasing social media content creation, and growing demand for compact, high-performance cameras.

- Emerging trends involve the rising popularity of mirrorless cameras, integration of AI in photography, and expansion in emerging markets, particularly in Asia-Pacific.

- The competitive landscape is dominated by major players such as Canon (40% market share), Sony (30%), and Nikon (20%). Smaller players like Fujifilm and Panasonic target niche markets.

- Regional analysis shows Asia-Pacific leading the market with 35% market share, followed by North America at 30% and Europe at 25%, driven by high consumer demand and professional applications in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The digital still camera market is categorized into compact digital cameras, digital single-lens reflex (DSLR) cameras, and mirrorless cameras. Among these, mirrorless cameras dominate the market, accounting for approximately 45% of the market share. This growth is driven by their lightweight design, superior image quality, and growing demand for professional-grade cameras among consumers. Mirrorless cameras provide advanced features like faster autofocus and higher video resolution, making them increasingly popular for both casual and professional photographers. DSLR cameras hold a significant portion, but their market share is gradually declining due to the rise of mirrorless alternatives.

- For instance, Nikon’s mirrorless camera shipments reached 760,000 units in 2024, demonstrating its transition toward mirrorless systems.

By Application

The market is segmented based on application into consumer use, professional photography, and commercial/industrial use. Consumer use holds the largest share, capturing around 50% of the market. This segment benefits from the increasing popularity of photography among hobbyists and social media influencers, driving demand for user-friendly, compact cameras. Professional photography follows closely, fueled by advancements in image quality and technological features that cater to high-end users. The commercial/industrial use segment, while smaller, continues to expand due to the demand for high-resolution imaging in sectors like real estate and media.

- For instance, Nikon’s full-frame mirrorless cameras have seen increasing market share in Japan, achieving a top monthly share in the category for the first time with the release of the Z5 II.

By Technology

The digital still camera market is also divided by technology, including digital sensors, image stabilization, and connectivity features such as Wi-Fi and Bluetooth. Digital sensors dominate, contributing to 40% of the market share, as they are critical to image clarity and performance. Technological innovations in sensor design, such as higher resolution and improved low-light capabilities, drive this dominance. Image stabilization is also a key factor, improving video and photo quality in dynamic settings. Connectivity features, while growing in importance, represent a smaller yet significant segment, enhancing the overall user experience with remote sharing and control.

Key Growth Drivers

Advancements in Camera Technology

The continuous advancement in camera technology is a significant growth driver for the digital still camera market. The integration of high-resolution sensors, faster autofocus systems, and improved low-light performance has elevated the capabilities of digital cameras, catering to both professional photographers and hobbyists. The development of mirrorless cameras with superior image quality, compact design, and faster shooting speeds has further driven adoption. Additionally, the inclusion of 4K and 8K video recording features in consumer-grade models has made these devices attractive for video production, expanding their appeal beyond traditional photography.

- For instance, Sony’s compact fixed‑lens model the RX1R III features a full‑frame 61.0‑megapixel back‑illuminated Exmor R image sensor paired with a BIONZ XR processing engine, enabling precise subject‑recognition tracking across humans, animals, birds, cars and insects.

Increasing Popularity of social media and Content Creation

The rising trend of social media usage and content creation is another key driver of growth in the digital still camera market. As platforms like Instagram, YouTube, and TikTok gain traction, individuals and businesses alike are investing in high-quality cameras to enhance their content. Consumers are increasingly looking for cameras that not only provide excellent photography capabilities but also feature advanced video recording options. This trend has led to a surge in demand for both entry-level and professional-grade cameras that can produce high-quality images and videos. The growing importance of visual content in personal branding and marketing is expected to continue propelling the digital still camera market, particularly for action and vlog-style cameras.

- For instance, the Sony ZV-1, a compact camera aimed at vloggers and content creators features a 1‑inch sensor, a fast f/1.8‑2.8 lens, and a fully articulating screen tailored for selfies and online video.

Growing Demand for Compact and User-Friendly Cameras

The increasing demand for portable, compact, and user-friendly cameras is driving the market, particularly in the consumer segment. Compact digital cameras and smartphones equipped with advanced camera features have gained popularity due to their ease of use and portability. This shift toward compact cameras is largely driven by consumer preferences for lightweight devices that can easily be carried on trips or used for daily activities. Manufacturers are responding to this demand by offering compact cameras with high-quality imaging sensors, longer battery life, and improved video capabilities. The growing number of tech-savvy consumers and travelers looking for high-quality photography on the go is expected to sustain the demand for these devices.

Key Trends & Opportunities

Shift Toward Mirrorless Cameras

One of the key trends in the digital still camera market is the growing shift from DSLR to mirrorless cameras. Mirrorless cameras are rapidly gaining popularity due to their compact design, advanced features, and enhanced performance. They offer similar image quality and performance to DSLRs while being more portable and lightweight. As a result, many photographers and content creators are making the switch to mirrorless cameras, driving growth in this segment. Opportunities for manufacturers lie in capitalizing on this shift by focusing on innovation in mirrorless technologies, such as enhanced image stabilization, better autofocus systems, and long-lasting battery life.

- For instance, the Sony α9 II, a flagship mirrorless sports camera, integrates AI-driven autofocus and high-speed shooting with up to 20 frames per second, meeting the demands of professional sports photographers.

Integration of AI and Machine Learning in Photography

Another significant opportunity for growth in the digital still camera market is the integration of artificial intelligence (AI) and machine learning technologies. AI-powered cameras are becoming increasingly sophisticated, offering features such as automatic scene recognition, real-time image enhancement, and advanced autofocus. These technologies simplify the photography process for users, making it easier to capture high-quality images even for beginners. As AI and machine learning continue to advance, the potential for new features, such as better facial recognition, object tracking, and enhanced photo editing, presents significant opportunities for camera manufacturers. This integration not only attracts casual photographers but also enhances the overall user experience, which could lead to wider adoption of digital still cameras across various segments.

- For instance, the Sony α9 III full‑frame mirrorless camera includes a “dedicated AI processing unit” for subject‑recognition autofocus (humans, animals, vehicles) and supports up to 120 fps continuous shooting.

Expansion in Emerging Markets

Emerging markets, particularly in Asia Pacific, Latin America, and Africa, represent a significant growth opportunity for the digital still camera market. As disposable incomes rise in these regions, the demand for consumer electronics, including cameras, is increasing. In particular, rising middle-class populations in countries such as India, Brazil, and China are driving demand for affordable, high-performance cameras. Manufacturers can tap into these regions by offering products at various price points, targeting both budget-conscious consumers and those looking for higher-end devices. With an expanding base of content creators, travelers, and photographers in emerging markets, there is a vast opportunity to introduce cameras with advanced features at competitive prices.

Key Challenges

Competition from Smartphone Cameras

A major challenge facing the digital still camera market is the increasing competition from smartphone cameras. With the rapid advancement of smartphone camera technology, many consumers find that they no longer need a dedicated digital still camera. Smartphones now offer high-quality sensors, advanced image processing capabilities, and multiple lenses that rival traditional cameras in terms of performance. Additionally, the convenience of having a camera built into a device that also serves other functions has made smartphones the preferred choice for many consumers. This trend poses a challenge for digital camera manufacturers, as they must differentiate their products by offering features that smartphones cannot replicate, such as higher resolution, better zoom capabilities, and professional-grade performance.

Declining Consumer Interest in Traditional Cameras

The digital still camera market is facing the challenge of declining interest in traditional cameras, particularly among younger consumers. As more people rely on their smartphones for photography and social media content, the demand for standalone digital cameras has decreased. Additionally, the rise of digital content creation on platforms like YouTube and Instagram has led to an increased preference for smartphones and action cameras, which offer ease of use, portability, and instant connectivity. This shift in consumer behavior poses a challenge for the market, as manufacturers must work to convince consumers of the added value of purchasing dedicated cameras over multifunctional smartphones.

Regional Analysis

North America

North America holds a significant share of the digital still camera market, accounting for 30% of the global market. This dominance is driven by strong demand from professional photographers, content creators, and high-income consumers. The United States is the largest market within the region, with a focus on both consumer and professional-grade cameras. The increasing popularity of mirrorless cameras, along with a growing content creation ecosystem, has contributed to sustained demand. However, the competition from smartphones equipped with advanced camera technology remains a challenge to traditional digital camera sales in the region.

Europe

Europe contributes 25% to the global digital still camera market. Countries like Germany, the United Kingdom, and France are the primary drivers of market growth in the region. The demand for high-quality digital cameras, especially in the professional photography sector, is robust due to the region’s strong media, advertising, and event photography industries. The growing trend of vlogging and travel photography has further bolstered the consumer segment. Additionally, the shift towards mirrorless cameras and increasing use of social media as a content-sharing platform are key factors fueling market growth in Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region for digital still cameras, accounting for 35% of the global market share. This growth is driven by the expanding middle class in countries like China, India, and Southeast Asian nations, along with the technological advancements of major camera manufacturers based in Japan. The demand for digital cameras is further boosted by the rising popularity of both amateur and professional photography, as well as the increasing number of content creators in the region. Additionally, the rapid adoption of new camera technologies such as AI-powered features and high-definition video recording contributes to the growth in this market.

Latin America

Latin America represents 7% of the global digital still camera market, with Brazil and Mexico leading in demand. The market is driven by the increasing popularity of photography, especially among young consumers and influencers. The rising number of content creators using platforms like Instagram and YouTube has led to greater demand for both affordable point-and-shoot cameras and mid-range models like DSLRs and mirrorless cameras. Despite economic challenges in some regions, the growing interest in photography and video content creation presents opportunities for camera manufacturers to cater to the growing consumer base.

Middle East & Africa

The digital still camera market in the Middle East and Africa accounts for 5% of the global market share. This region’s market growth is primarily driven by the increasing popularity of professional photography, especially in countries like the UAE, Saudi Arabia, and South Africa, where high-quality cameras are in demand for tourism, event, and wildlife photography. Social media content creation is also on the rise, contributing to the demand for digital cameras. However, the prevalence of smartphones with advanced camera features poses a challenge to the widespread adoption of traditional digital still cameras in this region.

Market Segmentations

By Type

- Compact Digital Cameras

- Digital Single-Lens Reflex (DSLR) Cameras

- Mirrorless Cameras

By Application

- Consumer Use

- Professional Photography

- Commercial/Industrial Use

By Technology

- Digital Sensors

- Image Stabilization

- Connectivity Features (Wi-Fi, Bluetooth)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the digital still camera market is marked by a moderately concentrated structure, with a handful of major players commanding the bulk of market share. Leading the field are Canon Inc., Sony Group Corporation, and Nikon Corporation, which collectively hold a dominant position through strong product portfolios, deep R&D capabilities, and extensive service networks. These firms differentiate themselves through advanced imaging technologies such as high-performance sensors, mirrorless systems, and autofocus innovations while also fostering ecosystem lock-in via lens mounts and accessories. Smaller and niche players like Fujifilm Holdings Corporation, Panasonic Corporation, Eastman Kodak Company, and SIGMA Corporation compete by targeting specialized segments or emphasizing design and imaging aesthetics. With entry barriers including high capital investment in optics and brand loyalty, the competitive rivalry remains intense, but entry by new players is limited.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sony

- Panasonic

- Nikon

- Olympus

- Samsung

- GoPro

- Blackmagic Design

- Hasselblad

- Kodak

- Sigma

Recent Developments

- In September 2025, Nikon Corporation released a new full-frame camera model, the Nikon ZR, developed in collaboration with RED Digital Cinema.

- In July 2025, Carl Zeiss AG (ZEISS) completed the acquisition of Pi Imaging Technology SA (a Swiss imaging-sensor company) to advance sensor technology and imaging solutions.

- In July 2025, Sony Corporation announced the launch of its Sony RX1R III a premium compact full-frame fixed-lens camera in the RX1R series.

- In June 2025, Fujifilm Holdings Corporation announced the launch of its new X-series digital camera, the Fujifilm X-E5

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The digital still camera market is expected to experience steady growth, anchored by the increasing demand for high‑quality imaging devices tailored to creators and professionals.

- The shift toward mirrorless systems will continue accelerating, as these models now command a majority share and offer superior portability and performance compared to DSLRs.

- AI‑powered functionalities such as subject recognition, scene optimisation and automatic post‑processing will become standard features, enhance user experience and justify premium pricing.

- Content‑creation and influencer ecosystems will drive demand for hybrid photo‑video cameras, with integrated livestreaming and direct‐to‐cloud capabilities gaining traction.

- Emerging markets in Asia‑Pacific, Latin America and the Middle East & Africa will offer considerable upside, backed by rising disposable incomes and growing interest in travel, vlogging and social media photography.

- Interchangeable‑lens systems will continue to dominate the premium segment, reinforcing ecosystem lock‑in as users invest in lens collections beyond the camera body.

- Connectivity features such as Wi‑Fi, Bluetooth and smartphone integration will become a baseline expectation, enabling seamless content sharing and remote control.

- Manufacturers will increasingly focus on sustainability, using recycled materials and energy‑efficient components to meet regulatory and consumer demand.

- Entry‑level and compact models will face pressure from ever‑improving smartphone cameras, compelling brands to reposition dedicated cameras around unique features and creative flexibility.

- Supply‑chain resilience and risk mitigation (e.g., for semiconductors and sensors) will gain importance as manufacturers aim to maintain production continuity and manage cost pressures.