Market overview

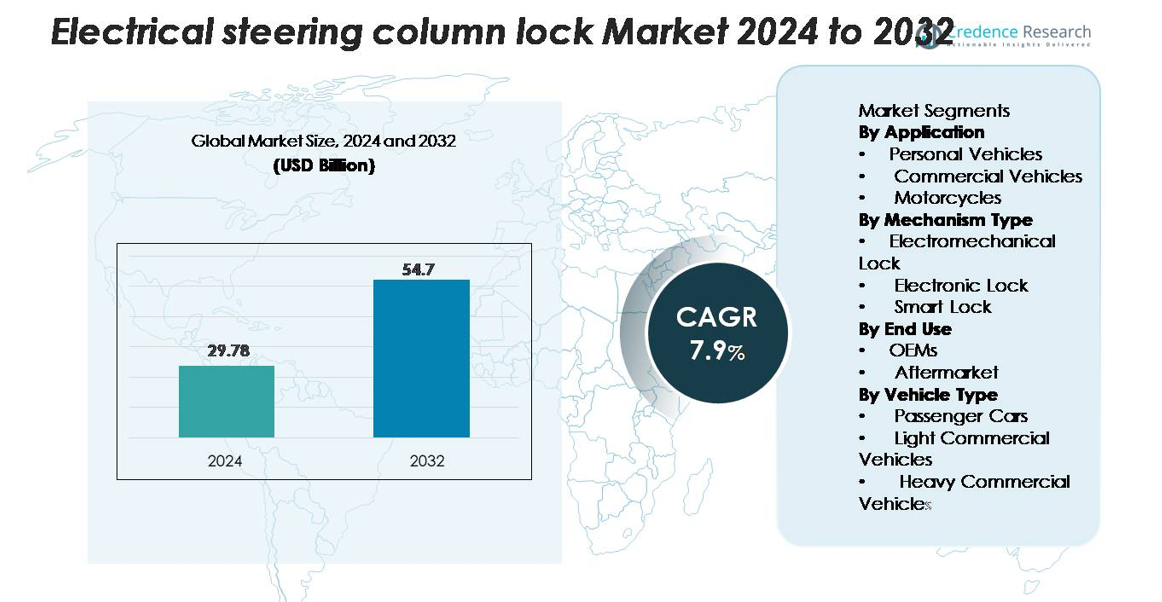

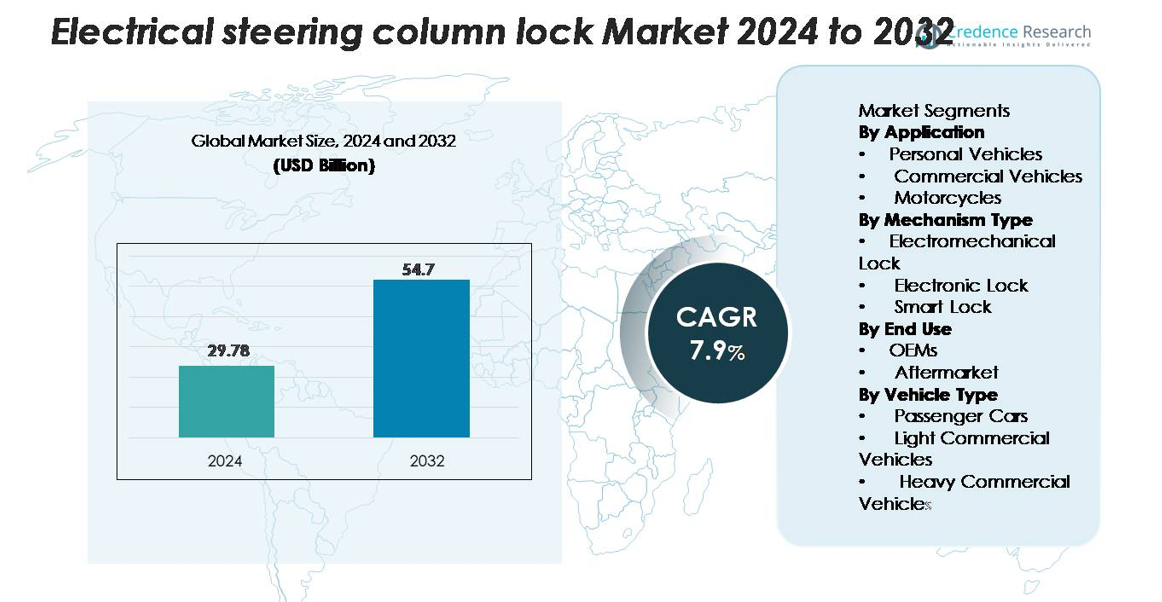

The Electrical Steering Column Lock market was valued at USD 29.78 billion in 2024 and is projected to reach USD 54.7 billion by 2032, expanding at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Steering Column Lock Market Size 2024 |

USD 29.78 billion |

| Electrical Steering Column Lock Market, CAGR |

7.9% |

| Electrical Steering Column Lock Market Size 2032 |

USD 54.7 billion |

The Electrical Steering Column Lock market features strong competition among global automotive suppliers and electronics manufacturers. Key players include JTEKT Corporation, Hyundai Mobis, Continental AG, MinebeaMitsumi Inc., Nexteer Automotive, Robert Bosch GmbH, Mando Corporation, NSK Ltd., Huf Hülsbeck & Fürst GmbH & Co. KG, and ZF Friedrichshafen AG. These companies focus on electromechanical and digital steering locks integrated with keyless entry, ECU control, and encrypted communication. North America leads the global market with a 33% share, supported by high vehicle theft prevention standards, widespread adoption of electronic immobilizers, and strong OEM production of connected and premium vehicles. Europe and Asia Pacific follow as major manufacturing hubs with rising installation in passenger and commercial vehicles.

Market Insights

- Electrical steering column lock market size reached USD 29.78 billion in 2024 and will hit USD 54.7 billion by 2032, growing at a CAGR of 7.9%.

- Rising use of electronic immobilizers, keyless ignition, and ECU-controlled locking systems drives adoption across passenger cars and commercial fleets, supported by insurance compliance and anti-theft regulations.

- Smart locks gain traction as automakers add encrypted communication, remote immobilization, and telematics integration; electromechanical locks still lead the mechanism segment with the largest share due to reliability and compatibility with mass-market vehicles.

- Global competition includes JTEKT Corporation, Bosch, Continental, Hyundai Mobis, Nexteer, Mando, NSK Ltd., and ZF Friedrichshafen, with companies focusing on compact modules, cybersecurity, and OEM partnerships; high cost of advanced smart locks remains a key restraint in price-sensitive markets.

- North America holds 33% share, driven by strict theft-prevention standards; Europe follows with strong OEM installations, while Asia Pacific is the fastest-growing region due to rising vehicle production and EV adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Personal vehicles dominate the Electrical Steering Column Lock market with the largest share, driven by rising adoption of advanced anti-theft systems in passenger cars and SUVs. Automakers integrate electronic column locks with keyless entry, immobilizers, and ECU-controlled modules to strengthen security. Demand rises as consumers prioritize vehicle safety, insurance compliance, and theft protection across urban areas. Commercial vehicles and motorcycles follow, supported by fleet protection requirements and growing penetration of electronic steering systems in two-wheelers. Expanding vehicle production and shift toward premium models further boost system installation across the application spectrum.

- For instance, Modern automotive security systems, such as those that might use a Bosch Secure Control Unit (SCU), employ robust cryptographic methods and hardware security modules (HSMs) to perform secure authentication and prevent cyber threats like relay attacks. These systems are designed to perform authentication in real-time, often using methods like distance bounding (measuring the round-trip time of a signal) or user context detection (using sensors like accelerometers or barometers) to verify the key’s proximity to the vehicle.

By Mechanism Type

Electromechanical locks hold the leading share due to their strong reliability, integration with ignition systems, and wide use in mid-range and premium passenger cars. These systems combine mechanical locking bars with electronic activation, offering better tamper resistance and long service life. Electronic and smart locks are gaining traction as connected vehicles and advanced keyless technologies grow. Smart locks support encrypted communication, remote control features, and improved theft detection, creating strong demand from next-generation vehicles. Automakers invest in lightweight electric actuators and compact lock modules to enhance efficiency and steering safety.

- For instance, Minebea Mitsumi manufactures precision miniature ball bearings at global volumes exceeding 2.1 billion units per year (approximately 180 million units per month) and various actuator components for automotive applications, enabling durable, low-friction mechanisms inside components like column-mounted lock modules.

By End Use

OEMs account for the dominant market share as steering column locks are installed during vehicle production to meet safety regulations and anti-theft standards. Automakers use integrated modules designed to work with electronic steering units, immobilizers, and CAN-based control systems. Demand in the aftermarket continues to grow due to replacement of worn locking systems and upgrades in aging vehicle fleets. Rising vehicle ownership, insurance-driven security compliance, and theft-sensitive urban markets increase aftermarket sales. The expansion of connected and premium vehicles helps OEM installation remain the primary revenue contributor across global markets.

Key Growth Drivers

Rising Vehicle Theft and Mandatory Safety Regulations

Growing vehicle theft cases worldwide push automakers toward advanced immobilization and digital locking solutions. Governments enforce anti-theft standards for new vehicles, making electronic steering column locks a compulsory safety component in many regions. Insurers also offer policy benefits for vehicles equipped with certified electronic locks, increasing installation rates in premium and mass-market passenger cars. Automakers integrate encrypted modules that lock the steering wheel as soon as ignition is off or unauthorized access is detected. These systems prevent towing-based theft, key duplication misuse, and ignition tampering. Increasing urban vehicle ownership, premium car sales, and adoption of connected car networks continue to reinforce regulatory compliance. As electric and hybrid vehicles replace mechanical ignition systems with electronic steering architectures, OEMs accelerate the shift from manual or mechanical locks to electromechanical or intelligent digital systems. This transition drives large-scale production of secure, tamper-resistant steering column lock units worldwide.

- For instance, Bosch Secure Control Units integrate hardware security modules capable of executing over 100,000,000 cryptographic operations per second, enabling real-time authentication that blocks relay attacks and unauthorized steering release.

Growth of Smart, Connected, and Autonomous Vehicles

Connected and autonomous vehicles rely heavily on ECU-based control units, requiring digital steering locks for safe immobilization and system authentication. Smart locks with encrypted communication, sensor-based activation, and diagnostic monitoring deliver improved performance over traditional locks. Automakers install digital modules capable of remote locking and unlocking through mobile apps, key fobs, or telematics platforms. Premium vehicles also integrate biometric access and proximity-based locking, supporting advanced security architectures. As electric steering systems replace hydraulic steering, digital locks achieve higher compatibility and better response with CAN and LIN automotive networks. Fleet operators and rental platforms adopt smart locks to track unauthorized access, enhance driver authentication, and reduce theft risk. Wireless firmware updates, remote diagnostics, and predictive maintenance attract OEMs and tier-1 suppliers. The rising number of semi-autonomous and electric vehicles reinforces demand for electronically controlled steering immobilizers at global scale.

- For instance, Bosch’s Automotive Steering division (now part of Bosch Mobility) supplies electric power steering systems and control units that are designed with a protected system architecture against unauthorized cyber-attacks, enabling secure, encrypted communication. These systems feature powerful, high-performance control units capable of performing “intelligent and fast calculations” for steering assistance and steering corrections to support advanced driver assistance systems and automated driving up to SAE Level 4.

OEM Integration and Falling Component Costs

OEMs install steering column locks during production to comply with safety standards, reducing dependence on aftermarket retrofits. High production volumes lead to cost reductions in sensors, microcontrollers, actuators, and lock modules, making digital locks more affordable across mid-segment passenger cars. Suppliers develop compact and lightweight modules that streamline assembly and reduce wiring complexity. Automakers choose integrated systems that communicate with ignition control, airbags, electronic brake force distribution, and anti-lock braking systems, creating a higher margin for suppliers. Economies of scale, modular design, and improved supply chain networks drive further price efficiency. Rapid industrialization, rising vehicle manufacturing in Asia Pacific, and expansion of automotive electronics manufacturing clusters help lower cost barriers. As affordability increases, OEMs widely adopt electromechanical and smart locks in entry-level and commercial vehicles, driving mass penetration across global markets.

Key Trends & Opportunities

Shift Toward Smart Locks and Remote Access Features

Smart locks create a strong technology-led opportunity in the market. These systems use encrypted data communication, keyless authentication, GPS tracking, and remote mobile control to secure vehicles. Cloud-linked access enables remote driver authorization, anti-theft alerts, and automated immobilization. OEMs use smart locks in subscription-based car sharing, fleet operations, and autonomous vehicle prototypes, offering better control and theft detection. Biometric locks with fingerprint or face authentication are under development for premium vehicle platforms. Suppliers invest in cybersecurity protocols, interference-resistant circuits, and IoT-enabled steering modules. As digital car keys replace conventional fobs, smart steering locks integrate seamlessly with digital ecosystems, offering long-term growth potential for connected transportation models.

- For instance, BMW’s Digital Key uses ultra-wideband (UWB) with a measured ranging accuracy under 10 centimeters, confirmed through BMW and Car Connectivity Consortium documentation.

Rising Adoption in Electric and Hybrid Vehicles

Electric and hybrid vehicles eliminate mechanical ignition systems and rely on electronically controlled steering architectures, driving higher demand for column locks. OEMs prefer electromechanical and smart locks because they integrate easily with battery management systems, regenerative braking controls, and advanced driver-assistance systems. Lightweight lock modules improve energy efficiency and meet compact EV design requirements. With global EV production expanding, suppliers gain opportunities to deliver encrypted, tamper-proof locks specifically optimized for EV controllers and central gateways. Government incentives, emission norms, and EV infrastructure development strengthen EV adoption, supporting long-term installation of electronic locks across passenger and commercial electric fleets. Rising demand from Asia Pacific, Europe, and North America makes electric mobility a major revenue channel for steering lock manufacturers.

- For instance, Nexteer offers a High-Output Rack-Assist Electric Power Steering (REPS) solution designed for heavy vehicles like full-size trucks and LCVs, capable of steering up to 24 kN (kilonewtons) of rack load. Steer-by-Wire (SbW) systems in general provide very fast, precise control and can enable electronic locking without a physical steering shaft, incorporating redundant safety systems (such as “Steer-by-Brake” technology) to ensure continuous operation and meet strict safety requirements.

Demand for Connected Fleet Security and Telematics Integration

Commercial fleets, logistics operators, and rental platforms invest in telematics-based security to reduce theft and unauthorized usage. Smart steering column locks integrate with GPS, IoT sensors, and fleet telematics dashboards to track access attempts and trigger immobilization. Fleet managers can remotely disable steering through cloud platforms, preventing vehicle movement after theft attempts. Subscription-based remote monitoring services create long-term revenue for manufacturers. Growth of e-commerce logistics, ride-sharing, and last-mile mobility increases fleet numbers worldwide, raising the need for advanced immobilization and real-time control solutions. As telematics and connectivity expand, electronic locks form a critical part of integrated fleet security ecosystems.

Key Challenges

Cybersecurity Risks and Electronic System Vulnerabilities

Increasing digitalization exposes steering column locks to potential hacking, cloning of electronic keys, and unauthorized ECU access. Smart locks with wireless communication can be targeted through relay attacks, signal interception, or malware-based intrusion. Manufacturers must invest in secure encryption, intrusion detection, and secure firmware updates to prevent tampering. Ensuring cybersecurity adds cost and development time, creating challenges for low-cost vehicle manufacturers. Failure to protect lock modules from electronic interference or remote hacking can lead to safety concerns, reputational damage, and regulatory scrutiny. As vehicles become more connected, cybersecurity certification and compliance become mandatory, increasing complexity for suppliers.

High Cost of Advanced Smart Locks in Price-Sensitive Markets

While premium and mid-segment vehicles adopt electronic locks widely, cost-sensitive markets still depend on basic mechanical or electromechanical options. Smart locks require processors, sensors, encryption chips, and communication modules, increasing system cost. Price-sensitive buyers and budget vehicle manufacturers hesitate to adopt advanced digital locks, especially in developing regions. Aftermarket installation of smart locks also remains limited due to compatibility and wiring complexity. Small manufacturers may struggle with cost pressure, testing requirements, and meeting OEM quality certifications. Balancing performance, safety, and affordability remains a key challenge to achieving wide-scale adoption across emerging automotive markets.

Regional Analysis

North America

North America leads the Electrical Steering Column Lock market with the highest global share, supported by strict vehicle theft prevention regulations and strong adoption of electronic immobilizers in passenger cars and SUVs. Automakers integrate advanced ECU-controlled locks, keyless entry systems, and encrypted communication to meet insurance and safety compliance. High production of premium vehicles and rising demand for connected car security strengthen OEM installation rates. The U.S. remains the largest market due to strong automotive electronics manufacturing, large vehicle fleets, and higher consumer spending on advanced safety features. Replacement demand and aftermarket upgrades further enhance regional growth.

Europe

Europe holds a significant market share driven by stringent anti-theft legislation, high adoption of digital steering locks in passenger cars, and strong presence of automotive OEMs. Germany, France, Italy, and the U.K. lead installations across premium and mid-segment vehicles. Automakers integrate column locks with keyless ignition, biometric access, and encrypted locking modules to meet safety standards. Growing electric vehicle sales and shift toward autonomous platforms accelerate demand for fully digital locks. Fleet operators and leasing companies adopt smart immobilization systems to protect vehicles from theft and unauthorized movement. Strong aftermarket channel boosts replacement and upgrade volumes.

Asia Pacific

Asia Pacific captures a fast-growing share of the Electrical Steering Column Lock market due to rising automotive production in China, Japan, South Korea, and India. OEMs install electromechanical and electronic locks across mass-market passenger cars, compact SUVs, and commercial fleets. Increased vehicle theft cases and insurance-driven security adoption support demand. Electric vehicle manufacturing expands rapidly, creating opportunities for digital and smart locks. Lower component costs, strong electronics supply chains, and production incentives help OEMs integrate locks in entry-level vehicles. Growing urbanization, vehicle ownership, and fleet operations make Asia Pacific the highest-growth regional market.

Latin America

Latin America holds a moderate market share, driven by rising theft incidents, insurance compliance, and increased use of immobilizers in passenger cars and motorcycles. Brazil and Mexico account for most installations due to expanding automotive manufacturing and higher penetration of electronic security systems. OEMs adopt electromechanical locks across compact and mid-range cars, while smart locks remain limited to premium models. Aftermarket upgrades increase as older vehicles require replacement of worn locking mechanisms. Expanding ride-sharing and fleet activity further boost adoption of electronic column locks for theft control and remote immobilization.

Middle East & Africa

The Middle East & Africa maintain a smaller yet expanding market share supported by rising security concerns, premium vehicle sales, and growth of connected car features. Gulf countries adopt electronic steering locks in luxury vehicles and high-value commercial fleets due to theft prevention needs. Local aftermarket demand rises as older vehicles switch from mechanical to electronic locks. South Africa shows increasing adoption in passenger vehicles and logistics fleets. While overall vehicle production remains limited, growing urban mobility solutions and demand for digital security features create long-term opportunities for OEM and aftermarket suppliers.

Market Segmentations:

By Application

- Personal Vehicles

- Commercial Vehicles

- Motorcycles

By Mechanism Type

- Electromechanical Lock

- Electronic Lock

- Smart Lock

By End Use

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electrical Steering Column Lock market remains highly competitive, with global automotive OEMs and tier-1 steering system suppliers focusing on product innovation, integration capabilities, and advanced digital security. Major participants invest in electromechanical and smart lock technologies that support ECU control, remote immobilization, and encrypted communication to prevent unauthorized steering movement. Companies strengthen partnerships with vehicle manufacturers to supply compact, lightweight locking modules compatible with electric power steering and keyless ignition systems. Premium vehicle platforms drive demand for biometric access, proximity sensing, and IoT-enabled locking features. Suppliers also expand aftermarket distribution through security system upgrades and replacement lock kits for aging vehicles. Firms compete on manufacturing cost, durability, integration with onboard electronics, and compliance with theft-prevention regulations. Growth of electric and autonomous vehicles pushes companies to develop software-driven steering locks, secure firmware, cybersecurity protocols, and OTA diagnostics. As regional automotive production expands, competition intensifies across North America, Europe, and Asia Pacific with new entrants targeting cost-efficient electronic locking units.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JTEKT Corporation (Japan)

- Hyundai Mobis (South Korea)

- Continental AG (Germany)

- MinebeaMitsumi Inc. (Japan)

- Nexteer Automotive (USA)

- Robert Bosch GmbH (Germany)

- Mando Corporation (South Korea)

- NSK Ltd. (Japan)

- Huf Hülsbeck & Fürst GmbH & Co. KG (Germany)

- ZF Friedrichshafen AG (Germany)

Recent Developments

- In February 2025, ZF Friedrichshafen AG began series production of its steer-by-wire technology with Chinese car manufacturer NIO. This technology eliminates the mechanical connection between the steering wheel and the front wheels, aligning with the industry’s shift towards electronic steering systems and the integration of electrical steering column locks.

- In August 2024, Nexteer Automotive introduced a new Modular Pinion-Assist Electric Power Steering (mPEPS) system, expanding its cost-effective, modular EPS offerings to include Single-Pinion and Dual-Pinion systems. This development enhances steering performance and supports the integration of electrical steering column locks in modern vehicles.

Report Coverage

The research report offers an in-depth analysis based on Application, Mechanism type, End use, Vehicle type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electronic and smart steering locks will rise as vehicle theft prevention laws tighten.

- Automakers will integrate encrypted communication and cybersecurity layers to block hacking attempts.

- Smart locks with remote immobilization and mobile app access will gain wider adoption in connected cars.

- Electric and hybrid vehicles will use more digital steering locks as mechanical ignition systems disappear.

- Fleet operators will install telematics-linked locks to track unauthorized movement and improve asset security.

- Biometric authentication features will expand in premium vehicles for keyless and driver-verified access.

- OEM installation rates will increase as compact, lightweight lock modules reduce manufacturing cost.

- Aftermarket upgrades will grow as older vehicles replace mechanical systems with electronic units.

- Suppliers will develop secure firmware and over-the-air diagnostic updates for connected steering locks.

- Asia Pacific will emerge as a high-growth market due to rising vehicle production and security adoption.