Market Overviews

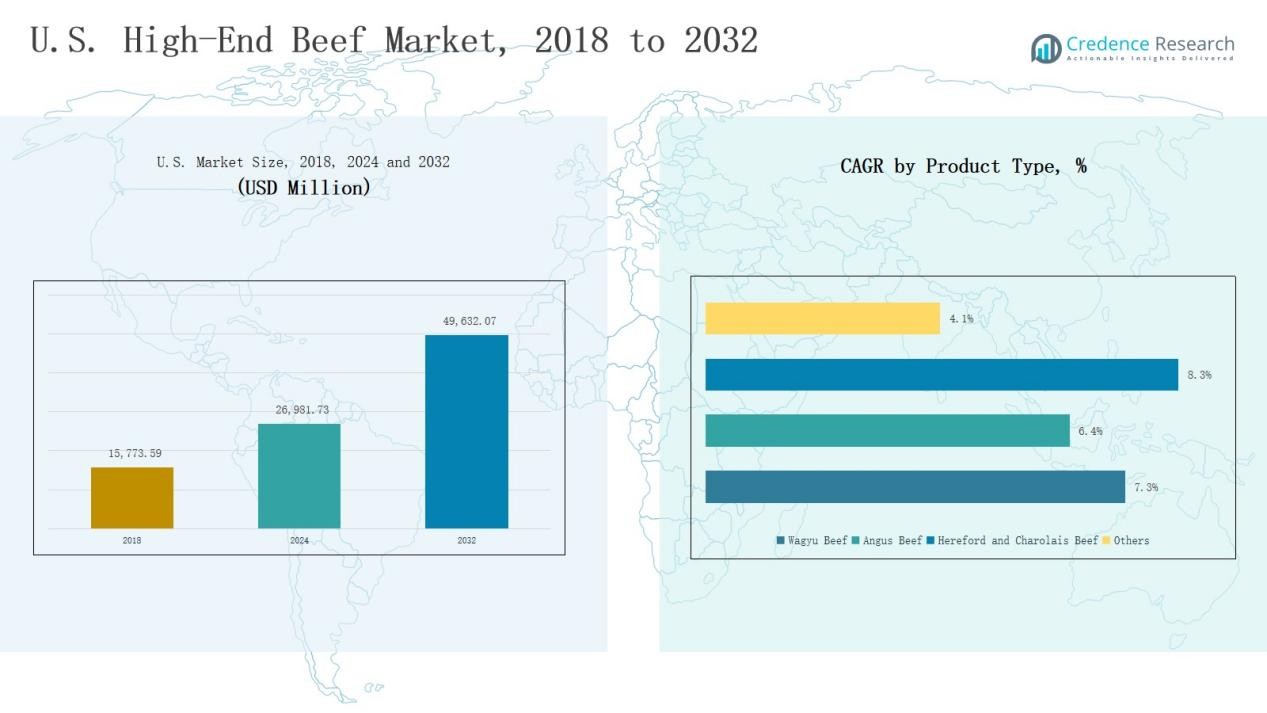

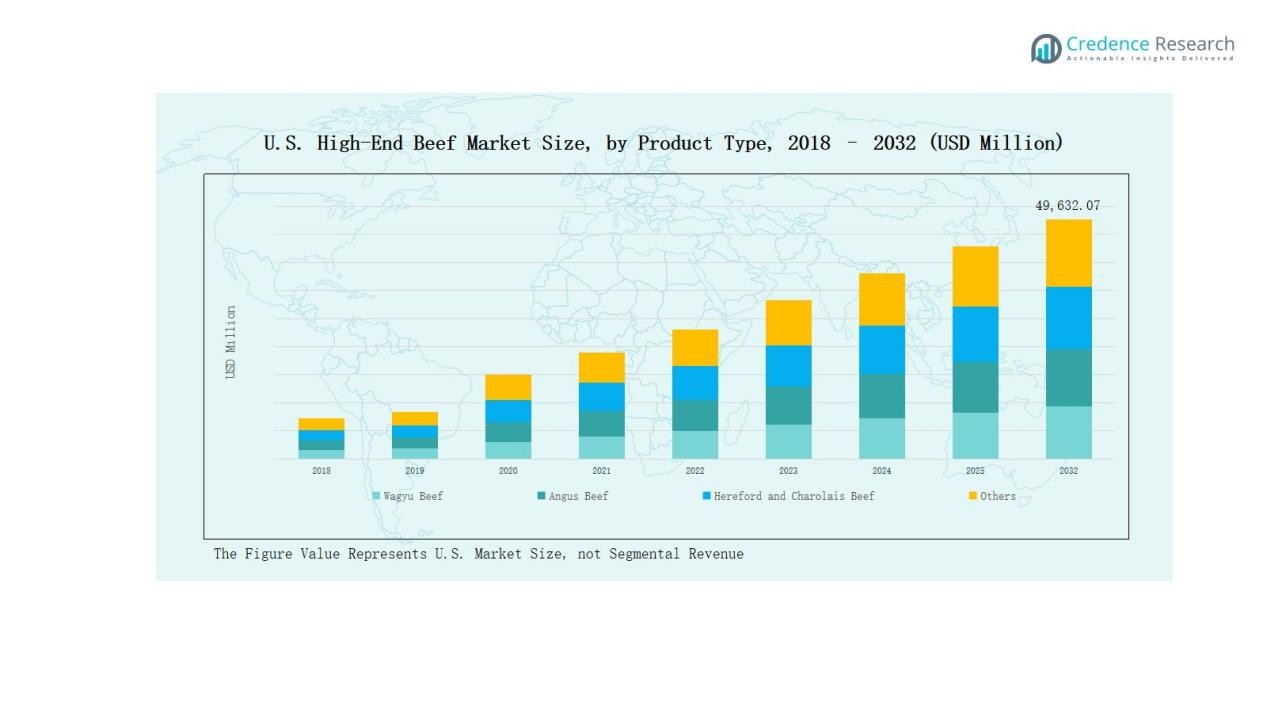

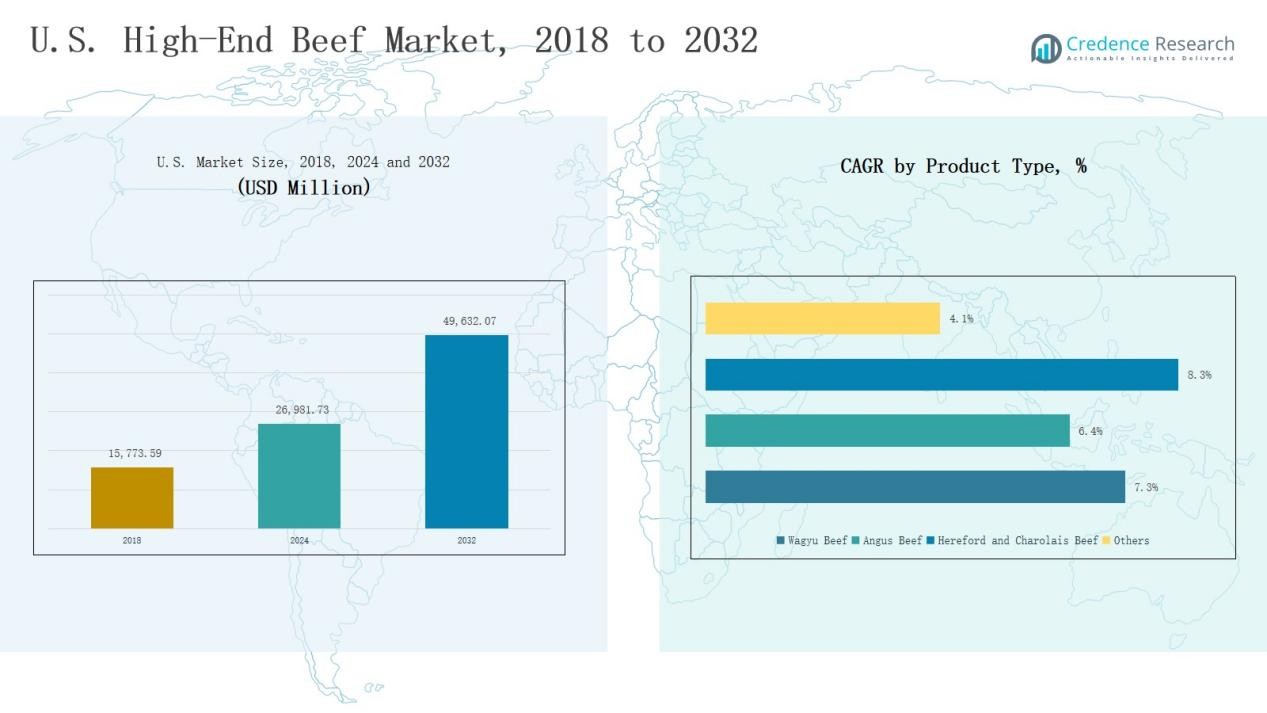

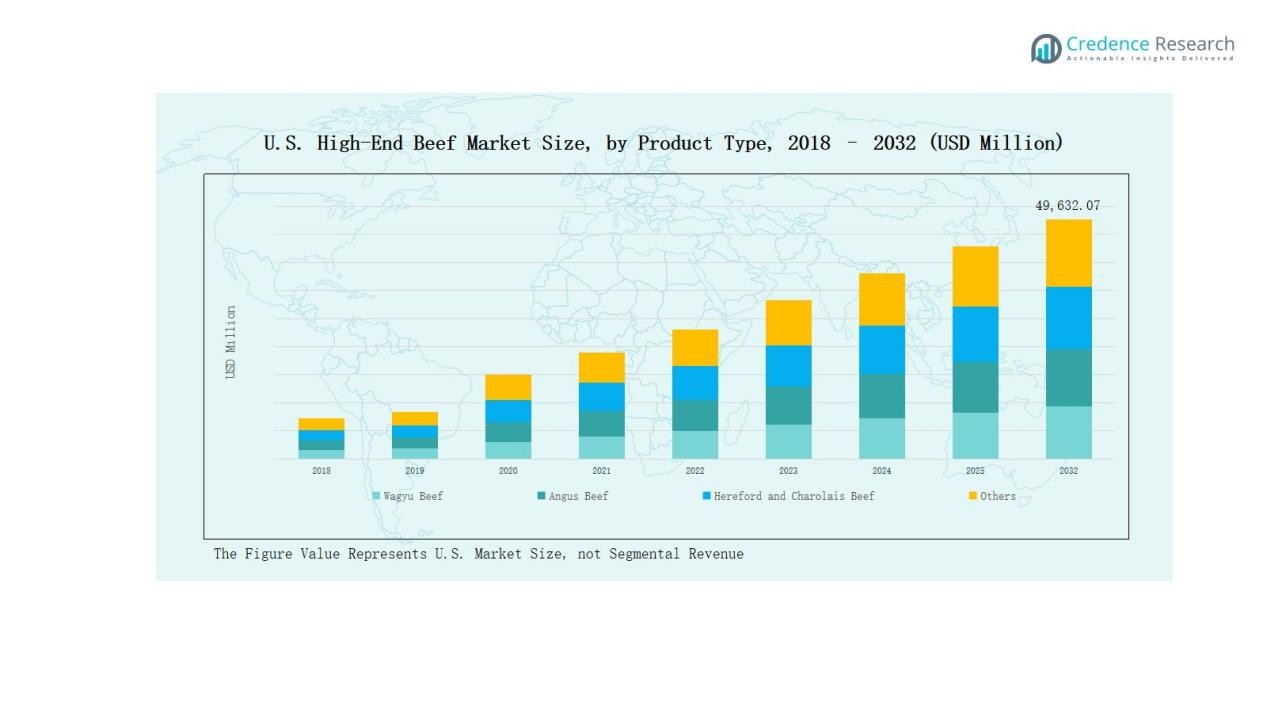

The U.S. High-End Beef Market size was valued at USD 15,773.59 million in 2018, grew to USD 26,981.73 million in 2024, and is anticipated to reach USD 49,632.07 million by 2032, expanding at a CAGR of 7.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. High-End Beef Market Size 2024 |

USD 26,981.73 Million |

| U.S. High-End Beef Market, CAGR |

7.37% |

| U.S. High-End Beef Market Size 2032 |

USD 49,632.07 Million |

The U.S. High-End Beef Market is led by prominent companies such as Cargill, Inc., National Beef Packing Company, LLC, Marfrig U.S. Foods S.A., Hormel Foods Corporation, Smithfield Foods, Inc., U.S. Premium Beef, LLC (USPB), and Holy Grail Steak Co. These players maintain a strong competitive position through integrated supply chains, advanced processing facilities, and premium product branding. They focus on superior breeding, consistent marbling, and sustainable sourcing to meet growing consumer expectations for quality and traceability. The South region emerged as the leading market in 2024, capturing a 30% share, supported by high consumption across luxury dining, tourism, and retail channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. High-End Beef Market grew from USD 15,773.59 million in 2018 to USD 26,981.73 million in 2024 and is projected to reach USD 49,632.07 million by 2032, at a CAGR of 7.37%.

- The South region led the market in 2024 with a 30% share, driven by luxury dining, tourism, and strong retail networks across Texas and Florida.

- Wagyu Beef dominated by product type with a 42% share in 2024, supported by premium quality, rich marbling, and rising demand in fine-dining restaurants.

- Specialty Butcher Shops accounted for a 40% share in distribution, reflecting consumer preference for curated, traceable, and fresh premium meat products.

- The Food Service Industry held a 58% share among end users, supported by growing demand from luxury hotels, steakhouses, and fine-dining establishments nationwide.

Market Segment Insights

By Product Type:

Wagyu Beef dominated the U.S. High-End Beef Market in 2024 with a 42% share, driven by its superior marbling, tenderness, and premium reputation among luxury consumers. Rising demand from fine-dining establishments and online gourmet meat platforms further boosts its popularity. Angus Beef followed with a 35% share, supported by widespread availability and consistent quality. Hereford and Charolais Beef maintained niche appeal due to traditional breeding lines preferred by select regional consumers.

- For instance, Snake River Farms introduced a new line of American Wagyu Gold Grade ribeyes tailored for upscale hospitality clients.

By Distribution Channel:

Specialty Butcher Shops led the distribution segment in 2024 with a 40% market share, owing to their personalized service, curated product selection, and emphasis on traceable sourcing. Consumers prefer these outlets for freshness and authenticity. Online Retail captured around 32% share, fueled by the rise in e-commerce, cold-chain logistics, and direct-to-home delivery. Supermarkets and hypermarkets continued to serve urban demand, though growth was slower due to limited premium inventory and shelf-space constraints.

- For instance, Whole Foods Market expanded its regional butchery programs but cited challenges in scaling local-sourced meat offerings beyond select metro locations.

By End User:

The Food Service Industry dominated the end-user segment in 2024 with a 58% share, driven by expanding fine-dining restaurants, steakhouses, and luxury hotel chains offering premium beef dishes. Growing emphasis on high-quality protein and gourmet dining experiences continues to strengthen this segment. Households accounted for nearly 34% share, supported by rising disposable income and the availability of portioned high-end beef cuts through online and specialty retail platforms.

Key Growth Drivers

Rising Demand for Premium and Gourmet Meat Products

Growing consumer preference for superior taste, texture, and quality has fueled strong demand for high-end beef across the U.S. market. Increasing disposable incomes and shifting dietary habits are pushing consumers toward premium meat experiences. The expansion of luxury dining outlets and online gourmet meat platforms further accelerates market growth. Consumers are also seeking authenticity and origin-based labeling, driving sales of traceable and ethically sourced beef varieties such as Wagyu and Angus.

- For instance, Creekstone Farms Premium Beef markets “Premium Black Angus” and “Natural Black Angus” lines through its processing and certification to appeal to consumers valuing breed traceability and high meat quality.

Expansion of E-Commerce and Direct-to-Consumer Channels

E-commerce growth has transformed how premium meat reaches consumers in the U.S. The emergence of specialized online retailers offering temperature-controlled logistics and quick delivery options enhances accessibility. Direct-to-consumer brands leverage digital platforms for personalized marketing, subscription services, and transparent sourcing. These developments expand the reach of high-end beef beyond urban markets, fostering convenience and customer loyalty among affluent and tech-savvy consumers seeking restaurant-quality beef at home.

- For instance, Pat LaFrieda has launched a “Direct to Home” meat channel, selling premium cuts straight to consumers via his website.

Growth in Fine-Dining and Hospitality Sectors

The expansion of luxury restaurants, hotels, and steakhouses has strengthened demand for premium beef cuts. Increasing tourism, corporate dining, and high-income clientele support higher consumption of gourmet meats. Chefs and restaurateurs emphasize quality sourcing, consistency, and flavor, creating steady demand for brands offering certified Wagyu and Angus varieties. This professional adoption has further reinforced brand recognition and premium positioning of high-end beef in the U.S. hospitality sector.

Key Trends & Opportunities

Shift Toward Sustainable and Ethically Sourced Beef

Sustainability has emerged as a key trend in the U.S. High-End Beef Market. Producers are adopting eco-friendly practices, such as grass-fed systems, carbon-neutral operations, and regenerative farming. Consumers increasingly value traceability and animal welfare, rewarding brands that promote transparency. Companies investing in sustainable packaging and low-emission logistics gain a competitive advantage. This shift aligns with broader environmental awareness and government initiatives encouraging responsible food production and sourcing.

- For instance, Cargill aims to reduce greenhouse gas intensity by 30% across its North American beef supply chain by 2030 through partnerships with farmers and regenerative agriculture programs.

Technological Integration in Meat Production and Supply Chains

Technological innovation is reshaping premium beef production and distribution. Advanced cold-chain systems, blockchain traceability, and precision feeding technologies enhance product quality and supply reliability. Automation in slaughtering and processing reduces waste and ensures consistency across batches. Brands using smart labeling and digital tracking offer greater transparency, boosting consumer confidence. These innovations provide opportunities for scalability and efficiency while maintaining the high standards expected from luxury meat brands.

- For instance, Zuoting Youyuan in China transports cattle up to 2,200 kilometers to company-owned slaughterhouses, ensuring each transport completes within 24 hours to maintain freshness.

Key Challenges

High Production and Operational Costs

Premium beef production involves high costs related to breeding, feed quality, and animal care. Maintaining superior marbling and tenderness requires intensive management and longer rearing cycles. These factors elevate retail prices, limiting accessibility to high-income consumers. Smaller producers often face margin pressures due to high feed costs and limited economies of scale. Volatility in input prices and logistics further strain profitability for both producers and distributors.

Supply Chain Constraints and Import Dependencies

The U.S. relies partly on imported Wagyu and other specialty beef varieties, exposing the market to international supply fluctuations. Global trade disruptions, transportation bottlenecks, and quarantine regulations can affect product availability. Maintaining consistent cold-chain conditions from processing to delivery also remains challenging. Such constraints impact reliability, increase operational costs, and can lead to uneven pricing across regions, affecting both retailers and end consumers seeking premium beef products.

Growing Competition from Alternative Proteins

The rise of plant-based and lab-grown meat alternatives poses a long-term challenge to the high-end beef segment. Health-conscious and environmentally aware consumers are exploring protein substitutes that claim lower carbon footprints. Marketing campaigns promoting “clean meat” options intensify competition, particularly in urban markets. While high-end beef retains strong cultural appeal, shifting dietary preferences and sustainability concerns could limit growth potential among younger demographics over the coming decade.

Regional Analysis

Northeast

The U.S. High-End Beef Market in the Northeast held a 22% share in 2024, supported by a dense population of high-income consumers and strong urban dining culture. Major cities such as New York and Boston drive demand for premium beef through fine-dining restaurants and boutique butcher shops. The region benefits from robust import channels for Wagyu and Angus beef, meeting luxury consumption patterns. Growth in e-commerce and home delivery services further expands consumer access to premium cuts. It continues to attract distributors investing in branded and traceable meat products.

Midwest

The Midwest accounted for a 26% market share in 2024, driven by extensive cattle farming and advanced meat processing infrastructure. States like Nebraska, Kansas, and Iowa serve as leading production hubs, ensuring consistent supply of Angus and Hereford beef. The region supports strong retail distribution networks and rising demand from local steakhouses. Consumers favor high-quality, locally sourced beef with sustainable and ethical production practices. It remains central to both domestic distribution and export of premium beef due to efficient logistics.

South

The South captured a 30% share in 2024, emerging as the dominant regional market. Rising household incomes and expanding luxury dining chains across Texas and Florida fuel consumption. The region’s cultural inclination toward grilled and smoked meats strengthens high-end beef demand. Increased penetration of specialty butcher shops and online delivery services supports accessibility. It continues to benefit from favorable trade conditions and strong tourism-driven hospitality demand for premium beef offerings.

West

The West held a 22% market share in 2024, supported by a strong premium food culture in states like California and Washington. Consumers in this region prioritize quality, origin certification, and sustainability, encouraging sales of organic and grass-fed beef. The concentration of gourmet restaurants and tech-driven food start-ups enhances product visibility and innovation. It also benefits from advanced cold-chain infrastructure and widespread adoption of online retail platforms. Rising preference for traceable and ethically produced beef continues to drive steady market growth across the region.

Market Segmentations:

By Product Type

- Wagyu Beef

- Angus Beef

- Hereford and Charolais Beef

- Others

By Distribution Channel

- Online Retail

- Specialty Butcher Shops

- Supermarkets/Hypermarkets

- Others

By End User

- Households

- Food Service Industry

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. High-End Beef Market is characterized by intense competition among established meat processors, premium beef producers, and specialized retailers. Leading companies such as Cargill, Inc., National Beef Packing Company, LLC, Marfrig U.S. Foods S.A., Hormel Foods Corporation, Smithfield Foods, Inc., U.S. Premium Beef, LLC (USPB), and Holy Grail Steak Co. dominate through vertically integrated operations, strong sourcing networks, and brand-driven marketing. These players focus on superior breeding programs, marbling consistency, and certified quality standards to maintain consumer trust. Investments in sustainable farming, advanced cold-chain logistics, and direct-to-consumer e-commerce platforms strengthen their market presence. Competition is further shaped by innovation in packaging, product diversification, and traceability solutions that appeal to health-conscious and ethical consumers. It continues to evolve with partnerships between producers and luxury restaurants, expanding domestic and export sales while reinforcing brand recognition in the premium meat industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In September 2025, American Farmers Network (AFN) acquired Open Range Beef, enhancing its domestic processing capacity and reinforcing its leadership in grass-fed and organic beef production.

- In March 2025, Creekstone Farms launched its new Irodori Wagyu line, showcasing premium Wagyu beef at the Annual Meat Conference 2025.

- In May 2025, Certified Angus Beef partnered with Sabatino to introduce co-branded products combining premium Angus beef with gourmet truffle ingredients.

- In May 2025, Legacy Beef Co-op partnered with Top Dollar Angus to launch a producer awareness program promoting high-value Angus genetics and premium beef quality.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium beef will grow due to rising consumer preference for gourmet dining experiences.

- Online retail platforms will expand their role in distributing high-end beef across urban and suburban regions.

- Sustainable and ethically sourced beef will gain stronger market traction among conscious consumers.

- Investments in cold-chain logistics will improve product freshness and nationwide distribution efficiency.

- Fine-dining restaurants and luxury hotels will continue driving sales of Wagyu and Angus beef.

- Branding and certification programs will enhance consumer trust and product differentiation.

- Domestic producers will focus on genetic improvement to match global premium beef standards.

- Partnerships between ranchers and digital food startups will strengthen traceability and transparency.

- Rising household income levels will support growing at-home consumption of high-end beef cuts.

- Innovation in packaging and preservation technology will extend shelf life and reduce waste.