Market Overview

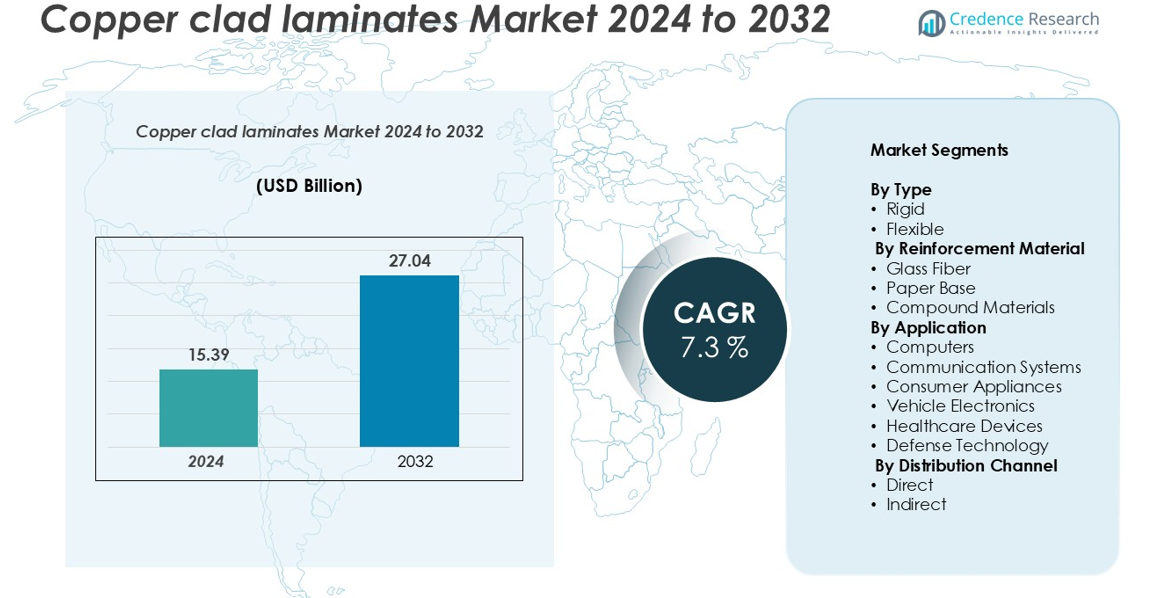

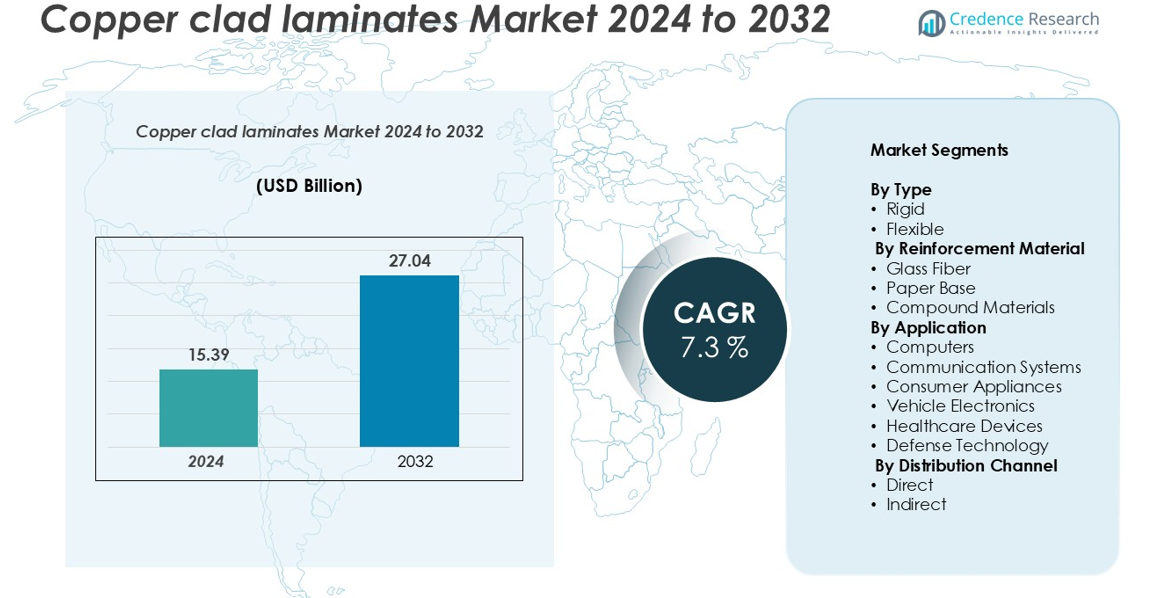

Copper Clad laminates market size was valued at USD 15.39 billion in 2024 and is anticipated to reach USD 27.04 billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Copper Clad laminates market Size 2024 |

USD 15.39 billion |

| Copper Clad laminates market, CAGR |

7.3% |

| Copper Clad laminates market Size 2032 |

USD 27.04 billion |

The Copper Clad Laminates market is led by prominent players such as Isola, ITEQ, Kingboard Laminates, Nan Ya Plastics, Panasonic Corporation, Rogers, Resonac, Shengyi Technology, Shandong Jinbao Electronics, Cipel Italia, Doosan Electro-Materials, and Guangdong Chaohua Technology. These companies maintain competitive advantages through advanced R&D, product innovation, and strong global distribution networks. Asia-Pacific emerges as the dominant region, holding over 40% of the market share, driven by large-scale electronics manufacturing in China, Japan, South Korea, and India. North America accounts for approximately 25% of the market, supported by high demand in computing, telecommunications, and automotive electronics. Europe contributes around 20% through robust automotive and industrial electronics sectors, while Latin America and the Middle East & Africa hold 8% and 7%, respectively, benefiting from growing consumer electronics, infrastructure projects, and emerging manufacturing hubs. These top players strategically expand across regions to strengthen market presence and capture growth opportunities.

Market Insights

- The Copper Clad Laminates market was valued at USD 15.39 billion in 2024 and is projected to reach USD 27.04 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

- Strong demand from consumer electronics, automotive electronics, and communication systems is driving market growth, with rigid laminates and glass fiber materials being the dominant sub-segments.

- Emerging trends include the adoption of flexible and high-density laminates, integration of eco-friendly materials, and growing opportunities in electric vehicles and 5G infrastructure.

- The market is highly competitive, led by key players such as Isola, ITEQ, Kingboard Laminates, Nan Ya Plastics, Panasonic Corporation, and Rogers, focusing on innovation, strategic partnerships, and expansion in regional hubs.

- Regionally, Asia-Pacific dominates with over 40% market share, followed by North America (25%), Europe (20%), Latin America (8%), and MEA (7%), supported by electronics manufacturing, automotive growth, and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Copper Clad Laminates market, segmented by type, comprises rigid and flexible laminates. Rigid laminates dominate the market, accounting for approximately 65% of the total share, driven by their extensive use in printed circuit boards (PCBs) for computers, communication devices, and automotive electronics. The high mechanical strength, dimensional stability, and cost-effectiveness of rigid laminates make them a preferred choice in large-scale electronic assemblies. Flexible laminates, although witnessing growing adoption in wearable electronics and compact devices, currently occupy a smaller share due to higher manufacturing complexity and cost considerations.

- For instance, in 2023, the global market for copper clad laminates (CCL) reached a certain significant value. Within this market, the rigid copper clad laminate segment was the largest contributor, accounting for over 82% of the total market share in 2023.

By Reinforcement Material

Glass fiber, paper base, and compound materials form the reinforcement material segment. Glass fiber-based laminates hold the leading position, representing nearly 70% of the market, owing to their excellent thermal resistance, dimensional stability, and superior electrical insulation properties. Paper-based laminates, typically used in low-cost consumer appliances, and compound materials, applied in specialized industrial devices, account for the remaining share. The demand for glass fiber laminates is further fueled by the growing need for high-performance PCBs in communication systems, healthcare devices, and automotive electronics, emphasizing durability and reliability.

- For instance, in 2024, glass fiber fabric-based copper clad laminates accounted for 70.12% of the market share, by reinforcement material.

By Application

In terms of application, the Copper Clad Laminates market spans computers, communication systems, consumer appliances, vehicle electronics, healthcare devices, and defense technology. The computer segment dominates, capturing over 40% of the market share, driven by the ongoing growth of PC and server production and high demand for miniaturized, high-performance PCBs. Communication systems and consumer appliances follow closely, benefiting from 5G adoption, IoT deployment, and smart device proliferation. Vehicle electronics and healthcare devices are witnessing accelerated growth due to electric vehicle adoption and the rise of medical electronics, highlighting innovation as a key market driver

Key Growth Drivers

Rising Demand for Consumer Electronics

The surge in consumer electronics, including smartphones, laptops, tablets, and wearable devices, is a major driver for the Copper Clad Laminates (CCL) market. High-performance and miniaturized printed circuit boards (PCBs) require reliable laminates that offer excellent thermal and electrical properties. As manufacturers aim to improve device performance and reduce size and weight, rigid and flexible CCLs are increasingly adopted. Additionally, growing internet penetration, digitalization, and the proliferation of smart home devices are boosting demand. The consumer electronics sector’s focus on innovation and faster product cycles directly supports sustained growth in the CCL market, emphasizing laminates that provide durability, heat resistance, and high signal integrity.

- For instance, EMC has developed advanced copper clad laminates tailored for high-frequency applications in consumer electronics. Their materials are optimized for 5G smartphones, tablets, wearable devices, and high-density interconnect (HDI) notebooks. These laminates are engineered to meet the stringent requirements of modern electronic devices, ensuring reliable performance in compact and high-speed environments.

Expansion in Automotive and Electric Vehicle Electronics

The rapid adoption of electric vehicles (EVs) and advanced automotive electronics is fueling demand for copper clad laminates. EVs and hybrid vehicles rely heavily on sophisticated PCBs for battery management, infotainment systems, and advanced driver-assistance systems (ADAS). Rigid and flexible laminates with high thermal conductivity and electrical insulation properties are essential to meet these requirements. The automotive industry’s push for lightweight and compact electronic components further enhances the need for advanced laminates. As global EV sales continue to rise and vehicles become increasingly connected, CCL manufacturers are capitalizing on this growing segment, ensuring consistent market expansion driven by innovation and stringent quality standards.

- For instance, Resonac Corporation (formerly Showa Denko Materials) has developed specialized copper clad laminates designed for automotive electronics. Their products are utilized in control devices and Advanced Driver-Assistance Systems (ADAS), which are critical for autonomous and safety-focused vehicle technologies. These laminates are engineered to withstand the harsh conditions within automotive environments, such as high temperatures and vibration, providing reliable performance and contributing to the advancement of automotive electronics.

Growth in Telecommunication and Data Infrastructure

The expansion of 5G networks, fiber-optic communication, and data centers is a significant growth driver for the Copper Clad Laminates market. High-frequency and high-speed PCBs are critical for communication devices, servers, and networking equipment. Laminates with low dielectric loss and superior signal integrity are increasingly preferred to handle high-frequency signals efficiently. As telecom operators invest in network upgrades and data centers expand to support cloud computing and IoT applications, the demand for advanced laminates rises. This growth is reinforced by the need for miniaturized and high-performance electronic circuits, positioning CCLs as a core material for modern telecommunication and networking infrastructure.

Key Trends & Opportunities

Adoption of Flexible and High-Density Laminates

Flexible and high-density copper clad laminates are emerging as a notable trend in the market. Flexible laminates enable compact designs in wearable electronics, foldable devices, and automotive applications, while high-density laminates support miniaturized PCBs with complex circuitry. Manufacturers are increasingly investing in R&D to improve thermal performance, signal integrity, and mechanical strength of these advanced laminates. This trend opens opportunities for innovative applications across consumer electronics, healthcare devices, and electric vehicles. Additionally, as industries demand lighter, thinner, and more reliable electronic assemblies, flexible and high-density CCLs are expected to gain a larger share, driving long-term market growth.

- For instance, DuPont’s Pyralux® TK copper-clad laminate features a proprietary layered dielectric comprising Kapton® polyimide and fluoropolymer films, achieving a very low dielectric loss (Df = 0.0015–0.002 @ 10 GHz) and high heat resistance (decomposition temperatures typically above 494°C). This makes it ideal for high-frequency, high-speed digital applications

Integration with Sustainable and Eco-Friendly Materials

Sustainability is becoming a crucial trend in the Copper Clad Laminates market, with manufacturers exploring eco-friendly and recyclable materials. The shift toward greener production processes, reduced use of hazardous chemicals, and energy-efficient manufacturing aligns with global environmental regulations. This trend presents opportunities to develop laminates that combine high performance with sustainability credentials, catering to environmentally conscious customers. Companies adopting these practices can differentiate themselves in competitive markets, particularly in consumer electronics and automotive sectors, where sustainability is increasingly influencing purchasing decisions.

- For instance, Jiva Materials Ltd has developed Soluboard®, which it claims is the world’s first fully recyclable rigid PCB substrate. The material can be dissolved using hot water (specifically, 90°C water) within a controlled environment, enabling easy recovery of valuable components and metals. This technology offers up to a 67% lower carbon footprint compared to traditional glass-fiber and epoxy technologies (FR-4), a figure supported by Life Cycle Assessments performed in collaboration with the University of Portsmouth.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present significant opportunities for the CCL market. Increasing electronics manufacturing hubs, rising disposable incomes, and government initiatives to support digital infrastructure are driving local demand. Companies are leveraging these regions to expand production facilities, reduce costs, and meet regional demand. The growing adoption of smartphones, IoT devices, and electric vehicles in these markets offers a strategic opportunity for CCL manufacturers to capture new customer segments and enhance global market presence.

Key Challenges

Volatility in Raw Material Prices

Copper and resin prices significantly impact the production cost of Copper Clad Laminates. Fluctuations in global copper markets, supply chain disruptions, and rising resin costs can adversely affect profitability. Manufacturers often face challenges in maintaining stable pricing while ensuring quality standards. Small and medium-sized producers may struggle to absorb cost increases, leading to competitive pressures. This volatility can also influence end-product prices in electronics, potentially impacting overall demand growth. Managing raw material procurement, optimizing production efficiency, and strategic sourcing are essential to mitigate these risks.

Stringent Regulatory and Environmental Compliance

The CCL industry faces challenges related to strict environmental regulations, including limits on hazardous substances and waste management standards. Compliance with RoHS, REACH, and other environmental directives requires investment in sustainable production processes and monitoring systems. Failure to meet these standards can result in penalties, supply chain disruptions, or restricted market access. Additionally, the pressure to develop eco-friendly products while maintaining high performance increases operational complexity. Manufacturers must balance innovation, regulatory compliance, and cost efficiency to remain competitive in the global market.

Regional Analysis

North America

North America holds a significant share of the Copper Clad Laminates market, accounting for approximately 25% of global revenue. The region benefits from advanced electronics manufacturing, widespread adoption of high-performance computing systems, and the growing automotive electronics sector. Continuous investments in 5G infrastructure and defense technology drive demand for high-quality laminates. The presence of leading semiconductor and PCB manufacturers, coupled with stringent quality standards, supports market growth. Increasing demand for compact, reliable electronic devices and expansion of data centers further reinforce North America’s position as a key regional market for CCLs.

Europe

Europe captures around 20% of the global Copper Clad Laminates market, driven by robust automotive and industrial electronics sectors. The adoption of electric and hybrid vehicles, coupled with rising investments in renewable energy and smart grid technologies, fuels demand for high-performance laminates. Stringent regulatory frameworks on environmental sustainability encourage manufacturers to develop eco-friendly CCLs. Key industries, including defense, healthcare, and telecommunications, are adopting advanced PCBs that rely on durable and thermally stable laminates. Europe’s focus on research, innovation, and high-quality production standards ensures steady growth in the regional CCL market.

Asia-Pacific

Asia-Pacific dominates the global Copper Clad Laminates market with a share exceeding 40%, fueled by large-scale electronics manufacturing hubs in China, Japan, South Korea, and India. High demand for consumer electronics, smartphones, automotive electronics, and industrial automation drives rapid growth. Expanding 5G networks, increasing adoption of electric vehicles, and government initiatives promoting digital infrastructure further support the market. Competitive manufacturing costs, availability of raw materials, and strong presence of leading CCL producers consolidate the region’s market leadership. Continuous technological advancements and rising urbanization create additional opportunities for market expansion in the Asia-Pacific region.

Latin America

Latin America holds approximately 8% of the Copper Clad Laminates market, supported by growing electronics manufacturing and communication infrastructure development. Expansion of consumer electronics, automotive electronics, and industrial automation is creating steady demand for high-quality laminates. Countries like Brazil and Mexico are investing in smart city projects and renewable energy initiatives, which indirectly boost PCB applications. Market growth is also driven by the presence of regional distributors and increasing awareness of advanced electronic solutions. While the region faces some supply chain and raw material cost challenges, emerging manufacturing facilities and technology adoption offer growth potential for CCLs.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for around 7% of the global Copper Clad Laminates market. Growth is primarily driven by defense, telecommunications, and infrastructure development projects. Increasing government investments in smart cities, industrial automation, and energy-efficient electronics support demand for advanced laminates. While the market is relatively smaller compared to Asia-Pacific and North America, emerging electronics manufacturing hubs and foreign investments are creating new opportunities. Adoption of high-performance laminates in healthcare devices, automotive electronics, and communication systems is expected to expand, with focus on durability, thermal stability, and regulatory compliance driving regional market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

By Reinforcement Material

- Glass Fiber

- Paper Base

- Compound Materials

By Application

- Computers

- Communication Systems

- Consumer Appliances

- Vehicle Electronics

- Healthcare Devices

- Defense Technology

By Distribution Channel

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Copper Clad Laminates market is highly competitive, characterized by the presence of global and regional players focusing on innovation, product differentiation, and strategic partnerships. Leading companies such as Isola, ITEQ, Kingboard Laminates, Nan Ya Plastics, Panasonic Corporation, and Rogers dominate the market, leveraging advanced R&D capabilities and strong distribution networks to maintain their market positions. Regional players, including Shengyi Technology, Shandong Jinbao Electronics, Cipel Italia, Doosan Electro-Materials, and Guangdong Chaohua Technology, compete by offering cost-effective solutions and catering to local demand. Companies are increasingly investing in high-performance laminates, flexible substrates, and eco-friendly materials to address evolving customer requirements in consumer electronics, automotive, telecommunications, and industrial applications. Strategic initiatives such as mergers, acquisitions, capacity expansions, and collaborations further intensify competition, while continuous innovation and quality improvement remain critical to sustaining long-term growth and market leadership.

Key Player Analysis

- Isola

- ITEQ

- Kingboard Laminates

- Nan Ya Plastics

- Panasonic Corporation

- Resonac

- Rogers

- Shandong Jinbao Electronics

- Shengyi Technology

- Cipel Italia

- Doosan Electro-Materials

- Guangdong Chaohua Technology

Recent Developments

- In June 2023, Doosan Corporation announced a strategic partnership with Vietnam’s Hai Duong province to explore new business opportunities in advanced electro-material manufacturing. The collaboration was formalized through a Memorandum of Understanding (MOU) signed in Hanoi, coinciding with South Korean President Yoon Suk Yeol’s state visit to Vietnam. This partnership underscores Doosan’s strategic focus on expanding its presence in the global electro-materials market and aligns with Vietnam’s goals of attracting foreign investment to boost economic development.

- In June 2023, Doosan Corporation Electro-Materials showcased its innovative products and technologies aimed at enhancing the customer experience in the 5G era and beyond. This presentation took place at IMS 2023, North America’s largest Microwave/RF trade show. During the event, Doosan highlighted its advancements in 5G millimeter-wave (mmWave) antenna modules, a MEMS timing solution, and copper clad laminates (CCL) designed for high-speed and high-frequency applications. These technologies underscore Doosan’s commitment to providing next-generation solutions for improved connectivity and advanced electronic performance.

Report Coverage

The research report offers an in-depth analysis based on Type, Reinforcement Material, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance laminates will increase with the growth of consumer electronics.

- Flexible and high-density laminates will see higher adoption in compact devices and wearable technology.

- Automotive electronics, including electric and hybrid vehicles, will drive sustained market growth.

- Expansion of 5G networks and advanced communication systems will boost demand for reliable PCBs.

- Manufacturers will focus on eco-friendly and recyclable laminates to meet environmental regulations.

- Technological advancements in thermal management and signal integrity will create new product opportunities.

- Emerging markets in Asia-Pacific, Latin America, and MEA will offer significant growth potential.

- Strategic collaborations, mergers, and capacity expansions will intensify market competition.

- Rising investment in smart devices, IoT, and industrial automation will increase CCL adoption.

- Continuous innovation and quality enhancement will remain critical to maintain market leadership.