Market Overview:

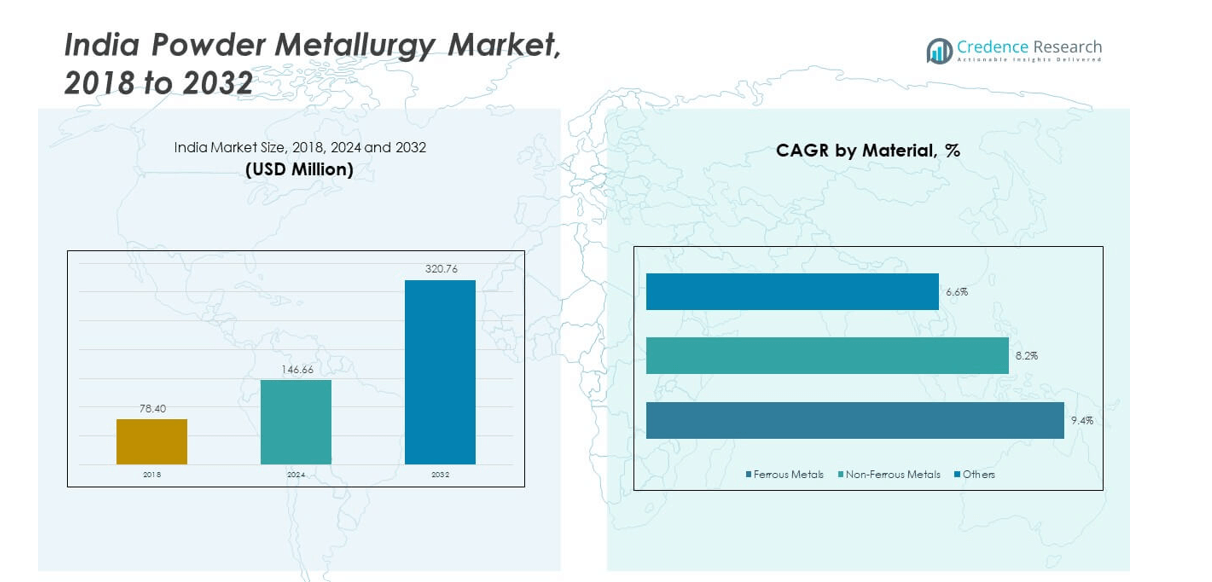

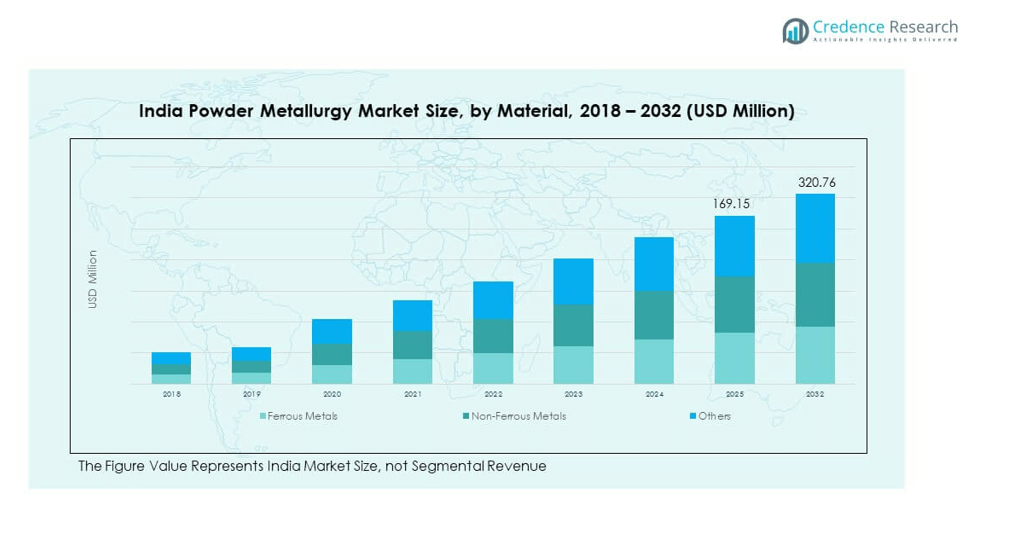

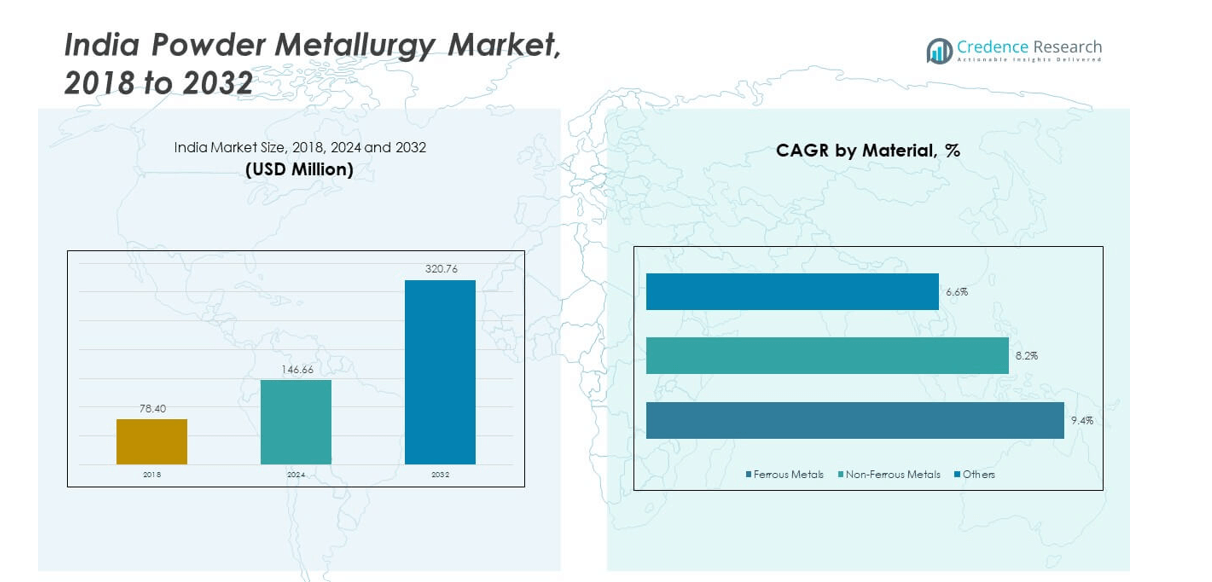

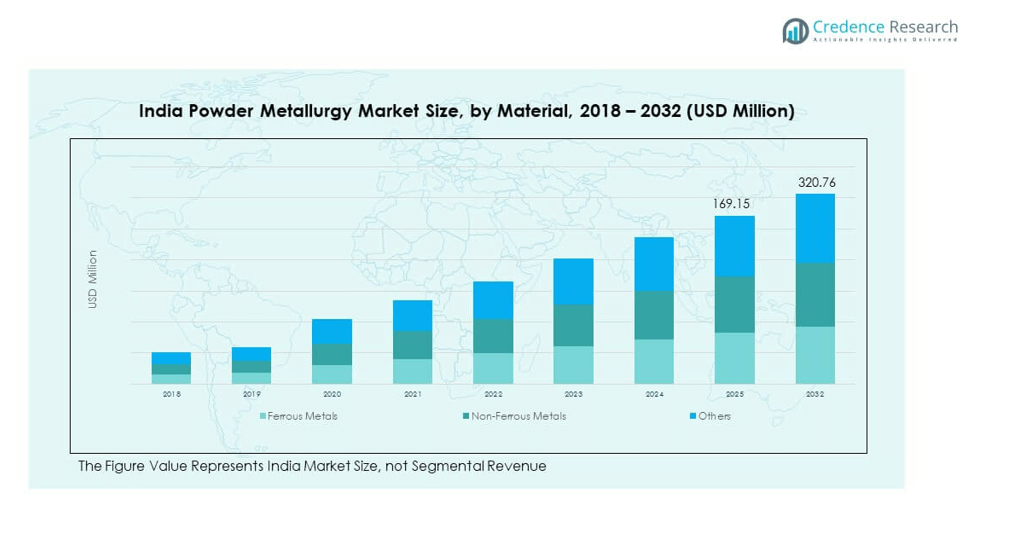

The India Powder Metallurgy Market size was valued at USD 78.40 million in 2018, reached USD 146.66 million in 2024, and is anticipated to reach USD 320.76 million by 2032, growing at a CAGR of 9.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Powder Metallurgy Market Size 2024 |

USD 146.66 million |

| India Powder Metallurgy Market, CAGR |

9.57% |

| India Powder Metallurgy Market Size 2032 |

USD 320.76 million |

The market growth is driven by rising demand from automotive, aerospace, and industrial machinery sectors. Powder metallurgy offers high precision, reduced material waste, and cost efficiency, making it an ideal choice for producing complex components. Expanding adoption of lightweight materials and advancements in metal powders such as iron, copper, and aluminum further strengthen market expansion. The increasing use of additive manufacturing technologies and electric vehicle production is also creating new opportunities for powder metallurgy applications across India.

Geographically, western and southern regions of India are the key growth hubs due to their strong automotive and manufacturing bases. Maharashtra, Tamil Nadu, and Gujarat lead market adoption owing to the presence of major automotive OEMs and component suppliers. Northern regions are emerging markets supported by industrial diversification and infrastructure expansion. Continuous investments in industrial automation and government initiatives like “Make in India” further accelerate regional adoption and technological development in powder metallurgy production.

Market Insights:

- The India Powder Metallurgy Market was valued at USD 78.40 million in 2018, reached USD 146.66 million in 2024, and is projected to reach USD 320.76 million by 2032, growing at a CAGR of 9.57% during the forecast period.

- The Western region led the market with a 38% share due to strong automotive and engineering manufacturing in Maharashtra and Gujarat, while the Southern region followed with 32%, supported by aerospace and electronics production in Tamil Nadu and Karnataka. The Northern and Eastern regions collectively held 30%, driven by infrastructure development and industrial diversification.

- The Southern region is the fastest-growing area, capturing 32%, fueled by rising investments in aerospace, electronics, and industrial machinery production, supported by favorable state policies and skilled labor.

- Ferrous metals accounted for the largest segment share at around 58% in 2024, supported by their strength, availability, and dominance in automotive and machinery components.

- Non-ferrous metals represented approximately 30% of the market, driven by growing demand for lightweight materials such as aluminum and copper in aerospace and electrical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Automotive and Industrial Manufacturing Sectors

The India Powder Metallurgy Market is expanding rapidly due to strong demand from automotive and industrial machinery manufacturers. Powder metallurgy enables the production of precision components such as gears, bearings, and bushings with minimal material waste. The increasing focus on lightweight and fuel-efficient vehicles is pushing automakers to adopt metal powder-based components for structural and functional parts. It benefits from the rising production of electric and hybrid vehicles that require compact, durable, and heat-resistant materials. Industrial equipment producers also prefer this technology for its cost-effectiveness and design flexibility. Government incentives for local manufacturing and the adoption of clean energy vehicles further strengthen demand. Continuous advancements in sintering and compaction processes enhance product performance and widen its industrial use.

Technological Advancements and Integration of Additive Manufacturing Processes

The growth of additive manufacturing and 3D printing is reshaping powder metallurgy applications across India. Integration of advanced metal powders and sintering technologies allows complex geometries and near-net-shape products. The India Powder Metallurgy Market gains from improved efficiency, reduced production time, and the ability to use various alloys. It supports small-scale manufacturers in producing custom parts for automotive, aerospace, and defense industries. Advancements in digital design and hybrid manufacturing platforms increase precision and repeatability. The growing presence of R&D centers and collaborations with global players accelerate innovation. Companies are investing in advanced atomization and surface treatment processes to ensure superior powder consistency. This technological evolution continues to make powder metallurgy more versatile and sustainable.

- For instance, Hindustan Aeronautics Limited (HAL) signed an MoU with Wipro 3D to adopt metal 3D printing in aerospace, with the collaboration producing airworthy and near-net shape engine components for aircraft applications.

Expanding Infrastructure and Industrialization Stimulating Metal Component Demand

Rapid urbanization and infrastructure projects across India are creating new growth avenues for powder metallurgy products. The demand for machinery, power tools, and heavy-duty equipment supports the widespread use of powder metallurgy components. It benefits from cost savings, material efficiency, and strength characteristics ideal for large-scale industrial operations. The growing infrastructure investment under national programs such as Smart Cities Mission and Make in India fosters domestic manufacturing. Industrial zones in Gujarat, Maharashtra, and Tamil Nadu serve as major production hubs for mechanical and engineering parts. Rising demand from construction equipment manufacturers enhances the need for wear-resistant and durable metal parts. This trend strengthens domestic supply chains and reduces dependence on imports.

Shift Toward Energy Efficiency and Sustainable Manufacturing Practices

Sustainability has become a key driver for adopting powder metallurgy across multiple industries. The process minimizes scrap waste and energy consumption compared to traditional casting and machining methods. The India Powder Metallurgy Market aligns with corporate goals focused on low-carbon manufacturing and green production. It offers efficient material usage and recyclability of metal powders, improving environmental performance. Increasing awareness of sustainable industrial practices among OEMs enhances technology adoption. Renewable energy sectors and electric mobility producers prefer powder metallurgy for energy-efficient parts. Continuous research into bio-based lubricants and eco-friendly binders further improves sustainability. This focus on resource efficiency supports long-term industry growth and global competitiveness.

Market Trends:

Growing Adoption of Electric Vehicles and Lightweight Automotive Components

The transition toward electric mobility is creating a significant trend in the India Powder Metallurgy Market. Manufacturers are increasingly using powder metallurgy to produce lightweight, high-strength components for electric powertrains. It enables reduced vehicle weight and improved energy efficiency, supporting national emission reduction goals. The technology is being integrated into EV motor parts, battery housings, and structural connectors. Automotive OEMs are partnering with powder producers to develop custom alloys optimized for thermal and magnetic performance. The push for domestic EV manufacturing under FAME and other government programs supports rapid adoption. The demand for reliable, corrosion-resistant, and cost-effective materials strengthens this trend across automotive supply chains.

- For instance, Tata Motors’ Nexon EV, one of India’s top-selling electric vehicles, uses advanced motor components and supports increased domestic value addition through powder metallurgy-related supply chains.

Increased Use of Metal Powders in Aerospace and Defense Applications

Rising investments in aerospace and defense manufacturing are fueling demand for precision metal components. Powder metallurgy offers lightweight and heat-resistant solutions suitable for aircraft engines, turbines, and weapon systems. The India Powder Metallurgy Market benefits from the ongoing expansion of domestic aerospace production under the Atmanirbhar Bharat initiative. It helps local manufacturers achieve design flexibility and maintain performance standards for complex structures. Aerospace suppliers use titanium, nickel, and superalloy powders for enhanced mechanical strength and fatigue resistance. The integration of advanced powder processing and controlled sintering ensures high reliability. Strategic collaborations between defense PSUs and private metal producers are expanding market scope in this segment.

- For instance, HAL’s HTFE-25 engine program utilizes nickel-based superalloy and titanium alloy components, produced in collaboration with domestic and private sector partners, to meet performance standards for aircraft engines under the Atmanirbhar Bharat initiative.

R&D Investments in Advanced Materials and Surface Engineering Technologies

Research in advanced alloys and nanostructured powders is accelerating across Indian institutions and private firms. Companies are exploring materials like tungsten, molybdenum, and stainless steel for superior hardness and conductivity. The India Powder Metallurgy Market gains from innovations in particle size distribution and coating technologies. It supports product customization across electronics, biomedical, and tooling applications. Developments in cold spray deposition, thermal spraying, and plasma sintering are improving surface strength and durability. The rise of public-private partnerships in materials science is expanding R&D capacity. Enhanced powder atomization techniques enable uniformity and purity essential for high-performance applications. These advancements are positioning India as a competitive materials manufacturing hub.

Automation and Digitalization in Powder Metallurgy Manufacturing Lines

Automation and Industry 4.0 technologies are transforming powder metallurgy production efficiency. Smart manufacturing tools enable real-time monitoring, quality control, and predictive maintenance. The India Powder Metallurgy Market is adopting robotics and AI-driven analytics for process optimization. It helps manufacturers minimize human error and ensure consistent material properties across batches. Integration of digital twins and machine learning supports design simulation and process calibration. Indian firms are modernizing plants to meet international quality benchmarks. Adoption of IoT-based data collection systems improves traceability and reduces downtime. This digital shift enhances productivity, profitability, and global export potential for domestic producers.

Market Challenges Analysis:

High Production Costs and Limited Technological Standardization Across Industries

The India Powder Metallurgy Market faces challenges related to high production and material costs. The cost of atomized metal powders, equipment maintenance, and energy consumption limits adoption among small and medium enterprises. It struggles with inconsistent technological standards and lack of interoperability between manufacturing systems. Limited awareness of process optimization also reduces yield efficiency. Dependence on imported powders adds cost volatility and supply chain risks. Many local manufacturers face financial constraints to invest in advanced sintering and additive systems. Lack of trained operators and precision equipment hinders large-scale commercialization. Addressing these structural inefficiencies is essential to ensure competitiveness and scalability.

Raw Material Availability, Quality Concerns, and Supply Chain Limitations

Supply chain fragmentation and inconsistent raw material quality are major constraints on growth. The availability of high-grade metal powders and specialized binders remains limited within India. The India Powder Metallurgy Market is dependent on imports from Europe and East Asia for critical alloy materials. It creates delays, price fluctuations, and dependence on external suppliers. Local powder production capacity needs major expansion to reduce reliance on foreign inputs. Quality assurance across small producers also varies due to limited certification systems. Transportation inefficiencies and storage issues affect powder consistency. Building strong domestic supply chains and certification standards will enhance reliability and market stability.

Market Opportunities:

Emerging Applications in Electric Mobility, Renewable Energy, and Medical Devices

The shift toward electric mobility and renewable energy generation opens new market opportunities. Powder metallurgy supports lightweight, high-efficiency parts for motors, batteries, and turbines. The India Powder Metallurgy Market is positioned to benefit from component demand in EVs and wind energy systems. It also finds applications in orthopedic implants and dental tools, offering precision and biocompatibility. Growing investments in clean energy and healthcare infrastructure accelerate product diversification. Local manufacturers expanding into specialty alloys and nanometal powders will gain a competitive edge. These emerging industries promise long-term growth and innovation-led expansion.

Government Support and Growing Industrial Ecosystem for Advanced Manufacturing

India’s industrial modernization and supportive policy landscape create favorable conditions for growth. The government’s focus on self-reliance and local production encourages powder metallurgy adoption across automotive, defense, and machinery sectors. The India Powder Metallurgy Market benefits from PLI schemes and R&D funding that promote advanced manufacturing. It aligns with the broader goals of import substitution and technological self-sufficiency. Expansion of industrial parks and collaborations with foreign technology providers enhance capability building. Training initiatives in metallurgy and materials science are improving workforce quality. These efforts collectively strengthen domestic competitiveness and export potential.

Market Segmentation Analysis:

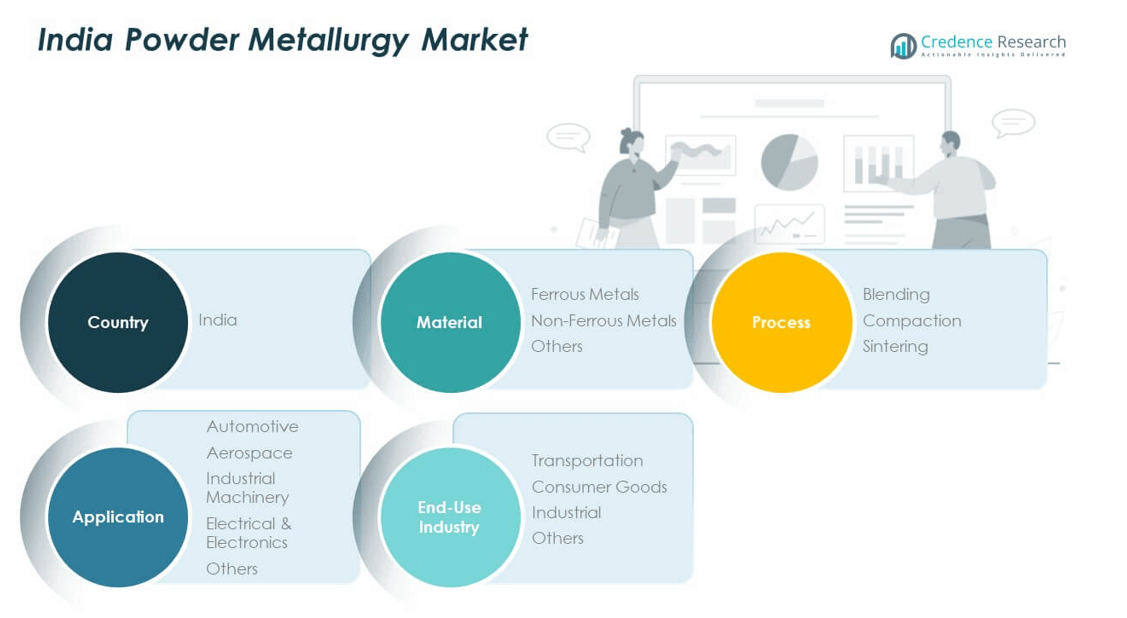

By Material

The India Powder Metallurgy Market is categorized into ferrous metals, non-ferrous metals, and others. Ferrous metals dominate due to their strength, cost-effectiveness, and widespread use in automotive and machinery components. Non-ferrous metals such as aluminum, copper, and titanium are gaining traction in aerospace and electronics for their lightweight and corrosion-resistant properties. The others segment includes specialty alloys used in precision and high-temperature applications. The growing demand for performance materials supports ongoing innovation in powder composition and treatment methods.

- For instance, Vedanta Aluminium launched AI-powered drones for mine safety and monitoring, highlighting the adoption of aluminum-based alloys in advanced industrial and technological uses.

By Process

The market is segmented into blending, compaction, and sintering processes. Sintering holds the largest share due to its ability to produce high-density and durable components with superior mechanical properties. Compaction follows closely, favored for achieving uniformity and dimensional accuracy in metal parts. Blending is essential for ensuring consistent powder composition, which enhances product quality and reduces defects. It benefits from technological advancements that improve efficiency and material utilization across industries.

- For instance, Sundram Fasteners has secured significant contracts for supplying electric vehicle parts to global automakers, with a focus on advanced compaction and powder metallurgy techniques in its Indian manufacturing operations.

By Application

Key applications include automotive, aerospace, industrial machinery, electrical and electronics, and others. The automotive sector leads due to demand for lightweight, wear-resistant components like gears, pistons, and bearings. Aerospace applications are expanding with precision parts for engines and airframes. Industrial machinery and electronics rely on powder metallurgy for its precision and cost efficiency.

By End-Use Industry

End-use industries include transportation, consumer goods, industrial, and others. Transportation dominates due to high vehicle production and EV adoption. Industrial applications are growing with increased manufacturing automation and infrastructure development. It continues to evolve with innovations aligning to sustainability and efficiency goals.

Segmentation:

By Material:

- Ferrous Metals

- Non-Ferrous Metals

- Others

By Process:

- Blending

- Compaction

- Sintering

By Application:

- Automotive

- Aerospace

- Industrial Machinery

- Electrical & Electronics

- Others

By End-Use Industry:

- Transportation

- Consumer Goods

- Industrial

- Others

By Country:

- India (Country-wise analysis across material, process, application, and end-use categories)

Regional Analysis:

Western Region – Industrial and Automotive Manufacturing Hub (38% Share)

The western region holds the dominant 38% share of the India Powder Metallurgy Market, driven by strong automotive, engineering, and metal component manufacturing in Maharashtra and Gujarat. The presence of major automobile OEMs, tier-1 suppliers, and metal producers supports large-scale adoption of powder metallurgy. Industrial clusters around Pune and Aurangabad lead in producing gears, bearings, and sintered parts. It benefits from robust infrastructure, skilled labor, and proximity to ports, enhancing raw material and export logistics. Increasing EV production and adoption of green manufacturing technologies further strengthen regional competitiveness. Research collaborations between industry and academia also boost technological advancement and material innovation.

Southern Region – Expanding Aerospace and Electronics Manufacturing Base (32% Share)

The southern region contributes around 32% of the market, supported by rapid industrial growth across Tamil Nadu, Karnataka, and Telangana. Aerospace, electronics, and industrial machinery sectors are key contributors to powder metallurgy adoption. The region houses major aerospace parks, defense production units, and electronic manufacturing zones driving precision metal component demand. It also benefits from the presence of international R&D centers and start-ups focusing on additive manufacturing. Favorable state policies, skilled technical workforce, and expanding supplier networks sustain long-term growth. The India Powder Metallurgy Market gains strong traction here due to the rising use of high-performance alloys in advanced manufacturing.

Northern and Eastern Regions – Emerging Growth Frontiers (30% Combined Share)

Northern and eastern India collectively account for about 30% of the market, emerging as new frontiers for industrial expansion. States such as Haryana, Uttar Pradesh, and West Bengal are investing in auto component parks and industrial corridors. Growing urbanization, infrastructure development, and small-scale manufacturing units stimulate powder metallurgy applications. It benefits from increasing government focus on localized production and investment incentives under the “Make in India” initiative. The presence of foundries and machine part producers enhances material demand consistency. Eastern states are gradually developing metallurgical industries to supply regional machinery and construction sectors. Together, these regions hold strong potential for future capacity expansion and domestic supply chain strengthening.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The India Powder Metallurgy Market features strong competition among domestic and international manufacturers focusing on automotive, aerospace, and industrial applications. Key players include Sumitomo Electric Industries, Ltd., Sandvik AB, JFE Steel Corporation, Showa Denko K.K., and Daido Steel Co., Ltd. They emphasize product innovation, R&D investment, and strategic partnerships to strengthen market presence. It benefits from technology transfer, joint ventures, and rising collaborations between Indian and global firms. Market players are expanding local production facilities and optimizing powder supply chains to reduce dependency on imports and enhance cost efficiency.

Recent Developments:

- In August 2025, Sandvik AB entered a strategic partnership with Additive Industries, directly supplying high-quality metal powder using their Powder Load Tool (PLT) for additive manufacturing systems.

- In August 2025, JFE Steel Corporation, in partnership with JSW Steel, announced the completion of a major acquisition and investment for expanding the manufacturing capacity of electrical steel sheet in India.

- In May 2025, Daido Steel Co., Ltd. resolved to acquire all outstanding shares of the Nippon Koshuha Steel Group from Kobe Steel, consolidating their specialty steel business to optimize production and enhance corporate value.

Report Coverage:

The research report offers an in-depth analysis based on Material, Process, Application, and End-Use Industry segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for lightweight and durable components will strengthen market growth.

- Expansion of electric mobility will drive adoption of powder metallurgy in EV parts.

- Increased localization of metal powder production will reduce import dependency.

- Technological innovation in sintering and compaction will enhance product performance.

- R&D partnerships will foster advancements in alloy development and additive manufacturing.

- Government support under industrial schemes will promote manufacturing investments.

- Aerospace and defense applications will open high-value growth opportunities.

- Digitalization and automation will improve process efficiency and output consistency.

- Sustainability and material recycling initiatives will shape production strategies.

- Emerging industrial hubs in southern and western India will sustain long-term expansion.