Market Overview

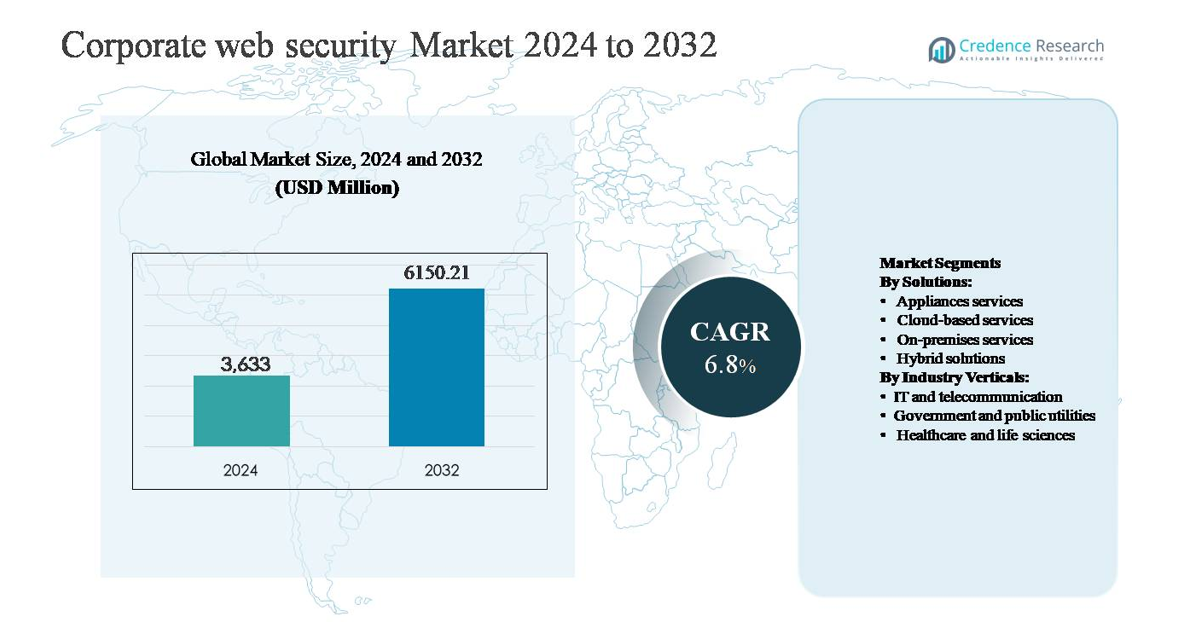

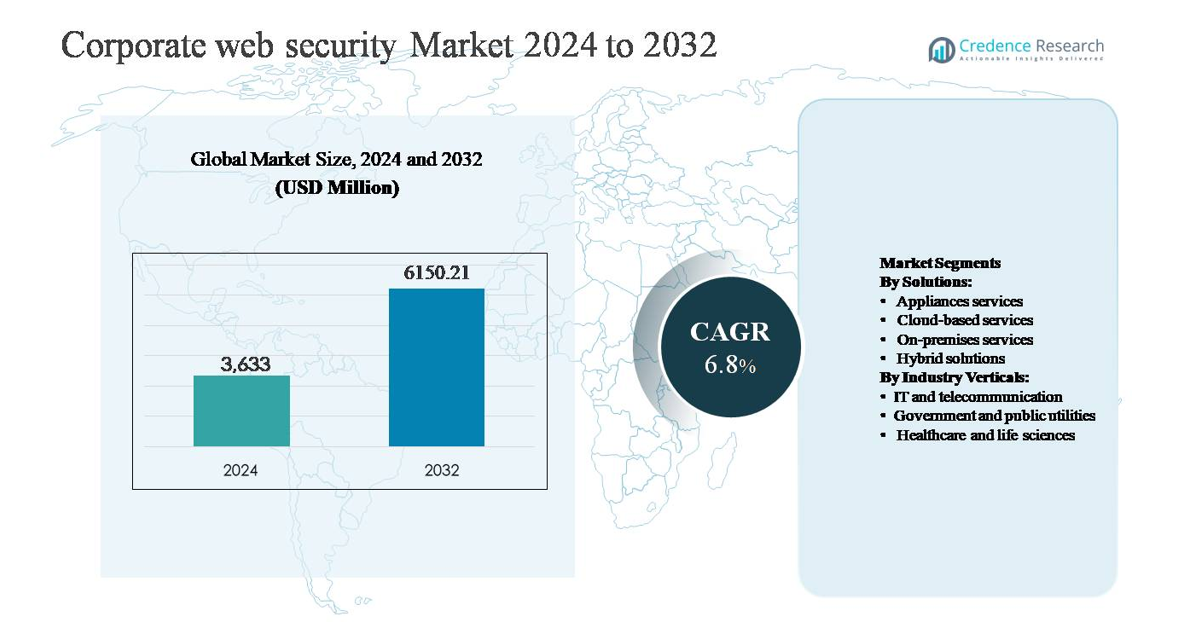

The corporate web security market was valued at USD 3,633 million in 2024 and is projected to reach USD 6,150.21 million by 2032, expanding at a compound annual growth rate (CAGR) of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corporate Web Security Market Size 2024 |

USD 3,633 million |

| Corporate Web Security Market, CAGR |

6.8% |

| Corporate Web Security Market Size 2032 |

USD 6,150.21 million |

The corporate web security market is led by a group of established global vendors and cloud-native specialists that compete through advanced threat protection, cloud-delivered platforms, and integrated Zero Trust capabilities. Key players include Cisco Systems, Zscaler, Trend Micro, Sophos, Barracuda Networks, Symantec, McAfee, Blue Coat Systems, Trustwave, Webroot, and Clearswift, each offering secure web gateways, cloud security, and AI-driven threat detection tailored for enterprise environments. Competitive differentiation centers on scalability, unified security management, and support for hybrid work models. North America is the leading region, holding approximately 38% of the global market share, driven by high cybersecurity spending, early adoption of cloud and SASE architectures, and stringent regulatory compliance across major industries.

Market Insights

- The corporate web security market was valued at USD 3,633 million in 2024 and is projected to reach USD 6,150.21 million by 2032, growing at a CAGR of 6.8% during the forecast period, supported by rising enterprise digitalization and increasing dependence on web-based applications.

- Market growth is primarily driven by the surge in sophisticated web-based cyber threats, increased cloud and SaaS adoption, and expanding remote work environments, pushing enterprises to deploy secure web gateways, cloud security platforms, and Zero Trust-based access controls.

- Key trends include the rapid shift toward cloud-based web security solutions, which represent the dominant solution segment due to scalability and centralized management, along with growing adoption of SASE and AI-driven threat detection to improve real-time visibility and response.

- The competitive landscape is characterized by strong presence of global cybersecurity vendors focusing on integrated platforms, managed security services, and continuous innovation, intensifying competition through technology differentiation and strategic partnerships.

- Regionally, North America leads with around 38% market share, followed by Europe at 27% and Asia Pacific at 24%, while IT and telecommunications remains the dominant industry segment due to high data traffic and elevated cyber risk exposure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solutions:

The corporate web security market by solutions is led by cloud-based services, which account for the dominant market share due to rapid cloud adoption, remote workforce expansion, and growing reliance on SaaS-based business applications. Enterprises increasingly favor cloud-based web security for its scalability, centralized policy management, and faster threat intelligence updates compared to traditional appliances. Drivers include rising web-based attacks, demand for secure access service edge (SASE) architectures, and lower upfront infrastructure costs. While on-premises and appliance-based solutions remain relevant in regulated environments, hybrid solutions are gaining traction as organizations balance legacy systems with cloud-native security models.

- For instance, Zscaler’s cloud security platform processes more than 500 billionsecurity transactions per day across more than 160 global data centers, enabling inline inspection and policy enforcement for millions of users without deploying on-premises appliances.”

By Industry Verticals:

Among industry verticals, IT and telecommunication represents the dominant sub-segment, holding the largest market share due to high internet traffic volumes, extensive use of cloud platforms, and constant exposure to sophisticated cyber threats. This sector prioritizes advanced web filtering, threat detection, and real-time traffic inspection to protect enterprise networks and customer data. Growth is driven by 5G rollouts, expanding data centers, and increased API-based services. Government and public utilities follow, supported by national cybersecurity mandates, while healthcare adoption accelerates due to growing digital health platforms and stringent data privacy requirements.

- For instance, AT&T operates a global IP backbone carrying over 500 petabytes of data traffic per day, supported by security platforms that perform continuous inline inspection to detect malicious web activity at scale.

Key Growth Drivers

Rising Frequency and Sophistication of Web-Based Cyber Threats

The escalating frequency and complexity of web-based cyberattacks remain a primary growth driver for the corporate web security market. Enterprises increasingly face advanced threats such as phishing-as-a-service, ransomware delivery through malicious URLs, zero-day exploits, and credential theft via compromised web applications. Attackers are leveraging encrypted traffic, fileless malware, and AI-assisted social engineering to bypass traditional perimeter defenses. As a result, organizations are prioritizing advanced web security solutions capable of real-time traffic inspection, behavioral analysis, and automated threat mitigation. The growing financial and reputational impact of data breaches is compelling enterprises to invest in comprehensive web security frameworks that protect users, applications, and data across distributed environments.

- For instance, Cloudflare reports that its global network processes and inspects tens of trillions of Internet requests daily, blocking billions of malicious requests every 24 hours using real-time bot management and machine-learning–based threat detection across hundreds of cities worldwide.

Accelerated Adoption of Cloud Applications and Remote Work Models

The widespread adoption of cloud computing and hybrid work models is significantly driving demand for corporate web security solutions. Enterprises now operate with a decentralized workforce accessing SaaS platforms, enterprise applications, and corporate resources from multiple locations and devices. This shift has expanded the attack surface and weakened traditional network-based security controls. Consequently, organizations are adopting cloud-native web security platforms that offer centralized policy enforcement, secure web gateways, and identity-aware access controls. The need to protect users regardless of location, ensure secure access to cloud workloads, and maintain consistent security policies across environments continues to accelerate investment in modern web security architectures.

- For instance, Microsoft’s Entra and Defender for Cloud Apps ecosystem processes more than 65 trillion security signals per day across identities, endpoints, and cloud applications, enabling real-time detection of anomalous access patterns tied to remote users.

Stricter Regulatory Compliance and Data Protection Requirements

Increasing regulatory pressure around data privacy and cybersecurity compliance is another critical growth driver for the corporate web security market. Governments and regulatory bodies worldwide are enforcing stricter standards for data protection, breach reporting, and secure access to sensitive information. Enterprises in regulated industries such as finance, healthcare, and public services must implement robust web security controls to ensure compliance with data sovereignty, privacy, and cybersecurity mandates. Web security solutions that provide logging, auditing, threat visibility, and policy enforcement help organizations demonstrate compliance while reducing legal and operational risks. As regulatory frameworks continue to evolve, compliance-driven security investments remain a strong market catalyst.

Key Trends & Opportunities

Shift Toward Secure Access Service Edge (SASE) and Zero Trust Architectures

A major trend shaping the corporate web security landscape is the transition toward Secure Access Service Edge (SASE) and Zero Trust security models. Organizations are moving away from perimeter-based security toward identity-centric, cloud-delivered architectures that continuously verify users, devices, and applications. Web security is increasingly integrated with secure web gateways, cloud access security brokers, and zero trust network access platforms. This convergence enables consistent protection for users accessing web and cloud resources from any location. Vendors offering unified, scalable SASE platforms have significant growth opportunities as enterprises seek simplified security management and reduced infrastructure complexity.

- For instance, Cisco Umbrella processes over 715 billion Internet requests each day, combining DNS-layer security, secure web gateway functions, and cloud-delivered Zero Trust access controls to protect users regardless of network location.

Integration of AI and Machine Learning for Advanced Threat Detection

The growing use of artificial intelligence and machine learning presents a key opportunity in corporate web security. AI-driven engines enhance threat detection by analyzing traffic patterns, user behavior, and anomalous activity in real time. These capabilities enable faster identification of unknown threats, automated response, and reduced dependency on manual security operations. Enterprises are increasingly favoring solutions that leverage predictive analytics and adaptive security policies to combat evolving attack techniques. As threat environments become more dynamic, AI-enabled web security platforms are positioned as a critical differentiator, creating long-term opportunities for innovation and value-added services.

- For instance, Fortinet’s FortiGuard AI-powered security services process over 100 billion security events daily, using deep-learning models trained on trillions of data points to detect zero-day malware and command-and-control activity across web traffic.

Key Challenges

Complexity of Managing Security Across Hybrid and Multi-Cloud Environments

One of the major challenges in the corporate web security market is managing consistent security controls across hybrid and multi-cloud infrastructures. Enterprises often operate a mix of on-premises systems, private clouds, and multiple public cloud platforms, each with different security configurations and visibility limitations. Ensuring uniform policy enforcement, threat detection, and compliance across these environments is operationally complex. Security teams face difficulties integrating legacy systems with cloud-native tools, leading to fragmented security postures. This complexity increases administrative overhead and can create gaps that attackers exploit, limiting the effectiveness of web security deployments.

Shortage of Skilled Cybersecurity Professionals and Budget Constraints

The persistent shortage of skilled cybersecurity professionals poses a significant challenge to effective web security implementation. Many organizations lack the in-house expertise required to manage advanced security platforms, analyze threats, and respond to incidents in real time. This skills gap often results in underutilized security capabilities or delayed threat response. Additionally, budget constraints particularly among small and mid-sized enterprises limit the adoption of comprehensive web security solutions. Balancing cost efficiency with robust protection remains difficult, slowing deployment cycles and increasing reliance on managed security services to compensate for internal resource limitations.

Regional Analysis

North America

North America dominates the corporate web security market, accounting for around 38% of global market share. The region benefits from early adoption of advanced cybersecurity technologies, high cloud penetration, and a strong presence of leading security vendors. Enterprises across IT, telecommunications, finance, and healthcare invest heavily in secure web gateways, cloud-based security, and Zero Trust frameworks to counter sophisticated cyber threats. Stringent data protection regulations and rising cyberattack incidents further support adoption. The U.S. leads regional demand due to large enterprise spending and mature digital infrastructure, while Canada contributes through increased regulatory compliance and cloud security initiatives.

Europe

Europe holds approximately 27% of the corporate web security market share, driven by strict regulatory frameworks and growing digital transformation across enterprises. Regulations such as GDPR and national cybersecurity directives compel organizations to strengthen web security controls, particularly around data privacy and access monitoring. Adoption is strong across government, public utilities, and healthcare sectors, where compliance and data sovereignty are critical. Western Europe leads demand due to advanced IT infrastructure, while Central and Eastern Europe show steady growth as cloud adoption increases. Enterprises increasingly deploy hybrid and cloud-based solutions to balance regulatory compliance with operational flexibility.

Asia Pacific

Asia Pacific represents about 24% of the global corporate web security market and is the fastest-growing regional segment. Rapid digitization, expanding cloud adoption, and increasing internet penetration across emerging economies are key growth factors. Enterprises in countries such as China, India, Japan, and Australia face rising cyber threats linked to expanding digital services and remote work adoption. The IT and telecommunications sector drives significant demand, supported by large user bases and high web traffic volumes. Growing awareness of cybersecurity risks and government-led digital initiatives are accelerating investments in scalable, cloud-delivered web security solutions.

Latin America

Latin America accounts for nearly 6% of the corporate web security market share, supported by increasing enterprise digitalization and rising awareness of cyber risks. Organizations across banking, telecommunications, and government sectors are strengthening web security to address growing phishing, malware, and ransomware incidents. Cloud-based security adoption is increasing due to cost efficiency and limited in-house cybersecurity expertise. Brazil and Mexico lead regional demand owing to larger enterprise bases and improving regulatory focus on data protection. However, budget constraints and skills shortages continue to moderate adoption rates compared to more mature regions.

Middle East & Africa

The Middle East & Africa region holds approximately 5% of the global market share, with growth driven by expanding digital infrastructure and government-led cybersecurity initiatives. Countries in the Gulf Cooperation Council invest in advanced web security solutions to protect critical infrastructure, public utilities, and financial systems. Increasing cloud adoption and smart city projects further elevate demand for secure web access. In Africa, adoption remains gradual but improving as enterprises modernize IT systems. Regional growth is supported by rising cyber awareness, though limited budgets and uneven digital maturity present ongoing challenges.

Market Segmentations:

By Solutions:

- Appliances services

- Cloud-based services

- On-premises services

- Hybrid solutions

By Industry Verticals:

- IT and telecommunication

- Government and public utilities

- Healthcare and life sciences

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The corporate web security market features a highly competitive landscape characterized by the presence of global cybersecurity vendors and specialized cloud-native security providers. Leading companies compete through comprehensive product portfolios that integrate secure web gateways, cloud access security brokers, Zero Trust network access, and advanced threat protection. Strategic focus areas include cloud-delivered platforms, AI-driven threat detection, and unified security management to address hybrid and remote work environments. Vendors actively pursue mergers, acquisitions, and partnerships to expand technological capabilities and regional reach. Continuous innovation in encryption inspection, behavioral analytics, and automated response differentiates market leaders from niche players. Pricing flexibility, managed security services, and strong enterprise support further influence competitive positioning as organizations seek scalable, compliant, and cost-effective web security solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems, Inc.

- Zscaler, Inc.

- Trend Micro Incorporated

- Sophos Ltd.

- Barracuda Networks, Inc.

- Symantec Corporation

- McAfee, Inc.

- Blue Coat Systems, Inc.

- Trustwave Holdings, Inc.

- Webroot Inc.

Recent Developments

- In November 2025, Zscaler completed its acquisition of AI security pioneer SPLX, extending its Zero Trust Exchange™ with AI asset discovery, automated red-teaming, and governance capabilities to secure AI system lifecycles from development through deployment.

- In October 2025, Trend Micro launched a new end-to-end protection suite for agentic AI environments in partnership with NVIDIA, enhancing infrastructure-to-application security with agentless EDR and integrated guardrails designed to secure next-generation AI deployments.

- In August 2025, Zscaler finalized the acquisition of Red Canary, integrating agentic AI-driven Managed Detection and Response (MDR) technologies into its security operations and SOC capabilities.

Report Coverage

The research report offers an in-depth analysis based on Solutions, Industry verticals and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Enterprises will increasingly adopt cloud-native web security platforms to support distributed workforces and hybrid IT environments.

- Integration of web security with Zero Trust and SASE architectures will become a standard enterprise security strategy.

- AI and machine learning will play a larger role in real-time threat detection, behavioral analysis, and automated incident response.

- Demand for unified security management consoles will grow as organizations seek simplified policy control across networks and clouds.

- Web security solutions will expand coverage to protect APIs, SaaS applications, and encrypted web traffic more effectively.

- Managed web security services will gain traction as enterprises address cybersecurity skills shortages.

- Regulatory compliance requirements will continue to shape solution design and deployment priorities.

- Industry-specific security frameworks will emerge to address unique risk profiles in healthcare, government, and telecom sectors.

- Vendors will focus on performance optimization to reduce latency while maintaining deep traffic inspection.

- Strategic partnerships and acquisitions will accelerate innovation and global market expansion.