| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corrugated Box Packaging Market Size 2024 |

USD 169.3 million |

| Corrugated Box Packaging Market, CAGR |

2.33% |

| Corrugated Box Packaging Market Size 2032 |

USD 233.8 million |

Market Overview:

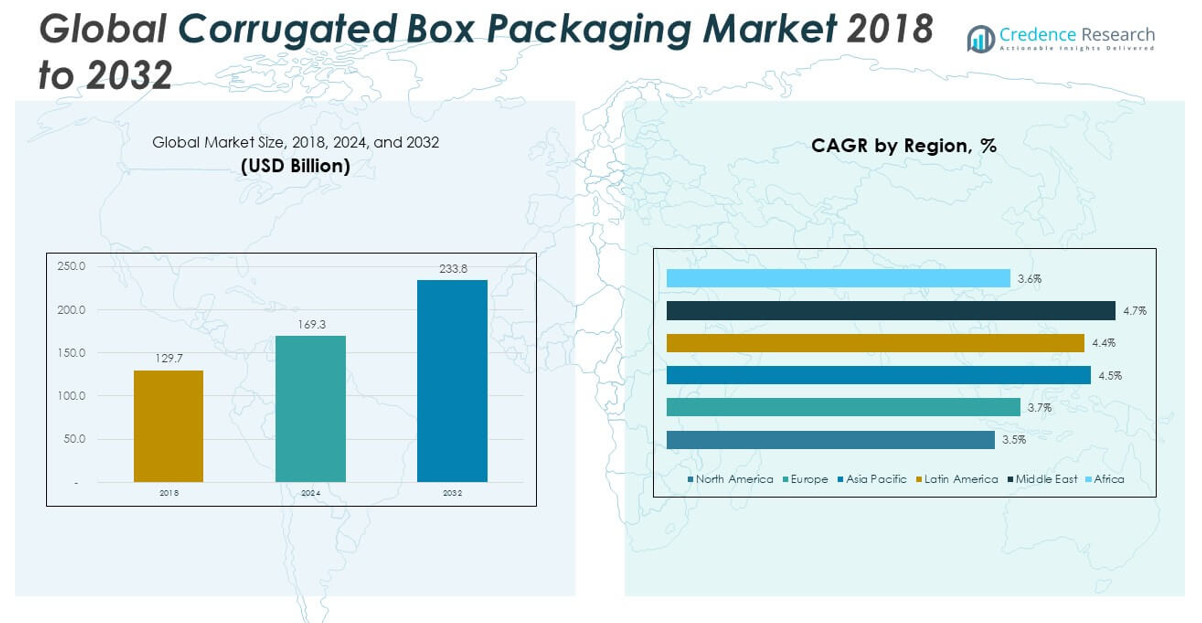

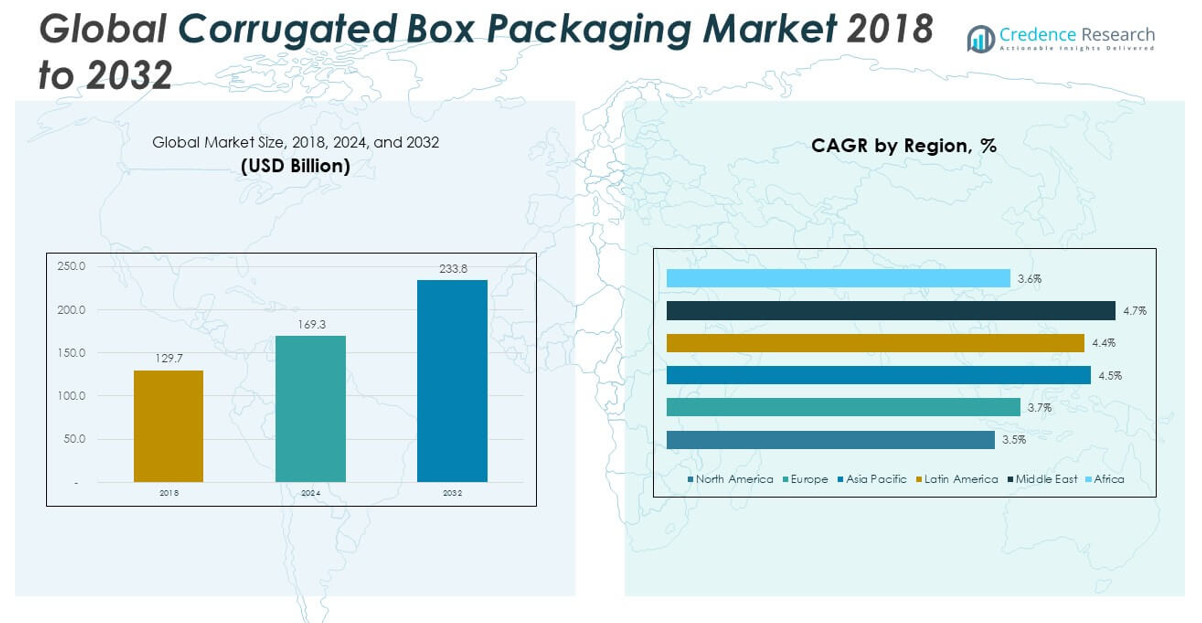

The Corrugated Box Packaging Market size was valued at USD 129.7 million in 2018 to USD 169.3 million in 2024 and is anticipated to reach USD 233.8 million by 2032, at a CAGR of 4.10% during the forecast period.

The growth of the global corrugated box packaging market is being driven by several key factors. The rapid expansion of e-commerce has significantly increased the demand for packaging that ensures the safety of products during transit, particularly for online retailers. Corrugated boxes are ideal for this purpose due to their durability and ability to be customized for various product types. Additionally, the rising focus on sustainability has made corrugated packaging an attractive choice, as it is recyclable and made from renewable resources, aligning with the growing consumer and corporate preference for eco-friendly solutions. Technological advancements in manufacturing, including box-on-demand systems and fit-to-product packaging, have also contributed to increased market efficiency, reducing material waste and improving supply chain logistics. Furthermore, industries such as food and beverages, electronics, and pharmaceuticals are major consumers of corrugated packaging, driving demand for reliable and cost-effective solutions.

Regionally, the Asia-Pacific region dominates the corrugated box packaging market, driven by the large manufacturing base in countries like China and India, rapid urbanization, and an expanding middle class. These factors, along with increasing demand for packaged goods, have established Asia-Pacific as the leading region for corrugated packaging. North America also holds a significant share, with the U.S. market benefiting from the growing trend towards sustainable packaging solutions and innovations in packaging technology. Europe follows closely, with steady growth fueled by stringent environmental regulations and the region’s commitment to recycling and waste reduction. The demand for corrugated packaging is gradually increasing in Latin America and the Middle East and Africa, supported by growing industrialization and urbanization, although these regions lag behind Asia-Pacific and North America in market share.

Market Insights:

- The Corrugated Box Packaging Market was valued at USD 129.7 million in 2018 and is expected to reach USD 233.8 million by 2032, growing at a CAGR of 4.10% during the forecast period.

- The rapid expansion of e-commerce continues to fuel demand for corrugated box packaging, with businesses relying on it to ensure product safety during transit, particularly in online retail.

- Rising consumer and corporate demand for eco-friendly packaging solutions is driving the adoption of corrugated boxes due to their recyclable and biodegradable properties.

- Technological advancements such as box-on-demand systems and automated manufacturing processes are enhancing packaging efficiency, reducing material waste, and enabling customized solutions.

- The food & beverage, electronics, and pharmaceuticals industries are key drivers for the market, requiring reliable, durable, and cost-effective packaging solutions.

- Raw material price fluctuations, particularly in paper and wood pulp, continue to pose challenges by disrupting the supply chain and affecting production costs.

- Competition from alternative packaging materials like molded pulp and bioplastics is growing, necessitating continuous innovation and investment in sustainable practices within the corrugated box packaging market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of E-commerce and Online Retail

The rapid growth of e-commerce has significantly influenced the demand for corrugated box packaging. With the surge in online shopping, businesses require packaging solutions that can protect products during transit while maintaining cost-efficiency. Corrugated boxes are the preferred choice due to their strength, lightweight nature, and ability to be easily customized for various product shapes and sizes. The increasing number of online consumers and a global shift toward digital retailing further amplifies the need for corrugated box packaging, especially for shipping and delivery purposes. This growth in e-commerce, coupled with the continuous improvement of delivery networks, continues to push the market forward.

Demand for Sustainable Packaging Solutions

Environmental concerns and a heightened awareness of sustainability among both consumers and businesses are driving the demand for eco-friendly packaging solutions. The corrugated box packaging market benefits from its recyclable and biodegradable properties, making it a sustainable option compared to plastic-based alternatives. Many companies are shifting to greener practices to reduce their carbon footprint, and corrugated boxes align with these efforts. Their ability to be recycled and reused supports the growing trend towards circular economies, positioning them as a leading packaging choice in various industries. This shift to sustainable packaging is becoming a critical factor for businesses aiming to meet regulatory requirements and consumer preferences for environmental responsibility.

- For instance, leading manufacturers such as Acme Corrugated Box have achieved EcoVadis bronze ratings by implementing energy-efficient facility upgrades, logistics optimization, and comprehensive recycling programs.

Technological Advancements in Packaging Manufacturing

Technological advancements in packaging manufacturing are contributing to the growth of the corrugated box packaging market. Innovations such as box-on-demand systems and automated manufacturing processes have enhanced the efficiency and customization of corrugated boxes. These technologies enable businesses to create packaging solutions tailored to specific product dimensions, reducing waste and material costs. The incorporation of digital printing techniques allows for high-quality graphics and branding, further enhancing the appeal of corrugated packaging. As production processes become more efficient and cost-effective, businesses are adopting these technologies to streamline their packaging operations and improve product delivery times.

- For instance, Spain-based Saica Group invested $110 million in a new corrugated packaging plant in Indiana, integrating AI-driven predictive maintenance and real-time defect detection to optimize uptime and quality

Growth of Key End-Use Industries

The demand for corrugated box packaging is closely tied to the growth of key end-use industries, including food and beverages, electronics, pharmaceuticals, and retail. The food and beverage industry requires secure and hygienic packaging for transporting perishable goods, while electronics and pharmaceuticals demand durable packaging to protect sensitive items. Retail industries are increasingly relying on corrugated boxes for retail-ready packaging that enhances the consumer experience. With rising global demand across these sectors, corrugated packaging provides a versatile, reliable, and cost-effective solution. The continued growth of these industries further fuels the expansion of the corrugated box packaging market.

Market Trends:

Growing Adoption of Customization and Fit-to-Product Packaging

Customization has become a key trend in the corrugated box packaging market, driven by the demand for more tailored and efficient packaging solutions. Businesses are increasingly opting for fit-to-product packaging, which ensures that boxes are specifically designed to suit the product dimensions, thereby reducing waste and enhancing product protection. This trend allows manufacturers to offer packaging solutions that meet the specific requirements of diverse products, from fragile electronics to bulky goods. Companies are also investing in digital printing technologies to improve branding, offering personalized packaging that resonates with consumers. These developments align with the shift towards more sustainable and efficient packaging practices across industries.

- For instance, DS Smith, a global leader in sustainable packaging, launched its “Made2Fit” technology in 2023, which enables the production of custom-sized corrugated boxes tailored to each e-commerce order.

Focus on Automation and Smart Packaging Technologies

The integration of automation and smart packaging technologies is a growing trend in the corrugated box packaging market. With advancements in automated production lines and robotics, manufacturers are increasing operational efficiency and reducing production costs. Smart packaging, which incorporates technologies such as sensors, QR codes, and RFID tags, is gaining traction for its ability to provide real-time tracking and enhance the consumer experience. These innovations offer benefits such as improved supply chain management, reduced errors, and better inventory control. As businesses seek to improve operational efficiency, the adoption of these technologies in corrugated packaging is expected to expand.

- For example, PepsiCo has indeed implemented advanced automation at its Frito-Lay plants, leading to significant reductions in energy and water usage through streamlined production and packaging processes.

Rise in E-commerce Packaging Innovations

E-commerce continues to drive innovation in packaging, particularly in the design of corrugated boxes that cater to online retail needs. The demand for packaging solutions that are not only protective but also visually appealing has led to the development of innovative designs. Custom-sized boxes that minimize material use and improve efficiency are becoming more common. The trend of enhancing the unboxing experience through attractive and functional packaging is also gaining momentum. Corrugated box manufacturers are focusing on creating packaging that reflects the brand identity and meets the growing consumer expectations for sustainability and presentation in e-commerce deliveries.

Increasing Demand for Sustainable and Eco-Friendly Packaging Solutions

Sustainability remains a dominant trend in the corrugated box packaging market, with businesses and consumers increasingly prioritizing environmentally friendly options. Corrugated boxes, known for their recyclability and biodegradability, are becoming the packaging of choice for companies committed to reducing their environmental impact. The push for sustainability is further reinforced by government regulations and consumer demand for eco-conscious products. Many companies are opting for corrugated packaging not only due to its environmental benefits but also because it aligns with corporate social responsibility (CSR) goals. The shift towards greener packaging is expected to continue shaping the market in the coming years.

Market Challenges Analysis:

Raw Material Price Fluctuations and Supply Chain Disruptions

One of the key challenges facing the corrugated box packaging market is the volatility in raw material prices, particularly the cost of paper and wood pulp. Fluctuating prices can disrupt the manufacturing process, affecting profitability and production schedules. The market relies heavily on a steady supply of raw materials, and any interruptions due to factors like natural disasters, transportation issues, or labor strikes can lead to supply chain disruptions. These uncertainties create a challenging environment for manufacturers, who must manage inventory levels and adjust pricing strategies to remain competitive. The increased demand for sustainable raw materials adds complexity, as sourcing eco-friendly alternatives may drive costs higher, further impacting the market.

Competition from Alternative Packaging Materials

Another significant challenge is the growing competition from alternative packaging materials, such as plastic and biodegradable options. While corrugated boxes are valued for their sustainability and cost-effectiveness, other materials are emerging with similar benefits, challenging its market share. The rise of materials like molded pulp and bioplastics, which offer biodegradable or compostable properties, presents alternatives that can cater to consumer preferences for eco-friendly packaging. Manufacturers in the corrugated box packaging market must continuously innovate to differentiate their products and meet the evolving demands of environmentally conscious consumers and businesses. This increased competition drives the need for continuous product development and greater investment in sustainable practices.

Market Opportunities:

Growing Demand for Sustainable Packaging Solutions

The increasing focus on sustainability presents a significant opportunity for the corrugated box packaging market. As consumers and businesses prioritize eco-friendly solutions, corrugated packaging’s recyclable and biodegradable nature positions it as an attractive choice. Companies aiming to meet sustainability goals and regulatory requirements can leverage corrugated boxes to reduce their environmental impact. This growing demand for sustainable packaging is likely to expand market opportunities, particularly as industries such as food and beverages, e-commerce, and retail continue to seek greener alternatives. Manufacturers who embrace eco-friendly practices can gain a competitive edge in the market.

E-Commerce Expansion and Customization Potential

The rapid growth of e-commerce presents an ongoing opportunity for the corrugated box packaging market. As online shopping continues to surge, packaging needs evolve, requiring tailored solutions that ensure product safety and enhance customer experience. The trend towards custom packaging offers a potential growth avenue, with businesses seeking unique and branded packaging for their products. Manufacturers can capitalize on this by offering highly customizable corrugated packaging options that cater to diverse product types and consumer preferences. The increasing volume of online orders provides ample growth prospects for corrugated box packaging solutions.

Market Segmentation Analysis:

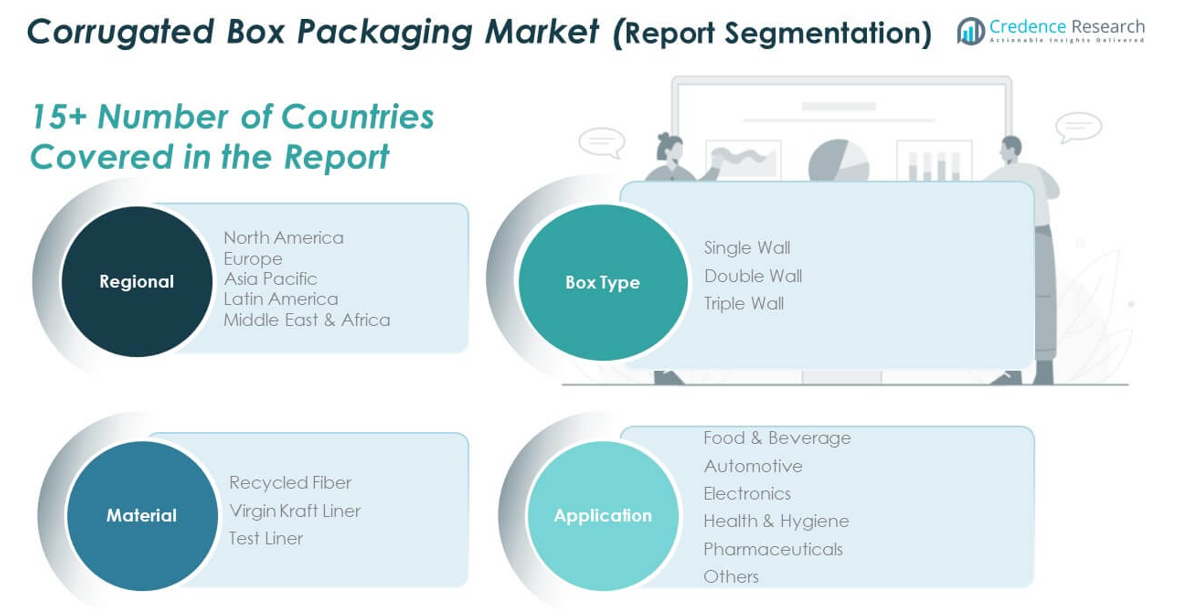

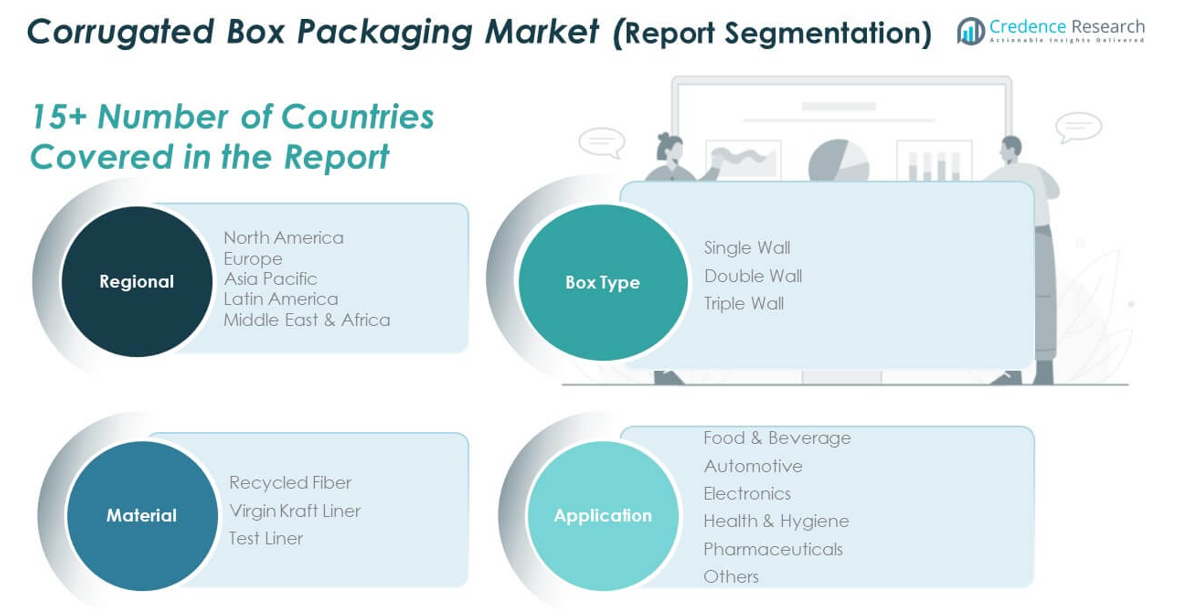

The Corrugated Box Packaging Market is segmented by box type, material, and application, each contributing to its overall growth.

By Box Type, the market is divided into Single Wall, Double Wall, and Triple Wall boxes. Single Wall boxes are the most commonly used, offering an optimal balance of cost-effectiveness and strength for many industries. Double Wall boxes provide enhanced strength and are ideal for heavier goods, while Triple Wall boxes offer superior durability and are used for transporting very heavy and bulky items.

- For example, WestRock supplies single wall corrugated boxes widely used in retail and e-commerce for their cost-effectiveness and adequate strength.

By Material, the market includes Recycled Fiber, Virgin Kraft Liner, and Test Liner. Recycled Fiber is gaining popularity due to its environmental benefits, reducing the reliance on virgin materials. Virgin Kraft Liner offers high strength and is widely used for premium packaging. Test Liner, a lower-cost alternative, is often used for lightweight packaging applications.

By Application, key segments include Food & Beverage, Automotive, Electronics, Health & Hygiene, Pharmaceuticals, and Others. The Food & Beverage sector remains a significant driver due to the need for safe, hygienic, and cost-effective packaging. The Electronics and Automotive sectors demand high-strength packaging solutions to ensure product protection during transit. Health & Hygiene and Pharmaceuticals sectors prioritize packaging that ensures safety, tamper-proof features, and regulatory compliance.

- For example, Ranpak provides cushioning and custom corrugated packaging for electronics, minimizing damage during transit.

Segmentation:

By Box Type:

- Single Wall

- Double Wall

- Triple Wall

By Material:

- Recycled Fiber

- Virgin Kraft Liner

- Test Liner

By Application:

- Food & Beverage

- Automotive

- Electronics

- Health & Hygiene

- Pharmaceuticals

- Other

By Application:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Corrugated Box Packaging Market

The North America Corrugated Box Packaging Market size was valued at USD 21.19 million in 2018, USD 26.70 million in 2024, and is anticipated to reach USD 35.07 million by 2032, at a CAGR of 3.5% during the forecast period. North America holds a significant share of the global corrugated box packaging market, driven by the growing demand for sustainable packaging solutions. The U.S. market is especially strong due to the increasing adoption of e-commerce and a shift towards eco-friendly packaging. With stringent environmental regulations and a consumer preference for recyclable products, manufacturers are focusing on developing innovative and sustainable packaging solutions. The rising demand for retail-ready packaging in industries like food and beverages, electronics, and pharmaceuticals further boosts the market’s growth.

Europe Corrugated Box Packaging Market

The Europe Corrugated Box Packaging Market size was valued at USD 29.97 million in 2018, USD 38.31 million in 2024, and is anticipated to reach USD 51.39 million by 2032, at a CAGR of 3.7% during the forecast period. Europe is a leading region in the corrugated box packaging market due to its strong environmental focus and sustainability initiatives. Countries like Germany, France, and the UK are prominent markets, with a significant shift towards recyclable and biodegradable packaging solutions. The growing demand for packaged goods and innovations in packaging design have fueled the market. Europe also benefits from well-established infrastructure and high adoption rates of automation and digital technologies in packaging.

Asia Pacific Corrugated Box Packaging Market

The Asia Pacific Corrugated Box Packaging Market size was valued at USD 49.42 million in 2018, USD 65.90 million in 2024, and is anticipated to reach USD 93.53 million by 2032, at a CAGR of 4.5% during the forecast period. Asia Pacific dominates the global market, with China and India leading the charge due to rapid industrialization and expanding consumer markets. The region benefits from its large manufacturing base and high demand for packaging across various sectors, including food and beverages, electronics, and pharmaceuticals. The significant population growth and increased consumer spending further contribute to market expansion. As demand for sustainable packaging rises, manufacturers in the region are focusing on eco-friendly solutions.

Latin America Corrugated Box Packaging Market

The Latin America Corrugated Box Packaging Market size was valued at USD 10.53 million in 2018, USD 13.99 million in 2024, and is anticipated to reach USD 19.76 million by 2032, at a CAGR of 4.4% during the forecast period. Latin America is witnessing steady growth in the corrugated box packaging market, driven by increasing industrialization and a rising demand for packaged goods. The food and beverage industry, in particular, contributes to this growth, along with the increasing popularity of e-commerce. Brazil and Mexico are key markets in the region, with businesses focusing on sustainability and cost-effective packaging solutions. The shift towards recyclable materials and improvements in infrastructure also support market development.

Middle East Corrugated Box Packaging Market

The Middle East Corrugated Box Packaging Market size was valued at USD 9.80 million in 2018, USD 13.29 million in 2024, and is anticipated to reach USD 19.24 million by 2032, at a CAGR of 4.7% during the forecast period. The market in the Middle East is expanding rapidly due to the region’s growing industrial base and increasing demand for durable, sustainable packaging solutions. The rise of e-commerce and the growing retail sector are key drivers of market growth, particularly in the UAE and Saudi Arabia. Manufacturers in the region are adopting advanced technologies to meet the growing demand for packaging that aligns with sustainability goals. The region is also benefiting from increased infrastructure investments, further driving the demand for corrugated packaging.

Africa Corrugated Box Packaging Market

The Africa Corrugated Box Packaging Market size was valued at USD 8.77 million in 2018, USD 11.14 million in 2024, and is anticipated to reach USD 14.82 million by 2032, at a CAGR of 3.6% during the forecast period. The African market is experiencing steady growth due to increased industrialization and a growing middle-class population. Countries such as South Africa and Nigeria are significant contributors to the market, with rising demand for packaged goods in sectors like food and beverages. The shift towards more sustainable packaging solutions also plays a key role in driving the market. The increasing demand for e-commerce and improvements in infrastructure are expected to further support the growth of the corrugated box packaging market in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mondi Group

- International Paper Company

- Nine Dragons Paper (Holdings) Limited

- Rock-Tenn Company

- Packaging Corporation of America

- Oji Holdings Corporation

- DS Smith Plc.

- Nammo AS

- Lee & Man Paper Manufacturing Ltd.

- Australian Corrugated Packaging

- Other Key Players

Competitive Analysis:

The competitive landscape of the corrugated box packaging market is characterized by the presence of both large multinational companies and regional players. Key market leaders include International Paper Company, WestRock Company, Smurfit Kappa Group, and DS Smith, which dominate the global market share. These companies are focusing on expanding their production capabilities and enhancing sustainability in their packaging solutions to cater to the growing demand for eco-friendly products. Innovation in manufacturing processes, such as the adoption of automation and digital printing, has become crucial in gaining a competitive edge. Regional players are also making significant strides by offering cost-effective and customized solutions, targeting local businesses and industries. Competition is intensifying as firms focus on diversifying their product offerings and adopting advanced technologies to improve packaging efficiency and reduce waste. The market is highly dynamic, with companies increasingly prioritizing innovation and sustainability in response to consumer and regulatory demands.

Recent Developments:

- In May 2025, International Paper broke ground on a new state-of-the-art corrugated box plant in Waterloo, Iowa. This facility, the company’s largest greenfield box plant, will focus on serving the protein segment with sustainable packaging solutions and is expected to begin operations in late 2026, creating up to 200 jobs.

- In April 2025, Mondi Group completed the acquisition of the Western European packaging assets of Schumacher Packaging. This strategic move expands Mondi’s corrugated converting footprint in Europe, adding over 1 billion square meters of capacity and strengthening its position in the eCommerce and FMCG packaging sectors. The acquisition includes seven corrugated converting plants, two solid board mills, and four solid board converting plants across Germany, the Netherlands, and the UK.

- In June 2024, International Paper announced its acquisition of DS Smith, a leading provider of sustainable packaging solutions. This strategic move aims to expand International Paper’s footprint in the European market and enhance its capabilities in innovative corrugated packaging.

Market Concentration & Characteristics:

The corrugated box packaging market is moderately concentrated, with a few large players holding significant market share, while regional and smaller companies account for a considerable portion of the market. The market is characterized by a high level of competition, driven by the increasing demand for sustainable and cost-effective packaging solutions. Large companies such as International Paper, WestRock, and Smurfit Kappa dominate the market, leveraging their extensive distribution networks, production capabilities, and innovation in packaging designs. Smaller players focus on providing customized solutions, targeting specific local markets and industries. The market is marked by continuous innovation, with firms investing in automation, digital printing, and sustainable packaging materials to enhance product offerings and meet consumer and regulatory demands. The increasing focus on sustainability and technological advancements in manufacturing processes are key factors shaping the competitive dynamics within the market.

Report Coverage:

The research report offers an in-depth analysis based on box type, material, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for sustainable packaging will continue to drive growth, with corrugated boxes being the preferred eco-friendly option.

- E-commerce expansion will significantly increase the need for corrugated packaging to protect products during delivery.

- Technological advancements in digital printing and automation will improve efficiency and customization in packaging solutions.

- The adoption of fit-to-product packaging will reduce waste and improve supply chain efficiency.

- Regulatory pressures on sustainability will push businesses to adopt recyclable and biodegradable packaging materials.

- Increased consumer preference for personalized packaging will drive innovation and custom solutions.

- Growth in the food and beverage, electronics, and pharmaceuticals industries will fuel demand for corrugated boxes.

- The rise of smart packaging technologies, such as RFID and sensors, will be integrated into corrugated packaging solutions.

- Emerging markets in Asia Pacific and Latin America will contribute to market expansion, driven by industrial growth.

- Increased investments in infrastructure and supply chain logistics will enhance the market’s overall reach and capabilities.