Market Overview

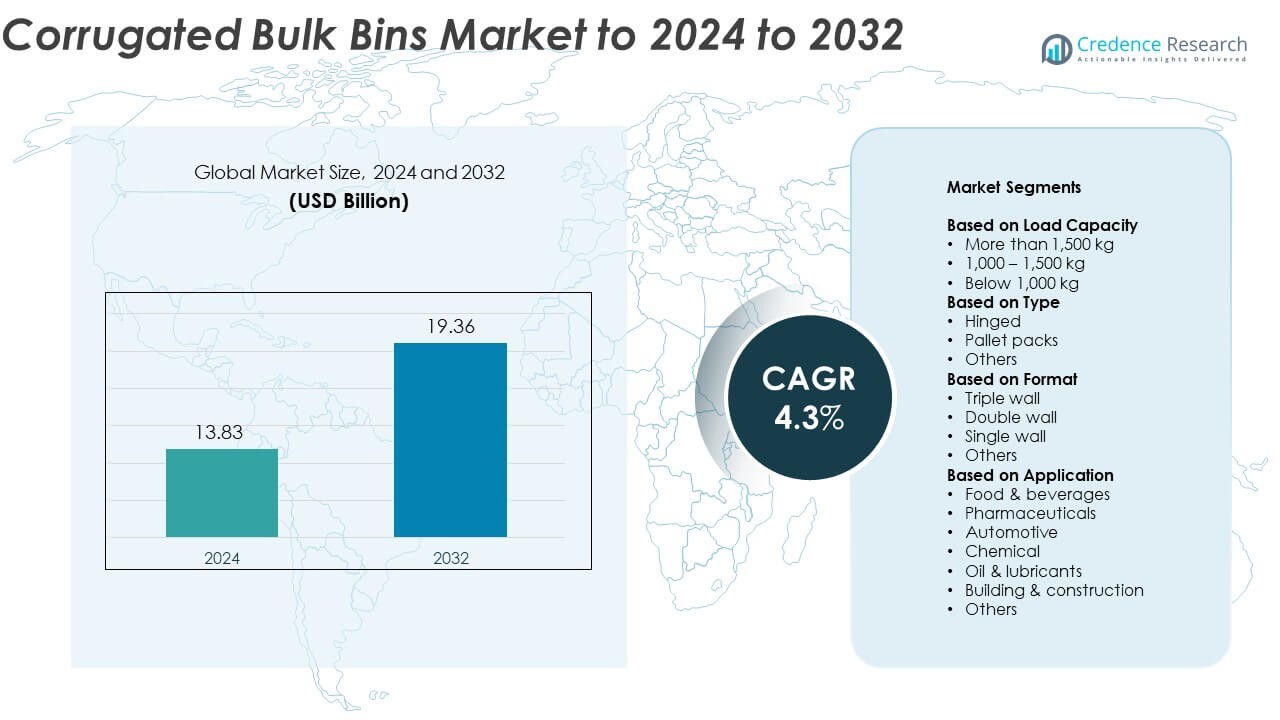

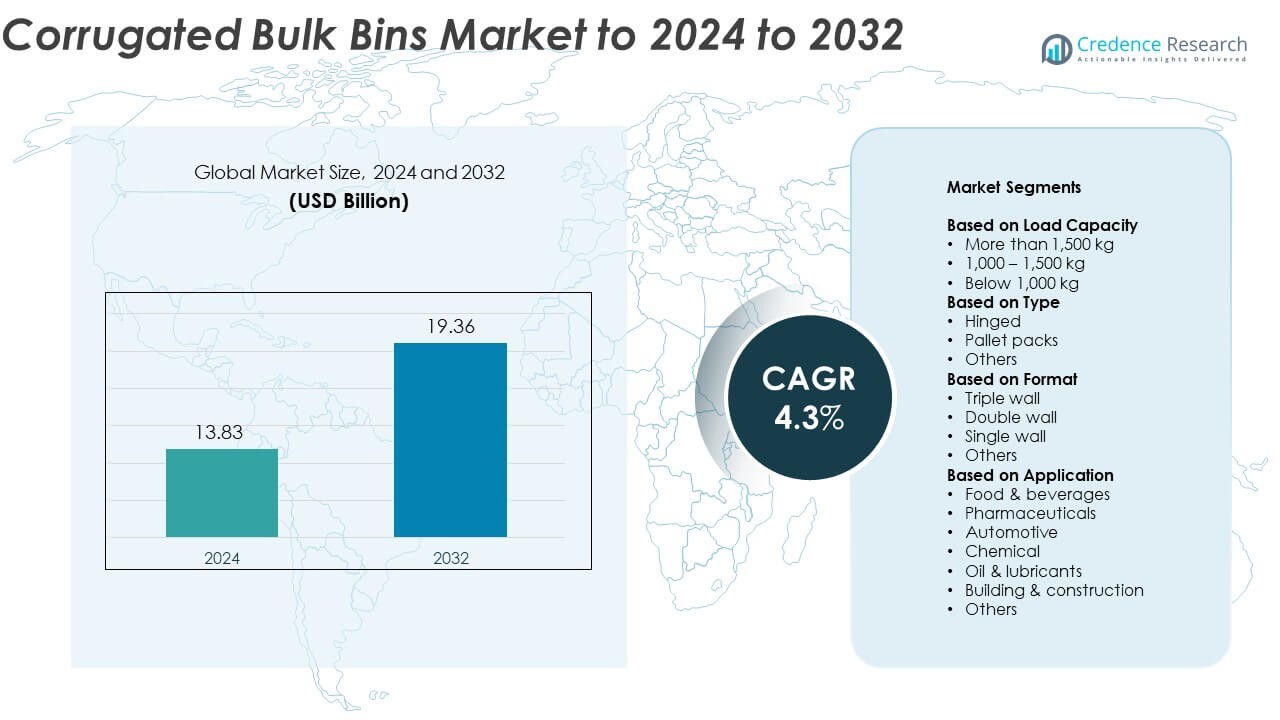

Corrugated Bulk Bins Market size was valued at USD 13.83 Billion in 2024 and is anticipated to reach USD 19.36 Billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corrugated Bulk Bins Market Size 2024 |

USD 13.83 Billion |

| Corrugated Bulk Bins Market, CAGR |

4.3% |

| Corrugated Bulk Bins Market Size 2032 |

USD 19.36 Billion |

The corrugated bulk bins market features leading players such as Mondi Group, Smurfit Kappa Group, DS Smith Plc, WestRock Company, and International Paper Company, which collectively dominate global production and innovation. These companies focus on sustainable, recyclable, and high-strength packaging solutions to meet growing demand across food, beverage, and industrial sectors. North America leads the market with a 34.8% share in 2024, driven by strong logistics and retail infrastructure, followed by Europe holding 27.6% due to strict environmental regulations promoting eco-friendly packaging. Asia Pacific accounts for 24.9%, fueled by rapid industrialization and expansion in manufacturing and export-driven economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The corrugated bulk bins market was valued at USD 13.83 Billion in 2024 and is projected to reach USD 19.36 Billion by 2032, growing at a CAGR of 4.3% during the forecast period.

- Rising demand for sustainable and recyclable packaging materials across food, beverage, and industrial sectors is a major growth driver.

- Key market trends include increasing adoption of automation in packaging processes and innovations in lightweight yet high-strength corrugated designs.

- The market remains moderately consolidated, with leading players focusing on eco-friendly product development and expansion in emerging markets.

- North America leads with a 34.8% share, followed by Europe at 27.6% and Asia Pacific at 24.9%, while the more than 1,500 kg load capacity segment dominates with 41.7% share in 2024.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Load Capacity

The more than 1,500 kg segment dominates the corrugated bulk bins market with nearly 41.7% share in 2024. This category is favored for its superior durability and strength, making it ideal for transporting heavy industrial goods, chemicals, and automotive components. Growing demand for cost-effective, reusable, and eco-friendly packaging solutions in large-scale logistics and warehousing supports its dominance. Manufacturers increasingly prefer these high-capacity bins for optimizing storage space and reducing handling costs across long-distance shipments, driving continued adoption in bulk packaging operations worldwide.

- For instance, DS\u00a0Smith specifies heavy-duty pallet boxes “suitable for weights of up to 1,000\u00a0kg and above,” evidencing high load use cases in corrugated systems.

By Type

The pallet packs segment leads the market with around 46.3% share in 2024. Its prominence is driven by widespread use in food, beverage, and consumer goods industries due to stackability, ease of handling, and compatibility with automated systems. Pallet packs offer efficient protection for bulk materials during transport and storage, minimizing product damage. Rising adoption of lightweight and recyclable corrugated materials to meet sustainability goals further strengthens this segment’s position in supply chains requiring flexible yet durable packaging formats.

- For instance, International Paper’s octagonal corrugated totes are designed to be stacked 3 high, supporting palletized, bulk workflows.

By Format

The triple wall segment holds the largest share of approximately 38.9% in 2024. This format’s superior strength and puncture resistance make it suitable for heavy-duty applications, including chemicals, automotive parts, and machinery components. Triple wall bins provide enhanced load-bearing capacity compared to double and single wall types, ensuring product safety in long-haul transport. Growing preference for robust packaging that withstands moisture and stacking pressure across logistics and industrial sectors supports the steady expansion of this high-performance segment globally.

Key Growth Drivers

Rising Demand from Food and Beverage Industry

The food and beverage sector is driving strong demand for corrugated bulk bins due to their ability to protect perishable goods during long-distance transportation. These bins offer hygienic, moisture-resistant, and recyclable packaging solutions suitable for fruits, vegetables, beverages, and processed foods. Expanding global food trade and e-commerce-based grocery distribution are further boosting adoption. The need for lightweight yet durable packaging to minimize waste and support cold-chain logistics continues to position this sector as a leading growth contributor.

- For instance, Greif reported an 84% cut in corrugated bulk-box purchases by reusing empties across plants.

Expansion of Automotive and Chemical Supply Chains

Growth in the automotive and chemical industries significantly supports the corrugated bulk bins market. Manufacturers rely on heavy-duty corrugated bins to transport machinery parts, lubricants, and chemical compounds securely. These bins reduce damage risk and optimize storage space, enhancing operational efficiency in warehouses and distribution centers. Increasing global trade volumes, along with sustainability-driven shifts toward recyclable packaging alternatives, strengthen this segment’s importance across industrial logistics networks.

- For instance, Mondi’s BrakeBox let 18 units travel per pack versus 12 before, a 50% density lift with nearly the same material.

Shift Toward Sustainable Packaging Solutions

The global shift toward sustainable and eco-friendly packaging materials acts as a major growth catalyst. Corrugated bulk bins, being recyclable and biodegradable, align well with circular economy principles. Companies are replacing plastic and metal packaging with paper-based corrugated solutions to meet environmental regulations and consumer preferences. Growing awareness about carbon footprint reduction, coupled with government initiatives encouraging green logistics, continues to boost market demand for recyclable corrugated packaging formats.

Key Trends & Opportunities

Adoption of Automation and Smart Logistics

Automation in logistics and warehousing is creating new opportunities for corrugated bulk bin manufacturers. The use of stackable, standardized bins compatible with robotic handling systems improves space efficiency and reduces labor costs. Growing investment in automated packaging lines and smart inventory tracking systems enhances product traceability. This integration of corrugated packaging with digital logistics platforms is transforming distribution efficiency, encouraging wider use in high-volume supply chains.

- For instance, a 2024 peer-reviewed review found 46 studies on robotic packing cells, with 29 research papers (63.04%) and 15 conference papers (32.61%).

Customization and Lightweight Design Innovations

Manufacturers are focusing on customizable, lightweight corrugated bulk bins to serve diverse industry needs. Advancements in corrugated board technology enable designs that balance strength with reduced material use, improving cost efficiency. Custom printing, variable dimensions, and reinforced edges are enhancing bin functionality across sectors. The rising preference for flexible designs that reduce transportation weight and lower emissions creates significant opportunities for innovation in the coming years.

- For instance, Mondi’s automotive case achieved 50% higher packing density and 33% lower material and space per shipped component set.

Key Challenges

Fluctuating Raw Material Prices

Volatility in paper and pulp prices remains a major challenge for market stability. These materials form the backbone of corrugated packaging production, and global supply chain disruptions or rising energy costs directly impact profit margins. Manufacturers face pressure to maintain competitive pricing while ensuring product quality. Sustained material cost fluctuations can affect long-term supply agreements, particularly for large-scale industrial packaging customers.

Limited Durability in Extreme Conditions

Corrugated bulk bins, while sustainable, have limited resistance to moisture, extreme temperatures, and prolonged outdoor exposure. This restricts their application in heavy-duty or long-term storage environments. Although coated and laminated variants offer partial protection, they add to production costs and reduce recyclability. Maintaining performance consistency under varying climatic conditions remains a technical hurdle, pushing producers to invest in advanced barrier technologies and hybrid material solutions.

Regional Analysis

North America

North America holds the largest share of around 34.8% in the corrugated bulk bins market in 2024. Strong growth in the food and beverage, automotive, and e-commerce sectors supports demand for durable and recyclable packaging. The United States leads the region with widespread use of heavy-duty bins in logistics and retail distribution. High consumer preference for sustainable packaging and stringent environmental regulations drive adoption of corrugated formats. Continuous technological improvements in material strength and automated packaging processes further enhance market penetration across diverse industrial supply chains.

Europe

Europe accounts for approximately 27.6% of the global corrugated bulk bins market in 2024. Growing emphasis on eco-friendly packaging solutions under the European Green Deal is a key factor driving regional demand. Countries such as Germany, France, and the United Kingdom are adopting high-performance corrugated bins for food, chemical, and construction applications. Rising automation in warehousing and retail logistics boosts the use of pallet-compatible corrugated bins. The increasing shift toward lightweight, recyclable materials is strengthening the region’s leadership in sustainable packaging innovation.

Asia Pacific

Asia Pacific captures about 24.9% share of the global corrugated bulk bins market in 2024. The region’s strong industrial expansion, particularly in China, India, and Japan, drives substantial consumption across food, pharmaceutical, and automotive sectors. Rapid urbanization and rising export activities are increasing demand for efficient and cost-effective bulk packaging. Expanding manufacturing bases and government focus on waste reduction are further supporting market growth. Growing investments in logistics infrastructure and corrugated board production capacity continue to enhance regional competitiveness in global packaging markets.

Latin America

Latin America represents around 7.4% of the global corrugated bulk bins market in 2024. Demand is largely driven by the growth of food exports, retail packaging, and chemical manufacturing. Brazil and Mexico are the key contributors, supported by expanding agricultural trade and industrialization. The shift toward recyclable packaging materials aligns with rising environmental awareness among producers and consumers. Limited access to advanced recycling infrastructure, however, constrains faster adoption. Continued investment in corrugated production facilities is expected to strengthen the regional supply chain over the forecast period.

Middle East & Africa

The Middle East & Africa region accounts for nearly 5.3% share of the global corrugated bulk bins market in 2024. The growing construction, oil, and consumer goods sectors are creating new opportunities for corrugated packaging. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are witnessing rising use of bulk bins in logistics and retail storage. Increasing focus on reducing plastic waste and adopting eco-friendly packaging supports gradual market expansion. Infrastructure development and regional trade integration are expected to further accelerate future growth.

Market Segmentations:

By Load Capacity

- More than 1,500 kg

- 1,000 – 1,500 kg

- Below 1,000 kg

By Type

- Hinged

- Pallet packs

- Others

By Format

- Triple wall

- Double wall

- Single wall

- Others

By Application

- Food & beverages

- Pharmaceuticals

- Automotive

- Chemical

- Oil & lubricants

- Building & construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the corrugated bulk bins market includes major participants such as Mondi Group, Smurfit Kappa Group, Packaging Corporation of America, DS Smith Plc, Nine Dragons Paper (Holdings) Limited, WestRock Company, Svenska Cellulosa Aktiebolaget SCA, Lee & Man Paper Manufacturing Limited, Georgia-Pacific LLC, International Paper Company, and Sonoco Products Company. The market is characterized by strong competition among global and regional manufacturers focusing on sustainable, durable, and cost-efficient packaging solutions. Companies are emphasizing innovation in corrugated material strength, lightweight design, and recyclability to meet growing sustainability regulations. Strategic mergers, capacity expansions, and advancements in automated packaging technologies are strengthening operational efficiency and market positioning. Increasing focus on digital printing, logistics optimization, and recyclable product portfolios is enhancing brand value across supply chains. Furthermore, ongoing R&D investment in moisture-resistant coatings and high-strength fiberboards continues to create differentiation, enabling market players to cater to diverse industrial packaging needs effectively.

Key Player Analysis

- Mondi Group

- Smurfit Kappa Group

- Packaging Corporation of America

- DS Smith Plc

- Nine Dragons Paper (Holdings) Limited

- WestRock Company

- Svenska Cellulosa Aktiebolaget SCA

- Lee & Man Paper Manufacturing Limited

- Georgia-Pacific LLC

- International Paper Company

- Sonoco Products Company

Recent Developments

- In 2025, International Paper completed the acquisition of DS Smith for approximately $7.2 billion on January 31, 2025, creating a new global leader in sustainable packaging solutions.

- In 2024, Liberty Coca-Cola Beverages and WestRock installed new equipment in Philadelphia to replace 200,000 pounds of plastic rings with recyclable paperboard carriers.

- In 2023, WestRock launched a new line of lightweight, high-strength corrugated bulk bins focusing on sustainable and eco-friendly packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Load Capacity, Type, Format, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for recyclable and eco-friendly packaging materials will continue to rise globally.

- Automation and smart logistics integration will boost adoption of pallet-compatible corrugated bins.

- Food and beverage industries will remain major consumers due to bulk handling efficiency.

- Lightweight and high-strength corrugated formats will gain traction across industrial applications.

- Manufacturers will invest in advanced coatings to enhance moisture and load resistance.

- Asia Pacific will witness the fastest growth driven by expanding manufacturing and exports.

- E-commerce and retail distribution networks will further strengthen market demand.

- Rising paper and pulp costs may influence pricing and profit margins for producers.

- Technological innovation in corrugated board design will improve durability and reusability.

- Sustainability commitments and regulatory support will shape future packaging standards worldwide.

Market Segmentation Analysis:

Market Segmentation Analysis: