Market Overview:

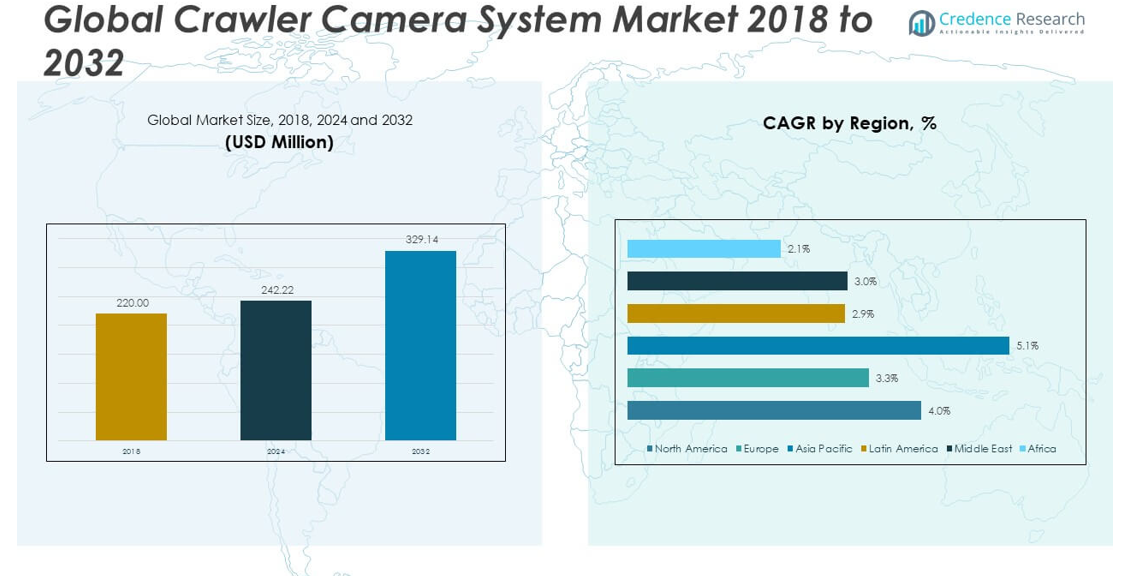

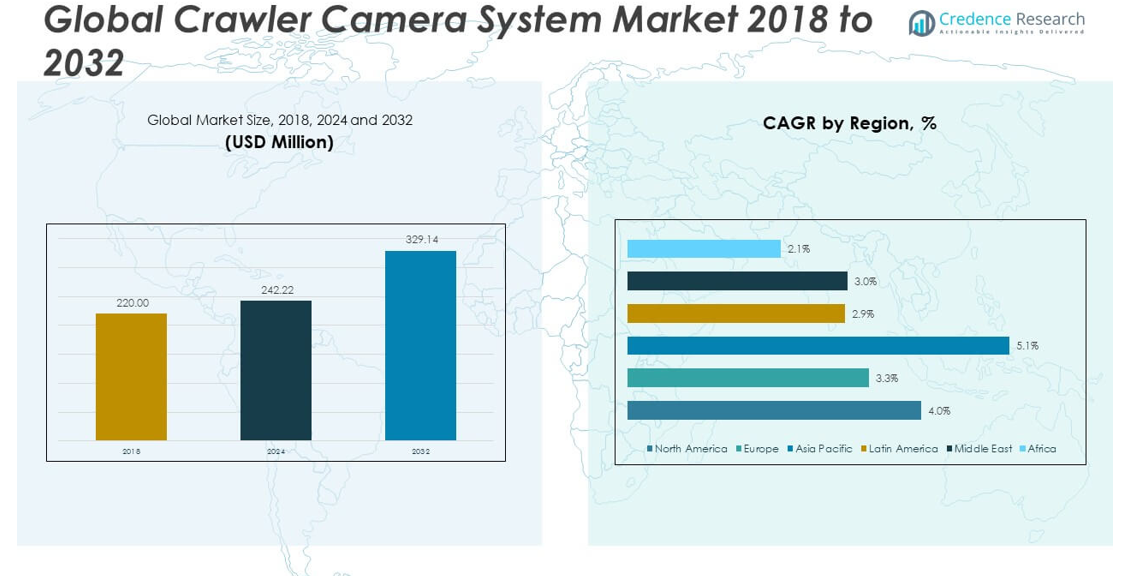

The Crawler Camera System Market size was valued at USD 220.00 million in 2018 to USD 242.22 million in 2024 and is anticipated to reach USD 329.14 million by 2032, at a CAGR of 3.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crawler Camera System Market Size 2024 |

USD 242.22 million |

| Crawler Camera System Market, CAGR |

3.95% |

| Crawler Camera System Market Size 2032 |

USD 329.14 million |

The Crawler Camera System Market is gaining traction as industries and municipalities increasingly adopt remote visual inspection tools. These systems provide high-resolution imaging and maneuver efficiently in hazardous or confined spaces, such as pipelines, tanks, and sewers. Aging infrastructure in developed countries is fueling demand for frequent inspections. The push toward smart maintenance is driving innovation in crawler systems, incorporating AI diagnostics and wireless features. Emerging economies are also adopting these tools amid growing urbanization and the need for efficient underground infrastructure monitoring.

The Crawler Camera System Market demonstrates strong regional patterns influenced by industrial development and regulatory frameworks. North America dominates due to advanced safety standards, early technology adoption, and the presence of leading companies. Europe follows, driven by aging infrastructure and rising public maintenance investments. Asia Pacific is rapidly expanding, particularly in China, India, and Southeast Asia, where smart city initiatives fuel demand. Latin America and the Middle East are emerging markets, while Africa remains nascent, with growth potential tied to increasing urbanization and infrastructure investment.

Market Insights:

- The Crawler Camera System Market was valued at USD 242.22 million in 2024 and is projected to reach USD 329.14 million by 2032, driven by growing demand for non-invasive infrastructure inspections.

- Growth is fueled by rising municipal maintenance needs and industrial safety regulations.

- Use of crawler systems is expanding in hazardous and confined spaces where human entry is restricted.

- High initial costs and technical limitations in harsh environments remain adoption challenges.

- Budget constraints in developing regions continue to limit full-scale deployment.

- North America and Europe dominate the market due to strong regulatory frameworks and public investments.

- Asia Pacific is the fastest-growing region, driven by urbanization, infrastructure development, and smart city initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Need for Infrastructure Inspection and Maintenance

A major force driving the Crawler Camera System Market is the rising demand for non-invasive inspection solutions for aging water, sewage, and gas pipeline infrastructure. Municipalities and utilities are under pressure to ensure uninterrupted service while avoiding disruptive excavation-based inspections. The crawler camera system enables efficient internal assessment of pipelines, minimizing downtime and labor costs. It offers high-resolution video capture and real-time fault detection, ensuring rapid maintenance decisions. Growing awareness of the economic impact of delayed pipeline repairs further amplifies this demand. Government policies mandating periodic pipeline assessments are pushing both public and private sectors to invest in crawler camera solutions.

- For example, the Envirosight ROVVER X uses IoT connectivity to stream HD video and sensor data in real time, enabling remote pipeline inspections without excavation. This technology helped Macomb County, Michigan, save around $4 million by switching to AI-powered crawler and drone systems, allowing them to inspect thousands of linear feet daily with minimal manual labor.

Increasing Industrial Applications across Hazardous Environments

Industries such as oil & gas, manufacturing, and chemical processing are deploying crawler camera systems for asset monitoring in dangerous or inaccessible zones. These systems facilitate remote inspections of storage tanks, heat exchangers, and confined spaces without compromising operator safety. Their durability under high temperature, pressure, and corrosive conditions enhances their suitability across industrial applications. Use of crawler cameras also aligns with occupational safety regulations, reducing human exposure to toxic environments. The growing trend of predictive maintenance and condition-based monitoring is further integrating these tools into industrial workflows.

Adoption of Technological Enhancements to Improve Efficiency

The Crawler Camera System Market is advancing with innovations such as pan-tilt-zoom (PTZ) camera heads, wireless data transmission, and AI-based defect recognition. These features allow operators to navigate complex environments with ease and identify corrosion, cracks, or obstructions faster. Integration of GPS and cloud-based analytics platforms improves data management and reporting accuracy. Automation and machine learning capabilities also support predictive diagnostics, making inspection processes smarter and less reliant on manual interpretation. The convergence of these technologies boosts operational efficiency and fosters widespread adoption across utilities and industrial sectors.

- For example, Cutting-edge Wi-Fi data modules, such as Dewesoft’s DS-WIFI4 system, offer wireless data transfer with up to a 2 km line-of-sight range, supporting frequencies at 2.4 GHz and 5 GHz for mission-critical inspections where cabling is impractical.

Supportive Government Regulations and Safety Standards

Global regulatory frameworks are strengthening the use of crawler cameras in compliance inspections for wastewater systems, fuel pipelines, and confined space entry. Standards set by agencies such as OSHA, EPA, and their regional counterparts require safe and periodic inspections of critical infrastructure. Non-compliance often leads to heavy penalties, driving organizations to adopt reliable inspection methods. The crawler camera system fits these mandates by offering detailed, auditable visual data. Its usage also supports sustainability goals by reducing unnecessary excavation and material waste, aligning with broader environmental regulations.

Market Trends:

Shift Toward Smart and Connected Inspection Systems

The Crawler Camera System Market is evolving through integration of IoT and smart technologies. Vendors are offering systems equipped with remote diagnostics, real-time data analytics, and cloud-based storage for better inspection workflows. This transformation is enhancing inspection quality, reducing human error, and supporting predictive maintenance strategies. Real-time alerts and intelligent fault detection are enabling faster response in critical infrastructure scenarios. The move toward digital twins and data-driven decision-making is encouraging the use of crawler cameras as integral components in smart asset management systems.

Growing Demand for Portable and Lightweight Systems

End users are increasingly seeking compact and lightweight crawler camera systems for ease of deployment in restricted environments. Traditional systems were often bulky, limiting usability in smaller diameter pipelines or complex cavities. The market is witnessing a trend toward miniaturized designs without compromising on resolution, lighting, or maneuverability. This shift allows maintenance teams to carry and deploy the system with minimal setup time, improving field efficiency. Lightweight systems also reduce physical strain on operators, aligning with ergonomic best practices in field operations.

- For example, the RX95 Crawler by AIT Products inspects pipelines as small as 100mm in diameter and weighs significantly less than legacy equipment. It uses a 100-meter cable (328 feet) and a six-wheel drive for versatile maneuverability, with a compact system weight and ergonomic, low-weight 800×600 touchscreen control station.

Expansion of Rental and Leasing Business Models

The high upfront cost of crawler camera systems is pushing the market toward service-based business models. Rental and leasing options are gaining traction, especially among small and mid-sized contractors who require advanced inspection tools on a project basis. Equipment vendors and service providers are capitalizing on this trend by offering flexible, usage-based pricing structures. This approach helps users access cutting-edge technology without significant capital investment, increasing market penetration. It also supports recurring revenue streams for manufacturers and enhances customer retention.

Increased Integration with GIS and Mapping Technologies

Crawler camera systems are increasingly integrated with Geographic Information Systems (GIS) to improve location tracking and data mapping of underground assets. This capability is crucial for utility management, where exact asset location and condition tracking enhance operational planning. GIS integration allows technicians to overlay visual inspection data with spatial information, improving asset life-cycle management. It also helps municipalities in urban planning by providing a clearer picture of subterranean infrastructure conditions. This trend reflects a broader movement toward unified infrastructure intelligence platforms.

- For example, Mosaic 360-degree imaging platforms, for example, combine HD imagery, LiDAR, and inertial measurement units (IMUs) with GIS software, creating immersive, high-accuracy virtual representations of underground and municipal assets.

Market Challenges Analysis:

High Equipment Cost and Limited Access in Cost-Sensitive Regions

The initial cost of crawler camera systems remains a significant barrier for widespread adoption, especially in developing countries. These systems require specialized cameras, rugged mechanical design, lighting units, and advanced navigation features, all of which drive up production costs. Small contractors and municipal bodies with constrained budgets often struggle to justify these investments. In regions with limited government support or weak regulatory enforcement, buyers may prioritize cheaper alternatives, even if they compromise inspection quality. This price sensitivity slows the adoption rate in cost-conscious markets and creates entry barriers for new players.

Operational Constraints and Technical Limitations in Harsh Environments

Despite advancements, crawler camera systems face challenges in environments with extreme debris, high water flow, or sharp bends. Their performance can degrade in muddy or chemically aggressive conditions, where camera lenses get obscured or mechanical components fail. Operators also require technical skills to manage system calibration, navigation, and data interpretation. Inadequate training or poor maintenance can limit system lifespan and reduce inspection accuracy. These limitations hinder deployment in certain industrial settings and reduce the system’s perceived reliability in unpredictable inspection environments.

Market Opportunities:

Surging Demand from Urban Infrastructure and Smart City Projects

Rapid urbanization is creating significant opportunities in the Crawler Camera System Market. Expanding city infrastructure, especially in developing regions, requires efficient underground inspection for utilities, drainage, and pipeline systems. Governments and municipalities are allocating budgets for smart city development, which includes modernizing maintenance operations with non-invasive tools. This demand presents a profitable avenue for vendors targeting urban infrastructure upgrades with compact and intelligent crawler systems.

Emerging Adoption in Disaster Management and Rescue Operations

The use of crawler camera systems is expanding into disaster response and confined-space search operations. Their ability to navigate collapsed structures and hazardous zones offers critical visual feedback for rescue teams. Emergency service agencies and defense units are investing in these tools for tactical surveillance and victim location. This niche yet essential application is opening new verticals for market growth, especially with increasing global climate-related disasters.

Market Segmentation Analysis:

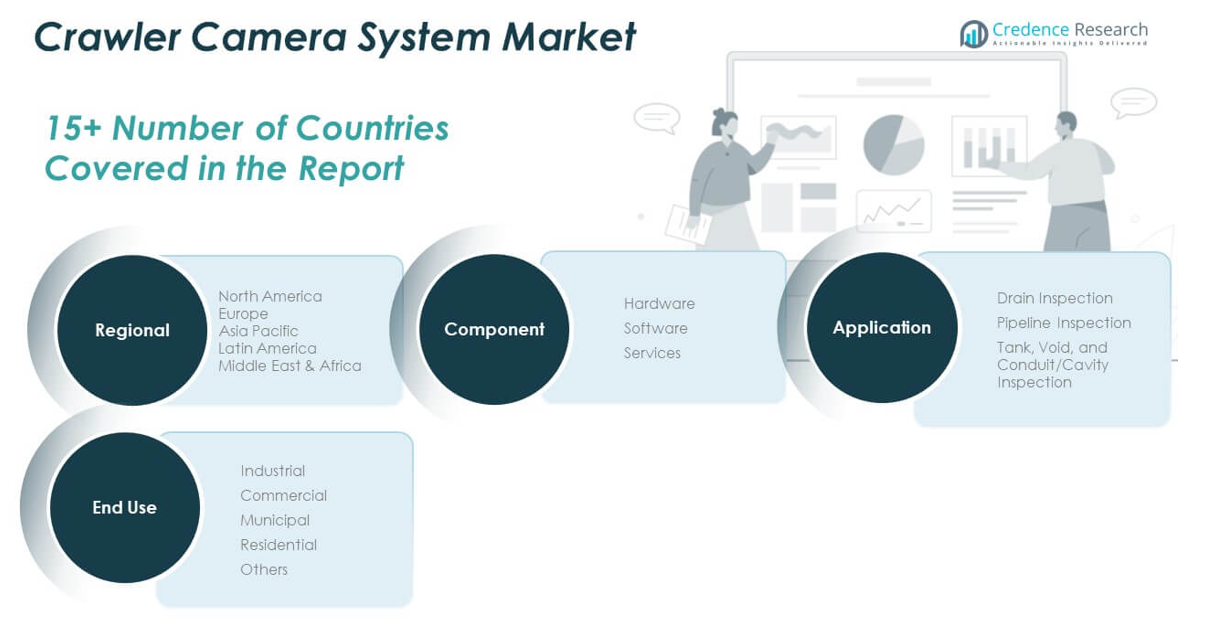

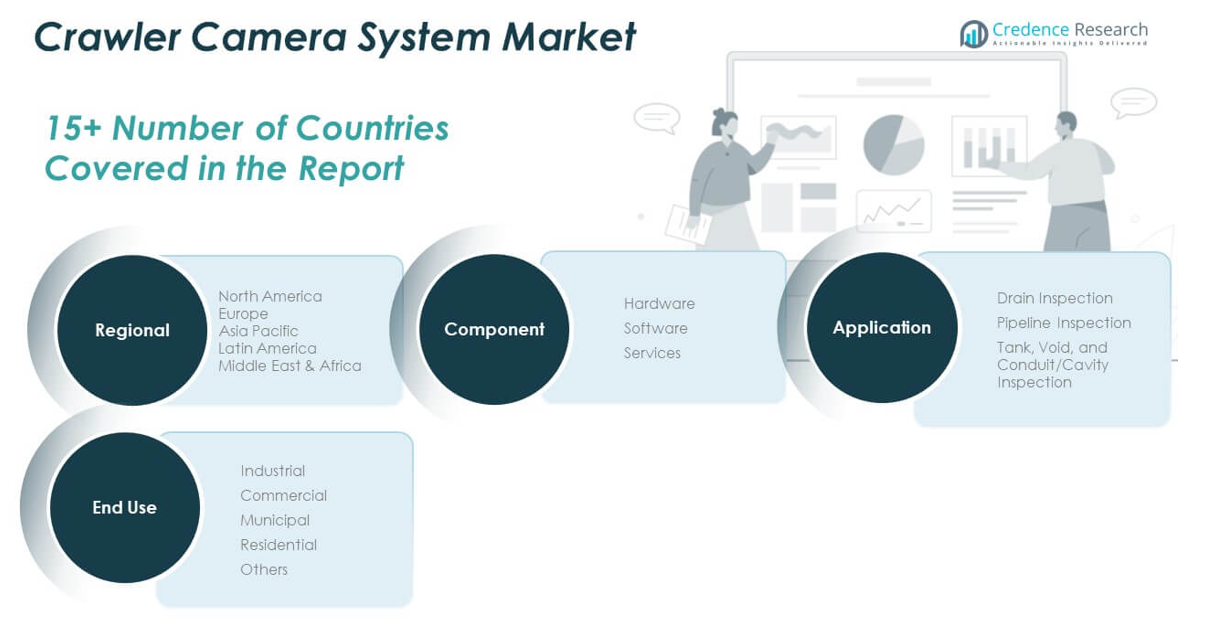

The Crawler Camera System Market is segmented into component, application, and end use categories, each reflecting distinct growth dynamics.

By component, hardware dominates due to its critical role in system performance, including camera modules, crawlers, and lighting units. It contributes the majority of the revenue share, while software gains traction through advanced analytics and AI-powered diagnostics. Services are steadily expanding, driven by recurring maintenance and inspection contracts across municipalities and industries.

- For instance, Easy Sight X5-HS, integrates an HD pan-tilt camera controlled via a wireless or wired connection, streaming footage and system health data to on-site tablets or remote laptops. All inspection data and environmental telemetry are auto-archived to secure cloud storage, supporting AI-powered defect analytics and field-to-office collaboration in real time.

By application, pipeline inspection leads the market due to extensive use in oil, gas, and water utilities. Drain inspection follows, supported by increasing urban sewage management efforts. Tank, void, and conduit/cavity inspection represents a niche but growing segment where safety and accessibility concerns drive demand for remote solutions.

- For example, Aries Industriesreporting over 10,000 miles of oil, gas, and water pipeline inspected annually using their ROVVER X crawler systems.

By end use, industrial users form the largest segment due to high operational safety requirements and regulatory compliance in hazardous environments. Municipal use is also significant, driven by the need to maintain aging infrastructure and prevent system failures. Commercial and residential segments contribute smaller shares but show potential through facility maintenance and construction-related inspections. The others category includes utilities and emergency services, where crawler cameras are used for special-purpose tasks such as disaster response and structural assessments. The Crawler Camera System Market benefits from diversified applications and cross-sectoral adoption, supporting its long-term growth prospects.

Segmentation:

By Component

- Hardware

- Software

- Services

By Application

- Drain Inspection

- Pipeline Inspection

- Tank, Void, and Conduit/Cavity Inspection

By End Use

- Industrial

- Commercial

- Municipal

- Residential

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Crawler Camera System Market size was valued at USD 71.70 million in 2018 to USD 77.87 million in 2024 and is anticipated to reach USD 105.65 million by 2032, at a CAGR of 4.0% during the forecast period. North America dominates the Crawler Camera System Market due to early adoption of inspection technologies and stringent regulatory mandates. The U.S. leads the region, supported by its large-scale pipeline infrastructure, extensive municipal sewer networks, and consistent federal investment in utility monitoring systems. Canada and Mexico are also advancing in adoption through industrial expansion and urban development initiatives. The presence of leading manufacturers and a strong emphasis on preventive maintenance further bolster regional market leadership.

Europe

The Europe Crawler Camera System Market size was valued at USD 60.46 million in 2018 to USD 64.08 million in 2024 and is anticipated to reach USD 82.47 million by 2032, at a CAGR of 3.3% during the forecast period. Europe holds a significant share of the Crawler Camera System Market due to aging infrastructure and increasing demand for rehabilitation of underground pipelines. Countries like Germany, the UK, and France are investing in non-invasive inspection solutions to comply with strict EU safety and environmental regulations. Municipal authorities and utilities are enhancing asset monitoring programs, fueling demand. The rise of smart city projects and sustainability-driven public infrastructure investments are also boosting the adoption rate across the region.

Asia Pacific

The Asia Pacific Crawler Camera System Market size was valued at USD 57.86 million in 2018 to USD 66.33 million in 2024 and is anticipated to reach USD 98.84 million by 2032, at a CAGR of 5.1% during the forecast period. Asia Pacific is emerging as the fastest-growing region in the Crawler Camera System Market due to urbanization, industrial expansion, and infrastructure development in countries such as China, India, Japan, and Southeast Asian nations. Growing investments in smart cities, coupled with rising awareness of preventive maintenance, are fueling market demand. Governments are prioritizing underground utility management and pipeline safety, driving crawler system deployments in both public and private sectors. The region also benefits from local manufacturing and technological innovation.

Latin America

The Latin America Crawler Camera System Market size was valued at USD 13.02 million in 2018 to USD 14.19 million in 2024 and is anticipated to reach USD 17.80 million by 2032, at a CAGR of 2.9% during the forecast period. Latin America presents a steady growth path in the Crawler Camera System Market, led by Brazil, Argentina, and Chile. Urban growth and water infrastructure modernization are prompting investments in inspection technologies. While the market is smaller in size, increasing awareness of asset reliability and environmental compliance is creating gradual demand. Government efforts to improve utility services and address water loss through leak detection support adoption of crawler systems in municipal operations.

Middle East

The Middle East Crawler Camera System Market size was valued at USD 10.78 million in 2018 to USD 11.29 million in 2024 and is anticipated to reach USD 14.19 million by 2032, at a CAGR of 3.0% during the forecast period. The Middle East is adopting crawler camera systems in response to increasing infrastructure investments and smart city initiatives, especially in the UAE and Saudi Arabia. These economies are integrating advanced inspection tools into urban development and public utility projects. Pipeline safety in oil-producing regions is another driver. The market is supported by rising industrial activity, regional construction booms, and a growing focus on sustainability in public infrastructure.

Africa

The Africa Crawler Camera System Market size was valued at USD 6.18 million in 2018 to USD 8.45 million in 2024 and is anticipated to reach USD 10.19 million by 2032, at a CAGR of 2.1% during the forecast period. Africa represents an early-stage but promising market for crawler camera systems, primarily driven by infrastructure improvement initiatives in South Africa, Egypt, and select West African nations. Urbanization, coupled with external development funding, is gradually modernizing sewer and water infrastructure. While adoption remains slow due to budget constraints and low awareness, international collaborations and the rising need for utility monitoring are opening new opportunities for market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Deep Trekker Inc.

- AM Industrial

- iPEK International GmbH (IDEX)

- CUES Inc.

- Eddyfi

- Kummert GmbH

- Minicam Limited

- Rausch USA

- Inspector Systems

- Subsite Electronics

Competitive Analysis:

The Crawler Camera System Market features a moderately fragmented competitive landscape with key players competing on technology, durability, and customization. Companies such as Deep Trekker Inc., iPEK International GmbH, and CUES Inc. are expanding their global presence through product launches, strategic partnerships, and regional expansions. Technological differentiation plays a vital role in sustaining competitive advantage, especially through innovations in camera quality, mobility, and software integration. New entrants often focus on niche applications or cost-effective solutions to penetrate underserved markets. The market is driven by demand for reliability, inspection depth, and service support, prompting vendors to invest in R&D and aftermarket services.

Recent Developments:

- In April 2025, Deep Trekker Inc. entered into a partnership with Navtech Radar, jointly showcasing advanced underwater and radar technologies at Ocean Business 2025 in Southampton, UK. This collaboration aims to enhance maritime safety and efficiency by integrating Deep Trekker’s remotely operated vehicles with Navtech Radar’s navigation and situational awareness solutions.

Market Concentration & Characteristics:

The Crawler Camera System Market shows moderate concentration, with a mix of established global players and emerging regional manufacturers. It is technology-driven, favoring companies with strong R&D capabilities and robust product customization. Product differentiation hinges on camera clarity, system mobility, automation, and ease of deployment in confined spaces. The market is characterized by high replacement cycles in industrial use and steady service demand from municipal users. While mature markets prioritize advanced features and integration with analytics platforms, emerging regions focus on affordability and rugged performance.

Report Coverage:

The research report offers an in-depth analysis based on component, application, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of AI-enabled fault detection will transform automated inspection workflows.

- Demand for lightweight and modular crawler systems will rise across municipal and industrial sectors.

- Rental and service-based business models will grow, supporting small to mid-size contractors.

- Integration with GIS and cloud platforms will enhance data accessibility and asset mapping.

- Smart city infrastructure investments in Asia and the Middle East will accelerate regional demand.

- Partnerships between manufacturers and public utilities will drive pilot-scale deployment in emerging economies.

- Technological innovations in sensor design and battery life will extend operational uptime.

- Rising regulations around pipeline integrity will encourage periodic, tech-driven inspections.

- Expansion of applications in disaster response and confined-space surveillance will open niche markets.

- Competitive intensity will rise as new players introduce cost-effective and portable systems.