Market Overview

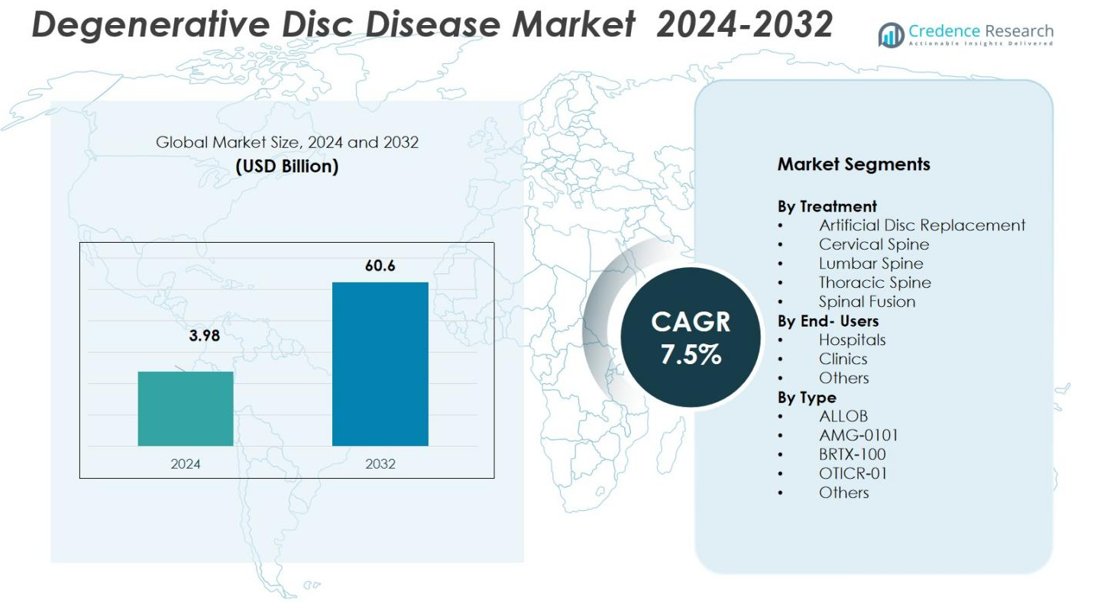

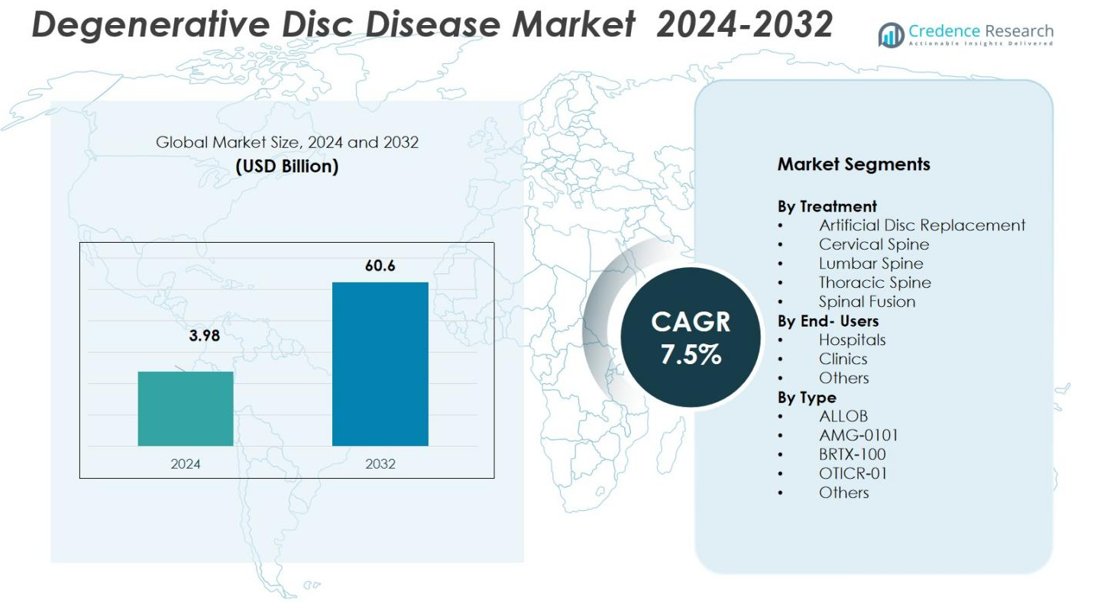

The Degenerative Disc Disease Market size was valued at USD 3.98 Billion in 2024 and is anticipated to reach USD 60.6 Billion by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Degenerative Disc Disease Market Size 2024 |

USD 3.98 Billion |

| Degenerative Disc Disease Market, CAGR |

7.5% |

| Degenerative Disc Disease Market Size 2032 |

USD 60.6 Billion |

The Degenerative Disc Disease (DDD) market features prominent global players such as Medtronic, Stryker, Zimmer Biomet, B. Braun Melsungen AG and AxioMed LLC leading industry efforts. These firms maintain broad product portfolios spanning spinal implants, surgical devices, motion‑preserving artificial discs, and emerging biologic/regenerative therapies. Their strong R&D pipelines, global distribution networks, and proven clinical track records have secured substantial market penetration. Regionally, the market concentrates heavily in North America, which commands 37% of global share, driven by advanced healthcare infrastructure, high DDD prevalence, and early adoption of innovative spine treatments.

Market Insights

- The global Degenerative Disc Disease (DDD) market stood at USD 3.98 Billion in 2024 and is forecast to grow at a CAGR of 7.5% through 2032.

- The rising geriatric population and increasing prevalence of spinal disorders are key growth engines for the market, driving demand for both surgical and non-surgical DDD treatments.

- Minimally invasive surgical techniques and advanced spinal implants are gaining wider adoption, improving patient outcomes and accelerating market expansion, particularly in treatment segments such as Spinal Fusion (51% share) and Artificial Disc Replacement (29%).

- Growing demand in emerging regions and expanding healthcare infrastructure contribute to regional growth; North America leads with a 35.82% share, followed by Europe (27.13%), Asia Pacific (20.46%), Latin America (9.21%), and Middle East & Africa (7.38%).

- Leading medical device firms such as Medtronic, Stryker, Zimmer Biomet, B. Braun Melsungen AG, and AxioMed LLC strengthen market position through broad product portfolios, innovative technologies, and global distribution networks; this bolsters both regional and global penetration across key segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Treatment

The Spinal Fusion treatment segment leads the market, commanding a 51% share. This dominance is attributed to its effectiveness in stabilizing vertebral segments, alleviating pain, and preventing further degeneration. Spinal fusion remains the gold standard, particularly for advanced DDD cases that require structural stabilization. The growing geriatric population and increasing incidence of spinal instability continue to drive the demand for this treatment. Other treatment types, including Artificial Disc Replacement (29%), are gaining traction due to their minimally invasive approach and ability to preserve spinal mobility post-surgery.

- For instance, Medtronic’s UNiD ASI platform surpassed 20,000 surgical cases, leveraging AI-driven patient-reported outcomes to enhance predictability in spinal fusion procedures.

By End-User

Hospitals are the dominant end-user segment, capturing 32% of the market. This dominance is due to their ability to support complex surgical procedures and provide multidisciplinary care. Hospitals also benefit from advanced surgical infrastructure and post-operative recovery systems. Clinics follow with 45% share, driven by the growing demand for outpatient care and less invasive procedures. The “Others” category, which includes rehabilitation centers and home-care providers, holds 23% of the market, supporting the need for post-operative rehabilitation and non-invasive pain management therapies.

- For instance, the Mayo Clinic utilizes cutting-edge robotic surgical systems to enhance precision in minimally invasive procedures.

By Type

The Device & Implant-based treatments, including spinal fusion and disc replacement devices, dominate the Type segment, representing 55% of the market. These traditional treatments have a long history of clinical acceptance, regulatory approval, and widespread use. However, cell-based therapies, particularly BRTX-100, are gaining momentum with a 22% market share. BRTX-100 has shown promising results in clinical trials and has the potential to revolutionize the treatment of degenerative disc disease by regenerating damaged tissue. The remaining 23% of the market is driven by experimental and adjunctive treatments, which are still in the early stages of development.

Key Growth Drivers

Increasing Geriatric Population

The growing global geriatric population is a significant driver of the Degenerative Disc Disease (DDD) market. As individuals age, the risk of degenerative conditions like DDD increases due to natural wear and tear on the spine. The aging population demands more treatments for chronic back pain and spinal instability, fueling the growth of surgical procedures such as spinal fusion and artificial disc replacement. This demographic shift is anticipated to substantially boost the market for both invasive and non-invasive treatments, creating long-term growth opportunities.

- For instance, Medtronic has advanced its spinal fusion and artificial disc replacement technologies to address the rising demand among older adults suffering chronic back pain.

Advancements in Minimally Invasive Surgical Techniques

Technological advancements in minimally invasive surgery (MIS) are significantly enhancing the Degenerative Disc Disease market. Techniques like Artificial Disc Replacement (ADR) are increasingly popular due to their ability to reduce recovery times, lower complication risks, and offer more precise targeting for patients. These improvements in surgical techniques, driven by innovations in robotics, imaging, and surgical instruments, make procedures less invasive while providing better outcomes. As a result, more patients are opting for these advanced, minimally invasive treatments, spurring market growth.

- For instance, Centinel Spine’s prodisc C Vivo and prodisc C SK achieved an 87.1% overall composite clinical success rate at two levels in an FDA IDE study, surpassing control cervical TDR devices.

Rising Adoption of Regenerative Therapies

The growing acceptance of regenerative therapies, such as stem cell treatments and gene therapy, is another key growth driver in the Degenerative Disc Disease market. These therapies aim to regenerate damaged disc tissue, offering a more sustainable alternative to traditional surgical treatments. As clinical trials yield positive results and regulatory pathways become more streamlined, regenerative therapies like BRTX-100 are gaining traction. These innovations represent the future of DDD treatment, providing potential for reduced pain, faster recovery, and long-term benefits, thus contributing to market expansion.

Key Trends & Opportunities

Rising Preference for Outpatient and Minimally Invasive Procedures

A significant trend in the Degenerative Disc Disease market is the increasing preference for outpatient and minimally invasive procedures. Patients and healthcare providers are moving towards less invasive treatment options that allow for quicker recovery and reduced hospital stays. This trend is not only cost-effective but also offers patients reduced pain and shorter rehabilitation periods. Clinics, particularly those specializing in outpatient spine care, are benefitting from this shift, creating substantial growth opportunities for providers of minimally invasive spinal procedures and devices.

- For instance, Hoag Orthopedic Institute, which includes ambulatory surgery centers (ASCs) such as one in Orange, CA, focuses on outpatient spine procedures. The larger Hoag system is recognized by U.S. News & World Report as the highest-ranked hospital in Orange County for overall orthopedics and is rated “High Performing” for specific procedures like spinal fusion.

Expansion of Regenerative Medicine

The regenerative medicine field is rapidly expanding within the Degenerative Disc Disease market, providing promising opportunities. Innovations such as stem cell therapy and platelet-rich plasma (PRP) injections are emerging as viable treatments for disc degeneration. These treatments focus on healing or regenerating damaged tissues rather than merely alleviating symptoms, which can offer longer-lasting results. The ongoing development of cell-based therapies and biologic solutions holds great potential for revolutionizing DDD care, offering new treatment avenues that could significantly improve patient outcomes.

- For instance, DiscGenics is pioneering an injectable, allogeneic cell therapy called IDCT (rebonuputemcel), which uses proprietary Discogenic Cells to treat mild to moderate lumbar disc degeneration aiming to restore function and reduce pain without surgery.

Key Challenges

High Treatment Costs and Limited Insurance Coverage

One of the primary challenges in the Degenerative Disc Disease market is the high treatment costs associated with advanced procedures such as spinal fusion and artificial disc replacement. These treatments, while effective, often come with significant financial burdens for patients, especially in regions with limited healthcare coverage. The lack of comprehensive insurance coverage for newer, cutting-edge therapies such as stem cell treatments further compounds the issue. This challenge could limit accessibility for patients and slow the widespread adoption of advanced treatment options.

Regulatory and Clinical Trial Uncertainty

Another significant challenge facing the Degenerative Disc Disease market is the uncertainty surrounding regulatory approval for emerging treatments, particularly in the area of regenerative medicine. Clinical trials for treatments like stem cell therapy and gene therapy are often complex and face regulatory hurdles. Approval timelines can be lengthy and unpredictable, delaying the availability of promising new therapies. Additionally, inconsistent regulatory standards across regions further complicate the market’s global expansion, potentially slowing the uptake of innovative treatments.

Regional Analysis

North America

North America leads the global market, capturing a 35.82% share in 2024. This dominance reflects the region’s advanced healthcare infrastructure, widespread availability of minimally invasive surgical and regenerative treatments, and high prevalence of degenerative spine conditions among aging populations. Strong reimbursement frameworks, robust R&D investments, and the presence of major medical device and biotech companies further bolster the region’s market strength. As a result, North America remains the primary growth engine for global DDD treatment adoption, accounting for a substantial portion of the market share.

Europe

Europe holds a significant portion of global DDD market demand, accounting for 27.13% of the market in 2024. This growth is supported by rising adoption of modern spine treatment techniques, an increasing geriatric population, and improved healthcare infrastructure across Western and Central European countries. High standards of clinical care, regulatory acceptance of advanced spinal devices, and growing investments in spine care contribute to Europe’s robust positioning in the market. With a well-established healthcare system, Europe remains a key player in the global DDD market.

Asia Pacific

The Asia Pacific region is emerging as a rapidly growing market, holding a 20.46% share in 2024. This growth is driven by increased healthcare expenditure, expanding spine-care infrastructure, and rising awareness of spinal disorders in countries such as China, India, and Japan. The demand for both surgical and non-surgical DDD treatments is increasing, fueled by the growing patient pool and improving affordability and accessibility to advanced care. The region’s high population and expanding middle class make it a key area for future market growth.

Latin America

Latin America represents 9.21% of the global DDD market in 2024, with gradual growth driven by expanding healthcare access and awareness across key countries. The region is seeing a rise in the elderly population, an increasing incidence of spinal disorders, and growing demand for effective treatments. As both public and private healthcare systems invest in spine-care capabilities, demand for both surgical and non-surgical interventions continues to rise. Despite regional disparities in access and affordability, Latin America remains an important emerging market for DDD treatments.

Middle East & Africa

The Middle East & Africa region accounts for 7.38% of the global DDD market in 2024. Although smaller in market share, it is a gradually growing segment due to improvements in healthcare infrastructure, particularly in urban centers, and the rising adoption of modern spine-care procedures. The increasing elderly population, coupled with government investments in spine care and orthopaedic facilities, are supporting the market’s expansion. However, access to advanced treatments is still limited in rural areas, which poses a challenge, but also an opportunity for growth in the long term.

Market Segmentations

By Treatment

- Artificial Disc Replacement

- Cervical Spine

- Lumbar Spine

- Thoracic Spine

- Spinal Fusion

By End- Users

By Type

- ALLOB

- AMG-0101

- BRTX-100

- OTICR-01

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Degenerative Disc Disease (DDD) market is highly competitive, with key players such as Medtronic, Stryker, Zimmer Biomet, B. Braun Melsungen AG, and AxioMed LLC dominating the landscape. These companies leverage advanced technology and clinical expertise to maintain a strong presence in the market, offering a broad range of treatment solutions from traditional spinal fusion and artificial disc replacement to emerging regenerative therapies. Medtronic and Stryker lead the market with their comprehensive portfolios, including spinal implants, surgical devices, and biologic products. Zimmer Biomet’s focus on minimally invasive surgical technologies and B. Braun’s innovative solutions in biologics further strengthen their market position. In addition to established players, new entrants in the regenerative medicine segment, such as stem cell and gene therapy developers, are challenging the status quo by offering novel treatments. These players focus on improving patient outcomes through innovative therapies, fueling growth and competition in the market. Strategic partnerships, mergers, and acquisitions are also key strategies for expanding product offerings and geographic reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic (Ireland)

- Kolon TissueGene, Inc. (US)

- Stryker (US)

- Biomet (US)

- B. Braun Melsungen AG (Germany)

- Ensol Biosciences Inc. (South Korea)

- AxioMed LLC (US)

- Zimmer Biomet Spine, Inc. (US)

- U.S. Stem Cell, Inc. (US)

- Medical Devices Business Services, Inc. (US)

Recent Developments

- In 2025, Vivex Biologics treated the first patient in its US clinical trial for VIA Disc NP a novel injectable designed for discogenic low‑back pain in patients with degenerative disc disease.

- In August 2025, CELZ, Inc. (or simply “CELZ”)’s candidate CELZ-201-DDT got a regulatory boost when it was granted “Fast Track” status by the relevant US authority for chronic lower‑back pain due to degenerative disc disease highlighting growing interest in regenerative, inflammation‑targeted DDD therapies.

- In June 2025, BioRestorative Therapies, Inc. reported compelling preliminary data for BRTX-100, an autologous stem‑cell therapy for painful lumbosacral disc degeneration; the therapy’s Phase 2 trial is ongoing.

Report Coverage

The research report offers an in-depth analysis based on Treatment, End Users, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Degenerative Disc Disease (DDD) market will continue to grow as the aging global population increases, driving higher demand for spine care and treatment options.

- Minimally invasive surgical techniques and advanced robotic surgeries will gain more traction, offering faster recovery times and fewer complications.

- Regenerative therapies, such as stem cell treatments and gene therapy, are expected to revolutionize the market, providing long-term solutions for disc degeneration.

- Non-invasive treatment options, including biologics and pain management therapies, will become increasingly popular as patients seek alternatives to traditional surgery.

- The rising prevalence of back pain and spinal disorders, particularly in emerging economies, will drive market expansion across regions.

- Technological advancements in imaging and diagnostic tools will enhance the accuracy of early detection, leading to better patient outcomes and personalized treatments.

- The increasing adoption of outpatient and clinic-based procedures will reduce healthcare costs and improve patient accessibility to treatment.

- Collaboration and partnerships between medical device companies, healthcare providers, and biotechnology firms will accelerate the development of innovative treatments.

- Rising awareness about spine health and available treatment options will empower patients to seek early interventions, boosting market growth.

- Government investments in healthcare infrastructure, especially in developing regions, will facilitate better access to advanced DDD treatments, further expanding market potential.