| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental CAD/CAM Market Size 2024 |

USD 2,228.38 million |

| Dental CAD/CAM Market, CAGR |

8.66% |

| Dental CAD/CAM Market Size 2032 |

USD 4,537.32 million |

Market Overview

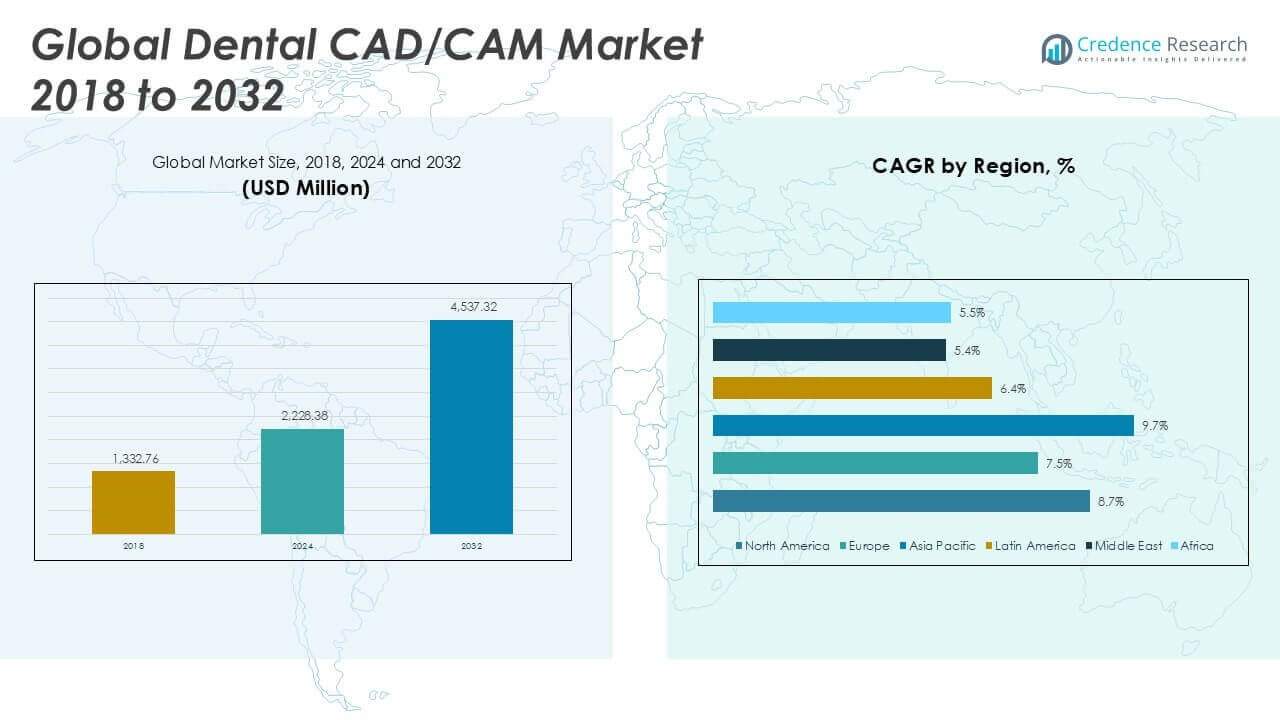

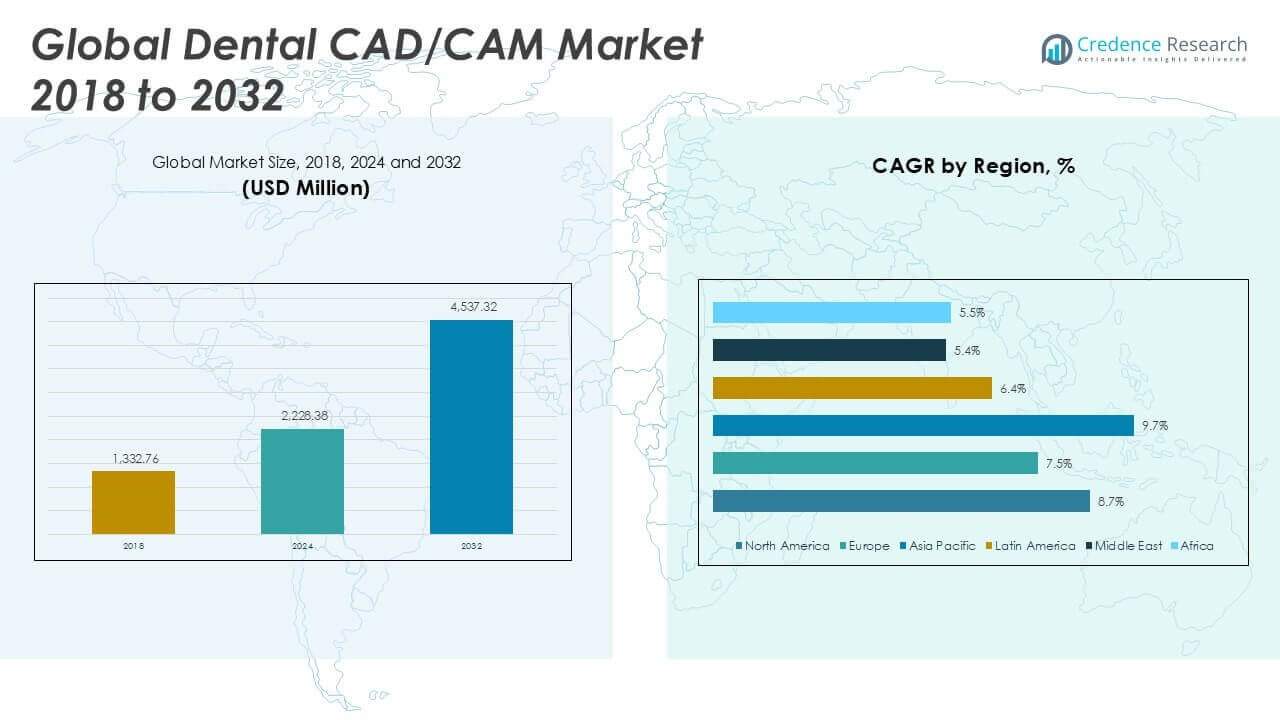

Dental CAD/CAM Market size was valued at USD 1,332.76 million in 2018 to USD 2,228.38 million in 2024 and is anticipated to reach USD 4,537.32 million by 2032, at a CAGR of 8.66% during the forecast period.

The Dental CAD/CAM market is primarily driven by the growing demand for efficient, high-precision dental restorations and the increasing shift toward digital dentistry among dental professionals and laboratories. Advancements in CAD/CAM technology, including improved software integration, enhanced scanning accuracy, and faster processing, support streamlined workflows and boost adoption rates. Rising awareness about the clinical benefits of CAD/CAM, such as reduced chair time, better aesthetic outcomes, and greater patient satisfaction, further fuels market growth. Key trends include the integration of artificial intelligence and cloud-based solutions for remote design and collaboration, as well as the expanding use of CAD/CAM in orthodontics and implantology. The market also benefits from a growing geriatric population with increased dental care needs and the rising prevalence of dental disorders globally. As regulatory standards evolve and reimbursement policies become more favorable, market players continue to invest in research and development to deliver innovative and cost-effective CAD/CAM solutions.

The Dental CAD/CAM Market demonstrates dynamic growth across major regions, including North America, Europe, and Asia Pacific, each benefiting from rising adoption of digital dentistry and expanding healthcare infrastructure. North America leads the market, driven by strong investment in dental technology and a large professional base, while Europe follows with significant demand for restorative and cosmetic dental procedures in countries such as Germany, France, and the UK. Asia Pacific exhibits robust potential due to increasing healthcare spending, growing awareness, and government initiatives supporting digital transformation in countries like China, Japan, and India. Key players such as Align Technology, Inc., Dentsply Sirona, and Institut Straumann AG shape the competitive landscape with extensive product portfolios, strategic partnerships, and continuous innovation. Companies like PLANMECA OY and 3Shape A/S also play vital roles, focusing on advanced solutions and global market expansion to strengthen their positions in this rapidly evolving sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

The Dental CAD/CAM Market reached USD 2,228.38 million in 2024 and is projected to grow to USD 4,537.32 million by 2032, with a CAGR of 8.66%.

· Rapid adoption of digital dentistry and growing demand for efficient, high-precision dental restorations are fueling market growth globally.

· Key trends include the integration of artificial intelligence, cloud-based platforms, and chairside CAD/CAM systems, supporting streamlined workflows and patient-centric care.

· Leading companies such as Align Technology, Inc., Dentsply Sirona, Institut Straumann AG, PLANMECA OY, and 3Shape A/S are strengthening their market positions through innovation, product portfolio expansion, and strategic partnerships.

· High initial investment and maintenance costs, along with the need for skilled professionals and complex integration, present significant challenges to broader market adoption, especially in developing regions.

· North America and Asia Pacific are witnessing robust growth due to advanced healthcare infrastructure and rising healthcare investments, while Europe shows steady adoption across key markets such as Germany, France, and the UK.

· The market’s competitive landscape is marked by continuous product launches, R&D activities, and a strong focus on enhancing digital capabilities to address evolving clinical needs and regulatory standards.

Market Drivers

Increasing Demand for Precision and Efficiency in Dental Restorations Fuels Market Growth

The Dental CAD/CAM Market is benefiting from rising patient expectations for durable and aesthetically pleasing dental restorations. Dentists and laboratories seek systems that deliver consistent accuracy, minimize errors, and ensure high-quality outcomes. CAD/CAM solutions streamline the restoration process, allowing for quicker turnaround times and reducing the need for multiple patient visits. This efficiency appeals to both dental professionals and patients who value convenience and reliability. The market responds well to demands for precision-milled crowns, bridges, veneers, and other restorations. Increasing awareness about the clinical advantages of digital workflows supports adoption in both developed and emerging regions.

- For instance, the World Health Organization (WHO) reports that over 2 billion people suffer from caries of permanent teeth, increasing the demand for precision-milled crowns, bridges, and veneers.

Technological Advancements and Integration of Artificial Intelligence Accelerate Adoption

Advancements in scanning technologies, software, and milling units play a critical role in expanding the Dental CAD/CAM Market. Integration of artificial intelligence enhances diagnostic accuracy and automates complex design processes, making CAD/CAM systems more user-friendly and efficient. The market continues to see the launch of cloud-based platforms that enable remote collaboration and data sharing, supporting digital transformation in dental practices. Interoperability between digital imaging devices and CAD/CAM systems further improves workflow efficiency. It also encourages investment in upgrading dental office infrastructure. Ongoing research and product development expand the capabilities of existing systems, driving more dental professionals to embrace digital solutions.

- For instance, AI-powered CAD/CAM systems use advanced algorithms to analyze a patient’s dental scans and produce accurate digital models, improving restoration precision.

Growing Prevalence of Dental Disorders and Expanding Geriatric Population Create Strong Demand

Rising incidence of dental caries, edentulism, and periodontal diseases directly supports the Dental CAD/CAM Market. The expanding elderly population requires complex restorative and prosthetic dental procedures, which benefit from digital precision and reduced turnaround times. This demographic trend increases the volume of restorative procedures, encouraging clinics and laboratories to adopt advanced digital technologies. The market benefits from increased healthcare spending and insurance coverage for dental services in several regions. Efforts to improve access to dental care and raise awareness about oral health contribute to growing adoption rates.

Supportive Regulatory Environment and Favorable Reimbursement Policies Stimulate Market Expansion

Government initiatives to modernize healthcare infrastructure and promote digital health encourage adoption of CAD/CAM systems in dentistry. The Dental CAD/CAM Market experiences growth as regulatory bodies establish clear standards for digital dental devices, ensuring patient safety and quality outcomes. Favorable reimbursement frameworks in key markets enable broader access to advanced restorative treatments. Industry stakeholders invest in compliance and certification, further strengthening market confidence. Evolving standards and guidelines motivate manufacturers to innovate and meet higher performance benchmarks. It helps ensure long-term market sustainability and competitiveness.

Market Trends

Adoption of Digital Workflows and Chairside CAD/CAM Systems Accelerates Clinical Practice Transformation

The Dental CAD/CAM Market demonstrates a strong shift toward fully digital workflows in both dental practices and laboratories. Dentists increasingly prefer chairside CAD/CAM systems that enable single-visit restorations, reducing patient wait times and improving satisfaction. The integration of intraoral scanners and high-speed milling units streamlines the entire restorative process. Market participants launch products that cater to the demand for faster, more accurate, and patient-friendly solutions. It aligns with the broader trend toward patient-centric care in dentistry. Digital workflows also facilitate easier record-keeping and treatment planning, which enhances operational efficiency.

- For instance, over 80% of dentists using chairside CAD/CAM report increased efficiency and patient satisfaction.

Integration of Artificial Intelligence and Machine Learning Improves System Performance

AI and machine learning tools are shaping the Dental CAD/CAM Market, driving automation in design and fabrication. AI-powered diagnostic features increase the accuracy of treatment planning and restoration fitting, minimizing manual intervention. Machine learning algorithms enable CAD/CAM software to optimize restoration design based on patient-specific data. The market benefits from smarter systems that can adapt and learn, offering continuous improvement in clinical outcomes. It pushes manufacturers to differentiate their offerings through intelligent software features. Dental professionals gain confidence in adopting these innovations for complex restorative and prosthetic cases.

- For instance, AI-driven CAD/CAM systems are automating repetitive tasks and optimizing design accuracy, reducing manual intervention.

Cloud-Based Collaboration and Remote Access Enhance Flexibility for Dental Professionals

The market is witnessing increased adoption of cloud-based CAD/CAM platforms, supporting seamless communication between clinics and laboratories. Remote access to design files allows specialists to consult and collaborate in real-time, regardless of location. The Dental CAD/CAM Market supports flexible working models and helps practices serve a wider patient base efficiently. Secure cloud storage ensures reliable backup and data integrity for sensitive patient records. It enables better integration with other digital health systems and simplifies software updates. Cloud adoption reflects the industry’s commitment to digital transformation and improved service delivery.

Focus on Material Innovation and Sustainability Drives Product Development

Manufacturers are investing in advanced materials compatible with CAD/CAM systems to meet growing demand for biocompatible, durable, and aesthetic restorations. New composite resins, ceramics, and hybrid materials improve clinical performance while expanding treatment options. The Dental CAD/CAM Market trends toward environmentally conscious manufacturing processes and recyclable materials to address sustainability concerns. Product innovation supports more personalized and long-lasting restorations for diverse patient needs. It helps practitioners deliver superior outcomes while adhering to stricter regulatory and environmental standards. Market leaders are also prioritizing eco-friendly packaging and streamlined logistics to minimize their environmental footprint.

Market Challenges Analysis

High Initial Investment and Maintenance Costs Limit Widespread Adoption

The Dental CAD/CAM Market faces challenges due to significant upfront costs associated with purchasing advanced equipment, software, and compatible materials. Many small dental clinics and laboratories find the initial investment prohibitive, slowing the pace of adoption, particularly in developing regions. Ongoing maintenance, software updates, and training requirements further add to the financial burden. Budget constraints in healthcare settings often make it difficult for practitioners to justify such expenses without immediate return on investment. It restricts market expansion to larger, well-funded dental practices and institutions. Cost barriers remain a key concern that market stakeholders must address through financing solutions and affordable product offerings.

- For instance, businesses struggle with aligning digital twin technologies with outdated infrastructure, leading to operational disruptions and increased transition times.

Complexity of Integration and Lack of Skilled Workforce Hinder Seamless Implementation

Integrating CAD/CAM technology into existing dental workflows presents operational and technical hurdles. Many dental professionals require extensive training to fully utilize advanced software and hardware features, leading to a steep learning curve. The Dental CAD/CAM Market struggles with a shortage of skilled technicians and clinicians experienced in digital design and fabrication. Interoperability issues between different brands and platforms complicate system integration, affecting workflow efficiency. It also creates uncertainty among users regarding long-term compatibility and service support. These challenges highlight the need for ongoing education and robust technical assistance to ensure successful market penetration.

Market Opportunities

Rising Demand in Emerging Markets and Untapped Demographics Presents Expansion Potential

The Dental CAD/CAM Market holds significant opportunity for growth in emerging economies, where rising healthcare expenditure and growing awareness about dental health drive adoption of advanced technologies. Rapid urbanization and increasing disposable incomes create a larger patient base seeking modern dental solutions. Government initiatives to improve healthcare infrastructure further support market entry for digital dentistry providers. It allows manufacturers to expand distribution networks and establish partnerships with local stakeholders. Untapped segments, such as rural populations and younger demographics, offer new avenues for business development. Expanding product accessibility and affordability can strengthen the market’s presence across diverse regions.

Product Innovation and Integration with Broader Digital Ecosystems Unlocks New Value

Continuous innovation in CAD/CAM systems and integration with digital imaging, artificial intelligence, and cloud-based solutions present significant opportunities for the Dental CAD/CAM Market. Advancements in materials science and the introduction of user-friendly software support the development of more efficient and customized dental treatments. Strategic collaborations between technology providers and dental organizations enable the creation of end-to-end digital workflows, improving outcomes for both patients and practitioners. It opens the door to value-added services such as remote consultations and digital treatment planning. Focusing on interoperability and enhanced connectivity strengthens customer loyalty and positions the market for sustained long-term growth.

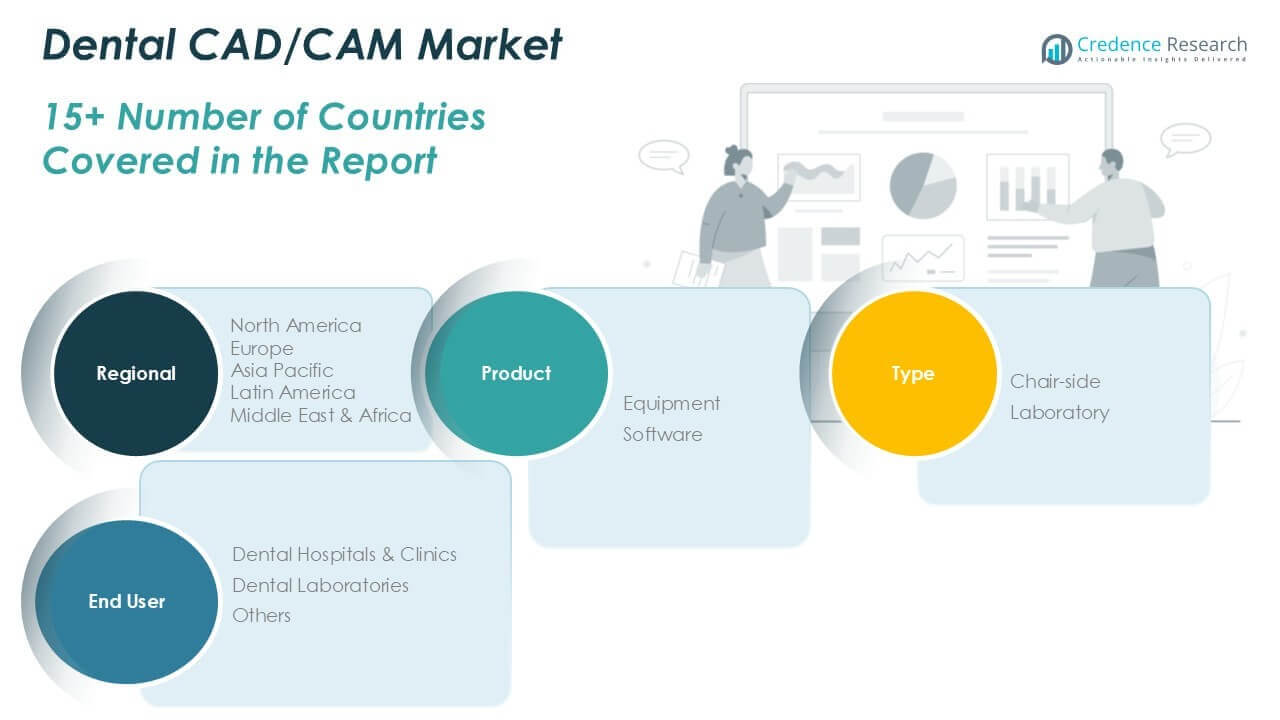

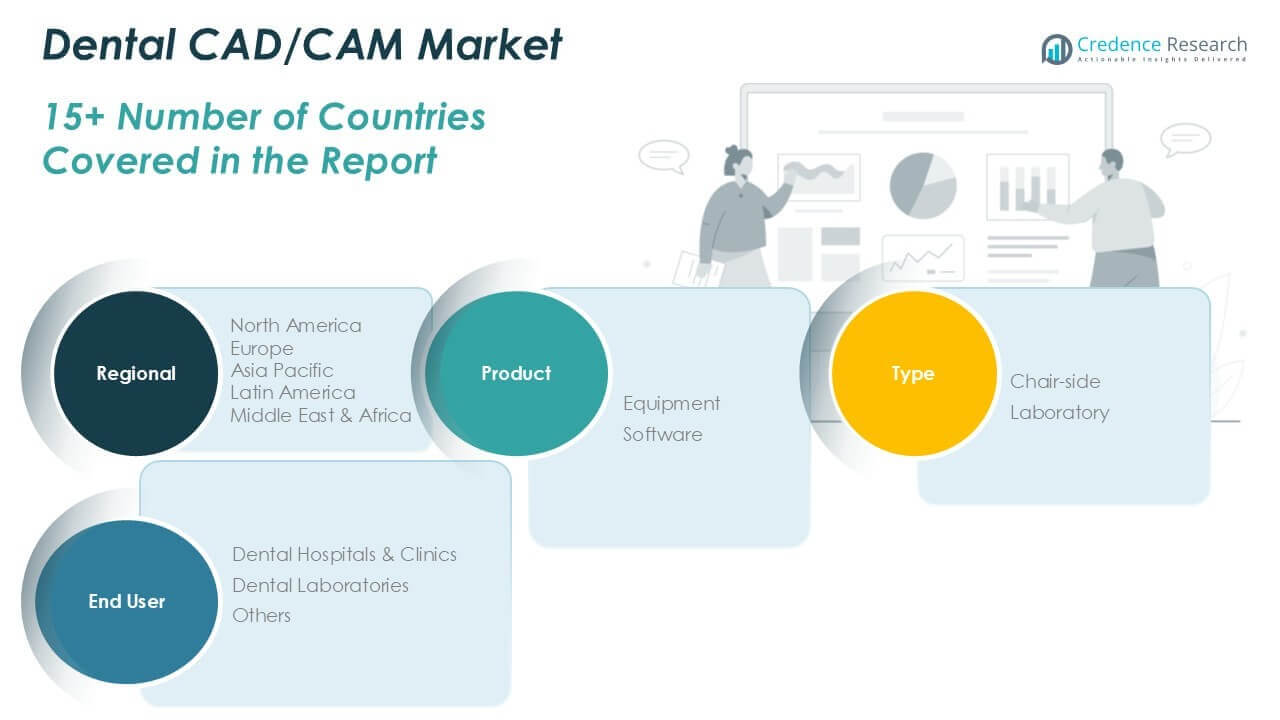

Market Segmentation Analysis:

By Product:

The market divides into equipment and software. Equipment includes intraoral scanners, milling machines, and 3D printers that enable accurate and efficient dental restorations. These hardware solutions represent a significant share of revenue due to their essential role in the CAD/CAM workflow and higher average selling price. Software encompasses design, modeling, and simulation tools that drive digital treatment planning and restoration fabrication. This segment benefits from regular updates and integration with broader digital dental ecosystems, which boosts market competitiveness and user engagement.

By Type:

The Dental CAD/CAM Market segments into chair-side and laboratory systems. Chair-side solutions appeal to dental clinics seeking to offer single-visit restorations, streamline workflow, and improve patient satisfaction. The convenience and immediacy of chair-side CAD/CAM systems continue to attract clinics focused on efficient, patient-centric care. Laboratory systems, on the other hand, cater to dental laboratories that manage higher case volumes and require more advanced equipment for complex or multi-unit restorations. These systems support high-precision, custom prosthetics, and serve as critical partners to clinics seeking external fabrication expertise.

By End User:

The Dental CAD/CAM Market addresses the needs of dental hospitals & clinics, dental laboratories, and others such as academic institutions or research organizations. Dental hospitals and clinics represent the largest end-user segment, driving demand for both chair-side and laboratory CAD/CAM systems to deliver comprehensive, timely restorative solutions. Dental laboratories play a pivotal role by leveraging laboratory systems for large-scale, specialized fabrication, supporting clinics and hospitals through outsourced services. The “others” category, which includes dental schools and research facilities, adopts CAD/CAM technology for educational and innovation purposes, helping to expand the skill base and promote further advancements in digital dentistry. It demonstrates versatility by meeting the specific needs of each end user group, ensuring market growth and technological advancement across the dental care continuum.

Segments:

Based on Product:

Based on Type:

Based on End User:

- Dental Hospitals & Clinics

- Dental Laboratories

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Dental CAD/CAM Market

North America Dental CAD/CAM Market grew from USD 525.73 million in 2018 to USD 868.91 million in 2024 and is projected to reach USD 1,774.68 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.7%. North America is holding a 39.0% market share. The United States dominates regional growth, supported by high adoption of advanced dental technologies, significant investments in healthcare infrastructure, and a large base of dental professionals. Canada and Mexico contribute to expansion through increasing awareness of digital dentistry and supportive regulatory environments. High insurance penetration and strong presence of key industry players further reinforce the region’s leadership.

Europe Dental CAD/CAM Market

Europe Dental CAD/CAM Market grew from USD 273.72 million in 2018 to USD 434.86 million in 2024 and is projected to reach USD 812.85 million by 2032, reflecting a CAGR of 7.5%. Europe accounts for a 19.2% market share. Germany, France, and the United Kingdom are leading countries driving adoption, benefiting from established dental care systems and strong focus on innovation in restorative and cosmetic dentistry. The region supports growth through favorable reimbursement policies and rising demand for dental aesthetic procedures. Expanding geriatric population across Western Europe accelerates the need for advanced restorative solutions.

Asia Pacific Dental CAD/CAM Market

Asia Pacific Dental CAD/CAM Market grew from USD 437.18 million in 2018 to USD 766.92 million in 2024 and is anticipated to reach USD 1,686.98 million by 2032, with a CAGR of 9.7%. Asia Pacific captures a 37.2% market share. China, Japan, and India are key contributors, driven by growing healthcare expenditure, rapid urbanization, and rising awareness of digital dental solutions. Government initiatives to modernize healthcare infrastructure and a large patient population drive strong market expansion. Local manufacturing capabilities and investments from international players support continued growth across the region.

Latin America Dental CAD/CAM Market

Latin America Dental CAD/CAM Market grew from USD 47.95 million in 2018 to USD 78.86 million in 2024 and is projected to reach USD 136.25 million by 2032, with a CAGR of 6.4%. Latin America holds a 3.0% market share. Brazil and Mexico are primary markets, benefiting from increased dental tourism, improved dental care access, and greater professional training in digital dentistry. Economic constraints and uneven healthcare infrastructure limit broader adoption, though public and private investment is gradually supporting digital transformation.

Middle East Dental CAD/CAM Market

Middle East Dental CAD/CAM Market grew from USD 28.01 million in 2018 to USD 41.47 million in 2024 and is expected to reach USD 66.30 million by 2032, reflecting a CAGR of 5.4%. The Middle East represents a 1.5% market share. The United Arab Emirates and Saudi Arabia are key growth centers, propelled by rising demand for premium dental services and investments in healthcare modernization. Limited access to advanced technology and high equipment costs restrict rapid adoption in less-developed areas, but ongoing government healthcare initiatives provide long-term growth potential.

Africa Dental CAD/CAM Market

Africa Dental CAD/CAM Market grew from USD 20.18 million in 2018 to USD 37.35 million in 2024 and is forecast to reach USD 60.25 million by 2032, at a CAGR of 5.5%. Africa accounts for a 1.3% market share. South Africa leads regional uptake, supported by improving healthcare infrastructure and increased professional education in digital dentistry. Market penetration remains low in many countries due to affordability issues and limited awareness. International partnerships and donor support are gradually helping address these challenges and enable broader adoption of digital dental technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Align Technology, Inc.

- Dentsply Sirona

- Axsys Dental Solutions

- Medit Corp.

- Institut Straumann AG

- PLANMECA OY

- 3Shape A/S

- YENADENT

Competitive Analysis

The Dental CAD/CAM Market is highly competitive, characterized by the presence of both established multinational companies and emerging technology innovators. Market leaders focus on continuous product innovation, investing significantly in research and development to enhance the functionality and accuracy of their digital solutions. Companies strive to expand their global footprint through strategic partnerships, mergers, and acquisitions, aiming to offer integrated workflows that cater to the diverse needs of dental clinics and laboratories. Product differentiation centers on the development of user-friendly interfaces, advanced imaging, and seamless interoperability with other dental technologies. Firms prioritize customer support, education, and training initiatives to help practitioners adopt new digital systems and optimize clinical outcomes. Competitive advantage often depends on the ability to launch reliable, cost-effective solutions that address regulatory standards and meet evolving clinical demands. The ongoing shift toward digital dentistry and patient-centric care ensures that the market remains dynamic, encouraging firms to continually advance their technology and services to maintain relevance and growth.

Recent Developments

- In January 2024, The Ivoclar Group, one of the world’s leading manufacturers of integrated solutions for high-quality dental applications, offers a comprehensive portfolio of products and systems for dentists, dental technicians and dental hygienists. The company launched IPS e.max Gel, a highly effective oral care gel based on a unique formula that protects valuable restorations and enhances their durability. The new oral care gel with chlorhexidine, fluoride, D-panthenol, and xylitol enables effective oral hygiene in the practice and at home. IPS e.max Gel forms a part of the IPS e.max family, a product line of high-quality allceramic dental materials from Ivoclar.

- In September 2023, Dentsply Sirona and 3Shape are expanding their workflow integrations to enable dental professionals through DS Core and 3Shape Unite to use a scan-to-lab workflow or establish design and manufacturing protocols directly in their practice. The harmonization of DS Core, Primemill and Primeprint, with the 3Shape TRIOS intraoral scanner powered by 3Shape Unite, creates more integrated workflows for digital dentistry. Dentists will be able to seamlessly connect TRIOS scanners to Primemill and Primeprint for in-office milling and printing via 3Shape Unite, DS Core and the inLab CAD software.

- In September 2023, The Straumann Group has signed an agreement to acquire AlliedStar, an intraoral scanner (IOS) manufacturer in China. It will enable the Group to offer customers in China a competitive intraoral scanner solution and to address additional price-sensitive markets and customer segments in the future. As part of the Straumann Group, AlliedStar will continue to serve existing channels. AlliedStar is a pioneering company in the field of digital dentistry, specializing in offering scanning and CAD/CAM solutions to dental clinics.

- In November 2023, Roland DGA’s DGSHAPE Americas Dental Business Group and Straumann USA, two of the most recognized and respected names in dental technology, are partnering to combine their collective talents and expertise to accelerate the awareness and acceptance of high-quality restorative solutions in the dental market. This new collaboration creates an exciting opportunity to provide world-class, full-service restorative solutions featuring Straumann’s implant solutions and DGSHAPE’s DWX Dental Milling Solutions. The partnership also enables Straumann USA to distribute Roland DGA’s state-of-the-art DGSHAPE DWX mills throughout the U.S. and Canada.

- In May 2023, Amann Girbach launched the Ceramill Motion 3 marketed as an intelligent hybrid machine which makes dental restorations even more convenient, efficient and simple: the 5-axis milling unit combines a wide variety of materials and indications as well as excellent fabrication quality with all the benefits of an end-to-end digital workflow.

Market Concentration & Characteristics

The Dental CAD/CAM Market exhibits a moderate to high level of concentration, with a select group of established companies driving the majority of global revenue through comprehensive digital solutions and expansive distribution networks. It features characteristics such as rapid technological advancement, high barriers to entry due to significant investment in R&D and regulatory compliance, and a strong emphasis on product reliability and integration. The market is defined by innovation cycles that respond to evolving clinical demands, including the integration of artificial intelligence, cloud-based workflows, and material advancements. Customer preference for efficiency, precision, and seamless workflow integration guides product development and market positioning. It also reflects growing demand for patient-centric care, with manufacturers adapting solutions to support both chairside and laboratory applications across various end-user environments. This environment fosters strategic collaborations, continuous training, and support initiatives aimed at maximizing user adoption and long-term market growth.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Dental CAD/CAM Market is projected to experience robust growth, driven by increasing demand for precise and efficient dental restorations.

- Integration of artificial intelligence and machine learning is expected to enhance design accuracy and streamline workflows in dental practices.

- The adoption of chairside CAD/CAM systems is anticipated to rise, enabling same-day restorations and improving patient satisfaction.

- Expansion into emerging markets, particularly in Asia Pacific and Latin America, will offer new growth opportunities due to rising healthcare investments and awareness.

- Development of biocompatible and sustainable materials will address environmental concerns and meet patient preferences for eco-friendly solutions.

- Advancements in 3D printing technology will facilitate the production of complex dental prosthetics with greater precision and customization.

- Cloud-based platforms will enable seamless collaboration between dental clinics and laboratories, enhancing efficiency and data management.

- Continuous innovation in software solutions will support more intuitive user interfaces and integration with existing dental equipment.

- Training and education programs will be essential to equip dental professionals with the skills needed to utilize advanced CAD/CAM technologies effectively.

- Strategic partnerships and mergers among key industry players will shape the competitive landscape, fostering innovation and expanding product offerings.