Market Overview

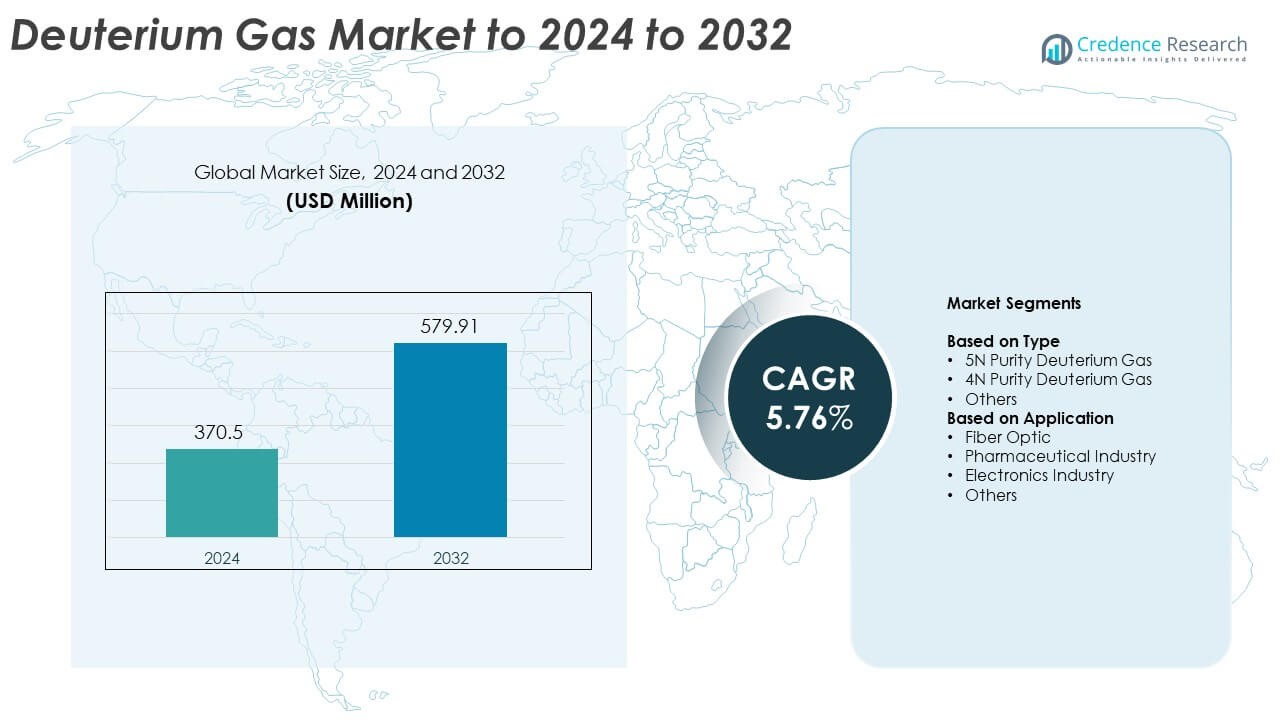

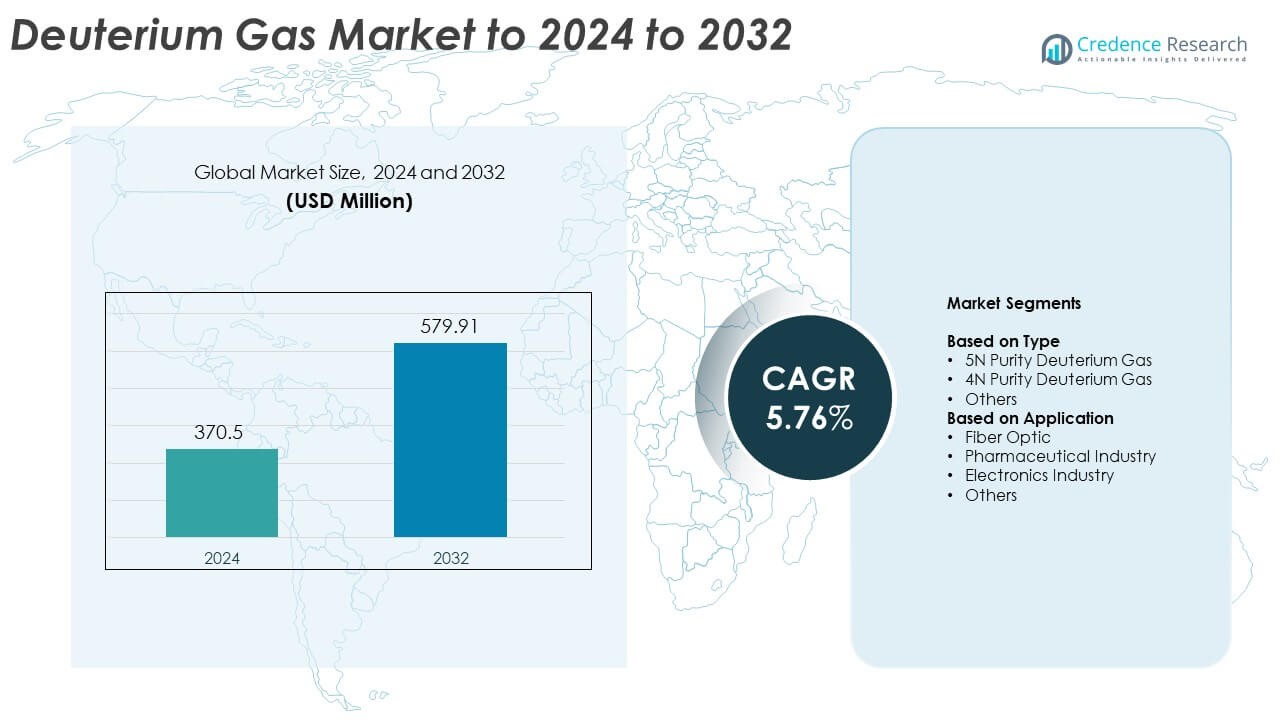

Deuterium Gas Market size was valued USD 370.5 million in 2024 and is anticipated to reach USD 579.91 million by 2032, at a CAGR of 5.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Deuterium Gas Market Size 2024 |

USD 370.5 Million |

| Deuterium Gas Market, CAGR |

5.76% |

| Deuterium Gas Market Size 2032 |

USD 579.91 Million |

Major players in the deuterium gas market include Cambridge Isotope Laboratories (CIL), Foshan Zhicheng Gas, MATHESON, Linde, KEY DH Technologies, Air Liquide, Huate Gas, PERIC Special Gases, Electronic Fluorocarbons, and Sumitomo Seika Chemical. These companies strengthened their positions through high-purity gas production, advanced purification systems, and stable global supply chains serving semiconductor, fiber-optic, and pharmaceutical applications. Asia Pacific remained the fastest-growing region, while North America led the market with 34% share in 2024 due to strong semiconductor output and extensive research infrastructure. Europe followed with about 29% share, supported by optics manufacturing, fusion research, and pharmaceutical advancements.

Market Insights

- The deuterium gas market reached USD 370.5 million in 2024 and is projected to hit USD 579.91 million by 2032, growing at a CAGR of 5.76% during the forecast period.

- Strong demand from semiconductor production remains the main market driver, as advanced chip nodes require high-purity deuterium for annealing, deposition, and isotopic engineering.

- Key trends include rising adoption of ultra-high-purity grades and growing consumption in fiber optics, photonics, and pharmaceutical research, supported by expanding global R&D investments.

- The competitive landscape features leading global suppliers focusing on purification technology, automated filling systems, and stable delivery networks to meet strict purity requirements across electronics and scientific applications.

- North America led the market with 34% share in 2024, followed by Europe with 29%, while Asia Pacific accounted for 32% driven by semiconductor fabs; the type segment saw 5N purity gas hold the largest share at 58%, and the electronics industry led applications with 52% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

5N purity deuterium gas dominated the type segment in 2024 with about 58% share. Buyers preferred 5N grade because high-purity gas supports accurate spectroscopy, stable plasma generation, and reliable isotope research. Semiconductor and optics manufacturers used this grade to reduce contamination risk in sensitive processes. 4N purity gas maintained steady demand in routine laboratory work and less sensitive industrial tasks. The “others” category grew slowly as niche applications explored custom purity levels, but 5N purity remained ahead due to stronger quality control and wider acceptance in high-precision operations.

- For instance, Matheson Tri-Gas’s product data sheet for deuterium (\(\text{D}_{2}\)) confirms that their “ULSI 5N” grade, which can be considered “Research Grade” in high-purity contexts, has a chemical purity of 99.999% and an oxygen impurity limit of below 1 ppmv (parts per million by volume).

By Application

The electronics industry led the application segment in 2024 with nearly 52% share. Chipmakers used deuterium gas in annealing, semiconductor deposition, and isotope engineering to improve device stability. Fiber optic producers relied on it for testing and calibration, while pharmaceutical companies used it in synthesis and labeled compound development. The “others” category covered research labs and isotope facilities with smaller consumption. Electronics stayed dominant because advanced nodes, rising wafer output, and tighter quality demands increased the need for high-purity deuterium across major fabrication hubs.

- For instance, GlobalFoundries plans Dresden capacity to exceed one million (specifically targeting 1.1 million) 300 mm wafers annually by the end of 2028.

Key Growth Drivers

Rising Semiconductor Production

Expanding semiconductor fabrication increased demand for high-purity deuterium gas across major global foundries. Advanced chip nodes required tighter control over contamination, which strengthened adoption in annealing and deposition steps. Growing wafer output in Asia, Europe, and the U.S. supported steady procurement volumes, making semiconductor expansion the key growth driver for the deuterium gas market.

- For instance, TSMC reported total wafer shipments of approximately 12.9 million 12-inch equivalent wafers in 2024, although their total annual manufacturing capacity across all facilities was approximately 17 million 12-inch equivalent wafers. Those wafers come from multiple fabs across Taiwan, China, the United States, and Japan.

Growth in Fiber Optic and Photonics Technologies

Telecom network upgrades and data-center expansion boosted the need for precise optical components. Deuterium gas enabled accurate spectral calibration and improved signal stability in fiber systems. Wider deployment of high-speed networks and photonic devices increased consumption, making this segment an important growth driver for the global deuterium gas market.

- For instance, Corning celebrated producing its one-billionth kilometer of optical fiber in 2017. Company releases state it has delivered more than 1,000,000,000 kilometers for networks worldwide.

Increasing Use in Pharmaceutical R&D

Pharmaceutical companies expanded the use of deuterium in labeled compounds, drug tracing, and metabolic studies. Higher research spending and broader adoption of isotopic tools supported steady market growth. Regulatory acceptance of deuterium-labeled molecules further improved demand, positioning pharmaceutical research as a notable growth driver in the deuterium gas market.

Key Trends & Opportunities

Shift Toward Ultra-High-Purity Grades

Industries moved toward higher-purity deuterium to support advanced optics, plasma systems, and chip fabrication. Demand for 6N-grade and customized purity blends rose as manufacturers pursued greater process stability. This shift created strong opportunities for producers with advanced purification technology and reliable quality certification in the deuterium gas market.

- For instance, Linde’s purity chart sets level 6.0 gases at roughly 1 ppm impurity. Level 7.0 gases carry an impurity specification near 0.1 ppm in that table.

Expansion of Fusion and Scientific Research

Government-backed fusion projects and isotope research centers increased deuterium consumption. Experimental reactors, neutron studies, and plasma physics laboratories required stable and consistent gas quality. Broader international funding in scientific programs opened new opportunities for suppliers targeting research-grade deuterium in the deuterium gas market.

- For instance, General Atomics announced a ten-year strategic investment in Fusion Fuel Cycles in 2025. The UNITY-2 facility will test a continuous deuterium-tritium-helium fuel-cycle loop under reactor-like conditions.

Automation and Purification Technology Upgrades

Producers invested in automated filling, advanced leak-detection systems, and membrane-based purification. These upgrades reduced impurities and improved production efficiency across supply chains. Enhanced purification capability created opportunities for meeting the rising global demand for stable high-purity deuterium in the deuterium gas market.

Key Challenges

High Production and Storage Costs

Deuterium extraction, purification, and cryogenic handling required significant capital and operational spending. Complex storage needs and tight purity standards increased the financial burden for suppliers. These cost pressures remained a major challenge for companies operating in the deuterium gas market.

Limited Global Supply Chain Resilience

Deuterium production concentrated in a few countries, creating supply-risk exposure. Disruptions in heavy-water plants, transport networks, or export policies led to unstable availability. This dependency on limited production hubs remained a key challenge for long-term stability in the deuterium gas market.

Regional Analysis

North America

North America held about 34% share of the deuterium gas market in 2024, driven by strong semiconductor activity, advanced research labs, and ongoing investments in fusion technology. The United States remained the primary consumer due to high wafer output and extensive isotope research programs. Demand from pharmaceutical companies also supported steady growth as drug-development pipelines expanded. Canada contributed through scientific institutions and specialized gas distributors, strengthening regional supply stability. Continued funding in microelectronics and national research initiatives is expected to keep North America a leading market for high-purity deuterium.

Europe

Europe accounted for nearly 29% share in 2024, supported by strong photonics manufacturing, advanced optics research, and established heavy-water processing capabilities. Germany, France, and the United Kingdom led regional consumption due to robust semiconductor design bases and high-precision laboratory activities. Fusion programs such as ITER enhanced long-term demand for deuterium gas across scientific facilities. Expanding pharmaceutical research and rising adoption of isotope tools also strengthened market needs. Europe continued to benefit from strict quality standards, which encouraged the use of high-purity grades across industrial and scientific applications.

Asia Pacific

Asia Pacific led most consumption growth and captured about 32% share of the market in 2024, driven by rapid semiconductor expansion in China, South Korea, Japan, and Taiwan. High wafer production and increasing fab capacity elevated demand for ultra-pure deuterium gas across advanced nodes. Photonics fabrication and telecom infrastructure upgrades further supported regional consumption. Pharmaceutical R&D growth in China and India also contributed to long-term adoption. Strong manufacturing ecosystems and government-backed technology programs positioned Asia Pacific as the fastest-growing region in the deuterium gas market.

Latin America

Latin America held close to 3% share in 2024, supported by growing research activities and rising industrial applications in select countries. Brazil and Mexico showed increasing interest in isotope-based analytical techniques used in environmental studies, pharmaceuticals, and materials research. Limited semiconductor presence kept consumption modest, but specialty labs and university research centers maintained steady demand. Partnerships with global gas suppliers improved access to high-purity grades. Gradual industrial modernization and expanding scientific funding are expected to support incremental growth across the region.

Middle East and Africa

Middle East and Africa accounted for around 2% share in 2024, driven mainly by emerging research institutions and specialized industrial applications. Countries such as the UAE and Saudi Arabia expanded investments in advanced analytics and nuclear research, supporting controlled demand for high-purity deuterium gas. Africa’s market remained small, with usage concentrated in academic and environmental research programs. Limited local production increased reliance on imports, influencing supply stability. As regional technology and scientific ecosystems develop, the market is expected to gain moderate traction over the forecast period.

Market Segmentations:

By Type

- 5N Рurіtу Deuterium Gаѕ

- 4N Рurіtу Deuterium Gаѕ

- Оthеrѕ

By Application

- Fiber Optic

- Pharmaceutical Industry

- Electronics Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players such as Cambridge Isotope Laboratories (CIL), Foshan Zhicheng Gas, MATHESON, Linde, KEY DH Technologies, Air Liquide, Huate Gas, PERIC Special Gases, Electronic Fluorocarbons, and Sumitomo Seika Chemical shaped the competitive landscape of the deuterium gas market in 2024. Global suppliers focused on high-purity production, advanced purification systems, and long-term supply stability to meet rising demand from semiconductor, optics, and pharmaceutical sectors. Companies expanded automated filling lines and enhanced leak-detection standards to support strict quality requirements. Strategic partnerships with research institutes and advanced manufacturing hubs strengthened distribution networks across major regions. Market players also increased investment in storage safety, cylinder technology, and certification processes to support high-precision applications. Growing interest in isotopic products across scientific and industrial fields encouraged suppliers to improve consistency and purity control. Strong competition centered on reliability, scale, purity grades, and compliance with global performance standards.

Key Player Analysis

- Cambridge Isotope Laboratories (CIL)

- Foshan Zhicheng Gas (China)

- MATHESON (U.S.)

- Linde (Praxair included) (Ireland)

- KEY DH Technologies Inc. (Canada)

- Air Liquide (France)

- Huate Gas (China)

- PERIC Special Gases Co., Ltd (U.S.)

- Electronic Fluorocarbons LLC (U.S.)

- Sumitomo Seika Chemical

Recent Developments

- In 2025, Cambridge Isotope Laboratories (CIL) launched ISOLED-D™, a new line of deuterated reagents specifically designed for organic light-emitting diode (OLED) manufacturing.

- In 2025, Air Liquide signed a binding agreement to acquire the South Korean industrial gas company DIG Airgas from Macquarie Asset Management for €2.85 billion.

- In 2025, Sumitomo Seika Chemicals completed a new pilot plant for super absorbent polymers (SAP) development at its Himeji Works in Japan.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor fabs expand advanced node production.

- High-purity grades will gain wider adoption across optics and photonics.

- Fusion energy projects will increase long-term consumption of deuterium.

- Pharmaceutical R&D will strengthen usage of deuterium-labeled compounds.

- Global suppliers will invest in improved purification and automation systems.

- Regional supply chains will diversify to reduce dependency on limited producers.

- Research institutions will boost procurement through isotope-based studies.

- Fiber optic expansion will support steady demand from telecom and data networks.

- Regulatory frameworks will favor certified high-purity deuterium across industries.

- Market growth will accelerate in Asia Pacific due to rapid technology adoption.