Market Overview:

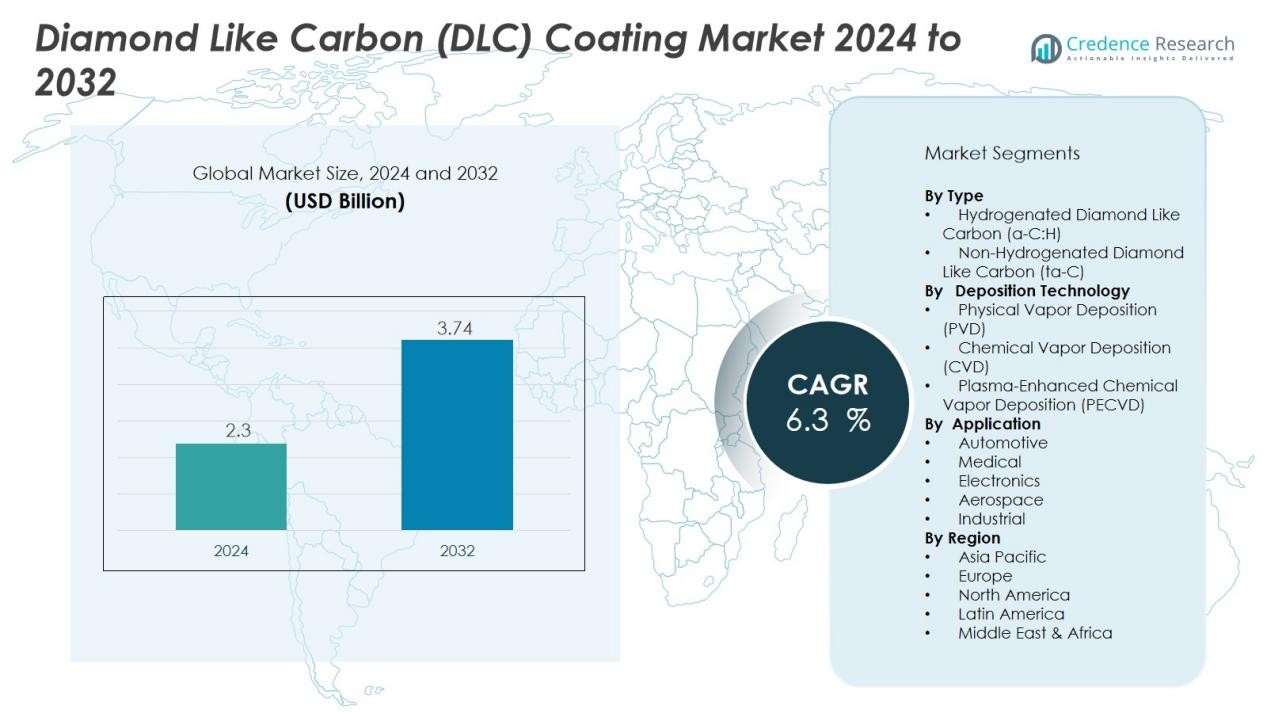

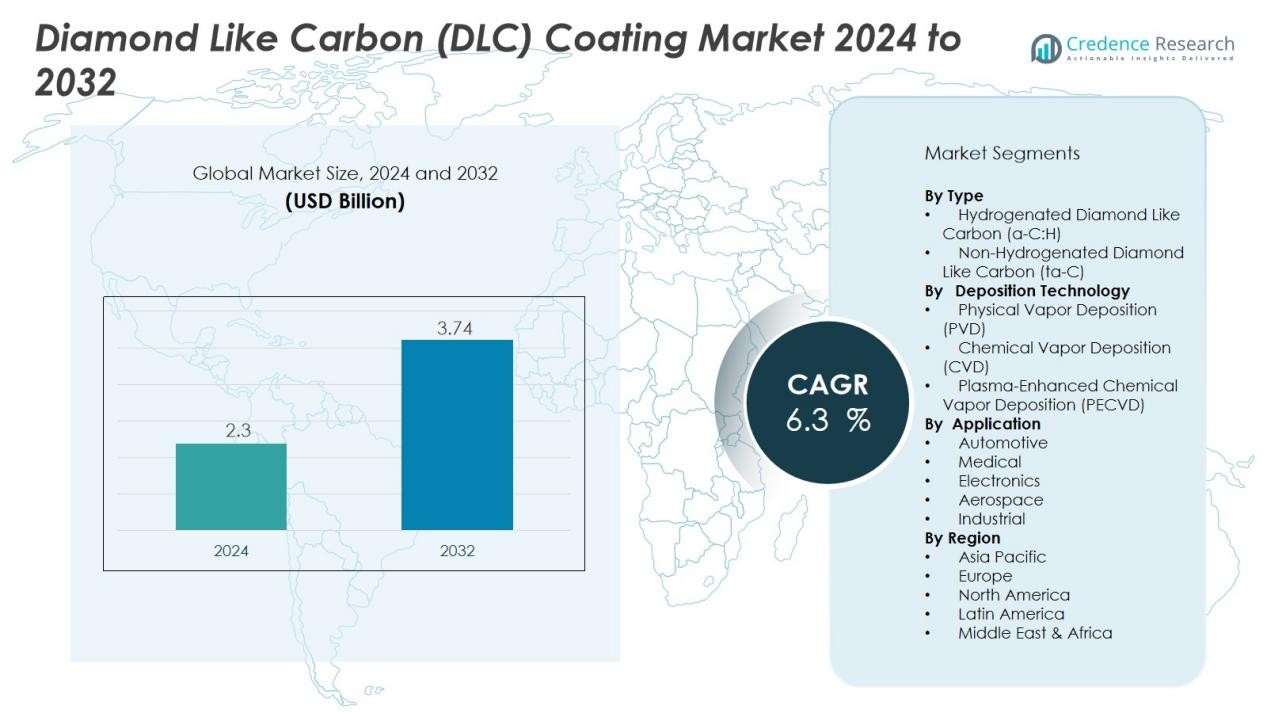

The Diamond Like Carbon (DLC) Coating Market size was valued at USD 2.3 billion in 2024 and is anticipated to reach USD 3.74 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diamond Like Carbon (DLC) Coating Market Size 2024 |

USD 2.3 Billion |

| Diamond Like Carbon (DLC) Coating Market, CAGR |

6.3% |

| Diamond Like Carbon (DLC) Coating Market 2032 |

USD 3.74 Billion |

The key drivers include increasing use of DLC coatings in automotive engine parts, gears, and pistons to improve fuel efficiency and reduce emissions. Advancements in physical and plasma-enhanced chemical vapor deposition technologies are enabling wider industrial adoption. The medical device sector also contributes significantly due to the coating’s biocompatibility and corrosion resistance, enhancing performance in implants and surgical tools.

Regionally, North America and Europe dominate due to strong automotive and aerospace manufacturing bases and early adoption of coating technologies. Asia-Pacific is expected to record the fastest growth, led by rapid industrialization and rising investments in electronics and electric vehicle manufacturing in China, Japan, India, and South Korea. Expanding healthcare infrastructure and precision manufacturing capabilities further strengthen the region’s market potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Diamond Like Carbon (DLC) Coating Market was valued at USD 1.52 billion in 2018, reached USD 2.3 billion in 2024, and is projected to hit USD 3.74 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- North America holds a 38.3% share, driven by established automotive, aerospace, and medical industries supported by advanced R&D infrastructure and strong OEM investments.

- Asia-Pacific leads with a 39.5% share, supported by rapid industrialization, EV manufacturing, and expanding electronics and medical device production in China, Japan, India, and South Korea.

- Europe maintains a 17.6% share due to strict emission norms, mature aerospace production, and a robust focus on fuel-efficient component design.

- By application, the automotive segment dominates with 46% share, followed by medical devices at 22%, driven by demand for low-friction coatings and biocompatible materials across advanced manufacturing sectors.

Market Drivers:

Market Drivers:

Growing Demand from Automotive and Aerospace Industries

The Diamond Like Carbon (DLC) Coating Market benefits from the strong demand in automotive and aerospace applications. Manufacturers use DLC coatings to reduce friction, wear, and emissions in components such as piston rings, fuel injectors, and gears. The coatings enhance energy efficiency and extend engine life, aligning with stricter emission regulations and sustainability goals. In aerospace, DLC coatings improve component reliability under high pressure and temperature, supporting long operational cycles in aircraft systems.

- For Instance, Tenneco (specifically, its subsidiary Federal-Mogul’s Powertrain division) offers a piston ring coating named DuroGlide®, which is a new generation tetrahedral amorphous carbon (ta-C) coating.

Advancements in Deposition Technologies

Rapid advancements in deposition processes such as Physical Vapor Deposition (PVD) and Plasma-Enhanced Chemical Vapor Deposition (PECVD) are driving market growth. These technologies provide superior coating adhesion, uniformity, and hardness for complex surfaces. It enables broader use across tools, mechanical components, and medical implants requiring precise coating control. Continuous improvements in hybrid coating systems also enhance corrosion resistance and scalability for high-volume industrial production.

- For instance, Oerlikon Balzers, a division of OC Oerlikon, signed a contract with ITP Aero in June 2023 to apply its advanced PVD coating to ITP Aero’s next-generation aircraft engine components, with the goal of enhancing performance and increasing service life. The contract is for a duration of 10 years

Expanding Use in Medical Devices and Healthcare Equipment

The market gains traction in the medical sector due to increasing use in implants, surgical tools, and diagnostic devices. DLC coatings provide biocompatibility, wear resistance, and low friction, which improve device longevity and patient safety. It minimizes tissue irritation and bacterial adhesion, supporting safer and cleaner surgical procedures. The rising production of advanced orthopedic and cardiovascular implants further strengthens healthcare-driven demand.

Rising Focus on Energy Efficiency and Sustainability

Sustainability initiatives across manufacturing industries fuel demand for energy-efficient coating solutions. DLC coatings help reduce mechanical losses in engines and machinery, lowering overall energy consumption. The coatings support environmental compliance by extending component lifespan and reducing material waste. Growing preference for eco-friendly, low-emission manufacturing processes positions DLC coatings as a vital enabler of green industrial transformation.

Market Trends:

Integration of DLC Coatings in Electric Vehicles and Advanced Mobility

The Diamond Like Carbon (DLC) Coating Market shows a strong shift toward electric vehicle (EV) and mobility component applications. EV manufacturers use DLC coatings to enhance performance and reduce wear in battery assemblies, drive units, and transmission components. The coatings lower friction losses and improve heat resistance, which boosts vehicle efficiency and component lifespan. It also supports lightweight design strategies by allowing thinner metal layers without compromising durability. Companies are developing DLC-coated bearings and gears for EVs to ensure smoother motion and higher power density. This growing integration across hybrid and electric powertrains strengthens long-term growth prospects.

- For instance, BMW established its cell coating line at the Leipzig plant with capacity to handle more than 10 million cells per year. For instance, NSK developed ultra-high-speed large-diameter ball bearings for hybrid vehicle motors capable of rotating at 2 million dmn (bearing diameter multiplied by maximum rotating speed).

Rising Adoption of Environmentally Friendly and Multi-Layer Coatings

The market is moving toward sustainable coating solutions that minimize environmental impact while maintaining superior mechanical properties. Manufacturers focus on hydrogen-free and low-temperature deposition techniques to reduce energy use and improve substrate compatibility. It encourages innovation in multi-layer DLC coatings that combine toughness, elasticity, and corrosion protection. These coatings are gaining adoption in precision tools, electronics, and optical components where both durability and appearance are critical. The trend aligns with global sustainability goals and regulatory requirements favoring eco-efficient materials. Expanding research collaborations among coating equipment makers and end-users continue to accelerate technological adoption and customization.

- For instance, Oerlikon Balzers applies its Balinit Milubia tetrahedral amorphous carbon coating at temperatures below 150°F (65°C), enabling application on heat-sensitive substrates while achieving a coefficient of friction consistently approaching 0.1 to 0.2 in both wet and dry conditions.

Market Challenges Analysis:

High Cost of Deposition and Maintenance Equipment

The Diamond Like Carbon (DLC) Coating Market faces cost-related challenges due to the complexity of coating systems. The initial setup for vacuum chambers, plasma generators, and deposition units requires significant investment. Small and medium manufacturers often struggle to adopt these technologies due to high capital and operational expenses. It also demands precise maintenance and quality control, increasing total production costs. The challenge limits market penetration in cost-sensitive sectors where low-margin components dominate.

Technical Limitations in Large-Scale and Complex Surface Applications

The market encounters difficulties in applying DLC coatings uniformly on large or geometrically complex surfaces. The deposition process requires controlled environments and substrate compatibility, which restricts use in certain materials. It can lead to uneven coating thickness or adhesion failures under high mechanical stress. These technical constraints hinder adoption in heavy machinery, large automotive components, and industrial tools. Ongoing research aims to improve coating uniformity and reduce process limitations through hybrid or advanced plasma-assisted technologies.

Market Opportunities:

Growing Opportunities in Electric Vehicles and Advanced Manufacturing

The Diamond Like Carbon (DLC) Coating Market presents strong growth potential in electric vehicles and next-generation manufacturing. EV makers integrate DLC coatings in powertrains, bearings, and gears to improve efficiency and reduce friction losses. It supports lightweight design goals by enabling thinner metal surfaces with enhanced wear resistance. The transition toward high-performance drivetrains and reduced mechanical losses amplifies adoption across electric and hybrid platforms. Expanding precision manufacturing and automation further boost demand for DLC-coated tools and molds that extend service life and improve product quality. This trend positions DLC coatings as a key enabler in energy-efficient mobility and smart production systems.

Expanding Role in Medical and Semiconductor Applications

Opportunities are widening in the medical and semiconductor sectors due to growing emphasis on precision and durability. DLC coatings enhance implant biocompatibility, corrosion resistance, and sterility in surgical instruments and diagnostic tools. It helps meet stringent medical device standards while improving patient outcomes. In semiconductors, DLC films are being adopted for wafer processing tools and optical lenses to ensure particle-free performance and long-term reliability. The expansion of cleanroom technologies and miniaturized electronics strengthens the market’s position in high-value industrial applications. These emerging uses create a favorable outlook for sustained market diversification.

Market Segmentation Analysis:

By Type

The Diamond Like Carbon (DLC) Coating Market is segmented into hydrogenated (a-C:H) and non-hydrogenated (ta-C) coatings. Hydrogenated DLC coatings dominate due to their versatility and cost-effectiveness in automotive, tooling, and mechanical components. It offers high wear resistance and low friction, making it suitable for large-scale industrial use. Non-hydrogenated coatings are gaining traction in high-performance applications requiring superior hardness and thermal stability. Their demand is rising in aerospace, electronics, and precision instruments that operate under extreme conditions.

- For instance, some advanced manufacturers report the application of their ta-C coatings, which can achieve hardness values up to 55 GPa (or even higher in some lab settings) and withstand continuous operational temperatures up to 450°C, in various high-performance industrial applications, including potentially in specialized components within semiconductor manufacturing equipment.

By Deposition Technology

The market is classified into Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), and Plasma-Enhanced Chemical Vapor Deposition (PECVD). PECVD holds the leading share due to its ability to deposit uniform coatings on complex surfaces with strong adhesion. It enables cost-efficient, low-temperature processing suitable for sensitive substrates. PVD is widely used for hard coatings in automotive and tooling applications where surface strength is critical. CVD technology is expanding in semiconductor and optical component manufacturing due to its precision and consistent film quality.

- For instance, ASM International’s CVD reactors enable silicon nitride deposition with highly precise and uniform thickness control across a full wafer, directly supporting the production of advanced, high-density DRAM chips.

By Application

The market serves automotive, medical, electronics, aerospace, and industrial sectors. The automotive segment leads the market, driven by the coating’s ability to enhance efficiency, durability, and emission control. It is applied on piston rings, fuel injectors, and valve trains to reduce wear and energy loss. The medical and electronics sectors show strong growth due to the coating’s biocompatibility and optical clarity. Rising semiconductor fabrication and implant production continue to drive new application opportunities.

Segmentations:

By Type

- Hydrogenated Diamond Like Carbon (a-C:H)

- Non-Hydrogenated Diamond Like Carbon (ta-C)

By Deposition Technology

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Plasma-Enhanced Chemical Vapor Deposition (PECVD)

By Application

- Automotive

- Medical

- Electronics

- Aerospace

- Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Region Performance

The North American region holds a market share of 38.3 % in the Diamond Like Carbon (DLC) Coating Market. Strong presence of automotive, aerospace, and medical industries drives demand. It benefits from major OEMs and coating service providers investing in high-performance surface treatments for engine, transmission and surgical components. The U.S. shows rapid adoption of DLC coatings to reduce friction, improve durability and meet emissions standards. Supply-chain maturity and advanced R&D infrastructure further support regional growth. It faces pressure from high equipment costs and intense competition for low-margin components.

Asia-Pacific Region Performance

The Asia-Pacific region accounts for the largest regional revenue share at 39.5 % in the Diamond Like Carbon (DLC) Coating Market. Rapid industrialisation in China, India, Japan and South Korea drives expansion of automotive, electronics and aerospace manufacturing. It leverages cost-competitive coating operations and growing domestic demand for EVs, medical devices and precision tools. Governments support advanced manufacturing and material technologies, creating favourable operating conditions. The region faces challenges due to variable regulatory standards and infrastructure gaps in some markets.

Europe, Latin America & Middle East & Africa Region Performance

Europe holds a significant share of the Diamond Like Carbon (DLC) Coating Market with steady growth driven by strict environmental regulations and strong automotive and aerospace sectors. It focuses on low-friction, wear-resistant coatings to boost fuel efficiency and component life. Latin America and Middle East & Africa markets hold smaller shares but show emerging potential thanks to infrastructure and industrial investment. It will benefit from expansion of tooling and manufacturing services in these regions. Local service provider networks and low-volume demand presently limit scale of adoption.

Key Player Analysis:

- Morgan Advanced Materials plc

- IBC Coatings Technologies, Inc.

- Acree Technologies Incorporated

- Wallwork Heat Treatment Ltd

- Calico Coatings

- HEF Group

- Renishaw plc

- OC Oerlikon

- Miba AG

- Nippon ITF Inc.

Competitive Analysis:

The Diamond Like Carbon (DLC) Coating Market features a competitive landscape driven by technological innovation and application diversity. Key players include Morgan Advanced Materials plc, IBC Coatings Technologies, Inc., Acree Technologies Incorporated, Wallwork Heat Treatment Ltd, and Calico Coatings. These companies focus on advanced deposition methods, customized coating solutions, and material optimization to enhance wear resistance and surface performance. It emphasizes strong partnerships with automotive, aerospace, and medical manufacturers to expand product reach. Continuous investment in plasma-assisted and hybrid coating technologies strengthens competitiveness. Companies are also expanding global production facilities and service centers to meet increasing demand for high-performance coatings across multiple sectors.

Recent Developments:

- InJanuary 2024, Wallwork Heat Treatment Ltd ordered a second Quintus Hot Isostatic Press for its HIP Centre, aiming to meet increased demand in additive manufacturing with installation planned for mid-2025.

- In June 2025, HEF Group acquired TELIC, a US company specializing in engraving and metal deposition, to strengthen its photonics division and presence in North America, particularly in defense, security, and aerospace applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Deposition Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Diamond Like Carbon (DLC) Coating Market is expected to expand with strong adoption across industrial and mobility sectors.

- Automotive manufacturers will continue integrating DLC coatings to enhance fuel efficiency and extend component life.

- Electric vehicle and hybrid powertrain applications will drive next-generation coating demand in lightweight materials.

- Medical device manufacturers will increase usage due to DLC’s biocompatibility and ability to minimize surface wear.

- Semiconductor and electronics industries will adopt ultra-thin coatings for high-precision components and wafer handling systems.

- New deposition technologies such as hybrid PVD-PECVD systems will enable faster, uniform coating processes.

- Sustainability goals will push industries toward low-emission coating methods and recyclable substrates.

- Asia-Pacific will emerge as the fastest-growing region with rising investments in EV, electronics, and healthcare manufacturing.

- Partnerships between coating equipment makers and end-use industries will strengthen innovation pipelines.

- Market competition will intensify as global players expand regional coating facilities and improve cost efficiency.

Market Drivers:

Market Drivers: