Market Overview

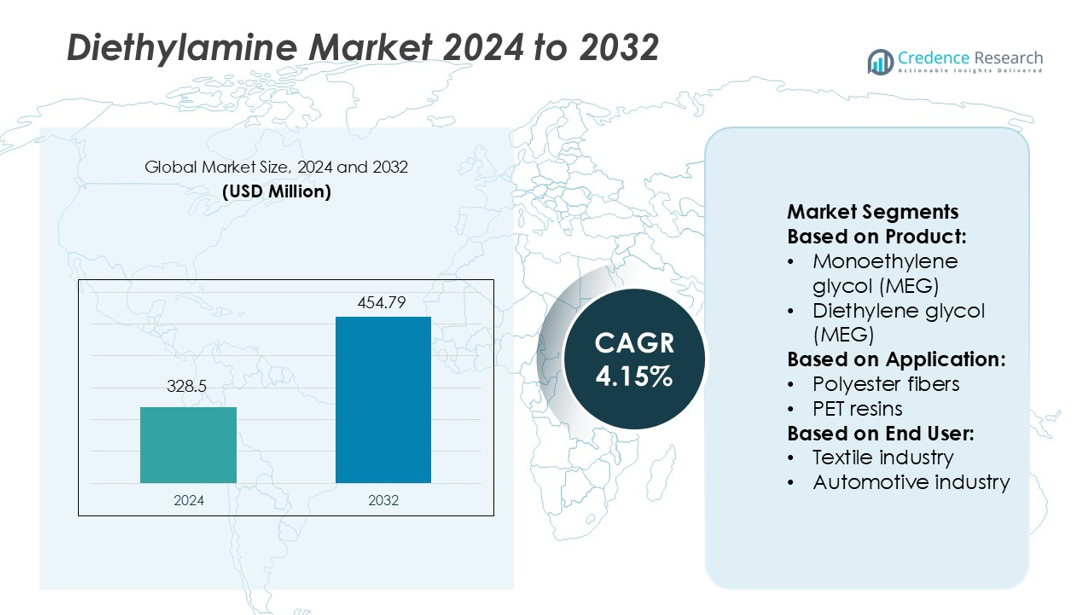

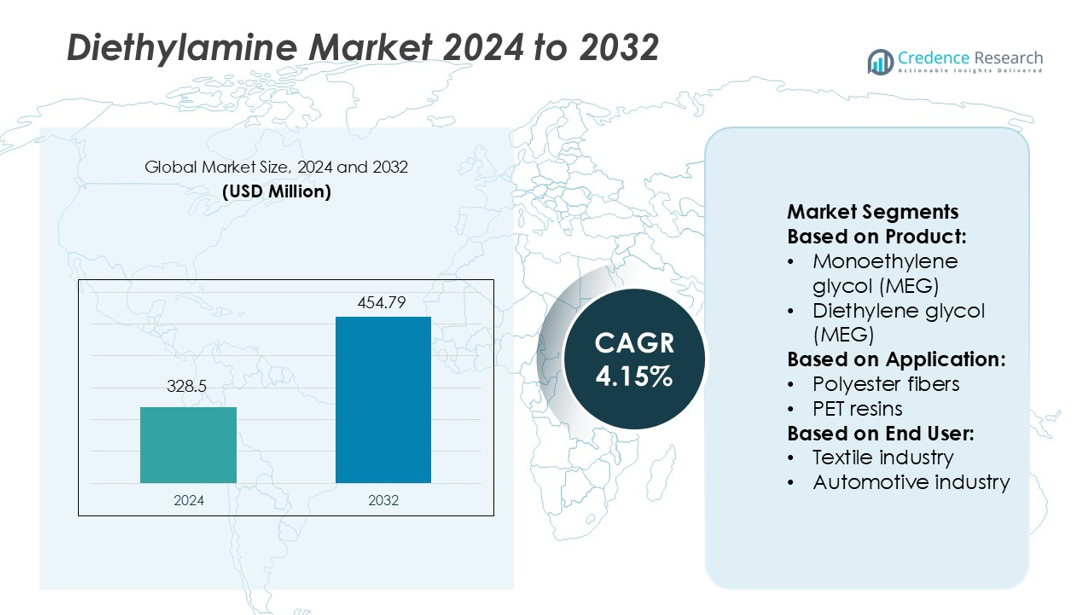

Diethylamine Market size was valued USD 328.5 million in 2024 and is anticipated to reach USD 454.79 million by 2032, at a CAGR of 4.15% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diethylamine Market Size 2024 |

USD 328.5 million |

| Diethylamine Market, CAGR |

4.15% |

| Diethylamine Market Size 2032 |

USD 454.79 million |

The Diethylamine market is led by major global players such as BASF SE, Dow Chemical, Eastman Chemical, LG Chem, Ineos Group, Mitsubishi Chemical, LOTTE Chemical, Indian Oil, Formosa Plastics, and LyondellBasell. These companies dominate through advanced production technologies, integrated supply chains, and extensive global distribution networks. Their strategic focus on sustainable synthesis, R&D investments, and product diversification strengthens competitiveness across end-use sectors like pharmaceuticals, agrochemicals, and industrial chemicals. North America leads the global Diethylamine market with a 36% share, driven by strong pharmaceutical manufacturing capacity, expanding agricultural demand, and ongoing investments in environmentally compliant chemical processing facilities.

Market Insights

- The Diethylamine Market was valued at USD 328.5 million in 2024 and is projected to reach USD 454.79 million by 2032, expanding at a CAGR of 4.15% during the forecast period.

- Growing demand from pharmaceuticals and agrochemicals is driving market growth, supported by increased use of diethylamine in drug formulations and pesticide production.

- Technological advancements and investments in sustainable synthesis processes are shaping industry trends, with leading manufacturers emphasizing eco-friendly production and product diversification.

- Market growth is restrained by stringent environmental regulations, health hazards linked to handling, and fluctuating raw material prices impacting production costs.

- North America holds the largest regional share of 36%, driven by strong pharmaceutical and agricultural sectors, while the Monoethylene Glycol (MEG) segment leads by product with 47% share, supported by high consumption in polyester and PET resin applications across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Diethylamine market is segmented into Monoethylene Glycol (MEG), Diethylene Glycol (DEG), and Triethylene Glycol (TEG). The MEG segment holds the dominant share of 47% due to its wide use in polyester fiber and PET resin manufacturing. MEG’s ability to deliver high purity and consistent performance supports large-scale polymerization processes in textiles and packaging. Increasing global demand for polyester-based fabrics and bottles continues to boost MEG consumption. Moreover, technological advancements in ethylene oxide conversion processes enhance MEG yield efficiency, further driving segment growth.

- For instance, LG Chem reports an ethylene cracker at its Daesan site with an ethylene capacity of 1.27 million metric tons/year, indicating the scale of its upstream feedstock capability for MEG and related glycols.

By Application

Among applications, polyester fibers lead the Diethylamine market with a 39% share. The strong performance of this segment stems from the increasing use of polyester in apparel, upholstery, and home furnishings. Rising population, urbanization, and affordability of synthetic fibers compared to natural alternatives support market expansion. PET resins also contribute significantly due to their role in beverage packaging and films. Growing sustainability trends are pushing demand for recyclable polyester materials, further strengthening the fiber segment’s position in global consumption.

- For instance, BASF launched loopamid® in January 2024 — a polyamide 6 product entirely based on textile waste from industrial fabric and used‑clothing streams.

By End User

The textile industry dominates the Diethylamine market, accounting for 35% of total demand. Its strong share is attributed to extensive use of diethylamine derivatives in producing polyester yarns and coatings. The automotive industry follows, driven by applications in coolants and lubricants. In healthcare and pharmaceuticals, diethylamine serves as a key intermediate in active pharmaceutical ingredient (API) synthesis. Expanding industrial and chemical sectors are also increasing diethylamine consumption for corrosion inhibitors and surfactants, highlighting its versatile role across manufacturing ecosystems.

Key Growth Drivers

Rising Demand from Pharmaceutical and Agrochemical Sectors

Diethylamine is widely used as an intermediate in the synthesis of pharmaceutical drugs and agrochemicals. Its application in producing antihistamines, anesthetics, and herbicides has significantly boosted demand. The growing prevalence of chronic diseases and the need for effective crop protection chemicals are driving production volumes. Expanding pharmaceutical manufacturing capacities in Asia-Pacific and Europe further strengthen market growth, supported by increasing R&D investments in active ingredient development using diethylamine derivatives.

For instance, LyondellBasell is developing its advanced-recycling capabilities by constructing an industrial-scale MoReTec plant in Wesseling, Germany, which is planned to process 50,000 metric tons/year of recycled plastic feedstock, enabling improved circular-feedstock integration for chemical-intermediate processes.

Increasing Use in Rubber and Dye Manufacturing

The rising consumption of diethylamine-based accelerators in rubber vulcanization processes is a key growth driver. These compounds enhance elasticity and durability, improving tire and industrial rubber product quality. Additionally, diethylamine is used in producing dyes and pigments for textiles and coatings. The expansion of the automotive and construction sectors, coupled with growing demand for synthetic rubber and vibrant dyes, supports steady market expansion, particularly in emerging economies such as China and India.

For instance, S-Oil operates a residue upgrading complex (RUC) and olefin downstream complex (ODC) in Ulsan, South Korea. This complex includes a plant for the production of propylene oxide (PO) with an annual capacity of 300,000 metric tons.

Growth of Chemical and Solvent Applications

Diethylamine serves as an important intermediate for manufacturing corrosion inhibitors, surfactants, and resins. The growing demand for these chemicals across petrochemical, industrial cleaning, and metal treatment sectors is driving market growth. Its ability to act as an efficient pH regulator and solvent for organic synthesis enhances its industrial importance. The continued expansion of specialty chemical production facilities and the shift toward high-performance materials are further accelerating the adoption of diethylamine in multiple downstream industries.

Key Trends & Opportunities

Shift Toward Sustainable Production Methods

Manufacturers are focusing on developing environmentally friendly synthesis routes for diethylamine using bio-based ethanol or green ammonia. This shift aligns with stricter emission norms and sustainability targets. The adoption of cleaner catalytic processes helps minimize by-products and reduce carbon footprints. Companies investing in renewable feedstock integration and circular manufacturing systems are likely to gain a competitive edge, especially in regions with stringent environmental policies such as Europe and North America.

- For instance, Indian Oil reports it had installed 172.5 MW of solar power capacity at its retail outlets as of 31 December 2024, and had solarised 34,641 retail outlets by that date.

Expanding Applications in Emerging Markets

Emerging economies in Asia-Pacific and Latin America are witnessing rising demand for diethylamine due to expanding manufacturing and industrial infrastructure. Rapid growth in pharmaceuticals, rubber, and agrochemicals is driving local production capacities. Governments are also supporting domestic chemical industries through favorable policies and investment incentives. These developments present new opportunities for market players to strengthen their regional presence through partnerships, capacity expansions, and technology collaborations with local producers.

- For instance, FPG announced in its 2024 annual report that it increased its petrochemical segment’s combined annual production capacity by 110,000 metric tons through bottleneck expansions.

Increasing Integration in High-Performance Materials

Diethylamine is finding growing application in high-performance resins, coatings, and polymer additives. Its ability to enhance flexibility, adhesion, and chemical resistance makes it suitable for advanced material development. With the increasing demand for durable coatings and engineered plastics, manufacturers are focusing on diethylamine-based formulations to meet performance and sustainability requirements. This trend is expected to continue as industries pursue lightweight, high-strength, and thermally stable materials across multiple end-use sectors.

Key Challenges

Health and Safety Concerns

Diethylamine is a highly volatile and corrosive compound that poses health risks during handling and storage. Exposure can cause respiratory irritation and chemical burns, leading to stringent workplace safety regulations. Compliance with Occupational Safety and Health Administration (OSHA) standards and other environmental guidelines increases operational costs. Manufacturers are investing in advanced containment and monitoring systems, but these requirements raise barriers for small-scale producers, limiting market entry and expansion.

Fluctuating Raw Material Prices

The market faces challenges due to price volatility of key feedstocks such as ammonia and ethanol. Supply chain disruptions and fluctuating energy prices impact production costs and profit margins. Global trade tensions and regulatory shifts affecting petrochemical production also influence pricing dynamics. To mitigate these risks, manufacturers are focusing on backward integration and diversifying sourcing strategies, though these approaches require significant capital investments and long-term planning.

Regional Analysis

North America

North America holds the largest share of the Diethylamine market at 36%. The region’s dominance is driven by strong demand from pharmaceutical, agricultural, and chemical industries. The United States leads consumption due to extensive use of diethylamine in drug formulation, herbicides, and corrosion inhibitors. Major chemical manufacturers are investing in advanced production facilities to ensure high-quality output and compliance with environmental regulations. Additionally, the growing focus on sustainable manufacturing and innovations in amine derivatives continues to support regional market expansion.

Europe

Europe accounts for 29% of the Diethylamine market, supported by a well-established pharmaceutical and agrochemical manufacturing base. Countries such as Germany, France, and the Netherlands serve as key production hubs due to advanced R&D infrastructure and strict regulatory frameworks promoting high-quality synthesis processes. The growing use of diethylamine in specialty coatings and dyes is also boosting demand. The European Green Deal’s emphasis on eco-friendly chemical processes is encouraging manufacturers to adopt cleaner production technologies, driving innovation and market growth.

Asia-Pacific

Asia-Pacific represents 25% of the global Diethylamine market, showing the fastest growth rate among all regions. China, India, and Japan are major contributors due to expanding industrialization, rising demand for pharmaceuticals, and growing agricultural activities. Increasing investments in chemical and intermediate production are fueling local supply capabilities. Government incentives supporting domestic manufacturing and export-oriented growth are enhancing competitiveness. The region’s large consumer base, cost-effective production, and strong trade networks position Asia-Pacific as a key hub for future market expansion.

Latin America

Latin America holds an 8% share of the Diethylamine market, primarily driven by growing agricultural and industrial sectors. Brazil and Mexico lead consumption, supported by expanding pesticide and rubber industries. Local manufacturers are adopting diethylamine-based intermediates to improve efficiency and crop yields. Economic diversification efforts and rising infrastructure projects are further stimulating chemical demand. However, limited domestic production capacities and dependence on imports pose challenges, prompting companies to explore regional partnerships and technology transfers for long-term supply stability.

Middle East & Africa

The Middle East & Africa region captures a 7% share of the Diethylamine market, with growth fueled by the expansion of petrochemical and construction sectors. The UAE and Saudi Arabia are emerging as key markets due to investments in industrial chemicals and corrosion inhibitors for oil and gas operations. Rising pharmaceutical production in South Africa and Egypt is also contributing to demand. Although market penetration remains moderate, infrastructure development and regional diversification initiatives are creating opportunities for diethylamine manufacturers and suppliers.

Market Segmentations:

By Product:

- Monoethylene glycol (MEG)

- Diethylene glycol (MEG)

By Application:

- Polyester fibers

- PET resins

By End User:

- Textile industry

- Automotive industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Diethylamine market features strong competition among key players such as Eastman Chemical, LG Chem, BASF SE, LyondellBasell, Ineos Group, Mitsubishi Chemical, LOTTE Chemical, Indian Oil, Formosa Plastics, and Dow Chemical. the Diethylamine market is characterized by high production capacity, technological innovation, and strategic expansion across global regions. Leading manufacturers are focusing on improving process efficiency and product quality through advanced catalytic synthesis and sustainable production methods. Many producers are investing in green chemistry initiatives to reduce emissions and enhance operational safety. The industry is witnessing consolidation through mergers, acquisitions, and long-term supply partnerships to strengthen global distribution networks. Continuous R&D investments, automation in manufacturing, and integration of digital monitoring systems are enabling companies to maintain cost competitiveness and adapt to shifting regulatory standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eastman Chemical

- LG Chem

- BASF SE

- LyondellBasell

- Ineos Group

- Mitsubishi Chemical

- LOTTE Chemical

- Indian Oil

- Formosa Plastics

- Dow Chemical

Recent Developments

- In May 2024, Asahi Kasei, Mitsui Chemicals, and Mitsubishi Chemical agreed to conduct a joint feasibility study on feedstock and fuel conversion at their ethylene production facilities in Western Japan. This initiative aimed to promote carbon neutrality and advance the decarbonization of society through sustainable practices.

- In May 2024, Dow commenced an expansion of its propylene glycol (PG) capacity at its integrated manufacturing facility in Map Ta Phut, Rayong, Thailand. This expansion boosts the facility’s PG output by 80,000 tons annually, elevating the total production to 250,000 tons annually.

- In January 2024, SABIC announced its decision to establish a petrochemical complex in China’s Fujian province. This petrochemical complex will have the capability of producing ethylene glycol along with polyethylene, polypropylene and polycarbonate, among others.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing industrial and pharmaceutical applications.

- Rising demand for diethylamine-based intermediates will drive expansion in agrochemicals and pharmaceuticals.

- Adoption of sustainable and low-emission production technologies will gain momentum.

- Asia-Pacific will continue to emerge as the key growth hub due to industrial expansion.

- Investments in research and process automation will improve product quality and efficiency.

- Strategic mergers and capacity expansions will strengthen global supply chains.

- Demand from rubber, dye, and coating industries will support long-term growth.

- Stringent safety and environmental regulations will shape production standards globally.

- Growing applications in specialty chemicals will open new market opportunities.

- Development of green synthesis routes will enhance competitiveness and regulatory compliance.