Market Overview:

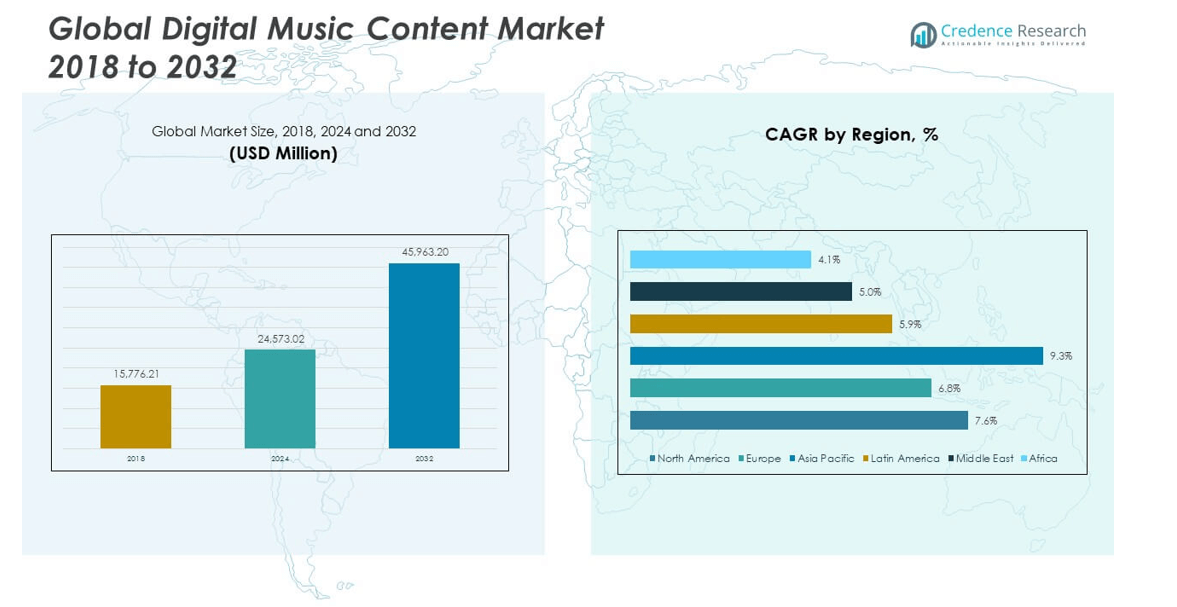

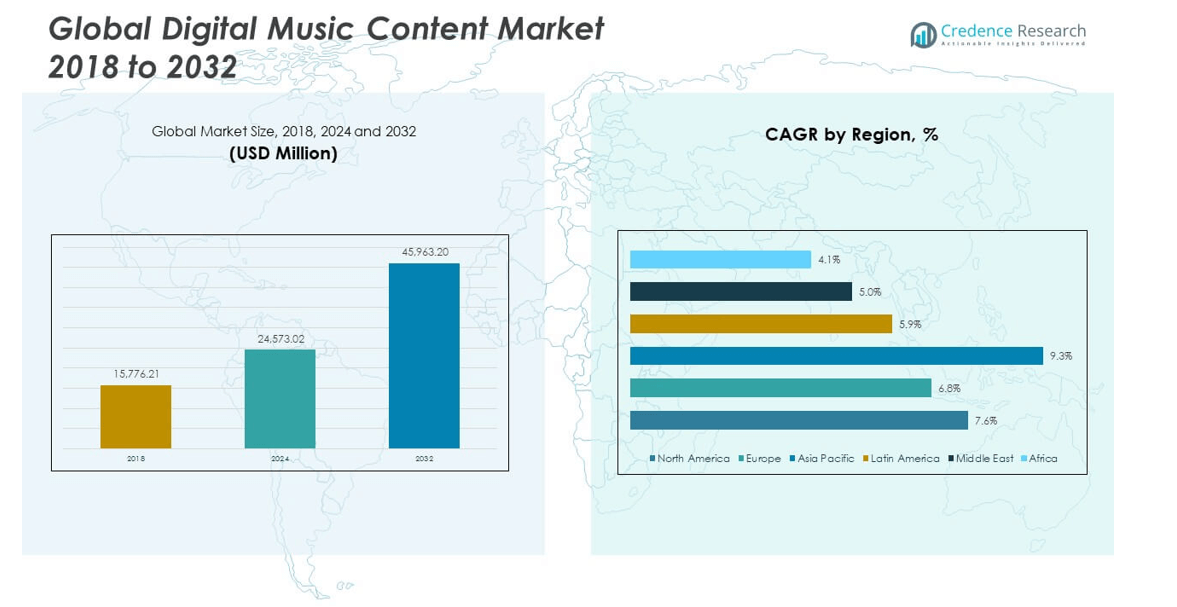

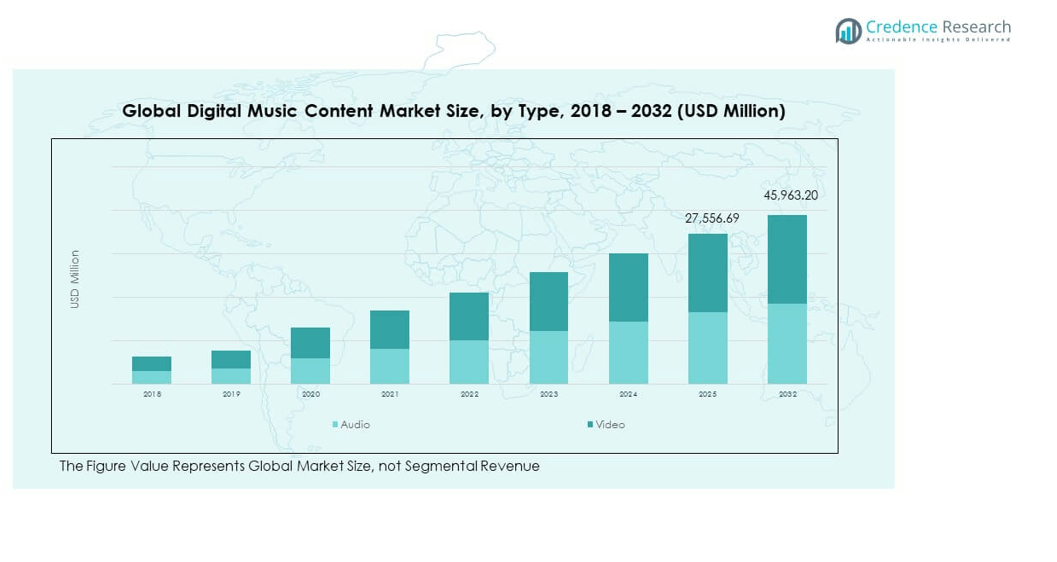

The Global Digital Music Content Market size was valued at USD 15,776.21 million in 2018, growing to USD 24,573.02 million in 2024, and is anticipated to reach USD 45,963.20 million by 2032, at a CAGR of 7.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Music Content Market Size 2024 |

USD 24,573.02 million |

| Digital Music Content Market, CAGR |

7.58% |

| Digital Music Content Market Size 2032 |

USD 45,963.20million |

The market is expanding due to the rising adoption of streaming platforms, increasing smartphone penetration, and better internet accessibility. Subscription-based and ad-supported services continue to dominate as users shift from physical and download-based music formats. Cloud-based libraries, AI-driven recommendations, and personalized playlists enhance user engagement, while strong social media integration fuels discovery and sharing. Growing interest in high-resolution and immersive music formats also adds momentum, with global labels and indie artists leveraging digital distribution for wider reach.

Geographically, North America leads the market due to widespread streaming adoption, established music licensing structures, and high digital spend per consumer. Europe follows closely, supported by strong adoption in countries like the UK, Germany, and France, where subscription models are well-embedded. Asia-Pacific emerges as the fastest-growing region, driven by rising internet penetration, expanding middle-class populations, and growing demand for affordable streaming services in countries such as India, China, and Southeast Asia. Latin America and the Middle East & Africa are also gaining traction as improving connectivity and localized content strategies attract more users.

Market Insights:

- The Global Digital Music Content Market was valued at USD 15,776.21 million in 2018, reached USD 24,573.02 million in 2024, and is projected to grow to USD 45,963.20 million by 2032, registering a CAGR of 7.58%.

- North America held the largest share at 35.3%, driven by high subscription adoption, advanced digital infrastructure, and premium service penetration. Europe followed with 22.8%, supported by strong regulatory frameworks and multilingual content demand. Asia Pacific accounted for 26.3%, fueled by massive smartphone penetration and localized streaming platforms.

- Asia Pacific is the fastest-growing region with 26.3% share, supported by affordable data plans, rising middle-class populations, and strong adoption in China, India, and Southeast Asia.

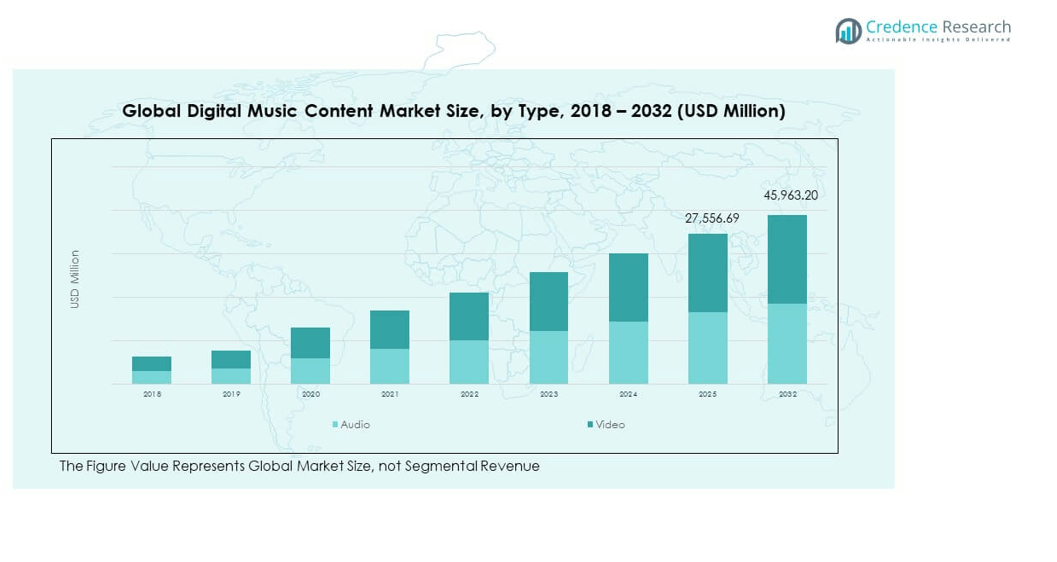

- Audio dominated the segmental distribution with 64% share in 2024, supported by streaming, podcast growth, and AI-driven playlist curation.

- Video accounted for 36% share in 2024, driven by music videos, short-form integrations, and live concert streaming.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Popularity of Subscription-Based Streaming Services Among Consumers:

Subscription services continue to drive the Global Digital Music Content Market by offering affordable access to large music libraries. Consumers prefer ad-free listening, offline downloads, and premium features, which strengthen adoption. Leading platforms focus on expanding their catalogs and improving user experience through curated playlists. Growing disposable incomes and digital literacy also fuel adoption in urban and semi-urban regions. The convenience of monthly pricing encourages retention and reduces piracy. It remains a dominant force in revenue generation across markets. Global competition among providers creates innovation in personalization features. The market continues to thrive due to this strong foundation.

- For instance, Spotify reported having 252 million premium subscribers as of Q3 2024, with over 100 million songs available on its platform, reflecting strong user engagement fueled by personalized playlists and AI-driven recommendations. Leading platforms focus on expanding their catalogs and improving user experience through curated playlists. Growing disposable incomes and digital literacy also fuel adoption in urban and semi-urban regions.

Increasing Internet Penetration and Smartphone Adoption Across Regions:

The rapid rise in smartphone ownership and affordable internet access supports music consumption on digital platforms. Affordable data plans in emerging markets enhance streaming habits among younger demographics. The Global Digital Music Content Market benefits from seamless mobile experiences, which encourage daily usage. Telecom partnerships with music platforms provide bundled services, further broadening reach. Consumers enjoy music anywhere, increasing time spent on apps. This trend strengthens digital engagement and shifts behavior away from physical formats. Streaming platforms also invest in lighter apps optimized for low bandwidth. Expansion of connectivity remains a major enabler of industry growth.

- For instance, Amazon Music provides a fitting example of how device integration drives user engagement. With over 80 million Prime Music users globally as of January 2025, primarily consisting of Amazon Prime subscribers, the platform leverages its extensive reach through smart devices like Alexa and Fire TV. The wider digital music market benefits from seamless mobile experiences, which encourage daily usage and increased time spent on apps. Strategic partnerships with telecom companies also further broaden reach by offering bundled services, such as Bharti Airtel’s exclusive offer of Apple Music and Apple TV+ to its customers in India as of February 2025.

Integration of Artificial Intelligence and Personalized Recommendation Engines:

AI-driven recommendation tools enhance engagement by tailoring playlists and suggestions based on user preferences. The Global Digital Music Content Market benefits when consumers feel connected to customized content. Platforms deploy machine learning to analyze listening history and create mood-based playlists. These advancements increase time spent on platforms and support premium conversions. AI also helps with content discovery, offering independent artists exposure to wider audiences. Personalization reduces churn and builds loyalty among subscribers. The technology ensures seamless cross-device continuity, enhancing the overall experience. Companies continue to prioritize AI integration for competitive differentiation.

Expansion of Licensing Agreements and Global Music Catalogs by Leading Players:

Major music labels and independent creators are broadening licensing agreements to reach global markets. The Global Digital Music Content Market grows as content availability becomes more diverse and inclusive. Consumers access international and regional genres on the same platforms. This diversity attracts multicultural audiences, supporting expansion in non-traditional markets. Licensing deals also protect copyright holders and ensure steady revenue streams. Independent artists benefit from direct-to-platform distribution models. The market benefits from lower entry barriers for artists and producers. The continuous expansion of catalogs enhances platform competitiveness worldwide.

Market Trends:

Rising Popularity of Podcasts and Non-Music Audio Content Within Streaming Platforms:

Streaming services are broadening offerings by incorporating podcasts and audiobooks to retain users. The Global Digital Music Content Market increasingly positions itself as an audio ecosystem beyond music. Consumers prefer versatile apps that combine entertainment and knowledge in one platform. Advertisers target podcast listeners with focused campaigns, diversifying revenue models. Exclusive podcast deals signed by leading platforms strengthen brand loyalty. Users spend longer on apps when multiple audio options are integrated. The trend appeals strongly to younger generations seeking on-demand content. Platforms continue to invest in diversifying non-music offerings to maintain engagement.

- For example, YouTube Music announced having over 1 billion monthly active podcast viewers as of early 2025, becoming the most frequently used podcast platform in the U.S., with over 400 million hours of podcast content streamed monthly on living room devices. The Global Digital Music Content Market increasingly positions itself as an audio ecosystem beyond music. Consumers prefer versatile apps that combine entertainment and knowledge in one platform.

Adoption of Immersive Audio Technologies Such as Spatial and High-Resolution Formats:

Demand for high-quality sound formats drives adoption of advanced streaming subscriptions. The Global Digital Music Content Market evolves by integrating spatial audio and lossless streaming options. Consumers value immersive sound experiences, especially on premium headphones and smart speakers. Streaming services differentiate themselves through exclusive high-resolution catalogs. The trend appeals to audiophiles and professional users who value fidelity. Technology companies collaborate with platforms to optimize hardware-software synergy. Premium subscriptions offering immersive formats generate higher average revenue per user. The market continues to innovate with advanced audio features to attract discerning listeners.

- For instance, Tencent Music Entertainment’s QQ Music became China’s first domestic streaming service to support Dolby Atmos spatial audio in mid-2022, offering immersive audio to SVIP subscribers using Dolby Atmos-enabled devices from multiple brands. The Global Digital Music Content Market evolves by integrating spatial audio and lossless streaming options. Consumers value immersive sound experiences, especially on premium headphones and smart speakers.

Integration of Social Media and Music Sharing Features Across Platforms:

Social media plays a major role in promoting music discovery and user-generated content. The Global Digital Music Content Market grows as platforms enable direct sharing of tracks on social networks. Viral trends and short video platforms boost music popularity across regions. Integration fosters higher engagement and creates opportunities for artists to reach audiences instantly. Music discovery is no longer limited to traditional radio but thrives on social-driven virality. Social challenges and influencer campaigns make songs trend quickly worldwide. This synergy enhances cross-platform engagement and encourages organic growth. Platforms rely heavily on this integration to maintain relevance.

Expansion of Smart Device Ecosystem Driving Consumption of Music Content:

Smart speakers, connected cars, and wearable devices fuel seamless digital music access. The Global Digital Music Content Market adapts to provide compatibility across diverse hardware ecosystems. Voice commands allow users to access music easily without complex navigation. Car manufacturers integrate streaming apps directly into infotainment systems. Wearables support fitness-driven music consumption during workouts and outdoor activities. Cross-platform integration ensures consistency of user experience across environments. This expansion widens opportunities for premium subscriptions tied to device ecosystems. Market leaders strengthen collaboration with device manufacturers to capture new consumer bases.

Market Challenges Analysis:

Growing Concerns Over Copyright Infringement and Revenue Distribution Disputes:

Copyright management remains a pressing issue in the Global Digital Music Content Market. Unauthorized downloads and piracy platforms still undermine legitimate revenue growth. Rights holders often dispute fair compensation from streaming platforms. Independent artists voice concerns over low royalty rates compared to traditional sales models. Complex licensing structures across multiple geographies create compliance challenges for providers. This friction threatens long-term relationships between creators and platforms. Consumers often lack clarity regarding how revenues reach musicians. Resolving these disputes remains crucial to achieving sustainable industry growth.

Intensifying Competition Among Streaming Platforms and Rising User Acquisition Costs:

The Global Digital Music Content Market faces intense competition from established global players and regional entrants. User acquisition requires significant marketing spend, increasing operational costs. Platforms compete on pricing, exclusive content, and user experience. Frequent free trials and discounted plans reduce profitability in the short term. Differentiation becomes challenging when competitors offer similar catalogs. Smaller players often struggle to sustain growth against global giants. Consumer loyalty is fragmented, as users switch platforms seeking better deals. Maintaining profitability while scaling operations poses a major challenge for the industry.

Market Opportunities:

Expanding Monetization Models Through Advertising, Premium Plans, and Live Events:

The Global Digital Music Content Market can unlock growth by diversifying monetization strategies. Ad-supported free tiers appeal to cost-sensitive users while premium plans attract heavy listeners. Virtual concerts and live-streaming events provide additional revenue channels. Partnerships with brands and sponsorships expand advertising reach. Gamified experiences and fan engagement tools strengthen loyalty. Offering hybrid subscription-advertising models widens consumer choice. These models support steady revenue streams across varying demographics. It opens new avenues for consistent profitability.

Rising Demand in Emerging Markets with Growing Internet Penetration and Localized Content:

Emerging economies present strong growth opportunities due to increasing smartphone usage and affordable internet. The Global Digital Music Content Market benefits when platforms localize content for regional audiences. Expanding vernacular music catalogs attracts first-time users in rural and semi-urban regions. Collaborations with local artists enhance cultural relevance and strengthen brand appeal. Affordable subscription pricing tailored for these markets drives adoption. Youth demographics play a critical role in sustaining demand growth. Companies that prioritize regional adaptation will capture untapped opportunities. The long-term momentum favors platforms investing in localized strategies.

Market Segmentation Analysis:

By Type

The Global Digital Music Content Market is segmented into audio and video formats. Audio dominates due to the widespread adoption of streaming services and high mobile penetration. Consumers prefer on-demand music libraries, curated playlists, and podcasts, which strengthen audio’s share. Video is gaining momentum as platforms integrate music videos, live concerts, and short-form clips to enhance engagement. Growth in video content is supported by social media integration and the rising demand for visual entertainment experiences. Both segments contribute to expanding user bases and diversified monetization models.

By Platform

Streaming holds the largest share within the Global Digital Music Content Market, driven by subscription-based and ad-supported services. It benefits from convenience, cross-device access, and growing partnerships with telecom providers. Streaming also supports real-time discovery and personalized experiences powered by artificial intelligence. Download remains a smaller segment, appealing to consumers seeking offline access and ownership. It continues to serve niche markets where consistent internet connectivity is limited. Both models support revenue diversity, with streaming leading long-term industry expansion.

- For instance, SoundCloud reached 180 million total users globally by 2025, hosting more than 375 million tracks, with 52% of listening occurring on mobile devices, showing strong app engagement across user demographics. It benefits from convenience, cross-device access, and growing partnerships with telecom providers. Streaming also supports real-time discovery and personalized experiences powered by artificial intelligence.

By End User

The Global Digital Music Content Market serves both individual and commercial users. Individual consumers account for the majority, with growth fueled by smartphone penetration, affordable data plans, and diverse content options. The market thrives on personalization, enabling listeners to engage with tailored playlists and regional catalogs. Commercial users include entertainment venues, broadcasters, and retail spaces adopting licensed digital music solutions. This segment benefits from background music services and targeted advertising opportunities. Both user groups shape demand patterns, ensuring steady market progression.

Segmentation:

By Type

By Platform

By End User

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Digital Music Content Market size was valued at USD 6,901.40 million in 2018 to USD 10,638.18 million in 2024 and is anticipated to reach USD 19,953.59 million by 2032, at a CAGR of 7.6% during the forecast period. North America accounts for the largest share of the Global Digital Music Content Market at 35.3%. The region benefits from high smartphone penetration, advanced broadband infrastructure, and strong consumer willingness to pay for premium services. Streaming platforms such as Spotify, Apple Music, and Amazon Music dominate revenue with large subscriber bases. Music licensing structures and favorable regulations support the monetization of both audio and video content. Commercial use, including radio, retail, and entertainment venues, further strengthens market demand. The adoption of immersive audio formats like spatial sound enhances subscription growth. Integration with connected devices such as smart speakers and cars drives seamless user engagement. The region’s mature digital ecosystem positions it as a leader in market innovation.

Europe

The Europe Global Digital Music Content Market size was valued at USD 4,594.57 million in 2018 to USD 6,905.18 million in 2024 and is anticipated to reach USD 12,180.56 million by 2032, at a CAGR of 6.8% during the forecast period. Europe contributes 22.8% of the Global Digital Music Content Market, supported by strong adoption across major economies like the UK, Germany, and France. Subscription services are widely accepted, with local and global platforms competing for market share. Government policies around copyright and digital rights management help secure fair revenue distribution. Consumers prefer curated playlists and multilingual catalogs that reflect cultural diversity. Growth in video content, particularly music videos and live concerts, is accelerating audience engagement. Partnerships with telecom operators enable bundled music subscriptions across the region. Commercial usage, including in hospitality and retail, supports steady revenue streams. The market thrives on a balance of global innovation and local adaptation.

Asia Pacific

The Asia Pacific Global Digital Music Content Market size was valued at USD 2,939.82 million in 2018 to USD 4,975.54 million in 2024 and is anticipated to reach USD 10,577.05 million by 2032, at a CAGR of 9.3% during the forecast period. Asia Pacific holds 26.3% of the Global Digital Music Content Market, making it the fastest-growing region. Rapid internet penetration and rising smartphone adoption in countries such as China, India, and Southeast Asia drive mass adoption. Localized platforms compete strongly with global players by offering regional language catalogs and affordable pricing. Youth demographics form a major consumer base, supporting high engagement with streaming platforms. Video content, particularly music integrated with short-video apps, drives virality and user growth. Partnerships with local artists and telecom companies strengthen expansion strategies. Affordable data plans and digital payment options fuel subscription adoption. The region remains a hotspot for innovation in both music and technology-driven platforms.

Latin America

The Latin America Global Digital Music Content Market size was valued at USD 729.40 million in 2018 to USD 1,121.68 million in 2024 and is anticipated to reach USD 1,851.71 million by 2032, at a CAGR of 5.9% during the forecast period. Latin America accounts for 4.6% of the Global Digital Music Content Market. Growth is fueled by rising internet access and urbanization in key economies such as Brazil and Argentina. Consumers adopt streaming services due to affordable subscription models and free ad-supported tiers. Local music styles, including Latin pop and reggaeton, enjoy global demand and support regional market growth. Social media platforms play a critical role in driving music discovery and streaming adoption. Commercial use in entertainment venues and events strengthens additional revenue channels. Piracy remains a challenge but continues to decline with accessible digital alternatives. The market expands steadily with increasing cultural influence on global music trends.

Middle East

The Middle East Global Digital Music Content Market size was valued at USD 398.10 million in 2018 to USD 560.94 million in 2024 and is anticipated to reach USD 865.37 million by 2032, at a CAGR of 5.0% during the forecast period. The Middle East represents 2.1% of the Global Digital Music Content Market. Growth is supported by rising smartphone adoption and increasing popularity of streaming platforms. Regional platforms and international services collaborate to expand Arabic and multilingual content. Countries like the UAE and Saudi Arabia lead adoption due to advanced digital infrastructure and younger demographics. Demand for video content, live streaming, and concerts drives cultural engagement. Licensing agreements ensure growing revenue opportunities for global and local artists. Subscription adoption is improving, supported by mobile data affordability. The region demonstrates gradual but steady progress in digital music monetization.

Africa

The Africa Global Digital Music Content Market size was valued at USD 212.93 million in 2018 to USD 371.50 million in 2024 and is anticipated to reach USD 534.92 million by 2032, at a CAGR of 4.1% during the forecast period. Africa holds 1.0% of the Global Digital Music Content Market, making it the smallest but emerging region. Growth is driven by increasing internet penetration and smartphone adoption in urban centers. Local music genres such as Afrobeats and hip hop gain international recognition, boosting digital consumption. Streaming platforms invest in partnerships with telecom operators to provide affordable subscription bundles. Piracy continues to challenge revenue growth but declines gradually with legal alternatives. Youth populations form the core of demand, ensuring long-term opportunities. Commercial use in radio and entertainment venues supports market expansion. The region remains promising as connectivity infrastructure improves.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Spotify

- Apple Music

- Amazon Music

- YouTube Music

- Tencent Music Entertainment

- Deezer

- Pandora

- SoundCloud

- Tidal

- iHeartRadio

- Napster

- Qobuz

Competitive Analysis:

The Global Digital Music Content Market is highly competitive with global players such as Spotify, Apple Music, Amazon Music, and YouTube Music leading the industry. It is defined by aggressive investments in subscription models, AI-powered personalization, and exclusive content partnerships. Tencent Music and regional providers strengthen competition in Asia with localized offerings. Platforms compete on catalog size, user experience, and pricing strategies. Independent-focused platforms such as SoundCloud and Deezer maintain niche audiences. Market leaders expand reach through telecom partnerships and bundled services. Strategic differentiation relies on innovation in immersive formats, social integration, and cross-platform compatibility. Competition remains intense as companies scale operations globally.

Recent Developments:

- In September 2025, Spotify launched Lossless audio streaming for its Premium subscribers in select markets, allowing streaming of tracks in up to 24-bit/44.1 kHz FLAC quality. This highly requested feature enhances the listening experience by delivering greater audio detail and clarity, complementing other popular features like AI playlist generation and DJ functionality. Additionally, in August 2025, Spotify introduced in-app direct messaging for music sharing, enabling users to share music, podcasts, and audiobooks within the platform securely and privately.

- In August 2025, Apple Music partnered with TuneIn to expand the availability of its six commercial-free live radio stations beyond its own platform. This partnership allows TuneIn’s 75 million global monthly users to access Apple Music radio stations on smart speakers, headphones, and certain automotive systems, marking Apple’s radio stations’ first appearance outside the Apple ecosystem.

- In early 2025, Amazon Music increased subscription prices in January but simultaneously introduced AI-powered music creation features through integration with Suno. This innovation enables users to create music by voice commands via Alexa, highlighting Amazon’s move into AI-assisted content generation despite industry debates on copyright concerns.

- In April 2025, Deezer unveiled new features aimed at highly personalized music experiences, including algorithm customization that allows users to fully control their music recommendations and enhanced playlist personalization options such as custom covers.

Report Coverage:

The research report offers an in-depth analysis based on type, platform, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Streaming services will remain the leading revenue driver with growing adoption.

- Personalized AI-driven music recommendations will enhance user engagement.

- Virtual concerts and live-streaming events will expand revenue streams.

- Integration with smart devices and connected cars will fuel content demand.

- Regional platforms will grow by offering localized catalogs and pricing models.

- High-resolution and spatial audio formats will attract premium subscribers.

- Social media-driven discovery will increase music virality and platform usage.

- Telecom partnerships will expand reach in emerging markets.

- Independent artists will gain visibility through direct-to-platform distribution.

- Regulatory changes on royalties and licensing will influence revenue sharing.