Market Overview

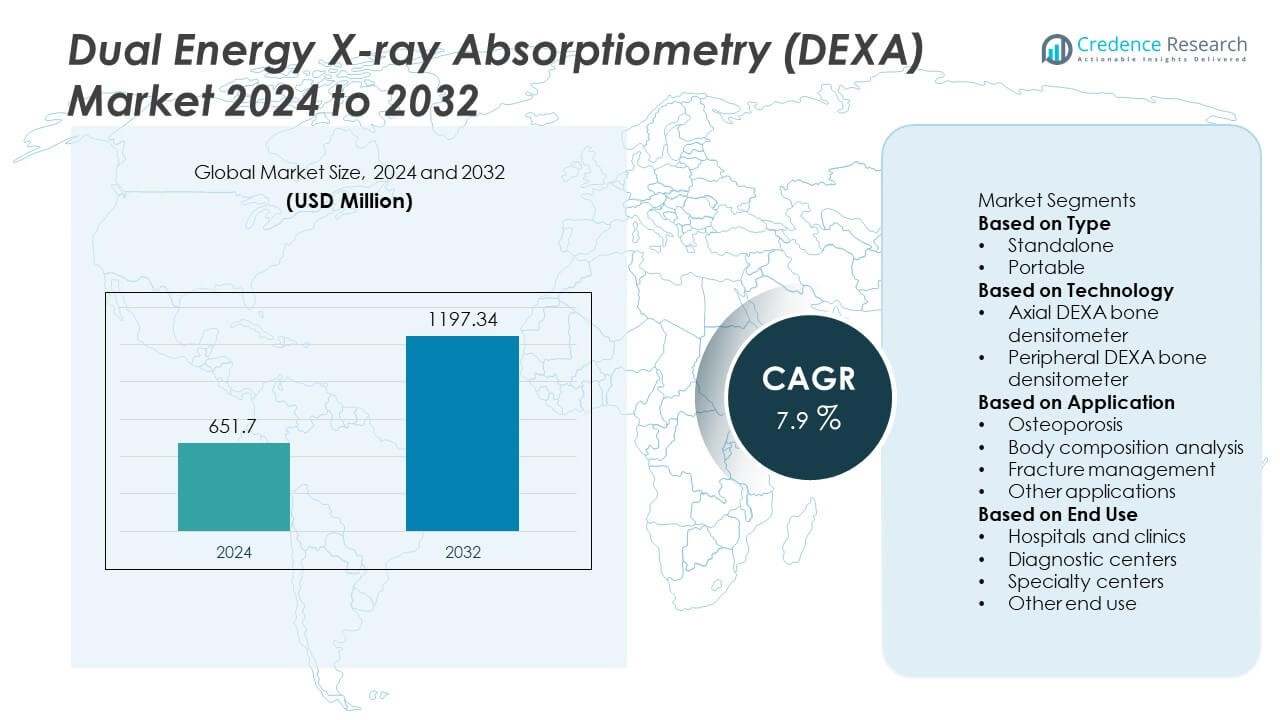

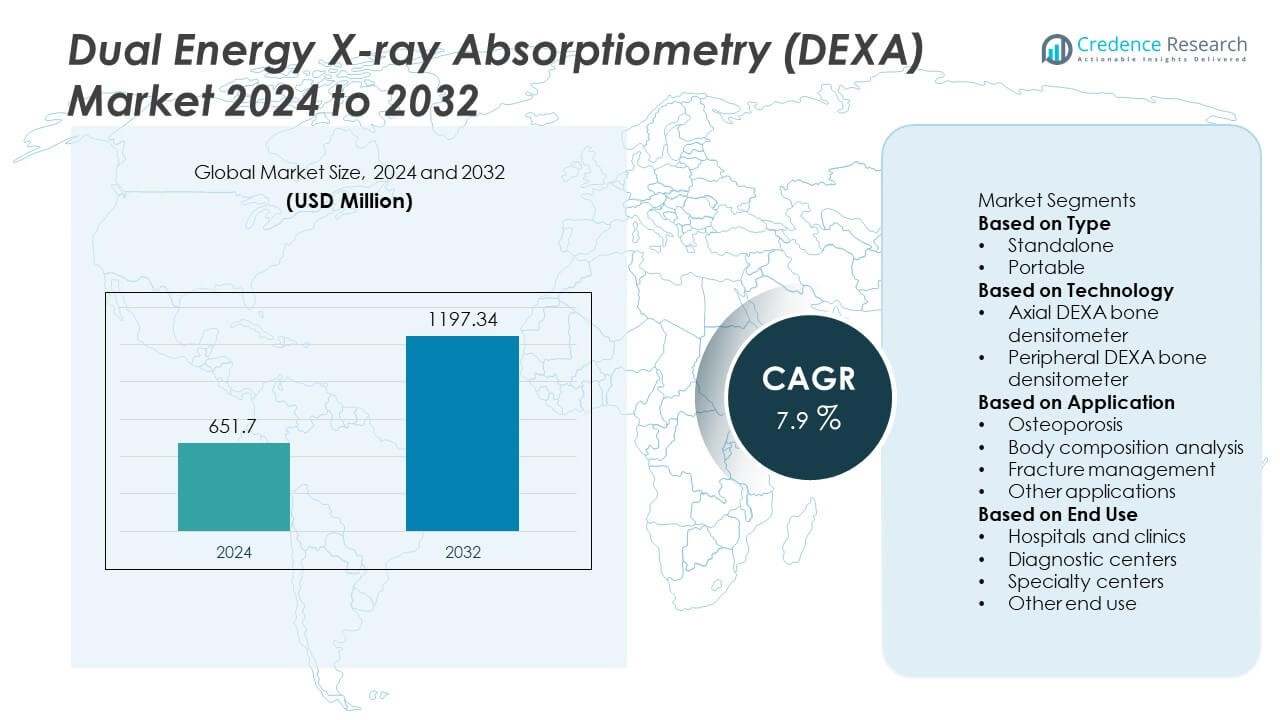

The Dual Energy X-ray Absorptiometry (DEXA) Market reached USD 651.7 million in 2024. It is projected to grow steadily and reach USD 1,197.34 million by 2032. The market is expected to expand at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual Energy X-Ray Absorptiometry Market Size 2024 |

USD 651.7 Million |

| Dual Energy X-Ray Absorptiometry Market, CAGR |

7.9% |

| Dual Energy X-Ray Absorptiometry Market Size 2032 |

USD 1,197.34 Million |

The top players in the Dual Energy X-ray Absorptiometry (DEXA) market include Medonica, Aurora Spine, Medilink International, GE Healthcare, BeamMed, Hologic, Furuno Electric, Fujifilm, DMS, and Fonar, each offering advanced bone density and body composition assessment technologies. North America leads the market with a 34% share, supported by strong adoption of osteoporosis screening and well-established diagnostic imaging networks. Europe follows with a 28% share, driven by structured fracture prevention programs and broader integration of bone health assessments in primary care. Asia Pacific holds a 25% share, emerging as a high-growth region due to rising elderly populations and expanding healthcare infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dual Energy X-ray Absorptiometry market reached USD 651.7 million in 2024 and is expected to hit USD 1,197.34 million by 2032, expanding at a CAGR of 7.9% due to rising demand for accurate bone density and body composition assessment.

- Growing osteoporosis cases and higher fracture risk among aging populations drive adoption, with the Standalone DEXA segment holding a 65% share because of advanced diagnostic accuracy and strong clinical acceptance.

- Portable and AI-integrated DEXA systems represent key market trends, improving point-of-care screening and remote reporting, and gaining traction in sports medicine and body composition monitoring centers.

- Competitive activity remains strong, with companies enhancing software precision, radiation safety, and cloud-based analytics, while reimbursement gaps and high device costs restrain adoption in small clinics and cost-sensitive regions.

- Regionally, North America leads with a 34% share, followed by Europe at 28% and Asia Pacific at 25%, while Latin America and Middle East & Africa account for 7% and 6%, supported by growing preventive screening programs.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type:

The Standalone DEXA systems segment holds a 65% share of the market. Healthcare providers choose standalone units due to higher scanning accuracy and broader patient assessment features. Hospitals and diagnostic imaging centers prefer these systems because they support detailed bone density analysis and integrate well with radiology workflows. The Portable DEXA systems segment grows as clinics and sports centers adopt compact solutions for body composition tracking. Rising demand for preventive screening and improved mobility features support portable unit adoption, yet the standalone segment remains dominant due to strong clinical reliability and advanced measurement capabilities.

- For instance, GE HealthCare’s Lunar iDXA uses advanced cadmium telluride (CdTe) photon-counting detectors that provide high resolution for enhanced edge detection and clarity in images, which is designed to enable clearer fracture risk evaluation.

By Technology:

The Axial DEXA bone densitometer segment leads the market with a 72% share. This technology offers precise measurements of spine and hip bone density, making it the primary choice for osteoporosis diagnosis. Axial systems remain essential in clinical settings due to strong diagnostic value and reimbursement support. The Peripheral DEXA segment expands in smaller clinics and fitness centers, supporting fast screening of wrists and heels. Growing adoption of early detection programs fuels demand, yet axial DEXA maintains dominance due to higher diagnostic accuracy and alignment with standard clinical guidelines.

- For instance, Fujifilm’s FDX Visionary-DR utilizes 2D-Fan Beam technology based on a 4-line, 64-element multi-array detector, which provides high image resolution for improving bone-mineral assessment and osteoporosis diagnosis in older adults.

By Application:

The Osteoporosis segment accounts for a 58% share, making it the leading application for DEXA systems. Rising osteoporosis cases in aging populations drive adoption across hospitals and specialty centers. Physicians rely on DEXA results to evaluate bone health, plan treatment, and monitor therapy outcomes. Body composition analysis gains traction in sports medicine and weight management programs as fitness professionals use DEXA scans to review fat and lean mass. Fracture management and other applications benefit from improved scanning features, yet osteoporosis remains dominant due to strong clinical necessity and established screening recommendations.

Key Growth Drivers

Rising Burden of Osteoporosis and Fracture Risk

The growing incidence of osteoporosis among aging populations drives strong demand for DEXA systems. Physicians rely on accurate bone density evaluation to reduce fracture risk and initiate timely treatment. Screening programs in hospitals and specialty imaging centers increase procedural volumes. Public health initiatives support early diagnosis and reduce long-term healthcare costs. As awareness improves, DEXA scanning becomes a central tool for bone health management across both developed and emerging healthcare settings, strengthening sustained market expansion.

- For instance, Hologic’s Horizon DXA platform offers enhanced precision for lumbar spine scans, with studies showing an in vivo precision of 0.63% Coefficient of Variation (%CV), and is designed with high-capacity X-ray generators to increase patient throughput by allowing continuous scanning with no cool-down time.

Growing Use in Sports Medicine and Body Composition Analysis

DEXA technology gains wider use in sports medicine, nutrition, and metabolic health tracking. Athletes, rehabilitation centers, and fitness programs utilize DEXA scans to measure fat, muscle, and bone distribution with high precision. Weight management and medical wellness clinics adopt these insights to form individualized treatment plans. Preventive healthcare trends support broader use outside traditional radiology departments. This driver expands the market as new user groups adopt DEXA systems to enhance performance monitoring and personalized health planning.

- For instance, the Dexalytics analytics platform processes body composition variables and maintains data storage for athlete records, enabling long-term progress tracking.

Technological Advancements and Integration with Digital Health

Advances in scanning software, reduced radiation dose, and faster imaging workflows enhance clinical value. Integration with AI-enabled diagnostic tools and digital health platforms improves interpretation accuracy and patient tracking. Interoperable systems link DEXA results with electronic medical records for streamlined care coordination. Cloud-based reporting and remote monitoring support long-term management of bone and metabolic conditions. These improvements strengthen adoption across hospitals, specialty centers, and preventive health programs.

Key Trends and Opportunities

Expansion of Portable and Point-of-Care DEXA Devices

Demand grows for portable scanners as mobile diagnostic units, clinics, and sports centers adopt compact systems. Portable devices enable greater access to bone density and body composition testing in remote and community care settings. Wireless data transfer and lightweight designs support clinical convenience and faster patient throughput. This trend expands the market beyond traditional imaging departments, improving screening compliance in high-risk populations and strengthening access to early diagnostic evaluation.

- For instance, BeamMed’s MiniOmni system is a portable, compact device that can be connected via USB to a laptop or PC, performs multi-site measurements including the tibia, and produces a graphical measurement report within minutes, making it suitable for field screening.

Growing Adoption in Preventive and Personalized Healthcare

DEXA systems support preventive care strategies focused on early detection of bone loss and metabolic conditions. Health programs and physicians use DEXA results to personalize intervention plans and track therapy outcomes. Increased awareness of lifestyle-related conditions drives patient interest in regular body composition monitoring. Digital platforms enhance long-term data comparison and patient engagement. This trend positions DEXA as a valuable tool in personalized medicine and chronic disease management.

- For instance, the Dexalytics athlete monitoring platform processes data from detailed DXA scans, which can involve over 200 variables in raw form, to create longitudinal reports covering multiple seasons to support personalized interventions.

Key Challenges

High System Cost and Limited Reimbursement Coverage

DEXA system purchase and servicing costs restrict adoption among smaller diagnostic centers and clinics. Limited reimbursement in several regions reduces test affordability and lowers scan frequency. Public hospitals often delay imaging upgrades due to budget constraints. Some providers choose alternative bone assessment tools despite reduced accuracy. Addressing these cost barriers through financing support, tiered pricing, and extended service plans is essential to increase market penetration and expand screening programs.

Shortage of Skilled Technicians and Interpretation Specialists

Accurate DEXA interpretation requires trained radiologists and technicians, yet many facilities face staffing gaps. Rural and underserved areas experience delays due to limited expertise and referral dependence. Insufficient understanding of standardized DEXA reporting may lead to diagnostic inconsistency. Continuous education, certification programs, and AI-assisted interpretation systems can help reduce skill shortages. Workforce development remains critical to ensure clinical confidence and broaden adoption of DEXA in diverse healthcare environments.

Regional Analysis

North America

North America holds a 34% share of the Dual Energy X-ray Absorptiometry market due to high osteoporosis screening rates and strong adoption of advanced diagnostic systems. The United States leads demand with well-established imaging infrastructure and favorable reimbursement frameworks that support routine bone density testing. Aging populations and higher awareness of fracture prevention further accelerate DEXA utilization across hospitals, outpatient imaging centers, and specialty bone health clinics. Research programs in sports science and body composition also boost system adoption. Canada expands preventive screening efforts, strengthening long-term market growth in the region.

Europe

Europe accounts for a 28% share of the global DEXA market, supported by strong clinical guidelines for osteoporosis detection and widespread integration of bone densitometry into primary care. Countries including Germany, France, Italy, and the United Kingdom drive imaging volumes due to significant elderly demographics and fracture management protocols. Public health systems emphasize preventive diagnostics, increasing demand for both axial and peripheral DEXA devices. Expanding use in metabolic and body composition assessments aids adoption in sports rehabilitation centers. Technology upgrades and investments in digital radiology networks contribute to stable market expansion across the region.

Asia Pacific

Asia Pacific holds a 25% share and stands as the fastest-growing DEXA market, driven by large aging populations, increased fracture incidence, and rising healthcare spending. China and Japan lead adoption, with hospitals expanding diagnostic imaging capacity to address bone health concerns. India and South Korea increase awareness programs that encourage early osteoporosis screening. Portable DEXA units gain traction in community hospitals and wellness centers. Growing demand for sports medicine and bariatric assessment also improves system uptake. Government focus on preventive healthcare and improved insurance coverage supports strong future growth across the region.

Latin America

Latin America represents a 7% share of the DEXA market, supported by rising healthcare modernization and improvements in diagnostic imaging access. Brazil and Mexico lead due to expanding hospital networks and growing demand for osteoporosis management. Awareness programs led by medical associations promote early screening and fracture risk evaluation, encouraging system use in urban care facilities. Adoption increases in private diagnostic centers and sports medicine providers. Limited reimbursement and budget constraints remain challenges, yet opportunities grow as governments invest in aging population healthcare and chronic disease monitoring.

Middle East and Africa

The Middle East and Africa hold a 6% share of the market, with growth led by Gulf countries investing in advanced imaging technologies. The United Arab Emirates and Saudi Arabia expand diagnostic capacity within public and private hospitals, supporting greater DEXA utilization for bone health assessment. South Africa sees rising interest in body composition analysis within wellness and rehabilitation centers. Limited specialist availability and higher equipment costs restrict broader penetration in low-income regions. However, increasing preventive care initiatives and investments in radiology infrastructure create long-term opportunities for market expansion.

Market Segmentations:

By Type

By Technology

- Axial DEXA bone densitometer

- Peripheral DEXA bone densitometer

By Application

- Osteoporosis

- Body composition analysis

- Fracture management

- Other applications

By End Use

- Hospitals and clinics

- Diagnostic centers

- Specialty centers

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Dual Energy X-ray Absorptiometry (DEXA) market includes key players such as Medonica, Aurora Spine, Medilink International, GE Healthcare, BeamMed, Hologic, Furuno Electric, Fujifilm, DMS, and Fonar. Companies compete through advanced imaging performance, dose reduction features, and faster scan times. Leading manufacturers focus on AI-based reporting, cloud data integration, and remote assessment capabilities. Partnerships with hospitals and diagnostic chains strengthen product placement and service networks. Growth strategies include regulatory approvals, product upgrades, and training programs that support clinical accuracy. Sports clinics and body composition centers create new revenue channels. Portable DEXA solutions attract fitness and wellness providers seeking compact, connected devices. Larger firms maintain strong portfolios through continuous software enhancements and integration with electronic medical records. Competitors expand in emerging markets through distribution agreements and flexible pricing. The landscape remains dynamic as vendors invest in research, product reliability, and long-term maintenance support to secure customer loyalty.

Key Player Analysis

- Medonica

- Aurora Spine

- Medilink International

- GE Healthcare

- BeamMed

- Hologic

- Furuno Electric

- Fujifilm

- DMS

- Fonar

Recent Developments

- In July 2024, Hologic Inc.’s Discovery Package for QDR X-Ray Bone Densitometer software, used on specific Horizon DXA system models, was subject to a Class 2 recall by the U.S. FDA.

- In February 2024, FUJIFILM India installed its advanced DEXA machine, the “FDX Visionary-DR”, at a new facility called the Center for Sports Injury in Delhi.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- DEXA systems will gain wider adoption in preventive bone health screening across primary care.

- Portable and point-of-care DEXA units will support faster access in community and remote settings.

- AI-enabled interpretation and automated reporting will enhance diagnostic accuracy and reduce reading time.

- Cloud-connected platforms will strengthen long-term monitoring and patient data integration.

- Sports medicine and nutrition programs will expand the use of DEXA for body composition analysis.

- Hospitals and diagnostic networks will upgrade to low-dose and faster-scan systems to improve workflows.

- Emerging markets will show strong demand as osteoporosis awareness and screening programs expand.

- New reimbursement models will improve patient access to bone density testing in several regions.

- Partnerships between device manufacturers and digital health platforms will support telehealth-based DEXA evaluation.

- Research advancements in metabolic health assessment will create new DEXA applications beyond bone density.

Market Segmentation Analysis:

Market Segmentation Analysis: