Market Overview

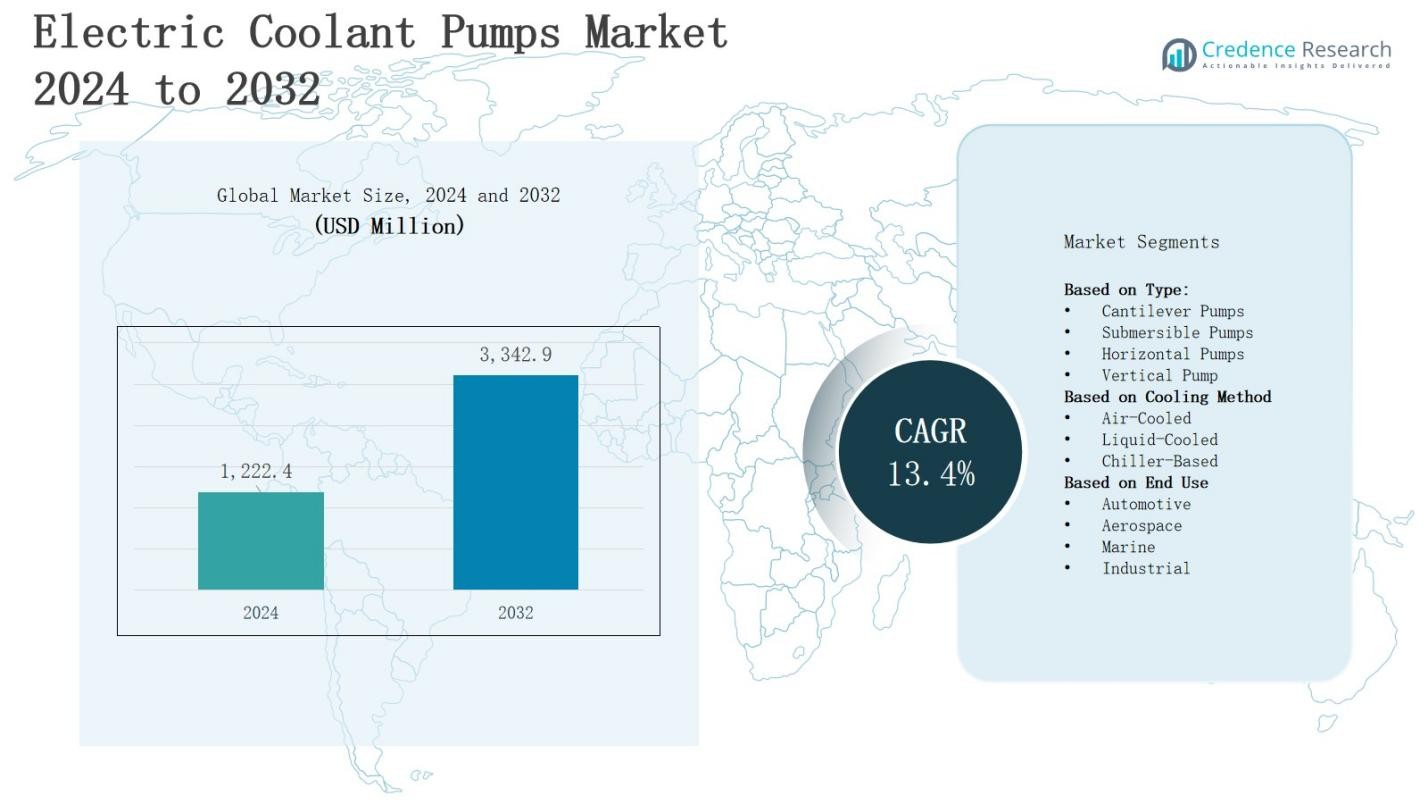

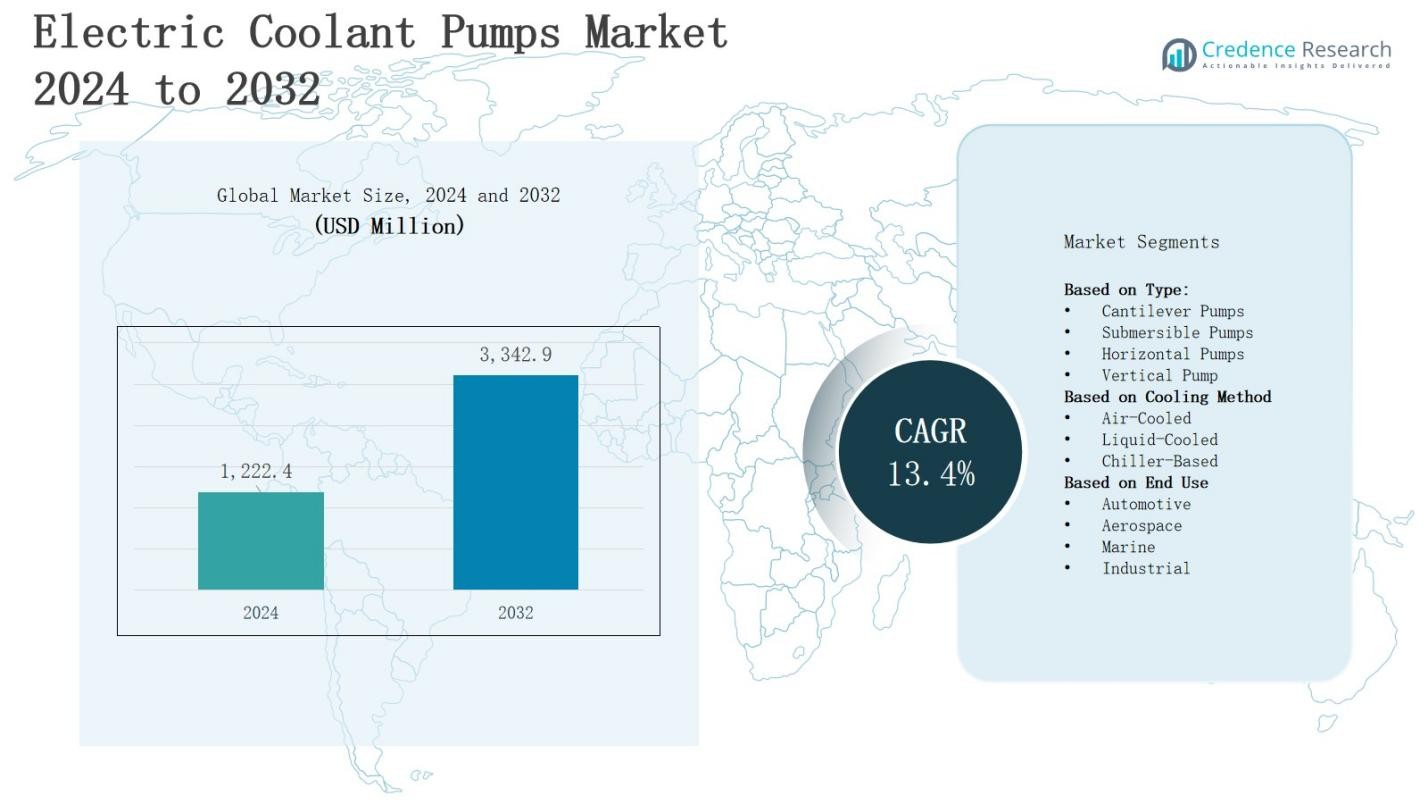

The electric coolant pumps market is projected to grow from USD 1,222.4 million in 2024 to USD 3,342.9 million by 2032, registering a robust CAGR of 13.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Coolant Pumps Market Size 2024 |

USD 1,222.4 Million |

| Electric Coolant Pumps Market, CAGR |

13.4% |

| Electric Coolant Pumps Market Size 2032 |

USD 3,342.9 Million |

Market growth in the electric coolant pumps market is driven by the rising adoption of electric and hybrid vehicles, which require efficient thermal management systems to enhance performance and battery life. Increasing demand for fuel efficiency, reduced emissions, and compliance with stringent environmental regulations is accelerating adoption. Advancements in pump design, including lightweight materials, variable speed control, and integration with vehicle electronics, are improving efficiency and reliability. Trends include the shift toward smart, electronically controlled pumps, growing use in high-performance vehicles, and expansion into off-highway and industrial applications, supported by ongoing R&D investments and collaborations among automotive component manufacturers.

The electric coolant pumps market spans North America, Europe, Asia-Pacific, and the Rest of the World, each contributing to global growth. North America benefits from strong EV adoption and advanced manufacturing, while Europe leads in sustainable mobility and premium automotive integration. Asia-Pacific holds the largest share, driven by rapid electrification in China, Japan, and South Korea. The Rest of the World sees rising demand from emerging economies. Key players include Robert Bosch, Kohler, Continental, Denso, Calsonic Kansei, Magna International, SHW AG, Gates Corporation, Aisin Seiki, Aperam, Dana Incorporated, and Aptiv.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electric coolant pumps market is projected to grow from USD 1,222.4 million in 2024 to USD 3,342.9 million by 2032, registering a CAGR of 13.4% driven by rising electric and hybrid vehicle adoption.

- Increasing demand for fuel efficiency, reduced emissions, and compliance with strict environmental regulations is accelerating market penetration across multiple end-use sectors.

- Advancements in pump technology, including lightweight materials, brushless motors, and integration with vehicle electronics, are enhancing performance and reliability.

- Expansion beyond automotive into industrial machinery, renewable energy systems, marine, and aerospace applications is creating new revenue opportunities.

- High initial costs and price sensitivity in emerging markets, along with complex integration requirements, remain key challenges for widespread adoption.

- Asia-Pacific leads with 34% market share, followed by North America at 28%, Europe at 26%, and Rest of the World at 12%, each supported by region-specific growth drivers.

- Key players such as Robert Bosch, Kohler, Continental, Denso, Calsonic Kansei, Magna International, SHW AG, Gates Corporation, Aisin Seiki, Aperam, Dana Incorporated, and Aptiv are focusing on R&D, partnerships, and market diversification.

Market Drivers

Rising Adoption of Electric and Hybrid Vehicles

The electric coolant pumps market is experiencing strong growth due to the rapid shift toward electric and hybrid vehicles worldwide. These vehicles require advanced thermal management systems to maintain optimal battery performance and motor efficiency. It offers precise cooling control, improving overall vehicle reliability. Government incentives for EV adoption and tightening emission norms further strengthen demand. Manufacturers are focusing on developing compact, energy-efficient pump designs to meet evolving automotive requirements.

- For instance, Aptiv has developed lightweight, energy-efficient electric coolant pumps that enhance cooling precision and are integrated across various electric vehicle platforms.

Stringent Emission Regulations and Fuel Efficiency Goals

Stringent global emission regulations are pushing automakers to adopt technologies that improve fuel efficiency and reduce CO₂ output. Electric coolant pumps provide precise, demand-driven cooling, which reduces parasitic losses compared to mechanical pumps. It enhances engine efficiency and supports compliance with environmental standards. Growing pressure from regulatory bodies in Europe, North America, and Asia-Pacific is accelerating the shift toward electrically driven systems. This regulatory landscape continues to drive innovation in pump efficiency and durability.

- For instance, MAHLE GmbH began mass supplying a 24V/480W electric cooling water pump in 2024 for battery electric heavy-duty trucks, optimizing thermal management and fuel efficiency in commercial vehicles.

Advancements in Pump Technology and Integration

Continuous advancements in design, materials, and electronics are boosting the performance of electric coolant pumps. Integration with vehicle control units enables smart cooling strategies that optimize thermal management under varying load conditions. It improves component longevity and reduces maintenance requirements. Lightweight materials and brushless motor technology enhance energy efficiency. Increasing R&D investment from leading automotive suppliers is leading to more compact, high-performance solutions tailored to diverse vehicle architectures.

Expansion into Non-Automotive Applications

While automotive remains the primary driver, electric coolant pumps are gaining traction in off-highway vehicles, industrial machinery, and stationary power systems. It supports the cooling of fuel cells, generators, and high-performance electronics. Growing demand for energy-efficient cooling in data centers and renewable energy systems is creating new revenue streams. Manufacturers are adapting automotive-grade pump technology for broader industrial use, enhancing performance, and ensuring reliability in demanding operational environments. This diversification strengthens long-term market growth.

Market Trends

Integration of Smart and Connected Cooling Systems

The electric coolant pumps market is witnessing a trend toward smart, electronically controlled systems that adapt cooling output based on real-time operating conditions. These pumps integrate with vehicle control units to optimize energy consumption and enhance system efficiency. It enables predictive maintenance by monitoring performance parameters and identifying potential failures early. Automakers are adopting these intelligent systems to improve reliability and reduce lifecycle costs, aligning with the broader shift toward connected and autonomous vehicles.

- For instance, Bosch Mobility Solutions’ eCool pump uses advanced electrical controls to regulate coolant flow, improving engine cooling efficiency while lowering energy consumption and emissions.

Shift Toward Lightweight and High-Efficiency Designs

Manufacturers are focusing on developing lighter, more compact electric coolant pumps without compromising performance. The adoption of advanced materials such as high-strength plastics and aluminum alloys reduces overall vehicle weight and improves fuel economy in conventional and hybrid models. It supports better thermal management in electric drivetrains, extending battery life and performance. This trend reflects the industry’s drive toward sustainable mobility solutions and compliance with increasingly stringent efficiency standards globally.

- For instance, Rheinmetall secured a major multi-million-euro order for high-voltage electric coolant pumps with a glandless design that reduces friction and extends component life while enhancing thermal management in 800V electric vehicle architectures.

Growing Application in Fuel Cell and High-Performance Vehicles

Electric coolant pumps are gaining importance in fuel cell-powered vehicles, where precise thermal control is critical to stack efficiency and durability. High-performance vehicles also benefit from variable-speed, electronically controlled pumps that maintain optimal cooling during extreme conditions. It ensures stability in demanding applications such as motorsports and luxury EVs. The rise in alternative propulsion systems and high-output drivetrains is expanding the scope of advanced pump solutions across diverse mobility segments.

Expansion into Industrial and Renewable Energy Sectors

While automotive demand dominates, electric coolant pumps are increasingly used in industrial equipment, renewable energy systems, and stationary power applications. These pumps offer reliable cooling for wind turbines, solar inverters, and energy storage systems. It provides consistent performance under continuous operation, supporting the growth of clean energy infrastructure. The trend toward electrification beyond transportation is creating new opportunities for manufacturers to adapt automotive-grade technology for broader commercial and industrial markets.

Market Challenges Analysis

High Initial Costs and Price Sensitivity in Emerging Markets

The electric coolant pumps market faces challenges due to the higher upfront cost of advanced pump systems compared to conventional mechanical pumps. This cost barrier is particularly significant in price-sensitive markets, where budget constraints limit adoption. It requires specialized components, advanced electronics, and precision manufacturing, which increase production expenses. Automotive OEMs in developing regions may prioritize cost over efficiency, slowing penetration. Fluctuations in raw material prices, especially for electronic and lightweight alloy components, further impact affordability and supply chain stability.

Complex Integration and Reliability Concerns in Harsh Conditions

Integrating electric coolant pumps into diverse vehicle architectures requires compatibility with existing thermal management and electrical systems. It demands extensive calibration to ensure optimal performance, adding complexity for manufacturers and OEMs. Harsh operating environments, including extreme temperatures, vibration, and exposure to contaminants, can affect long-term reliability. Failures in pump performance may impact critical vehicle functions, raising warranty risks. Ensuring consistent durability across varied use cases remains a key challenge, driving the need for rigorous testing and quality assurance standards.

Market Opportunities

Rising Demand from Electric and Hybrid Vehicle Expansion

The electric coolant pumps market is positioned to benefit from the accelerating global shift toward electric and hybrid vehicles. These vehicles require efficient thermal management to optimize battery life, motor efficiency, and charging performance. It enables precise cooling control, supporting higher power densities and extended component lifespan. Government incentives, infrastructure expansion, and stricter emission targets are creating favorable conditions for adoption. Suppliers offering scalable, adaptable pump solutions can capture significant opportunities in both mass-market and premium EV segments.

Emerging Applications Beyond Automotive Sector

Opportunities are expanding in industrial equipment, renewable energy systems, and high-performance electronics. Electric coolant pumps are increasingly used in wind turbine generators, solar inverters, and energy storage systems to ensure consistent thermal regulation. It provides dependable operation in continuous-duty environments, supporting growth in clean energy and industrial automation. The adaptation of automotive-grade technology to non-vehicle applications allows manufacturers to diversify revenue streams and strengthen market resilience. This cross-sector potential enhances long-term growth prospects for pump suppliers.

Market Segmentation Analysis:

By Type

The electric coolant pumps market is segmented into cantilever pumps, submersible pumps, horizontal pumps, and vertical pumps. Cantilever pumps hold a steady share due to their durability and minimal maintenance needs in heavy-duty operations. Submersible pumps gain traction in compact systems where space efficiency is critical. Horizontal pumps dominate large-scale applications for their stability and high flow capacity. Vertical pumps serve specialized installations requiring a smaller footprint and high head delivery, driving niche demand.

- For instance, cantilever pumps are preferred for heavy-duty applications due to their durability and low maintenance, exemplified by their use in chemical processing plants where continuous operation is critical.

By Cooling Method

Based on cooling method, the market includes air-cooled, liquid-cooled, and chiller-based systems. Liquid-cooled pumps lead adoption in electric and hybrid vehicles due to superior thermal performance and efficiency. Air-cooled variants appeal in applications with moderate heat loads and simpler maintenance requirements. Chiller-based systems see growing demand in high-performance and industrial sectors requiring precise temperature control. It supports advanced cooling strategies that enhance component longevity and system stability in demanding operational conditions.

- For instance, Toyota Prius utilizes a liquid-cooled electric water pump to manage both engine and electric motor temperatures within a single loop system, enhancing operational efficiency.

By End Use

By end use, the market covers automotive, aerospace, marine, and industrial sectors. Automotive dominates due to rising EV and hybrid production, where thermal management directly impacts efficiency and reliability. Aerospace applications require lightweight, high-performance pumps capable of operating under extreme conditions. Marine segments focus on corrosion-resistant designs for propulsion and auxiliary systems. Industrial usage is expanding for cooling high-performance electronics, renewable energy systems, and heavy machinery, creating broader revenue opportunities for pump manufacturers.

Segments:

Based on Type:

- Cantilever Pumps

- Submersible Pumps

- Horizontal Pumps

- Vertical Pump

Based on Cooling Method

- Air-Cooled

- Liquid-Cooled

- Chiller-Based

Based on End Use

- Automotive

- Aerospace

- Marine

- Industrial

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 28% of the electric coolant pumps market, driven by strong adoption of electric and hybrid vehicles, advanced automotive manufacturing capabilities, and stringent emission regulations. The region benefits from the presence of major EV producers and component suppliers, particularly in the United States. It supports innovation through extensive R&D investments and collaborations between OEMs and technology firms. Government incentives for clean transportation strengthen demand. Expanding applications in aerospace and industrial sectors further enhance market growth. Robust infrastructure and consumer preference for high-performance vehicles maintain the region’s competitive position.

Europe

Europe accounts for 26% of the electric coolant pumps market, supported by aggressive electrification targets, strict CO₂ emission limits, and advanced automotive engineering. Countries such as Germany, France, and the United Kingdom lead in adoption due to strong EV manufacturing bases. It benefits from integration into premium and luxury vehicle models, where efficiency and performance are critical. The region’s emphasis on sustainable mobility accelerates innovation in pump designs and materials. Aerospace and marine industries also contribute to demand, leveraging high-reliability cooling systems. Collaborative projects between automakers and suppliers drive continuous technological improvement.

Asia-Pacific

Asia-Pacific commands the largest share at 34%, propelled by rapid EV adoption in China, Japan, and South Korea. The electric coolant pumps market in this region grows on the back of large-scale automotive production and supportive government policies. It serves both domestic and export markets, with manufacturers offering cost-effective and high-performance solutions. Expanding industrial applications, including renewable energy systems, further boost growth. Local suppliers compete aggressively while global brands invest in regional manufacturing to strengthen presence. Rising consumer awareness of energy efficiency sustains long-term demand.

Rest of the World

The Rest of the World region holds 12% of the electric coolant pumps market, with growth fueled by increasing adoption of electric mobility in Latin America, the Middle East, and Africa. It benefits from gradual policy support for low-emission transportation and infrastructure development. Industrial and marine applications contribute significantly to demand, especially in regions with developing manufacturing bases. Partnerships with global suppliers help introduce advanced pump technologies. Renewable energy projects requiring efficient cooling systems also open new market opportunities. Emerging economies remain an important growth frontier.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch

- Kohler

- Continental

- Denso

- Calsonic Kansei

- Magna International

- SHW AG

- Gates Corporation

- Aisin Seiki

- Aperam

- Dana Incorporated

- Aptiv

Competitive Analysis

The electric coolant pumps market is highly competitive, with global and regional players focusing on innovation, cost efficiency, and product reliability to strengthen their positions. It features companies such as Robert Bosch, Kohler, Continental, Denso, Calsonic Kansei, Magna International, SHW AG, Gates Corporation, Aisin Seiki, Aperam, Dana Incorporated, and Aptiv, each leveraging advanced engineering and strategic partnerships to expand market reach. Leading manufacturers invest in lightweight materials, smart pump technologies, and integration with vehicle control systems to meet rising demand from electric and hybrid vehicles. Partnerships with automakers and industrial equipment producers help secure long-term supply agreements, while targeted expansions in Asia-Pacific and Europe capture growing EV adoption. Companies focus on R&D to enhance pump efficiency, durability, and adaptability across diverse applications including automotive, aerospace, marine, and industrial sectors. Competitive differentiation comes from the ability to deliver scalable solutions that meet stringent regulatory standards, reduce energy consumption, and provide consistent thermal management performance in high-demand environments.

Recent Developments

- In June 2025, Rheinmetall received a double-digit-million-euro order for its high-voltage CWA 2000 electric coolant pumps, set to supply a North American truck manufacturer between 2028 and 2035.

- In April 2025, ABC Technologies completed the acquisition of TI Fluid Systems and introduced the eCP, a next-generation 12 V electric coolant pump for BEVs, featuring a rare-earth-free design and scalable power range from 60 W to 230 W.

- In March 2024, MAHLE Group unveiled an advanced integrated thermal management system that incorporates a next-generation electronic coolant pump to enhance cooling efficiency and powertrain performance.

- In November 2023, Concentric AB secured a nomination for its electric coolant pump from a major commercial vehicle OEM in India. The contract, valued at 70 MSEK over five years, begins production in 2025 and supports a new battery-electric bus platform

Market Concentration & Characteristics

The electric coolant pumps market demonstrates a moderately high level of concentration, with a mix of global leaders and specialized regional manufacturers competing on technology, cost efficiency, and product reliability. It is characterized by strong innovation in lightweight materials, variable-speed control, and integration with advanced vehicle management systems. Leading players focus on securing long-term supply agreements with automotive OEMs and expanding into industrial, marine, and renewable energy applications. Competitive dynamics are shaped by stringent regulatory requirements, rapid EV adoption, and the need for scalable, high-performance solutions. Strategic partnerships, localized production, and continuous R&D investment enable companies to maintain market relevance and address evolving customer needs. The presence of established brands such as Robert Bosch, Kohler, Continental, Denso, and Magna International reinforces technological leadership, while emerging suppliers compete through cost competitiveness and niche product offerings, ensuring a dynamic balance between innovation and market accessibility.

Report Coverage

The research report offers an in-depth analysis based on Type, Cooling Method, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with the global expansion of electric and hybrid vehicle production.

- Manufacturers will focus on developing more compact and energy-efficient pump designs.

- Integration of smart control systems will enhance cooling precision and efficiency.

- Industrial and renewable energy applications will become a stronger revenue stream.

- Advanced materials will improve pump durability and reduce overall system weight.

- Partnerships between OEMs and component suppliers will accelerate technology adoption.

- Regulatory pressure will drive innovation in low-emission and high-efficiency cooling solutions.

- Emerging markets will witness gradual adoption supported by localized manufacturing.

- Fuel cell vehicles will create new opportunities for high-performance cooling systems.

- Competition will intensify as new entrants introduce cost-effective and specialized solutions.