| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Charging Station Market Size 2024 |

USD 34.2 Million |

| Electric Vehicle Charging Station Market, CAGR |

16.70% |

| Electric Vehicle Charging Station Market Size 2032 |

USD 117.7 Million |

Market Overview:

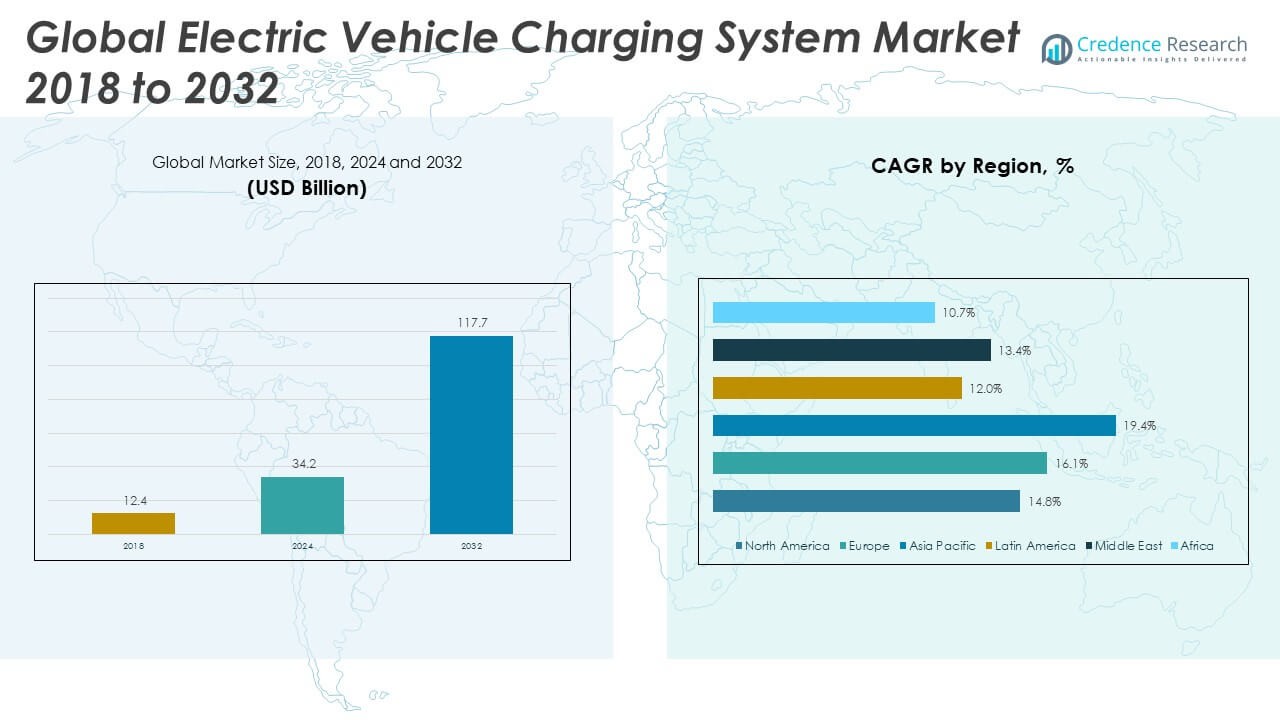

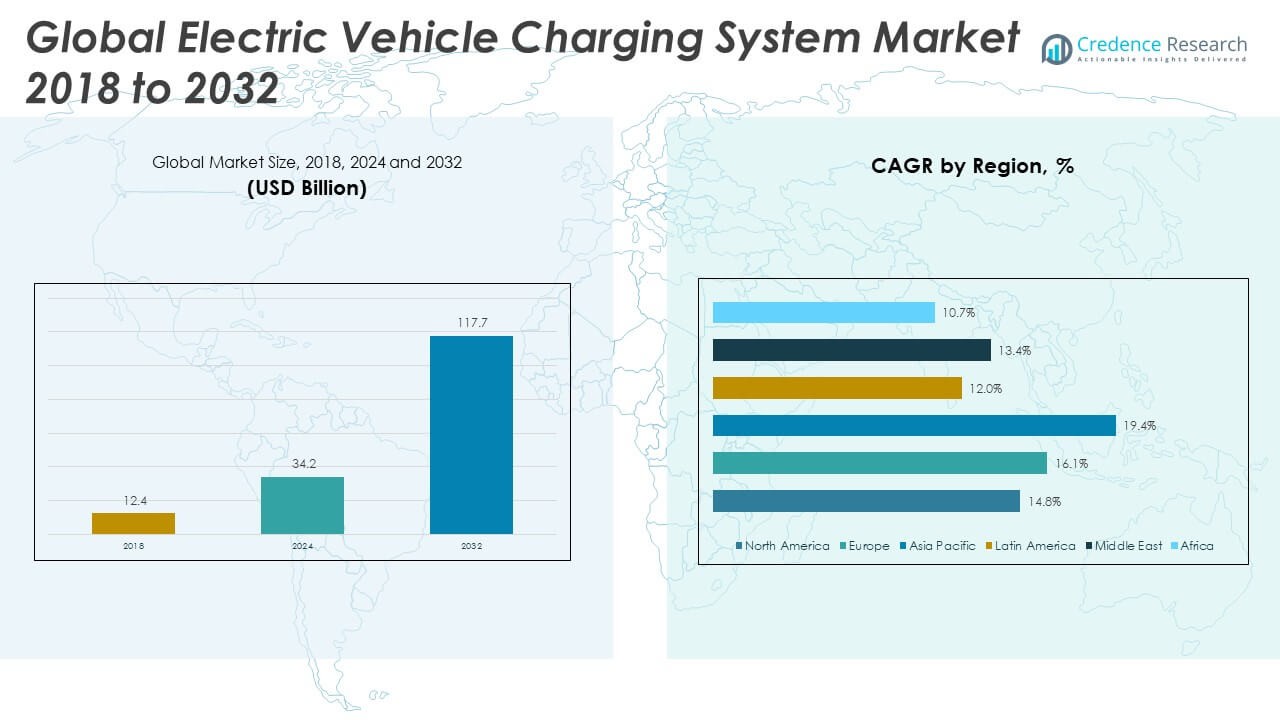

The Electric Vehicle Charging Station Market size was valued at USD 12.4 million in 2018 to USD 34.2 million in 2024 and is anticipated to reach USD 117.7 million by 2032, at a CAGR of 16.70% during the forecast period.

The Electric Vehicle Charging Station Market is primarily driven by the rapid adoption of EVs and government initiatives that support electrification of transportation. Regulatory mandates to reduce carbon emissions, coupled with incentives such as subsidies, tax credits, and grants, are encouraging both consumers and businesses to invest in EV infrastructure. Technological advancements in charging hardware, such as ultra-fast DC chargers and vehicle-to-grid (V2G) systems, are enhancing user convenience and energy efficiency, reducing range anxiety. Moreover, increasing collaboration between automakers, utilities, and tech companies is fostering the development of smart and interoperable charging networks. The expansion of e-mobility services, growth in electric fleet vehicles, and the integration of renewable energy with EV chargers further contribute to the growing demand for sophisticated, high-capacity charging solutions across urban and rural landscapes.

Asia Pacific leads the global Electric Vehicle Charging Station Market, driven by robust government support, rapid urbanization, and a strong EV manufacturing base, especially in China, which accounts for the majority of the world’s public charging stations. India, Japan, and South Korea are also rapidly scaling up their infrastructure through policy mandates and private investment. North America follows, with the United States experiencing accelerated deployment of public chargers, supported by federal programs like the NEVI initiative and private sector investments from firms such as Tesla, ChargePoint, and Electrify America. Canada is also making notable progress through its Zero-Emission Vehicle Infrastructure Program. Europe remains a mature but evolving market, with countries like the Netherlands, Germany, France, and the UK investing heavily to meet carbon neutrality targets. The region’s stringent emissions regulations and clean energy policies are further fueling demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electric Vehicle Charging Station Market was valued at USD 34.2 million in 2024 and is projected to reach USD 117.7 million by 2032, growing at a CAGR of 16.70%.

- Rising government mandates, subsidies, and tax incentives are significantly boosting EV infrastructure investment across both public and private sectors.

- Technological advancements, such as ultra-fast DC chargers and vehicle-to-grid (V2G) integration, are reducing charging times and enhancing grid efficiency.

- Strategic partnerships among automakers, utilities, and tech firms are expanding smart, interoperable charging networks and services.

- Urbanization and rising EV ownership are driving demand for location-optimized charging stations in commercial zones and high-density residential areas.

- High installation costs, permitting delays, and limited grid capacity remain key challenges, especially in rural and low-demand locations.

- Asia Pacific leads the market due to China’s infrastructure dominance, followed by North America and Europe, which are rapidly scaling through policy-driven initiatives and private investment.

Market Drivers:

Rising Government Support and Regulatory Push for Clean Transportation

Government policies and environmental regulations are playing a critical role in accelerating the deployment of EV charging infrastructure. Countries are introducing subsidies, tax incentives, and funding programs to promote the adoption of electric vehicles and support the installation of public and private charging stations. The U.S. NEVI program and the European Union’s Fit for 55 plan are prominent examples of policy frameworks aimed at creating comprehensive EV ecosystems. National targets to reduce carbon emissions are pushing state and local authorities to mandate charging availability in residential and commercial developments. The Electric Vehicle Charging Station Market is benefiting from regulatory obligations requiring automakers and developers to contribute to EV infrastructure development. It is also supported by public–private partnerships designed to address infrastructure gaps in underserved areas.

- For instance, in the European Union, the “Fit for 55” legislative package mandates that by 2026, charging pools with a minimum 400 kW output must be installed at least every 60 km along core TEN-T network routes, increasing to 600 kW by 2028. For trucks and buses, stations must be installed every 120 km with power output between 1,400 kW and 2,800 kW, and hydrogen refueling stations every 200 km by 2031.

Technological Advancements in Charging Hardware and Smart Grid Integration

Advancements in charging technology are enhancing convenience, speed, and efficiency, making EV adoption more feasible across use cases. The market is seeing the deployment of ultra-fast DC chargers capable of recharging vehicles in under 30 minutes, addressing range anxiety and reducing downtime. Integration with smart grids allows for dynamic energy pricing and load management, improving grid stability and cost-efficiency. Interoperable systems and standardization efforts, including the adoption of Tesla’s NACS protocol by multiple OEMs, are fostering wider access to fast-charging networks. The Electric Vehicle Charging Station Market is also witnessing growth in bidirectional charging capabilities, enabling vehicles to return power to the grid during peak hours. It is evolving with a focus on intelligent, scalable solutions to match increasing EV penetration.

Private Investment and Strategic Collaborations Across the Value Chain

Growing commercial interest from energy companies, automotive manufacturers, and venture capital firms is expanding the scale and scope of the market. Leading oil and gas firms are diversifying into EV charging by acquiring or launching charging network subsidiaries. Automakers are investing in branded charging networks or forming alliances to ensure a seamless charging experience for their customers. Technology firms are entering the space through software platforms that manage payments, diagnostics, and charger availability. The Electric Vehicle Charging Station Market is becoming a strategic priority for companies seeking long-term positioning in clean mobility. It is also benefiting from mergers and acquisitions that consolidate infrastructure providers and boost geographic reach.

- For instance, seven major automakers—BMW Group, General Motors, Honda, Hyundai, Kia, Mercedes-Benz Group, and Stellantis—have formed a joint venture to deploy 30,000 new charging stations in North America, all meeting or exceeding NEVI minimum standards.

Rising Consumer Demand and Urbanization Driving Infrastructure Expansion

Consumer expectations for convenient, accessible charging options are driving expansion in both public and residential segments. Urbanization is intensifying the need for on-street charging and infrastructure in multifamily dwellings, where home chargers are less practical. EV owners increasingly seek fast, reliable charging at shopping centers, workplaces, and transit hubs. Fleet operators are demanding scalable solutions for depots and commercial routes, contributing to high-volume installations. The Electric Vehicle Charging Station Market is responding with location-specific strategies that optimize site selection and user engagement. It is also aligning with smart city initiatives that prioritize sustainable mobility and digital infrastructure.

Market Trends:

Expansion of Fast-Charging Networks to Support Long-Distance Travel

The shift toward fast-charging infrastructure is gaining momentum to meet the needs of long-distance EV drivers and reduce charging time. Companies are prioritizing the deployment of high-capacity DC fast chargers along highways, urban corridors, and high-traffic routes. These chargers significantly improve vehicle turnaround time and support broader adoption among commercial fleets and private consumers. Automakers and energy providers are partnering to build branded supercharging stations that enhance brand loyalty and driver convenience. The Electric Vehicle Charging Station Market is adapting by prioritizing high-speed solutions that reduce range anxiety and promote cross-country mobility. It is increasingly integrating fast-charging as a core offering in public charging networks.

- For instance, Electrify Canada, a Volkswagen Group subsidiary, has standardized its new installations on 350 kW DC fast chargers, and all 204 of its current chargers deliver at least 150 kW, with further expansion planned in high-demand areas

Integration of Smart Technology and Energy Management Systems

Smart charging features are becoming standard across new installations, enabling real-time monitoring, automated load balancing, and predictive maintenance. These technologies improve energy efficiency and reduce operational costs for both users and operators. Software-driven platforms are central to the shift toward connected infrastructure, offering scheduling, payment integration, and data analytics capabilities. Grid-responsive charging systems help utilities manage peak demand by coordinating vehicle charging with energy availability. The Electric Vehicle Charging Station Market is evolving toward intelligent infrastructure that aligns with smart city goals and enhances user experience. It is also attracting investment from tech firms entering the market with cloud-based and IoT-enabled solutions.

- For example, ChargePoint and Eaton have established an industry-first partnership to deliver integrated EV charging and electrical infrastructure solutions, including co-developed technologies for bidirectional power flow and vehicle-to-everything (V2X) capabilities.

Standardization of Charging Connectors and Interoperability Across Networks

Uniform charging standards are becoming critical as the number of EV brands and models grows globally. Industry stakeholders are adopting common protocols such as CCS, CHAdeMO, and NACS to enable compatibility between vehicles and chargers. Governments and regulatory bodies are encouraging this shift to reduce user confusion and improve access to charging services. Interoperable networks allow EV drivers to use multiple providers without technical or billing restrictions. The Electric Vehicle Charging Station Market is responding by aligning infrastructure with evolving standards that support seamless connectivity. It is also seeing a push from original equipment manufacturers (OEMs) to simplify the charging process through unified platforms.

Growth of Urban Charging Solutions and Focus on User-Centric Design

Urban areas are becoming focal points for charging infrastructure due to high EV concentration and limited private parking. Municipalities are deploying curbside chargers, lamp post integrations, and shared infrastructure to address dense population needs. Companies are redesigning charging stations with features like digital interfaces, modular layouts, and integrated lighting to improve safety and usability. Retail and hospitality businesses are adding chargers to attract environmentally conscious customers and generate secondary revenue. The Electric Vehicle Charging Station Market is shifting toward location-optimized and design-driven installations that enhance accessibility and engagement. It is aligning infrastructure development with urban mobility trends and changing consumer behaviors.

Market Challenges Analysis:

High Installation Costs and Infrastructure Complexity Slowing Deployment

Setting up EV charging stations involves substantial capital investment, including land acquisition, electrical upgrades, equipment procurement, and permitting. Fast-charging stations, in particular, require significant grid capacity and robust infrastructure, making them costly and time-intensive to install. Smaller businesses and municipalities often struggle to justify upfront expenses without guaranteed usage or government incentives. Coordination with utility providers and compliance with local zoning laws further complicate the process. The Electric Vehicle Charging Station Market faces delays and cost overruns due to fragmented regulatory frameworks and inconsistent permitting timelines. It continues to encounter financial and logistical barriers that limit rapid scale-up, especially in rural or low-demand areas.

Grid Constraints and Uneven Access Hindering Widespread Adoption

Electric grids in many regions lack the capacity to support large-scale charging infrastructure without significant upgrades. High electricity demand from clustered charging stations can overload existing systems, creating instability and deterring further expansion. Urban centers face congestion and space constraints, while rural regions often lack the infrastructure to support even basic public charging. The Electric Vehicle Charging Station Market must overcome disparities in access, where infrastructure growth favors affluent, high-density regions, leaving others underserved. It also faces challenges in integrating renewable energy sources into the grid without compromising reliability. These infrastructure limitations hinder equitable access and delay market maturity across key geographies.

Market Opportunities:

Expansion into Emerging Markets with Untapped Infrastructure Potential

Emerging economies present a significant growth opportunity for EV charging infrastructure, driven by increasing urbanization, rising EV adoption, and supportive government policies. Countries in Asia, Africa, and Latin America are beginning to implement national e-mobility strategies, creating favorable conditions for early infrastructure investment. Public–private partnerships and international climate funding can accelerate development where local financing is limited. The Electric Vehicle Charging Station Market can capitalize on this momentum by deploying scalable, cost-effective charging solutions tailored to regional needs. It can also benefit from collaboration with local utilities and city planners to integrate infrastructure into existing transport frameworks. Long-term demand in these markets will support sustained expansion and revenue diversification.

Advancement in Renewable Energy Integration and Energy Management Systems

The growing emphasis on sustainable energy solutions is opening new avenues for integrating EV charging with solar, wind, and energy storage systems. On-site renewable generation reduces dependence on grid power and improves operational economics for charging providers. Smart energy management platforms enable dynamic load balancing, real-time monitoring, and vehicle-to-grid interactions. The Electric Vehicle Charging Station Market can leverage these technologies to offer environmentally responsible and grid-resilient infrastructure. It can also introduce new service models, including energy resale, off-peak pricing, and microgrid participation. These innovations align with climate goals and create competitive differentiation for infrastructure providers.

Market Segmentation Analysis:

The Electric Vehicle Charging Station Market is segmented

By charger type into slow chargers and fast chargers. Fast chargers dominate the market in terms of revenue share due to rising demand for quick turnaround times, especially in commercial and highway locations. They offer high power output and reduced charging durations, making them suitable for fleet operations and long-distance travel. Slow chargers, while less costly, are primarily used in residential settings and remain relevant for overnight charging applications where time is less critical. The market continues to shift toward fast-charging infrastructure as consumer expectations for convenience grow.

- For instance, Tesla’s Supercharger V4, launched in 2024, exemplifies the dominance of fast chargers in the market. According to Tesla’s official Supercharger documentation, the V4 delivers up to 350 kW of power, enabling compatible vehicles to gain up to 200 miles of range in just 15 minutes.

By application, the commercial segment holds a larger share of the Electric Vehicle Charging Station Market. Public charging networks, workplace chargers, and fleet depots contribute significantly to this segment’s growth. Government funding and private investments are driving expansion across urban centers, retail zones, and transit hubs. The residential segment is expanding steadily, supported by increasing EV ownership and home charger installations. It benefits from affordability, ease of use, and supportive energy policies that incentivize at-home charging.

- For example, according to Electrify America’s 2024 Network Expansion Report, the company operates more than 900 charging stations with over 4,000 individual chargers across the U.S., primarily in public, workplace, and fleet depot settings.

Segmentation:

By Charger Type

- Slow Charger

- Fast Charger

By Application

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Electric Vehicle Charging Station Market size was valued at USD 3.4 billion in 2018 to USD 7.4 billion in 2024 and is anticipated to reach USD 20.2 billion by 2032, at a CAGR of 14.8% during the forecast period. The market accounts for nearly 15% of the global share, driven by rising EV adoption and favorable federal funding initiatives. The U.S. is leading the region, supported by the National Electric Vehicle Infrastructure (NEVI) program and large-scale investments by public and private players. Companies like Tesla, ChargePoint, and Electrify America are expanding their networks, while utilities are modernizing the grid to handle increased EV load. Urban centers, highways, and commercial zones are receiving priority deployment, although rural infrastructure remains underdeveloped. The Electric Vehicle Charging Station Market in this region benefits from strong regulatory backing and a competitive ecosystem of hardware and software providers. It continues to grow with increasing fleet electrification and policy-driven targets.

Europe

The Europe Electric Vehicle Charging Station Market size was valued at USD 3.2 billion in 2018 to USD 8.2 billion in 2024 and is anticipated to reach USD 25.3 billion by 2032, at a CAGR of 16.1% during the forecast period. Europe holds approximately 17% of the global market share, led by countries such as Germany, the Netherlands, France, and the UK. Stringent emission norms and government mandates for zero-emission mobility are accelerating infrastructure rollout. Public charging networks are expanding rapidly, with integrated digital platforms supporting payment, navigation, and access. Grid integration, smart charging, and support for bidirectional energy flow are also shaping infrastructure design. The Electric Vehicle Charging Station Market in Europe is aligned with climate action strategies and benefits from cross-border standardization efforts. It continues to evolve through public–private collaborations and green energy integration.

Asia Pacific

The Asia Pacific Electric Vehicle Charging Station Market size was valued at USD 4.6 billion in 2018 to USD 14.3 billion in 2024 and is anticipated to reach USD 53.8 billion by 2032, at a CAGR of 19.4% during the forecast period. This region commands the largest global share at over 45%, primarily led by China’s vast and mature charging network. The Chinese government supports EV infrastructure through national mandates, subsidies, and industrial policies. Japan, South Korea, and India are also scaling up their networks through strategic initiatives and public investment. Urban density and high EV adoption rates are driving demand for fast and accessible charging. The Electric Vehicle Charging Station Market in Asia Pacific benefits from strong local manufacturing, favorable policy, and high consumer awareness. It remains the most dynamic and rapidly expanding regional market.

Latin America

The Latin America Electric Vehicle Charging Station Market size was valued at USD 0.4 billion in 2018 to USD 1.5 billion in 2024 and is anticipated to reach USD 6.1 billion by 2032, at a CAGR of 12.0% during the forecast period. Latin America holds a modest market share of around 3%, with growth primarily concentrated in countries like Brazil, Mexico, and Chile. Governments are beginning to adopt e-mobility targets and introduce incentives to stimulate EV infrastructure. The private sector is playing a significant role in deploying urban charging stations, especially in commercial and retail spaces. Grid limitations and economic variability pose challenges but also open opportunities for distributed energy solutions. The Electric Vehicle Charging Station Market in this region is in an early stage, with high long-term potential. It is gradually gaining traction through international collaboration and local innovation.

Middle East

The Middle East Electric Vehicle Charging Station Market size was valued at USD 0.6 billion in 2018 to USD 2.1 billion in 2024 and is anticipated to reach USD 8.0 billion by 2032, at a CAGR of 13.4% during the forecast period. The region contributes nearly 4% to the global market, with the UAE and Saudi Arabia emerging as early adopters. Government-driven sustainability goals and smart city initiatives are accelerating the rollout of EV infrastructure. Integrated charging hubs and solar-powered stations are gaining prominence in urban development projects. Public transport electrification and premium EV adoption are pushing demand for high-speed charging solutions. The Electric Vehicle Charging Station Market in the Middle East benefits from strategic urban planning and growing environmental awareness. It is positioned for accelerated growth as regulatory frameworks evolve.

Africa

The Africa Electric Vehicle Charging Station Market size was valued at USD 0.2 billion in 2018 to USD 0.8 billion in 2024 and is anticipated to reach USD 4.2 billion by 2032, at a CAGR of 10.7% during the forecast period. Africa holds under 2% of the global share but is seeing early-stage development in countries like South Africa, Kenya, and Morocco. Infrastructure gaps, limited grid access, and high EV costs are key barriers to rapid growth. International aid, climate funding, and private pilot projects are beginning to support charging infrastructure deployment. Mobile charging units and off-grid solar-based systems are emerging solutions tailored to local conditions. The Electric Vehicle Charging Station Market in Africa remains in a nascent phase but offers strong potential in urban centers and transit corridors. It is expected to grow steadily with greater policy support and technological adaptation.

Key Player Analysis:

- Tesla

- ChargePoint

- Electrify America

- EVgo

- ABB

- Siemens

- Schneider Electric

- Blink Charging

- EVBox

- Shell Recharge

- BP Pulse

- Ionity

- Wallbox

- Tritium

Competitive Analysis:

The Electric Vehicle Charging Station Market features a competitive landscape driven by innovation, strategic partnerships, and global expansion efforts. Key players such as Tesla, ChargePoint, Shell Recharge, BP Pulse, ABB, and EVgo are investing heavily in network expansion, fast-charging technologies, and integrated software solutions. Companies are differentiating themselves through hardware reliability, user experience, and backend analytics platforms. The Electric Vehicle Charging Station Market is witnessing increased collaboration between automakers and infrastructure providers to ensure seamless interoperability and brand-aligned charging ecosystems. Emerging firms are targeting niche markets, including residential and fleet-focused solutions, while established players continue to consolidate their presence through acquisitions. It is evolving rapidly, with competition intensifying across hardware manufacturing, energy management, and charging-as-a-service business models. Strong emphasis on product scalability, grid integration, and sustainable operations continues to shape strategic decisions within the competitive landscape.

Recent Developments:

- In April 2025, ChargePoint announced a generational leap in AC Level 2 charging technology. The new product architecture introduces bidirectional charging and speeds up to double that of typical AC Level 2 chargers, with vehicle-to-home capability and dynamic load balancing. The first models based on this platform will launch in Europe in summer 2025 and in North America by the end of 2025.

- In April 2025, Cummins expanded its EV charging solutions by partnering with OpConnect, Autel, and additional providers to enhance its charging infrastructure capabilities and accelerate deployment across North America

- In March 2025, GM, Pilot, and EVgo commenced installation of fast chargers at Pilot and Flying J travel centers under an agreement to deploy up to 2,000 fast-charging stalls across 500 locations, offering amenities aimed at improving the long-distance EV experience.

Market Concentration & Characteristics:

The Electric Vehicle Charging Station Market remains moderately concentrated, with a mix of global giants and regional players competing across hardware, software, and service segments. Leading firms such as Tesla, ABB, Shell, and ChargePoint hold significant market share through extensive charging networks and vertically integrated solutions. It exhibits high entry barriers due to capital intensity, regulatory compliance, and the need for advanced technology. The market is characterized by rapid innovation, growing emphasis on interoperability, and strong reliance on public–private partnerships. It shows a trend toward consolidation, with larger firms acquiring smaller providers to expand geographic reach and technical capabilities. Strategic focus areas include ultra-fast charging, grid connectivity, and renewable energy integration. The Electric Vehicle Charging Station Market is shaped by evolving regulatory frameworks, dynamic consumer demand, and the pace of EV adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on charger type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing EV adoption worldwide will drive sustained demand for fast and accessible charging infrastructure.

- Investment in ultra-fast DC charging and bidirectional systems will redefine charging speed and grid interaction.

- Integration with renewable energy sources will strengthen the market’s alignment with clean energy goals.

- Advancements in smart charging software will enhance user experience, energy efficiency, and load management.

- Public–private partnerships will accelerate deployment in underserved urban and rural areas.

- Standardization of charging connectors will improve interoperability across networks and vehicle brands.

- Expansion of fleet electrification will boost demand for high-capacity depot and en-route charging solutions.

- Regulatory mandates for zero-emission vehicles will continue to push infrastructure development.

- Increased focus on curbside and shared residential charging will address urban accessibility challenges.

- Market consolidation and strategic alliances will shape competitive dynamics and service innovation.