Market Overview

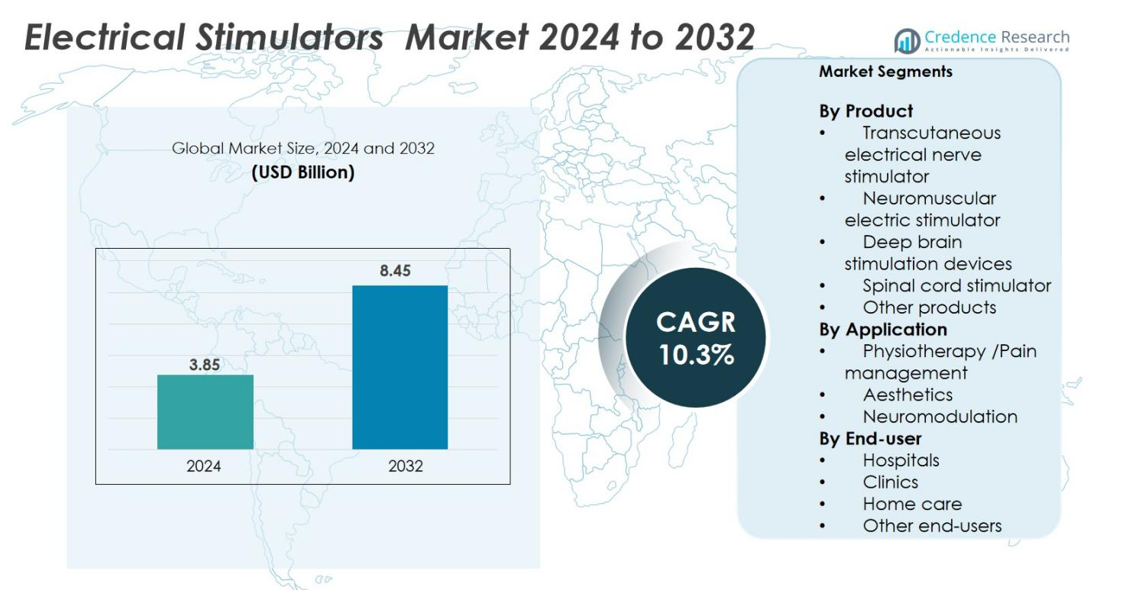

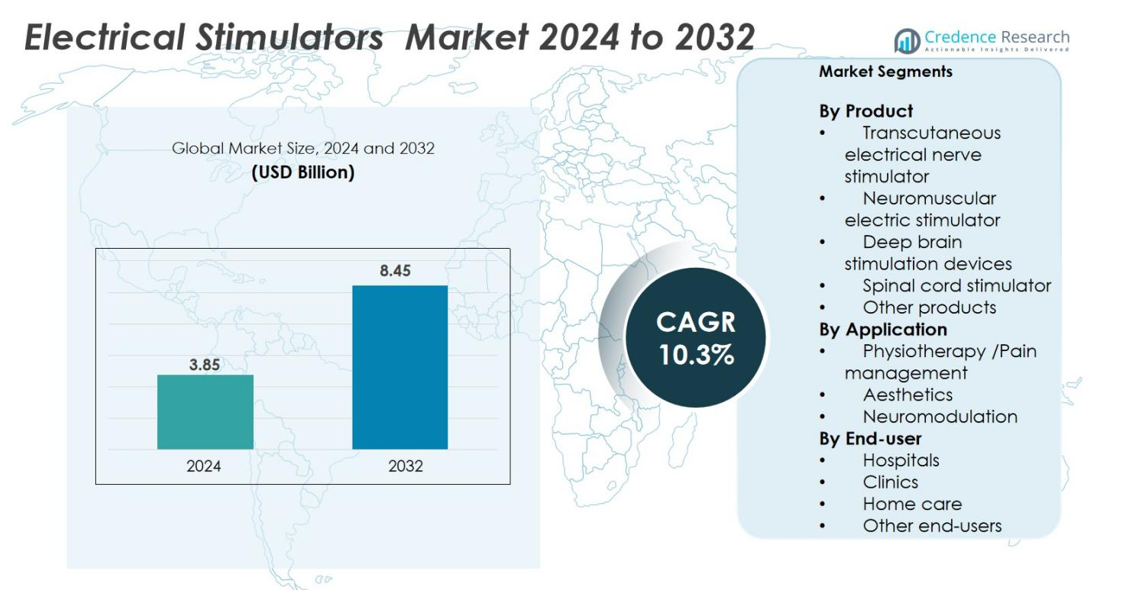

Electrical Stimulators market size was valued at USD 3.85 billion in 2024 and is anticipated to reach USD 8.45 billion by 2032, at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrical Stimulators Market Size 2024 |

USD 3.85 billion |

| Electrical Stimulators Market, CAGR |

10.3% |

| Electrical Stimulators Market Size 2032 |

USD 8.45 billion |

Electrical Stimulators market features strong participation from major companies such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, OMRON Corporation, Zynex Inc., Saluda Medical, BTL Corporate, HASOMED GmbH, BioMedical Life Systems, and HMS Medical Systems. These firms focus on advanced pain therapy, neuromuscular rehabilitation, and wearable stimulators for home care. The United States leads product innovation with wireless, app-connected devices and neuromodulation systems for chronic pain and neurological disorders. North America remains the dominant region with 36% market share, driven by high adoption across hospitals, physiotherapy centres, and sports medicine facilities. Europe and Asia Pacific follow as key growth regions supported by ageing populations and rising rehabilitation demand.

Market Insights

- The Electrical Stimulators market reached USD 3.85 billion in 2024 and will grow to USD 8.45 billion by 2032 at a 10.3% CAGR.

- Transcutaneous electrical nerve stimulators hold the largest 38% product share due to wide adoption in pain relief, rehabilitation, and home use.

- Leading players, including Medtronic, Boston Scientific, Abbott, and Zynex, focus on compact, wireless, and app-connected devices to support physiotherapy, neuromodulation, and long-term pain care.

- High device cost and limited reimbursement in developing regions remain restraints, slowing adoption in public hospitals and among low-income patient groups.

- North America leads with 36% share, followed by Europe at 28%, while Asia Pacific accounts for 23% and expands fastest due to growing physiotherapy centres, rising chronic pain cases, and strong demand for portable stimulators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

Transcutaneous electrical nerve stimulators hold the dominant share of 38% in the Electrical Stimulators market. Their wide use in non-invasive pain relief, low cost, and portable design drives strong adoption in hospitals and home care settings. Neuromuscular electrical stimulators follow, supported by rising demand for muscle rehabilitation in sports injury and post-stroke therapy. Deep brain and spinal cord stimulators continue to gain traction due to rising approvals for neurological disorders, including Parkinson’s and chronic pain. Manufacturers invest in compact, wearable formats with programmable stimulation patterns, boosting product penetration across developed healthcare markets.

- For instance, Medtronic’s DBS systems have been approved since 1997 for essential tremor and later for Parkinson’s disease, now featuring bilateral stimulation capabilities.

By Application

Physiotherapy and pain management account for 55% share of the Electrical Stimulators market, making it the leading application segment. Growth is supported by increasing chronic pain cases, post-operative rehabilitation needs, and a shift toward non-pharmacological treatment. Neuromodulation gains momentum due to expanding usage in spinal injuries and neurological diseases, supported by device innovation. Aesthetic applications grow at a steady pace, supported by rising demand for muscle toning and skin tightening procedures. Expanding use in sports medicine and geriatric rehabilitation encourages long-term market growth.

- For instance, Neuromodulation is advancing with innovations like Medtronic’s BrainSense Adaptive Deep Brain Stimulation system, which adjusts stimulation in real time to manage Parkinson’s disease symptoms effectively.

By End-User

Hospitals lead the Electrical Stimulators market with 42% share, driven by high patient inflow, advanced therapy availability, and access to trained medical staff. Clinics adopt advanced devices for physiotherapy, orthopaedics, and neurology services, supporting rapid outpatient treatments. Home care grows quickly as portable and wearable stimulators become common for chronic pain, muscle recovery, and elderly rehabilitation. Other end-users, including sports centres and research facilities, expand adoption of targeted stimulation devices. Rising reimbursement support for pain management and neurological rehabilitation fuels demand across settings.

Key Growth Drivers

Surge in Chronic Pain and Musculoskeletal Disorders

Rising chronic pain cases drive strong demand for advanced electrical stimulators. Patients seek non-invasive therapy to reduce pain and improve mobility. Hospitals and clinics adopt portable units to support outpatient recovery. Home care use rises as patients manage long-term pain without drugs. Physiotherapists prefer stimulators for faster muscle activation and strength recovery. Ageing populations also increase cases of osteoarthritis and neurological disorders. Sports injuries add another group of regular users. Device makers offer programmable modes for lower back pain, neck injuries, and post-surgical rehabilitation. Growing awareness of safer pain therapy strengthens market penetration across developed and emerging regions.

- For instance, the Xcite functional electrical stimulation system at Brooks Rehabilitation offers a portable design that supports long-term therapy, enabling home use for muscle activation and post-surgical recovery.

Shift Toward Home-Based Therapy and Wearable Devices

Electrical stimulators move from clinical settings to home use. Compact designs allow patients to continue therapy without supervision. Wireless and app-linked devices track sessions and adjust intensity. Home care adoption grows because patients avoid frequent hospital visits. Elderly users benefit from easy-to-operate controls. Companies introduce rechargeable, skin-friendly pads and longer operation hours. Remote monitoring supports tele-rehab programs. Insurers in some regions reimburse specific home therapy devices, improving access. Rising preference for self-managed recovery strengthens long-term market growth for portable stimulators.

- For instance, the STIMGRASP system offers a home-based functional electrical stimulator for patients with tetraplegia or hemiplegia, featuring a mobile app for user control and battery power to ensure portability without supervision.

Increasing Demand in Neurological Rehabilitation

Neurological patients require repeated therapy sessions for motor function recovery. Electrical stimulators help restore limb movement after stroke, spinal injury, and nerve damage. Rehabilitation centres use them to improve muscle coordination and prevent atrophy. Neuromodulation devices also support tremor control and movement balance in Parkinson’s disease. New deep brain and spinal devices offer higher precision and better stimulation mapping. Research labs and universities test solutions for functional electrical stimulation in gait training and robotic exoskeleton therapy. Growing investment in neuro-rehab technology supports continued device innovation.

Key Trends & Opportuntites

Integration of Digital and Smart Technologies

Manufacturers integrate AI-driven stimulation patterns and cloud connectivity. Smart systems adjust output based on muscle response and patient feedback. Mobile apps store therapy history and track pain reduction. Clinics use cloud dashboards to monitor home patients. Smart pads improve contact quality and reduce skin irritation. Wireless charging and Bluetooth control replace bulky wires. Compact designs expand adoption in sports medicine and fitness recovery. Digital upgrades also help differentiate premium products and increase long-term service revenue through software updates.

- For instance, NeuroSkin®, a wearable FES system, uses AI-driven stimulation integrated with sensor-based gait monitoring to streamline clinical rehabilitation and remotely adjust therapy based on patient feedback.

Growing Use in Sports Performance and Aesthetic Treatments

Athletes use electrical stimulators for faster muscle recovery and reduced fatigue. Fitness centres adopt them for strength conditioning and warm-up support. Beauty clinics use stimulators for facial toning and body shaping. Demand increases for non-surgical treatments as consumers seek visible results with minimal discomfort. Wearable belts and patches attract health-conscious buyers. Smart marketing through sports brands and fitness influencers boosts awareness. As device prices fall, home users gain access to wellness-focused stimulation therapies.

- For instance, EMS training programs increase muscle contraction efficiency and strength during exercise sessions according to leading device manufacturers like Compex.

Key Challenges

Limited Clinical Evidence in Some Applications

Many aesthetic and wellness claim still lack strong clinical proof. Regulators expect validated safety data and measurable outcomes before allowing wide adoption. Hospitals also seek peer-reviewed research to confirm treatment reliability. Small brands often overstate benefits, which reduces buyer confidence. Long-term clinical studies remain limited, slowing new approvals. Device makers must fund stronger trials to support marketing messages and secure reimbursement support in key markets. This gap in evidence delays broader acceptance across medical and fitness settings.

Cost Barriers and Limited Reimbursement in Emerging Countries

High device prices restrict adoption in low-income regions. Hospitals and clinics often defer purchases due to strict budgets and competing priorities. Reimbursement programs usually exclude basic wellness or aesthetic systems, forcing patients to cover full treatment costs. Import duties raise final prices for global brands and weaken market entry. Local production, rental models, and pay-per-use setups help ease cost pressure but progress remains slow. Without policy support and better insurance coverage, adoption stays limited in many developing markets.

Regional Analysis

North America

North America dominates the Electrical Stimulators market with 36% share, supported by advanced healthcare infrastructure, high chronic pain prevalence, and strong insurance coverage for rehabilitation therapies. Hospitals and physiotherapy centres widely adopt neuromuscular and pain management devices. The United States drives demand through strong product approvals and early adoption of smart and wearable stimulators. Sports medicine facilities and home care users show rising usage for faster recovery and long-term pain relief. Growing demand for non-opioid pain alternatives and supportive reimbursement policies continue to strengthen regional market expansion.

Europe

Europe holds 28% share of the Electrical Stimulators market, fueled by widespread use in physiotherapy, stroke rehabilitation, and musculoskeletal treatments. Germany, France, and the UK lead adoption across hospitals and rehabilitation centres. Ageing populations with chronic pain and limited mobility increase clinical demand for neuromuscular stimulators. Research institutions support innovation in neurostimulation and deep brain devices. The region also sees steady home care adoption of portable and app-linked units. Government-backed healthcare systems and rising acceptance of non-invasive therapy encourage long-term market growth.

Asia Pacific

Asia Pacific accounts for 23% share of the market and remains the fastest-growing region. China, Japan, India, and South Korea expand adoption due to rising chronic pain and stroke cases, along with growing physiotherapy centres. Affordable portable stimulators boost home care demand. Sports recovery and wellness trends attract young consumers. Local manufacturers introduce cost-effective units, improving accessibility in developing countries. Healthcare investments and awareness programs increase clinical usage of spinal cord and neuromuscular stimulators for rehabilitation. The region’s large elderly population supports sustained market momentum.

Latin America

Latin America holds 8% share of the Electrical Stimulators market. Brazil, Mexico, and Argentina lead device adoption across hospitals and sports medicine facilities. Rising cases of diabetes-related neuropathy and chronic pain drive physiotherapy demand. Import reliance increases device costs, but growing local distribution networks improve availability. Home care usage rises slowly as portable stimulators gain attention among chronic pain patients. Public hospitals adopt devices for neuro and orthopaedic rehabilitation, although reimbursement remains limited. Awareness campaigns and government healthcare modernization support steady, long-term growth.

Middle East & Africa

The Middle East & Africa represent 5% share, driven by expanding private healthcare systems and growing demand for post-surgical and orthopaedic rehabilitation. Gulf countries lead adoption due to modern hospitals and high treatment spending. Portable and wearable units gain attention in home care settings, especially for chronic pain and sports injuries. Africa sees slower adoption due to cost barriers and limited physiotherapy facilities. International device manufacturers partner with regional distributors to improve access. Gradual growth continues as rehabilitation programs expand and patients seek non-drug pain management solutions.

Market Segmentations

By Product

- Transcutaneous electrical nerve stimulator

- Neuromuscular electric stimulator

- Deep brain stimulation devices

- Spinal cord stimulator

- Other products

By Application

- Physiotherapy /Pain management

- Aesthetics

- Neuromodulation

By End-user

- Hospitals

- Clinics

- Home care

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electrical Stimulators market features strong competition among multinational manufacturers and specialized medical device companies. Leading players include Medtronic, Boston Scientific Corporation, Abbott Laboratories, OMRON Corporation, Zynex Inc., Saluda Medical, BTL Corporate, HASOMED GmbH, BioMedical Life Systems, and HMS Medical Systems. These companies compete on therapy precision, portability, digital connectivity, and clinical effectiveness. Major brands focus on advanced pain management, neuromodulation, and post-operative rehabilitation devices, while wearable and home-use stimulators expand the user base. Firms invest in innovation such as AI-driven stimulation patterns, app-enabled monitoring, rechargeable systems, and compact wireless formats. Strategic partnerships with physiotherapy chains, sports centres, and rehabilitation hospitals help expand market exposure. Regulatory approvals for deep brain and spinal cord stimulators improve clinical adoption in neurological disorders. Pricing strategies, distributor networks, and tele-rehab integration also shape competitive dynamics. As demand for non-invasive pain treatment and at-home therapy grows, companies accelerate product launches and expand global footprints.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zynex, Inc

- HASOMED GmbH

- Abbott Laboratories

- BioMedical Life Systems

- Medtronic plc

- OMRON Corporation

- Saluda Medical Pty Ltd

- BTL Corporate

- HMS Medical Systems

- Boston Scientific Corporation

Recent Developments

- In May 2025, electroCore, Inc. completed the acquisition of NeuroMetrix, Inc., including its Quell® platform, to strengthen its position in non-invasive neuromodulation.

- In October 2023, the FDA approved an expanded indication for WaveWriter Alpha spinal cord stimulator systems from Boston Scientific, now allowing the system to treat painful diabetic peripheral neuropathy.

- In May 2023, Abbott Laboratories received U.S. FDA approval for its spinal cord stimulation systems to treat chronic back pain in individuals who have not had or are not eligible to receive back surgery.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for non-invasive pain therapy will increase in hospitals and home care.

- Wireless and app-connected stimulators will see higher adoption for self-managed treatment.

- More clinics will use neuromuscular stimulators for stroke and spinal injury rehabilitation.

- Sports centres will adopt muscle recovery stimulators for faster training outcomes.

- Wearable and portable designs will expand usage among elderly patients.

- AI-based stimulation patterns will improve therapy accuracy and patient comfort.

- Manufacturers will focus on skin-friendly pads and longer battery performance.

- Product approvals for neurological disorders will boost deep brain and spinal devices.

- Local manufacturing in emerging countries will reduce device costs and improve access.

- Tele-rehabilitation platforms will connect home users with physiotherapists for remote monitoring.