| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrocardiogram Devices Market Size 2024 |

USD 7,948.56 Million |

| Electrocardiogram Devices Market, CAGR |

7.15% |

| Electrocardiogram Devices Market Size 2032 |

USD 14,368.52 Million |

Market Overview

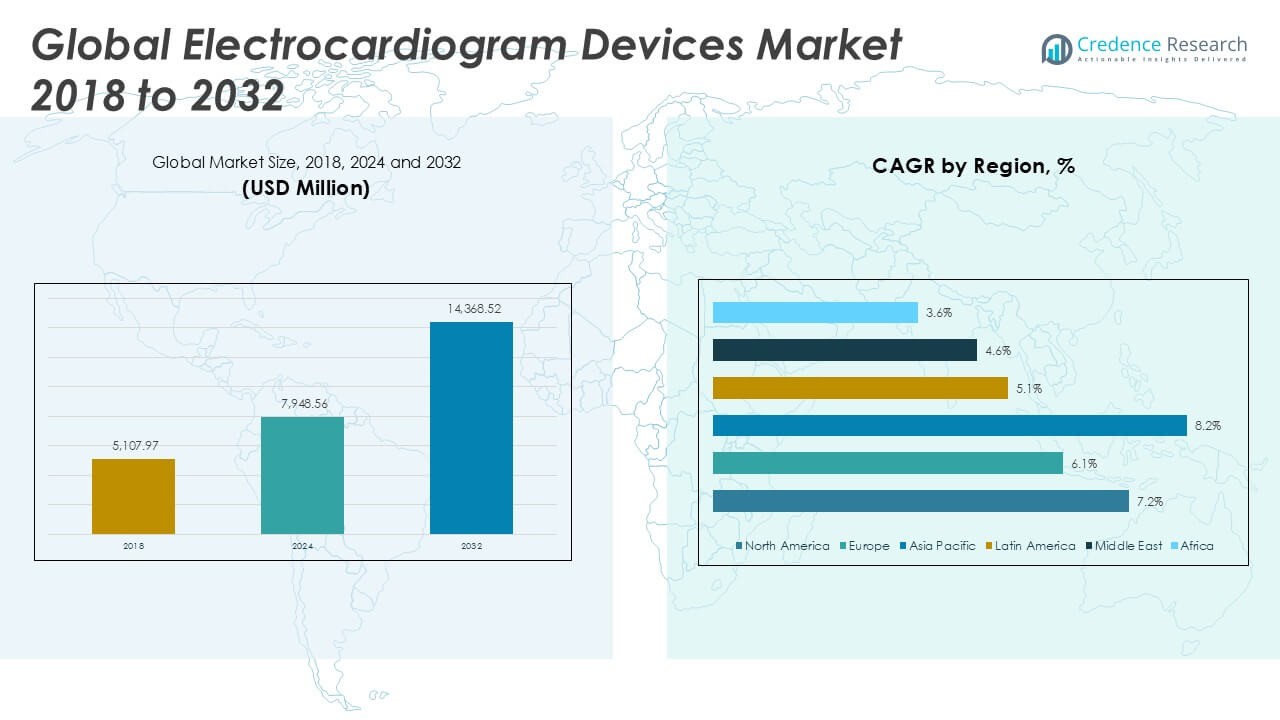

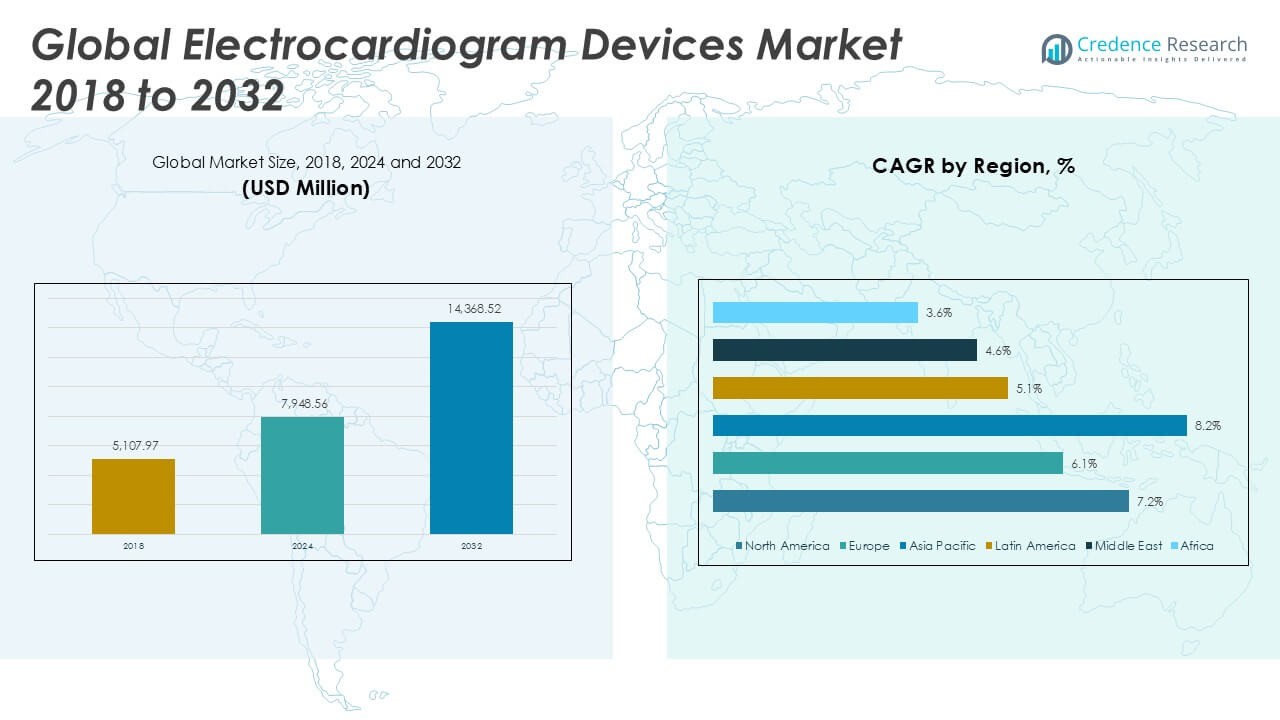

The Electrocardiogram Devices Market was valued at USD 5,107.97 million in 2018, increased to USD 7,948.56 million in 2024, and is anticipated to reach USD 14,368.52 million by 2032, at a CAGR of 7.15% during the forecast period.

The Electrocardiogram Devices market is experiencing robust growth, fueled by the rising prevalence of cardiovascular diseases, increasing geriatric population, and growing awareness about early diagnosis. Advancements in ECG technology, including the development of portable and wireless devices, are enhancing accessibility and improving patient outcomes. Healthcare providers are adopting these devices for their efficiency in detecting arrhythmias and other heart-related conditions, while the integration of AI and cloud-based data management is streamlining diagnostics and monitoring. The shift towards remote patient monitoring, especially after the COVID-19 pandemic, has further accelerated market adoption. Additionally, supportive government initiatives and expanding healthcare infrastructure in emerging economies are creating new opportunities. However, market players face challenges related to high costs of advanced devices and reimbursement limitations in certain regions. Overall, technological innovation and the growing demand for efficient cardiac care solutions continue to drive the Electrocardiogram Devices market forward.

The Electrocardiogram Devices Market demonstrates strong growth across North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa, with each region benefiting from rising healthcare investments and technological advancements. North America and Europe lead the adoption of innovative ECG solutions due to advanced healthcare infrastructure and robust diagnostic networks, while Asia Pacific experiences rapid expansion driven by growing populations, increasing healthcare access, and greater demand for portable cardiac devices. Latin America, the Middle East, and Africa are making steady progress as healthcare modernization efforts and public awareness campaigns improve access to cardiac diagnostics. Key players shaping the competitive landscape include GE HealthCare, Koninklijke Philips N.V., and Medtronic, each offering comprehensive product portfolios and pioneering technology. Companies such as Schiller AG and NIHON KOHDEN CORPORATION also play significant roles, leveraging global reach and continuous innovation to address evolving clinical needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electrocardiogram Devices Market was valued at USD 7,948.56 million in 2024 and is expected to reach USD 14,368.52 million by 2032, growing at a CAGR of 7.15%.

- The market is experiencing robust expansion, supported by the rising incidence of cardiovascular diseases and growing awareness of early diagnosis.

- Technological advancements such as portable, wearable, and wireless ECG devices, along with AI-powered analytics, are driving innovation and improving diagnostic accuracy.

- The adoption of remote monitoring and telehealth solutions is increasing, especially in response to shifting patient preferences and healthcare delivery models post-pandemic.

- Leading companies, including GE HealthCare, Koninklijke Philips N.V., Medtronic, and Schiller AG, are actively expanding their product portfolios and investing in R&D to maintain competitive advantage.

- High costs of advanced ECG devices and limited reimbursement in some regions are key restraints, affecting broader adoption, particularly in resource-constrained settings.

- North America and Europe remain dominant markets for ECG devices due to established healthcare infrastructure, while Asia Pacific shows the fastest growth driven by increasing healthcare investments and rising demand for affordable, innovative diagnostic solutions.

Market Drivers

Rising Incidence of Cardiovascular Diseases and Increasing Geriatric Population Bolster Market Expansion

The increasing global burden of cardiovascular diseases, including arrhythmias, coronary artery disease, and heart failure, significantly boosts demand for electrocardiogram devices. Aging populations in developed and emerging regions drive up screening and monitoring needs, as elderly individuals face higher risks of cardiac events. Governments and healthcare organizations are emphasizing early detection and regular cardiac assessments to reduce mortality and improve quality of life. The Electrocardiogram Devices Market responds to this need with advanced solutions that enable accurate and non-invasive diagnostics. Hospitals, clinics, and primary care centers integrate these devices into routine check-ups. It ensures wider adoption in preventive healthcare settings. These trends create steady growth opportunities for manufacturers and service providers.

- For instance, GE HealthCare reported more than 100,000 MAC series ECG systems installed globally, supporting hospitals and clinics in routine cardiac screenings.

Technological Advancements and Product Innovation Accelerate Device Adoption

Rapid progress in ECG technology transforms traditional devices into portable, wireless, and AI-enabled systems that offer improved convenience and diagnostic accuracy. Wearable ECG monitors, smartphone-compatible devices, and cloud-based data sharing platforms are entering the market, empowering both patients and clinicians. It streamlines remote cardiac monitoring and facilitates quick medical intervention. Technological advancements also support early diagnosis of complex heart conditions, reducing the need for lengthy hospital stays. Enhanced connectivity and miniaturization make ECG devices more user-friendly and suitable for point-of-care use. The trend toward continuous innovation fosters intense competition and accelerates device adoption worldwide.

- For instance, AliveCor’s KardiaMobile device has logged over 150 million ECG recordings, making remote heart rhythm assessment accessible for millions of users.

Shift Toward Home-Based and Remote Monitoring Increases Market Penetration

Growing preference for home-based healthcare solutions is driving demand for ECG devices that support remote monitoring. Patients now rely on user-friendly, portable ECG monitors for regular cardiac assessments outside of traditional healthcare settings. It improves patient compliance, lowers readmission rates, and reduces healthcare costs for both patients and providers. The COVID-19 pandemic intensified the need for remote monitoring, leading to increased market penetration of telehealth and mobile ECG solutions. Hospitals and healthcare practitioners integrate remote ECG monitoring into chronic disease management protocols. This approach expands access to timely cardiac care, especially in rural or underserved regions.

Supportive Regulatory Policies and Expanding Healthcare Infrastructure Stimulate Market Growth

Favorable regulatory policies and investments in healthcare infrastructure by governments worldwide help stimulate growth in the Electrocardiogram Devices Market. Fast-track approvals for innovative devices and initiatives to improve access to medical diagnostics encourage manufacturers to introduce new solutions. It allows emerging economies to benefit from advanced ECG technology and improved healthcare delivery. Public-private partnerships, funding for research and development, and health awareness campaigns further strengthen the market landscape. Increased adoption of ECG devices in primary and secondary care settings reflects the positive impact of these initiatives. The supportive environment continues to promote market expansion and foster innovation.

Market Trends

Surge in Wearable and Portable ECG Devices Redefines Patient Engagement

The increasing popularity of wearable and portable ECG devices is transforming cardiac care by empowering patients to monitor their heart health more conveniently. The Electrocardiogram Devices Market witnesses a strong shift toward compact, lightweight designs that enable continuous tracking without interrupting daily activities. Patients are becoming more proactive in health management due to the accessibility of devices integrated with smartphones and wireless connectivity. It allows for real-time data sharing with healthcare professionals, improving diagnostic efficiency and patient compliance. The versatility of these devices supports use across diverse settings, from home care to sports medicine. Growing consumer awareness about personal health drives higher adoption and fuels innovation in device functionality.

- For instance, Philips’ wearable Biosensor BX100 has been deployed in over 20,000 patient cases to continuously monitor heart rate and respiratory patterns in clinical settings.

Integration of Artificial Intelligence and Cloud-Based Analytics Enhances Diagnostic Precision

The integration of artificial intelligence (AI) and cloud-based analytics is revolutionizing the interpretation of ECG data. Automated algorithms analyze vast amounts of cardiac data, reducing diagnostic errors and supporting early intervention in critical cases. The Electrocardiogram Devices Market benefits from AI-driven tools that offer predictive insights and decision support for clinicians. It streamlines workflow, allowing healthcare professionals to focus on complex cases while routine diagnostics are automated. Cloud connectivity enables remote access to ECG data, fostering collaboration among care teams and improving patient outcomes. This trend highlights a broader move toward data-driven healthcare and personalized treatment pathways.

- For instance, Schiller AG’s CARDIOVIT FT-1 ECG system can store up to 350 patient records locally and connect to cloud platforms for real-time consultation.

Expansion of Telehealth and Remote Cardiac Monitoring Solutions Gains Momentum

Widespread adoption of telehealth platforms and remote cardiac monitoring solutions accelerates market growth. Healthcare providers now leverage ECG devices to extend cardiac care beyond clinical settings, reaching patients in rural and underserved regions. The Electrocardiogram Devices Market evolves to include devices compatible with telemedicine systems, supporting seamless patient-practitioner communication. It improves access to timely care and helps manage chronic cardiac conditions with greater efficiency. The expansion of remote monitoring reduces hospital readmissions and improves quality of life for at-risk populations. Ongoing investment in digital health infrastructure supports this trend globally.

Focus on User-Friendly Design and Patient-Centric Features Drives Product Development

Manufacturers prioritize user-friendly design and patient-centric features in new ECG devices to enhance usability and patient experience. Intuitive interfaces, wireless operation, and automated alerts are now standard in next-generation devices. The Electrocardiogram Devices Market responds to patient and clinician feedback by introducing customizable options and advanced comfort features. It increases patient adherence and ensures accurate, reliable results. Design improvements make these devices accessible to a broader demographic, including elderly and non-technical users. The emphasis on usability accelerates device uptake and drives future product innovation.

Market Challenges Analysis

High Cost of Advanced Devices and Limited Reimbursement Constrain Market Expansion

The high cost of technologically advanced electrocardiogram devices presents a significant barrier for both healthcare providers and patients. The Electrocardiogram Devices Market faces constraints when healthcare systems in low- and middle-income regions cannot afford to upgrade their existing equipment. Reimbursement challenges persist, with insurance coverage often failing to keep pace with evolving technology, limiting patient access to the latest diagnostic tools. It can slow down the adoption rate, especially where public healthcare funding is limited. Hospitals and clinics may hesitate to invest in new systems without clear financial incentives. This pricing dynamic impacts market growth and prevents widespread deployment of innovative solutions.

Data Privacy Concerns and Technical Complexity Impede Broader Adoption

Stringent regulatory requirements and growing concerns about data privacy hinder the adoption of digital and connected ECG devices. The Electrocardiogram Devices Market must address risks related to patient data security, especially when leveraging cloud-based and wireless technologies. It becomes critical to ensure compliance with global privacy laws and maintain robust cybersecurity frameworks. Technical complexity also poses a challenge, particularly for end-users who lack technical expertise or training. Complex device interfaces and integration hurdles can discourage consistent use and impede workflow efficiency. Overcoming these challenges remains vital to ensuring long-term growth and successful market penetration.

Market Opportunities

Expansion in Emerging Markets and Rising Healthcare Investments Unlock Growth Potential

Emerging markets present significant opportunities for the Electrocardiogram Devices Market as governments and private entities invest in healthcare infrastructure. Increased funding for public health, greater insurance penetration, and improved access to diagnostic services create favorable conditions for market expansion. It allows manufacturers to introduce cost-effective and portable ECG devices tailored to local needs. Rising awareness of cardiovascular health and early diagnosis among expanding middle-class populations drives demand for advanced cardiac care solutions. Strategic collaborations with local distributors and healthcare providers further enhance market reach. These trends position emerging regions as key drivers of future growth.

Innovation in Wearable Technology and Artificial Intelligence Drives Future Applications

Advancements in wearable technology and artificial intelligence offer new avenues for product development and differentiation in the Electrocardiogram Devices Market. Companies can leverage AI-powered analytics and miniaturized sensors to deliver smarter, more personalized diagnostic tools. It enables real-time monitoring, predictive insights, and improved patient engagement. Integration with telemedicine platforms opens doors to remote cardiac care for broader populations. Research partnerships and investments in R&D accelerate the introduction of next-generation devices with enhanced functionality. These innovations support improved clinical outcomes and generate new revenue streams for industry participants.

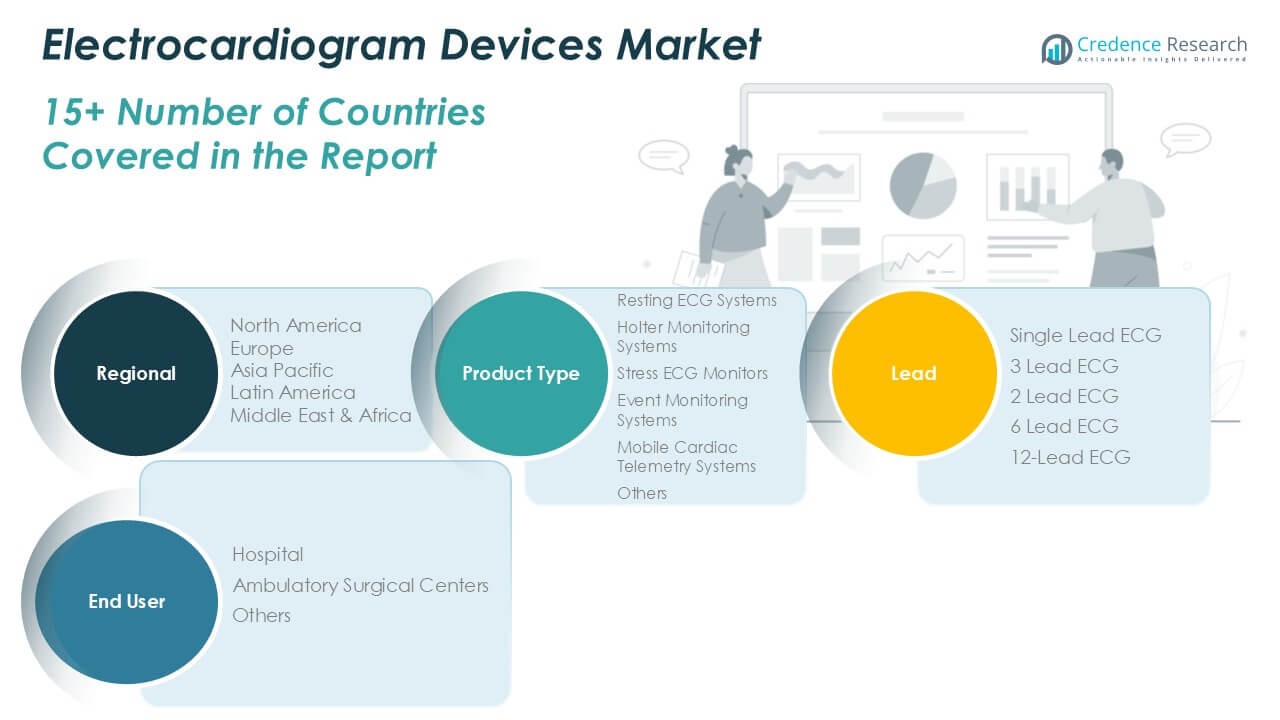

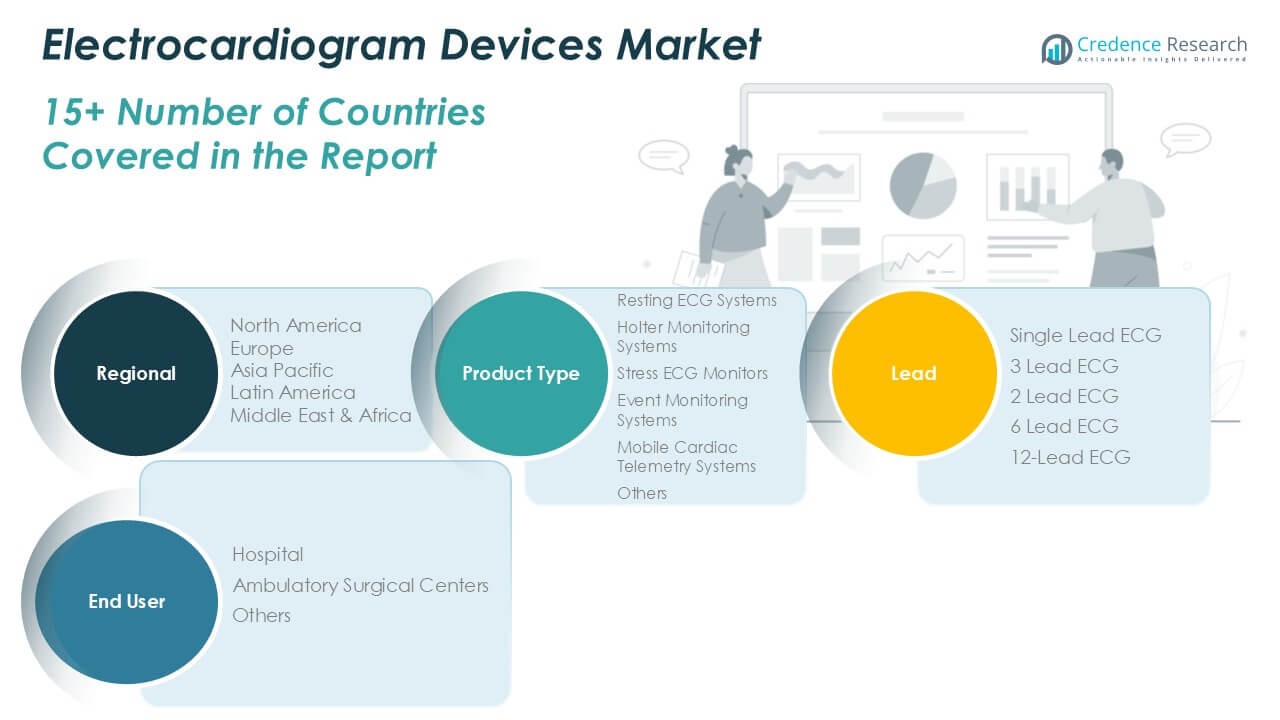

Market Segmentation Analysis:

By Product Type:

The Electrocardiogram Devices Market features a diverse product landscape, with Resting ECG Systems maintaining the largest share due to their routine use in hospitals and clinics for baseline cardiac assessment. Holter Monitoring Systems also hold a strong position, offering continuous ambulatory monitoring and supporting the growing trend of long-term cardiac observation. Stress ECG Monitors play a critical role in detecting exercise-induced cardiac abnormalities and remain essential for cardiac stress testing protocols. Event Monitoring Systems provide valuable episodic data for patients experiencing infrequent arrhythmias, while Mobile Cardiac Telemetry Systems enable real-time cardiac monitoring and rapid intervention for high-risk patients. The “Others” segment, which includes innovative and emerging ECG technologies, continues to attract interest from both clinicians and patients seeking advanced diagnostic options.

- For instance, Medtronic has deployed more than 10,000 Mobile Cardiac Telemetry devices across specialty clinics for continuous remote patient monitoring.

By Lead:

The market includes a range of lead configurations, each tailored for specific diagnostic needs. Single Lead ECG devices have gained traction, particularly in wearable and portable segments, supporting personal and remote monitoring initiatives. The 3 Lead and 2 Lead ECG systems find use in emergency and point-of-care settings where rapid, preliminary assessment is required. Six Lead ECG devices bridge the gap between basic and advanced diagnostics, offering more detailed information while maintaining user-friendly design. Twelve-Lead ECG devices represent the clinical gold standard, providing comprehensive cardiac data for definitive diagnosis and guiding treatment decisions in hospital and specialty care environments. It reflects the demand for flexibility in monitoring solutions to suit different care scenarios.

- For instance, NIHON KOHDEN CORPORATION has delivered over 8,000 twelve-lead ECG units to tertiary hospitals in Japan for advanced diagnostic workflows.

By End User:

Hospitals serve as the primary end users in the Electrocardiogram Devices Market, driven by high patient volumes and the need for advanced diagnostic capabilities in acute care settings. Ambulatory Surgical Centers rely on ECG devices for preoperative assessment and intraoperative monitoring, supporting efficient and safe surgical workflows. The “Others” segment includes clinics, home healthcare providers, and diagnostic centers that contribute to market growth by expanding access to cardiac diagnostics beyond traditional hospital environments. It demonstrates the market’s responsiveness to evolving healthcare delivery models and the rising emphasis on preventive and personalized medicine.

Segments:

Based on Product Type:

- Resting ECG Systems

- Holter Monitoring Systems

- Stress ECG Monitors

- Event Monitoring Systems

- Mobile Cardiac Telemetry Systems

- Others

Based on Lead:

- Single Lead ECG

- 3 Lead ECG

- 2 Lead ECG

- 6 Lead ECG

- 12-Lead ECG

Based on End User:

- Hospital

- Ambulatory Surgical Centers

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Electrocardiogram Devices Market

North America Electrocardiogram Devices Market grew from USD 1,973.97 million in 2018 to USD 3,035.67 million in 2024 and is projected to reach USD 5,504.80 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.2%. North America is holding a 38% market share. The United States leads the region, supported by advanced healthcare infrastructure, strong reimbursement frameworks, and high adoption of cutting-edge ECG technology. Canada contributes steadily, driven by robust public health programs and ongoing investments in cardiac care. It benefits from a well-established base of hospitals and research institutes, making the region an innovation hub for ECG device manufacturers. Demand remains high for portable and home-based ECG systems, especially in response to rising chronic disease prevalence.

Europe Electrocardiogram Devices Market

Europe Electrocardiogram Devices Market grew from USD 1,094.84 million in 2018 to USD 1,622.40 million in 2024 and is forecasted to reach USD 2,702.90 million by 2032, with a CAGR of 6.1%. Europe holds a 20% market share, led by Germany, the United Kingdom, and France. The region’s emphasis on preventive healthcare and early disease detection drives strong demand for electrocardiogram devices. The market benefits from growing investments in digital health and the rapid integration of AI and cloud-based ECG solutions. Regulatory support and health awareness campaigns further encourage uptake across hospitals and specialty clinics. It capitalizes on expanding telemedicine and remote monitoring applications.

Asia Pacific Electrocardiogram Devices Market

Asia Pacific Electrocardiogram Devices Market grew from USD 1,646.81 million in 2018 to USD 2,690.87 million in 2024 and is set to reach USD 5,261.39 million by 2032, representing a CAGR of 8.2%. Asia Pacific holds a 37% market share, with China, Japan, and India driving growth. Rising healthcare investments, a growing middle class, and escalating cardiovascular disease rates fuel rapid market expansion. The region sees a strong shift towards portable and wearable ECG devices, addressing both urban and rural needs. Governments prioritize healthcare infrastructure and accessibility, supporting widespread adoption of advanced cardiac diagnostics. It stands out for its dynamic market environment and innovation-driven approach.

Latin America Electrocardiogram Devices Market

Latin America Electrocardiogram Devices Market grew from USD 196.40 million in 2018 to USD 300.95 million in 2024 and is predicted to reach USD 467.02 million by 2032, posting a CAGR of 5.1%. Latin America represents a 3% market share, with Brazil, Mexico, and Argentina as primary contributors. The region is focusing on improving healthcare access and modernizing hospital infrastructure. Public health campaigns target early diagnosis and treatment of cardiovascular diseases, creating opportunities for ECG device manufacturers. It faces challenges related to limited reimbursement and budget constraints but is experiencing steady progress in urban medical centers.

Middle East Electrocardiogram Devices Market

Middle East Electrocardiogram Devices Market grew from USD 128.89 million in 2018 to USD 181.45 million in 2024 and is projected to reach USD 270.52 million by 2032, registering a CAGR of 4.6%. The Middle East accounts for a 2% market share, led by Saudi Arabia, the United Arab Emirates, and Israel. The region invests in healthcare modernization, with major hospitals adopting advanced cardiac diagnostic equipment. Rising awareness of cardiovascular risk and national health initiatives stimulate market growth. It benefits from strategic partnerships between international device manufacturers and local distributors. The sector is evolving, but faces hurdles due to varying regulatory standards and procurement processes.

Africa Electrocardiogram Devices Market

Africa Electrocardiogram Devices Market grew from USD 67.05 million in 2018 to USD 117.22 million in 2024 and is set to reach USD 161.89 million by 2032, with a CAGR of 3.6%. Africa holds a 1% market share, with South Africa, Nigeria, and Egypt as key countries. Investments in healthcare infrastructure and increased focus on non-communicable diseases drive gradual market growth. It faces ongoing challenges from limited resources and access disparities between urban and rural areas. Adoption of low-cost and portable ECG devices is rising, supported by international aid and NGO initiatives. The region presents long-term opportunities for manufacturers committed to affordable and accessible healthcare solutions.

Key Player Analysis

- GE HealthCare

- Koninklijke Philips N.V.

- Schiller AG

- Medtronic

- Johnson & Johnson Services, Inc.

- AliveCor, Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- ACS Diagnostics

- Spacelabs Healthcare

- NIHON KOHDEN CORPORATION

- Allengers

- Hill-Rom Services, Inc. (Baxter)

Competitive Analysis

The Electrocardiogram Devices Market features strong competition among leading global players, including GE HealthCare, Koninklijke Philips N.V., Medtronic, Schiller AG, NIHON KOHDEN CORPORATION, and AliveCor, Inc. These companies hold prominent positions through broad product portfolios, global distribution networks, and continuous investments in research and development. Firms prioritize the integration of artificial intelligence, wireless connectivity, and cloud-based data management to enhance diagnostic accuracy and user convenience. The market witnesses frequent product launches, strategic collaborations, and investments in research and development, reflecting an active pursuit of market leadership. Companies also compete by improving after-sales support, training services, and customization options for healthcare providers. Emphasis on developing portable and wearable devices allows businesses to tap into the growing trend of personal health management. This competitive landscape drives continual improvement, benefiting end users with more efficient, accessible, and reliable ECG technologies.

Recent Developments

- In December 2024, DocGo Inc. broadened its partnership with SHL Telemedicine to integrate the SmartHeart® portable 12-lead ECG device across DocGo mobile health care units. Initially launched in New York, this extended partnership will now provide cutting-edge cardiovascular diagnostics to patients’ homes and underserved areas in other markets.

- In September 2024, OMRON Healthcare Korea introduced OMRON Complete, its new home-use medical device that can simultaneously measure ECG and blood pressure. The device helps in preventing the risk of complications like heart failure and stroke among individuals at risk for cardiovascular diseases.

- In May 2024, OMRON Healthcare India collaborated with AliveCor India to provide AI-based handheld ECG technology. This collaboration marked an important milestone in the former’s ‘Going for Zero’ vision to improve cardiovascular health awareness.

- In February 2024, Thyracore acquires Think Health a key industry player in home ECG services. As a result, Thyrocare has now positioned itself as one of the leading providers of at-home healthcare services in India.

- In January 2024, Omron Healthcare launched a portable ECG AliveCor’s KardiaMobile in Italy and France to advance fibrillation awareness and stroke prevention in alignment with its ‘Going for zero’ vision.

Market Concentration & Characteristics

The Electrocardiogram Devices Market displays moderate to high market concentration, with several multinational corporations holding significant influence through their advanced technologies, broad product offerings, and established distribution channels. It features a mix of longstanding industry leaders and agile innovators who continuously invest in research and development to enhance device functionality, integration, and ease of use. The market is characterized by a steady influx of new products incorporating wireless connectivity, artificial intelligence, and cloud-based platforms, reflecting a strong commitment to digital transformation in cardiac diagnostics. Regulatory compliance, patient safety, and clinical accuracy remain central characteristics, guiding product development and market entry strategies. The Electrocardiogram Devices Market benefits from increasing demand for preventive healthcare, rising adoption of remote monitoring, and evolving care delivery models that prioritize portability and patient engagement. It adapts rapidly to technological advances and shifting healthcare priorities, supporting ongoing growth and heightened competition among global and regional players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Lead, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will benefit from broader adoption of wearable ECG devices by consumers and clinicians.

- Advances in AI-driven analytics will enhance early detection of arrhythmias and cardiac abnormalities.

- Remote and home-based monitoring will become more prevalent, improving patient compliance and care access.

- Integration with telehealth platforms will streamline patient management and reduce hospital visits.

- Miniaturization and improved battery life will make devices more portable and user-friendly.

- Cloud-based data sharing will facilitate real-time collaboration between patients and practitioners.

- Enhanced interoperability with electronic health records will improve clinical workflow.

- Emerging markets will present new opportunities due to rising healthcare investments and digital infrastructure.

- Focus on cybersecurity will strengthen patient data protection and regulatory confidence.

- Research collaborations will drive development of multifunctional ECG devices that support comprehensive cardiac analytics.