Market Overview:

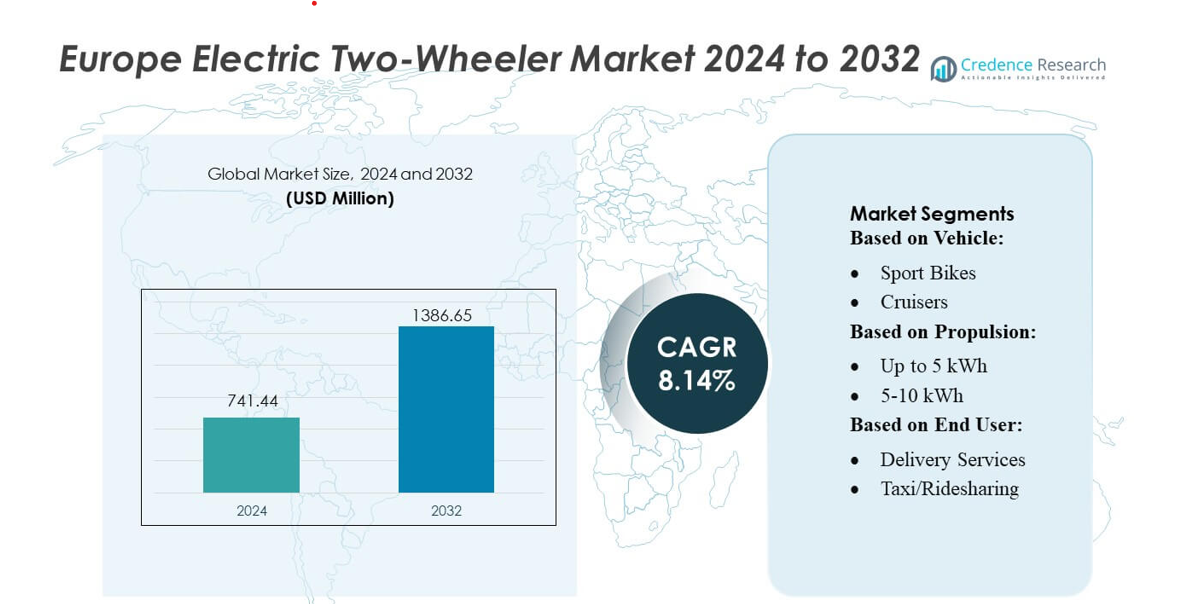

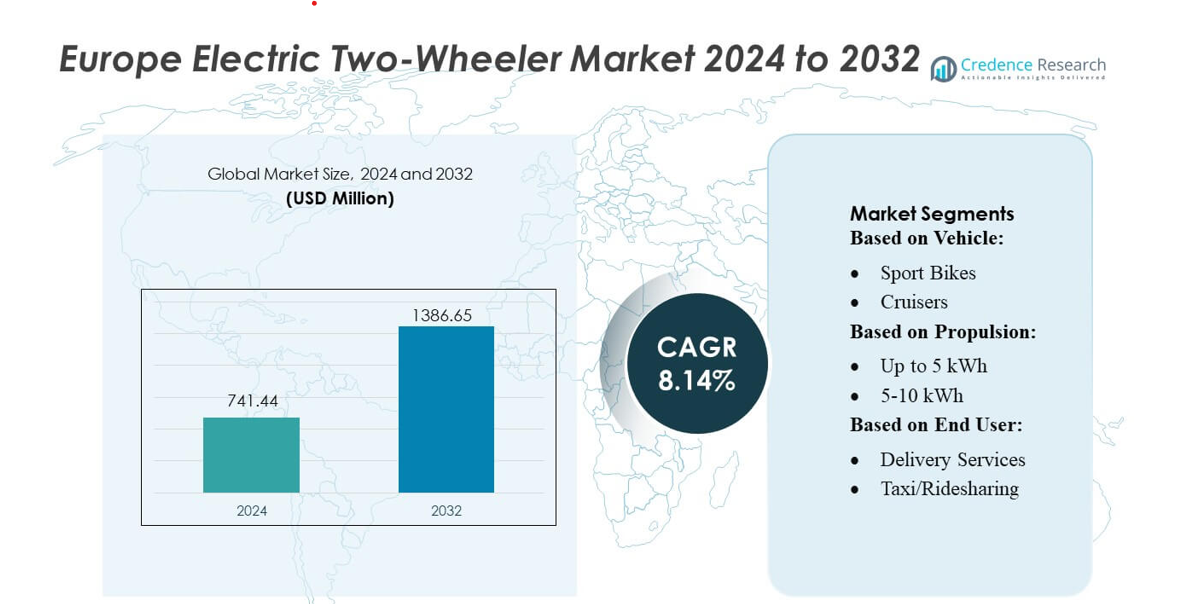

Europe Electric Two-Wheeler Market size was valued USD 741.44 million in 2024 and is anticipated to reach USD 1386.65 million by 2032, at a CAGR of 8.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Electric Two-Wheeler Market Size 2024 |

USD 741.44 million |

| Europe Electric Two-Wheeler Market, CAGR |

8.14% |

| Europe Electric Two-Wheeler Market Size 2032 |

USD 1386.65 million |

The Europe Electric Two-Wheeler Market is dominated by major players including Yamaha Motor, Ducati, Silence, Harley-Davidson, Kawasaki Motors, BMW Motorrad, Honda Motor, Royal Enfield, Suzuki Motor, and KTM. These companies focus on innovation, battery efficiency, and connected vehicle features to strengthen their market presence and meet growing urban mobility demand. Product diversification, premium positioning, and expansion into shared mobility and delivery fleet segments are key competitive strategies. Western Europe emerges as the leading region, accounting for approximately 45% of the market, driven by robust government incentives, stringent emission regulations, advanced urban infrastructure, and high consumer environmental awareness. The combination of technological advancement and strategic regional focus enables these companies to capture significant market share while addressing evolving commuter and commercial needs across Europe.

Market Insights

- The Europe Electric Two-Wheeler Market size was valued at USD 741.44 million in 2024 and is projected to reach USD 1386.65 million by 2032, growing at a CAGR of 8.14% during the forecast period.

- Market growth is driven by government incentives, stringent emission regulations, rising urban congestion, and increasing environmental awareness, which encourage adoption of electric scooters, motorcycles, and mopeds.

- Key trends include expansion of shared mobility and delivery fleets, advancements in battery technology, lightweight vehicle designs, and integration of connected and smart features for enhanced safety and efficiency.

- Competitive landscape is dominated by Yamaha Motor, Ducati, Silence, Harley-Davidson, Kawasaki Motors, BMW Motorrad, Honda Motor, Royal Enfield, Suzuki Motor, and KTM, focusing on innovation, product diversification, and regional expansion to capture market share.

- Western Europe leads with approximately 45% market share, while electric vehicles in the 5–10 kWh segment and personal use end-users hold the largest segment share across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

Motorcycles dominate the European electric two-wheeler market, accounting for approximately 35% of the segment share, with sport bikes and adventure motorcycles driving growth due to high performance and long-range capabilities. Scooters and mopeds follow closely, appealing to urban commuters with their compact design and low operating costs. The shift towards electric motorcycles is propelled by government incentives, urban emission regulations, and increasing consumer preference for sustainable mobility. Key drivers include advancements in battery technology, lightweight materials, and expanding charging infrastructure, enhancing adoption across both personal and commercial users.

- For instance, Yamaha Motor has introduced electric scooters and small electric motorcycles such as the NEO’s, offering a removable lithium‑ion battery that delivers about 37 km per charge — extendable to 68 km with a second battery pack.

By Propulsion

Electric Vehicles (EVs) are the dominant propulsion sub-segment, holding over 40% market share. Within EVs, models with 5–10 kWh batteries are the most popular, balancing range and affordability for urban commuting. ICE vehicles continue to see demand in larger capacity categories (above 200 CC), but growth is constrained by stricter emission regulations. Hybrid vehicles are emerging but remain niche. Key growth drivers for EVs include supportive European Union policies, subsidies for electric mobility, improving battery efficiency, and rising awareness of environmental impacts, encouraging both private and fleet operators to transition from ICE models.

- For instance, Ducati’s V21L electric prototype — unveiled as part of its racing‑to‑road technology pipeline — features an 18 kWh battery pack composed of 1,152 cylindrical “21700” cells.

By End User

Personal use represents the largest end-user segment, capturing nearly 50% of the market, driven by urban commuters and environmentally conscious consumers. Delivery services and commercial use follow, fueled by the rise of e-commerce, on-demand delivery platforms, and cost-efficient fleet electrification. Tourism, rental, and shared mobility segments are gradually expanding as cities implement low-emission zones and promote micro-mobility solutions. Key drivers include lower operating costs, government incentives, and increasing investment in charging infrastructure, which collectively support adoption across diverse user groups, particularly in urbanized regions with high congestion and pollution levels.

Key Growth Drivers

Government Policies and Incentives

Government regulations and incentives significantly drive the Europe electric two-wheeler market. Subsidies, tax benefits, and grants for EV adoption encourage both consumers and fleet operators to switch from conventional vehicles. Stricter emission norms and low-emission zones in urban centers further promote cleaner mobility. These measures reduce upfront costs and improve affordability, making electric motorcycles, scooters, and mopeds more accessible. Additionally, funding for charging infrastructure accelerates market penetration, ensuring convenient adoption for personal, commercial, and shared mobility users across Europe.

- For instance, Silence’s S01 model uses a removable 5.6 kWh lithium‑ion battery that powers a 7 kW (9 kW peak) motor and delivers a WLTC‑certified range of up to 133 km on a single charge — enabling urban commuting that meets low‑emission zone requirements.

Technological Advancements in Batteries and Motors

Advances in battery energy density, motor efficiency, and lightweight materials are key growth enablers. Lithium-ion and emerging solid-state batteries extend range while reducing charging time, addressing consumer concerns over range anxiety. Efficient electric motors enhance performance across motorcycles, scooters, and mopeds, making EVs competitive with ICE vehicles. These innovations lower operational costs and maintenance requirements, improving total cost of ownership. Combined with smart connectivity and regenerative braking systems, technological progress strengthens consumer confidence and accelerates market adoption in Europe.

- For instance, Harley‑Davidson’s electric division LiveWire deploys a high‑voltage lithium‑ion battery system (RESS) with a usable capacity of 13.6 kWh (15.5 kWh total), powering a water‑cooled permanent‑magnet synchronous motor offering 78 kW (105 hp) peak power and delivering 117 Nm torque.

Rising Urbanization and Environmental Awareness

Urban congestion and increasing environmental awareness are major drivers for electric two-wheeler adoption. European cities promote low-emission mobility to combat air pollution, favoring compact EVs for personal commuting, shared mobility, and delivery services. Consumers increasingly prefer sustainable transport alternatives, aligning with lifestyle choices and corporate sustainability goals. The convenience of electric scooters and mopeds for short-distance travel, coupled with cost savings on fuel and maintenance, supports widespread adoption, especially in metropolitan areas with high population density and growing demand for eco-friendly urban transport solutions.

Key Trends & Opportunities

Expansion of Shared Mobility Services

Shared mobility platforms present a strong growth opportunity. Electric scooters and motorcycles are increasingly deployed in rental, taxi, and ridesharing services, reducing traffic congestion and emissions in urban centers. Fleet operators are adopting EVs to lower operational costs and comply with regulatory mandates. Integration with mobile apps and IoT-based fleet management enhances user experience, enabling real-time availability, tracking, and payment solutions. The trend of micro-mobility adoption continues to gain traction, providing cities with flexible, sustainable transport options while driving market expansion.

- For instance, Kawasaki Ninja e-1 features dual removable lithium‑ion battery packs (50.4 V, 30 Ah each) that support a 5.0 kW continuous / 9.0 kW peak brushless electric motor, delivering zero-emission propulsion and clutch‑less operation — ideal for rental or urban sharing services.

Integration of Smart and Connected Features

The adoption of connected vehicle technologies is shaping the market. Smart dashboards, GPS navigation, mobile connectivity, and predictive maintenance features enhance the safety and convenience of electric two-wheelers. Advanced telematics allow fleet operators to optimize routes and monitor battery health, reducing downtime. Integration of AI-based systems and IoT connectivity creates opportunities for personalized mobility services. This trend also supports regulatory compliance and incentivizes innovation, attracting tech-savvy consumers and businesses seeking efficient, environmentally friendly transport solutions.

- For instance, BMW CE 04 exemplifies how BMW Motorrad integrates smart connectivity and advanced telematics into electric two‑wheelers. The CE 04 uses an 8.5 kWh usable (8.9 kWh gross) lithium‑ion battery (60.6 Ah) and a liquid-cooled permanent‑magnet motor rated at 31 kW (42 hp), enabling 0‑50 km/h acceleration in 2.6 seconds and a top speed of 120 km/h.

Expansion of Charging Infrastructure

Growing investment in charging networks is unlocking new market opportunities. Public and private stakeholders are establishing fast-charging stations, particularly in urban areas and along major transport corridors. Improved accessibility and reduced charging times encourage adoption among commuters and fleet operators. Energy providers are also introducing smart charging solutions integrated with renewable energy sources, enhancing sustainability. Expansion of infrastructure supports long-distance travel for motorcycles and higher-capacity EVs, reducing range anxiety and enabling broader acceptance of electric two-wheelers across Europe.

Key Challenges

High Initial Purchase Cost

Despite decreasing battery costs, electric two-wheelers still have higher upfront prices compared to ICE counterparts. This can deter price-sensitive consumers and small fleet operators, particularly in emerging urban areas. Limited affordability restricts adoption among lower-income segments and affects market penetration. Although government incentives partially offset costs, the total investment, including batteries and smart features, remains a barrier. Companies must balance pricing, performance, and value-added services to attract a wider customer base and overcome this financial constraint.

Range Limitations and Charging Constraints

Range anxiety and insufficient charging infrastructure pose significant challenges. Low-capacity EVs often require frequent recharging, limiting their usability for long-distance travel and commercial operations. Inconsistent charging availability in rural or suburban regions further hampers adoption. While technological improvements are underway, the pace of infrastructure development lags behind market demand. Overcoming these limitations requires coordinated efforts among manufacturers, governments, and energy providers to expand network coverage and improve battery efficiency, ensuring reliability and convenience for users.

Regional Analysis

North America

North America accounts for approximately 25% of the market, led by the United States and Canada. Urban commuting demand, environmental policies, and growing awareness of sustainable mobility drive adoption. Electric two-wheelers, particularly scooters and motorcycles, are increasingly used for personal commuting, delivery services, and shared mobility platforms. Government subsidies, incentives, and investments in charging infrastructure facilitate market growth. High consumer interest in eco-friendly transport solutions, coupled with urban congestion challenges, supports the expansion of compact and efficient EV models. The region is expected to maintain steady growth as infrastructure and technological adoption increase.

Europe

Europe leads the electric two-wheeler market with a 40% share, driven by strong adoption in Western and Northern Europe. Government incentives, strict emission regulations, and urban congestion policies encourage personal, commercial, and shared mobility EV use. Well-established charging infrastructure and high environmental awareness support the growth of scooters, motorcycles, and mopeds. Technological advancements in batteries and lightweight designs enhance performance and range, appealing to daily commuters and fleet operators. The market continues to expand through investments in micro-mobility solutions, last-mile delivery, and urban transportation initiatives, making Europe the largest and most mature region globally.

Asia-Pacific

Asia-Pacific holds around 20% of the market, driven by high population density, rapid urbanization, and supportive government policies in China, India, and Southeast Asia. Two-wheelers are widely used for daily commuting, delivery services, and micro-mobility applications. EV adoption is encouraged by subsidies, reduced operational costs, and increasing environmental awareness. Technological improvements in battery efficiency and range are making electric scooters and motorcycles more accessible. Expansion of urban charging infrastructure and integration with smart mobility solutions further support market growth. Asia-Pacific represents a high-potential market with significant room for adoption and innovation.

Latin America

Latin America contributes roughly 10% of the market, with adoption driven by urban mobility needs and increasing awareness of sustainable transport. Countries such as Brazil and Mexico are witnessing gradual growth in electric scooters and motorcycles for personal and commercial use, including delivery services. Government initiatives, fleet electrification projects, and partnerships with local operators support the market. Limited but expanding charging infrastructure and moderate pricing remain key focus areas. The market shows strong potential as urban congestion rises and consumer interest in eco-friendly transportation increases, positioning Latin America as an emerging region for electric two-wheelers.

Middle East & Africa

The Middle East and Africa hold about 5% of the market, with adoption still in early stages. Growth is concentrated in urban centers with pilot EV programs and supportive government policies, such as in the UAE and South Africa. Personal use, commercial fleets, and delivery services are gradually adopting electric scooters and motorcycles. Limited charging infrastructure and higher upfront costs slow growth, but initiatives for renewable energy integration and urban mobility planning present opportunities. Market expansion is expected as governments and private operators increase investment in infrastructure, fleet electrification, and awareness campaigns for sustainable urban transport.

Market Segmentations:

By Vehicle:

By Propulsion:

By End User:

- Delivery Services

- Taxi/Ridesharing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Europe Electric Two-Wheeler Market players such as Yamaha Motor, Ducati, Silence, Harley-Davidson, Kawasaki Motors, BMW Motorrad, Honda Motor, Royal Enfield, Suzuki Motor, and KTM. The Europe Electric Two-Wheeler Market is highly competitive, driven by rapid technological advancements, product innovation, and the growing focus on sustainable mobility solutions. Manufacturers are investing in battery efficiency, lightweight designs, and smart connectivity features to enhance vehicle performance and user experience. Strategic expansion into urban mobility, delivery fleets, and shared mobility services is intensifying market rivalry. Price competitiveness, brand differentiation, and after-sales support are critical factors influencing consumer choice. The market is witnessing a shift toward eco-friendly, high-performance, and cost-efficient electric two-wheelers, with companies emphasizing innovation, operational efficiency, and targeted regional strategies to capture the expanding demand across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yamaha Motor

- Ducati

- Silence

- Harley-Davidson

- Kawasaki Motors

- BMW Motorrad

- Honda Motor

- Royal Enfield

- Suzuki Motor

- KTM

Recent Developments

- In 2025, Honda Motors introduced their new electric scooter named QC1. The scooter has a digital speedometer and instrument cluster for the necessary data bridging. The range of the scooter is up to 80 km, as the company claimed.

- In March 2025, Simple Energy unveiled its latest electric scooter called Simple OneS. The company claimed that the scooter has a range of 181km and a top speed of 105 km. Also, the scooter is compatible with four riding modes: dash, eco, ride, and sonic.

- In March 2024, TVS Motor Company announced its entry into the French market at the Salon du Deux Roues in Lyon, a move made possible by a strategic partnership with the Swiss distributor Emil Frey. The company showcased its product lineup, which includes both traditional internal combustion engine (ICE) and electric models like the TVS X and TVS iQube, to a wider European audience.

- In March 2024, DHL became the official logistics partner for the FIM Enel MotoE World Championship, a multi-year agreement designed to champion sustainability and advance e-mobility in motorsports. This collaboration supports Europe’s focus on sustainable two-wheeler mobility by using the race series as a “racing laboratory” to develop and showcase electric vehicle technology and logistics solutions

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of electric two-wheelers is expected to rise steadily due to stricter emission regulations.

- Expansion of charging infrastructure across urban and suburban areas will improve convenience and accessibility.

- Battery technology advancements will enhance range and reduce charging time, supporting broader adoption.

- Shared mobility and delivery services will increasingly integrate electric two-wheelers into their fleets.

- Lightweight and compact designs will drive preference for scooters and mopeds in congested cities.

- Government incentives and subsidies will continue to stimulate consumer and commercial adoption.

- Connected vehicle technologies will enhance safety, maintenance, and user experience.

- Fleet electrification by logistics and delivery companies will contribute significantly to market growth.

- Rising environmental awareness will encourage individuals and businesses to choose sustainable mobility options.

- Urban congestion and micro-mobility trends will reinforce the demand for electric two-wheelers in metropolitan areas.