| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Geospatial Analytics Market Size 2024 |

USD 22,417.30 million |

| Europe Geospatial Analytics Market CAGR |

8.7% |

| Europe Geospatial Analytics Market Size 2032 |

USD 47,634.93 million |

Market Overview:

Europe Geospatial Analytics Market size was valued at USD 22,417.30 million in 2023 and is anticipated to reach USD 47,634.93 million by 2032, at a CAGR of 8.7% during the forecast period (2023-2032).

Several factors are propelling the growth of the geospatial analytics market in Europe. The increasing integration of Geographic Information Systems (GIS) with emerging technologies like artificial intelligence (AI) and machine learning (ML) is enhancing data analysis capabilities. Additionally, the proliferation of smart city projects across Europe is a significant driver, as these initiatives rely heavily on geospatial data for urban planning and resource management. The aerospace and defense sector also contributes to market growth, utilizing geospatial analytics for infrastructure upgrades and strategic planning. Moreover, the need for real-time location-based insights in transportation and logistics is accelerating adoption. Public and private sectors are increasingly investing in geospatial solutions to improve operational efficiency and spatial intelligence.

Within Europe, countries like Germany, the United Kingdom, France, and Italy are leading in the adoption of geospatial analytics. The United Kingdom is also making significant investments in geospatial technologies, particularly in smart city development and environmental monitoring. France and Italy are focusing on integrating geospatial analytics into sectors like agriculture and disaster management. Overall, the region’s commitment to technological innovation and digital infrastructure is fostering a conducive environment for the growth of geospatial analytics. Nordic countries are also emerging as important players, particularly in climate-related applications. Additionally, the EU’s emphasis on open data policies is enabling broader access to geospatial datasets, encouraging innovation across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Geospatial Analytics Market was valued at USD 22,417.30 million in 2023 and is projected to reach USD 47,634.93 million by 2032, growing at a CAGR of 8.7%.

- Integration of GIS with AI, ML, and IoT is significantly enhancing real-time data processing, automation, and decision-making across industries.

- Government-led digitalization programs and smart city projects across Europe are major growth drivers, especially in urban planning and environmental monitoring.

- Sectors such as agriculture, transportation, logistics, construction, and utilities are increasingly adopting spatial intelligence for operational optimization.

- Countries like Germany, the UK, France, and Italy are leading in market adoption, while Nordic nations are emerging in climate-focused applications.

- Data privacy regulations like GDPR pose compliance challenges, raising operational costs and slowing adoption, particularly for SMEs.

- High initial investment, skills shortage, and data standardization issues continue to hinder seamless implementation across the region.

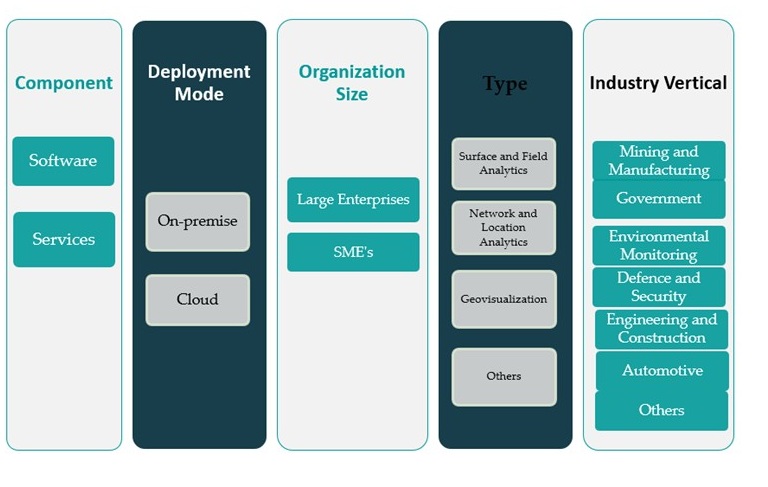

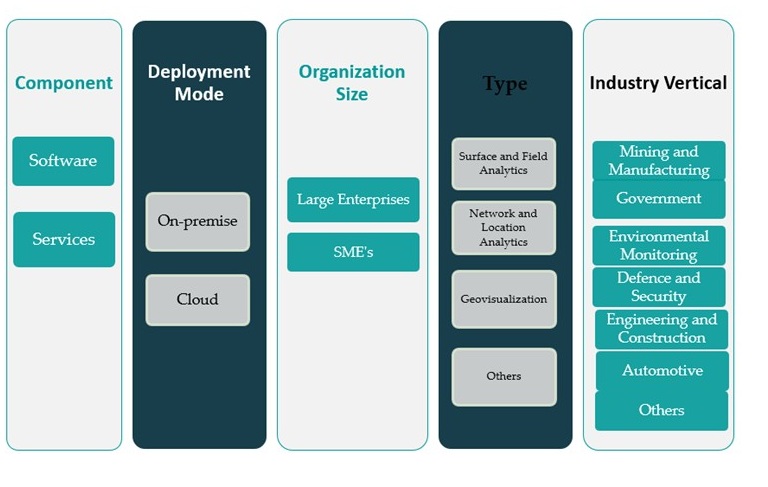

Report Scope

This report segments Europe Geospatial Analytics Market as follow

Market Drivers:

Government Support and Smart City Initiatives

Government-led digital transformation initiatives play a pivotal role in driving the Europe geospatial analytics market. Many European countries are actively investing in smart city infrastructure and e-governance frameworks, which depend heavily on geospatial technologies for urban planning, transportation optimization, and environmental monitoring. Initiatives such as the European Union’s “Digital Europe Programme” and local government efforts to digitize spatial data services have created a favorable environment for market expansion. These programs emphasize open data sharing, smart infrastructure development, and integration of geographic information systems (GIS), enabling cities to make data-driven decisions that enhance public services and sustainability efforts.

Integration with Emerging Technologies

The convergence of geospatial analytics with advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is significantly enhancing the value proposition of spatial intelligence. Organizations are leveraging these technologies to gain real-time insights, automate spatial data interpretation, and improve decision-making accuracy. For example, AI-powered image recognition tools are being used in satellite imagery analysis to monitor deforestation, urban sprawl, and disaster impacts. Meanwhile, IoT-enabled sensors generate continuous location-based data streams that feed directly into geospatial platforms, enabling dynamic analysis of everything from traffic flows to environmental conditions. This integration is streamlining workflows across industries, from agriculture to defense.

Rising Demand Across Industrial Verticals

The increasing reliance on location-based services across key sectors is further accelerating the adoption of geospatial analytics in Europe. In agriculture, precision farming techniques use spatial data to monitor crop health, manage irrigation, and optimize yields. In transportation and logistics, route optimization and fleet tracking are powered by real-time geospatial insights, enhancing efficiency and reducing costs. Similarly, the construction and infrastructure sectors benefit from geospatial tools for land surveying, site selection, and project monitoring. The energy and utilities industry also deploys these technologies to manage grid infrastructure, monitor environmental impacts, and plan renewable energy projects. This sectoral diversification reflects the broad applicability and value of geospatial analytics in solving real-world challenges.

Security, Environment, and Climate Monitoring

Heightened concerns around environmental sustainability, climate change, and national security have increased the demand for sophisticated spatial analysis tools. For instance, Airbus operates more than 20 Earth observation satellites for climate change monitoring, measuring atmospheric constituents, land and sea topography, and air quality, providing actionable insights for governments and humanitarian agencies. Governments and research institutions across Europe are deploying geospatial analytics to track pollution, assess natural disaster risks, and implement climate resilience strategies. In defense and public safety, geospatial intelligence supports surveillance, threat detection, and mission planning. The ability to overlay various datasets including topography, population density, and infrastructure enables comprehensive situational awareness and rapid response. Furthermore, as Europe continues to prioritize its Green Deal and climate targets, the role of geospatial technologies in monitoring ecological footprints, biodiversity loss, and carbon emissions will become even more critical. This alignment with environmental and strategic priorities reinforces geospatial analytics as a vital component of Europe’s digital and sustainable transformation.

Market Trends:

Growing Adoption of Cloud-Based Geospatial Platforms

A key trend shaping the Europe geospatial analytics market is the increasing shift toward cloud-based platforms for spatial data processing and analysis. Traditional on-premise GIS solutions are being replaced by scalable, flexible, and cost-efficient cloud infrastructure that enables real-time access and collaboration across departments and geographic locations. For example, CloudFerro, a leading European provider, manages over 530 petabytes of storage and 90+ petabytes of Earth Observation (EO) data through its public cloud infrastructure, supporting major projects like the Copernicus Data Space Ecosystem and CREODIAS. This shift is particularly beneficial for organizations with large-scale operations, such as utility providers and transportation agencies, that require seamless data integration from multiple sources. Cloud-native geospatial solutions also facilitate continuous software updates, enhanced data security protocols, and easier interoperability with other enterprise applications, which is accelerating their adoption across both public and private sectors.

Emergence of Real-Time and Predictive Analytics

The market is witnessing a growing demand for real-time and predictive geospatial analytics, driven by the need for immediate insights and proactive decision-making. Real-time geospatial tools are increasingly used in emergency response, traffic management, and urban mobility systems, enabling instant visualization of evolving situations. For instance, cities are deploying real-time location data to manage congestion zones, monitor public transport routes, and respond swiftly to accidents or disruptions. Predictive analytics, meanwhile, leverages historical geospatial data to model future scenarios—such as predicting flood-prone areas or estimating infrastructure wear and tear. This capability is becoming vital for risk mitigation and long-term urban planning across Europe.

Increasing Role in Renewable Energy and Environmental Monitoring

Geospatial analytics is playing a progressively important role in supporting Europe’s green energy transition and environmental conservation efforts. Energy companies are using spatial data to identify optimal locations for solar and wind farms, assess environmental risks, and monitor ecosystem changes. Enel Green Power, for example, uses a GIS Portal platform to digitally manage renewable energy plants, integrating accurate geographical data for site selection and operational oversight. This aligns with the European Union’s sustainability agenda, where renewable energy deployment and land-use efficiency are core priorities. Environmental organizations also utilize geospatial tools to map habitats, monitor deforestation, and assess the impact of climate policies. As the focus on decarbonization intensifies, geospatial analytics is expected to remain at the forefront of energy and ecological innovation across the continent.

Expansion of 3D and Indoor Mapping Applications

Another emerging trend in the European market is the advancement of 3D geospatial technologies and indoor mapping solutions. Cities are increasingly adopting 3D modeling for infrastructure development, building inspections, and digital twin simulations, which offer a more comprehensive view of spatial relationships. Indoor geospatial solutions, meanwhile, are being used in airports, shopping centers, and hospitals to improve navigation, asset tracking, and facility management. These applications are particularly valuable in densely built environments where traditional GPS signals may be unreliable. The evolution of 3D and indoor mapping is not only enhancing user experience but also unlocking new business models and service capabilities across sectors.

Market Challenges Analysis:

Data Privacy and Regulatory Compliance

One of the primary challenges restraining the growth of the Europe geospatial analytics market is the complex regulatory environment surrounding data privacy and protection. For instance, with stringent laws such as the General Data Protection Regulation (GDPR), companies are under increased scrutiny when collecting, storing, and processing geospatial data, especially when it involves personal or location-based identifiers. These regulations, while essential for safeguarding user rights, often limit the scope of data utilization and complicate cross-border data transfers. Organizations must invest in robust compliance frameworks, legal audits, and data governance protocols, which increases operational costs and slows down the deployment of analytics solutions.

High Implementation Costs and Technical Barriers

Despite advancements in technology, the initial cost of implementing geospatial analytics solutions remains a significant barrier, particularly for small and medium-sized enterprises (SMEs). High expenses associated with satellite imagery procurement, sensor deployment, software licensing, and skilled personnel recruitment can deter widespread adoption. Additionally, many organizations face integration challenges when incorporating geospatial platforms into legacy IT infrastructures. The need for specialized expertise in GIS, remote sensing, and spatial statistics further compounds the issue, as the talent pool in Europe for advanced geospatial skills remains relatively limited. This skills gap inhibits efficient utilization of existing technologies and delays the realization of full-scale benefits.

Data Quality and Standardization Issues

Another persistent challenge in the market is the inconsistency in data quality and lack of standardized formats across geospatial datasets. Disparate sources, varying coordinate systems, and incomplete or outdated data can undermine the accuracy and reliability of spatial analysis. This hampers effective decision-making, particularly in mission-critical applications such as disaster response or infrastructure planning. Although the European Union promotes open data initiatives, achieving full interoperability across platforms and institutions remains a complex task, requiring greater collaboration and technical harmonization across member states.

Market Opportunities:

The Europe geospatial analytics market presents significant growth opportunities, primarily driven by the region’s accelerating digital transformation and its commitment to sustainability. As governments and enterprises seek smarter, data-driven decision-making tools, geospatial analytics emerges as a critical enabler for optimizing infrastructure, improving public services, and addressing environmental challenges. The increasing adoption of digital twin technology, which integrates real-time geospatial data with 3D modeling for simulating urban environments, is opening new avenues for urban planning, construction, and infrastructure management. Moreover, the European Union’s emphasis on open data policies and cross-border digital collaboration supports the development of scalable and interoperable geospatial solutions that can be leveraged across industries.

Additionally, the growing emphasis on climate action, renewable energy deployment, and precision agriculture presents vast untapped potential for geospatial analytics. Energy companies can utilize spatial insights to determine optimal locations for solar and wind projects, while farmers can benefit from precision mapping to enhance crop productivity and resource management. As the market shifts towards automation and real-time monitoring, the demand for geospatial analytics integrated with AI and IoT technologies is expected to grow rapidly. Furthermore, sectors such as insurance, retail, and real estate are beginning to explore location intelligence for customer analytics, risk assessment, and market expansion strategies. These developments signal a strong opportunity for geospatial technology providers to expand their offerings and address emerging needs in a rapidly evolving landscape. Europe’s progressive policy environment and technological readiness position the region as a fertile ground for innovation in spatial intelligence.

Market Segmentation Analysis:

The Europe geospatial analytics market is segmented across various dimensions, reflecting the diverse application scope and technological preferences within the region.

By component, the market is divided into software and services. Software holds a dominant position due to growing demand for GIS platforms, spatial data visualization tools, and real-time analytics engines. However, the services segment is witnessing rising traction as organizations increasingly rely on consulting, integration, and managed services to implement customized geospatial solutions aligned with their operational needs.

By deployment mode, the market is classified into on-premise and cloud. While on-premise solutions continue to serve large organizations with strict data control requirements, cloud-based deployment is rapidly gaining momentum owing to its scalability, cost-effectiveness, and compatibility with remote data access and AI-driven applications.

By organization size, large enterprises currently account for a significant share due to higher investment capacities and large-scale operations. However, SMEs are emerging as a promising segment as cloud-based geospatial tools become more affordable and user-friendly.

By type, the market is segmented into surface and field analytics, network and location analytics, geovisualization, and others. Network and location analytics are in high demand, particularly in logistics, utilities, and retail, where spatial data enables operational optimization and customer insights. Meanwhile, geovisualization is gaining popularity in urban planning and infrastructure management.

By industry vertical, the market caters to mining and manufacturing, government, environmental monitoring, defense and security, engineering and construction, automotive, and others. Among these, government and environmental monitoring lead the adoption, followed by engineering and defense sectors seeking enhanced spatial awareness and planning capabilities.

Segmentation:

By Component:

By Deployment Mode:

By Organization size:

By Type:

- Surface and Field Analytics

- Network and Location Analytics

- Geovisualization

- Others

By Industry Vertical:

- Mining and Manufacturing

- Government

- Environmental Monitoring

- Defence and Security

- Engineering and Construction

- Automotive

- Others

Regional Analysis:

The Europe geospatial analytics market exhibits robust growth dynamics, driven by increasing digitalization across key industries, advancements in satellite imagery, and a strong governmental focus on smart city and environmental initiatives. In 2023, Europe accounted for 27.5% of the global geospatial analytics market, positioning it as the second-largest regional market. The region is anticipated to maintain steady momentum through 2032, supported by widespread adoption of location-based services in urban planning, transportation, and emergency management systems.

Western Europe leads the regional market, contributing nearly 61% of Europe’s geospatial analytics revenue in 2023. Countries such as Germany, the United Kingdom, and France are at the forefront, leveraging geospatial intelligence for infrastructure development, military applications, and disaster response planning. Germany’s thriving manufacturing and logistics sectors are integrating geospatial tools for efficient supply chain management, while the UK focuses on leveraging satellite data for climate modeling and agricultural monitoring. France’s emphasis on national security and defense modernization further boosts demand for real-time geospatial intelligence.

Southern Europe, comprising Italy, Spain, and Portugal, holds approximately 17% of the regional market share. These nations are increasingly deploying geospatial analytics in urban mobility solutions, environmental conservation, and tourism management. Italy, in particular, has invested in GIS technologies for heritage preservation and natural disaster assessment. Spain is also expanding the use of geospatial tools in renewable energy site planning and marine surveillance, given its extensive coastline.

Northern Europe, including countries like Sweden, Finland, Denmark, and Norway, represents around 12% of the regional share. These nations benefit from strong digital infrastructure and proactive governmental strategies in environmental sustainability and public safety. Nordic countries are pioneering the use of geospatial analytics in climate research, smart transportation, and forestry management. Their high emphasis on data privacy and cybersecurity also fosters trust and innovation in geospatial applications.

Eastern Europe accounts for the remaining 10% of the market. The region is gradually catching up with Western counterparts as investments in digital transformation rise. Countries such as Poland, the Czech Republic, and Romania are witnessing growing adoption of geospatial analytics in agriculture, mining, and public infrastructure projects. EU-funded regional development programs and smart city initiatives are further accelerating technology deployment in these markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- General Electric

- SAP SE

- Google, Inc.

- Bentley Systems, Incorporated

- Alteryx, Inc.

- Oracle Corporation

- TOMTOM International, Inc.

- Hexagon AB

- Geosystems International

- Trimble, Inc.

- Esri

- Rheinmetall

- BlueSky International

- Systra

- Microsoft Corporation

- Others

Competitive Analysis:

The Europe geospatial analytics market features a competitive landscape marked by the presence of both global technology leaders and regionally focused providers. Key players such as Hexagon AB, Airbus Defence and Space, Esri, and Trimble Inc. dominate the market through their advanced geospatial solutions, robust R&D capabilities, and strategic partnerships. Hexagon AB, headquartered in Sweden, leverages its broad portfolio across surveying, mapping, and geospatial intelligence, making it a major contributor to the region’s innovation. Esri maintains a strong presence through its ArcGIS platform, widely adopted across European governmental and environmental sectors. Airbus Defence and Space focuses on satellite-based analytics and imagery, serving defense and aerospace clients. Regional firms also play a vital role by offering niche solutions tailored to specific industry verticals such as agriculture, urban planning, and transportation. The market is characterized by rising competition, with companies investing in AI integration, cloud-based platforms, and strategic acquisitions to expand their regional footprint.

Recent Developments:

- In March 2025, Esri announced a significant partnership with Google Maps Platform, integrating Google’s Photorealistic 3D Tiles into the ArcGIS suite. This collaboration enables users to create highly detailed and visually immersive 3D maps and scenes, supporting a wide range of applications such as urban planning, real estate, and public sector infrastructure projects.

- In Oct 2024, Bentley Systems, Incorporated revealed a strategic partnership with Google to integrate Google’s high-quality geospatial content-including Photorealistic 3D Tiles-into Bentley’s infrastructure engineering software and digital twin platform. This partnership allows infrastructure professionals to design, build, and operate assets with improved geospatial context and actionable insights, leveraging Google’s geospatial data, AI, and cloud technologies.

Market Concentration & Characteristics:

The Europe geospatial analytics market demonstrates moderate to high market concentration, with a few dominant players controlling a significant share of the industry. Companies such as Hexagon AB, Esri, Airbus Defence and Space, and Trimble Inc. maintain a strong foothold through diversified product portfolios, long-standing client relationships, and continuous technological innovation. The market is characterized by high entry barriers due to the complexity of geospatial technologies, data accuracy requirements, and the need for substantial investments in satellite infrastructure and software development. Additionally, the market exhibits a strong emphasis on data integration, real-time analytics, and AI-powered solutions, reflecting the region’s advanced digital ecosystem. Regulatory compliance with GDPR and a growing demand for data privacy shape the development and deployment of geospatial services. Moreover, the market is increasingly shifting toward cloud-based platforms and open-source geospatial tools, enhancing accessibility and flexibility for end-users across sectors such as government, energy, transportation, and environmental management.

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment Mode, Organization size, Type and Industry Vertical. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased adoption of AI and machine learning will enhance predictive geospatial modeling across industries.

- Expansion of smart city initiatives will drive demand for real-time spatial data analysis in urban planning.

- Growth in autonomous vehicle development will require advanced geospatial mapping and location intelligence.

- Integration of 5G networks will improve the speed and accuracy of location-based analytics.

- Public sector investment in climate monitoring will strengthen the use of satellite-based geospatial tools.

- Rising use of drones in agriculture and infrastructure will boost demand for aerial data processing.

- Development of interoperable and cloud-native geospatial platforms will improve cross-sector applications.

- Increasing cybersecurity concerns will shape stricter data governance and compliance in geospatial solutions.

- Cross-border EU collaborations will foster innovation and funding for spatial data infrastructure projects.

- Emergence of spatial digital twins will create new opportunities in simulation, planning, and risk assessment.