Market Overview:

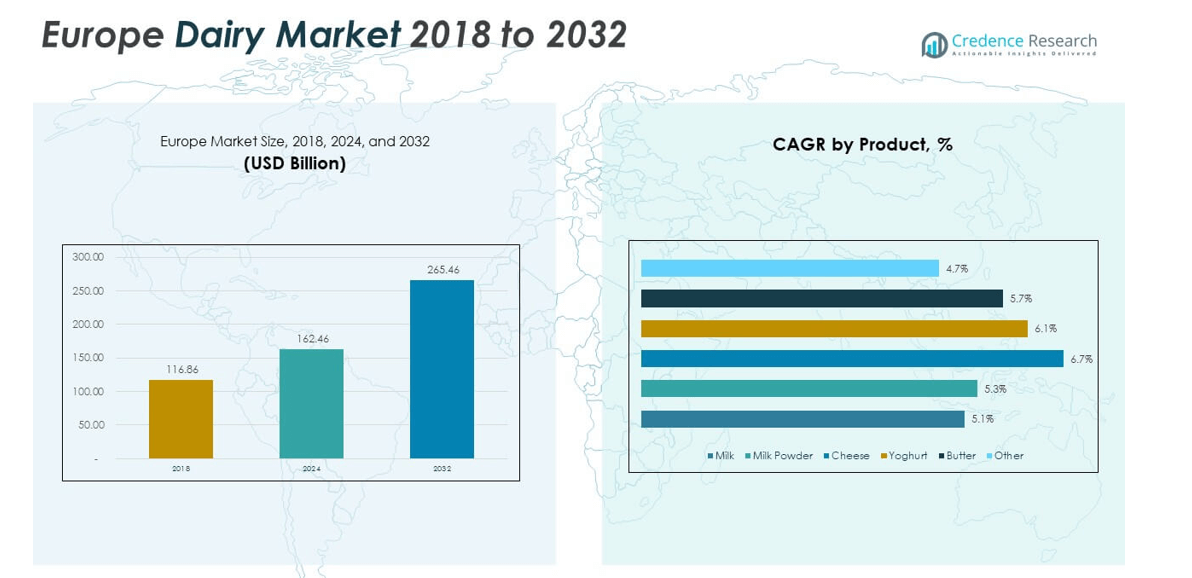

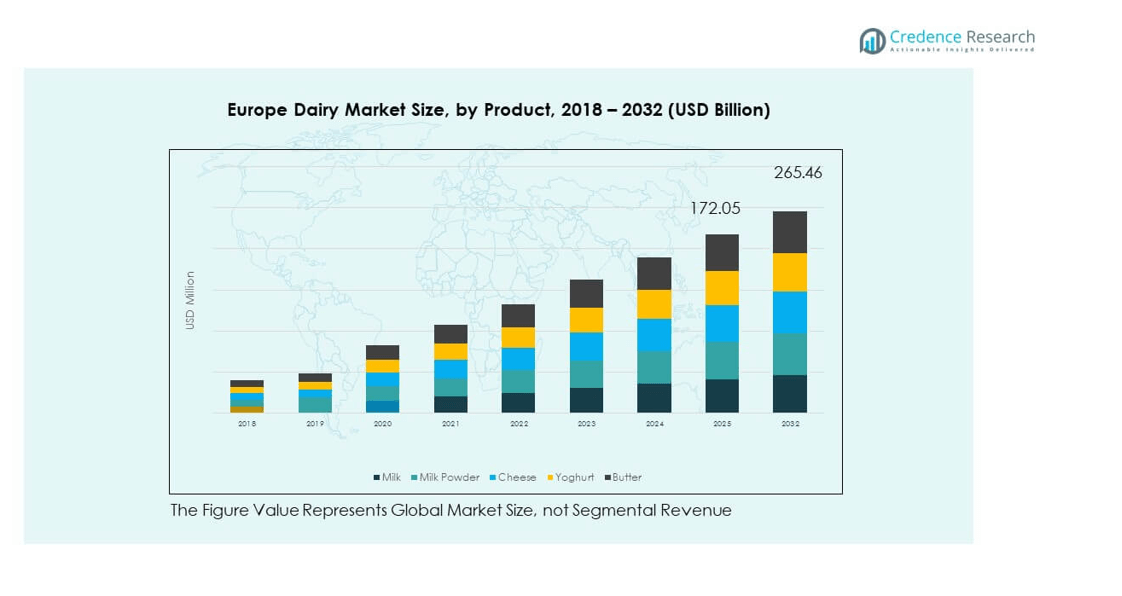

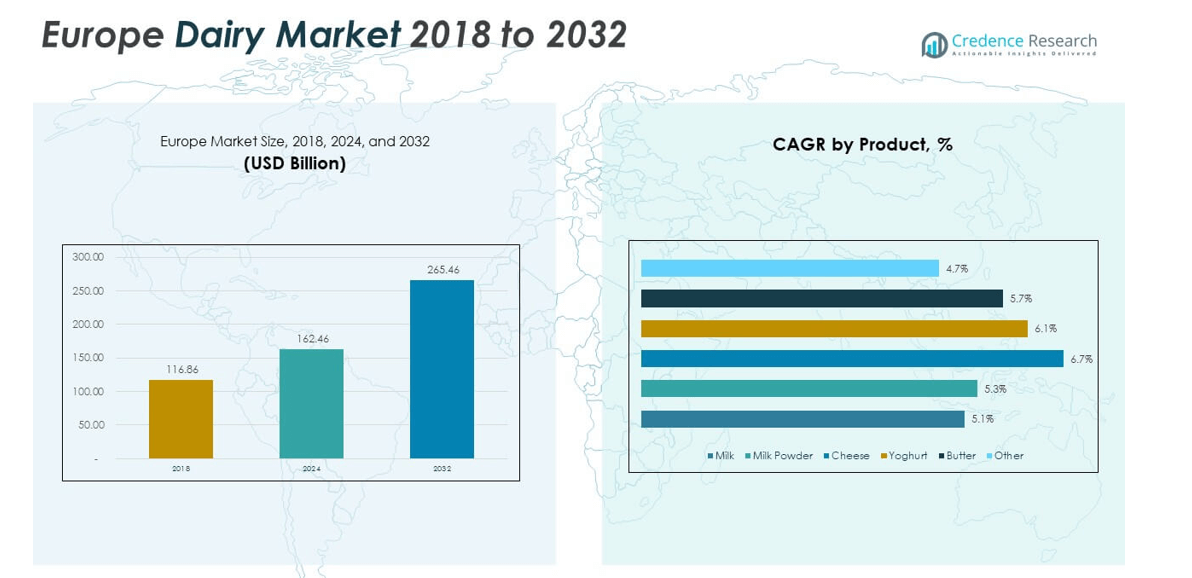

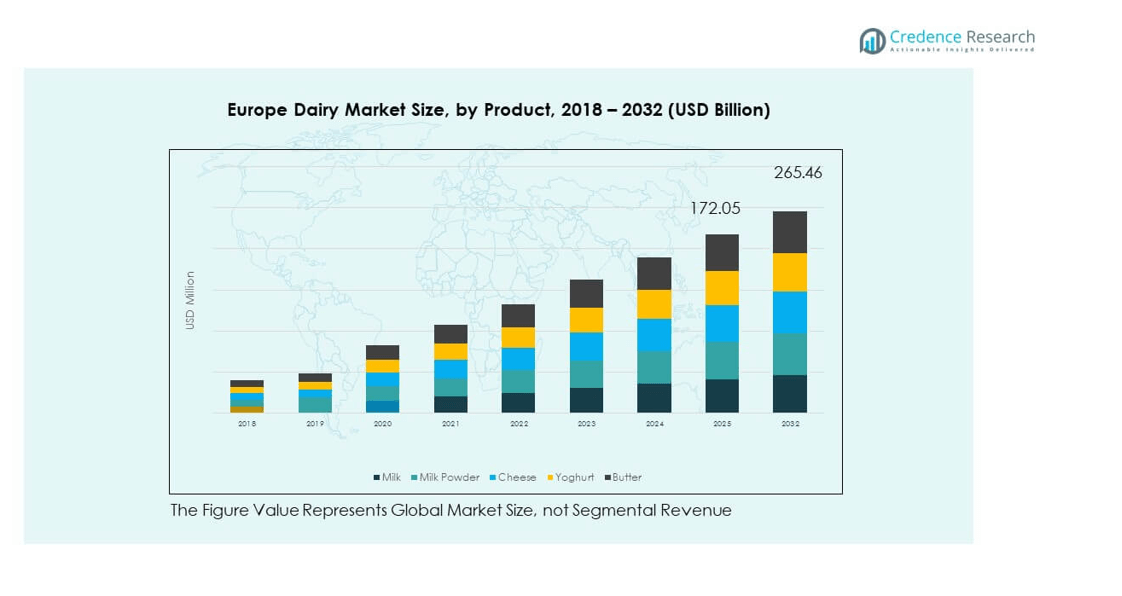

The Europe Dairy Market size was valued at USD 116.86 billion in 2018 to USD 162.46 billion in 2024 and is anticipated to reach USD 265.46 billion by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Dairy Market Size 2024 |

USD 162.46 billion |

| Europe Dairy Market, CAGR |

6.40% |

| Europe Dairy Market Size 2032 |

USD 265.46 billion |

The market growth is driven by increasing consumer preference for high-quality and protein-rich dairy products, rising health consciousness, and expanding demand for functional and fortified dairy items. It benefits from innovation in dairy processing, growing investments in sustainable farming, and the introduction of plant-based dairy alternatives catering to lactose-intolerant and vegan consumers. Strong retail infrastructure, coupled with expanding e-commerce penetration, supports broader product availability, while strategic branding and premiumization continue to enhance product appeal across diverse consumer segments.

Western Europe remains the dominant market due to strong consumption patterns, advanced processing facilities, and established dairy brands in countries such as Germany, France, and the Netherlands. Southern European nations show steady growth, driven by evolving dietary preferences and increasing export opportunities. Eastern Europe emerges as a promising region with rising disposable incomes, improving supply chains, and government support for agricultural modernization, creating favorable conditions for both domestic production expansion and foreign investments in dairy processing and distribution.

Market Insights:

- The Europe Dairy Market was valued at USD 162.46 billion in 2024 and is projected to reach USD 265.46 billion by 2032, growing at a CAGR of 6.40%.

- The Global Dairy Market size was valued at USD 472.9 billion in 2018 to USD 665.6 billion in 2024 and is anticipated to reach USD 1,105.6 billion by 2032, at a CAGR of 6.61% during the forecast period.

- Rising demand for high-nutrition and functional dairy products, including fortified milk and probiotic-rich yoghurt, is driving sustained market growth.

- Premiumization trends are boosting sales of artisanal cheese, organic butter, and specialty dairy items across diverse consumer segments.

- Fluctuating raw milk prices and rising production costs present challenges to profitability for producers and processors.

- Regulatory compliance related to food safety, labeling, and sustainability requirements is influencing product innovation and operational strategies.

- Western Europe holds 48% of the market share, supported by advanced production capabilities and established dairy brands.

- Eastern and Southern Europe are witnessing steady growth driven by modernizing agriculture, evolving dietary preferences, and expanding export potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Nutritional and Functional Dairy Products

The Europe Dairy Market benefits from a steady rise in consumer demand for high-nutrition and functional dairy products. Health-conscious consumers are increasingly seeking products enriched with protein, probiotics, and vitamins. The market responds with fortified milk, yogurt, and cheese targeting digestive health, immunity, and bone strength. It experiences strong growth from the premiumization trend, where consumers prefer products perceived as healthier and more natural. Advances in dairy technology support the development of functional variants without compromising taste or texture. Marketing campaigns highlighting health benefits strengthen brand positioning. The combination of innovation and consumer awareness sustains steady demand.

Advancements in Processing and Packaging Technologies

The Europe Dairy Market gains momentum from modern processing and packaging technologies that enhance product shelf life and quality. Innovative pasteurization and cold-chain solutions maintain freshness while meeting safety regulations. It benefits from smart packaging that offers traceability and sustainability features to appeal to eco-conscious buyers. Technology integration reduces production costs and optimizes efficiency, enabling competitive pricing. Dairy processors invest in automation and AI-driven quality control to ensure consistent standards. Flexible packaging formats cater to varying consumer lifestyles and consumption patterns. Such technological progress enhances market competitiveness and consumer trust.

- For instance, Hochwald’s Mechernich facility in Germany processes 1.4 million liters of milk daily across 17 production lines and uses Hitachi vision systems for full traceability down to batch level.

Rising Influence of Sustainable Farming Practices

The adoption of sustainable farming practices plays a significant role in shaping the Europe Dairy Market. Dairy producers increasingly implement eco-friendly feed management, waste reduction, and renewable energy solutions. It gains from consumer preference for ethically sourced products with transparent supply chains. Retailers and brands highlight carbon footprint reduction and animal welfare to strengthen consumer loyalty. EU sustainability regulations push producers toward greener operations, encouraging industry-wide transformation. The alignment of environmental responsibility with market demand creates opportunities for differentiation. Sustainable practices also reduce long-term operational risks. This alignment fosters resilience and market credibility.

Expanding Retail and E-commerce Distribution Networks

The Europe Dairy Market sees growth from an expanding retail infrastructure and e-commerce penetration. Supermarkets, specialty stores, and online platforms broaden access to diverse dairy categories. It benefits from direct-to-consumer models that allow brands to engage customers with personalized offerings. Online channels support niche and premium product visibility beyond local markets. Retail collaborations with dairy brands boost promotional reach and consumer engagement. Improved logistics networks ensure timely delivery and product quality across regions. Stronger retail presence supports both traditional and innovative product launches. The integration of offline and online strategies strengthens market scalability.

- For instance, Hochwald’s Mechernich facility in Germany processes close to 2 million liters of milk daily across 17 production lines and uses Hitachi vision systems to ensure full traceability down to the production line, packaging, and raw milk batch level.

Market Trends

Rising Popularity of Plant-Based Dairy Alternatives

The Europe Dairy Market experiences a surge in plant-based alternatives that appeal to vegan, lactose-intolerant, and environmentally conscious consumers. Almond, oat, soy, and coconut-based products expand into milk, yogurt, and cheese categories. It benefits from innovation that enhances taste, texture, and nutritional profiles of plant-based options. Brands introduce fortified products to match the health value of traditional dairy. Product launches increasingly target flexitarian consumers who balance plant-based and animal-derived dairy. Packaging and marketing highlight environmental benefits, reinforcing appeal to sustainability-minded buyers. The segment’s expansion contributes to portfolio diversification for traditional dairy brands.

Premiumization and Artisan Dairy Offerings

The Europe Dairy Market witnesses a shift toward premium and artisan dairy products reflecting consumer demand for authenticity and quality. Gourmet cheese varieties, organic butter, and handcrafted yogurts gain strong market traction. It benefits from storytelling and provenance marketing that emphasize local sourcing and traditional methods. Premium offerings often feature limited editions and unique flavor combinations to attract niche segments. Consumers value artisanal craftsmanship and are willing to pay a premium for perceived exclusivity. Specialty retailers and high-end foodservice outlets support this trend’s visibility. Premiumization strengthens brand identity and customer loyalty.

- For instance, Italy’s Puglia-based dairy company produces 100% locally sourced buffalo milk mozzarella. It maintains a herd of around 800 buffalo and ensures tight control over the supply chain, processing milk within 24 hours of milking. Its mozzarella di bufala receives hand-stretching at 98 °C to preserve texture and nutrients. The company also crafts hand-formed trecce and artisanal ricotta using regional techniques.

Growth of Dairy-Based Functional Beverages

The Europe Dairy Market is expanding in the functional beverage segment, including protein shakes, probiotic drinks, and fortified smoothies. It leverages health trends and busy lifestyles that favor convenient nutrition solutions. Product formulations focus on immunity support, muscle recovery, and digestive health. Packaging innovations ensure portability and extended shelf life. Brands collaborate with nutritionists and fitness influencers to position products in the wellness segment. Dairy-based functional beverages appeal to both young urban professionals and active lifestyle consumers. This segment’s rapid growth provides opportunities for product differentiation.

- For instance, Danone’s Actimel probiotic drink delivers around 20 billion live L. casei Danone® cultures per bottle and includes vitamins D and B6 to support immune function. Valio offers functional dairy innovations such as its lactose-free Eila® MPC 65 milk protein concentrate, which enhances taste and texture in high-protein products while providing essential nutrients for healthy aging.

Adoption of Smart and Sustainable Packaging Solutions

The Europe Dairy Market sees increasing adoption of smart packaging that enhances product safety, freshness, and consumer interaction. It includes QR codes for origin tracking, freshness indicators, and eco-friendly materials. Sustainability drives the use of biodegradable, recyclable, and lightweight packaging. Brands integrate digital tools to engage consumers with recipes, sourcing information, and promotions. Packaging innovations support compliance with evolving environmental regulations. Improved materials help maintain product quality throughout distribution. Such advancements position dairy brands as both innovative and responsible market players.

Market Challenges Analysis

Volatility in Raw Material Prices and Production Costs

The Europe Dairy Market faces challenges from fluctuating raw milk prices and rising production costs. Global supply chain disruptions, feed cost increases, and energy price volatility affect profitability. It experiences pressure to maintain competitive pricing while ensuring quality standards. Producers face financial strain in balancing operational efficiency with investment in sustainable practices. Currency fluctuations in export markets add complexity to pricing strategies. Smaller producers find it harder to absorb cost fluctuations, risking market consolidation. Maintaining affordability without compromising quality remains a persistent challenge.

Regulatory Compliance and Shifting Consumer Preferences

The Europe Dairy Market operates within a highly regulated environment with stringent food safety, labeling, and sustainability requirements. It must adapt to evolving consumer expectations for transparency, ethical sourcing, and health-focused formulations. Compliance with EU environmental and nutritional labeling laws requires significant operational adjustments. Growing demand for plant-based alternatives challenges traditional dairy categories. Negative perceptions about dairy’s environmental impact can influence purchasing decisions. Competition from innovative non-dairy products puts additional pressure on brand loyalty. Aligning product innovation with regulatory and consumer trends is critical for long-term competitiveness.

Market Opportunities

Expansion into Health-Focused and Specialty Segments

The Europe Dairy Market has strong opportunities in health-focused and specialty product categories. Functional dairy with added probiotics, vitamins, and protein caters to wellness-driven consumers. It can target niche dietary needs such as lactose-free and low-fat products for specific demographics. Premium and organic offerings capture higher-margin segments, supported by storytelling and local sourcing narratives. Collaborations with healthcare and nutrition sectors can boost credibility and reach. Rising awareness about preventive healthcare encourages long-term demand for fortified dairy. Seasonal and limited-edition product launches can further strengthen brand differentiation and consumer loyalty.

Leveraging E-commerce and Export Potential

The Europe Dairy Market can expand through e-commerce and international trade. Online channels allow brands to reach diverse consumer bases with personalized offerings. Export opportunities exist in regions seeking high-quality European dairy. It can leverage strong brand heritage to penetrate premium global markets. Strategic distribution partnerships can enhance market penetration and brand visibility. Digital marketing campaigns can increase global brand awareness and drive direct-to-consumer sales. Adapting packaging and flavors for international tastes can improve competitiveness in new markets.

Market Segmentation Analysis:

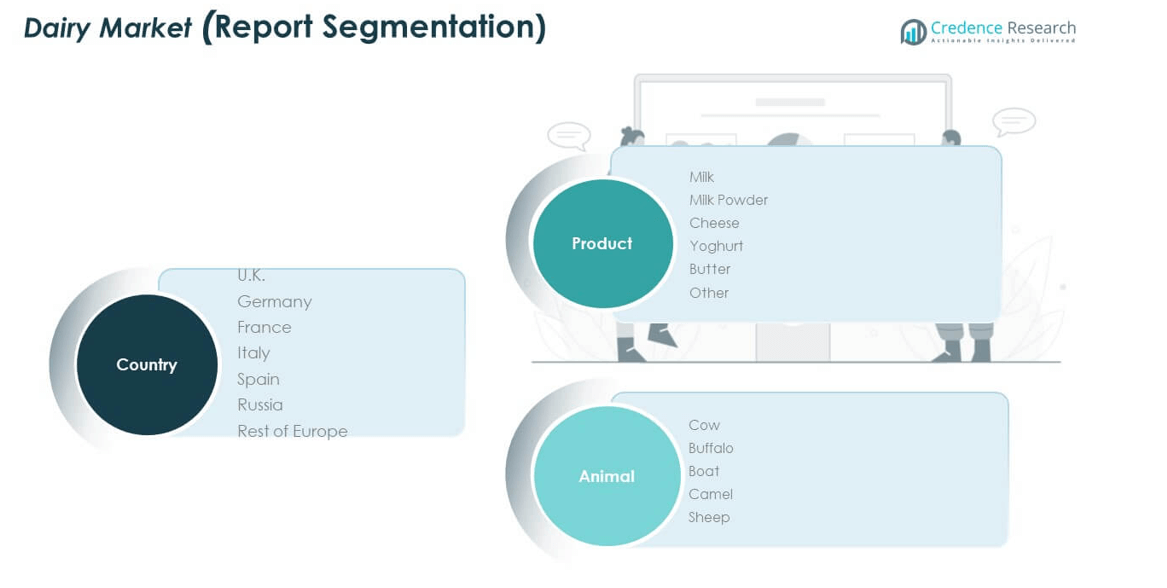

The Europe Dairy Market is segmented

By product into milk, milk powder, cheese, yoghurt, butter, and other dairy items. Milk remains the largest segment, supported by high household consumption and its role as a base ingredient in multiple processed dairy products. Cheese holds a strong position due to regional culinary traditions and growing demand for premium varieties. Yoghurt experiences steady growth driven by rising health awareness and the popularity of probiotic-rich options. Milk powder caters to both domestic processing industries and export markets, benefiting from longer shelf life and convenience. Butter maintains stable demand, supported by artisanal baking and premium foodservice use. Other dairy products, including cream and flavored beverages, contribute to portfolio diversification and niche market expansion.

- For example, Danone’s Activia stands out as a prominent probiotic yogurt brand in Europe. It incorporates the probiotic strain Bifidobacterium animalis DN‑173 010, specially formulated to survive the gastrointestinal tract and support digestive comfort.

By animal, the market includes cow, buffalo, goat, camel, and sheep milk. Cow milk dominates due to well-established dairy farming infrastructure and high production efficiency. Buffalo milk finds strong demand in specific regions for its rich texture and higher fat content, often used in specialty cheese and dairy desserts. Goat milk gains attention from lactose-sensitive consumers and those seeking unique nutritional benefits. Sheep milk serves both artisanal and industrial cheese-making, contributing to premium product categories. Camel milk remains a smaller segment but is gaining traction for its nutritional profile and appeal in functional and specialty health products. The diversity across product and animal segments enables the market to cater to varied consumer preferences, dietary needs, and regional demands, ensuring resilience and growth potential across multiple categories.

- For example, Mozzarella di Bufala Campana PDO stands as Europe’s most iconic buffalo milk cheese, holding Protected Designation of Origin (PDO) status since 1996. Italy annually produces around 33,000 tonnes of buffalo mozzarella, with approximately 16% allocated to export markets primarily within Europe.

Segmentation:

By Product

- Milk

- Milk Powder

- Cheese

- Yoghurt

- Butter

- Other

By Animal

- Cow

- Buffalo

- Goat

- Camel

- Sheep

By Region

- Europe (Overall)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe dominates the Europe Dairy Market with a market share of 48%, driven by mature consumption patterns, advanced processing facilities, and strong retail networks. Countries such as Germany, France, and the Netherlands lead production and exports, supported by efficient dairy farming and robust supply chains. Premium product demand, including specialty cheese and organic dairy, remains strong in this region. It benefits from established brands and high consumer trust in product quality and safety standards. Innovation in value-added products, coupled with sustainability-focused initiatives, continues to strengthen market presence. Western Europe also acts as a key hub for global dairy trade, leveraging its export capabilities to serve international markets.

Eastern Europe holds a market share of 28%, reflecting steady growth driven by rising disposable incomes and evolving dietary preferences. Poland, Hungary, and Romania are emerging as competitive producers with improving processing capabilities and export readiness. It gains from supportive government policies aimed at modernizing agriculture and enhancing food quality standards. The region shows increased adoption of advanced dairy technologies and investment in cold chain logistics. Domestic demand for both traditional and modern dairy products is expanding, supported by retail growth and urbanization. Export potential is also rising, particularly to nearby non-EU markets seeking affordable, good-quality dairy.

Southern Europe accounts for 24% of the market, with Italy, Spain, and Greece contributing significantly through their rich culinary traditions and specialty dairy offerings. It benefits from strong demand for artisanal cheese, yoghurt, and high-value niche products that enjoy both domestic and export appeal. Tourism boosts sales of premium dairy, particularly in hospitality and foodservice channels. Producers in this region emphasize local sourcing, authenticity, and traditional production methods to attract discerning consumers. Warmer climates in some areas encourage the growth of chilled and functional dairy segments. The combination of cultural heritage, product diversity, and growing international recognition supports long-term regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- Fonterra Cooperative Group

- Royal FrieslandCampina N.V.

- Arla Foods amba

- Danone S.A.

- Lactalis Group

- Ausnutria Dairy Corporation Ltd.

- Emmi Group

- Goat Partners International Inc.

- Holle Baby Food AG

- St Helen’s Farm

- Hewitt’s Dairy

- Woolwich Dairy Inc.

- Xi’an Baiyue Goat Dairy Group Co. Ltd.

- Courtyard Farms

- Other Key Players

Competitive Analysis:

The Europe Dairy Market is highly competitive, with a mix of multinational corporations, regional leaders, and niche producers. Major players such as Nestlé S.A., Danone S.A., Arla Foods amba, Lactalis Group, and Royal FrieslandCampina N.V. maintain dominance through extensive product portfolios, strong brand equity, and expansive distribution networks. It witnesses ongoing product innovation, with companies introducing functional, organic, and plant-based alternatives to meet evolving consumer preferences. Strategic mergers, acquisitions, and partnerships strengthen market positioning and broaden geographic reach. Smaller producers compete by focusing on artisanal quality, sustainability, and local sourcing. Competitive pricing strategies, coupled with marketing investments, remain central to gaining and retaining market share. The market’s diversity enables both large-scale industrial production and premium niche offerings to thrive.

Recent Developments:

- In June 2025, Amul entered the European market through a strategic partnership with Spain’s COVAP, launching its flagship fresh milk products in Spain and wider parts of the EU. The initiative debuted in Madrid and Barcelona, with plans for further expansion into Germany, Italy, Switzerland, and more, leveraging COVAP’s advanced processing capabilities and European dairy networks.

- In August 2025, Arla Foods amba announced a landmark merger with Germany’s DMK Group, creating what will be Europe’s largest dairy cooperative with over €19 billion in combined revenue. This move aims to enhance resilience and expand product offerings amid milk supply challenges and a competitive European market.

- In June 2025, Bel UK, a subsidiary of Bel Group, announced the launch of The Laughing Cow Spicy Chilli, a new chilli-flavored cream cheese portion targeting growing demand for spicy variants among younger consumers. This product, notable for having no artificial colors or flavors and only 31 calories per portion, became available through Ocado online in June and in Asda and Sainsbury’s from July.

Market Concentration & Characteristics:

The Europe Dairy Market demonstrates moderate to high concentration, with a few major companies accounting for a significant share of total revenue. It combines mature segments such as milk and cheese with fast-growing categories like functional dairy and plant-based alternatives. The market is characterized by strong regulatory oversight, advanced processing capabilities, and a focus on quality assurance. Consumer preferences are shifting toward health-focused, sustainable, and premium products, prompting continuous innovation. Both traditional dairy farming and advanced production facilities coexist, allowing flexibility in meeting diverse regional and export demands. Ongoing investments in technology and sustainability initiatives are expected to strengthen competitiveness and long-term growth.

Report Coverage:

The research report offers an in-depth analysis based on Product and Animal. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Dairy Market is set to expand with increasing consumer preference for nutrient-rich and functional dairy products tailored to health and wellness needs.

- Demand for premium and artisanal dairy items is likely to grow, driven by interest in authentic, locally sourced, and high-quality offerings.

- Plant-based dairy alternatives are expected to gain further traction, supported by innovation in taste, texture, and nutritional fortification.

- Sustainable production practices and eco-friendly packaging will become more integral to brand strategies and consumer purchasing decisions.

- Technological advancements in processing and preservation will enhance product quality, shelf life, and operational efficiency.

- E-commerce will play a stronger role in distribution, offering brands direct access to diverse consumer segments across multiple regions.

- Export potential will rise as European dairy continues to hold a reputation for quality in international markets.

- Product diversification into fortified beverages, lactose-free options, and specialty cheeses will open new revenue streams.

- Strategic mergers, acquisitions, and collaborations will reshape the competitive landscape and expand market reach.

- Regulatory frameworks focusing on health, safety, and sustainability will influence innovation and long-term market positioning.