Market Overview:

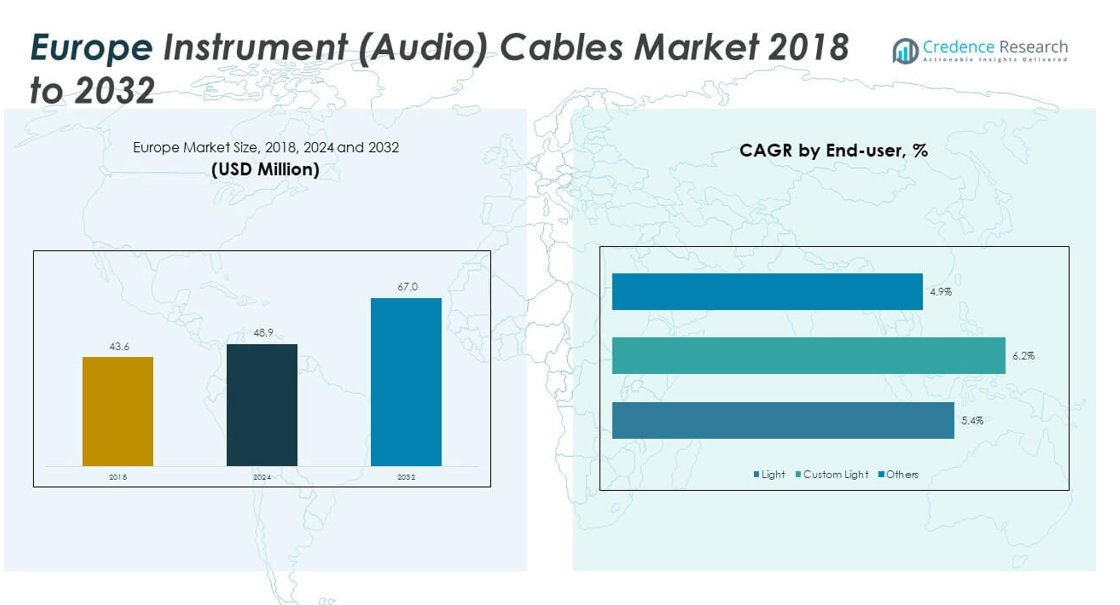

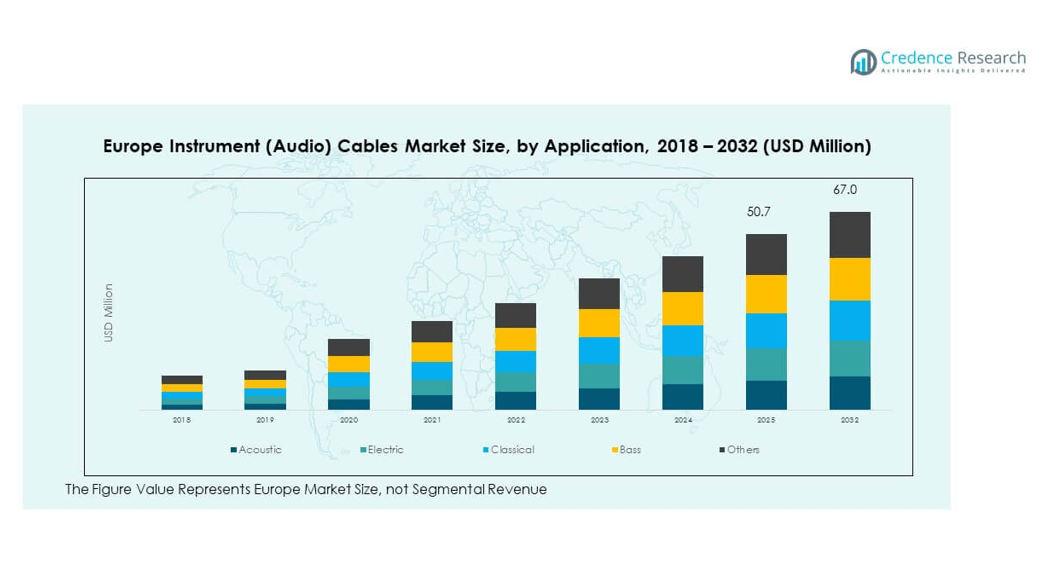

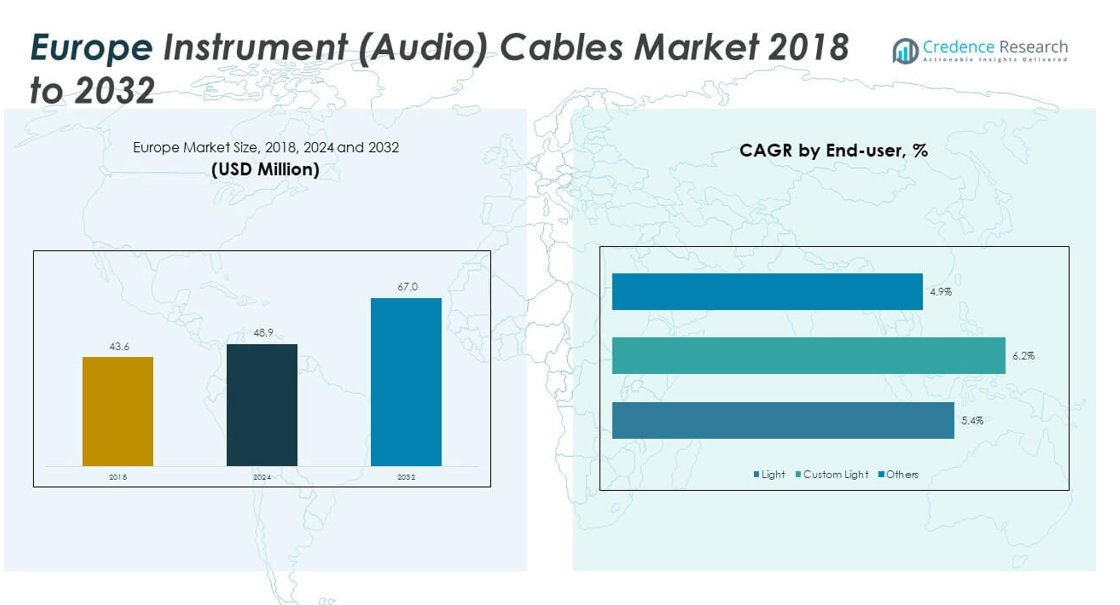

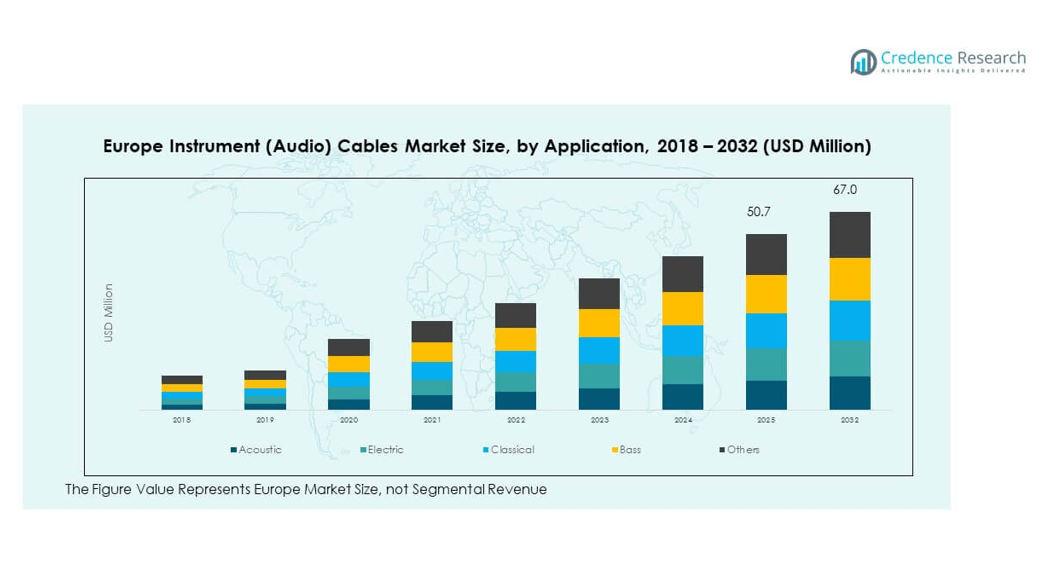

The Europe Instrument (Audio) Cables Market size was valued at USD 43.6 million in 2018 to USD 48.9 million in 2024 and is anticipated to reach USD 67.0 million by 2032, at a CAGR of 4.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Instrument (Audio) Cables Market Size 2024 |

USD 48.9 million |

| Europe Instrument (Audio) Cables Market, CAGR |

4.10% |

| Europe Instrument (Audio) Cables Market Size 2032 |

USD 67.0 million |

The market growth is being driven by rising demand for high-quality audio transmission in live performances, recording studios, and broadcasting applications. Increasing adoption of advanced audio equipment among musicians, coupled with growing entertainment and music production activities, is boosting the demand for durable and noise-resistant instrument cables. Furthermore, consumer preference for professional-grade audio accessories and the integration of advanced shielding technologies enhance signal clarity, contributing to steady market expansion across Europe.

Geographically, Western Europe leads the market with strong contributions from countries such as Germany, the UK, and France, driven by their thriving music industries and advanced live event infrastructure. Southern Europe is also emerging as a growth hub due to the rising adoption of audio equipment in cultural and tourism-driven events. Meanwhile, Eastern Europe is witnessing gradual growth supported by increasing investments in live entertainment and rising demand from emerging musicians, signaling broader regional opportunities for market players.

Market Insights:

- The Europe Instrument (Audio) Cables Market was valued at USD 48.9 million in 2024 and is anticipated to reach USD 67.0 million by 2032, expanding at a CAGR of 4.10%.

- The Global Instrument (Audio) Cables Market size was valued at USD 179.3 million in 2018 to USD 210.0 million in 2024 and is anticipated to reach USD 306.5 million by 2032, at a CAGR of 4.9% during the forecast period.

- Growth is supported by strong demand from live performances, recording studios, and broadcasting, with musicians prioritizing high-quality sound clarity.

- Rising music production and content creation across Europe drive the adoption of advanced cable technologies with better shielding and durability.

- Market restraints include growing competition from wireless alternatives and rising raw material costs impacting affordability for manufacturers.

- Western Europe leads the market with 42% share, driven by Germany, the UK, and France, while Southern and Eastern Europe show steady growth potential.

- Consumer preference for durable, customizable, and noise-resistant cables strengthens demand across both professional and institutional users.

- Expanding cultural events, educational initiatives, and home studio setups enhance the long-term growth outlook for the Europe Instrument (Audio) Cables Market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Professional Audio Quality in Entertainment and Live Performance

The Europe Instrument (Audio) Cables Market benefits from the growing preference for high-fidelity sound in concerts, theaters, and music festivals. Artists and performers expect cables that ensure clarity and eliminate interference during live shows. It is being supported by event organizers investing in upgraded audio infrastructure. Increasing live performances across urban centers fuel demand for premium-grade cables. Musicians prefer durable products capable of handling frequent stage use. The entertainment industry’s focus on delivering immersive experiences enhances product adoption. Professional studios also drive sales by requiring reliable cabling for consistent audio output. This demand continues to influence production and innovation in the market.

- For instance, Sommer Cable, a German manufacturer, is recognized for producing low-capacitance instrument and microphone cables such as the SC-SPIRIT LLX ‘Low Loss,’ which is widely used in professional live sound and studio applications to ensure interference-free audio transmission.

Expanding Music Production Activities Across Multiple Segments

Music recording, broadcasting, and content creation increase the requirement for robust cabling solutions. The Europe Instrument (Audio) Cables Market responds to this growth with innovations in shielding technologies. Studios demand cables that reduce signal loss and preserve tone accuracy. Streaming platforms and digital content providers encourage higher-quality production standards. Independent artists also invest in advanced equipment to meet listener expectations. Educational institutions offering music programs require reliable solutions for training purposes. The shift toward quality-driven production expands the addressable consumer base. It strengthens the market by driving long-term procurement cycles for specialized instrument cables.

Growing Preference for Durable and Customizable Cable Solutions

Consumers prioritize durability due to frequent handling, transport, and usage stress. The Europe Instrument (Audio) Cables Market sees higher adoption of reinforced designs that resist wear and tear. Professional users demand cables offering customizable lengths and connectors. It creates opportunities for manufacturers providing tailored solutions. Durable materials such as oxygen-free copper and braided shielding dominate product design. End users value flexibility in product selection to match instruments and stage setups. Brands invest in research to improve lifespan and reduce replacement costs. The focus on durability encourages repeat business and customer loyalty within the segment.

Integration of Advanced Technologies for Signal Clarity and Noise Reduction

Advanced shielding, gold-plated connectors, and multi-layered conductors are widely adopted in the Europe Instrument (Audio) Cables Market. It addresses the industry’s demand for interference-free transmission. Growing emphasis on superior sound reproduction encourages manufacturers to enhance specifications. High-end users consider advanced features critical for consistent studio and stage performance. The competitive market landscape drives innovation in material science and cable engineering. Professional users and hobbyists both seek products that elevate sound quality. Enhanced reliability creates stronger brand positioning for manufacturers. This push toward premium cable technology strengthens long-term market growth.

- For instance, Cordial GmbH, a German cable manufacturer, offers CSI series instrument cables equipped with gold-plated jack connectors, designed to deliver reliable signal transmission and enhanced sound clarity in both live and studio environments.

Market Trends

Rising Adoption of Eco-Friendly Materials and Sustainable Cable Production

Environmental concerns encourage cable manufacturers to adopt eco-friendly practices. The Europe Instrument (Audio) Cables Market aligns with regional sustainability regulations. Brands introduce recyclable jackets and low-toxicity insulation materials. It creates appeal among environmentally conscious consumers and institutions. The shift improves corporate reputations while meeting stricter compliance standards. Music schools and event organizers prefer products that align with sustainable initiatives. Green design innovation also drives differentiation in a competitive landscape. This trend influences procurement decisions in both professional and consumer segments.

- For instance, CORDIAL launched its ECOCORD instrument cables with sheaths made from 100% PVC-free, fully recyclable TPE-V material, eliminating PVC waste entirely.

Increasing Influence of E-Commerce Platforms on Distribution Models

The Europe Instrument (Audio) Cables Market experiences growth in online retail channels. E-commerce platforms simplify access to a wide range of product options. It benefits consumers seeking price comparisons, reviews, and quick delivery. Manufacturers collaborate with digital platforms to expand visibility. Online distribution reduces dependence on traditional stores while capturing new buyers. Smaller brands gain entry to international markets by leveraging digital sales. Professional musicians also rely on e-commerce for specialized accessories. This transition reshapes competitive strategies for both established and emerging players.

Rising Popularity of Home Studios and Independent Music Production

Affordable recording equipment and creative independence increase demand for instrument cables. The Europe Instrument (Audio) Cables Market benefits from this trend in urban and suburban areas. Independent artists build small studios that require high-performance cabling. It strengthens market penetration in segments outside large studios and concert halls. Social media platforms encourage aspiring musicians to create and share original content. Growth in this trend expands sales of entry-to-mid-range cable categories. Cable producers adjust offerings to cater to hobbyists and semi-professionals. This widespread adoption further diversifies the market’s consumer base.

Growing Role of Smart Technology and Connectivity in Audio Equipment

Integration of smart systems with audio devices impacts cable design. The Europe Instrument (Audio) Cables Market adapts to increased demand for compatibility with hybrid setups. It supports users combining traditional instruments with digital processors. Innovations in connectors and compatibility features improve usability. Technological integration reduces signal disruptions between analog and digital equipment. Cable makers position products as enablers of hybrid music ecosystems. Emerging compatibility with wireless accessories also influences product designs. This technology-driven trend enhances long-term relevance of instrument cables.

- For instance, KLOTZ AIS offers its M2FM series with precision shielding rated for full coverage, ensuring reliable performance in both analog and digital music systems, and supporting hybrid configurations in professional stage and studio environments.

Market Challenges Analysis

Rising Competition from Wireless Alternatives and Shifting Consumer Preferences

The Europe Instrument (Audio) Cables Market faces pressure from wireless solutions gaining popularity among musicians. It confronts challenges as artists seek mobility and convenience during performances. Wireless technologies reduce stage clutter and appeal to younger consumers. Cable producers must counter this perception by promoting reliability and sound quality. Traditional products risk losing ground if manufacturers fail to highlight unique advantages. Competition also intensifies from low-cost imports that undercut established brands. Shifts in consumer behavior create uncertainty in long-term adoption patterns. The challenge forces the industry to balance innovation with price competitiveness.

Supply Chain Vulnerabilities and Rising Raw Material Costs

Volatility in copper prices directly impacts manufacturing costs for instrument cables. The Europe Instrument (Audio) Cables Market struggles with balancing affordability and quality. It also faces risks from supply chain disruptions affecting timely product availability. Dependence on imported materials exposes manufacturers to currency fluctuations. Smaller players face greater difficulty in sustaining profit margins. Production delays affect distributors and retailers, weakening customer confidence. Environmental regulations on plastics increase operational burdens for cable producers. Managing these cost and supply pressures remains a significant challenge for the industry.

Market Opportunities

Expanding Demand from Educational Institutions and Music Academies

Music schools and academies create significant demand for reliable cables. The Europe Instrument (Audio) Cables Market benefits from training programs requiring durable and affordable solutions. It gains traction as governments support creative education initiatives. Educational institutions purchase in bulk, ensuring consistent revenue for suppliers. Long-term partnerships with universities strengthen brand visibility across regions. This demand extends to workshops, cultural festivals, and youth music programs. Manufacturers offering affordable yet quality solutions capture strong market share. Expanding outreach to this segment provides enduring growth opportunities.

Growing Potential in Emerging Eastern European Markets

Economic growth in Eastern Europe enhances consumer spending on music equipment. The Europe Instrument (Audio) Cables Market gains new opportunities in these regions. It builds momentum as local events and music festivals increase. Rising urbanization drives interest in musical instruments and supporting accessories. Retail expansion supports availability of professional audio products. Partnerships with regional distributors strengthen supply networks. Cultural diversification also boosts interest in modern music production. These developments create favorable ground for market expansion across emerging economies.

Market Segmentation Analysis:

By application, the Europe Instrument (Audio) Cables Market demonstrates diverse demand across its application segments. Acoustic cables hold strong relevance due to their widespread use among performers and learners seeking affordable yet reliable solutions. Electric cables account for significant adoption in studios and live concerts, supported by their role in professional setups that demand high sound clarity. Classical cables maintain a niche appeal, catering to traditional musicians who value tonal precision. Bass cables show steady demand because of their robust construction tailored for lower frequencies. The “Others” category covers hybrid and specialized cables serving experimental and modern audio setups.

- For instance, Cordial offers the CTI instrument cable series, widely used in acoustic applications for reliable performance in stage and studio environments.

By end-user segmentation, the market caters to distinct consumer groups. Light users represent casual performers and learners who prioritize cost-effective solutions with acceptable durability. The custom light segment grows steadily as musicians and semi-professionals demand cables tailored for specific instruments or stage configurations. It reflects the increasing willingness of users to invest in personalized products that enhance performance reliability. The “Others” category captures institutional and commercial buyers, including studios, schools, and cultural organizations, that require bulk purchases and long-term partnerships. This segmentation underscores the market’s ability to address both individual and institutional needs with tailored solutions.

- For instance, KLOTZ expanded its reach in educational and entry-level markets by supplying its versatile instrument cables across the UK and Poland, supporting both classroom use and budding musicians in introductory setups.

Segmentation:

By Application Segment

- Acoustic

- Electric

- Classical

- Bass

- Others

By End-User Segment

- Light

- Custom Light

- Others

Regional Analysis:

Western Europe dominates the Europe Instrument (Audio) Cables Market, holding a market share of 42%. Strong contributions come from Germany, the UK, and France, where live performances, music festivals, and recording studios create sustained demand. The region benefits from advanced entertainment infrastructure and a highly active professional music scene. It also gains momentum from rising investments in broadcasting and large-scale cultural events. High consumer preference for professional-grade accessories supports premium product adoption. Western Europe remains a hub for both domestic consumption and export activity.

Southern Europe accounts for 27% of the market share, led by Italy and Spain with their dynamic music and cultural sectors. Demand grows steadily due to strong tourism and frequent live events that require reliable audio equipment. It shows consistent growth in both consumer and institutional segments. Local distributors play a significant role in expanding availability of branded cables. The popularity of classical and traditional music in this region maintains demand for specialized cable categories. Southern Europe continues to strengthen its position with expanding retail networks and rising consumer spending on musical instruments.

Eastern Europe represents 18% of the market share and demonstrates emerging potential. It gains traction from economic growth and increasing investments in music education and cultural development. Rising urbanization and expanding middle-class income levels encourage higher spending on music accessories. The market benefits from government-supported events and local festivals driving equipment adoption. Russia leads the region in terms of demand, followed by Poland and other developing economies. It shows promise as an important growth frontier for long-term expansion. The rest of Europe, including smaller markets, contributes the remaining 13% share, supported by gradual improvements in consumer adoption and cultural engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Instrument (Audio) Cables Market is characterized by strong competition among global and regional players focused on performance, innovation, and brand reputation. Leading companies such as Mogami, Klotz, Fender, and Ernie Ball dominate the premium segment by offering cables engineered for professional musicians and studios. It maintains competitive intensity through constant product upgrades, durability enhancements, and advanced shielding technologies. Mid-tier brands like Shure, Boss, and Line 6 strengthen their positions by delivering versatile and affordable solutions, appealing to hobbyists and semi-professionals. Monster continues to emphasize high-end consumer products supported by strong retail visibility. Market dynamics also feature growing competition from local manufacturers offering cost-effective alternatives, particularly in emerging markets of Eastern Europe. Companies strengthen their presence through mergers, new product launches, and strategic regional expansions aimed at capturing niche and mass-market audiences. Competitive differentiation rests on durability, sound quality, and the ability to cater to both individual and institutional buyers.

Recent Developments:

- In January 2025, Fender unveiled a wide range of new cables and gigging essentials at the NAMM show, expanding their accessory portfolio. These additions included upgraded cables designed to enhance sound quality and playability for musicians. Fender also highlighted fresh cable models among other accessory innovations tailored for diverse musical applications.

- In January 2025, Ernie Ball announced a new release of Braided Instrument Cables in a Pumpkin Pie colorway, as well as an updated Flex Cable Collection with straight-to-angle plugs. The company also launched the Silent Cable for noiseless performance and added Tim Henson Signature cables to its premium lineup.

- In December 2023, International Audio Holding (IAH), a Netherlands-based developer and producer of high-end audio products, completed the acquisition of HMS Elektronik. This move was aimed at expanding IAH’s product portfolio and strengthening its standing in the European high-end audio market.

Market Concentration & Characteristics:

The Europe Instrument (Audio) Cables Market demonstrates moderate concentration with a mix of established global leaders and strong regional players. It reflects characteristics of a technology-driven industry where durability, quality, and customization drive consumer choice. Leading brands dominate the premium segment, while local companies compete in the low-to-mid price categories. The market features high product differentiation, with brands leveraging materials, design, and advanced shielding to stand out. It relies on both retail and online distribution, expanding accessibility across consumer groups. Product innovation remains essential for maintaining competitive advantage, supported by strategic alliances and consistent portfolio upgrades.

Report Coverage:

The research report offers an in-depth analysis based on Application and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Instrument (Audio) Cables Market is expected to witness steady growth as professional musicians, studios, and broadcasters continue prioritizing high-quality sound transmission.

- Demand for eco-friendly and recyclable materials will expand as sustainability regulations in Europe shape manufacturing practices and consumer preferences.

- Advancements in shielding and connector technologies will support higher adoption in premium and professional-grade segments.

- Online distribution channels will strengthen market reach, with e-commerce platforms becoming a preferred choice for both professional and hobbyist buyers.

- Growth in independent music production and home studios will expand the consumer base, creating opportunities for mid-tier and affordable product categories.

- Partnerships with educational institutions and music academies will provide long-term growth, supported by bulk purchasing and consistent replacement cycles.

- Eastern Europe will emerge as a high-potential market driven by rising disposable income, urbanization, and cultural investments.

- Hybrid usage combining traditional instruments with digital processors will increase, creating demand for versatile and compatible cable solutions.

- Competition from wireless alternatives will continue, but focus on reliability and superior audio performance will sustain cable demand.

- Product innovation and regional expansion strategies will remain critical for leading players to retain market share and strengthen brand positioning.