| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Industrial Fasteners Market Size 2024 |

USD 26020.89 million |

| Europe Industrial Fasteners Market, CAGR |

5.38% |

| Europe Industrial Fasteners Market Size 2032 |

USD 39571.92 million |

Market Overview

The Europe Industrial Fasteners Market is projected to grow from USD 26020.89 million in 2024 to an estimated USD 39571.92 million by 2032, with a compound annual growth rate (CAGR) of 5.38% from 2024 to 2032. The steady growth is attributed to the increasing demand for fasteners across key industries such as automotive, construction, aerospace, and machinery.

Several factors are propelling the growth of the Europe Industrial Fasteners Market. The robust growth in construction and infrastructure projects, as well as the rising demand from the automotive sector, are primary market drivers. Additionally, the shift towards automation and advanced manufacturing techniques is contributing to the need for high-quality, durable fasteners. Technological advancements in fastener manufacturing and the growing emphasis on sustainability also contribute to the market’s positive outlook.

Geographically, the European market shows varied demand patterns, with countries such as Germany, the UK, and France being the major contributors to the industrial fasteners market due to their developed manufacturing and automotive sectors. Key players in the region include companies such as Würth Group, LISI Group, and Arnold Umformtechnik, who are leading the market with innovative solutions and strong distribution networks. These companies focus on expanding their product portfolios and enhancing manufacturing capabilities to stay competitive.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Industrial Fasteners Market is expected to grow from USD 22,449.01 million in 2024 to USD 27,344.53 million by 2032, with a CAGR of 2.50% from 2025 to 2032.

- Growth in the automotive, construction, aerospace, and machinery sectors is fueling demand for durable and high-performance fasteners.

- Automation and advanced manufacturing techniques are contributing to the increased demand for specialized, high-quality fasteners.

- The rising focus on sustainability is pushing for eco-friendly, recyclable fasteners in industries such as automotive and construction.

- Western Europe, led by Germany, the UK, and France, dominates the market due to a well-established industrial base.

- Fluctuating raw material prices and supply chain disruptions pose challenges to manufacturers in maintaining cost efficiency.

- Major players like Würth Group, LISI Group, and Böllhoff lead the market with their innovative solutions and strong distribution networks.

Report scope

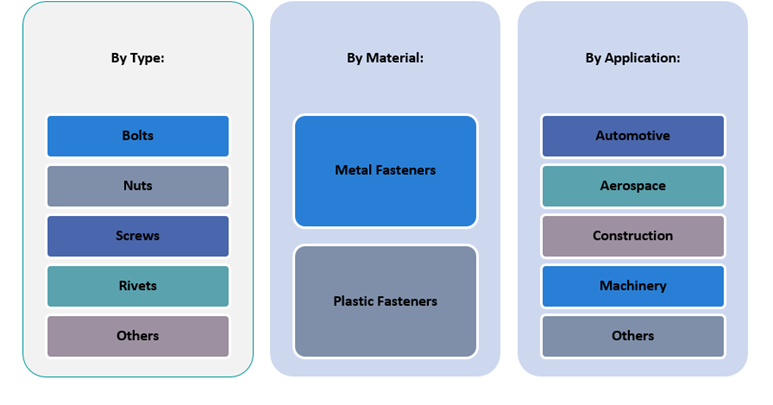

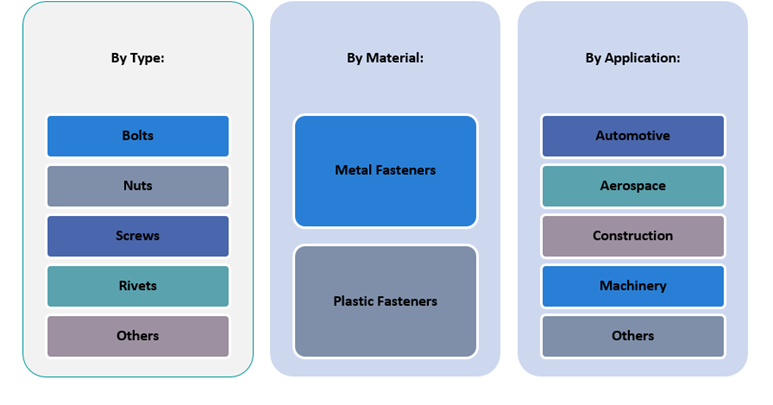

This report segments the Europe Industrial Fasteners Market as follow:

Market Drivers

Expanding Automotive and Aerospace Sectors

The automotive and aerospace sectors in Europe are pivotal to the growth of the industrial fasteners market, driven by the presence of leading manufacturers such as Volkswagen, BMW, Airbus, and Rolls-Royce. These industries require high-performance fasteners to ensure safety, durability, and structural integrity in vehicles and aircraft. For instance, the aerospace industry increasingly demands lightweight yet durable fasteners made from advanced materials like titanium and high-grade alloys to optimize fuel efficiency and performance. In the automotive sector, the shift toward electric vehicles (EVs) and autonomous technologies has introduced new fastening requirements. These include specialized fasteners for battery packs, electronic systems, and lighter vehicle structures. Germany, with its focus on precision engineering, leads in developing advanced fasteners for EVs and other applications. Additionally, ongoing investments in EV battery manufacturing across Europe highlight the need for innovative fastening solutions tailored to modern production lines.The aerospace industry is also experiencing growth due to rising air passenger traffic and next-generation aircraft development. This has led to increased demand for aerospace fasteners capable of withstanding stress and vibrations during flight. Companies like SPS Technologies are pioneering super alloys for fasteners to enhance durability and performance. As these sectors continue to innovate, the demand for reliable industrial fasteners will remain robust across Europe.

Growth in Construction and Infrastructure Development

The construction sector is another major driver of industrial fastener demand in Europe. Fasteners are essential for residential buildings, commercial complexes, transportation networks, and industrial facilities. The modernization of aging infrastructure in Western Europe and urbanization in Eastern Europe have intensified the need for durable fastening solutions. For instance, public infrastructure projects funded by EU initiatives like NextGenerationEU focus on railways, roads, bridges, and renewable energy installations.Green building practices are reshaping construction methods across Europe. Modular construction techniques using prefabricated components rely heavily on advanced fastening systems for secure connections and long-lasting performance. This trend aligns with sustainability targets emphasizing energy-efficient materials and eco-friendly fasteners. Additionally, smart city projects involve fastener-intensive activities such as attaching sensors for building automation systems.Despite challenges like labor shortages and fluctuating material costs, signs of recovery are evident in the construction sector. Rising house prices across many EU countries are encouraging new developments, particularly in regions like the Netherlands where housing demand is strong. Infrastructure investments remain stable due to government funding, further supporting the growth of industrial fastener consumption in construction activities. As Europe continues to invest in renovation projects and sustainable infrastructure, the demand for high-quality fasteners will grow steadily.

Advancements in Fastener Technology and Materials

Technological innovations in the fastener industry are reshaping product performance, quality, and efficiency. Manufacturers are increasingly developing fasteners that meet the demands of high-performance applications. These include corrosion-resistant coatings, lightweight materials, and customized designs tailored to specific industry requirements.One major trend is the integration of automation in manufacturing processes, which has led to greater precision, reduced waste, and enhanced production scalability. Computer-aided design (CAD), simulation tools, and CNC machining have become standard in fastener production, enabling manufacturers to offer bespoke solutions with superior performance characteristics.Moreover, the growing use of composite materials in industries like automotive and aerospace necessitates fasteners that can ensure reliable joints without damaging these lightweight substrates. This has led to the development of specialized fasteners like self-piercing rivets and structural adhesives used in conjunction with mechanical fasteners.Innovation is also driven by sustainability goals. Many manufacturers are adopting eco-friendly coatings and recyclable materials, aligning their product development strategies with the EU’s Green Deal and other environmental policies. These advancements not only improve fastener functionality but also appeal to environmentally conscious buyers and regulatory bodies.

Robust Industrial Manufacturing Base and Supply Chain Networks

Europe boasts a well-established industrial manufacturing base that supports the production and consumption of industrial fasteners. Countries such as Germany, Italy, and France have long-standing traditions in machinery, heavy equipment, and precision engineering. These industries consistently generate demand for fasteners in both assembly and maintenance operations.The presence of a mature supply chain ecosystem, including raw material suppliers, fastener manufacturers, distributors, and end-users, ensures a steady flow of products throughout the region. Logistics networks across Europe are highly integrated, enabling timely delivery and minimizing production downtimes for end-user industries.Moreover, industry clusters and trade associations play a significant role in enhancing collaboration among stakeholders. Initiatives to standardize product specifications, improve quality control, and promote innovation have collectively strengthened the regional market. The increasing focus on reshoring and regionalizing supply chains due to geopolitical uncertainties has also encouraged domestic production of fasteners, reducing reliance on imports and enhancing market stability.This robust industrial framework not only supports local demand but also strengthens Europe’s position as an exporter of high-quality industrial fasteners to global markets, reinforcing the region’s economic resilience and growth prospects.

Market Trends

Emphasis on Sustainability and Eco-Friendly Fastening Solutions

Sustainability is becoming an increasingly important trend in the European Industrial Fasteners Market. As part of the European Union’s Green Deal and other environmental regulations, industries across the continent are under pressure to reduce their environmental impact. Fastener manufacturers are responding by investing in eco-friendly materials, recyclable coatings, and sustainable production practices. There is a growing preference for fasteners made from materials that have a lower environmental footprint, such as biodegradable composites and alloys that can be easily recycled at the end of their life cycle.In the automotive and construction sectors, the use of sustainable materials in fasteners is also driven by the growing consumer demand for environmentally conscious products. OEMs are seeking fasteners that help reduce the overall carbon footprint of their products while maintaining high performance and safety standards. Additionally, fastener manufacturers are exploring alternative energy sources for production processes, such as solar and wind energy, to minimize carbon emissions.The shift towards sustainability is also evident in the growing trend of modular and prefabricated construction. These building techniques reduce waste, lower energy consumption during construction, and are more environmentally friendly, requiring innovative fastening solutions. Fasteners used in modular construction are often designed for easy disassembly and reuse, further contributing to the circular economy. The adoption of sustainable fastening solutions is expected to continue as part of Europe’s broader commitment to achieving net-zero emissions by 2050.

Growth of E-Commerce and Online Distribution Channels

Another significant trend in the Europe Industrial Fasteners Market is the rise of e-commerce and online distribution channels. The digitalization of purchasing and distribution in the fastener industry is transforming the way businesses and consumers access fastener products. The increasing reliance on online platforms for ordering industrial fasteners is driven by the growing need for convenience, quick delivery, and competitive pricing.Online distributors, such as Amazon Business, have emerged as key players in the market, offering a wide variety of fasteners from multiple manufacturers in one online marketplace. These platforms allow businesses to quickly search for and purchase fasteners, reducing lead times and simplifying the procurement process. Additionally, e-commerce platforms often provide product recommendations, reviews, and detailed specifications that assist customers in making more informed purchasing decisions.The convenience of online ordering is especially important for smaller businesses and DIY professionals who may not have access to large-scale physical distributors. Moreover, the growth of e-commerce is supported by advancements in logistics and supply chain management, enabling faster delivery times and more efficient inventory management. As e-commerce continues to expand, it is expected to become an increasingly important channel for fastener sales, especially as more businesses look to streamline their procurement processes and reduce costs.

Increasing Demand for High-Performance and Lightweight Fasteners

The demand for high-performance, lightweight fasteners has significantly increased across multiple industries in Europe, particularly in automotive, aerospace, and renewable energy sectors. As the automotive industry moves toward electric vehicles (EVs), manufacturers are focusing on reducing vehicle weight to improve energy efficiency. This trend is driving the need for lightweight fasteners made from advanced materials such as aluminum, titanium, and composites. These fasteners offer strength without adding excessive weight, which is essential in the automotive sector. For instance, surveys from major automotive companies highlight the importance of lightweight fasteners in achieving better fuel efficiency and reducing emissions.In aerospace, where fuel efficiency and performance are paramount, fasteners that offer both high strength and low weight are in high demand. Manufacturers are developing fasteners using advanced materials, including carbon fiber composites, which are lightweight and resistant to corrosion. Additionally, aerospace applications require fasteners that can withstand extreme temperatures, stresses, and vibrations, further pushing innovation in material selection and design. The renewable energy sector, particularly wind and solar power, is also contributing to the demand for lightweight and durable fasteners. Wind turbines, for instance, require fasteners that can hold up in harsh environments and withstand the forces generated by the turbines.

Integration of Automation and Digitalization in Manufacturing

The industrial fasteners market in Europe is witnessing significant advancements through automation and digitalization. The integration of robotics, artificial intelligence (AI), and the Internet of Things (IoT) into the manufacturing process is reshaping how fasteners are produced. Automated systems are being employed to improve precision, enhance efficiency, and reduce production costs. These technologies are enabling faster production cycles, lower error rates, and more consistent product quality, which is essential for industries with stringent quality standards such as aerospace and automotive. For instance, government surveys indicate that companies leveraging AI and IoT technologies have seen notable improvements in production efficiency and product reliability.Digitalization has also facilitated the introduction of smart manufacturing techniques, such as predictive maintenance and real-time monitoring of production lines. These innovations allow manufacturers to detect potential issues before they result in production delays or defects. Additionally, the use of AI in design and testing phases enables the creation of more optimized, durable, and cost-effective fasteners tailored to the specific needs of industries. The rise of Industry 4.0, which involves the interconnectivity of machines, data, and human resources, has further contributed to the adoption of automation in fastener manufacturing. With the use of cloud computing, manufacturers can collect and analyze vast amounts of data to make informed decisions, optimize supply chain management, and improve overall operational efficiency.

Market Challenges

Intense Competition and Price Sensitivity

The Europe Industrial Fasteners Market is highly competitive, with a large number of players, ranging from established multinational corporations to smaller local manufacturers. This intense competition drives price sensitivity among customers, particularly in price-conscious industries like construction and general manufacturing. With numerous suppliers offering similar products, price has become a key deciding factor for many customers, especially for bulk purchases.This competitive environment pressures manufacturers to constantly innovate and lower their production costs while maintaining product quality. Smaller players may struggle to compete with the economies of scale achieved by larger manufacturers, which can lead to market consolidation or the exit of smaller firms. In such a competitive landscape, fastener manufacturers must differentiate themselves by offering specialized, high-performance solutions, exceptional customer service, or value-added services to maintain profitability and market share. Balancing the need for cost reduction with the demand for innovation and product quality remains a major challenge for companies operating in this space.

Volatile Raw Material Prices and Supply Chain Disruptions

The Europe Industrial Fasteners Market faces significant challenges due to volatile raw material prices and persistent supply chain disruptions. Materials like steel, aluminum, and titanium, essential for fastener production, experience frequent price fluctuations driven by geopolitical tensions, global trade policies, and changes in demand. For instance, the European Union’s imposition of duties on Chinese fasteners has exacerbated supply chain vulnerabilities, creating long-term price instability. This unpredictability complicates cost planning for manufacturers and impacts profitability, as sudden hikes in material costs often force producers to absorb expenses or pass them to customers, straining market equilibrium. Supply chain disruptions have further intensified post-pandemic due to transportation delays, port congestion, labor strikes, and geopolitical conflicts like the Ukraine war. These issues have led to extended lead times—sometimes tripling delivery schedules—and increased costs for raw materials and logistics. Manufacturers reliant on just-in-time inventory systems, particularly in sectors like automotive and construction, face production halts and delayed project timelines. To mitigate these risks, companies are diversifying supplier bases, adopting advanced inventory management practices, and exploring alternative materials like high-performance plastics or recycled alloys. Such strategies aim to enhance resilience against disruptions while maintaining operational efficiency.

Market Opportunities

Emerging Demand from the Renewable Energy Sector

The growing focus on renewable energy sources, such as wind and solar power, presents significant opportunities for the Europe Industrial Fasteners Market. As Europe aims to meet sustainability targets and reduce carbon emissions, the expansion of wind farms and solar energy infrastructure is driving the demand for high-performance fasteners. These fasteners are essential for the installation and maintenance of renewable energy systems, requiring advanced materials that can withstand harsh environmental conditions. As investments in green technologies continue to grow, fastener manufacturers can capitalize on this trend by providing durable, corrosion-resistant solutions tailored to the renewable energy sector.

Growth in Electric Vehicle (EV) Manufacturing

The shift toward electric vehicles (EVs) is reshaping the automotive industry and creating new opportunities for the industrial fasteners market. As OEMs (Original Equipment Manufacturers) and suppliers focus on electric vehicle production, there is a rising need for specialized fasteners that meet the unique demands of EV assembly, such as lightweight materials, high-strength performance, and precision. The increase in EV adoption across Europe, driven by government incentives and environmental regulations, will further spur the demand for automotive fasteners. Manufacturers can leverage this opportunity by offering tailored fastening solutions that address the specific needs of electric vehicle designs, including battery assembly, chassis, and electrical components. This shift toward EVs will likely lead to long-term growth in the industrial fasteners market.

Market Segmentation Analysis

By Product

The Externally Threaded Fasteners segment is one of the largest in the market, accounting for a significant portion of demand. These fasteners, including bolts, screws, and studs, are used across industries like automotive, construction, and machinery. Externally threaded fasteners are preferred for their ability to create strong, removable connections. Internally Threaded Fasteners, such as nuts and inserts, are also in high demand for applications that require secure fastening from the inside of components. These fasteners play a critical role in structural integrity, especially in machinery and automotive applications. The Non-threaded Fasteners segment, including rivets, pins, and clips, is used extensively in industries that require permanent or semi-permanent connections. Non-threaded fasteners are particularly common in the aerospace and automotive sectors due to their ability to handle vibration and load stress. Aerospace Grade Fasteners have unique requirements in terms of material strength, corrosion resistance, and weight, contributing to their growing demand in the aerospace sector as the industry continues to expand.

By Raw Material

The market is primarily driven by Metal Fasteners, which dominate the segment due to their strength, durability, and suitability for high-stress environments. Steel and titanium fasteners are especially prevalent in automotive, aerospace, and industrial machinery due to their resistance to heat, corrosion, and mechanical stress. Plastic Fasteners are gaining traction, particularly in industries that prioritize lightweight materials and corrosion resistance. These fasteners are increasingly used in automotive applications, electrical equipment, and consumer electronics, where reducing weight and preventing corrosion are key factors.

Segments

Based on Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

Based on Raw Material

- Metal fasteners

- Plastic Fasteners

Based on Application

- Automotive

- Aerospace

- Oil & Gas

- Building & Construction

- Others

Based on Distribution Channel

Based on Region

- Western Europe

- Eastern Europe

- Northern Europe

Regional Analysis

Western Europe (60%)

Western Europe holds the largest market share in the Europe Industrial Fasteners Market, contributing approximately 60% of the total market share. This dominance is primarily driven by the robust industrial and manufacturing sectors in countries such as Germany, France, and the UK. Germany is a key player, known for its automotive, machinery, and engineering industries, which are the primary consumers of industrial fasteners. The UK and France also contribute significantly, with a strong presence of aerospace, automotive, and construction industries. The demand for high-quality and durable fasteners is expected to continue growing in this region due to the increasing demand for advanced manufacturing techniques, automotive production, and infrastructure development.

Eastern Europe (20%)

The Eastern Europe region is experiencing rapid industrialization and infrastructure development, which is propelling the growth of the industrial fasteners market. Countries like Poland, Czech Republic, and Hungary are witnessing increased demand for fasteners as they expand their automotive, construction, and manufacturing industries. The region holds a market share of approximately 20%, with fasteners being in high demand for construction, automotive assembly, and machinery manufacturing. The region benefits from lower labor costs, which make it an attractive destination for manufacturing facilities, further driving the consumption of fasteners. As Eastern Europe continues to develop and attract foreign investments, the demand for industrial fasteners is expected to increase steadily in the coming years.

Key players

- Böllhoff

- Würth Group

- LISI Group

- SFS Group

- Honsel Group

Competitive Analysis

The Europe Industrial Fasteners Market is highly competitive, with several established players like Böllhoff, Würth Group, LISI Group, SFS Group, and Honsel Group leading the market. These companies focus on product innovation, strategic partnerships, and robust distribution networks to maintain market dominance. Böllhoff stands out with its strong product portfolio, offering high-quality fasteners and assembly solutions for a variety of industries, while Würth Group’s extensive reach and established brand make it a formidable player in the distribution segment. LISI Group differentiates itself through specialized aerospace-grade fasteners, while SFS Group leverages its expertise in precision engineering and fastener technology. Honsel Group is focusing on expanding its manufacturing capabilities and enhancing product offerings to cater to growing demand. The competition among these players is driven by a strong emphasis on customer service, quality, and innovation. Their strategies focus on expanding their global presence, adopting digital transformation, and diversifying product offerings to meet evolving industry needs.

Recent Developments

- In December 2024, Nitto Seiko reported progress under its medium-term business plan “Mission G-second,” focusing on automation and electrification demands. Despite economic slowdowns in regions like the U.S. and Thailand, the company improved operating income through price adjustments for screw fastening machines.

- In December 2024, ARP launched an upgraded high-strength fastener kit for DART LS Next engine blocks. This kit uses 8740 chromoly steel, offering improved fatigue strength and reliability, catering to high-performance automotive applications.

- In February 2024, ITW reported its financial results for 2023, highlighting a 2% organic growth and a 130 basis point increase in operating margin to 25.1%. While the report emphasizes customer-focused innovation, it does not specifically detail advancements in fastener product lines.

- As of January 1, 2025, SFS Group restructured its Distribution & Logistics and Fastening Systems segments to focus more sharply on end-market-specific needs, particularly in construction fasteners.

Market Concentration and Characteristics

The Europe Industrial Fasteners Market is moderately concentrated, with a few key players dominating the market share, including Böllhoff, Würth Group, LISI Group, SFS Group, and Honsel Group. These companies hold significant market power through extensive product portfolios, advanced manufacturing capabilities, and strong distribution networks. However, the market also has room for smaller, specialized players who focus on niche applications such as aerospace-grade fasteners or eco-friendly solutions. The market is characterized by intense competition, driven by technological innovation, quality differentiation, and the need for customization to meet the specific demands of industries like automotive, aerospace, construction, and manufacturing. While large companies have a competitive edge due to economies of scale, smaller players often compete by offering highly specialized or region-specific solutions. The overall market is evolving toward higher performance standards, sustainability, and digital integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Raw Material, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The automotive industry will remain a major driver of demand, especially with the growing adoption of electric vehicles and autonomous driving technology, necessitating high-quality, lightweight fasteners.

- Fastener manufacturers will increasingly focus on high-performance materials like titanium and composites to meet the evolving demands of aerospace, automotive, and renewable energy sectors.

- The growing emphasis on sustainability in Europe will lead to increased demand for eco-friendly, recyclable fasteners, particularly in construction, automotive, and industrial machinery.

- Automation and digitalization in manufacturing processes will increase, allowing for greater precision, reduced costs, and faster production cycles in the fastener market.

- The expansion of the renewable energy sector, particularly in wind and solar power, will drive demand for durable and corrosion-resistant fasteners for infrastructure and machinery.

- As industries require more specialized fastening solutions, manufacturers will focus on providing custom-designed fasteners to meet unique performance and safety standards.

- Plastic fasteners will continue to gain traction, especially in lightweight and corrosion-resistant applications, providing alternative solutions in automotive and electronics industries.

- The rise of e-commerce platforms will make it easier for businesses and consumers to access a wide range of fastener products, enhancing distribution and reducing lead times.

- As Eastern Europe continues to industrialize, there will be increased investments in manufacturing and infrastructure, boosting demand for industrial fasteners across the region.

- With market growth, competition will intensify as both large multinational companies and smaller specialized players work to differentiate themselves through innovation, product quality, and customer service.