| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Industrial Pumps Market Size 2024 |

USD 12,061.54 Million |

| Europe Industrial Pumps Market, CAGR |

3.5% |

| Europe Industrial Pumps Market Size 2032 |

USD 15,883.54 Million |

Market Overview:

The Europe Industrial Pumps Market is projected to grow from USD 12,061.54 million in 2024 to an estimated USD 15,883.54 million by 2032, with a compound annual growth rate (CAGR) of 3.5% from 2024 to 2032.

Several factors are propelling the growth of the Europe industrial pumps market. The increasing demand for efficient fluid handling solutions across industries such as water and wastewater treatment, chemicals, oil and gas, and power generation highlights the critical role of industrial pumps. Notably, the expansion of the water and wastewater sector, driven by urbanization and stricter environmental regulations, requires advanced pumping systems for effective water management. Furthermore, ongoing technological advancements aimed at improving pump efficiency and reducing energy consumption are contributing to the rising market demand. The adoption of smart pumps, which offer enhanced monitoring and control capabilities, is also gaining traction as industries seek greater automation and operational efficiency. These innovations are aligning with the broader trend toward Industry 4.0, fueling the demand for more advanced solutions.

Regionally, Germany is expected to experience the highest growth, driven by its strong industrial base and commitment to technological innovation. In terms of product segments, centrifugal pumps have traditionally dominated the market, but positive displacement pumps are anticipated to witness the fastest growth in the coming years. The continued expansion of the chemical, oil, and gas industries in key European countries is driving demand for both centrifugal and positive displacement pumps. Additionally, significant investments in infrastructure development across the region are spurring the need for advanced pumping solutions across various industrial sectors, further boosting market prospects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Industrial Pumps Market is projected to grow from USD 12,061.54 million in 2024 to an estimated USD 15,883.54 million by 2032, with a compound annual growth rate (CAGR) of 3.5% from 2024 to 2032.

- The global industrial pumps market is projected to grow from USD 45,756.97 million in 2024 to USD 63,738.11 million by 2032, driven by increasing demand across multiple sectors.

- Technological advancements, including smart pumps with automation and real-time monitoring, are enhancing operational efficiency and reducing maintenance costs, fueling market expansion.

- The increasing need for sustainable water and wastewater management, spurred by urbanization and stricter environmental regulations, is a major growth factor.

- The oil and gas industry’s growth continues to drive demand for industrial pumps, especially for fluid transfer, refining, and transportation of oil and gas products.

- As the industrial and manufacturing sectors in Europe expand, there is a rising need for advanced pumps to meet the fluid handling demands in chemicals, pharmaceuticals, and food processing.

- Despite growth prospects, high initial investment costs for advanced pumping systems pose a challenge, particularly for small and medium-sized enterprises (SMEs).

- Regulatory compliance with evolving environmental standards and increased competition in the market are key challenges that manufacturers need to address to maintain market position.

Market Drivers:

Rising Demand in Water and Wastewater Treatment

One of the primary drivers of the Europe Industrial Pumps Market is the growing demand for effective water and wastewater management solutions. As urbanization accelerates, there is an increasing need for advanced infrastructure to manage water resources efficiently. Stricter environmental regulations across European countries also require industries to adopt technologies that ensure clean water supply and treatment. For instance, Germany, which holds the largest share of the European water and wastewater treatment market, has implemented advanced technologies to meet stringent environmental regulations and improve water quality. Industrial pumps are essential for transporting, pressurizing, and managing water and wastewater, making them indispensable for industries involved in water purification and treatment. The consistent expansion of this sector, particularly with the rise in population density and the push for sustainability, continues to fuel market growth.

Technological Advancements and Energy Efficiency

Technological innovations in industrial pumps are playing a critical role in driving the market forward. Manufacturers are increasingly focusing on developing pumps that are more energy-efficient, durable, and capable of handling a wider variety of fluids. Advancements such as smart pumps, which integrate monitoring, control, and automation capabilities, are gaining significant traction. These smart systems allow for real-time data collection, better performance management, and predictive maintenance, all of which contribute to reduced operational costs. As industries continue to prioritize energy efficiency and cost reduction, the demand for these high-performance pumps is set to rise.

Growth of Oil and Gas Industry

The oil and gas industry remains a significant contributor to the growth of the industrial pumps market in Europe. As exploration and production activities intensify, there is a growing need for pumps that can handle the complex transportation and storage requirements of oil, gas, and their derivatives. Industrial pumps are crucial for upstream and downstream activities, such as crude oil extraction, refining, and the transportation of refined products. The stability and growth of this sector, along with the increasing demand for energy, directly impact the demand for pumps that can operate efficiently under challenging and extreme conditions. The ongoing investments in the oil and gas industry across Europe are expected to sustain this market demand.

Expansion of Industrial and Manufacturing Sectors

The expanding industrial and manufacturing sectors in Europe also contribute to the rising demand for industrial pumps. Industries such as chemicals, pharmaceuticals, and food processing rely on pumps for fluid transfer and precise material handling. For instance, Germany’s strong industrial base drives innovation in pump technologies that meet stringent environmental standards while ensuring operational efficiency. The European region is home to numerous multinational companies in these industries, which consistently invest in advanced pumping solutions to enhance productivity and meet high-quality standards. Furthermore, the growing trend toward automation and process optimization in these sectors ensures that pumps play a vital role in maintaining continuous operations. As European manufacturing continues to modernize and expand, the need for reliable and efficient pumping systems is anticipated to increase, further driving market growth.

Market Trends:

Shift Toward Smart and Automated Pumps

One of the significant trends shaping the Europe Industrial Pumps Market is the increasing shift toward smart and automated pumping solutions. As industries focus more on improving operational efficiency and reducing maintenance costs, the adoption of pumps with integrated sensors, advanced monitoring systems, and automation capabilities is growing. These smart pumps are designed to provide real-time data on performance, enabling predictive maintenance and minimizing downtime. The automation trend in industries such as manufacturing, chemicals, and water treatment is propelling the demand for pumps that offer enhanced control and monitoring. This transition toward digitalization aligns with the broader Industry 4.0 movement and is expected to continue influencing market dynamics in the coming years.

Growing Focus on Sustainability and Environmental Regulations

Sustainability continues to be a driving force in the European industrial pumps market. Governments across the region are imposing stricter environmental regulations to minimize water usage, reduce energy consumption, and improve waste management. Industrial pumps play a crucial role in achieving these sustainability goals, particularly in sectors like water treatment and chemical processing. In response to these regulations, pump manufacturers are focusing on developing products that comply with environmental standards while improving efficiency. For example, Grundfos launched a line of corrosion-resistant pumps equipped with smart sensors to support water treatment applications while minimizing energy use. Energy-efficient pumps and those designed for use with environmentally friendly fluids are gaining popularity as industries look for solutions that minimize their environmental footprint.

Integration of Energy-Efficient Solutions

Energy efficiency is becoming a key trend within the Europe Industrial Pumps Market as companies seek to reduce operational costs and comply with increasingly stringent environmental standards. Industrial pumps are among the largest consumers of energy in various industries, and improving their efficiency can lead to significant savings. Manufacturers are responding to this trend by introducing energy-efficient pump designs, including variable frequency drives (VFDs) and advanced control systems, which allow pumps to adjust their speed and power consumption based on demand. For instance, Flygt utilizes computational fluid dynamics (CFD) to design pump stations that minimize sedimentation and enhance operational reliability. As energy prices rise and environmental concerns grow, companies are prioritizing the adoption of energy-efficient pump solutions to ensure long-term cost savings and sustainability.

Rise in Demand for Customized Pump Solutions

Another key trend in the Europe Industrial Pumps Market is the increasing demand for customized pump solutions. As industrial processes become more complex and specialized, there is a growing need for pumps tailored to meet specific operational requirements. Customization allows manufacturers to design pumps that can handle unique fluids, pressures, and temperatures, enhancing efficiency and performance. Industries such as chemicals, pharmaceuticals, and food processing are driving this trend, as each sector has distinct requirements that standard pumps may not meet. The ability to offer customized solutions is becoming an essential competitive advantage for pump manufacturers, and this trend is expected to continue as industrial processes evolve and become more diverse.

Market Challenges Analysis:

High Initial Investment Costs

One of the key restraints in the Europe Industrial Pumps Market is the high initial investment required for advanced pumping systems. While the long-term benefits of energy-efficient, smart, and customized pumps are substantial, the initial capital required for these advanced systems can be a barrier for many businesses, particularly small and medium-sized enterprises (SMEs). For instance, centrifugal pumps equipped with smart monitoring systems and variable frequency drives (VFDs) can cost significantly more due to premium materials and advanced technologies. The costs associated with the purchase, installation, and integration of high-tech pumps can be prohibitive for industries with limited budgets. As a result, some companies may opt for less advanced or older models that are less efficient, ultimately impacting long-term operational efficiency and increasing maintenance costs.

Maintenance and Operational Complexity

The increasing complexity of modern industrial pumps presents another challenge for market growth. With the integration of advanced technologies such as automation, sensors, and digital control systems, these pumps require specialized maintenance and operation knowledge. As a result, companies may face difficulties in training their workforce to effectively manage and maintain these advanced systems. Moreover, the need for specialized parts and maintenance services increases operational complexity and downtime, particularly when pumps require repairs or replacements. These factors can lead to higher operational costs and reduced efficiency, creating challenges for industries looking to optimize their pump systems.

Regulatory Compliance and Environmental Standards

While stricter environmental regulations are driving market growth in some cases, they also pose challenges for manufacturers and industries in the Europe Industrial Pumps Market. The need to comply with evolving environmental standards requires constant innovation and adaptation of pumping solutions. Meeting these regulatory requirements often involves additional research, development, and certification processes, which can increase costs and time to market. For companies, staying compliant with these regulations while maintaining cost-effective operations can be a significant challenge, particularly in industries where environmental standards are constantly evolving.

Market Saturation and Competition

The Europe Industrial Pumps Market is highly competitive, with numerous players offering a wide range of products. This saturation can make it difficult for new entrants to gain a foothold in the market. Established players benefit from brand recognition, extensive distribution networks, and long-term relationships with clients, making it challenging for smaller manufacturers to compete effectively. Intense competition can lead to price wars, which might compromise profitability for companies trying to differentiate themselves through innovation and quality.

Market Opportunities:

One of the key opportunities for growth in the Europe Industrial Pumps Market lies in the expansion of emerging industrial sectors, particularly renewable energy, biotechnology, and electric vehicle (EV) manufacturing. As Europe continues to transition toward cleaner energy sources and more sustainable industrial practices, industries related to renewable energy, such as wind and solar power, require specialized pumping systems for their processes. The growth of these sectors presents an opportunity for manufacturers to design and provide customized pumps that meet the specific requirements of renewable energy production, such as fluid handling for cooling systems and wastewater treatment. Similarly, as the biotechnology and EV industries evolve, new applications for industrial pumps are emerging, creating a demand for innovative pumping solutions in areas like fluid transfer, chemical processing, and battery manufacturing.

Another significant opportunity in the market lies in the growing demand for technological innovation and smart pumping solutions. The increasing focus on automation, Industry 4.0, and the integration of the Internet of Things (IoT) in industrial operations opens up opportunities for pump manufacturers to offer intelligent systems that enhance performance, improve energy efficiency, and reduce maintenance costs. The development of smart pumps with real-time monitoring and predictive analytics allows businesses to optimize their operations, prevent downtime, and improve overall system performance. As industries across Europe continue to invest in digital transformation and automation, there is a clear opportunity for companies to capitalize on the demand for these advanced, high-performance pump systems.

Market Segmentation Analysis:

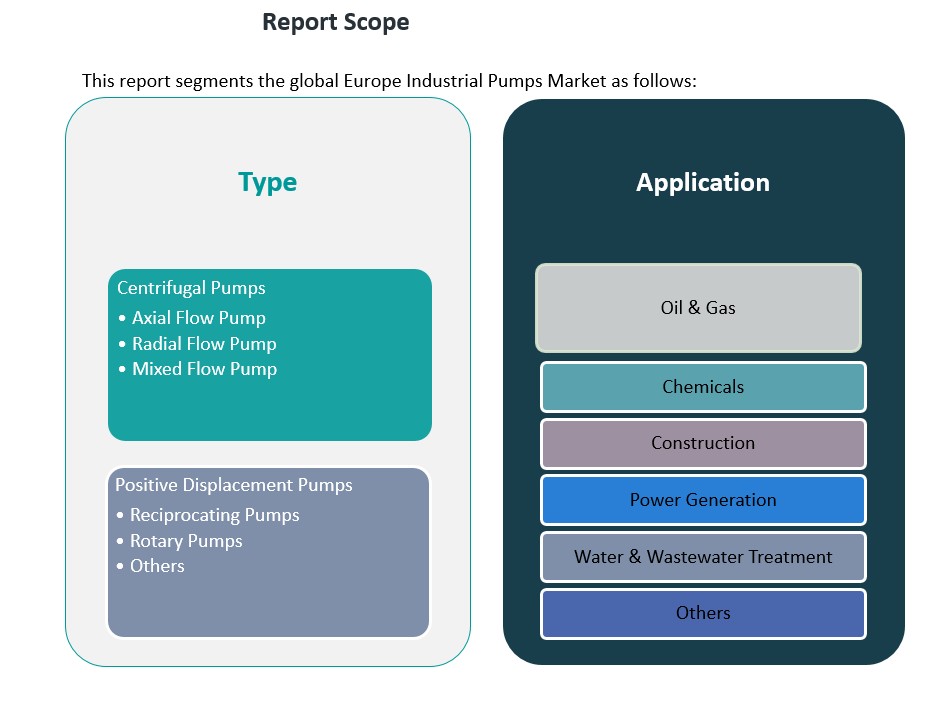

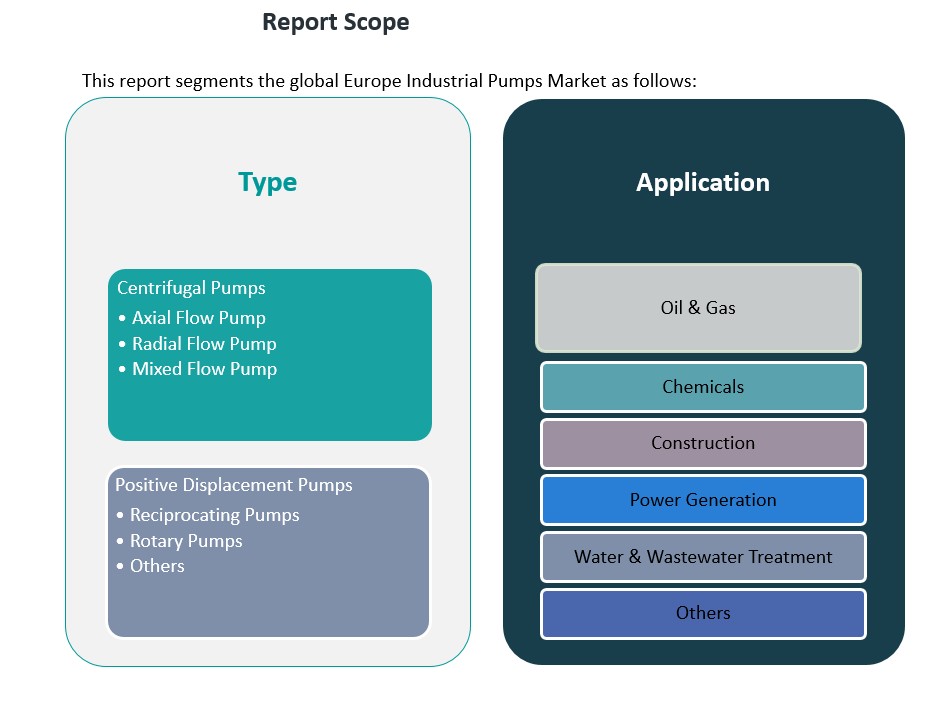

The Europe Industrial Pumps Market is broadly segmented by product type and application, each playing a crucial role in driving market dynamics.

By Product Type

The market is divided into two primary categories: centrifugal pumps and positive displacement pumps. Centrifugal pumps dominate the market, with sub-segments including axial flow, radial flow, and mixed flow pumps. These pumps are widely used in applications requiring efficient fluid transfer, especially in industries such as water treatment and power generation. Axial flow pumps are used for high flow rates at low pressures, while radial and mixed flow pumps handle medium to high-pressure applications. Positive displacement pumps, which are also gaining traction, include reciprocating and rotary pumps. These are ideal for applications where precise flow control and high pressure are essential, such as in the oil and gas and chemical sectors. Reciprocating pumps are commonly used in high-pressure applications, while rotary pumps are preferred in industries requiring continuous and smooth flow.

By Application

In terms of application, the Europe industrial pumps market is segmented into oil & gas, chemicals, power generation, water & wastewater treatment, and others. The water and wastewater treatment sector holds a significant share due to rising urbanization and stringent environmental regulations. The oil and gas industry also drives strong demand for pumps, particularly in fluid transfer and processing operations. The chemicals and power generation industries contribute to market growth, as both sectors require pumps for fluid handling, cooling, and chemical processes. The construction sector relies heavily on pumps for dewatering, concrete mixing, and other fluid handling tasks. Water and wastewater treatment applications drive substantial demand for pumps, as efficient fluid distribution and filtration are essential for sustainable water management. Other applications include food processing, pharmaceuticals, and manufacturing, where pumps are critical for various fluid handling needs.Top of Form

Segmentation:

By Product Type:

- Centrifugal Pumps

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pumps

- Reciprocating Pumps

- Rotary Pumps

- Others

By Application:

- Oil & Gas

- Chemicals

- Construction

- Power Generation

- Water & Wastewater Treatment

- Others

Regional Analysis:

The Europe Industrial Pumps Market is characterized by a diverse and dynamic landscape, driven by the region’s strong industrial base and rapid technological advancements. The market is segmented into several key regions, including Western Europe, Eastern Europe, and Northern Europe, each exhibiting distinct growth drivers and challenges.

Western Europe

Western Europe holds the largest market share in the Europe Industrial Pumps Market, accounting for a significant portion of the overall revenue. This region includes major industrial hubs such as Germany, France, and the United Kingdom, where industrial activities such as manufacturing, chemicals, oil and gas, and water treatment are prevalent. Germany, in particular, stands out as the dominant market, supported by its robust industrial base, high investment in infrastructure, and technological advancements. The demand for industrial pumps in Western Europe is primarily driven by the expansion of automation, energy efficiency initiatives, and stringent environmental regulations. Additionally, the growing emphasis on renewable energy and sustainable water management further boosts the demand for advanced pumping solutions in this region.

Eastern Europe

Eastern Europe, although smaller in terms of market share, is witnessing significant growth. Countries such as Russia, Poland, and Hungary are investing heavily in industrialization and infrastructure development, which is creating new opportunities for industrial pump manufacturers. The demand in this region is driven by the rapid expansion of sectors such as energy, water treatment, and manufacturing, along with the increasing need for modernized industrial infrastructure. While Eastern Europe lags behind Western Europe in market share, the ongoing industrial developments and adoption of energy-efficient technologies position it as a region of growing potential in the industrial pumps market.

Northern Europe

Northern Europe, which includes countries such as Sweden, Finland, and Denmark, is also experiencing steady growth in the industrial pumps market. The demand for pumps in this region is closely linked to the growth of industries such as chemical processing, marine, and renewable energy. Northern Europe has been at the forefront of sustainability efforts, with a strong focus on eco-friendly technologies and energy-efficient solutions. As a result, there is a growing demand for industrial pumps that align with these sustainability goals. This, combined with ongoing investments in automation and digitalization, contributes to the steady growth of the market in Northern Europe.

Key Player Analysis:

- Grundfos Holding A/S

- Wilo SE

- Sulzer Ltd

- Pentair plc

- Schneider Electric

Competitive Analysis:

The Europe Industrial Pumps Market is highly competitive, with several key players dominating the landscape. Major manufacturers such as Grundfos, Flowserve, KSB, and Sulzer hold substantial market shares, driven by their established brand presence, extensive product portfolios, and strong distribution networks. These companies are focused on innovation, offering a wide range of pumps, including centrifugal and positive displacement models, designed for various applications in sectors such as water treatment, chemicals, oil and gas, and energy. Additionally, the growing trend towards smart pumps and energy-efficient solutions has prompted these players to invest heavily in research and development to meet the rising demand for advanced pumping technologies. Smaller, regional players are also gaining traction by providing customized solutions tailored to specific industrial needs, allowing them to capture niche markets. The competition is further intensified by pricing pressures, with companies striving to balance cost-effectiveness with technological advancements.

Recent Developments:

- In Feb 2024, Wilo UK acquired Arfon Rewinds Limited to enhance its service capabilities in water management, including installation, repair, condition monitoring, and pump maintenance. This acquisition strengthens Wilo’s position in the European industrial pumps market by expanding its operational capacity across two workshops specializing in clean and dirty water pumps.

- In January 2022, Sulzer launched the SES and SKS ranges of clean water pumps in Europe. These EN733 standard pumps are designed for applications such as water treatment and irrigation. Equipped with high-efficiency IE3 or IE4 motors, they offer customizable instrumentation and auxiliary components to meet diverse customer needs.

- Sulzer launched the ZF-RO end-suction pump in October 2024 to meet technical requirements for energy recovery device booster pump services. This innovation caters to hydrocarbon and desalination industries with enhanced efficiency and reliability.

Market Concentration & Characteristics:

The European industrial pumps market is characterized by a moderate level of market concentration, with several prominent manufacturers competing alongside numerous smaller firms. Major players such as Grundfos, Flowserve, KSB, and Sulzer have established significant market shares, benefiting from their extensive product portfolios and strong distribution networks. These companies often lead in technological innovation, offering advanced pumping solutions tailored to various industrial applications. However, the market also comprises a multitude of smaller enterprises that specialize in niche applications or provide customized solutions, contributing to a diverse and competitive landscape. This blend of large corporations and specialized firms fosters a dynamic environment, encouraging continuous innovation and responsiveness to evolving industry demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The European industrial pumps market is projected to experience steady growth in the coming years, driven by increased industrial activities across various sectors.

- Germany is expected to maintain its position as the market leader, supported by strong industrial infrastructure and continuous technological advancements.

- Centrifugal pumps are anticipated to continue dominating the market due to their broad applicability and high efficiency in multiple industries.

- The water and wastewater treatment sector will see continued expansion, fueled by urbanization and tightening environmental regulations.

- Technological advancements, such as the integration of smart pumps with sensors and automation, will enhance operational performance and reduce maintenance costs.

- The oil and gas sector will continue to be a key driver of pump demand, especially for handling complex transportation and storage operations.

- Growing environmental concerns will drive the demand for energy-efficient and environmentally friendly pumping solutions in various industries.

- Ongoing investments in infrastructure development throughout Europe will further stimulate the demand for advanced pumping systems in multiple industrial sectors.

- The adoption of digital technologies and IoT in pumps will enhance performance monitoring, predictive maintenance, and operational efficiency.

- Customization of pumps to meet specific industrial needs will become a more prominent trend, with manufacturers offering tailored solutions to various industries.