Market Overview:

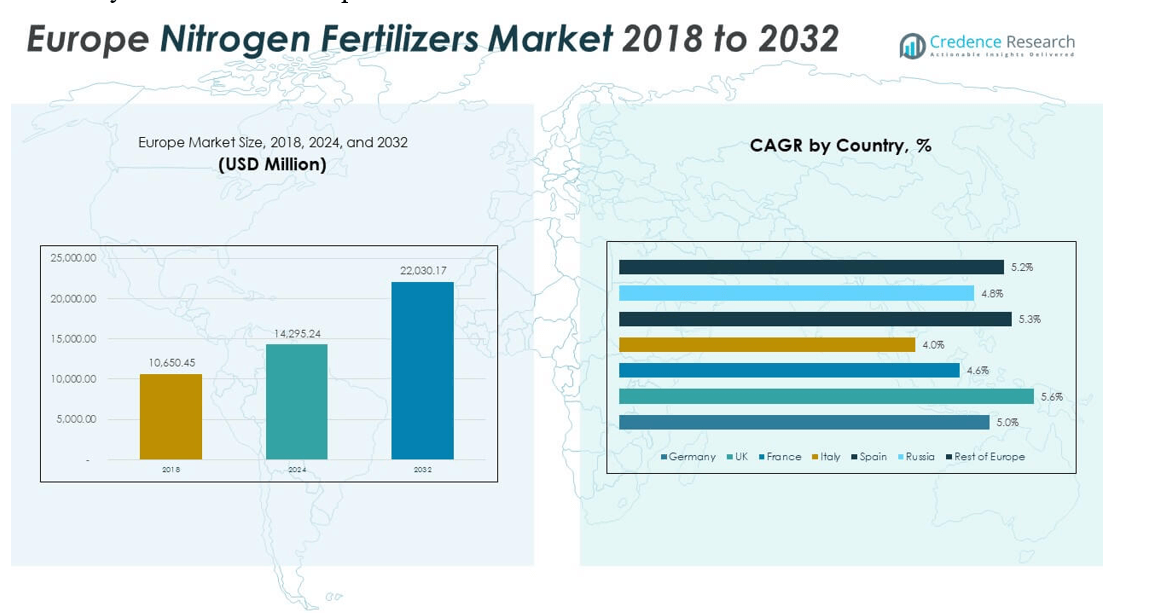

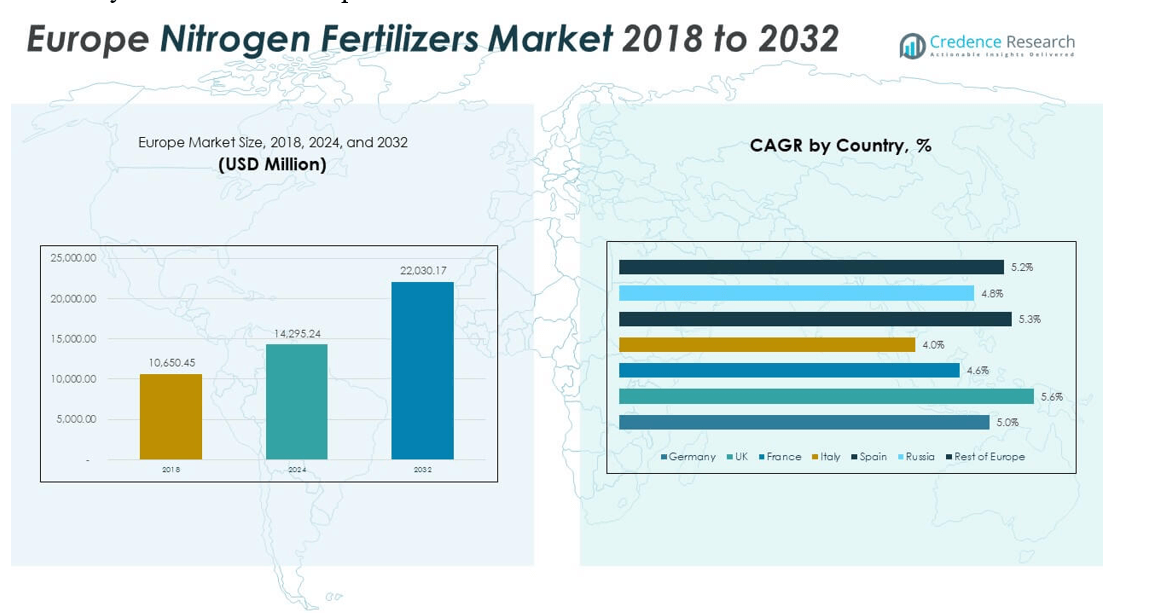

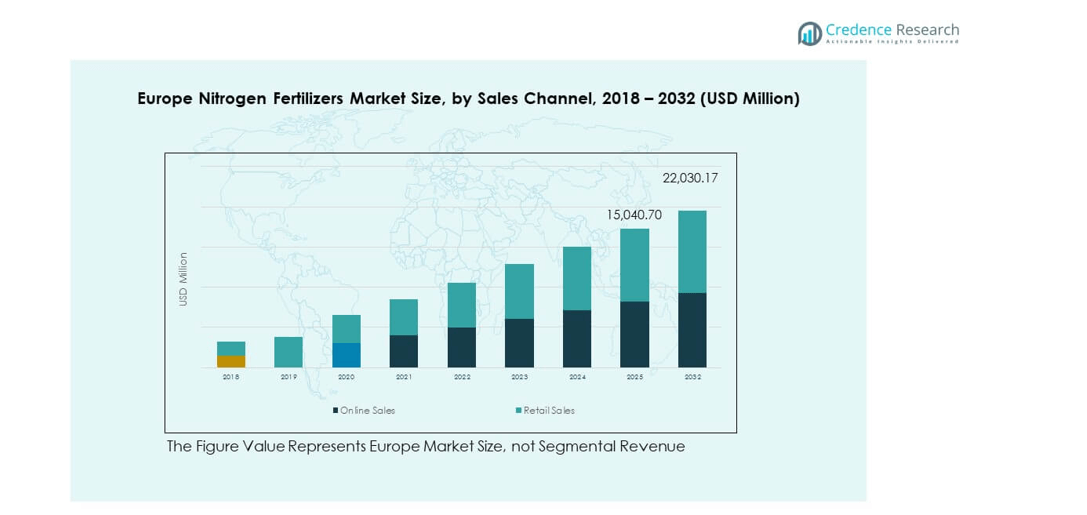

The Europe Nitrogen Fertilizers Market size was valued at USD 10,650.45 million in 2018 to USD 14,295.24 million in 2024 and is anticipated to reach USD 22,030.17 million by 2032, at a CAGR of 5.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Nitrogen Fertilizers Market Size 2024 |

USD 14,295.24 million |

| Europe Nitrogen Fertilizers Market, CAGR |

5.60% |

| Europe Nitrogen Fertilizers Market Size 2032 |

USD 22,030.17 million |

The Europe nitrogen fertilizers market is driven by rising food demand, expanding agricultural productivity, and increasing adoption of precision farming methods. Farmers rely on nitrogen-based fertilizers to enhance soil fertility and maximize yields of cereals, oilseeds, and horticultural crops. Government initiatives promoting sustainable farming and balanced nutrient management strengthen adoption. Shifts in dietary patterns toward protein-rich foods create added pressure on food production, which elevates fertilizer demand. Advanced technologies and training programs further support the growth trajectory of the market.

Western Europe leads the market with strong infrastructure, advanced farming practices, and significant fertilizer adoption across countries such as Germany, France, and the UK. Eastern Europe is emerging as a high-growth region, supported by modernization of agriculture and expansion of grain exports from countries like Poland and Romania. Southern Europe contributes notably with demand for liquid fertilizers in fruit, vegetable, and vineyard cultivation across Italy and Spain. Regional variations in crop production and farming systems shape overall market dynamics across Europe.

Market Insights

- The Europe Nitrogen Fertilizers Market was valued at USD 10,650.45 million in 2018, grew to USD 14,295.24 million in 2024, and is projected to reach USD 22,030.17 million by 2032 at a CAGR of 5.60%.

- Western Europe accounted for 42% share, driven by advanced farming practices, while Eastern Europe held 31% and Southern Europe 27%, reflecting strong agricultural diversification.

- Eastern Europe represents the fastest-growing region with 31% share, supported by modernization efforts and rising grain exports.

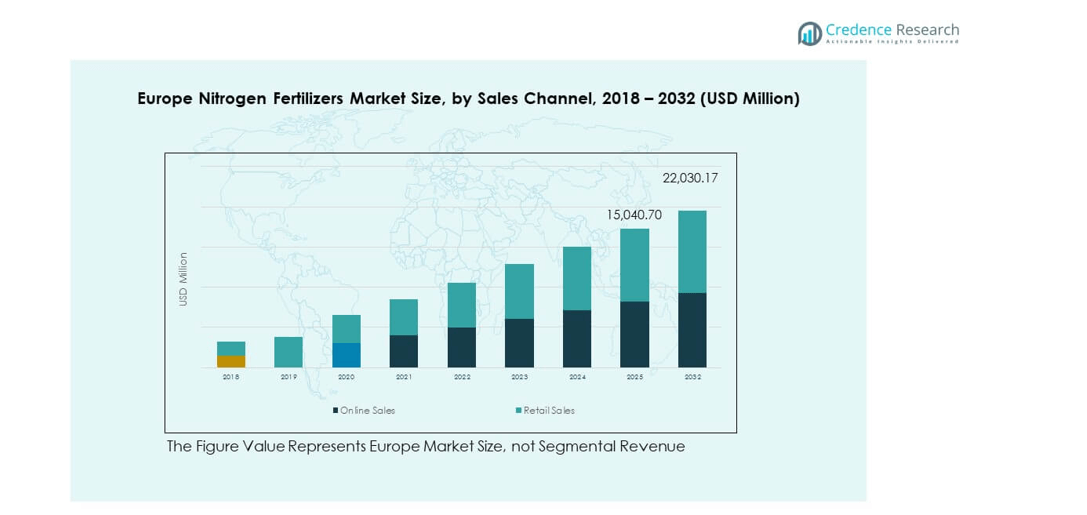

- Retail sales represented 65% of the Europe Nitrogen Fertilizers Market share, supported by strong accessibility and established distributor networks.

- Online sales accounted for 35% share, reflecting growing digital adoption and demand for faster, transparent product access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Food Demand and Expanding Agricultural Productivity Across Europe

The rising population in Europe has pushed food demand to higher levels. Farmers must increase productivity to meet the region’s dietary needs. The Europe Nitrogen Fertilizers Market supports this demand by enhancing soil fertility and boosting yields. It helps sustain production of key crops including cereals, oilseeds, and fruits. Consumers prefer protein-rich diets, creating pressure on farmers to expand supply. Efficient fertilizers help maintain consistent output. Government policies favoring higher production targets add momentum. This driver keeps the market central to Europe’s food supply chain.

- For example, EuroChem supplied more than 16.5 million metric tons of fertilizers to global markets in 2022, despite losing over 1.5 million metric tons of potential output due to supply chain constraints, as reported in its official Annual Review.

Growing Focus on Soil Fertility Management and Balanced Nutrient Application

The need for sustainable agriculture has made soil fertility management a priority. Farmers apply nitrogen fertilizers to restore soil health and improve nutrient levels. The Europe Nitrogen Fertilizers Market benefits from increasing adoption of balanced nutrient strategies. It ensures optimum crop growth without exhausting natural resources. Fertilizer efficiency becomes vital for long-term soil productivity. Awareness programs help farmers understand nutrient requirements better. Agricultural agencies encourage balanced application methods. This driver strengthens the link between fertilizer use and sustainable soil health.

Government Support Through Subsidies and Favorable Agricultural Policies

Governments across Europe continue to offer subsidies to farmers for fertilizer adoption. These measures help reduce financial pressure on growers. The Europe Nitrogen Fertilizers Market gains strength from such institutional support. It ensures small and medium farmers access fertilizers at lower costs. Favorable agricultural policies prioritize stable food output. Policymakers promote precision farming practices for efficiency. Training initiatives encourage farmers to adapt innovative methods. This driver integrates government support with market expansion strategies.

- For instance, EuroChem highlighted in its 2022 Annual Review that its sales network spans 21 countries and serves over 10,000 customers worldwide, supporting small and medium farmers with timely fertilizer access and reinforcing stable production aligned with regional agricultural goals.

Technological Advancements and Precision Farming Practices in European Agriculture

Advanced technologies have changed farming methods across Europe. Farmers use precision farming tools to apply nitrogen fertilizers more effectively. The Europe Nitrogen Fertilizers Market expands through these innovations. It allows accurate measurement of soil conditions and nutrient requirements. Farmers reduce waste and maximize productivity with advanced solutions. Precision farming ensures fertilizers reach targeted areas directly. Technology-driven practices lower environmental risks. This driver creates long-term advantages for both producers and consumers.

Market Trends

Rising Adoption of Controlled-Release and Enhanced-Efficiency Fertilizers in Europe

Controlled-release products are gaining popularity among European farmers. They provide steady nutrient supply to crops over longer cycles. The Europe Nitrogen Fertilizers Market benefits from this rising demand. It reduces environmental risks linked to excessive application. Enhanced-efficiency fertilizers help improve nitrogen use rates. Farmers adopt these solutions to cut input costs. Agrochemical firms expand production of such innovative products. This trend reflects a shift toward precision and sustainability in farming practices.

- For example, in December 2024, Grupa Azoty launched eNpluS, a granular nitrogen fertilizer with sulfur and calcium produced at its Puławy and Kędzierzyn-Koźle facilities.

Integration of Digital Platforms and Smart Agriculture Tools in Fertilizer Use

Digital platforms are transforming the way fertilizers are applied. Farmers use sensors and software to track soil health and crop growth. The Europe Nitrogen Fertilizers Market adapts to this digital integration. It improves decision-making for nutrient application strategies. Data-driven tools reduce risks of overuse. Precision agriculture aligns with smart farming models across the region. Agritech startups bring new platforms into farming networks. This trend accelerates digital adoption across European agriculture.

- For example, in July 2024, Yara and PepsiCo Europe formed a partnership involving around 1,000 farms across the EU and UK, covering nearly 128,000 hectares, where farmers will use Yara’s AtFarm platform and MegaLab soil analysis alongside low-carbon fertilizers under the Yara Climate Choice range.

Growing Preference for Organic and Bio-Based Fertilizer Blends Alongside Nitrogen Fertilizers

Farmers show greater interest in bio-based alternatives to strengthen soil health. Organic fertilizers are often combined with nitrogen-based products for efficiency. The Europe Nitrogen Fertilizers Market adapts to this blended use. It reflects consumer demand for sustainable crop production. Bio-based solutions reduce environmental footprints. Retailers promote organic food, creating demand for eco-friendly inputs. Producers diversify portfolios to include hybrid fertilizer lines. This trend highlights the balance between sustainability and productivity.

Regional Expansion of Distribution Channels and Cross-Border Fertilizer Trade

Distribution networks play a growing role in fertilizer availability. European suppliers strengthen regional supply chains across borders. The Europe Nitrogen Fertilizers Market gains from wider access to rural farming zones. It improves timely delivery of fertilizers during peak seasons. Online platforms now support direct fertilizer sales. Distributors establish storage hubs for quicker delivery. Cross-border trade agreements enhance product flow within Europe. This trend reflects broader integration of the regional market system.

Market Challenges Analysis

Environmental Regulations and Rising Concerns Over Fertilizer Overuse in Europe

Strict regulations in Europe restrict excessive fertilizer use. Authorities aim to reduce nitrogen leaching into water bodies. The Europe Nitrogen Fertilizers Market faces pressure from compliance standards. It must adapt to environmental targets while sustaining growth. Farmers balance crop needs with policy limits. High penalties discourage overuse of nitrogen fertilizers. Public concerns about soil degradation amplify the challenge. This issue influences long-term market strategies across the region.

Volatile Raw Material Costs and Supply Chain Disruptions Impacting Fertilizer Prices

Rising energy costs influence nitrogen fertilizer production expenses. Supply chain disruptions affect timely product availability. The Europe Nitrogen Fertilizers Market struggles with fluctuating raw material prices. It creates uncertainty for farmers planning seasonal purchases. Import dependency in some regions worsens the challenge. Currency fluctuations impact trade dynamics further. Producers face difficulty in maintaining stable margins. This challenge creates long-term risks for consistent supply security.

Market Opportunities

Expansion of Sustainable Fertilizer Solutions and Growing Role of Green Ammonia in Europe

Sustainability goals push demand for green fertilizer solutions. Producers explore green ammonia as a nitrogen source. The Europe Nitrogen Fertilizers Market finds scope in this development. It aligns with Europe’s decarbonization targets. Farmers prefer sustainable inputs that maintain crop performance. Green solutions gain momentum in both Western and Eastern Europe. Companies invest in eco-friendly production plants. This opportunity strengthens the market’s long-term outlook.

Rising Demand for Customized Fertilizer Blends Tailored to Specific Crop Requirements

Farmers demand crop-specific fertilizer blends for better efficiency. Producers develop tailored nitrogen products for cereals, vegetables, and horticulture. The Europe Nitrogen Fertilizers Market grows by addressing this shift. It supports higher yields through precision nutrient supply. Customized blends minimize waste and increase soil health. Regional suppliers create products adapted to local soil conditions. This opportunity highlights innovation in product design. It drives future market competitiveness across Europe.

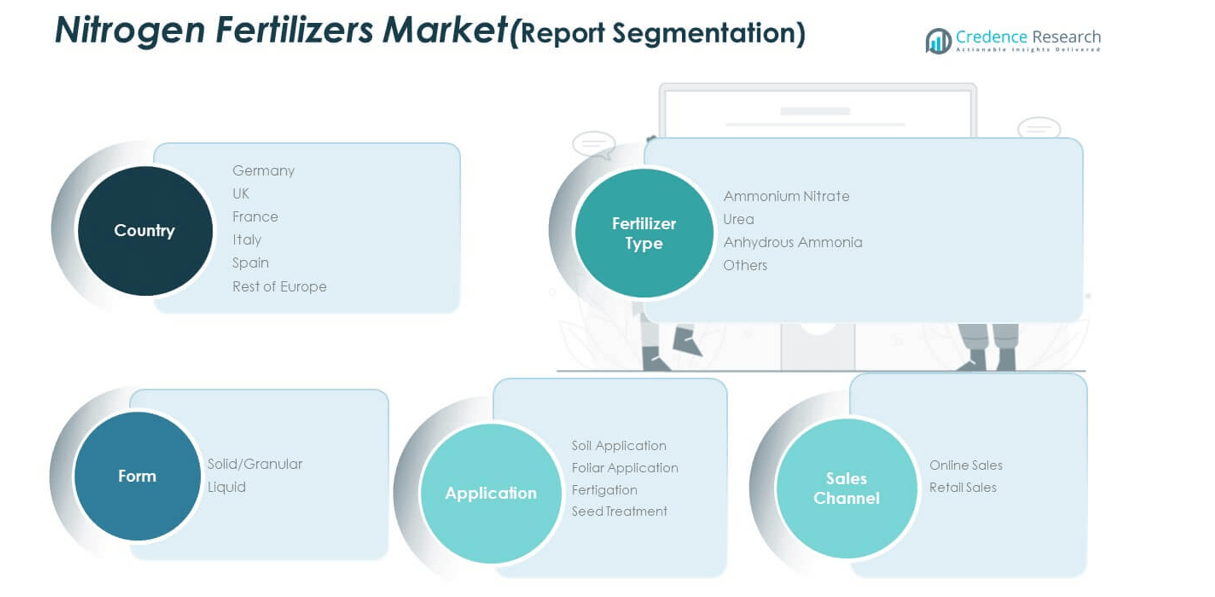

Market Segmentation Analysis

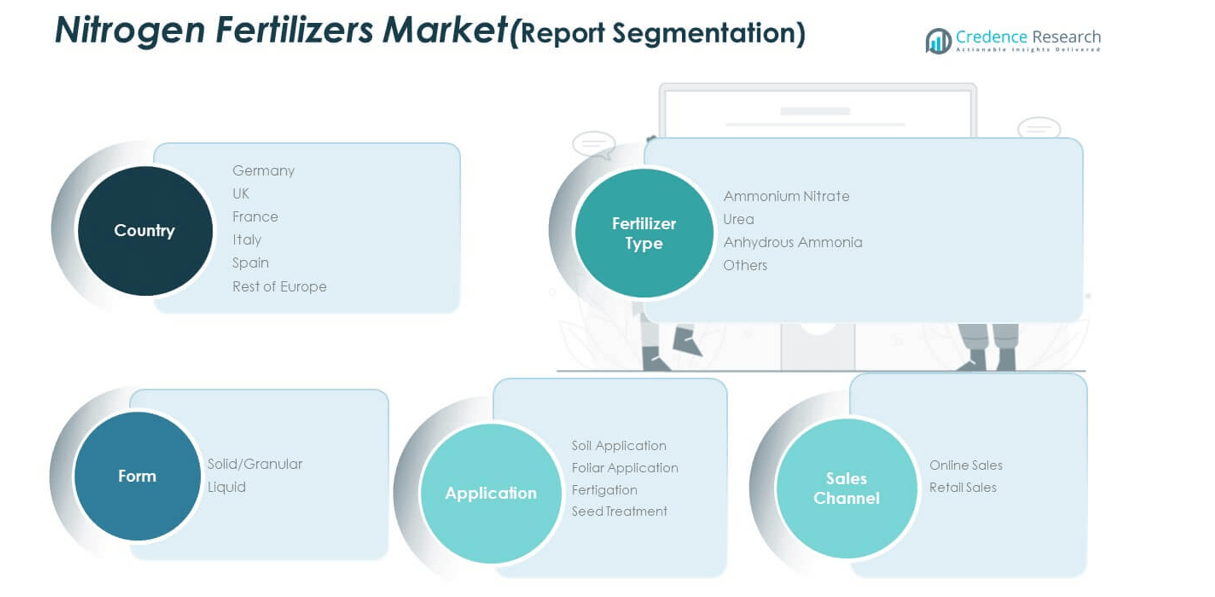

By fertilizer type, urea dominates the Europe Nitrogen Fertilizers Market due to its widespread use in cereals and horticulture. It is preferred for its high nitrogen content and cost efficiency. Ammonium nitrate maintains strong demand in regions with established grain farming. Anhydrous ammonia caters to large-scale producers focusing on efficiency. Other specialized fertilizers serve niche applications across diverse crops.

By form, solid or granular fertilizers lead the market because of easier handling and broader distribution networks. It remains the most common choice for both small and large farms. Liquid fertilizers are expanding in use, particularly in horticulture and vineyards. Farmers prefer liquid options for uniform application through irrigation systems. The balance between solid and liquid reflects diverse agricultural practices across the region.

- For instance, EuroChem Group’s Urea 46.2 Granulated formulation is widely produced in Europe, consistently delivering a guaranteed 46.2% nitrogen content per application, and is used in both broadacre cereal and specialty crop farming throughout the European Union.

By application, soil application holds the largest share due to its efficiency in delivering nutrients to crops. It supports major grain and oilseed production across Europe. Foliar application grows in demand for horticultural and high-value crops. Fertigation gains traction with modern irrigation systems, particularly in Southern Europe. Seed treatment remains a smaller segment but contributes to early crop protection.

- For instance, Poland reported the use of 1.0 million tonnes of nitrogen-based fertilizers in 2023, primarily for direct soil application on maize and wheat, according to Eurostat data. This made Poland one of the top three European countries by applied nitrogen fertilizer volumes in agriculture.

By sales channel, retail sales dominate through agricultural suppliers and distributors. It ensures accessibility for farmers in rural areas. Online sales gain momentum as digital platforms expand, offering faster delivery and product transparency. It provides farmers with broader choices and enhances competition among suppliers. This mix reflects the evolving distribution structure of the fertilizer industry.

Segmentation

By Fertilizer Type

- Ammonium Nitrate

- Urea

- Anhydrous Ammonia

- Others

By Form

By Application

- Soil Application

- Foliar Application

- Fertigation

- Seed Treatment

By Sales Channel

- Online Sales

- Retail Sales

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis

Western Europe holds the largest share of the Europe Nitrogen Fertilizers Market with 42%. Countries such as Germany, France, and the UK dominate due to advanced agricultural practices and strong infrastructure. It benefits from government support for sustainable farming and precision technologies. The region shows high demand for ammonium nitrate and urea, particularly in cereals and horticulture. Strong distribution networks ensure timely supply to large-scale farms. Western Europe continues to set benchmarks for innovation and environmental compliance.

Eastern Europe accounts for 31% of the Europe Nitrogen Fertilizers Market. Countries including Poland, Romania, and Ukraine focus on expanding production capacity to strengthen exports. It experiences rising adoption of modern farming inputs driven by crop diversification. Fertilizer demand is high for grains and oilseeds, reflecting the region’s role as a major supplier to global markets. Modernization of agriculture and supportive policies enhance market growth. Eastern Europe provides significant opportunities for suppliers aiming to capture emerging demand.

Southern Europe holds 27% share of the Europe Nitrogen Fertilizers Market. Italy, Spain, and Greece drive this growth due to strong cultivation of fruits, vegetables, and vineyards. It relies heavily on urea and liquid fertilizers to support intensive horticulture. High-value crops and irrigation systems increase demand for efficient nitrogen solutions. Farmers seek tailored fertilizer blends for diverse soil conditions. Southern Europe positions itself as a specialized hub for horticultural and niche crop fertilizer use.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Europe Nitrogen Fertilizers Market is highly competitive with the presence of multinational producers and regional firms. Leading companies include Yara International ASA, EuroChem Group, OCI N.V., Grupa Azoty, K+S AG, Lovochemie, Fertiberia, Agrofert, and Achema. It is marked by strong competition on pricing, product innovation, and distribution strength. Yara International ASA leads with advanced product portfolios and significant regional presence. EuroChem Group and OCI N.V. focus on capacity expansion and trade efficiency. Grupa Azoty and Fertiberia concentrate on serving domestic and neighboring markets with tailored solutions. K+S AG and Agrofert enhance competitiveness through diversified fertilizer offerings. Emerging players such as Lovochemie and Achema strengthen regional supply, contributing to overall market resilience. The competitive environment encourages investment in sustainable technologies and efficiency improvements, shaping long-term market positioning.

Recent Developments

- In September 2025, Yara International ASA signed a definitive offtake agreement with ATOME PLC, confirming the purchase of renewable fertilizer volumes targeted at key European markets. Yara also continues to strengthen its portfolio of low-carbon ammonia and crop nutrition solutions, seeking to enhance sustainable agriculture through new partnerships and commercial agreements across Europe.

- In October 2024, OCI N.V. sold its entire equity stake (50% plus one share) in Fertiglobe PLC to ADNOC (Abu Dhabi National Oil Company). The deal raised OCI’s strategic liquidity and allowed ADNOC to increase its holding in Fertiglobe to over 86%, giving ADNOC more control over the nitrogen fertilizer platform.

Report Coverage

The research report offers an in-depth analysis based on Fertilizer Type, Form, Application and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Nitrogen Fertilizers Market will experience steady expansion with growing food demand across the region.

- Rising protein-based diets will push fertilizer demand for cereals, grains, and horticultural crops.

- Precision farming adoption will enhance efficiency, reducing wastage and improving soil nutrient balance.

- Controlled-release and enhanced-efficiency fertilizers will see higher uptake in advanced agricultural systems.

- Government initiatives will support sustainable fertilizer practices through subsidies and training programs.

- Green ammonia and eco-friendly fertilizer solutions will gain traction in meeting climate goals.

- Eastern Europe will emerge as a stronger contributor, driven by modernization and export growth.

- Southern Europe will strengthen demand for liquid fertilizers due to horticulture and vineyard expansion.

- Digital tools and agritech platforms will accelerate smart fertilizer management across farming practices.

- Competitive pressures will push companies to expand portfolios with sustainable and customized blends.