Market Overview

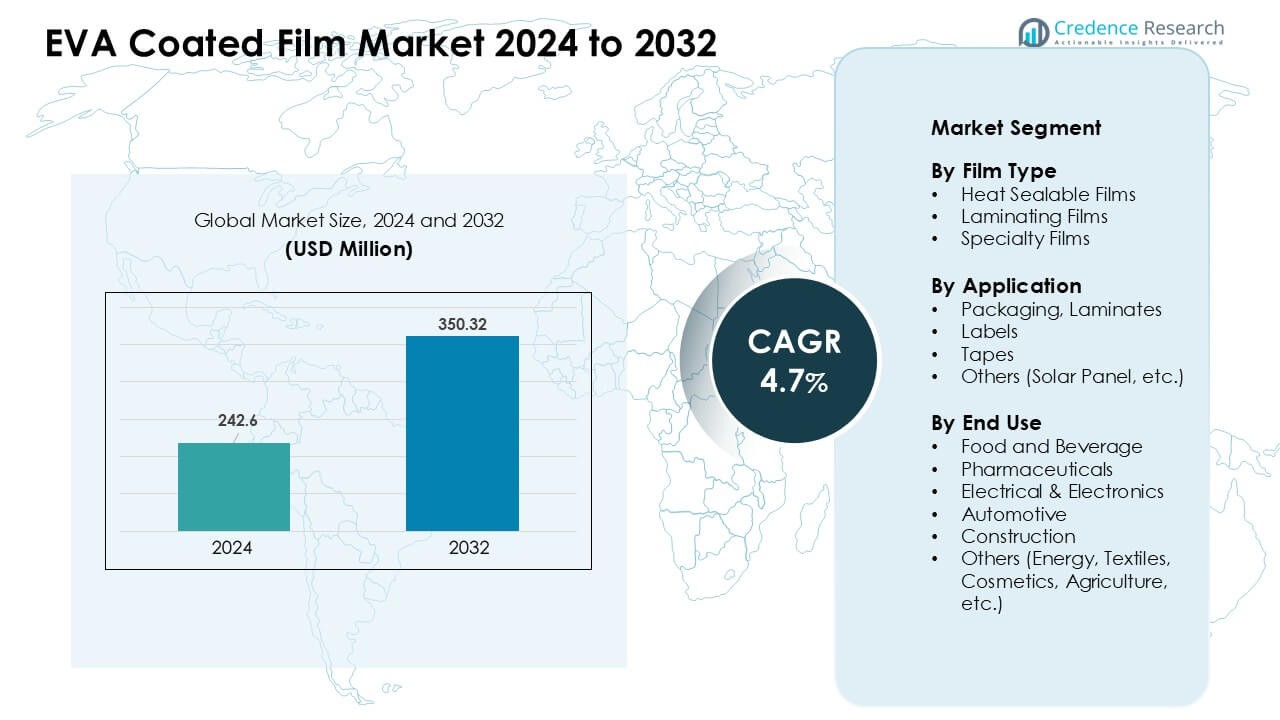

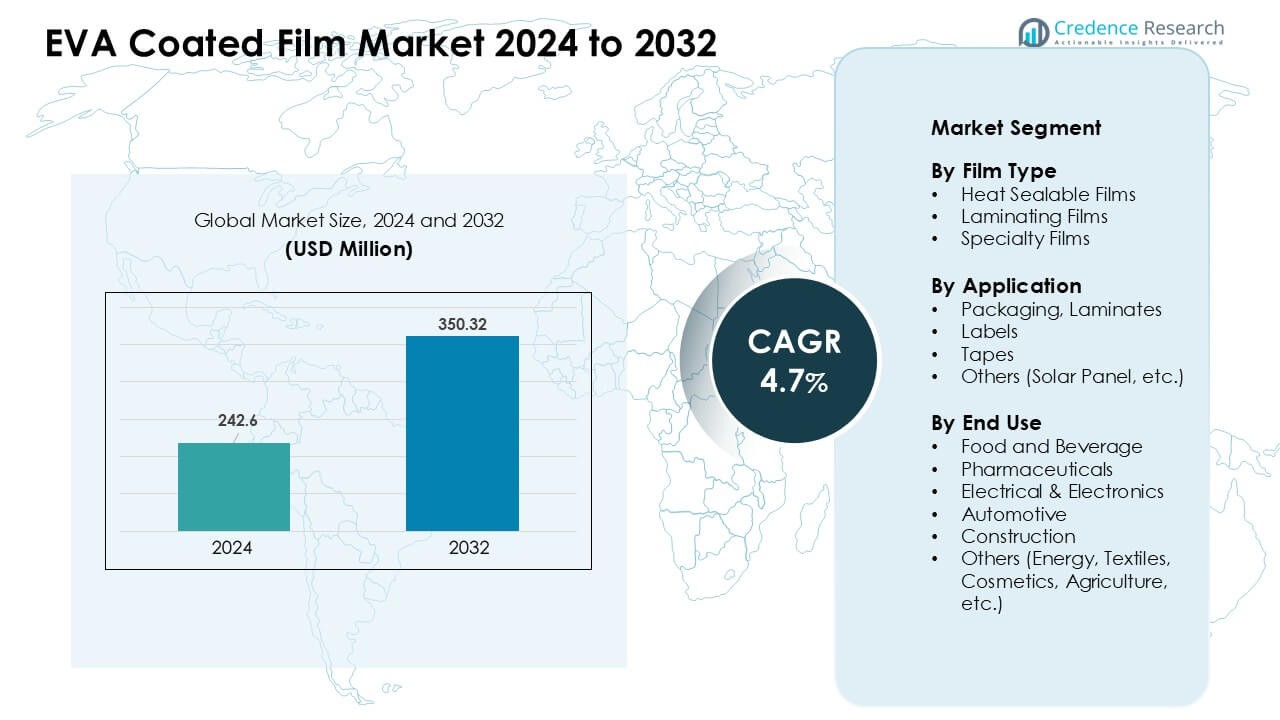

EVA Coated Film Market was valued at USD 242.6 million in 2024 and is anticipated to reach USD 350.32 million by 2032, growing at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EVA Coated Film Market Size 2024 |

USD 242.6 Million |

| EVA Coated Film Market, CAGR |

4.7% |

| EVA Coated Film Market Size 2032 |

USD 350.32 Million |

The EVA coated film market is shaped by key players such as Hanwha Solutions, Celanese Corporation, Arkema, Mitsui Chemicals Tohcello, Folienwerk Wolfen, Brentwood Plastics, Dr. Dietrich Müller, Changzhou Bbetter Film Technologies, and Allied Glasses, each competing through material innovation and application-specific film development. These companies focus on stronger sealing layers, improved optical clarity, and advanced lamination performance to serve packaging, solar, electronics, and automotive sectors. Asia Pacific emerged as the leading region in 2024 with about 38% share, driven by its large packaging base, expanding solar module production, and strong electronics manufacturing ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The EVA coated film market was valued at USD 6 million in 2024 and is projected to reach USD350.32 million by 2032, growing at a CAGR of 4.7%.

- Demand rises due to strong use in flexible packaging, where heat-sealable films led the segment with about 41% share in 2024, driven by better sealing strength and higher line efficiency.

- Key trends include growing adoption in solar module encapsulation and electronics, along with rising interest in recyclable mono-material packaging structures across major manufacturing regions.

- Leading players such as Hanwha Solutions, Celanese, Arkema, Mitsui Chemicals Tohcello, and Folienwerk Wolfen compete through coating innovation, expanded capacity, and application-specific film portfolios.

- Asia Pacific dominated the market with nearly 38% share in 2024, followed by North America at 28% and Europe at 25%, supported by strong packaging, solar, and automotive demand across these regions.

Market Segmentation Analysis:

By Film Type

Heat sealable films dominated this segment in 2024 with about 41% share. These films gained strong demand due to reliable sealing strength, flexibility, and wide use in food pouches and medical packs. Laminating films followed as converters used them to enhance durability and print clarity in consumer packaging. Specialty films grew in premium sectors that needed high optical clarity or barrier support. Rising focus on safe sealing, faster line speeds, and consistent pack quality helped heat sealable films maintain their lead across major packaging formats.

- For instance, Sealed Air Corporation supplies multilayer co-extruded heat-sealable films under its Cryovac® brand, engineered for high seal strength and reliable hot-tack performance on high-speed form-fill-seal packaging lines used in food and protein packaging.

By Application

Packaging and laminates led the application segment in 2024 with nearly 52% share. This category grew due to strong adoption in snacks, frozen goods, and flexible retail packs that required tight seals and stable mechanical strength. Labels saw steady demand in branded FMCG products, while EVA-coated tapes expanded in industrial bundling and protective wrapping. The solar panel segment also gained traction as EVA layers supported strong adhesion and moisture resistance. Higher packaging hygiene standards and the shift toward lightweight materials kept packaging and laminates at the top.

- For instance, Taghleef Industries Group supplies sealable BOPP films with wide sealing windows and strong hot-tack performance, supporting reliable vertical form-fill-seal packaging for heavy snack and frozen-food products.

By End Use

Food and beverage accounted for the largest share in 2024 with around 38%. Manufacturers preferred EVA-coated films because these films offered strong sealing, odor resistance, and clarity suited for ready-to-eat meals, snacks, and chilled foods. Pharmaceuticals adopted them for sterile wraps and protective pouches, while electrical and electronics companies used EVA films for insulation layers. Automotive and construction sectors applied them in laminates and protective sheets. Growth in packaged foods, rising cold-chain expansion, and stricter safety norms supported the strong position of food and beverage as the leading end-use.

Key Growth Drivers

Rising Demand for High-Performance Flexible Packaging

Growing use of flexible packaging in food, beverage, personal care, and pharmaceutical items drives strong demand for EVA coated films. Brand owners prefer EVA layers because the coating improves seal strength, clarity, and puncture resistance, which helps protect products during storage and transit. Many converters shift toward EVA-coated structures to meet faster sealing speeds and reduce material failures on automated lines. Expanding snack consumption, rising e-commerce shipments, and the shift toward lightweight packaging also strengthen this demand. EVA coated films support product safety, extend shelf life, and enable appealing pack formats, which keeps them central to the global flexible packaging growth cycle.

- For instance, Polfilm supplies BOPP films used in flexible packaging, where EVA-based coatings improve adhesion and enhance moisture and oil resistance for food and retail applications.

Expansion of Solar and Electronics Applications

Growth in solar panel production and electronics manufacturing increases the need for EVA-coated films, especially in lamination and encapsulation layers. Solar modules rely on EVA coatings to provide strong adhesion, UV resistance, and moisture barriers that help maintain panel efficiency over long periods. Electronics makers use EVA-coated films for insulation, cushioning, and protective interfaces. Rising investments in renewable energy, expanding semiconductor output, and broader use of smart devices lift consumption across these applications. EVA coatings also support thermal stability and optical clarity, which benefit both solar and electronic components. These features push the segment toward steady, long-term growth.

- For instance, solar industry data indicate that roughly 75–80% of photovoltaic modules worldwide use EVA encapsulant films between the glass and backsheet, due to their high light transmittance, elasticity, and long-term performance stability.

Strong Adoption in Automotive and Construction Sectors

Automotive and construction companies use EVA-coated films for vibration damping, interior laminates, safety glass layers, and protective coatings. These features improve noise control, durability, and resistance to cracking or delamination. Rapid urban growth boosts construction projects that require high-performance glazing and laminated structures. The automotive industry also moves toward lightweight components, where EVA-coated films support better energy absorption and long-term stability. Demand rises as both industries focus on safety, energy efficiency, and improved material performance. EVA-coated films serve as reliable intermediate layers that raise structural strength and enhance long-term mechanical behavior, making them key to many modern engineering needs.

Key Trends & Opportunities

Growing Shift Toward Recyclable and Sustainable Materials

Sustainability goals push packaging and industrial users to adopt EVA-coated films that support downgauging, reduced waste, and improved recyclability. Many companies explore mono-material structures where EVA coatings replace complex multilayer formats. This trend helps reduce disposal challenges and aligns with global regulations focused on reducing plastic waste. Brands seek materials with lower processing emissions and better end-of-life outcomes, which builds interest in EVA-coated solutions. The market continues to explore bio-based EVA and solvent-free coating technologies, creating new opportunities for cleaner production and greener product portfolios.

- For instance, Ester Industries supplies polyester films with EVA-based coatings designed to improve sealability, transparency, and dimensional stability, making them suitable for food-contact compliant flexible packaging applications, including lightweight mono-material structures.

Advancements in High-Clarity and Specialty Film Technologies

Innovations in coating and extrusion help manufacturers develop EVA-coated films with superior optical clarity, higher temperature resistance, and improved surface properties. These advancements benefit premium electronics, solar panels, and healthcare packaging. Better adhesion performance and controlled melt behavior also support faster manufacturing speeds. Many market players invest in new resin formulations to enhance durability without raising material cost. These innovations create opportunities for specialized applications that need tailored performance, such as advanced laminates, display screens, and technical tapes, expanding the market’s reach.

- For instance, Kuraray supplies EVA encapsulant films for photovoltaic modules with light transmittance above 90%, volume resistivity exceeding 10¹⁴ Ω·cm, and gel content typically above 80%, supporting long-term optical stability and mechanical durability in solar panel lamination.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in EVA resin prices create cost pressures for film converters and brand owners. Price swings typically result from changes in crude oil values, supply disruptions, and regional production imbalances. These issues make it difficult for manufacturers to maintain stable pricing or forecast long-term costs. Smaller producers struggle more because they lack scale advantages. Persistent volatility often delays investment in new capacity or product innovation. Managing procurement risks becomes essential as global demand for EVA expands across packaging, solar, and automotive applications.

Limited Recycling Infrastructure and Material Compatibility

Recycling EVA-coated films remains challenging due to coating-layer separation issues and limited processing capacity. Many recycling facilities lack equipment that can efficiently handle coated structures, which restricts collection and reprocessing rates. This limitation affects adoption in regions with strict sustainability rules. Compatibility issues with certain polymers also reduce the ability to integrate EVA-coated films into closed-loop systems. These challenges slow progress toward circularity goals and force manufacturers to invest in redesigning materials for easier recycling.

Regional Analysis

North America

North America held about 28% share of the EVA coated film market in 2024. Strong demand came from food packaging, medical supplies, and electronics that required high seal strength and stable performance. The U.S. led regional use due to strong flexible packaging output and rising solar panel installations. Growth in ready-to-eat meals and cold-chain expansion also supported higher EVA film consumption. Regional converters adopted EVA coatings to improve clarity and mechanical strength in premium packs. Favorable investments in renewable energy and advanced electronics helped maintain steady momentum across end-use industries.

Europe

Europe captured nearly 25% share in 2024, supported by strong packaging regulations and high-quality manufacturing standards. Germany, Italy, and France led demand through automotive, solar, and industrial applications that relied on EVA-coated laminates for durability and optical clarity. Regional focus on recyclable and lightweight materials pushed converters to adopt EVA coatings as part of mono-material solutions. Expanding solar projects in Germany and the Netherlands also raised EVA usage. Strong pharmaceutical and food industries further contributed to steady market adoption across both Western and Eastern Europe.

Asia Pacific

Asia Pacific dominated the EVA coated film market in 2024 with about 38% share. China, India, Japan, and South Korea drove consumption due to rapid industrialization, strong packaging production, and large-scale solar module manufacturing. The region’s growth in electronics and automotive sectors strengthened demand for EVA-coated specialty films. Fast expansion of food processing and e-commerce packaging further supported market acceleration. High investments in renewable energy projects also boosted EVA film usage for encapsulation and lamination. Competitive manufacturing costs, rising export activity, and advanced film production capabilities kept Asia Pacific at the forefront.

Latin America

Latin America held around 5% share in 2024, with Brazil and Mexico leading adoption across food packaging, construction laminates, and automotive applications. Growth in processed food consumption and local packaging upgrades encouraged wider use of EVA-coated films for better sealing and clarity. Solar installations increased in parts of Brazil, driving modest uptake in encapsulation films. Regional converters adopted EVA coatings to improve product durability under warm climates. While market expansion remained steady, investment growth and rising retail packaging standards are expected to strengthen demand over the next few years.

Middle East & Africa

The Middle East & Africa accounted for nearly 4% share in 2024. Demand rose in construction, food packaging, and renewable energy projects, particularly in the UAE, Saudi Arabia, and South Africa. Solar capacity additions supported EVA film use in module encapsulation, while expanding retail sectors increased demand for flexible packaging. Adoption remained slower than other regions due to limited local film production, but imports met most requirements. Growing infrastructure projects, rising packaged food consumption, and investments in solar parks continue to support gradual regional growth.

Market Segmentations:

By Film Type

- Heat Sealable Films

- Laminating Films

- Specialty Films

By Application

- Packaging, Laminates

- Labels

- Tapes

- Others (Solar Panel, etc.)

By End Use

- Food and Beverage

- Pharmaceuticals

- Electrical & Electronics

- Automotive

- Construction

- Others (Energy, Textiles, Cosmetics, Agriculture, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the EVA coated film market features a mix of global chemical manufacturers, specialty film producers, and regional converters that focus on high-performance packaging and industrial laminates. Leading companies such as Hanwha Solutions, Celanese Corporation, Arkema, Mitsui Chemicals Tohcello, Folienwerk Wolfen, Brentwood Plastics, Dr. Dietrich Müller, Changzhou Bbetter Film Technologies, and Allied Glasses compete through advancements in coating technology, improved resin formulations, and expanded application-specific product lines. Many players invest in solar encapsulation films, high-clarity laminating films, and heat-sealable structures to strengthen their presence in fast-growing sectors. Companies also pursue capacity expansions, strategic partnerships, and regional distribution enhancements to meet rising demand from packaging, electronics, automotive, and construction industries. The market remains innovation-driven, with strong emphasis on durability, recyclability, and cost-efficient production to maintain competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Mitsui Chemicals Tohcello, Inc. partnered with packaging converters to advance recyclable mono-material flexible packaging using EVA-coated sealant films. The collaboration focused on improving seal strength and hot-tack on BOPP and PE-based structures.

Report Coverage

The research report offers an in-depth analysis based on FilmType, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as flexible packaging demand increases across global retail channels.

- Solar panel installations will boost consumption of EVA-coated encapsulation films.

- Advances in coating technology will improve clarity, seal strength, and heat resistance.

- Mono-material packaging designs will create new opportunities for recyclable EVA structures.

- Automotive applications will expand due to growing use in safety glass and interior laminates.

- Electronics manufacturing will adopt more EVA-coated films for insulation and protective layers.

- Manufacturers will invest in higher-capacity coating lines to support rising output needs.

- Sustainability rules will drive adoption of solvent-free and low-emission coating processes.

- Regional players will strengthen partnerships to expand supply chains and reduce import reliance.

- Growing industrial diversification will push EVA-coated films into emerging sectors such as energy storage and advanced construction materials.