Market Overview:

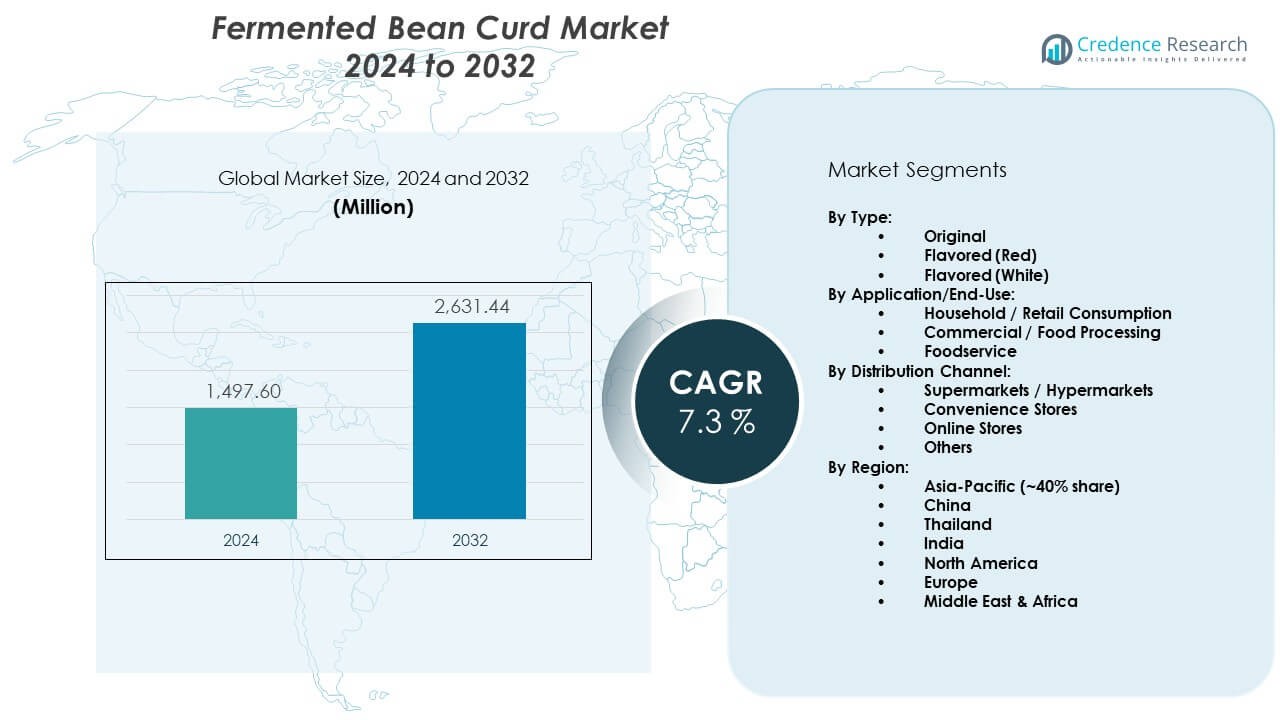

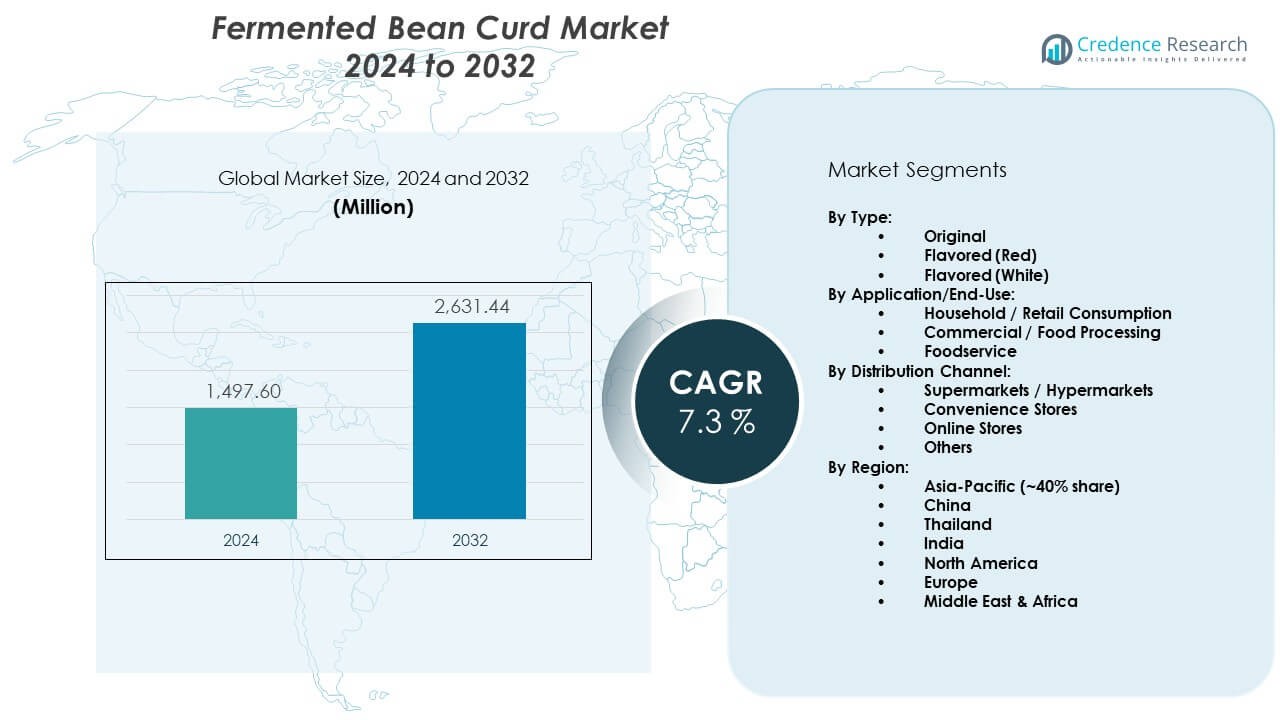

The Fermented Bean Curd Market is projected to grow from USD 1497.6 million in 2024 to an estimated USD 2631.44 million by 2032, with a CAGR of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fermented Bean Curd Market Size 2024 |

USD 1497.6 Million |

| Fermented Bean Curd Market, CAGR |

7.3% |

| Fermented Bean Curd Market Size 2032 |

USD 2631.44 Million |

Growing demand for natural flavor enhancers drives stronger consumption across households and restaurants. Consumers choose fermented bean curd for deeper umami notes and improved texture in sauces and dishes. Rising awareness of fermented food benefits boosts interest among younger populations. It expands through wider availability in supermarkets and specialty stores. Manufacturers upgrade packaging to extend shelf life and retain quality. Foodservice chains add fermented bean curd to fusion menus, which broadens global exposure. Chefs promote its use in marinades and dips, driving repeat sales.

Asia Pacific leads due to strong cultural use and widespread integration in daily cooking. China and Southeast Asian countries maintain dominant supply networks supported by local producers. North America shows fast growth backed by rising adoption of Asian cuisine in retail and restaurants. Europe gains traction through specialty stores and premium food lines targeting diverse taste profiles. Middle Eastern markets expand gradually as consumers explore global flavors. Emerging regions benefit from rising urban populations seeking convenient fermented food options for home meals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Fermented Bean Curd Market is valued at USD 1,497.6 million in 2024 and is projected to reach USD 2,631.44 million by 2032, growing at a 3% CAGR driven by rising demand for fermented flavor enhancers and wider retail access.

- Asia-Pacific (40%), North America (25%), and Europe (20%) hold the largest shares due to strong cultural usage, expanding global cuisine trends, and steady uptake in premium food categories.

- Middle East & Africa (15%) emerges as the fastest-growing region, supported by rising urban populations, broader exposure to Asian flavors, and growing online retail presence.

- The Original type segment holds the leading share due to high household adoption and strong alignment with traditional cooking patterns.

- The Supermarkets/Hypermarkets channel accounts for the largest distribution share, driven by strong product visibility, broader flavor availability, and steady foot traffic.

Market Drivers:

Growing Consumer Shift Toward Fermented and Plant-Based Foods

The Fermented Bean Curd Market gains momentum from rising interest in fermented foods across global households. Consumers prefer deeper flavors that support diverse cooking methods. Many buyers search for plant-based proteins that offer natural taste enhancement. It attracts attention from health-focused groups that value digestive comfort. Restaurants add fermented bean curd to modern dishes to expand menu depth. Food producers highlight clean-label attributes to build stronger brand identity. Retail stores increase shelf space for multipack formats that suit family needs. Wider social media influence drives curiosity among younger consumers.

- For instance, salt-reduced fermentation technology has demonstrated significant consumer health benefits with documented salt reduction achievements. Recent fermentation research utilizing multiple bacterial strains achieved a salt content reduction of 59.2% compared to conventional high-salt liquid-state fermentation methods, while maintaining amino acid nitrogen content at 8.40 g/L, which exceeds low-salt solid-state fermented alternatives.

Expansion of Product Innovation and Flavor Diversification

Manufacturers upgrade recipes to deliver better texture and controlled salt levels. The Fermented Bean Curd Market benefits from wider flavor releases that suit varied cuisines. Brands launch chili-based, herbal, and mild versions to target broader taste groups. It encourages chefs to experiment with marinades and sauces for fusion dishes. Producers invest in fermentation control to maintain batch consistency. Packaging teams design airtight formats that improve storage and handling. Retailers promote premium variants that attract home cooks seeking gourmet options. Rising flavor innovation supports repeat buying patterns across regions.

- For instance, Packaging teams design airtight formats that improve storage and handling, with studies confirming that aluminium laminate and PET jar packaging materials provide superior barrier protection, reducing proteolytic bacteria counts to 3.90-3.95 Log10 CFU compared to paper packaging at 4.25-4.75 Log10 CFU.

Rising Integration Into Foodservice and Quick-Service Chains

Foodservice operators use fermented bean curd to elevate sauces, dips, and plant-based meals. The Fermented Bean Curd Market grows through higher usage in hotpots, noodles, and stir-fries. It helps restaurants create signature recipes that offer rich umami layers. Chefs rely on predictable flavor output to maintain menu stability. Quick-service chains explore fermented ingredients to improve menu diversity. Hotels highlight fermented bean curd in regional cooking events to attract food enthusiasts. Supply partners strengthen distribution to prevent stock fluctuations. Foodservice growth drives stronger commercial demand across busy urban centers.

Growing Focus on Natural Seasoning and Clean-Label Eating Patterns

Natural seasoning preferences push consumers to replace artificial enhancers with fermented options. The Fermented Bean Curd Market expands through rising clean-label demand across developed and emerging regions. It fits well into home-cooking habits that prioritize natural salt sources. Buyers value minimal processing and stable quality across brands. Health-conscious groups choose fermented bean curd for simple ingredient lists. Producers focus on transparent labeling that supports trust-building efforts. Retail chains support this shift by promoting low-preservative variants. Clean-label momentum strengthens long-term market acceptance.

Market Trends:

Premiumization and Growth of Gourmet Fermented Bean Curd Lines

The Fermented Bean Curd Market observes rising demand for premium jars with specialty flavors. Consumers seek gourmet options designed for specific dishes. It gains traction through aged variants that deliver stronger aroma profiles. Chefs promote high-end versions for culinary events and tasting menus. Premium products attract urban buyers with interest in artisanal foods. Packaging teams introduce glass formats to boost visual appeal. Brands use heritage messaging to differentiate value. Premiumization reshapes purchasing habits among quality-driven customers.

- For instance, Consumers seek gourmet options designed for specific dishes, with manufacturers utilizing controlled fermentation temperatures between 26°C and 32°C to optimize enzymatic activities and flavor compound development in sufu products.

Widening Presence Across E-Commerce and Cross-Border Online Retail

Online platforms strengthen product visibility for global buyers. The Fermented Bean Curd Market benefits from higher availability on major e-commerce sites. It reaches wider audiences through improved shipping protection and temperature-stable packaging. Cross-border trade expands demand in markets with cultural ties to Asian cuisine. Digital ads target young shoppers who search for unique flavors. Subscription models help brands build loyalty. Retail data analytics guide inventory planning. Online momentum enables wider experimentation among first-time buyers.

- For instance, Cross-border trade expands demand in markets with cultural ties to Asian cuisine, supported by standardized production processes where pH, acidity, and amino nitrogen levels remain within industry standards across varying fermentation temperatures of 20°C, 24°C, and 28°C.

Stronger Influence of Fusion Cuisine and Global Culinary Exploration

Global culinary trends fuel curiosity about fermented bean curd among home cooks and chefs. The Fermented Bean Curd Market gains push from rising adoption in fusion sauces and spreads. It supports creative recipes that mix Asian flavors with Western cooking styles. Cooking shows highlight fermented ingredients that deliver complexity. Food influencers share quick recipes that boost awareness. Restaurants introduce tasting plates to engage new diners. Many kitchens rely on fermented bean curd for richer dips. Fusion appeal shapes new consumption patterns worldwide.

Technological Advancements in Fermentation and Quality Stabilization

Producers adopt controlled fermentation systems to manage taste and texture precision. The Fermented Bean Curd Market grows through better microbial monitoring tools. It benefits from stabilized fermentation cycles that reduce batch variability. Quality teams use advanced sensors to check moisture and pH levels. Improved filtration enhances smoothness across product lines. Automated filling supports hygiene requirements in large facilities. Production upgrades reduce waste during processing. Technology-driven consistency helps brands maintain a competitive edge.

Market Challenges Analysis:

Supply Chain Volatility and Quality Control Limitations

Supply fluctuations affect ingredient availability for large manufacturers. The Fermented Bean Curd Market faces challenges when soybean quality varies across seasons. It struggles to maintain flavor consistency during rapid scaling. Storage conditions require strict monitoring to prevent spoilage. Limited cold-chain coverage in developing regions increases risk. Production delays impact retail supply flows. Smaller producers find it difficult to sustain uniform output. Quality variation restricts expansion in premium segments.

Consumer Perception Barriers and Limited Awareness Outside Core Regions

The Fermented Bean Curd Market encounters hesitation among consumers unfamiliar with fermented flavors. It requires strong education efforts to overcome misconceptions about aroma. Retailers report slower adoption in regions lacking exposure to Asian cuisine. Marketing teams design sampling programs to build comfort. Some buyers hesitate to try products with strong visual appearance. Cultural gaps influence early-stage acceptance. Limited recipe awareness reduces usage frequency. Awareness challenges slow penetration in new markets.

Market Opportunities:

Market Opportunities:

Growing Global Curiosity Toward Fermented and Functional Foods

The Fermented Bean Curd Market benefits from rising interest in functional eating patterns. It attracts consumers exploring fermented products for deeper flavor and digestive comfort. Global cuisine trends push buyers to try fermented bean curd in home cooking. Retailers expand international food aisles to support wider access. Food producers promote mild variants that suit new users. Restaurants add creative recipes to introduce fermented flavors. Strong culinary exploration builds long-term demand. Health-driven eating habits strengthen opportunity growth.

Expansion Through Premiumization and New Distribution Channels

The Fermented Bean Curd Market gains new openings through gourmet product lines. It reaches broader audiences through online grocery and specialty stores. Premium packaging improves shelf appeal in global retail chains. Foodservice expansion creates strong demand for high-quality variants. Brands introduce travel-friendly jars to attract convenience seekers. Flavor innovation helps producers target multiple cuisines. Wider distribution boosts visibility across emerging markets. Premium growth supports stronger revenue potential.

Market Segmentation Analysis:

By Type

The Fermented Bean Curd Market expands through varied product types that support diverse cooking styles. Original variants lead due to their strong use in traditional dishes and daily home meals. Flavored red options gain traction for richer aroma and deeper color that suit sauces and hotpots. Flavored white varieties appeal to consumers seeking milder taste profiles for broad culinary use. It benefits from rising experimentation among younger buyers exploring fermented foods. Flavours innovation strengthens brand positioning across retail shelves. Producers launch customized variants to meet local preferences. Type segmentation supports wide adoption across regions.

- For instance, Flavored red options gain traction for richer aroma and deeper color that suit sauces and hotpots, with fermentation processes at 25°C to 30°C optimized for Actinomucor elegans and other mold species producing enhanced flavor compounds and deeper color development.

By Application/End-Use

Household and retail consumption dominate due to frequent home cooking and rising interest in fermented flavors. Commercial and food processing units use fermented bean curd for marinades, pastes, and seasoning blends. Foodservice outlets adopt it for menu expansion, especially in fusion cuisine and hotpot formats. The Fermented Bean Curd Market gains steady push from growing restaurant chains across urban regions. It supports scalable demand through predictable taste and texture. End-use diversification strengthens supply stability. Wider culinary awareness increases product visibility. Application spread ensures long-term market resilience.

- For instance, Commercial and food processing units use fermented bean curd for marinades, pastes, and seasoning blends, utilizing products where amino acid nitrogen content typically ranges from 0.35 g/100g to over 1.0 g/100g in quality products. The specific value of 0.48 g/100g represents a standard for minimum quality or an intermediate stage in some fermentation processes, rather than the peak for a premium product.

By Distribution Channel

Supermarkets and hypermarkets remain key outlets due to strong visibility and wider product assortments. Convenience stores support impulse buying and quick access in busy neighborhoods. Online stores gain momentum through doorstep delivery and broader flavor availability. Other channels, including specialty shops, expand reach among gourmet-focused customers. It benefits from improved packaging suited for both retail shelves and e-commerce logistics. Distribution networks evolve to reduce stock gaps across cities. Brands use online data insights to refine consumer targeting. Channel diversity strengthens overall market growth.

Segmentation:

By Type:

- Original

- Flavored (Red)

- Flavored (White)

By Application/End-Use:

- Household / Retail Consumption

- Commercial / Food Processing

- Foodservice

By Distribution Channel:

- Supermarkets / Hypermarkets

- Convenience Stores

- Online Stores

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

The Fermented Bean Curd Market holds its strongest position in Asia-Pacific with nearly 40% share. China leads due to long-standing culinary use and deep cultural integration in daily meals. Thailand and India support growth through rising adoption of fermented foods across urban households. It benefits from strong supply networks and established manufacturing clusters in Southeast Asia. Retail expansion widens access for both traditional and flavored variants. Foodservice chains promote fermented bean curd through regional and fusion menus. Rising interest in plant-based products strengthens long-term market engagement across the region.

North America

North America accounts for roughly 25% share, driven by rising demand for international flavors and fermented products. Consumers explore fermented bean curd through Asian cuisine, home cooking trends, and growing interest in plant-based seasonings. The Fermented Bean Curd Market gains traction through specialty stores, online platforms, and mainstream retail chains. It receives support from chefs who highlight fermented ingredients for deeper flavor. Immigrant communities strengthen demand in major metropolitan areas. Restaurants integrate fermented bean curd into fusion dishes that appeal to younger diners. Improved distribution networks help brands reach broader consumer groups.

Europe and Middle East & Africa

Europe holds close to 20% share, with strong demand from specialty food retailers and premium culinary segments. Growing interest in fermented foods boosts uptake among health-conscious households. Middle East & Africa contribute nearly 15% share, supported by expanding urban populations and rising exposure to Asian flavors. The Fermented Bean Curd Market expands through ethnic stores and emerging online retail channels. It builds presence in foodservice sectors that seek diverse flavor bases for global menus. Regional awareness campaigns and chef-led promotions support trial among new consumers. Distribution improvements allow producers to strengthen reach in developing markets.

Key Player Analysis:

Competitive Analysis:

The Fermented Bean Curd Market reflects a competitive landscape shaped by regional producers and established food processing companies. It benefits from strong participation by Asian manufacturers that focus on traditional recipes and steady flavor consistency. Leading brands compete through packaging upgrades, distribution expansion, and broader flavor offerings. Many companies strengthen sourcing ties to maintain stable soybean quality. Smaller players gain visibility through online channels and niche flavor variants. Product differentiation remains a key strategy for sustaining loyal customers. Market competition intensifies as global interest in fermented foods increases steadily.

Recent Developments:

- February 26, 2025, when JDE Peet’s reported its full-year 2024 results. In this earnings report, JDE Peet’s confirmed it is the world’s leading pure-play coffee and tea company serving approximately 4,400 cups of coffee or tea per second. The company’s portfolio includes over 50 brands including Super, alongside L’OR, Peet’s, Jacobs, Senseo, Tassimo, Douwe Egberts, OldTown, Pickwick, and Moccona.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Application/End-Use, and By Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Demand for fermented seasonings will rise as global interest in Asian cuisine grows.

- Premium and artisanal jars will attract consumers seeking stronger flavor depth.

- Online sales will expand through subscription models and curated food platforms.

- Brands will introduce lower-salt and mild variants to target new users.

- Foodservice adoption will increase through fusion menus and regional hotpot chains.

- Packaging upgrades will improve shelf stability and expand export potential.

- Manufacturers will invest in controlled fermentation technology for consistent output.

- Clean-label preferences will boost uptake among health-focused consumers.

- Distribution partnerships will strengthen reach across emerging markets.

- Strong cultural demand in Asia-Pacific will continue to set the pace for global growth.

Market Opportunities:

Market Opportunities: