Market Overview

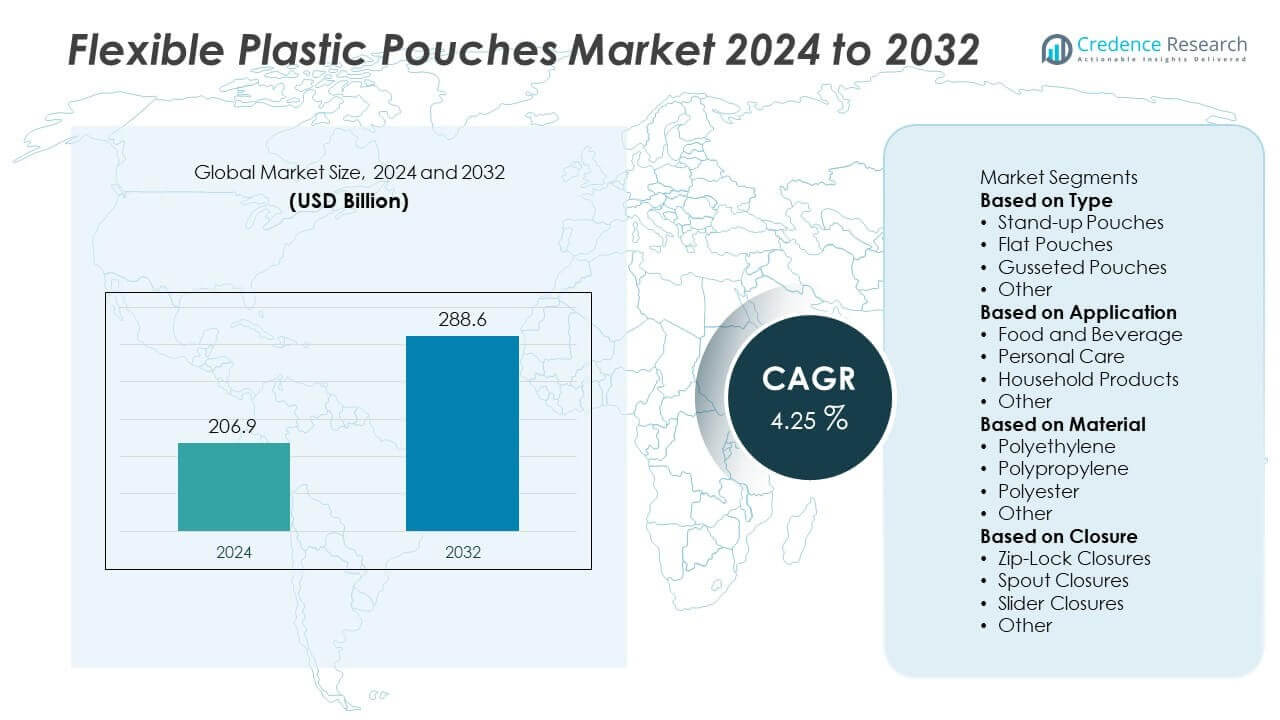

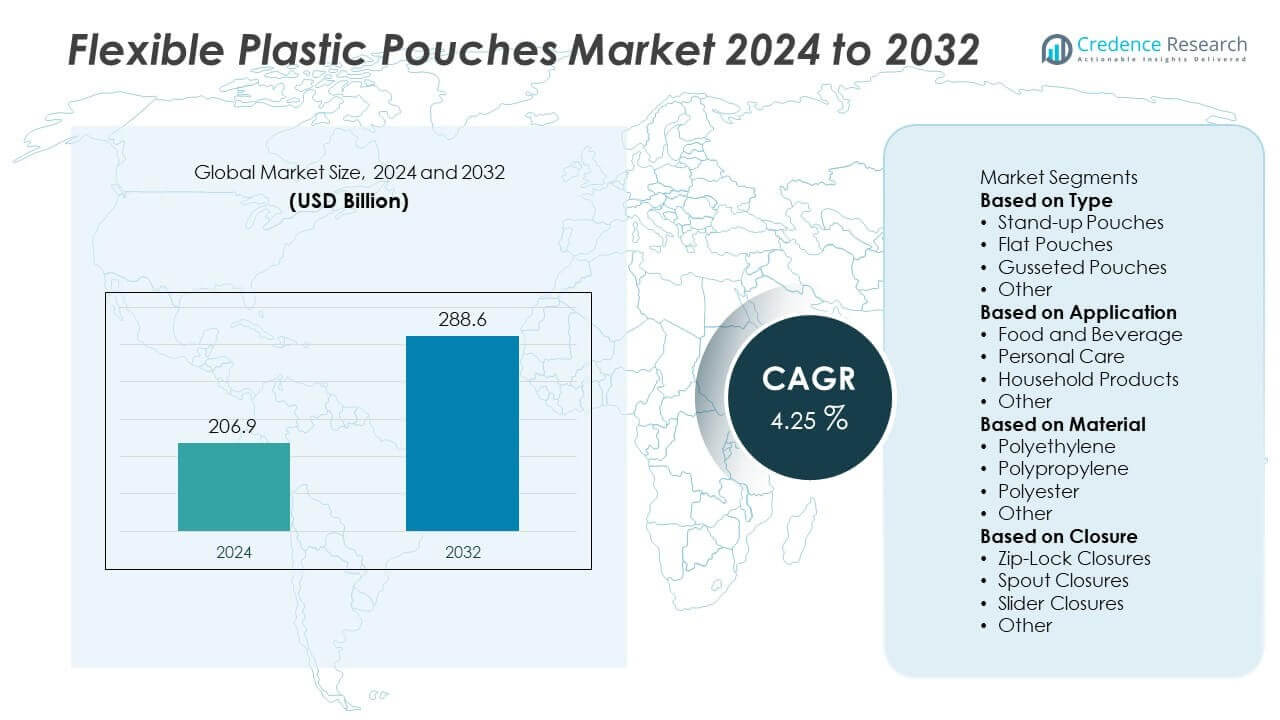

The Flexible Plastic Pouches Market was valued at USD 206.9 billion in 2024 and is anticipated to reach USD 288.6 billion by 2032, expanding at a CAGR of 4.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Plastic Pouches Market Size 2024 |

USD 206.9 Billion |

| Flexible Plastic Pouches Market, CAGR |

4.25% |

| Flexible Plastic Pouches Market Size 2032 |

USD 288.6 Billion |

Flexible Plastic Pouches Market grows with rising demand for lightweight, cost-effective, and versatile packaging solutions. Food and beverage industries drive adoption due to the need for extended shelf life, resealability, and consumer convenience. Increasing popularity of single-serve formats and ready-to-eat meals strengthens demand across retail and e-commerce.

North America leads the Flexible Plastic Pouches Market with strong demand from food, beverage, and household product sectors, supported by advanced retail infrastructure and rising consumer preference for convenience packaging. Europe follows with rapid adoption of recyclable and eco-friendly pouches, driven by strict environmental regulations and the region’s focus on sustainable packaging solutions. Asia-Pacific emerges as the fastest-growing region, fueled by expanding middle-class populations, urbanization, and rising consumption of packaged foods in China, India, and Southeast Asia. Latin America and the Middle East & Africa show steady adoption, supported by growth in retail distribution and consumer goods industries. Global players such as Amcor, Mondi Group, Huhtamaki Group, and Sonoco Products Company strengthen their regional presence by investing in innovative materials, expanding production facilities, and offering eco-friendly packaging formats that align with shifting consumer expectations. It highlights a market shaped by regional dynamics and sustainability-driven strategies.

Market Insights

- Flexible Plastic Pouches Market was valued at USD 206.9 billion in 2024 and is expected to reach USD 288.6 billion by 2032, expanding at a CAGR of 4.25% during the forecast period.

- The market grows with strong demand for lightweight, cost-efficient, and versatile packaging that reduces logistics costs and supports convenience across food, beverage, and personal care industries.

- Sustainability trends accelerate innovation in recyclable, biodegradable, and bio-based pouches, with stand-up and resealable formats gaining popularity due to eco-conscious consumer preferences and stricter regulations.

- Leading players including Amcor, Mondi Group, Huhtamaki Group, and Sonoco Products Company focus on product innovation, sustainable packaging solutions, and digital printing technologies to strengthen market presence.

- Market restraints include volatility in raw material prices, dependency on petroleum-based resins, and challenges related to recycling infrastructure, which increase costs and create operational hurdles for manufacturers.

- North America leads with advanced retail and e-commerce infrastructure, Europe emphasizes eco-friendly and recyclable packaging driven by strict regulations, and Asia-Pacific emerges as the fastest-growing region due to rising packaged food demand in China, India, and Southeast Asia.

- Latin America and Middle East & Africa register steady growth supported by rising consumer goods demand, expanding retail distribution, and gradual adoption of sustainable packaging practices across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Lightweight and Cost-Efficient Packaging

Flexible Plastic Pouches Market grows with increasing demand for lightweight packaging that reduces transportation costs and improves handling efficiency. Brands adopt pouches to lower material usage compared to rigid packaging. The convenience of flexible formats also supports faster logistics and reduced carbon emissions. Food and beverage companies particularly rely on these solutions for efficient distribution. It reinforces the role of pouches as a cost-effective alternative to traditional packaging formats.

- For instance, Amcor launched its AmPrima® 2-liter stand-up refill pouch in July 2025, engineered to use 80% less plastic than rigid bottles while passing 1.5 m e-commerce drop tests, enabling lightweight and durable bulk packaging.

Expanding Adoption Across Food and Beverage Applications

Food and beverage sectors dominate demand for flexible plastic pouches. Growing consumption of snacks, ready-to-eat meals, and beverages drives adoption of resealable, spouted, and stand-up pouch formats. Flexible Plastic Pouches Market benefits from the ability of pouches to maintain product freshness and extend shelf life. Increasing popularity of single-serve and on-the-go formats supports strong growth. It strengthens consumer preference for practical packaging that combines convenience with product safety.

- For instance, Mondi introduced its 950 ml re/cycle spouted pouch for Sherwin-Williams (brand Ronseal) in February 2025. It contains paint concentrate that, when mixed with water, replaces 5 L tubs of premixed fence stain sold in the UK. This innovation reduces plastic use by 90% and increases pallet efficiency by allowing 230% more units per load, meeting the DIY sector’s need for compact and efficient distribution.

Growing Focus on Sustainability and Recyclable Materials

Sustainability pressures encourage innovation in recyclable and bio-based pouch materials. Brands shift toward mono-material pouches that improve recyclability without compromising performance. Flexible Plastic Pouches Market adapts with packaging solutions designed to meet regulatory requirements and consumer expectations for eco-friendly products. Global food and personal care companies promote recyclable pouches to enhance brand reputation. It supports long-term industry transformation toward circular packaging models.

Technological Advancements in Barrier Properties and Customization

Technological progress enhances barrier properties that protect products against moisture, oxygen, and contaminants. Innovations in printing and design allow high-quality graphics and greater customization. Flexible Plastic Pouches Market leverages these advancements to support premium branding and differentiation on shelves. Flexible packaging enables resealability, spouts, and zip locks, aligning with evolving consumer needs. It creates opportunities for producers to deliver both functional and visually appealing solutions.

Market Trends

Shift Toward Sustainable and Eco-Friendly Packaging Solutions

Flexible Plastic Pouches Market witnesses a strong trend toward recyclable and biodegradable materials. Global regulations and consumer expectations accelerate the adoption of eco-friendly designs. Brands focus on mono-material pouches that simplify recycling and reduce environmental impact. Leading companies invest in bio-based plastics and advanced recycling technologies. It highlights a transition from conventional multilayer structures to sustainable packaging solutions.

- For instance, Coveris launched its MonoFlexBE recyclable barrier pouches for Tesco’s cooked chicken line in October 2021, cutting plastic use by 55% per pack while ensuring full recyclability through store soft-plastic collection bins.

Growing Popularity of Stand-Up and Resealable Formats

Consumer convenience drives demand for stand-up and resealable pouch formats. Flexible Plastic Pouches Market benefits from features such as zip locks, sliders, and spouts that extend usability. Food and beverage industries adopt these designs for snacks, sauces, and ready-to-drink products. Personal care and household products also leverage resealability for premium appeal. It strengthens adoption across both consumer and industrial applications.

- For instance, Amcor and Mediacor introduced the AmPrima® 2-liter spouted stand-up pouch in July 2025, designed with a resealable closure and tested to withstand 1.5 m drop tests, providing safe large-volume storage while reducing material use by 80% compared to rigid packaging.

Expansion of Digital Printing and Customization Capabilities

Digital printing technologies reshape the packaging landscape with high-quality graphics and shorter production runs. Flexible Plastic Pouches Market leverages these advancements to deliver eye-catching designs and personalization. Brands adopt customized pouches to enhance shelf visibility and improve customer engagement. E-commerce growth further drives demand for attractive and protective flexible packaging. It positions customization as a competitive advantage in branding strategies.

Increased Penetration in Emerging Economies and New Applications

Emerging economies offer strong growth potential with rising demand for packaged foods and consumer goods. Flexible Plastic Pouches Market expands into applications such as pharmaceuticals, pet food, and industrial products. Rising disposable income and urbanization support broader adoption across diverse categories. Local manufacturers invest in capacity expansion to meet growing domestic and export demand. It reinforces the global shift toward versatile and practical packaging solutions.

Market Challenges Analysis

Regulatory Pressure and Environmental Concerns

Flexible Plastic Pouches Market faces growing challenges from stringent regulations and rising environmental concerns. Governments worldwide impose strict guidelines on single-use plastics and packaging waste. Compliance with recycling standards increases costs for manufacturers and reduces design flexibility. Public criticism of plastic pollution pushes brands to accelerate shifts toward eco-friendly alternatives. It forces companies to invest in sustainable materials and advanced recycling systems. The pressure creates a complex environment where innovation must balance functionality, cost, and regulatory expectations.

Fluctuating Raw Material Costs and Supply Chain Disruptions

Volatility in raw material prices presents another challenge for the industry. Flexible Plastic Pouches Market relies heavily on petroleum-based resins, which are vulnerable to global oil price fluctuations. Rising input costs strain profit margins, particularly for small and mid-sized manufacturers. Supply chain disruptions further complicate raw material availability and production schedules. Manufacturers face difficulties in maintaining consistent pricing for end users. It creates uncertainty in long-term planning and increases dependence on diversification of raw material sources.

Market Opportunities

Rising Demand for Sustainable and Innovative Packaging Solutions

Flexible Plastic Pouches Market presents significant opportunities through innovation in recyclable and bio-based materials. Global brands invest in mono-material designs to improve recyclability and meet sustainability goals. Eco-conscious consumers create strong demand for packaging with lower environmental impact. Growing acceptance of compostable and renewable material options supports long-term growth. It enables manufacturers to differentiate by aligning with green initiatives while enhancing brand value. Opportunities expand further with government incentives and policies promoting sustainable packaging adoption.

Expansion Across Emerging Markets and Diversified Applications

Rapid urbanization and rising disposable incomes in emerging economies drive demand for packaged food, beverages, and personal care items. Flexible Plastic Pouches Market expands into new applications including pharmaceuticals, pet food, and industrial goods. E-commerce growth strengthens opportunities for durable and lightweight packaging formats that ensure product safety. Local and international players scale operations to serve both domestic and export markets. It allows manufacturers to capitalize on growing consumer bases while diversifying revenue streams. The trend creates space for innovation in design, convenience, and functionality across multiple industries.

Market Segmentation Analysis:

By Type

Flexible Plastic Pouches Market is segmented by type into flat pouches and stand-up pouches. Stand-up pouches dominate due to their convenience, shelf visibility, and ability to hold both solid and liquid products. Food and beverage industries increasingly adopt these formats for snacks, sauces, and ready-to-drink items. Flat pouches maintain demand for single-serve and low-cost packaging applications. Their compact structure supports storage efficiency and portability. It reflects how different pouch types serve diverse packaging needs across industries.

- For instance, Huhtamaki received the prestigious Eco-Design Award at PharmaPack 2025 in Paris (January 2025) for its innovative Omnilock™ Ultra PAPER. The company also showcased its blueloop™ portfolio, which features sustainable solutions for sachets, stickpacks, and blisters. Omnilock™ Ultra PAPER is a fully recyclable, heat-sealable paper solution that provides an alternative to non-recyclable multi-layer laminates.

By Application

Segmentation by application covers food and beverages, personal care, pharmaceuticals, household products, and others. Food and beverages remain the largest segment, driven by rising demand for ready-to-eat meals, snacks, and packaged drinks. Flexible Plastic Pouches Market benefits from extended shelf life and resealability features that preserve freshness. Personal care products such as shampoos, lotions, and wipes increasingly use pouches for travel convenience and cost savings. Pharmaceuticals adopt them for lightweight and protective medicine packaging. Household products including detergents and cleaners further expand adoption, highlighting versatility across consumer sectors. It reinforces pouches as a multipurpose packaging solution.

- For instance, At PharmaPack 2025, Huhtamaki showcased its latest advancements in sustainable healthcare and pharmaceutical packaging, winning the prestigious Eco-Design Award for its innovative and fully recyclable Omnilock™ Ultra Paper. The company’s display also featured sustainable packaging solutions from its blueloop portfolio for sachets, stickpacks, and blisters, in addition to its broader range of specialized pouches with protective barrier layers and sterilizable capabilities for medical uses.

By Material

Flexible Plastic Pouches Market is segmented by material into polyethylene, polypropylene, PET, and others. Polyethylene holds a dominant position due to durability, flexibility, and cost efficiency. Polypropylene gains traction with its strength and moisture resistance, making it suitable for food and healthcare packaging. PET is preferred for clarity, lightweight strength, and recyclability, aligning with sustainability goals. Other materials, including specialty films and bio-based plastics, emerge in response to eco-conscious demand. It illustrates how material selection balances performance, cost, and environmental priorities in flexible pouch production.

Segments:

Based on Type

- Stand-up Pouches

- Flat Pouches

- Gusseted Pouches

- Other

Based on Application

- Food and Beverage

- Personal Care

- Household Products

- Other

Based on Material

- Polyethylene

- Polypropylene

- Polyester

- Other

Based on Closure

- Zip-Lock Closures

- Spout Closures

- Slider Closures

- Other

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% of the Flexible Plastic Pouches Market in 2024, making it the leading regional segment. Strong demand is driven by packaged food, beverages, and household products, supported by a mature retail and e-commerce ecosystem. U.S. food and beverage manufacturers adopt stand-up and resealable pouches to enhance product shelf appeal and consumer convenience. Rising popularity of ready-to-eat meals and single-serve packaging further strengthens adoption. Sustainability trends shape innovation, with brands introducing recyclable and bio-based pouches to meet both regulatory requirements and consumer expectations. Canada and Mexico also show steady growth, supported by cross-border trade and rising adoption in personal care and household goods. It reinforces the role of North America as a hub for innovation and premium product packaging.

Europe

Europe holds 27% of the market share in 2024, supported by strict regulatory frameworks and strong consumer demand for sustainable packaging. The European Union’s focus on reducing single-use plastics accelerates the adoption of recyclable and compostable pouches. Food and beverage industries across Germany, France, and the UK lead usage, while personal care and pharmaceutical sectors adopt pouches for lightweight and convenient packaging. Growing emphasis on circular economy models drives investments in mono-material and biodegradable solutions. Flexible Plastic Pouches Market in Europe is shaped by both regulatory compliance and consumer preference for eco-friendly options. It establishes Europe as a front-runner in sustainable flexible packaging adoption.

Asia-Pacific

Asia-Pacific represents 28% of the market share in 2024, emerging as the fastest-growing region. Rapid urbanization, rising disposable incomes, and growing demand for packaged food products fuel strong adoption in China, India, and Southeast Asia. Japan and South Korea lead in technological advancements, focusing on high-barrier films and innovative pouch formats. Expanding e-commerce in the region increases demand for durable, lightweight, and visually appealing packaging. The pharmaceutical and personal care industries also adopt flexible pouches at a rapid pace. Flexible Plastic Pouches Market in Asia-Pacific benefits from large-scale manufacturing capabilities and expanding consumer bases. It positions the region as a major driver of long-term global growth.

Latin America

Latin America holds 7% of the market share in 2024, with growth driven by rising demand for packaged foods, beverages, and household cleaning products. Brazil and Mexico lead adoption, supported by expanding retail and increasing urban consumption patterns. Cost-efficient packaging formats attract local brands seeking affordability and consumer convenience. Flexible Plastic Pouches Market in the region also benefits from gradual adoption of sustainable packaging initiatives. However, economic volatility and limited recycling infrastructure pose challenges. It reflects both opportunity and constraint in a developing market environment.

Middle East & Africa

Middle East & Africa account for 6% of the market share in 2024, with demand led by rising packaged food consumption and expanding retail distribution. Gulf Cooperation Council (GCC) countries drive growth with premium packaging demand, while African economies expand adoption through low-cost pouch formats. Flexible Plastic Pouches Market benefits from rising demand for household and personal care products in urban centers. However, the region faces infrastructure limitations for recycling and regulatory enforcement. It maintains steady growth potential, supported by rising population, growing incomes, and regional diversification efforts in packaging industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor

- Tredegar Corporation

- Ube Industries, Ltd.

- Mondi Group

- Bemis Worldwide

- Coveris Holdings S.A

- Huhtamaki Group

- Westrock Company

- PolyOne Corporation

- Sonoco Products Company

Competitive Analysis

Competitive landscape of the Flexible Plastic Pouches Market features leading players such as Amcor, Tredegar Corporation, Ube Industries, Ltd., Mondi Group, Bemis Worldwide, Coveris Holdings S.A, Huhtamaki Group, Westrock Company, PolyOne Corporation, and Sonoco Products Company. These companies compete through innovation in materials, barrier properties, and designs that address both functionality and sustainability. Product portfolios are strengthened by recyclable, bio-based, and lightweight pouch formats that meet regulatory requirements and consumer demand for eco-friendly packaging. Investments in advanced printing technologies and digital platforms enable customization and enhance brand visibility across retail and e-commerce channels. Expansion into emerging economies supports long-term growth, with companies scaling operations to meet rising demand in food, beverage, and personal care sectors. Strategic mergers, acquisitions, and partnerships allow these players to broaden geographic presence and strengthen supply chains. It reflects a highly competitive market where innovation, sustainability, and global reach define leadership, positioning these firms to capture expanding opportunities and respond to evolving consumer and regulatory expectations.

Recent Developments

- In March 2025, Amcor received two Silver Flexible Packaging Achievement Awards in Sustainability for innovations like vacuum Moda rollstock that produce 40% more bags per pallet and Eco-Tite® film using 29% less material.

- In August 2023, Amcor acquired Phoenix Flexibles, expanding its capacity in the Indian market. Phoenix Flexibles is situated in Gujarat, India, and generates revenue of approximately USD 20 Mn per year from the sale of flexible packaging for food, home care, and personal care applications.

- In February 2023, Sealed Air acquired Liquibox for a purchase price of USD 1.15 Bn on a cash and debt-free basis. Liquibox is a pioneer, innovator and manufacturer of Bag-in-Box sustainable fluids & liquids packaging and dispensing solutions for fresh food.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material, Closure and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for flexible plastic pouches will grow with rising preference for lightweight packaging.

- Sustainable and recyclable pouch formats will dominate product innovation.

- Stand-up and resealable pouches will gain wider acceptance in food and beverage industries.

- Bio-based and compostable materials will see strong adoption due to regulatory pressure.

- Digital printing and customization will expand to enhance brand visibility.

- E-commerce growth will boost demand for durable and protective pouch packaging.

- Emerging markets will drive consumption with rising packaged food and personal care demand.

- Raw material innovation will help balance cost efficiency and sustainability.

- Strategic mergers and acquisitions will strengthen global presence of leading players.

- Investment in recycling infrastructure will create long-term growth opportunities.