Market Overview:

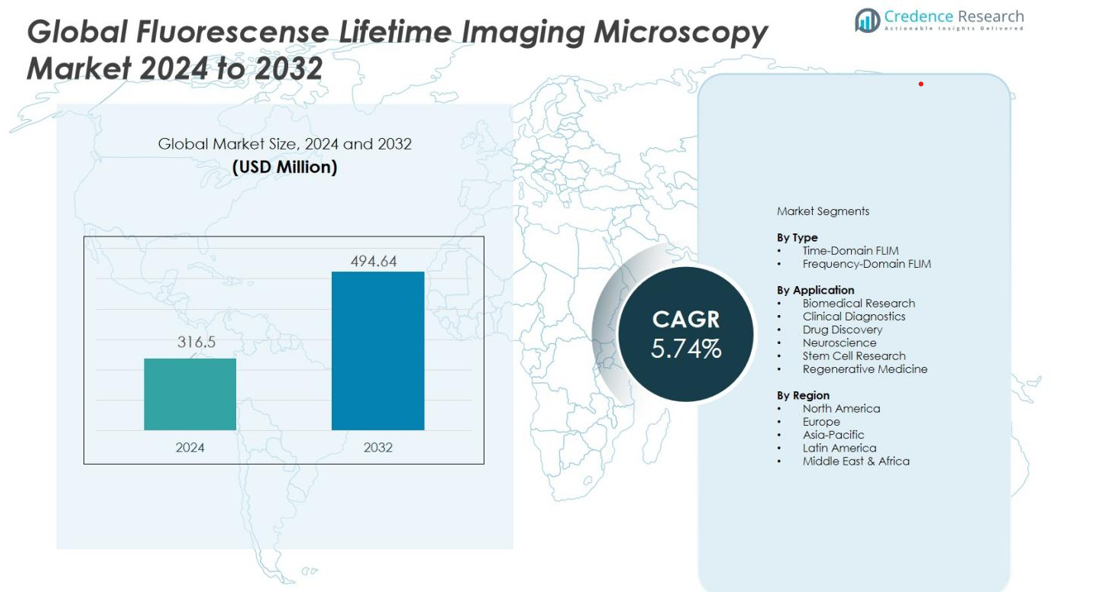

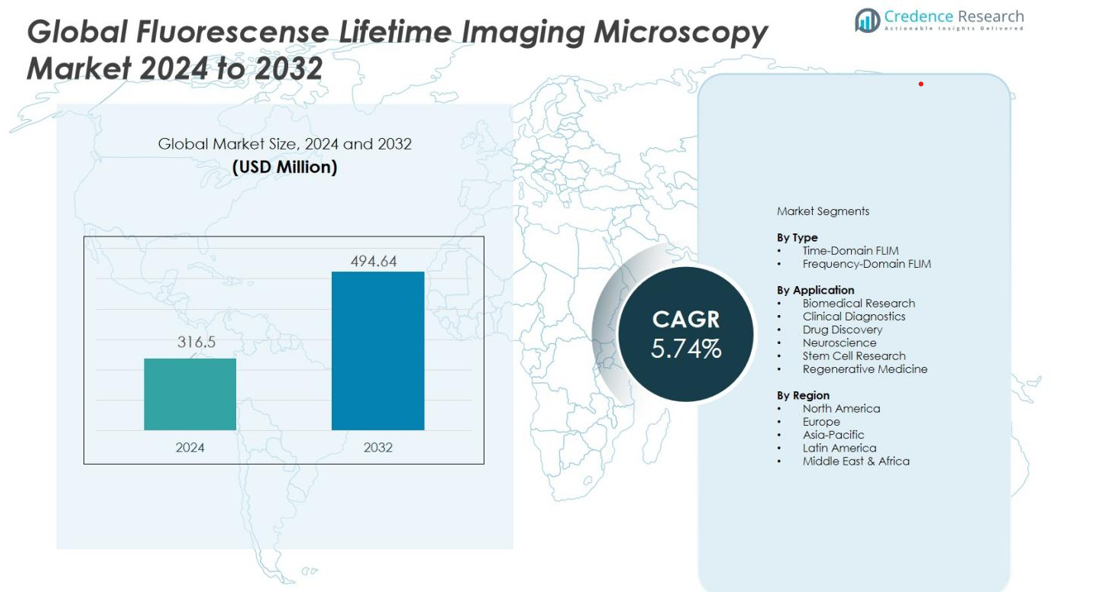

The Global Fluorescense Lifetime Imaging Microscopy Market size was valued at USD 316.5 million in 2024 and is anticipated to reach USD 494.64 million by 2032, at a CAGR of 5.74% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluorescence Lifetime Imaging Microscopy Market Size 2024 |

USD 316.5 million |

| Fluorescence Lifetime Imaging Microscopy Market, CAGR |

5.74% |

| Fluorescence Lifetime Imaging Microscopy Market Size 2032 |

USD 494.64 million |

The growth is driven by increasing demand for advanced, non‑invasive imaging technologies in biomedical research, diagnostics, and drug discovery. Rising prevalence of cancer and other chronic diseases globally fuels the need for precise cellular and molecular imaging — a domain where FLIM offers unique advantages by enabling analysis of molecular interactions, metabolic changes, and micro‑environmental conditions in live cells. Additional drivers include increasing investment in life‑sciences R&D, growth in pharmaceutical and biotechnology sectors, and integration of FLIM with complementary imaging modalities in research and clinical settings.

Regionally, North America leads the global FLIM market, owing to its robust R&D ecosystem, advanced healthcare infrastructure, and high adoption rate of cutting‑edge imaging technologies. Europe also maintains a significant share thanks to strong academic research presence and growing focus on precision medicine. Meanwhile, the Asia‑Pacific region is poised to register the fastest growth over the forecast period — driven by increasing healthcare investments, growing number of research institutions, expanding disease burden, and rising adoption of advanced diagnostic and imaging technologies in emerging economies.

Market Insights:

- The Global Fluorescence Lifetime Imaging Microscopy Market was valued at USD 316.5 million in 2024 and is expected to reach USD 494.64 million by 2032, driven by demand for advanced, non-invasive imaging technologies in research, diagnostics, and drug discovery.

- Advancements in imaging hardware and software, including more sensitive detectors and faster photon-counting modules, enhance temporal and spatial resolution, enabling precise analysis of molecular interactions and cellular dynamics.

- Rising investments in life sciences R&D, along with growth in pharmaceutical and biotechnology sectors, strengthen demand for FLIM systems and improve accessibility through shared core imaging facilities.

- Integration of FLIM with other microscopy techniques, such as two-photon, confocal, and super-resolution imaging, expands its applications across neuroscience, stem cell research, materials science, and drug discovery.

- North America leads the market with 38% share due to advanced research infrastructure, Europe holds 27% supported by academic and healthcare investments, and Asia-Pacific, representing 21%, shows the fastest growth driven by rising healthcare expenditure and expanding research facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Advancements in imaging technology improve capabilities

The Global Fluorescence Lifetime Imaging Microscopy (FLIM) Market benefits strongly from continual improvements in imaging hardware and software. Manufacturers have introduced more sensitive detectors, faster photon‑counting modules, and enhanced data‑analysis algorithms to deliver superior temporal and spatial resolution. These technical innovations enable researchers to capture molecular interactions and cellular dynamics at high speed and precision. Performance improvements drive wider adoption of FLIM in laboratories and clinical institutions for advanced applications.

- For dynamic live-cell studies, Becker & Hickl GmbH developed advanced multi-dimensional time-correlated single photon counting (TCSPC) systems that can record and display online fluorescence lifetime images (FLIM) at rates of up to 10 images per second with a resolution of 128×128 pixels.

Growing demand for precise, non‑invasive diagnostics and biomedical research

Healthcare and life‑sciences sectors increasingly require imaging tools that offer molecular-level insights without damaging samples. FLIM meets this demand by enabling non‑invasive visualization of metabolic states, protein‑protein interactions, and tissue micro‑environment changes. Researchers and clinicians use FLIM for disease pathology studies, early detection of conditions such as cancer, and monitoring treatment responses. This rising need for reliable, high‑resolution diagnostic and research tools fuels broader adoption of FLIM systems in biomedical and clinical settings.

- For Instance, Becker & Hickl GmbH provides Fluorescence Lifetime Imaging (FLIM) systems which are widely cited in hundreds of scientific publications annually and extensively used in various fields, including research into early cancer detection and personalized therapy monitoring.

Increased investments in life‑sciences R&D and expansion in pharmaceutical and biotechnology sectors

Public and private funding for R&D has surged globally, strengthening demand for advanced instruments like FLIM. Governments, universities, and biotech firms allocate substantial resources toward molecular biology, drug discovery, and personalized medicine programs, driving procurement of FLIM systems. Many research institutions establish core imaging facilities, enabling multiple projects to share resources. This trend lowers per‑project costs and increases FLIM’s appeal, accelerating market growth in both developed and emerging economies.

Expansion into multimodal imaging and broader application fields

FLIM’s adoption extends beyond standalone microscopy. Researchers integrate FLIM with other imaging methods — for example, combining with two‑photon, super‑resolution, or confocal microscopy — creating multimodal platforms that offer richer data and broader insights. This broadens FLIM’s relevance across diverse applications including neuroscience, stem cell research, materials science, and drug discovery. Hybrid systems that deliver more comprehensive analysis drive increasing demand for FLIM-equipped platforms across scientific disciplines.

Market Trends:

Integration of FLIM with Multimodal and Hybrid Imaging Platforms

The market shows a clear shift toward combining FLIM with other imaging modalities such as two‑photon, confocal, and super‑resolution microscopy. This hybrid approach delivers richer datasets by merging spatial, spectral, and temporal information, letting researchers observe molecular events with greater depth and detail. It enables studies of complex tissues, deep‑tissue imaging, and detailed in‑vivo investigations that were previously difficult or impossible. Institutions increasingly invest in these multimodal setups because they support diverse applications across neuroscience, cancer biology, and developmental studies. This trend expands FLIM’s relevance beyond traditional cell‑biology labs into more advanced research and clinical environments.

- For example, a system was developed that integrated Fluorescence Lifetime Imaging Microscopy (FLIM) with super-resolution microscopy, a combination that has achieved spatial resolutions down to approximately 20 nanometers (nm).

Advances in Data Analysis Software, Speed, Portability and Accessibility

Providers of FLIM systems now deliver enhanced data‑analysis software and algorithms that lighten the burden of complex fluorescence‑lifetime data processing. New tools accelerate lifetime estimation, reduce noise, and support quantitative analysis, enabling more reliable and reproducible results. It lowers the technical barrier for labs without extensive expertise, broadening adoption beyond elite research centers. Systems are becoming faster and more sensitive — some achieving lifetime resolution below 100 picoseconds — which shortens acquisition time and boosts throughput. Miniaturization and development of more cost‑efficient or compact configurations make FLIM viable for smaller institutions and point‑of-care or in‑vivo applications. This growing accessibility supports widespread integration of FLIM across pharmaceutical, clinical, and academic research settings.

- For instance, Becker & Hickl’s modular FLIM systems leverage high-speed time-correlated single-photon counting (TCSPC) detectors to achieve temporal resolution at the picosecond level and spatial resolution below 200 nm, enabling high-speed volumetric imaging at over 30 volumes per second, critical for neuroscience research.

Market Challenges Analysis:

High Cost and Technical Complexity Limit Adoption

FLIM instrumentation demands significant capital investment, often placing it out of reach for smaller laboratories or institutions with limited funding. It requires specialized hardware such as pulsed lasers and high‑sensitivity detectors, which raises purchase and maintenance costs substantially. The complexity of system operation and requirement for highly skilled operators add to the barrier. Many institutions hesitate to adopt FLIM because they lack trained personnel or cannot justify sustained operational expenses. This financial and technical burden slows penetration in underfunded research settings and emerging economies.

Data Handling, Interpretation Challenges and Limited Depth Penetration

FLIM generates complex, high‑dimensional datasets that demand robust computational resources and sophisticated software for accurate lifetime analysis. Many users struggle with data processing, interpretation, and integration with existing lab information systems, which impedes efficient workflow and reproducibility. Imaging deep tissues or thick biological samples also presents difficulties: scattering, absorption, and limited penetration depth reduce signal-to-noise ratio and degrade resolution in deep‑tissue applications. These technical and methodological constraints restrict FLIM’s utility in some in‑vivo and clinical contexts, limiting its broader adoption.

Market Opportunities:

Expansion of FLIM Applications into Disease Diagnostics, Drug Development, and Personalized Medicine

The Global Fluorescence Lifetime Imaging Microscopy (FLIM) market stands to gain substantial traction as researchers and clinicians explore its application beyond basic cell biology. It offers precise insights into molecular interactions, metabolic states, and tissue micro‑environment changes — attributes that suit diagnostics in oncology, neurodegenerative disorders, and other complex diseases. It can support early disease detection, monitor treatment response, and enable real‑time tracking of therapeutic effects. Pharmaceutical and biotechnology firms may increasingly adopt FLIM for drug screening, target validation, and toxicity assessment. This growth in demand across diagnostics and drug development segments can drive wider FLIM deployment in both research and clinical settings.

Growth in Emerging Markets, Research Funding, and Technological Accessibility

FLIM finds fertile ground in emerging markets where investments in life sciences and biomedical research are rising. Governments and private institutions in Asia‑Pacific, Latin America, and other regions ramp up funding for molecular biology, cancer research, and precision medicine — creating new demand for advanced imaging tools. Systems are gradually becoming more accessible thanks to advances in detector technology, data‑analysis software, and modular configurations. Affordable and compact FLIM platforms may appeal to smaller research labs and institutions, expanding the addressable market. Growing research collaboration and cross‑sector use, including material science, regenerative medicine, and drug development, further broaden FLIM’s applicability and long‑term growth potential.

Market Segmentation Analysis:

By Type:

The Global Fluorescence Lifetime Imaging Microscopy Market is segmented by type into time-domain and frequency-domain systems. Time-domain FLIM systems hold the largest share due to their ability to provide high temporal resolution and precise lifetime measurements in complex biological samples. They are widely used in preclinical and clinical research for monitoring molecular interactions and metabolic processes. Frequency-domain systems are gaining traction for their faster acquisition times and suitability for high-throughput applications. Both types continue to evolve with advancements in detectors, lasers, and computational analysis, enhancing accuracy and usability.

- For instance, Becker & Hickl GmbH’s time-domain FLIM system, utilizing advanced time-correlated single photon counting (TCSPC) technology and specialized detectors, can achieve an optical instrument response function (IRF) width of less than 20 picoseconds (ps) in optimal configurations, enabling detailed lifetime separation and the resolution of ultra-short decay components (e.g., in the 10 ps range) in complex tissue samples with multiple fluorophores simultaneously.

By Application:

By application, FLIM serves multiple sectors including biomedical research, clinical diagnostics, and drug discovery. Biomedical research dominates adoption due to its demand for non-invasive cellular and molecular imaging to study metabolic states, protein interactions, and tissue microenvironments. Clinical diagnostics is expanding rapidly, driven by the need for early disease detection, particularly in oncology and neurodegenerative disorders. Drug discovery and development utilize FLIM to evaluate therapeutic efficacy, toxicity, and pharmacokinetics at the molecular level. It provides actionable insights that accelerate research and reduce time-to-market for novel therapies. Emerging applications in neuroscience, stem cell research, and regenerative medicine further diversify its use, strengthening the overall market potential.

- For Instance, Researchers use fluorescence lifetime imaging microscopy (FLIM) technology in conjunction with Förster resonance energy transfer (FRET) to quantify protein-protein interactions in live cells.

Segmentations:

By Type

- Time-Domain FLIM

- Frequency-Domain FLIM

By Application

- Biomedical Research

- Clinical Diagnostics

- Drug Discovery

- Neuroscience

- Stem Cell Research

- Regenerative Medicine

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Maintains Leadership Through Advanced Infrastructure

North America accounts for 38% of the Global Fluorescence Lifetime Imaging Microscopy Market, reflecting its dominant position in the industry. The region benefits from well-established research institutions, robust healthcare infrastructure, and high adoption of advanced imaging technologies. It receives strong government and private sector funding for biomedical research, cancer studies, and pharmaceutical R&D. Many universities and hospitals maintain state-of-the-art imaging facilities that integrate FLIM with other microscopy modalities. High awareness of precision medicine and rising demand for molecular-level diagnostics drive steady adoption. Manufacturers prioritize North America for launching innovative systems and expanding service networks.

Europe Exhibits Stable Growth Driven by Research and Healthcare Investment

Europe holds 27% of the FLIM market, supported by its strong academic and research ecosystem and substantial healthcare investments. Collaborative initiatives between universities, research institutions, and biotech firms encourage technology adoption. Rising interest in personalized medicine, cancer research, and neuroscience applications fuels FLIM deployment. Countries such as Germany, the UK, and France contribute heavily through government grants and funding programs. Clinical and preclinical research increasingly use FLIM for detailed cellular and molecular analysis.

Asia-Pacific Emerges as the Fastest-Growing Region with Expanding Opportunities

Asia-Pacific represents 21% of the Global FLIM Market and shows the highest growth potential due to rising healthcare expenditure and expansion of research infrastructure. It attracts investments in molecular imaging, drug discovery, and cancer diagnostics. Growing prevalence of chronic diseases and adoption of advanced diagnostic tools stimulate market expansion. Countries including China, Japan, and India drive demand for cost-efficient and compact FLIM systems. Collaborative research initiatives and rising technical expertise further enhance regional growth, positioning Asia-Pacific as a key driver in the coming decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Fluorescence Lifetime Imaging Microscopy Market is highly competitive and characterized by the presence of leading players focusing on technological innovation, product development, and strategic collaborations. Companies invest heavily in research and development to improve detector sensitivity, laser performance, and data analysis software, enhancing system precision and usability. It faces competition from both established imaging solution providers and emerging specialized startups offering compact or cost-effective FLIM systems. Strategic partnerships with research institutions, hospitals, and pharmaceutical firms strengthen market positioning and facilitate adoption across diverse applications. Continuous introduction of advanced multimodal platforms and expansion into emerging markets further intensifies the competitive landscape. Market leaders emphasize customer support, service networks, and training programs to differentiate their offerings and maintain long-term relationships with research and clinical users. This dynamic environment drives innovation and broadens the adoption of FLIM technologies globally.

Recent Developments:

- In July 2024, Leica Microsystems celebrated its 175th anniversary with a ceremony in Wetzlar, Germany, highlighting its legacy and innovations in microscopy and scientific instruments under the Danaher Corporation umbrella.

- In February 2025, Leica Microsystems acquired ATTO-TEC to advance its microscopy imaging workflows with high-quality fluorescent dyes and reagents for complex experiments.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Fluorescence Lifetime Imaging Microscopy Market will witness growing adoption in biomedical research and clinical diagnostics due to its ability to provide precise molecular and cellular insights.

- Integration of FLIM with multimodal imaging platforms will expand its application across neuroscience, oncology, and regenerative medicine.

- Advancements in detector technology and laser systems will improve temporal and spatial resolution, enabling more accurate imaging of complex biological samples.

- Development of compact, cost-effective, and portable FLIM systems will increase accessibility for smaller laboratories and emerging markets.

- Enhanced data analysis software and AI-assisted algorithms will streamline fluorescence lifetime interpretation and support high-throughput workflows.

- Expansion in drug discovery and development applications will drive demand, particularly for monitoring therapeutic efficacy and molecular interactions.

- Increasing collaborations between academic institutions, research organizations, and industry will accelerate technology adoption and knowledge transfer.

- Emerging markets in Asia-Pacific and Latin America will provide significant growth opportunities due to rising healthcare investments and research infrastructure.

- Training programs and technical support initiatives will help overcome operational complexity and promote widespread implementation.

- Ongoing innovation and integration with other imaging techniques will sustain the market’s relevance and strengthen its long-term growth potential.