| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Industrial Catalyst Market Size 2024 |

USD 107.4 Million |

| GCC Industrial Catalyst Market, CAGR |

2.03% |

| GCC Industrial Catalyst Market Size 2032 |

USD 126.17 Million |

Market Overview:

The GCC Industrial Catalyst Market is projected to grow from USD 107.4 million in 2024 to an estimated USD 126.17 million by 2032, with a compound annual growth rate (CAGR) of 2.03% from 2024 to 2032.

Several factors are propelling the growth of industrial catalysts in the GCC region. The GCC’s strategic position as a global hub for oil and gas production has led to a strong emphasis on refining and petrochemical sectors, which are major consumers of industrial catalysts. The increasing demand for high-value petrochemical products necessitates advanced catalytic processes to enhance yield and efficiency. Additionally, stringent environmental regulations are prompting industries to adopt cleaner technologies, further boosting the demand for catalysts that facilitate low-emission processes. The GCC’s investment in diversifying its economy, with a focus on sustainable and high-value-added chemical products, also contributes to the growing adoption of industrial catalysts.

The GCC region, comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE), plays a pivotal role in the global industrial catalyst market. Saudi Arabia, in particular, stands out with its extensive oil reserves and advanced petrochemical infrastructure, hosting numerous refineries and chemical plants that rely heavily on catalytic processes. The UAE, especially Dubai and Abu Dhabi, has emerged as a significant player in chemical manufacturing, attracting investments in catalyst technologies to support its growing industrial base. Qatar and Kuwait are also notable contributors, with substantial investments in petrochemical projects aimed at enhancing production capabilities and meeting international standards. Oman’s strategic initiatives to develop its refining and petrochemical sectors further underscore the region’s commitment to leveraging advanced catalyst technologies. This collective focus positions the GCC as a dynamic and influential market for industrial catalysts, with ongoing investments and technological advancements driving sustained growth

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The GCC Industrial Catalyst Market is expected to grow from USD 107.4 million in 2024 to USD 126.17 million by 2032, with a CAGR of 2.03%, driven by the region’s strong reliance on the petrochemical and refining sectors.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- Increasing demand for high-value petrochemical products, such as plastics and specialty chemicals, is fueling the need for advanced catalytic processes to improve yield and efficiency across various industries.

- Stricter environmental regulations in the GCC are driving industries to adopt cleaner technologies, boosting demand for catalysts that facilitate low-emission processes and enhance energy efficiency.

- Ongoing technological advancements, including biocatalysts and nano-catalysts, are improving the efficiency and selectivity of chemical processes, further propelling the growth of the industrial catalyst market.

- The GCC’s move toward economic diversification, especially in manufacturing, renewables, and technology, is creating new opportunities for industrial catalysts in emerging sectors.

- High initial investment costs for advanced catalysts and associated infrastructure remain a barrier for some companies, particularly those with smaller budgets or operating in low-margin industries.

- Geopolitical factors and supply chain disruptions can impact the availability and cost of raw materials, posing challenges for catalyst production and procurement in the GCC market.

Market Drivers:

Increasing Demand for Petrochemical Products

The GCC region’s strategic position as a leading global producer of oil and gas has led to an increasing demand for petrochemical products. As the region seeks to diversify its economy, the petrochemical industry has become a central pillar of growth. Industrial catalysts play a crucial role in enhancing the efficiency and yield of various chemical processes, such as refining and polymer production. For instance, Saudi Arabia’s SABIC has invested in advanced polyethylene and polypropylene plants to meet the rising global demand for plastics. The growing demand for high-value petrochemical products such as plastics, fertilizers, and specialty chemicals has significantly bolstered the need for advanced catalytic technologies. These catalysts not only optimize the production process but also ensure that the end products meet stringent quality standards, driving their adoption across the region.

Environmental Regulations and Sustainability Initiatives

The GCC nations are increasingly focused on environmental sustainability, with stricter regulations and initiatives to reduce industrial emissions. These regulations necessitate the implementation of cleaner, more efficient technologies across sectors, particularly in petrochemical production. Industrial catalysts help address these regulatory challenges by facilitating processes that reduce pollutants such as sulfur and carbon emissions. Moreover, catalysts improve energy efficiency, reducing both operational costs and the carbon footprint of industrial operations. For instance, the UAE’s Al Reyadah CCUS project captures up to 800,000 tonnes of CO2 annually from Emirates Steel facilities and uses it for enhanced oil recovery, reducing emissions and freeing natural gas for power generation. Industrial catalysts are vital in such projects, enabling cleaner chemical reactions and improving energy efficiency. As governments in the region continue to enforce stringent environmental standards, the demand for catalysts that enable cleaner production methods will grow, positioning them as a critical component of sustainability efforts in the GCC.

Technological Advancements in Catalysis

Ongoing advancements in catalytic technologies are a significant driver of growth in the GCC industrial catalyst market. With a focus on enhancing the performance of existing catalytic processes, there has been continuous research and development to create more efficient, durable, and cost-effective catalysts. Innovations such as biocatalysts, nano-catalysts, and solid catalysts are gaining traction for their ability to improve reaction rates and selectivity. These technologies not only increase the efficiency of chemical processes but also enable the production of high-value chemicals from unconventional feedstocks. As industries in the GCC region adopt these advanced catalyst technologies, the overall market for industrial catalysts is poised for sustained growth.

Diversification of the GCC Economy

The GCC countries are undergoing a significant transformation as they seek to reduce their dependence on oil exports and diversify into other sectors, such as manufacturing, renewables, and technology. This shift has prompted increased investment in industries such as chemicals, construction materials, and automotive production. As these sectors expand, there is an increased need for industrial catalysts to support complex manufacturing processes, enhance product quality, and improve production efficiency. The move toward a diversified economy, coupled with the ongoing industrial expansion, will continue to drive the demand for industrial catalysts in the GCC region, positioning the market for long-term growth.

Market Trends:

Adoption of Green and Sustainable Catalysts

One of the prevailing trends in the GCC industrial catalyst market is the increasing adoption of green and sustainable catalysts. As environmental concerns become more pronounced, industries in the region are exploring catalysts that facilitate cleaner and more sustainable chemical processes. Green catalysts, which reduce energy consumption and minimize the release of harmful emissions, are gaining popularity in various sectors, particularly in petrochemical and refining industries. For instance, bio-based catalysts and nano-catalysts are being developed to enhance efficiency while minimizing environmental impact. These catalysts are designed to meet environmental regulations without compromising productivity or cost-effectiveness, aligning with the GCC’s broader commitment to sustainability and cleaner industrial practices. The shift towards green catalysts is expected to drive innovation and adoption in the market, as industries seek to reduce their ecological footprint.

Rising Demand for High-Performance Catalysts

Another prominent trend is the growing demand for high-performance catalysts capable of operating under harsh industrial conditions. In the GCC, where the chemical and petrochemical sectors are integral to economic growth, there is a constant push for catalysts that deliver superior performance, such as enhanced thermal stability, selectivity, and longevity. For instance, platinum-based reforming catalysts are used in refineries to enhance gasoline production efficiency, while cobalt-based catalysts are employed in Fischer-Tropsch processes to convert natural gas into liquid fuels. These high-performance catalysts enable industries to maintain productivity while optimizing efficiency. As the region’s industrial processes become more complex and sophisticated, the demand for catalysts that can handle more challenging chemical reactions without degrading over time is expected to rise. This trend is particularly strong in the refining and petrochemical sectors, where catalyst performance directly impacts production efficiency and product quality.

Shift Toward Automation and Digitalization in Catalyst Management

Automation and digitalization are emerging as key trends in the management and optimization of catalysts in the GCC. With advancements in digital technologies, industries are increasingly turning to data-driven solutions to monitor and optimize catalytic processes. These technologies enable real-time tracking of catalyst performance, ensuring that catalysts are operating at optimal conditions and providing early detection of potential issues. Additionally, digital tools can predict the lifespan of catalysts and suggest timely maintenance or replacements, minimizing downtime and improving overall efficiency. The integration of automation and digitalization in catalyst management is expected to enhance operational efficiency, reduce costs, and improve the sustainability of industrial processes in the GCC.

Emergence of New Catalytic Technologies

The GCC industrial catalyst market is witnessing an increase in the development and implementation of innovative catalytic technologies. New materials and catalyst formulations, such as nano-catalysts and bio-based catalysts, are being explored to improve the effectiveness of chemical processes. These advancements enable industries to achieve better yield, selectivity, and conversion rates, offering higher returns on investment. The development of new catalytic materials also allows for the use of alternative feedstocks and energy sources, providing industries in the region with greater flexibility in their operations. As technological innovation continues to play a significant role in enhancing catalyst performance, these emerging technologies are expected to drive further growth in the GCC market.

Market Challenges Analysis:

High Initial Investment Costs

One of the key restraints in the GCC industrial catalyst market is the high initial investment required for catalyst development and implementation. Advanced catalysts, particularly those designed for high-performance and sustainable processes, often come with a premium price. For instance, platinum-based catalysts used in hydrogenation processes are expensive due to the high cost of raw materials like platinum and the complex manufacturing processes involved. For many companies in the GCC, especially smaller players or those operating in industries with tight profit margins, these upfront costs can be a significant barrier. Although the long-term benefits of improved efficiency and reduced operational costs may offset the initial investment, the financial burden can delay the adoption of advanced catalytic technologies.

Supply Chain Disruptions

Another challenge facing the GCC industrial catalyst market is the vulnerability of supply chains. The production of industrial catalysts relies on a steady supply of specific raw materials, some of which are rare or difficult to procure. Geopolitical factors, natural disasters, or fluctuations in global demand for these materials can lead to disruptions in the supply chain, affecting the availability and cost of catalysts. The GCC, being a hub for oil and gas production, is particularly sensitive to such disruptions, which can impact the region’s refining and petrochemical industries that rely heavily on catalysts. As supply chain volatility increases, companies may face delays in catalyst procurement and additional costs.

Technological and Process Adaptation Challenges

The adoption of new catalytic technologies requires significant modifications to existing industrial processes. In many cases, industries must invest in training personnel and upgrading equipment to accommodate new catalytic systems. This technological adaptation can be time-consuming and costly, particularly for companies that have established operations with traditional catalytic methods. Additionally, the risk of compatibility issues between new catalysts and existing infrastructure can create operational disruptions, further challenging the market’s growth. The complexity of process adaptation can deter some companies from pursuing new catalyst technologies, thereby limiting overall market expansion.

Market Opportunities:

The GCC industrial catalyst market is poised for substantial growth driven by the expansion of the region’s petrochemical and refining industries. As countries in the GCC continue to diversify their economies, there is a growing emphasis on the development of high-value petrochemical products. This expansion presents significant opportunities for catalyst manufacturers, as catalysts play a vital role in optimizing refining processes and enhancing the yield of petrochemical products. Additionally, as GCC countries strive to meet global demand for sustainable and high-quality chemical products, there is a rising demand for advanced catalysts that improve process efficiency while adhering to environmental standards. Companies investing in new catalyst technologies that enable cleaner, more efficient operations are likely to gain a competitive edge in this rapidly growing market.

The increasing focus on sustainability and environmental regulation in the GCC offers another key market opportunity for industrial catalysts. As the region faces mounting pressure to reduce carbon emissions and improve energy efficiency, there is a strong push toward adopting green catalytic technologies. Catalysts that facilitate low-emission processes, improve fuel efficiency, and enable the production of renewable chemicals are becoming increasingly attractive to industries looking to comply with stricter environmental regulations. Additionally, government initiatives aimed at promoting sustainable practices, including renewable energy projects and carbon capture technologies, will further drive demand for green catalysts. This trend presents a promising opportunity for catalyst suppliers to innovate and capitalize on the shift toward more environmentally friendly industrial practices.

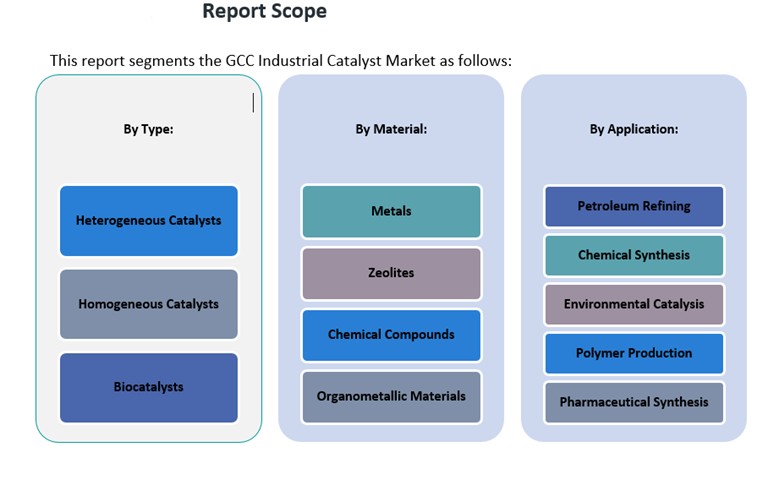

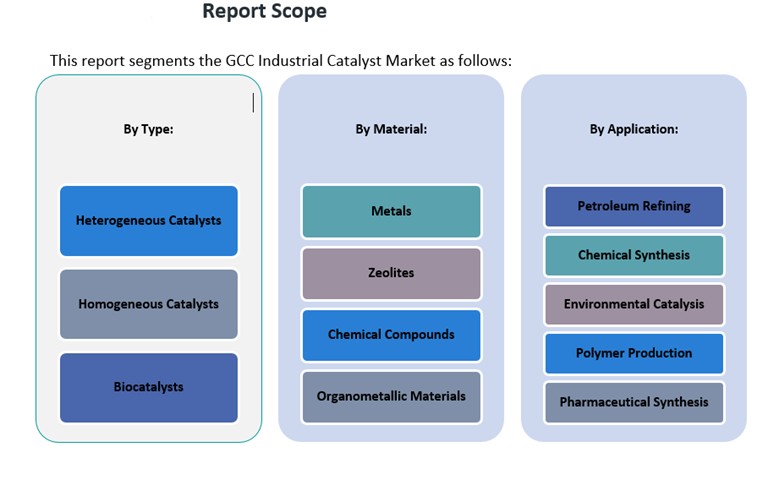

Market Segmentation Analysis:

The GCC industrial catalyst market is segmented by type, application, and material, each of which plays a crucial role in the growth and development of the region’s industrial base.

By Type Segment:

The market is primarily divided into three categories: heterogeneous catalysts, homogeneous catalysts, and biocatalysts. Heterogeneous catalysts dominate the market, particularly in petroleum refining and chemical synthesis, due to their high stability and efficiency under industrial conditions. Homogeneous catalysts are used in specialized applications such as fine chemical production and pharmaceutical synthesis, where they provide high selectivity. Biocatalysts, although still emerging, are gaining traction due to their environmentally friendly attributes and application in green chemistry, especially in pharmaceutical and bio-based chemical industries.

By Application Segment:

The GCC market sees significant demand across several key applications, including petroleum refining, chemical synthesis, environmental catalysis, polymer production, and pharmaceutical synthesis. Petroleum refining remains the largest application segment due to the region’s extensive oil production. Chemical synthesis and polymer production are growing as the GCC diversifies its industrial activities, while environmental catalysis is gaining importance due to increasing regulatory pressures to reduce emissions. Pharmaceutical synthesis is a smaller but fast-growing segment, driven by advancements in biocatalysts.

By Material Segment:

The material segment includes metals, zeolites, chemical compounds, and organometallic materials. Metals, particularly precious metals like platinum and palladium, are widely used in refining and chemical synthesis. Zeolites are crucial in petroleum refining and environmental applications due to their high surface area and catalytic properties. Chemical compounds and organometallic materials are increasingly used in advanced chemical processes and polymer production, offering higher efficiency and selectivity.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The GCC industrial catalyst market is primarily driven by the six member countries: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE). Each of these nations plays a pivotal role in the regional catalyst market, with differing levels of economic development, industrial output, and investment in advanced catalytic technologies. Saudi Arabia, being the largest economy in the region and a global leader in oil and gas production, holds the largest market share in the GCC industrial catalyst market. The kingdom’s vast petrochemical and refining sectors, coupled with ongoing investments in new projects, are central to its dominant position. Saudi Arabia accounts for approximately 40% of the GCC industrial catalyst market share, driven by the significant demand for catalysts used in its extensive oil refining and chemical manufacturing operations.

The UAE follows closely behind, holding around 25% of the market share. Dubai and Abu Dhabi are key industrial hubs in the country, with significant investments in petrochemicals, chemicals, and energy sectors. The UAE is also making strides in sustainable and high-value-added manufacturing, creating opportunities for catalysts in new, high-performance applications. The push toward green technologies and sustainable industrial processes in the UAE is fueling demand for advanced catalyst solutions, particularly those designed to reduce emissions and enhance energy efficiency.

Qatar and Kuwait contribute smaller but notable portions to the market, with each accounting for about 10% of the market share. Qatar’s rapidly growing petrochemical industry, particularly in liquefied natural gas (LNG) production, is a major driver for catalyst adoption in the region. Similarly, Kuwait’s strong refining and chemical sectors continue to demand efficient catalytic solutions for production optimization. Both countries are also aligning their industrial processes with environmental regulations, creating opportunities for the adoption of more sustainable catalyst technologies.

Oman, although smaller in comparison, holds about 5% of the market share. Oman is focusing on expanding its refining and petrochemical capabilities, particularly through initiatives in Muscat and Salalah, which will contribute to the growing demand for industrial catalysts. As the country strengthens its industrial base and pursues technological advancements, the demand for efficient and sustainable catalyst solutions is expected to rise.

Key Player Analysis:

- SABIC

- Arkema Group

- Johnson Matthey

- BASF SE

- Haldor Topsoe A/S

- Qatar Petroleum

- Evonik Industries AG

- PetroSA

- Dow Inc.

- Chevron Phillips Chemical Company

Competitive Analysis:

The GCC industrial catalyst market is highly competitive, with a mix of global players and regional manufacturers offering a wide range of catalyst solutions. Leading international companies such as BASF, Johnson Matthey, and Clariant dominate the market, leveraging their extensive technological expertise and strong supply chains. These companies provide advanced catalysts for various industrial sectors, including petrochemicals, refining, and energy. Regional players, including SABIC and Qatar Petroleum, also hold a significant market share, benefiting from strong ties with local industries and governments. These companies are increasingly focusing on sustainable and high-performance catalyst solutions to align with regional environmental regulations and enhance process efficiency. The competition is further intensifying as both global and regional players invest in research and development to innovate catalysts that meet the evolving needs of the GCC market, such as low-emission technologies and enhanced catalyst longevity. The market remains dynamic, with growing emphasis on technological advancements and sustainability.

Recent Developments:

- In November 2024, Clariant launched its Plus series syngas catalysts, including ReforMax LDP Plus, ShiftMax 217 Plus, and AmoMax 10 Plus. These advanced catalysts were designed as drop-in solutions to enhance plant economics and reduce carbon emissions in hydrogen, ammonia, and methanol production.

- In April 2022, SABIC completed the acquisition of Clariant’s 50% stake in Scientific Design, granting SABIC full ownership of this catalyst leader. This move strengthens SABIC’s position in high-performance process technologies and catalysts, enabling it to meet growing catalyst demands and drive innovation in the sector.

- On February 26, 2025, Johnson Matthey launched state-of-the-art Advanced Cracking Evaluation (ACE) units for catalyst testing in fluid catalytic cracking (FCC) additives. This investment enhances JM’s innovation capabilities by enabling faster development timelines and higher precision in catalyst optimization for renewable feedstock processing.

Market Concentration & Characteristics:

The GCC industrial catalyst market is characterized by a moderate level of concentration, with several key players dominating the sector. Major international corporations, including BASF SE, Albemarle Corporation, and Clariant AG, hold significant market shares, benefiting from their extensive technological expertise and established distribution networks. These companies offer a diverse portfolio of catalysts catering to various applications, such as petrochemicals, refining, and chemical synthesis. Their strong presence in the GCC region is bolstered by strategic partnerships and collaborations with local enterprises. Regional companies, notably SABIC (Saudi Basic Industries Corporation), also play a crucial role in the market. SABIC’s substantial investments in catalyst technologies and its integration within the regional petrochemical industry enhance its competitive position. The interplay between global and regional entities fosters a dynamic market environment, driving innovation and the development of advanced catalytic solutions tailored to the unique demands of the GCC industrial landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The GCC industrial catalyst market is expected to grow due to increasing investments in petrochemical and refining sectors.

- Rising environmental regulations will drive the adoption of sustainable and green catalyst technologies in the region.

- Enhanced demand for high-performance catalysts will support growth in the petrochemical and energy industries.

- The shift towards cleaner production methods will foster innovation in low-emission catalytic solutions.

- Technological advancements in catalyst development, such as nano-catalysts and biocatalysts, will create new market opportunities.

- GCC governments’ commitment to diversifying economies will promote demand for catalysts in manufacturing and other industrial sectors.

- The UAE’s focus on sustainable growth and renewable energy will accelerate the need for advanced catalytic solutions.

- Continued regional partnerships and collaborations will strengthen the market presence of global catalyst suppliers.

- The expansion of LNG and chemical industries in Qatar and Kuwait will fuel demand for more efficient catalyst technologies.

- Ongoing research and development will result in catalysts with improved durability, reducing operational costs in the long term.