Market Overview

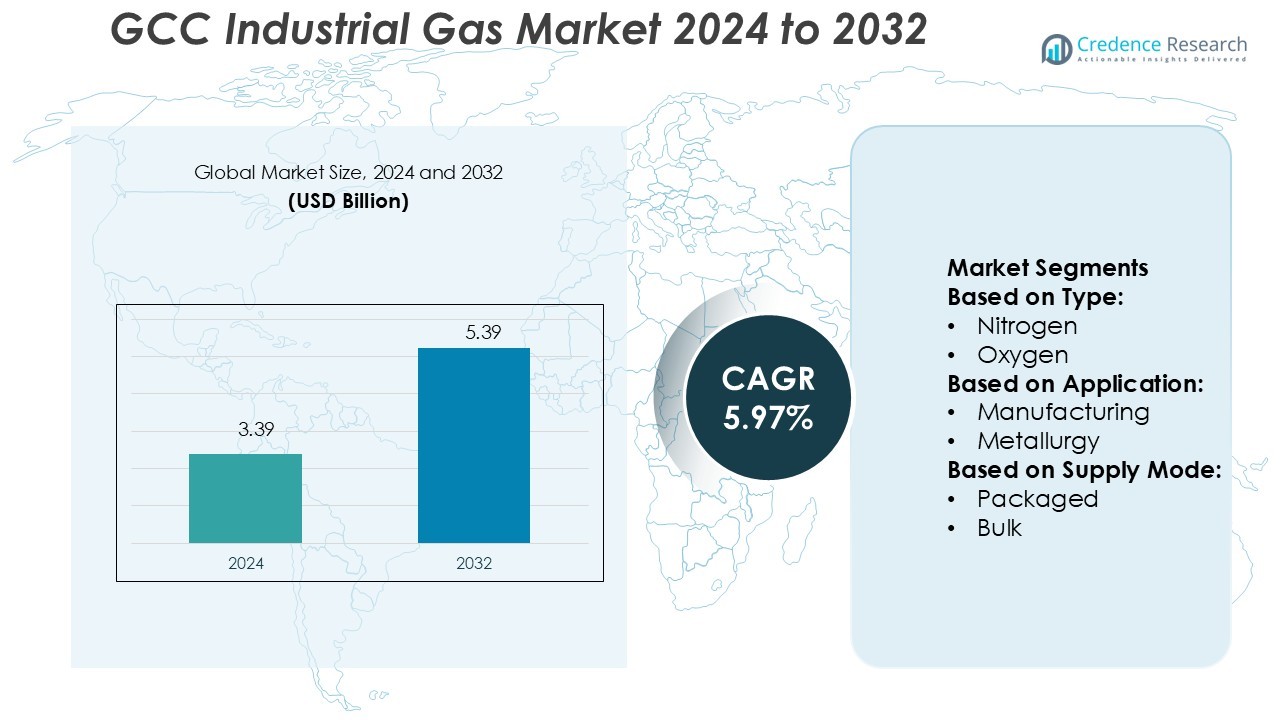

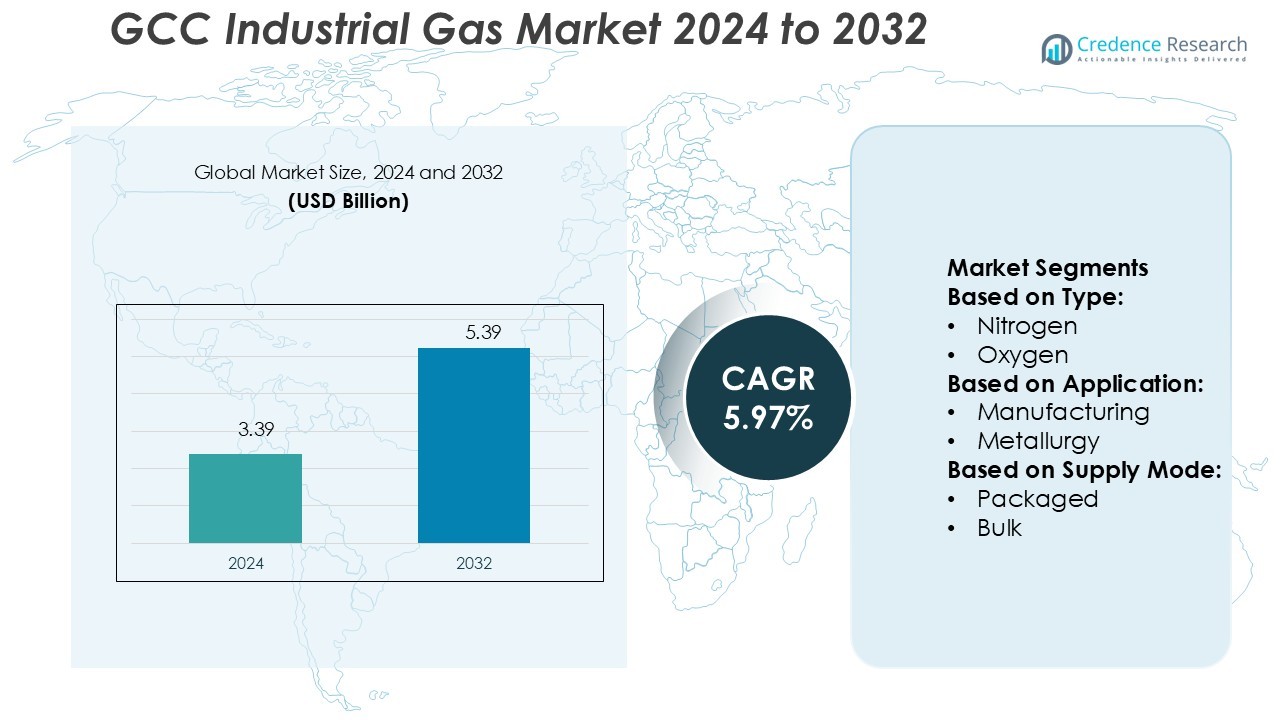

GCC Industrial Gas Market size was valued USD 3.39 billion in 2024 and is anticipated to reach USD 5.39 billion by 2032, at a CAGR of 5.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Industrial Gas Market Size 2024 |

USD 3.39 Billion |

| GCC Industrial Gas Market, CAGR |

5.97% |

| GCC Industrial Gas Market Size 2032 |

USD 5.39 Billion |

The GCC Industrial Gas Market is shaped by strong competition among Jotun, RPM International Inc., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, Hempel A/S, Diamond Paints, BASF SE, Akzo Nobel N.V., Axalta Coating Systems, and PPG Industries, Inc. These players focus on expanding production capacity, modernizing distribution networks, and integrating advanced technologies to strengthen their market position. Strategic collaborations and investments in sustainable solutions support long-term growth and operational efficiency. The market is geographically led by Saudi Arabia, which holds a 43.6% share, supported by its strong industrial base, large energy sector, and government-backed infrastructure development. High demand from manufacturing, metallurgy, and energy industries continues to drive competitive strategies across the region, positioning leading companies to leverage scale, innovation, and operational excellence to maintain market dominance.

Market Insights

- The GCC Industrial Gas Market was valued at USD 3.39 billion in 2024 and is projected to reach USD 5.39 billion by 2032, growing at a CAGR of 5.97%.

- Market growth is driven by rising demand from manufacturing, metallurgy, and energy sectors supported by infrastructure investments and industrial expansion.

- The market is witnessing a strong trend toward digitalization, sustainability, and on-site production solutions to improve efficiency and reduce emissions.

- Intense competition is shaping the market as major players focus on technology upgrades, capacity expansion, and sustainable solutions to secure market share.

- Saudi Arabia leads the regional market with a 43.6% share, driven by its strong energy sector and large industrial base, while manufacturing applications account for a major segment share, supported by steady growth in other end-use sectors across the GCC region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Nitrogen dominates the GCC industrial gas market with a 34.6% market share. The strong position is driven by extensive use in inerting, blanketing, and purging applications across manufacturing and energy sectors. Its role in maintaining process stability and reducing oxidation risks makes it a preferred choice for large-scale industries. Growing demand from the food processing and electronics sectors further strengthens nitrogen’s dominance. Oxygen and carbon dioxide also show steady growth due to their increasing adoption in steelmaking, water treatment, and beverage carbonation processes.

- For instance, RPM recently opened a 60,000-square-foot Innovation Center of Excellence in Greensboro, North Carolina. This center houses liquid and powder application labs, analytical labs, and formulation labs to accelerate product development.

By Application

Manufacturing holds the dominant share of 39.2% in the GCC industrial gas market. High consumption of nitrogen, oxygen, and argon in welding, cutting, and precision manufacturing processes drives this segment’s growth. The expanding petrochemical and metal fabrication industries in Saudi Arabia and the UAE support strong demand. Energy and chemicals applications are also expanding rapidly, driven by the shift toward cleaner fuels and advanced refining processes. Healthcare applications are gaining traction, particularly for oxygen in hospitals and medical facilities.

- For instance, Nippon Paint launched its Tokyo Innovation Center in 2025 — a five‐story R&D hub with total floor area of 9,929 m², hosting over 200 engineers across divisions.

By Supply Mode

Bulk supply leads the GCC industrial gas market with a 42.5% market share. The dominance is driven by large industrial operations requiring uninterrupted supply for continuous processes. Bulk delivery ensures cost efficiency, consistent quality, and operational reliability for end users in manufacturing and energy sectors. Growing investments in refining and petrochemical infrastructure further increase demand for bulk supply. On-site generation is also rising as companies aim to reduce logistics costs and secure supply for mission-critical applications. Packaged mode serves smaller operations and niche industries.

Key Growth Drivers

Rising Industrial and Manufacturing Activities

The rapid expansion of manufacturing sectors in the GCC is a major driver for the industrial gas market. Nitrogen, oxygen, and argon are widely used in metal fabrication, welding, and chemical processing. Government-backed infrastructure projects and industrial diversification plans support steady consumption. Saudi Arabia and the UAE lead this growth with strong investments in refining, petrochemicals, and metallurgy. The increasing adoption of advanced manufacturing technologies further amplifies gas demand across core industries.

- For instance, Sherwin-Williams is building a new 600,000-square-foot R&D Center in Brecksville, Ohio, to centralize its chemists, engineers, and process labs — about 900 employees will work there.

Expanding Energy and Petrochemical Sector

The energy and petrochemical industry plays a central role in driving industrial gas consumption in the GCC. Large volumes of oxygen, nitrogen, and hydrogen are essential for refining, enhanced oil recovery, and petrochemical production. Ongoing capacity expansions and refinery modernization projects strengthen bulk and on-site gas demand. The shift toward cleaner fuels and value-added products accelerates the need for high-purity industrial gases to support process optimization and efficiency.

- For instance, Hempel rolled out Hempaline Defend 430, a solvent-free epoxy phenolic lining with resistance up to 90 °C for tank applications in energy projects.

Growing Healthcare and Medical Applications

The rising healthcare infrastructure across the GCC significantly boosts demand for medical-grade oxygen and specialty gases. Investments in hospitals, clinics, and emergency care facilities drive steady oxygen consumption. The increasing prevalence of respiratory diseases and critical care requirements also supports market growth. Governments are strengthening medical supply chains and storage capabilities, ensuring reliable access to oxygen and other specialty gases. This expanding healthcare base creates strong long-term demand for industrial gas suppliers.

Key Trends & Opportunities

Shift Toward On-Site Gas Generation

Companies are increasingly adopting on-site gas generation systems to secure reliable supply and reduce logistics costs. On-site units provide flexibility and continuous availability, especially for large manufacturing and petrochemical facilities. This shift aligns with industrial efficiency goals and supports sustainability initiatives by lowering transport emissions. Technological advancements in PSA and cryogenic systems make on-site production more viable and cost-effective. The trend is expected to expand further with growing industrial infrastructure in the GCC.

- For instance, BASF commissioned a 54 MW proton exchange membrane (PEM) electrolyzer in Germany in 2025, with capacity to produce about 8,000 metric tons of hydrogen annually.

Adoption of Sustainable and Low-Carbon Solutions

Sustainability is emerging as a key opportunity in the GCC industrial gas market. Companies are investing in carbon capture, utilization, and storage (CCUS) and renewable hydrogen production to meet decarbonization goals. Industrial gas suppliers are focusing on green technologies to align with national energy transition plans. This shift opens new revenue streams, particularly in low-emission hydrogen and CO₂ recovery projects. The growing emphasis on ESG compliance further accelerates investment in cleaner gas production methods.

- For instance, Axalta partnered with Xaar to launch NextJet™, a digital paint technology. This system enables overspray-free application and helped reduce CO₂ emissions by 30 % in two-tone vehicle trials.

Rising Integration with Smart Industrial Systems

Digitalization is driving operational efficiency in gas production, storage, and distribution. Advanced monitoring systems and IoT-enabled solutions improve delivery reliability and optimize energy use. Integration with smart factory systems enhances real-time control and forecasting of gas consumption. This trend supports cost savings for end users and strengthens supplier competitiveness. The GCC’s investment in Industry 4.0 infrastructure is expected to boost demand for digitally integrated industrial gas solutions.

Key Challenges

High Capital and Infrastructure Costs

Setting up gas production and distribution infrastructure requires high initial investment. Cryogenic facilities, storage systems, and pipeline networks involve significant capital expenditure. These costs limit entry for smaller players and slow expansion in less developed regions. Price volatility in raw materials and energy further affects project feasibility. Ensuring competitive pricing while maintaining quality and supply security remains a critical challenge for market participants.

Regulatory and Environmental Compliance Pressure

Industrial gas producers face increasing pressure to comply with stringent environmental and safety regulations. Emissions reduction targets and safety standards require continuous investment in advanced technologies and monitoring systems. Compliance with carbon reduction goals also increases operational complexity and costs. These regulatory requirements can delay project timelines and affect profitability. Balancing regulatory compliance with commercial competitiveness remains a major challenge in the GCC market.

Regional Analysis

North America

North America holds a 39.2% share of the GCC Industrial Gas Market in 2024. Strong demand from the manufacturing, energy, and healthcare industries drives market growth. Advanced infrastructure and extensive adoption of hydrogen technologies support large-scale on-site production. Strategic investments in carbon capture and low-emission solutions boost sustainable gas supply. The U.S. and Canada lead in technological advancements for nitrogen and oxygen generation. Robust logistics and well-developed distribution networks ensure efficient delivery. High R&D spending and industrial automation further strengthen North America’s leading position in the global market.

Europe

Europe accounts for 27.4% of the market share in 2024. Strict environmental regulations and the strong push toward decarbonization increase investments in low-emission and green hydrogen projects. Major industries such as chemicals, metallurgy, and energy remain key demand generators. The region benefits from advanced production technologies and a highly connected distribution network. Germany, France, and the U.K. lead in innovation for cryogenic air separation and carbon recycling solutions. Industrial gas producers are focusing on bulk and on-site supply modes to improve efficiency. Europe’s emphasis on sustainability supports its strong market position.

Asia Pacific

Asia Pacific captures a 22.6% share of the GCC Industrial Gas Market in 2024. Rapid industrialization, growing electronics production, and infrastructure expansion in China, India, and Southeast Asia drive high consumption of oxygen, nitrogen, and argon. Government investments in renewable energy and hydrogen projects strengthen the market outlook. Expanding healthcare and chemical sectors add further demand. Cost-efficient production capabilities and expanding distribution networks give the region a competitive edge. Ongoing industrial development and strategic international partnerships position Asia Pacific as a rapidly growing market.

Latin America

Latin America represents 6.1% of the market share in 2024. Brazil and Mexico lead the region with growing demand from energy, food processing, and metallurgy industries. Economic development and infrastructure expansion support increased use of packaged and bulk industrial gases. Governments are investing in renewable projects, driving hydrogen and carbon dioxide demand. While the region faces some logistical challenges, partnerships with global gas producers improve supply chain efficiency. Steady industrial growth and foreign investments make Latin America an emerging contributor to the global market.

Middle East & Africa

The Middle East & Africa account for a 4.7% share in 2024. Rising investments in oil and gas, refining, and chemicals industries support strong industrial gas demand. Countries like Saudi Arabia and the UAE lead hydrogen and carbon capture project development. Healthcare and manufacturing sectors also contribute to growth. Infrastructure upgrades and new free zone developments enhance supply chain efficiency. Strategic collaborations with international producers drive technology adoption. Although smaller in share compared to other regions, MEA is positioned for stable growth driven by industrial diversification.

Market Segmentations:

By Type:

By Application:

By Supply Mode:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The GCC Industrial Gas Market is characterized by strong competition among Jotun, RPM International Inc., Nippon Paint Holdings Co., Ltd., The Sherwin-Williams Company, Hempel A/S, Diamond Paints, BASF SE, Akzo Nobel N.V., Axalta Coating Systems, and PPG Industries, Inc. The GCC Industrial Gas Market is experiencing intense competition driven by rising demand from key end-use industries. Companies are investing in advanced production technologies, expanding storage capacities, and enhancing distribution networks to secure a stronger market position. Strategic mergers, acquisitions, and long-term supply agreements are enabling suppliers to optimize production efficiency and ensure stable delivery. Many market participants are focusing on sustainable and low-emission processes to align with regional environmental regulations and energy transition goals. Digital integration across supply chains supports better operational control and improved cost efficiency. Continuous innovation in gas purity, storage solutions, and delivery systems strengthens competitive positioning. As manufacturing, metallurgy, and energy industries expand, competition is expected to intensify further, encouraging companies to prioritize capacity expansion, technology upgrades, and customer-centric strategies to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jotun

- RPM International Inc.

- Nippon Paint Holdings Co., Ltd.

- The Sherwin-Williams Company

- Hempel A/S

- Diamond Paints

- BASF SE

- Akzo Nobel N.V.

- Axalta Coating Systems

- PPG Industries, Inc.

Recent Developments

- In September 2025, Linde expanded its stake in Airtec, one of the leading industrial gas companies in the Middle East, increasing ownership from 49% to over 90%. The acquisition strengthens Linde’s regional presence, supported by Airtec’s network of air separation units, CO₂ plants, and on-site gas generation facilities serving energy, healthcare, and manufacturing industries.

- In January 2025, Air Liquide Healthcare has signed contracts with 20 hospitals, including its first in Brazil, to supply certified low-carbon medical gases through its ECO ORIGIN™ offer. Launched in early 2024, the solution helps healthcare facilities cut CO₂ emissions by over 70% on average.

- In January 2024, Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- In January 2023, Iwatani Corporation of America acquired Aspen Air US, a leading producer and distributor of bulk liquid industrial gases in Montana, marking its strategic entry into the U.S. industrial gases market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Supply Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for industrial gases will increase with expanding manufacturing and energy industries.

- Companies will adopt advanced gas production technologies to boost efficiency.

- Digital tools will enhance supply chain visibility and operational performance.

- Sustainability initiatives will drive investment in low-emission gas production.

- Strategic collaborations will strengthen regional distribution networks.

- Healthcare sector growth will create new opportunities for medical gas suppliers.

- On-site production solutions will gain more preference for cost and reliability.

- Storage and transportation infrastructure will expand to meet rising demand.

- Regulatory support for cleaner energy will accelerate market growth.

- Innovation in gas purification and delivery systems will enhance competitiveness.