Market Overview

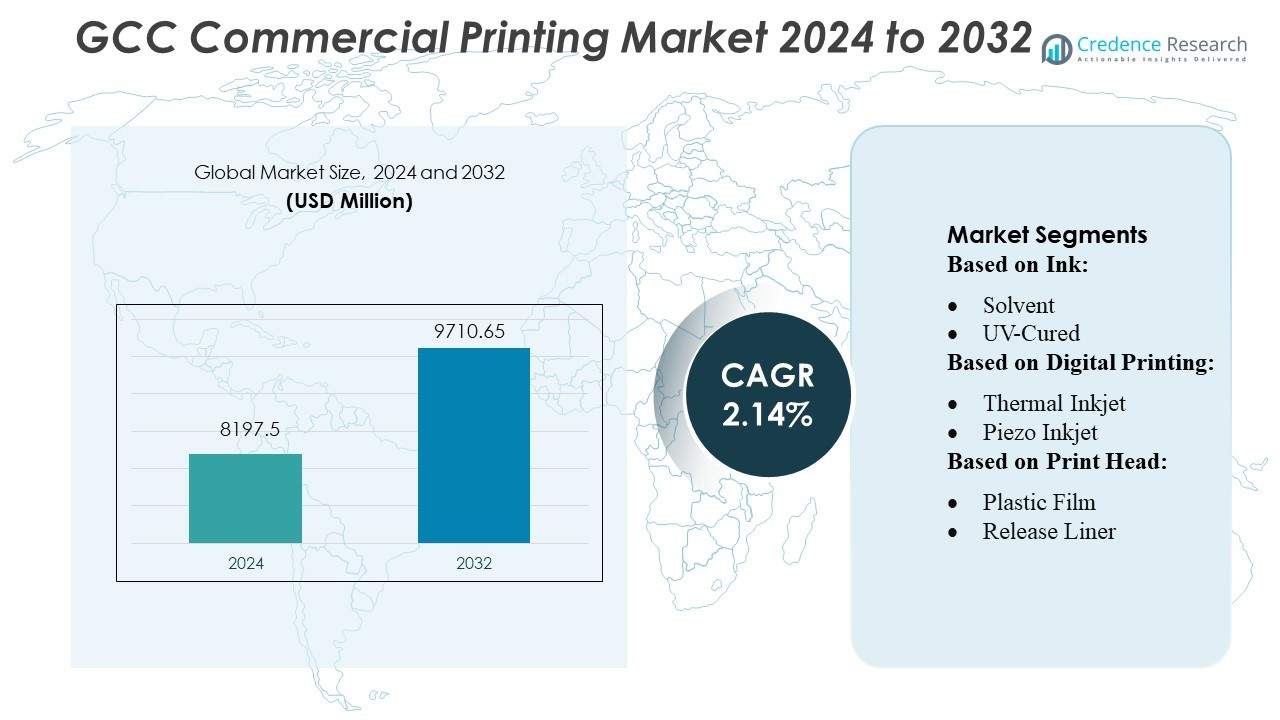

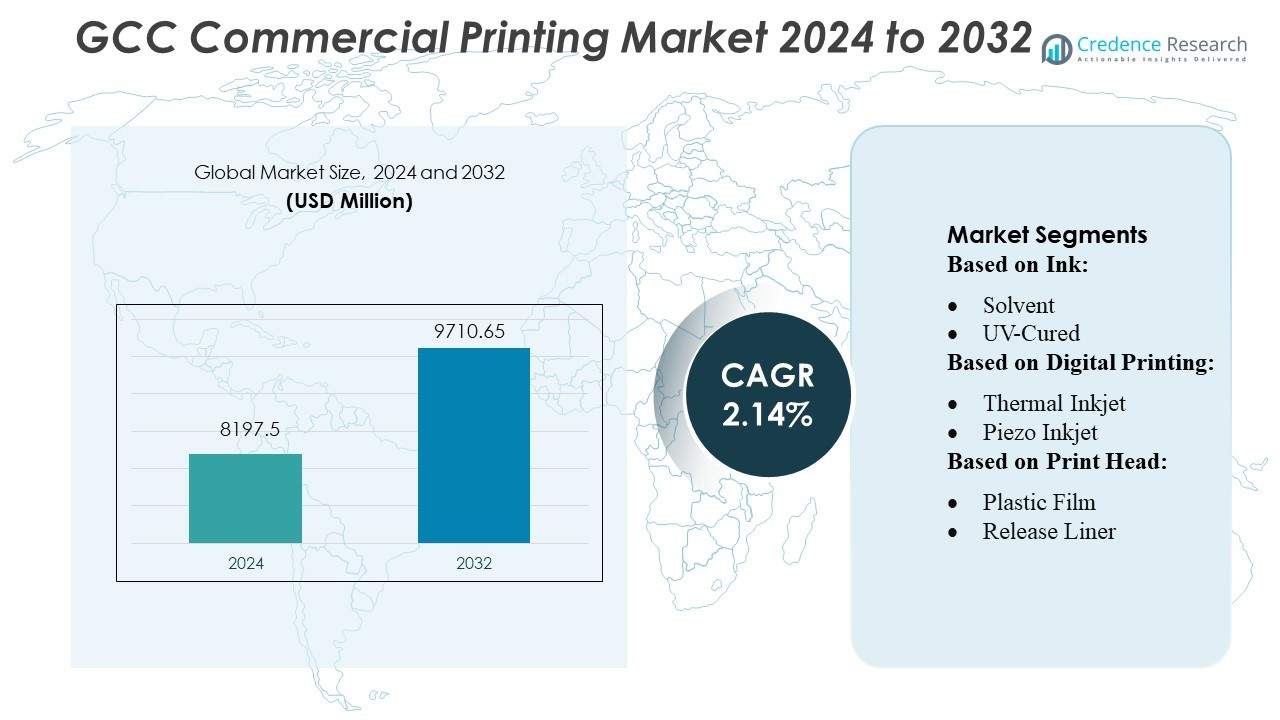

GCC Commercial Printing Market size was valued USD 8197.5 million in 2024 and is anticipated to reach USD 9710.65 million by 2032, at a CAGR of 2.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Commercial Printing Market Size 2024 |

USD 8197.5 Million |

| GCC Commercial Printing Market, CAGR |

2.14% |

| GCC Commercial Printing Market Size 2032 |

USD 9710.65 Million |

The GCC commercial printing market features strong participation from international and regional players such as Mixam UK Limited, Gorham Printing, Inc., Transcontinental Inc., Quad.com, Dai Nippon Printing Co., Ltd., Cimpres, R.R. Donnelley & Sons Company, Cenveo Worldwide Limited, LSC Communications LLC, and Acme Printing, all of which contribute to technology adoption and quality advancement across the region. Saudi Arabia emerges as the leading regional market, holding an estimated 45% share driven by its large industrial base, expanding retail sector, and sustained investments in high-quality packaging and digital printing solutions. The competitive landscape continues to evolve as companies enhance capabilities, pursue automation, and prioritize faster, more customized print services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The GCC Commercial Printing Market was valued at USD 8197.5 million in 2024 and is projected to reach USD 9710.65 million by 2032, registering a CAGR of 2.14% during the forecast period.

- Market growth is driven by rising demand for high-quality packaging, increasing retail and e-commerce activity, and strong adoption of digital printing technologies across key industries.

- Trends such as automation, sustainable materials, and short-run customized printing continue to reshape operational capabilities and improve efficiency among leading players.

- The competitive environment remains dynamic as major international and regional companies enhance their technological portfolios, though high initial investment costs and pricing pressure act as restraints.

- Saudi Arabia leads the regional landscape with 45% market share, while the packaging segment continues to dominate overall demand, supported by rapid industrial expansion across GCC countries.

Market Segmentation Analysis:

By Ink

Solvent inks dominate the GCC commercial printing market, holding the largest share due to their strong adhesion on diverse substrates and suitability for high-durability outdoor applications. Their ability to withstand extreme temperatures and UV exposure aligns well with GCC climatic conditions, driving broad adoption across signage, billboards, and industrial labels. UV-cured inks follow as a high-growth segment supported by faster curing times and reduced VOC emissions. Latex and dye-sublimation inks continue expanding in textile and décor applications, while other specialty inks gain traction in value-added printing solutions.

- For instance, Screen (part of Dainippon Screen) offers the Truepress Jet L350UV label press series for high-throughput label production, utilizing piezo single-pass printheads and UV-curable inks. While the original Truepress Jet L350UV ran at a maximum speed of 50 meters per minute, subsequent models like the Truepress Jet L350UV+ and the Truepress LABEL 350UV SAI S achieve faster web speeds of 60 meters per minute or more, enabling even higher productivity.

By Digital Printing

Digital printers represent the leading sub-segment within the digital printing category, capturing the largest market share driven by rapid turnaround capabilities and the growing shift toward short-run, variable-data printing across retail, packaging, and promotional sectors. Increasing demand for on-demand production and reduced setup costs supports the continued dominance of digital printers. Digital printing inks and printheads follow as essential complementary components, with rising investment in high-resolution printheads and advanced ink formulations that enable improved color accuracy, faster job completion, and enhanced operational efficiency for commercial print service providers.

- For instance, Gorham Printing, Inc. operates its digital book-printing business out of a 7,500-square-foot facility in Centralia, Washington, where the digital pressroom handles custom print runs from 25 up to 5,000 copies per job, according to their official website and guidebook.

By Print Head

Inkjet printheads maintain the dominant share in the GCC market due to their versatility, high-speed performance, and compatibility with multiple ink types used in commercial and wide-format printing. Thermal and piezo inkjet technologies further strengthen adoption, supported by their fine droplet control and ability to deliver sharp image quality. Electrostatic and MEMS inkjet printheads remain niche but gain relevance in high-precision industrial applications. Overall market growth is driven by increasing investment in high-resolution printing, demand for flexible substrates, and the rising need for energy-efficient, low-maintenance printhead technologies.

Key Growth Drivers

1. Rising Demand for Short-Run and On-Demand Printing

The GCC commercial printing market grows significantly as businesses shift toward short-run, customized, and on-demand printing models. Retailers, hospitality brands, and e-commerce platforms increasingly require personalized packaging, promotional materials, and variable-data prints to enhance customer engagement. Digital printing technologies enable faster production cycles and cost efficiency for low-volume jobs, driving operational advantages for print service providers. The expansion of SMEs and start-ups further accelerates demand for flexible printing solutions that support frequent design changes, rapid prototyping, and localized marketing campaigns across GCC countries.

- For instance, Quad integrated the Landa S10P Nanographic Printing Press into its in-store production operations; this press prints at 6,500 sheets per hour, supports full variable-data printing on every sheet regardless of run length, and reproduces 96% of Pantone colors.

2. Expansion of the Advertising and Branding Ecosystem

Large-scale investments across retail, real estate, aviation, and tourism sectors boost printing requirements for signage, outdoor displays, exhibition graphics, and brand activation materials. Mega projects such as new shopping malls, hospitality developments, and entertainment venues significantly increase demand for high-quality wide-format prints. Government-driven economic diversification initiatives encourage businesses to expand their branding footprint, supporting continuous demand for print collateral. As brands focus on premium visual communication and consistent identity across touchpoints, commercial printers benefit from recurring orders and opportunities for long-term service partnerships.

- For instance, DNP added a second wide-range coating device at its Mihara plant capable of handling optical film up to 2,500 mm in width, boosting its production area capacity by more than 15%.

3. Growing Adoption of Digital and Automated Printing Technologies

Digital printing adoption accelerates due to its efficiency, automation potential, and compatibility with diverse substrates. GCC print service providers increasingly invest in high-speed digital presses, UV-curable systems, and advanced workflow automation tools to reduce labor costs and minimize wastage. Automated color calibration, inline finishing, and cloud-enabled print management improve turnaround times and consistency. These capabilities align with the region’s fast-paced retail and commercial environment, supporting high-volume, deadline-driven projects. The shift from analog to digital platforms strengthens operational scalability and drives modernization across the printing ecosystem.

Key Trends & Opportunities

1. Growth of Eco-Friendly and Sustainable Printing Solutions

Sustainability emerges as a major trend as brands and regulatory bodies encourage environmentally responsible printing. The market sees rising adoption of water-based, latex, and low-VOC inks, along with recyclable substrates for packaging and signage. Print service providers increasingly adopt energy-efficient printers and waste-minimization processes to meet green compliance requirements. Eco-certifications create differentiation opportunities for market players, especially in retail and hospitality sectors prioritizing sustainability goals. This shift enables printers to attract premium clients while supporting regional environmental commitments and long-term resource efficiency.

- For instance, R.R. Donnelley & Sons has committed to reducing its greenhouse gas emissions by more than 43,000 metric tons of CO₂e over the next decade, per its 10-year roadmap.

2. Expansion of Packaging and Label Printing Applications

Packaging becomes a high-opportunity segment as consumer goods, food & beverage, pharmaceuticals, and cosmetics industries expand across the GCC. Growth in e-commerce and home-delivery services amplifies demand for corrugated packaging, product labels, and custom-branded boxes. Digital and hybrid printing systems enable shorter runs, faster changeovers, and high-quality graphics tailored to promotional cycles. Value-added features such as anti-counterfeit printing, variable QR codes, and personalization further strengthen opportunities. The shift toward premium and visually appealing packaging enhances market potential for high-resolution, multi-color commercial printing solutions.

- For instance, LSC invested in HP PageWide Web Press T490 HD technology for digital book production and upgraded existing PageWide presses with HDNA (High Definition Nozzle Architecture), enabling higher print quality and improved productivity.

3. Increasing Use of Wide-Format and Large-Format Printing

Large-format printing continues to grow due to increasing requirements for outdoor advertising, fleet graphics, building wraps, and event branding. GCC’s active construction and retail development projects create strong demand for façade banners, directional signage, and interior décor prints. Advancements in UV-cured and latex printing technologies enable faster production, higher durability, and better weather resistance—critical for harsh regional climates. The growing popularity of fabric-based soft signage and backlit displays provides additional avenues for innovation. This segment offers profitable expansion opportunities for commercial print service providers.

Key Challenges

1. Volatility in Raw Material and Equipment Costs

Fluctuations in the cost of inks, substrates, printing chemicals, and imported equipment challenge profitability for print service providers. Dependence on international supply chains exposes the market to currency variations, shipping delays, and geopolitical disruptions. High upfront investment in advanced digital presses and printhead technologies becomes a barrier for smaller firms. Rising operational costs, including energy and skilled labor, further pressure margins. Printers must adopt efficient procurement strategies and automation to maintain cost competitiveness while ensuring consistent production quality.

2. Competition from Digital Media and Declining Traditional Print Demand

The growing shift toward digital marketing, online advertising, and electronic communication threatens traditional print categories such as brochures, magazines, and corporate documents. Businesses increasingly reduce spending on conventional print materials, redirecting budgets to digital channels with measurable audience reach. This shift forces commercial printers to adapt their offerings, diversify into packaging or large-format printing, and invest in value-added services. Companies unable to modernize face declining demand and reduced profitability. Continuous innovation and service differentiation are essential to remain competitive in a digitally evolving landscape.

Regional Analysis

North America

North America holds about 30% of the global commercial printing market and remains one of the most technologically advanced regions. The United States drives the majority of demand due to its strong presence in packaging, publishing, retail marketing, and corporate communication materials. The region benefits from widespread adoption of digital printing, variable-data printing, and automated workflow systems that enhance speed and efficiency. Growth is further supported by sustained investments in sustainable substrates, energy-efficient presses, and premium print services. Although traditional offset printing remains relevant, the shift toward short-run, on-demand printing continues to strengthen the region’s competitive position.

Asia-Pacific

Asia-Pacific accounts for approximately 35% of the global commercial printing market, making it the largest and fastest-expanding regional contributor. The region’s growth is driven by strong industrialization, rapid urbanization, and rising consumption across China, India, Southeast Asia, and Japan. Demand is fueled by booming e-commerce, large-scale manufacturing, and high requirements for labels, packaging, and promotional prints. Print service providers in Asia-Pacific increasingly invest in digital presses, flexographic systems, and high-volume packaging equipment to meet fast-turnaround expectations. Cost-efficient production capabilities, a massive customer base, and continuous technological upgrades solidify the region’s dominant position.

Europe

Europe represents roughly 25% of the global commercial printing market and is known for its advanced production capabilities and strong emphasis on quality and sustainability. Countries such as Germany, the UK, France, and Italy lead adoption of eco-friendly inks, recyclable materials, and digital automation to meet strict environmental regulations. The region benefits from stable demand in luxury packaging, premium promotional materials, specialty publishing, and corporate branding. Although the market is mature, European printers continue to innovate in high-precision printing, variable-data output, and specialty finishing techniques. These strengths ensure Europe maintains a solid and competitive market presence.

Latin America

Latin America holds close to 8% of the global commercial printing market, supported by growing retail activity, expanding consumer goods production, and increased investment in advertising materials. Brazil and Mexico dominate the regional landscape with rising needs for packaging, labels, brochures, and promotional prints. While offset printing still accounts for much of the volume, digital printing adoption is increasing as businesses seek cost-efficient, short-run, high-quality output. Urbanization and expanding middle-class consumption continue to generate steady demand, even as economic variability presents challenges. Overall, the region shows healthy long-term growth potential driven by modernization and diversification.

Middle East & Africa

The Middle East & Africa region contributes about 7% of the global commercial printing market and demonstrates gradual but steady expansion. The UAE and Saudi Arabia lead the market with strong demand for high-end packaging, signage, promotional prints, and large-format advertising materials. Rapid growth in tourism, retail, and infrastructure stimulates continuous print requirements across commercial sectors. Meanwhile, African markets such as South Africa and Nigeria show increasing demand in education, FMCG packaging, and government communication materials. Printers across MEA are investing in digital technologies, sustainable materials, and workflow automation, supporting the region’s ongoing modernization and upward momentum.

Market Segmentations:

By Ink:

By Digital Printing:

- Thermal Inkjet

- Piezo Inkjet

By Print Head:

- Plastic Film

- Release Liner

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the GCC commercial printing market features a mix of global and regional players, with leading international companies such as Mixam UK Limited, Gorham Printing, Inc., Transcontinental Inc., Quad.com, Dai Nippon Printing Co., Ltd., Cimpres, R.R. Donnelley & Sons Company, Cenveo Worldwide Limited, LSC Communications LLC, and Acme Printing. The GCC commercial printing market is characterized by rising digital adoption, expanding service portfolios, and increasing investments in high-quality, technology-driven printing solutions. Companies across the region focus on modernizing their production environments through automated workflows, advanced digital and large-format presses, and environmentally sustainable materials to meet evolving customer expectations. Competition intensifies as firms differentiate through faster turnaround times, enhanced print precision, and customizable short-run jobs tailored to retail, packaging, corporate, and advertising clients. Regional printers also benefit from growing demand in e-commerce packaging, event marketing, and tourism-driven promotional prints, prompting continuous upgrades in capability, efficiency, and service innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mixam UK Limited

- Gorham Printing, Inc.

- Transcontinental Inc.

- Dai Nippon Printing Co., Ltd.

- Cimpres

- R. Donnelley & Sons Company

- Cenveo Worldwide Limited

- LSC Communications LLC

- Acme Printing

Recent Developments

- In September 2024, Artisan Colour acquired MarComm, a digital marketing agency, to offer an integrated print and digital marketing solution. This move combines Artisan Colour’s commercial printing and color management expertise with MarComm’s digital marketing and cross-channel strategy skills, aiming to provide a single partner for a unified marketing ecosystem.

- In May 2024, Canon and Heidelberg collaborated to integrate inkjet printing solutions into the commercial printing industry. Heidelberg will integrate Canon’s B2 and B3 sheetfed inkjet presses into their Prinect workflow.

- In March 2024, Mimaki Engineering Co., Ltd. announced the launch of TRAPIS, an environmentally next-generation textile printing system. The TRAPIS system utilizes a heat transfer machine to transfer a design printed on special paper onto fabric, resulting in a textile printing process that generates minimal wastewater.

Report Coverage

The research report offers an in-depth analysis based on Ink, Digital Printing, Print Head and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to shift further toward digital printing as businesses demand faster turnaround times and greater customization.

- Packaging printing is likely to grow steadily due to expanding retail, FMCG, and e-commerce sectors across the GCC.

- Print service providers are expected to invest more in automation to reduce operational costs and improve workflow efficiency.

- Demand for sustainable inks, recyclable substrates, and eco-friendly production methods will continue to rise.

- Large-format and signage printing will gain momentum as tourism, events, and infrastructure projects expand.

- Variable-data printing is set to increase as brands focus on personalized marketing campaigns.

- Hybrid printing solutions integrating digital and offset technologies will become more common across commercial facilities.

- Regional printers are expected to diversify into value-added services such as finishing, specialty coatings, and premium packaging.

- Cross-border printing partnerships may grow as GCC countries strengthen trade links and regional logistics networks.

- Market competitiveness will intensify as both local and international players enhance capabilities to meet evolving quality and speed requirements.