| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Biomaterials Market Size 2024 |

USD 11,125.65 Million |

| Germany Biomaterials Market, CAGR |

15.62% |

| Germany Biomaterials Market Size 2032 |

USD 35,523.84 Million |

Market Overview

Germany Biomaterials Market size was valued at USD 11,125.65 million in 2024 and is anticipated to reach USD 35,523.84 million by 2032, at a CAGR of 15.62% during the forecast period (2024-2032).

The Germany biomaterials market is driven by increasing demand for advanced medical devices, implants, and prosthetics, as well as advancements in tissue engineering and regenerative medicine. The rising prevalence of chronic diseases, aging populations, and the growing need for customized medical solutions are contributing to market growth. Additionally, the shift toward minimally invasive surgeries, coupled with technological innovations in biomaterials, such as bioresorbable polymers and smart biomaterials, is further accelerating market expansion. Increased healthcare spending, favorable government policies, and significant investments in research and development are also fostering growth. The trend toward sustainability and eco-friendly biomaterials is gaining momentum, with a focus on biodegradable and non-toxic materials. These drivers, along with the growing adoption of biomaterials in diverse applications like drug delivery systems and orthopedic devices, are expected to fuel the market’s progress during the forecast period.

Germany’s biomaterials market is highly concentrated in key regions such as Berlin, Munich, Hamburg, and Bremen, each contributing significantly to the industry’s growth. Berlin serves as a hub for research and innovation, particularly in regenerative medicine, while Munich leads in medical technology development, with a focus on orthopedic and dental biomaterials. Hamburg plays a critical role in manufacturing and distribution, supporting medical device production, and Bremen, with its strong engineering capabilities, contributes to the development of durable biomaterials. Key players driving the German biomaterials market include Biotronik, DePuy Synthes, Evonik Industries AG, Carl Zeiss Meditec AG, and Wittenstein SE, among others. These companies are at the forefront of biomaterial innovations, contributing to advancements in tissue engineering, biodegradable materials, and medical devices. Their continuous investment in research and strategic collaborations further solidify Germany’s position as a leader in the global biomaterials market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany biomaterials market was valued at USD 11,125.65 million in 2024 and is expected to reach USD 35,523.84 million by 2032, growing at a CAGR of 15.62% during the forecast period (2024-2032).

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Increasing demand for personalized medicine and 3D-printed biomaterials is driving market growth.

- Advancements in digital health technologies and their integration with biomaterials are expected to further expand market opportunities.

- The growing emphasis on sustainable and biodegradable biomaterials is reshaping industry trends.

- Competitive players like Biotronik, DePuy Synthes, Evonik Industries, and Carl Zeiss Meditec are driving innovation in medical applications.

- Market restraints include high manufacturing costs, complex regulatory approval processes, and technical limitations of existing materials.

- Regionally, Munich, Berlin, Hamburg, and Bremen are key hubs, with Munich leading in medical technology and innovation.

Report Scope

This report segments the Germany Biomaterials Market as follows:

Market Drivers

Technological Advancements and Innovation in Biomaterials

Technological innovation plays a crucial role in the rapid expansion of the biomaterials market in Germany. For instance, Germany ranks second globally in medical technology patents, following the United States, demonstrating its strong focus on biomaterials research and development. New materials with enhanced properties, such as bioresorbable polymers, ceramic composites, and smart biomaterials, are being developed to meet the growing needs of the healthcare industry. These innovations enable more efficient and personalized treatment options, particularly in areas like tissue engineering and drug delivery. For example, the development of bioactive and biodegradable materials has enhanced the functionality of implants, improving patient recovery times and minimizing complications. Furthermore, advancements in 3D printing technology allow for the creation of customized medical devices, tailored to individual patients, which further increases the adoption of biomaterials.

Sustainability and Environmental Considerations

Sustainability is becoming a key consideration in the development and adoption of biomaterials in Germany. For instance, Germany’s Sustainable Development Strategy emphasizes the integration of eco-friendly biomaterials into healthcare applications. Manufacturers are increasingly focused on producing materials that not only meet the functional requirements of medical devices but also have minimal environmental impact. The demand for green biomaterials is further supported by increasing regulatory pressures and public awareness regarding sustainability in healthcare. As a result, manufacturers are investing in research to develop materials that are both high-performing and environmentally responsible. This trend is likely to contribute to the long-term growth of the German biomaterials market as companies and healthcare providers seek solutions that align with both medical needs and environmental goals.

Rising Demand for Advanced Medical Devices

The growing demand for advanced medical devices is one of the primary drivers of the Germany biomaterials market. Medical technologies, such as implants, prosthetics, and surgical instruments, are increasingly relying on high-performance biomaterials. These materials offer biocompatibility, strength, and durability, essential for long-lasting and effective medical solutions. As the healthcare industry seeks to provide better outcomes for patients, the demand for biomaterials in orthopedic devices, dental implants, and cardiovascular stents has risen significantly. The adoption of advanced biomaterials enables the creation of custom-designed implants that meet the specific needs of patients, offering enhanced functionality and improved quality of life.

Aging Population and Increasing Prevalence of Chronic Diseases

Germany, like many developed nations, is experiencing an aging population, which is contributing to an increased need for biomaterials. Older adults often experience conditions such as osteoarthritis, joint degeneration, and cardiovascular diseases, leading to a growing demand for implants, prosthetics, and other medical devices that use biomaterials. According to demographic forecasts, the number of elderly people in Germany is expected to rise steadily over the coming years, further driving the demand for medical solutions that can address age-related health challenges. Additionally, the increasing prevalence of chronic diseases such as diabetes, heart disease, and cancer is also boosting the need for biomaterials, as these conditions often require advanced medical treatments and interventions involving biomaterials.

Market Trends

Surge in Personalized and 3D-Printed Biomaterials

The demand for personalized medicine is rapidly transforming Germany’s biomaterials market. With advancements in 3D printing technologies, medical devices and implants can now be custom-tailored to meet the specific needs of individual patients. This is particularly significant in fields like orthopedics, dental care, and facial reconstruction, where custom-fit implants can improve patient outcomes and reduce recovery times. Companies in Germany are leveraging cutting-edge technologies to create patient-specific devices, reducing the risk of implant rejection and enhancing the overall effectiveness of treatments. One prominent example is Evonik Industries’ VESTAKEEP iC4800 3DF, a 3D printable osteoconductive polymer that supports bone growth, providing a more personalized approach to orthopedic implants. This trend towards personalization is not only improving the quality of care but also contributing to a more efficient healthcare system by reducing complications and post-surgical rehabilitation times.

Integration of Digital Health Technologies

Germany’s biomaterials market is increasingly integrating digital health technologies, creating a powerful synergy that enhances both the functionality of medical devices and the overall patient experience. For instance, the Digital Healthcare Act (DVG) has facilitated the adoption of digital health applications, allowing for remote monitoring and personalized treatment plans. Digital health tools, such as remote monitoring systems and recovery apps, are being combined with advanced biomaterials to offer more personalized and comprehensive care. For example, the development of smart implants that can track real-time data on their performance, such as joint movement or pressure distribution, is becoming more common. These innovations allow healthcare providers to monitor patient progress remotely, improving the speed of recovery and allowing for faster interventions when necessary. The convergence of biomaterials with digital health technologies is poised to revolutionize patient management by providing actionable insights that can lead to better outcomes and more efficient use of healthcare resources. This trend highlights the growing importance of data-driven healthcare solutions in the modern medical landscape.

Emphasis on Sustainable and Biodegradable Materials

As environmental concerns grow globally, sustainability is becoming a central theme in the development of biomaterials. For instance, Germany’s Federal Ministry of Education and Research has launched initiatives to promote biodegradable biomaterials, emphasizing their role in reducing medical waste. Research into biodegradable polymers, bioresorbable metals, and other sustainable biomaterials is gaining momentum, offering the healthcare sector alternatives to traditional materials that may be more harmful to the environment. These innovations are particularly valuable in applications like drug delivery systems and surgical implants, where materials are absorbed by the body over time, reducing the need for removal and minimizing waste. By investing in sustainable biomaterials, Germany is positioning itself as a leader in the eco-conscious healthcare market, responding to both environmental challenges and the growing consumer demand for sustainable products in all sectors.

Strategic Collaborations and Industry Partnerships

Another notable trend in the German biomaterials market is the increasing number of strategic collaborations and partnerships among biomaterial companies, healthcare providers, and research institutions. These collaborations are helping to accelerate the development of new biomaterials and the expansion of their applications across various medical fields. By pooling resources and expertise, stakeholders are driving the innovation necessary to create advanced biomaterials that can be used in a broader range of medical treatments. For example, collaborations between universities and biomaterial manufacturers are focusing on the development of next-generation tissue-engineered scaffolds and drug delivery systems. These partnerships are fostering a collaborative ecosystem that accelerates time-to-market for new biomaterials, facilitating faster adoption in clinical settings. Moreover, they are enhancing the interdisciplinary approach needed to tackle the complex challenges of biomaterials development, ensuring that the latest breakthroughs are incorporated into practical, real-world healthcare solutions.

Market Challenges Analysis

Regulatory and Compliance Challenges

One of the primary challenges facing Germany’s biomaterials market is the complex and stringent regulatory landscape. For instance, the European Medicines Agency (EMA) has introduced new regulatory frameworks that require extensive clinical trials and safety assessments before biomaterials can be approved for medical applications. Biomaterials, particularly those used in medical devices, must meet rigorous safety, performance, and biocompatibility standards established by national and international regulatory bodies, such as the European Medicines Agency (EMA) and the U.S. Food and Drug Administration (FDA). These regulations can vary significantly depending on the material’s application, making it challenging for manufacturers to navigate the approval process. Furthermore, the introduction of new materials often requires extensive clinical trials to prove their safety and efficacy, which can be time-consuming and costly. Delays in regulatory approvals can hinder the speed at which new biomaterials are brought to market, limiting innovation and market growth. Additionally, the increased focus on environmental sustainability has led to more complex testing and certification processes for eco-friendly biomaterials, further complicating the regulatory environment.

High Manufacturing Costs and Technical Limitations

Another significant challenge in the German biomaterials market is the high cost of research, development, and manufacturing of advanced biomaterials. While innovations such as personalized 3D-printed implants and biodegradable materials offer tremendous potential, the cost of developing these materials remains high. The specialized equipment required for 3D printing, as well as the complex processes involved in creating biocompatible and sustainable biomaterials, can significantly increase production costs. Additionally, scaling up production of these advanced materials while maintaining high standards of quality and performance presents technical difficulties. Manufacturers may struggle with the balance between cost-efficiency and the pursuit of cutting-edge innovations, which can affect the affordability and accessibility of biomaterials. These high costs can be a barrier for smaller companies, limiting competition and innovation within the market. Moreover, the technical limitations of existing materials, such as issues with strength, durability, and tissue integration, still require significant improvements to meet the growing demand for more sophisticated solutions.

Market Opportunities

Germany’s biomaterials market presents significant opportunities driven by the increasing demand for advanced medical solutions and personalized treatments. With the rise of chronic diseases, aging populations, and a greater focus on minimally invasive surgeries, there is a growing need for innovative biomaterials that can enhance patient outcomes. One of the most promising areas is the development of custom implants and prosthetics using 3D printing technologies. These solutions allow for the creation of patient-specific devices, reducing complications and improving recovery times. As medical advancements push the boundaries of what biomaterials can achieve, there is a vast opportunity for companies to tap into the demand for personalized, high-performance materials in areas like orthopedics, dental care, and cardiovascular devices. This trend is further supported by an increasing focus on regenerative medicine, tissue engineering, and bioactive implants, which offer long-term solutions to complex medical conditions.

In addition, the growing emphasis on sustainability and environmental consciousness offers opportunities for the development of eco-friendly and biodegradable biomaterials. With stricter regulations on waste and environmental impact, there is a rising demand for materials that can be safely absorbed by the body or that degrade without harming the environment. Companies that focus on creating biodegradable polymers, bioresorbable materials, and sustainable biomaterial alternatives are well-positioned to meet this demand. Furthermore, the convergence of biomaterials with digital health technologies presents a new avenue for growth, as smart implants and wearables that integrate with healthcare systems become more common. These innovations not only improve patient monitoring but also open doors for new applications in areas like remote diagnostics and personalized treatment plans. The combination of personalized healthcare, sustainability, and digital integration creates a broad spectrum of growth opportunities for stakeholders in the German biomaterials market.

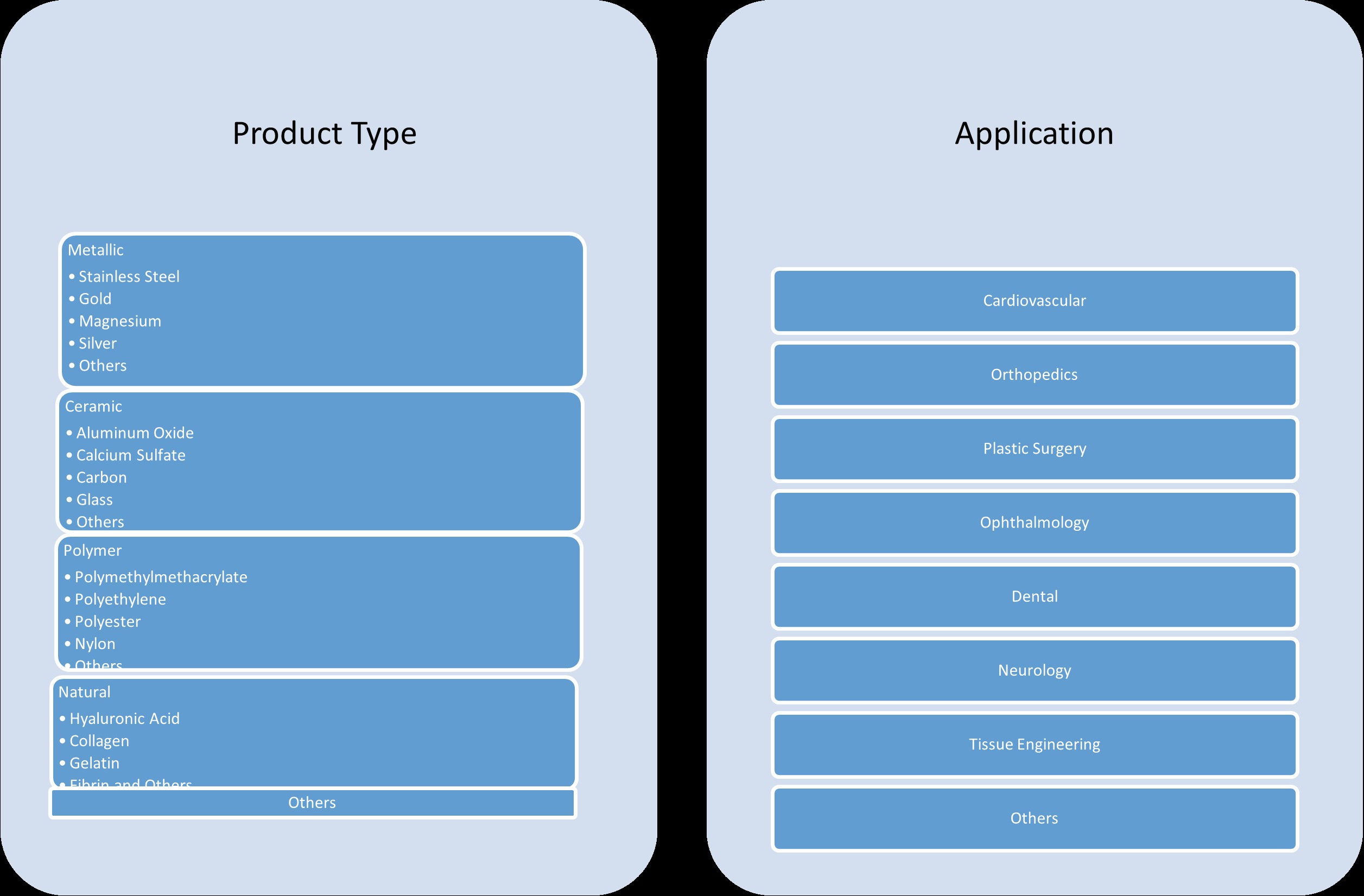

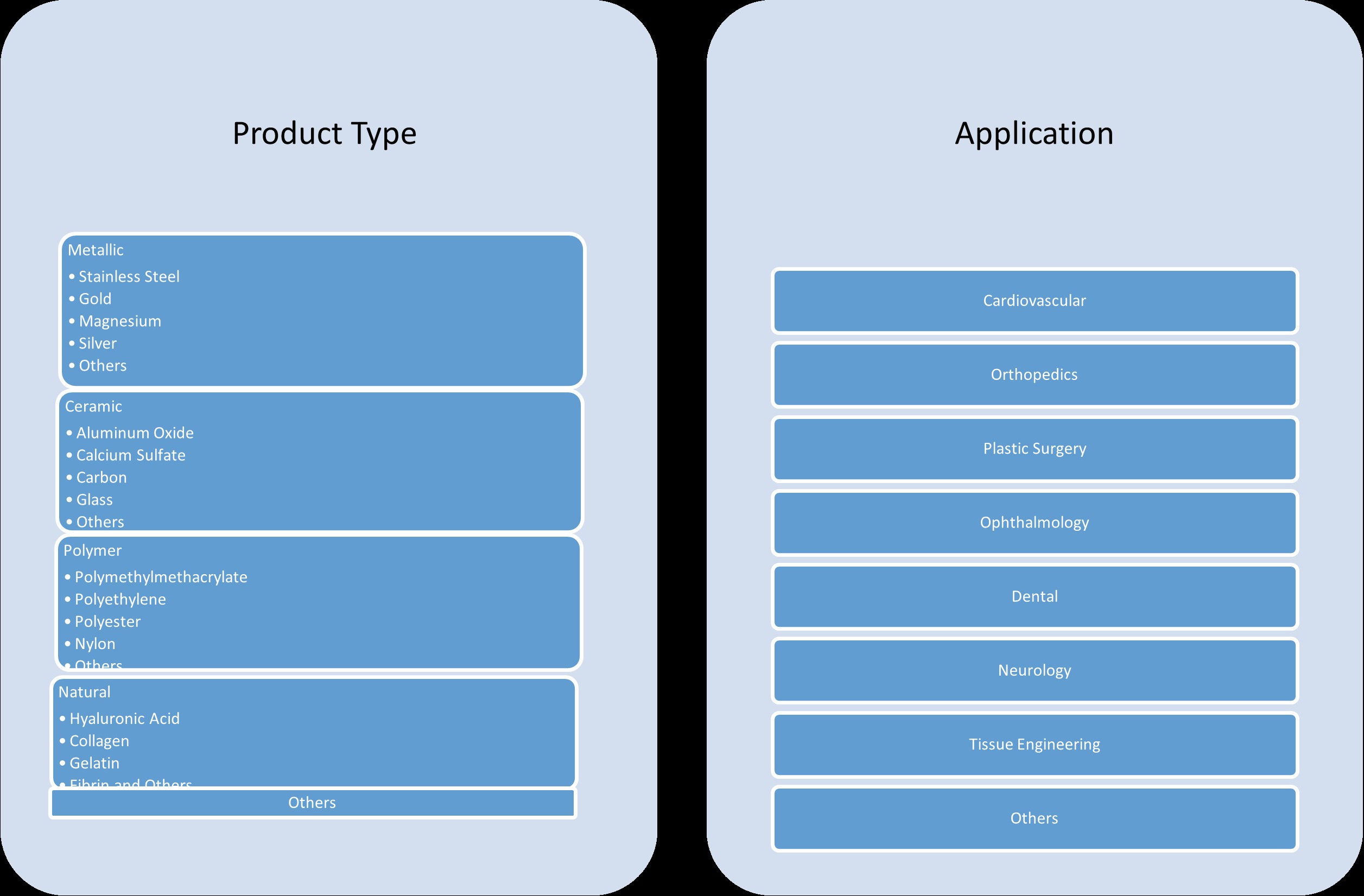

Market Segmentation Analysis:

By Product Type:

The German biomaterials market is segmented by product type, with each category playing a vital role in various medical applications. Metallic biomaterials, such as stainless steel, gold, magnesium, and silver, are widely used in implants due to their strength, durability, and biocompatibility. Stainless steel remains a dominant material, particularly in orthopedic and dental applications. Ceramic biomaterials, including aluminum oxide, calcium sulfate, and glass, are increasingly used in medical devices like bone implants and prosthetics because of their excellent wear resistance and compatibility with human tissues. Polymeric biomaterials, including polymethylmethacrylate, polyethylene, polyester, and nylon, offer flexibility, biocompatibility, and ease of processing, making them suitable for a variety of applications ranging from drug delivery systems to soft tissue implants. Natural biomaterials, such as hyaluronic acid, collagen, and gelatin, are gaining popularity due to their biocompatibility and ability to support tissue regeneration, particularly in wound healing and cosmetic procedures. The category Others encompasses emerging materials, such as smart biomaterials and composites, which are expected to see significant growth in the coming years.

By Application:

In terms of application, the cardiovascular segment remains a key driver for the biomaterials market in Germany. Biomaterials used in cardiovascular implants, such as stents and heart valves, require high durability and biocompatibility to function optimally. The orthopedics segment is also a major contributor, with biomaterials used in joint replacements, spinal implants, and bone repair. As the aging population increases, the demand for orthopedic biomaterials continues to rise. Plastic surgery and ophthalmology are also significant areas, with biomaterials such as collagen and hyaluronic acid being used in reconstructive and aesthetic procedures. The dental segment remains robust, driven by the use of ceramics and polymers in implants, crowns, and dentures. Neurology applications are expanding, with biomaterials playing a crucial role in the development of neural implants and prosthetics. Tissue engineering is another fast-growing application, with biomaterials being used to develop scaffolds and regenerative treatments for damaged tissues. Together, these segments indicate the diverse and rapidly expanding scope of biomaterial applications across the healthcare sector in Germany.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- Berlin

- Munich

- Hamburg

- Bremen

Regional Analysis

Berlin

Berlin holds a prominent position in the German biomaterials market, contributing approximately 20% to the overall market share. The city benefits from its status as a hub for scientific research and innovation, with numerous research institutes and universities dedicated to biomaterials and medical device development. Berlin’s strong medical technology sector, combined with a vibrant startup ecosystem, drives the adoption of cutting-edge biomaterial technologies, particularly in tissue engineering and regenerative medicine. Furthermore, Berlin’s proximity to healthcare institutions and hospitals fosters collaborations that accelerate the development and commercialization of new biomaterial products. The city’s focus on sustainability also supports the growing demand for eco-friendly biomaterials, contributing to its significant market share.

Munich

Munich represents one of the largest markets for biomaterials in Germany, accounting for approximately 25% of the national market share. The city’s well-established medical technology and life sciences sectors, supported by leading companies like Siemens Healthineers and Bayer, contribute significantly to its dominance in the biomaterials industry. Munich is a key player in the development of advanced biomaterials for orthopedics, dental implants, and cardiovascular applications. The region’s strong focus on innovation, backed by major research institutions such as the Technical University of Munich, fosters an environment conducive to the growth of the biomaterials market. As a result, Munich continues to lead in the adoption of high-performance biomaterials and cutting-edge healthcare solutions.

Hamburg

Hamburg is another important region for the German biomaterials market, contributing around 18% to the overall market share. The city’s strategic location as a major port and transportation hub enhances its role in the distribution of biomaterials, particularly those used in the manufacturing of medical devices. Hamburg is home to a number of leading medical device manufacturers and suppliers, which use biomaterials in the production of various healthcare products, including orthopedic implants and diagnostic devices. The city also has a strong presence in the field of medical research, with institutions like the University Medical Center Hamburg-Eppendorf conducting significant research in biomaterials and tissue engineering. This focus on research and development, combined with Hamburg’s robust manufacturing sector, positions it as a key player in the German biomaterials market.

Bremen

Bremen, while smaller compared to Berlin, Munich, and Hamburg, still holds a notable share of approximately 10% in the German biomaterials market. The city’s strengths lie in its manufacturing capabilities and advanced engineering expertise, which contribute to the development of durable and high-quality biomaterials used in various medical devices. Bremen’s significant focus on innovation and collaboration between local universities and industry players helps drive the region’s growth in the biomaterials sector. Additionally, the region’s focus on sustainability and environmental responsibility aligns with the growing demand for biodegradable and eco-friendly biomaterials, further boosting its market presence. Bremen’s contributions to Germany’s biomaterials market continue to grow, particularly in specialized biomaterial applications.

Key Player Analysis

- Biotronik

- DePuy Synthes

- Evonik Industries AG

- Carl Zeiss Meditec AG

- Wittenstein SE

Competitive Analysis

The competitive landscape of Germany’s biomaterials market is driven by several key players, including Biotronik, DePuy Synthes, Evonik Industries AG, Carl Zeiss Meditec AG, and Wittenstein SE. These companies are at the forefront of innovation, continually enhancing their product offerings to meet the growing demand for advanced biomaterials across medical fields. Companies operating in this space focus on developing high-performance biomaterials tailored for various medical applications, including orthopedics, cardiovascular devices, tissue engineering, and drug delivery systems. The market is witnessing the entry of both established players and emerging startups, each aiming to capture market share by offering cutting-edge solutions. Leading firms are heavily investing in research and development to enhance the functionality, biocompatibility, and sustainability of biomaterials. In terms of competition, companies are differentiating themselves by offering specialized products that meet the increasing demand for personalized and patient-specific solutions, such as 3D-printed implants and custom prosthetics. Another key factor driving competition is the integration of digital technologies with biomaterials, creating smart implants and devices that can monitor patient conditions in real-time. Partnerships between biomaterial manufacturers, research institutions, and healthcare providers are also crucial in fostering innovation and accelerating the time-to-market for new products. This collaborative approach allows companies to leverage diverse expertise, leading to the development of next-generation biomaterials that address both clinical and environmental challenges.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The Germany biomaterials market exhibits a moderate level of market concentration, with a mix of established multinational companies and specialized local players driving the industry forward. While large, well-funded companies dominate key segments such as orthopedic and cardiovascular biomaterials, smaller firms and startups are making significant strides in niche areas like tissue engineering, regenerative medicine, and biodegradable materials. This dynamic market structure fosters a competitive environment, encouraging innovation and the development of cutting-edge technologies. The characteristics of the market are marked by a strong emphasis on research and development, as companies seek to improve the performance, biocompatibility, and sustainability of biomaterials. Collaboration between academic institutions, healthcare providers, and industry players is common, further promoting the rapid advancement of medical solutions. Additionally, Germany’s robust regulatory framework and focus on high-quality standards ensure that the market remains highly specialized, with strict requirements for safety and performance in medical applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany biomaterials market is expected to continue its strong growth, driven by advancements in personalized and 3D-printed medical solutions.

- Increasing demand for regenerative medicine and tissue engineering will open new opportunities for innovative biomaterial applications.

- There will be a growing shift towards sustainable and biodegradable biomaterials as environmental concerns become more prominent.

- The integration of digital health technologies with biomaterials will lead to the development of smart implants and devices for better patient monitoring and outcomes.

- Orthopedic and cardiovascular biomaterials will remain key focus areas, with an increasing need for customized implants and prosthetics.

- Research in bioactive and bioresorbable materials will enhance the efficacy of implants, reducing the need for follow-up surgeries.

- The rising elderly population in Germany will drive demand for biomaterials in joint replacements, dental implants, and other age-related applications.

- Collaborations between industry, academia, and healthcare providers will foster innovation and accelerate the development of new biomaterial products.

- The regulatory landscape will become increasingly focused on ensuring the safety and sustainability of biomaterials, influencing future market trends.

- The growing focus on minimally invasive surgeries will drive the demand for biomaterials that offer better integration and reduced recovery times.