Market Overview:

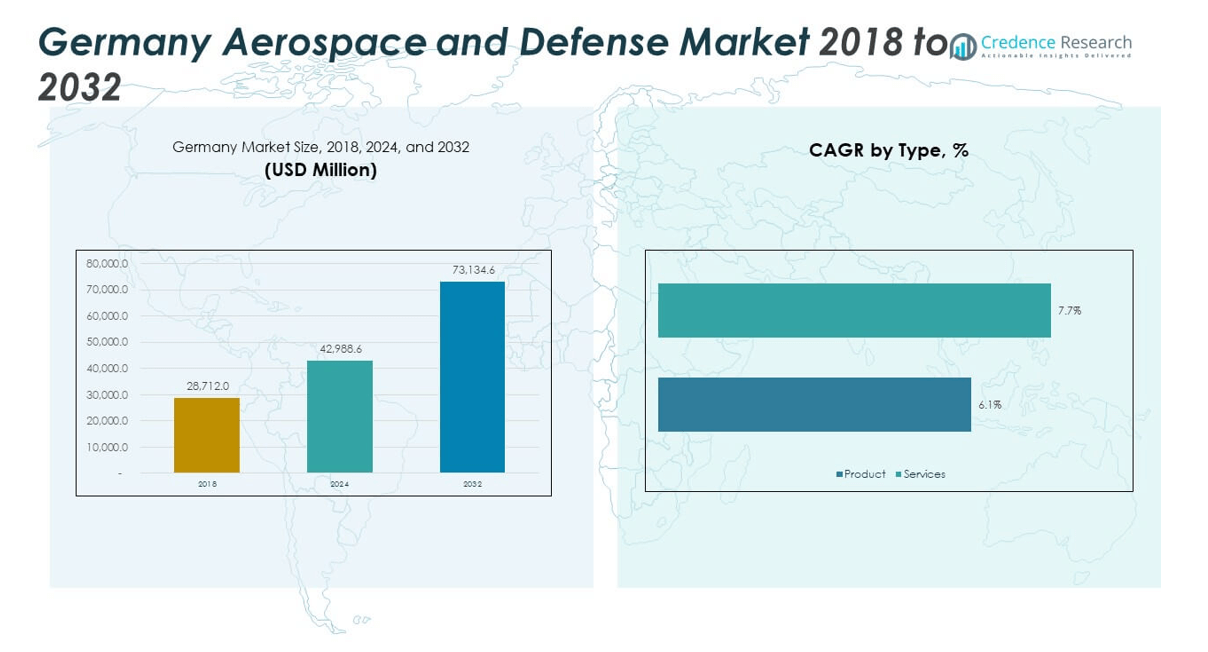

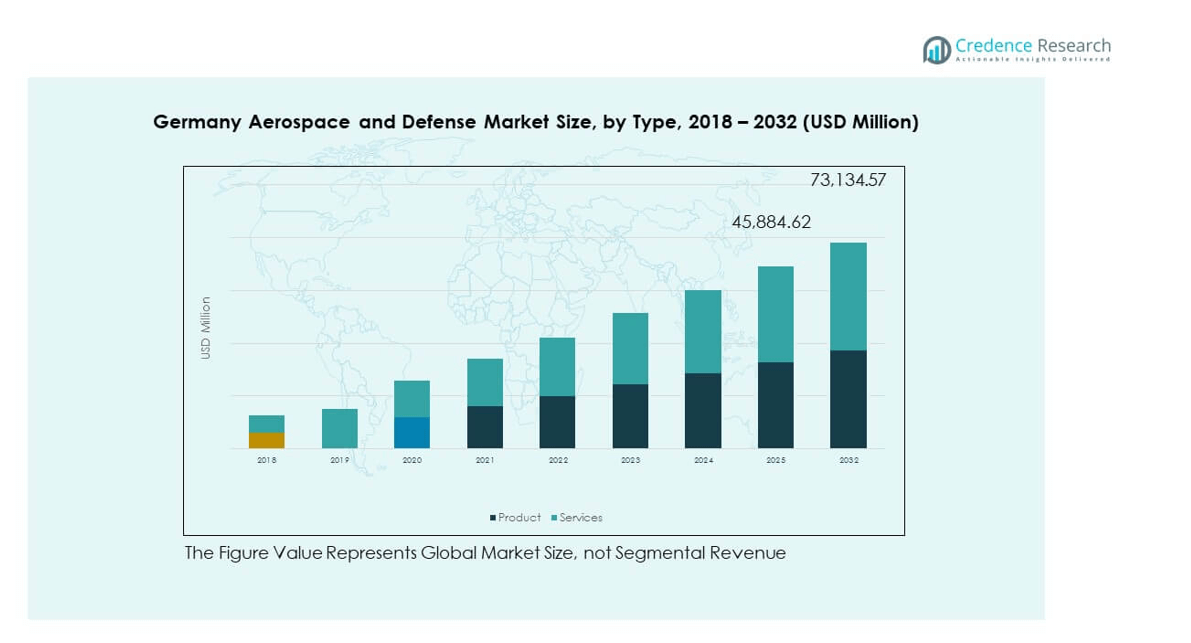

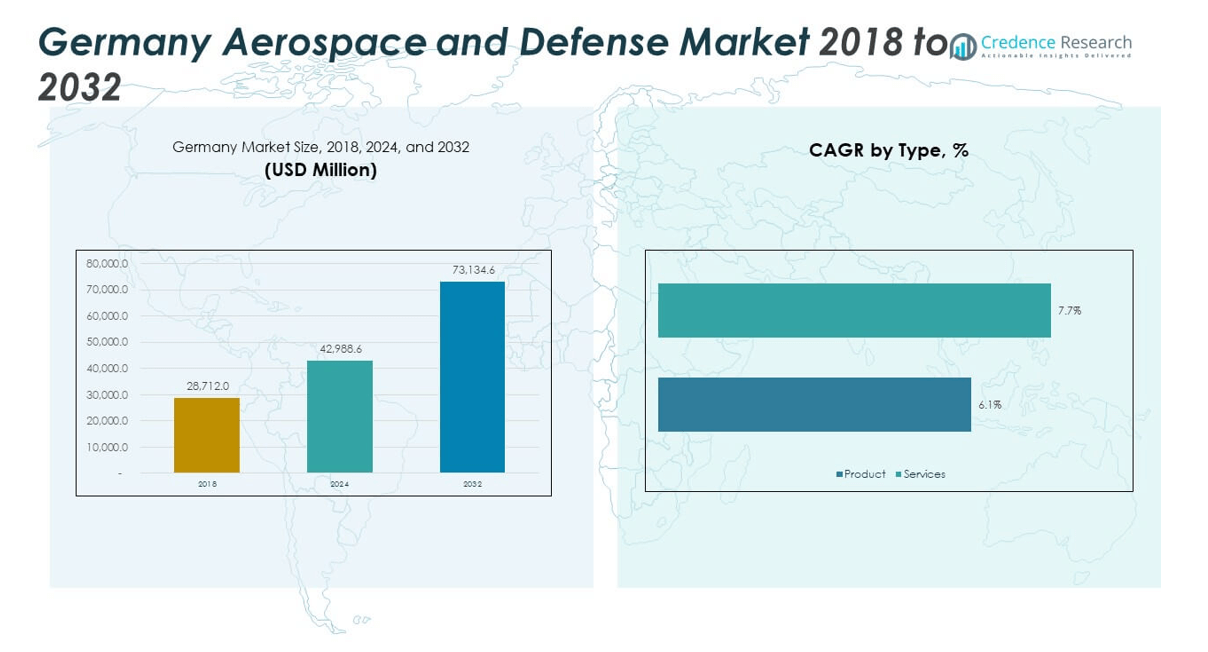

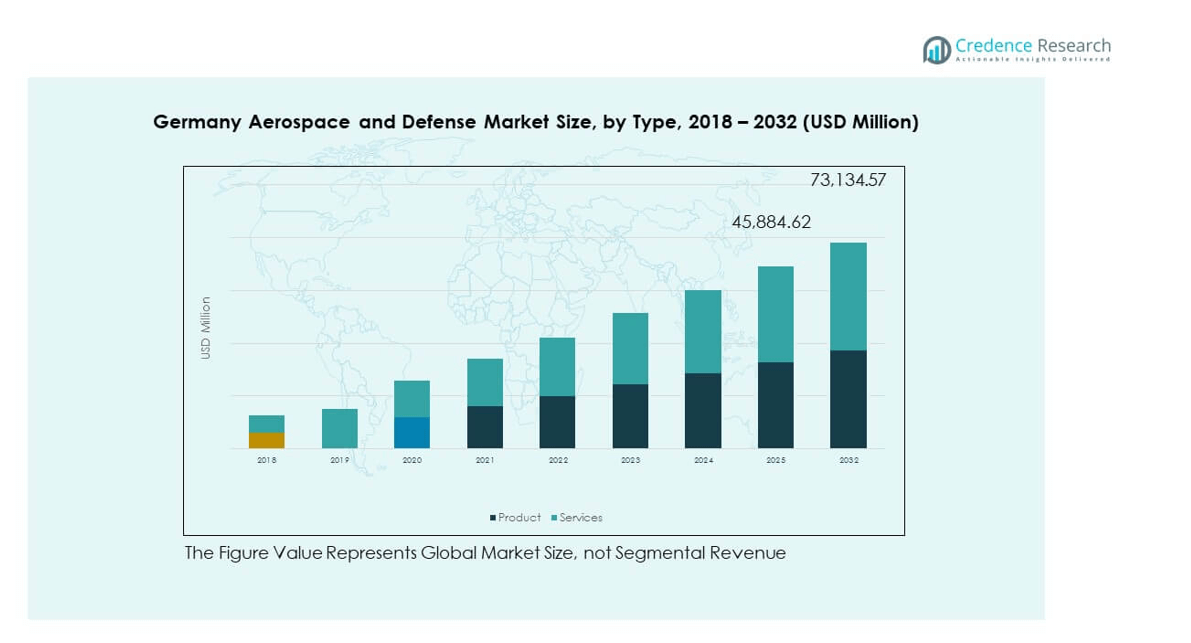

The Germany Aerospace and Defense Market size was valued at USD 28,712.00 million in 2018 to USD 42,988.60 million in 2024 and is anticipated to reach USD 73,134.60 million by 2032, at a CAGR of 6.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Aerospace and Defense Market Size 2024 |

USD 42,988.60 million |

| Germany Aerospace and Defense Market, CAGR |

6.78% |

| Germany Aerospace and Defense Market Size 2032 |

USD 73,134.60 million |

The growth of the Germany Aerospace and Defense Market is primarily driven by increased defense spending, rising geopolitical tensions, and strong government support for innovation in defense technology. Germany has accelerated investments in military modernization programs, including procurement of advanced aircraft, radar systems, and missile defense solutions. The commercial aerospace segment is also gaining momentum, supported by increased air travel demand and airline fleet expansion. Public-private collaborations, focus on local manufacturing, and the rise of dual-use technologies have collectively boosted research and production capabilities across the aerospace and defense ecosystem.

Within the broader European context, Germany leads the aerospace and defense market due to its robust industrial base, strategic partnerships, and strong R&D infrastructure. It serves as a manufacturing hub and export leader, particularly in aircraft components and defense systems. Neighboring countries such as France and the UK are also major players with established defense sectors, while Eastern European nations like Poland and Romania are emerging markets, driven by modernization efforts and integration into NATO-led defense frameworks. This regional dynamic supports both competition and collaboration across the continent.

Market Insights:

- The Germany Aerospace and Defense Market was valued at USD 42,988.60 million in 2024 and is projected to reach USD 73,134.60 million by 2032, growing at a CAGR of 6.78%.

- Rising defense spending and military modernization programs are key drivers strengthening procurement and R&D investments.

- Strategic focus on cybersecurity and space defense is expanding operational domains and attracting high-tech partnerships.

- Complex regulatory compliance and supply chain disruptions continue to challenge market efficiency and production timelines.

- Western Germany leads the market with a 45% share, supported by aerospace clusters and major defense contractors.

- Southern Germany holds 30% share, driven by strong export capabilities and high-value avionics production.

- Emerging regions in Eastern Germany are gaining momentum through government incentives and EU-funded innovation programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Defense Budget and Strategic Procurement Programs Fuel Market Expansion

Germany has significantly raised its defense budget to modernize military capabilities and support NATO commitments. The government is actively procuring advanced equipment, including next-generation fighter jets, armored vehicles, and missile defense systems. These investments help enhance operational readiness and national security. The Germany Aerospace and Defense Market benefits directly from this financial commitment to defense modernization. It has created new opportunities for domestic manufacturers and global defense contractors. Strategic collaborations with key allies support technology transfer and production partnerships. Germany’s focus on rapid procurement has accelerated market movement and created long-term supply chain demand. The industry continues to scale innovation through increased government-backed contracts and industrial alliances.

- For example, Germany will increase its annual defense budget from about €62 billion in 2025 to approximately €153 billion by 2029, achieving 3.5% of GDP according to official projections. It plans to procure up to 5,000 Boxer armored vehicles, around 3,500 Patria AMVs, and 20 new Eurofighter jets to support this expansion.

Strong Emphasis on Airborne Capabilities Strengthens Sectoral Demand

Germany is prioritizing the development and deployment of advanced airborne capabilities, including unmanned aerial vehicles (UAVs), electronic warfare systems, and long-range surveillance aircraft. The Germany Aerospace and Defense Market experiences growing demand for these technologies across both military and civilian applications. It responds to changing security threats and the need for real-time intelligence. The government supports domestic R&D programs focused on enhancing air dominance and surveillance. German firms collaborate with European defense programs like FCAS (Future Combat Air System) to develop next-gen fighter aircraft. These initiatives create strategic value for the national aerospace supply chain. The increasing use of drones for border monitoring and battlefield awareness further drives this trend. Germany positions itself as a key aerospace contributor within Europe through sustained investment in air power.

- For example, Germany plans to purchase an additional 15 F‑35A fighter jets, increasing its fleet from 35 to 50 aircraft, with deliveries expected in the mid-to-late 2020s and full strength by around 2030 per government discussions

Increased Focus on Cybersecurity and Space Defense Capabilities

Germany recognizes cyber and space domains as critical to national defense. The government has established new defense divisions to monitor and counter emerging threats in these areas. The Germany Aerospace and Defense Market expands through contracts focusing on satellite-based intelligence, cybersecurity protocols, and communication networks. It aligns with broader NATO priorities on space situational awareness and secure communications. Public-private collaborations are pushing technological innovation in orbital platforms and cybersecurity solutions. Investments in ground stations, satellite networks, and quantum communication offer long-term strategic advantage. The market integrates software-driven capabilities into traditional defense systems. Germany’s emphasis on space sovereignty and cyber resilience attracts funding and fuels R&D.

Public-Private Partnerships and Technological Advancements Stimulate Growth

The collaboration between government, industry, and academia drives technological innovation across the Germany Aerospace and Defense Market. It supports the development of AI-powered systems, autonomous platforms, and digital twin technologies. Defense startups receive funding to accelerate disruptive solutions. Aerospace manufacturing facilities are adopting Industry 4.0 technologies to boost productivity and maintain quality. The Bundeswehr partners with private firms for simulation training, logistics management, and system integration. These partnerships reduce lead times, enhance cost-efficiency, and enable rapid deployment. Germany’s investment in dual-use technologies strengthens both civilian and defense capabilities. The industry benefits from synergies between commercial aviation and military systems, creating a resilient innovation ecosystem.

Market Trends

Integration of Artificial Intelligence and Automation into Defense Systems

Artificial Intelligence (AI) is transforming operational capabilities across the Germany Aerospace and Defense Market. It supports predictive maintenance, autonomous navigation, and decision-making systems. The market sees high adoption of AI in surveillance, threat detection, and electronic warfare. Automated logistics and supply chain systems reduce operational burden and enhance efficiency. AI integration helps optimize mission planning and execution. Military vehicles and drones are equipped with intelligent sensors for situational awareness. Simulation training powered by AI enhances preparedness and reduces cost. Germany’s defense sector increasingly prioritizes autonomous decision-making platforms to maintain tactical superiority.

Emergence of Green Aviation Technologies within Commercial Aerospace

The push for environmental sustainability is shaping aerospace production trends in Germany. The Germany Aerospace and Defense Market adopts green technologies to reduce emissions and comply with EU environmental targets. Aircraft manufacturers are investing in lightweight materials, electric propulsion systems, and hybrid engines. Research institutions and OEMs collaborate on sustainable fuel alternatives and electrification. Regulatory support promotes low-emission aviation infrastructure. Commercial airlines seek fleet upgrades aligned with green performance metrics. These developments influence procurement and R&D strategies. The green aviation trend aligns with Germany’s broader climate goals and positions it as a leader in sustainable aerospace engineering.

- For example, Airbus is actively developing its first hydrogen-powered commercial aircraft under the ZEROe program, aiming for entry into service by 2035. This initiative is supported through various European and German research partnerships, including funding from government-backed programs. Separately, H2FLY and Diehl Aerospace, in collaboration with the German Aerospace Center (DLR), successfully conducted piloted test flights of a hydrogen-powered aircraft using liquid hydrogen, achieving flight durations exceeding three hours.

Digital Twin Technology Enhances Testing and Simulation in Product Development

Digital twin technology is gaining traction in the aerospace and defense production cycle. The Germany Aerospace and Defense Market uses this tool to replicate real-world systems for virtual testing. It helps reduce development costs and improve system accuracy. Defense engineers simulate stress, fatigue, and real-time responses without physical trials. Maintenance teams use digital twins to predict equipment failure and schedule timely repairs. Aircraft system designers evaluate component interaction and integration through simulations. These capabilities enhance product lifecycle management. Germany’s focus on advanced modeling drives operational excellence and boosts export competitiveness.

Rise of Modular and Multi-Mission Systems for Greater Flexibility

Defense procurement strategies in Germany now favor modular designs and multi-mission systems. The Germany Aerospace and Defense Market offers equipment that can adapt to diverse mission needs with limited reconfiguration. Military forces deploy modular platforms for land, sea, air, and cyber operations. This trend increases interoperability and reduces long-term operating costs. Modular payloads and scalable electronics enable rapid deployment in dynamic environments. Procurement teams prefer flexible systems to counter evolving threats. The trend supports lean logistics and improves equipment uptime. Germany advances its defense posture by investing in reconfigurable systems that improve force agility.

- For example, Rheinmetall’s Gladius 2.0 soldier system is integrated into the Bundeswehr’s Very High Readiness Joint Task Force (VJTF), enhancing interoperability across platforms like the PUMA and BOXER. The Panther KF51 main battle tank features a 130 mm Future Gun System and allows modular payload reconfiguration in under 90 minutes using NATO-standard NGVA architecture.

Market Challenges Analysis

Supply Chain Constraints and Regulatory Complexity Impact Market Efficiency

The Germany Aerospace and Defense Market faces supply chain challenges due to dependence on global suppliers and components. It struggles with delays caused by material shortages, logistics disruptions, and geopolitical tensions. The pandemic exposed vulnerabilities in aerospace part sourcing and highlighted the need for regional supply networks. Strict regulatory standards and export control rules often delay production timelines and increase compliance costs. Companies must navigate defense procurement procedures that require multiple stakeholder approvals. The complex certification process affects innovation speed and time-to-market. Smaller players face entry barriers due to high capital requirements and lengthy licensing. These issues hinder scalability and affect contract fulfillment.

Workforce Shortages and Technological Gaps Limit Innovation Potential

Skilled workforce availability presents a major obstacle for the Germany Aerospace and Defense Market. It faces a shortage of engineers, software developers, and cybersecurity specialists needed to meet growing demand. Aging workforce and limited STEM pipeline reduce the industry’s talent pool. Competition from commercial tech sectors makes it harder for defense firms to attract digital talent. Training new personnel in defense-grade systems takes significant time and investment. Technological gaps emerge due to limited integration of AI, quantum tech, and cloud computing in traditional aerospace segments. These gaps slow modernization efforts. Bridging them requires structural changes in education and corporate upskilling initiatives.

Market Opportunities

Expansion into Emerging Defense Domains Including Space and Cyber Technologies

The Germany Aerospace and Defense Market holds strong potential in space-based defense and cybersecurity sectors. It is focusing on satellite deployment, launch vehicle development, and secure communication networks. Strategic defense programs now include space situational awareness and orbital threat detection. Cyber technologies offer new avenues for partnerships with startups and IT firms. Germany’s commitment to sovereign capabilities in these domains opens new funding streams and procurement channels. Emerging technologies will attract public and private investment, boosting R&D across multiple platforms.

Growing Demand from NATO Allies and Export Markets Supports Market Reach

Germany’s reputation as a reliable defense supplier creates strong export opportunities within Europe and beyond. The Germany Aerospace and Defense Market can leverage NATO programs and bilateral defense agreements to expand its footprint. Rising demand for interoperable systems among allies drives export-oriented production. Countries in Eastern Europe and the Middle East are actively upgrading defense systems, creating opportunities for German OEMs. Collaborative projects with partner nations support technology licensing and co-development initiatives.

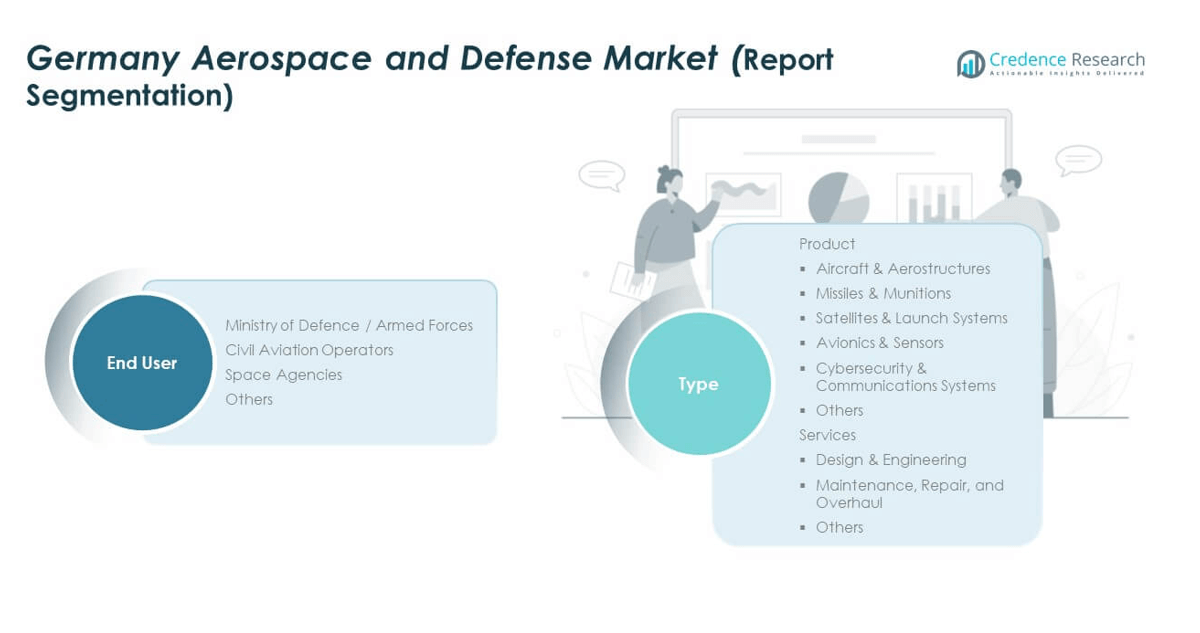

Market Segmentation Analysis:

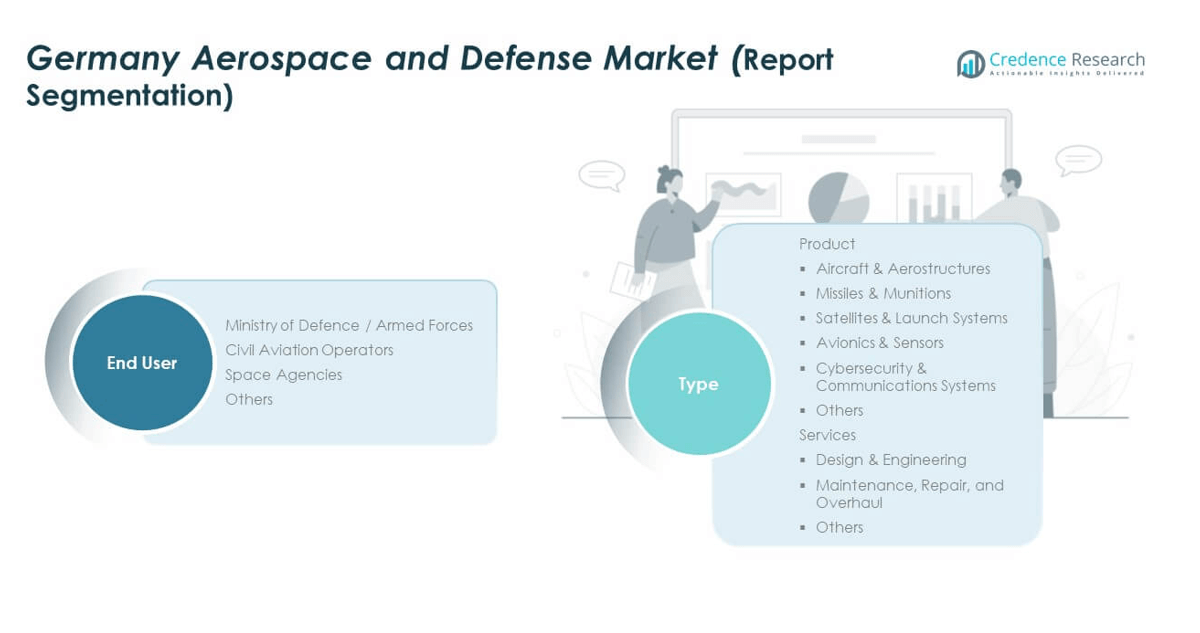

By Type, the Germany Aerospace and Defense Market is segmented into product, services, and end user categories. Within the product segment, aircraft and aerostructures account for a major share due to continued investments in military aviation and commercial fleet upgrades. Missiles and munitions follow closely, driven by increased demand for precision strike capabilities. Satellites and launch systems are gaining importance with the expansion of Germany’s role in space-based defense and communication. Avionics and sensors support real-time surveillance and target acquisition, while cybersecurity and communication systems address evolving threats in digital warfare. In the services segment, design and engineering lead with strong demand for system integration and prototyping. Maintenance, repair, and overhaul (MRO) services show consistent growth, supported by extended lifecycle management of existing platforms. Other services include logistics and simulation training.

- For example, Airbus SE, headquartered in Germany, is a global leader in aircraft and aerostructures.

By end user, the Ministry of Defence and Armed Forces represent the largest share due to national security modernization. Civil aviation operators and space agencies are emerging end users, supported by dual-use technologies and increasing space collaborations.

- For example, Lufthansa Group invested in green fleet upgrades, integrating the latest-generation Airbus A350s equipped with lighter aerostructures and new avionics.

Segmentation:

By Type:

· Product:

- Aircraft & Aerostructures

- Missiles & Munitions

- Satellites & Launch Systems

- Avionics & Sensors

- Cybersecurity & Communications Systems

- Others

· Services:

- Design & Engineering

- Maintenance, Repair, and Overhaul (MRO)

- Others

By End User:

- Ministry of Defence / Armed Forces

- Civil Aviation Operators

- Space Agencies

- Others

Regional Analysis:

Western Germany holds the largest share of the Germany Aerospace and Defense Market, accounting for approximately 45% of total revenue in 2024. This dominance stems from the presence of major aerospace manufacturers, defense contractors, and research institutes clustered around North Rhine-Westphalia, Hesse, and Baden-Württemberg. The region benefits from well-developed infrastructure, access to skilled labor, and strong government-industry partnerships. Key facilities, including manufacturing plants for Airbus and MTU Aero Engines, operate in this zone. Defense production and engineering services are highly concentrated here. Western Germany continues to attract significant investments in innovation and production scale.

Southern Germany follows with a 30% market share, supported by its high-tech industrial base and strong export orientation. Bavaria plays a critical role with its advanced aerospace cluster, housing firms like Diehl Aviation and IABG. The region leads in developing electronics, sensors, and avionics systems for both military and civil applications. Southern Germany benefits from proximity to central European trade routes and NATO logistic networks. It contributes significantly to the development of simulation systems, guidance technologies, and defense R&D. The market in this region reflects high productivity and advanced system integration capabilities.

Northern and Eastern Germany collectively contribute 25% to the Germany Aerospace and Defense Market. Northern Germany, particularly Hamburg, is vital for commercial aircraft assembly and cabin systems. It supports a strong MRO (maintenance, repair, and overhaul) ecosystem. Eastern Germany, while smaller in scale, shows growing activity through government incentives and EU-funded innovation programs. The region focuses on UAV testing zones, missile technologies, and cybersecurity initiatives. Emerging aerospace startups and vocational training centers add momentum to the sector’s regional balance. This area holds potential for growth through targeted investment and cross-border collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Aerospace and Defense Market features a mix of established global corporations and specialized domestic players. Key companies such as Airbus Defence and Space, Rheinmetall AG, MTU Aero Engines, and Diehl Defence lead in defense systems, propulsion technologies, and aircraft manufacturing. It supports a strong supplier base and engineering service providers across various tiers. Competitive advantage relies on advanced manufacturing, R&D capabilities, and integration into NATO and EU defense frameworks. Companies engage in joint ventures, offset agreements, and strategic procurement programs to expand their market share. Innovation in areas like unmanned systems, avionics, and space technologies remains a core focus. International players maintain partnerships with local firms to meet offset obligations and strengthen regional presence. The Germany Aerospace and Defense Market remains highly competitive and innovation-driven, responding rapidly to defense modernization needs and export opportunities.

Recent Developments:

- In March 2025, Leonardo SpA announced an updated Industrial Plan for 2025-2029 that focuses on digitalisation, strategic partnerships, and the launch of advanced digital solutions, including the Leonardo Hypercomputing Continuum line of business.

- In April 2025, Rheinmetall AG completed the acquisition of Hagedorn-NC GmbH, a historic German producer of industrial nitrocellulose. This move is designed to secure Rheinmetall’s ammunition supply chain by enabling the conversion of industrial production capabilities to military-grade applications.

- In June 2025, THEON INTERNATIONAL revealed it had secured approximately €50 million in new orders, mainly for its advanced digital A.R.M.E.D. night vision and thermal imaging products. This strong order intake, mostly scheduled for delivery within the year, highlights increased market traction and positions THEON for further growth in the European defense technology sector.

- In June 2025, MBDA Deutschland unveiled a new low-cost, long-range kamikaze drone at the Paris Air Show. This system, under rapid development since December 2024, features a 40kg warhead and a jet engine with a 500km range.

Market Concentration & Characteristics:

The Germany Aerospace and Defense Market exhibits moderate to high market concentration, dominated by a few major players with extensive vertical integration. It features a structured supply chain network, supported by SMEs that specialize in component manufacturing, software systems, and integration services. The market favors long-term government contracts and defense procurement cycles. High entry barriers, strict regulatory standards, and capital-intensive R&D reinforce the position of incumbents. It emphasizes technological excellence, export compliance, and interoperability with NATO systems. The market maintains a balanced mix of commercial aerospace and military applications. Government-industry collaboration supports innovation, supply chain resilience, and global competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on type and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Aerospace and Defense Market will experience strong momentum from ongoing modernization of military platforms and strategic equipment.

- Increased integration of AI, robotics, and advanced sensors will redefine defense operations and mission planning.

- The market will benefit from Germany’s active participation in multinational defense programs and EU-funded aerospace projects.

- Growth in space defense initiatives will expand opportunities in satellite development, launch systems, and orbital monitoring.

- Rising demand for green aviation technologies will push manufacturers to adopt electric propulsion and sustainable materials.

- The industry will see expanded exports due to rising demand for interoperable systems among NATO allies and partner nations.

- Digitalization across production, maintenance, and training will boost operational efficiency and cost optimization.

- Cybersecurity will remain a priority, driving investment in secure communication networks and electronic warfare systems.

- Collaboration between startups, defense primes, and research institutions will foster innovation and dual-use technology development.

- Workforce development initiatives will address skill shortages and support future capabilities across the aerospace and defense value chain.