| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Construction Aggregates Market Size 2024 |

USD 22,873.38 Million |

| Germany Construction Aggregates Market, CAGR |

5.64% |

| Germany Construction Aggregates Market Size 2032 |

USD 35,465.27 Million |

Market Overview

Germany Construction Aggregates Market size was valued at USD 22,873.38 million in 2024 and is anticipated to reach USD 35,465.27 million by 2032, at a CAGR of 5.64% during the forecast period (2024-2032).

The Germany construction aggregates market is driven by rapid urbanization, increasing infrastructure development, and rising demand for sustainable building materials. Government initiatives supporting green construction and circular economy practices are propelling the adoption of recycled aggregates. The growing residential and commercial construction sectors, fueled by population growth and industrial expansion, are further boosting market demand. Additionally, advancements in technology, such as automated aggregate processing and efficient transportation systems, enhance operational efficiency and reduce costs. The rising emphasis on environmental regulations and carbon footprint reduction encourages the use of eco-friendly aggregates, including recycled concrete and manufactured sand. Moreover, the expansion of public transportation networks, highways, and smart city projects accelerates aggregate consumption. The market also benefits from Germany’s strong economic stability and investment in renewable energy infrastructure. With continuous innovation and sustainable initiatives, the construction aggregates sector is poised for steady growth, ensuring long-term development in line with environmental and economic goals.

Germany’s construction aggregates market is geographically diverse, with major urban centers such as Berlin, Munich, Hamburg, and Bremen driving demand through infrastructure development, residential projects, and industrial expansion. The southern and western regions, known for their strong manufacturing and commercial hubs, also contribute significantly to aggregate consumption. Additionally, Germany’s commitment to sustainable construction and the use of recycled aggregates is influencing regional demand patterns.

Key players in the German construction aggregates market include Heidelberg Materials AG, Holcim Group, CRH plc, CEMEX S.A.B. de C.V., and EUROVIA Kamenolomy AS. These companies focus on product innovation, sustainable mining practices, and strategic mergers to strengthen their market position. Other notable players, such as Tarmac, Colas Group, Buzzi S.p.A., and Boral Limited, contribute to market growth through advanced material technologies and efficient supply chain operations. With a strong emphasis on eco-friendly aggregates and digitalized production processes, these key players continue to shape the future of Germany’s construction materials industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Germany’s construction aggregates market was valued at USD 22,873.38 million in 2024 and is projected to reach USD 35,465.27 million by 2032, growing at a CAGR of 5.64% (2024-2032).

- Increasing urbanization and infrastructure development projects are driving market growth.

- Rising demand for sustainable and recycled aggregates is shaping industry trends.

- Key players, including Heidelberg Materials AG, Holcim Group, and CRH plc, are expanding their market presence through mergers and technological advancements.

- Stringent environmental regulations on mining and extraction processes act as a restraint on market expansion.

- Southern and western regions, with strong industrial and commercial sectors, contribute significantly to aggregate demand.

- Advancements in digitalized production and eco-friendly material processing are expected to enhance efficiency in the market.

Report Scope

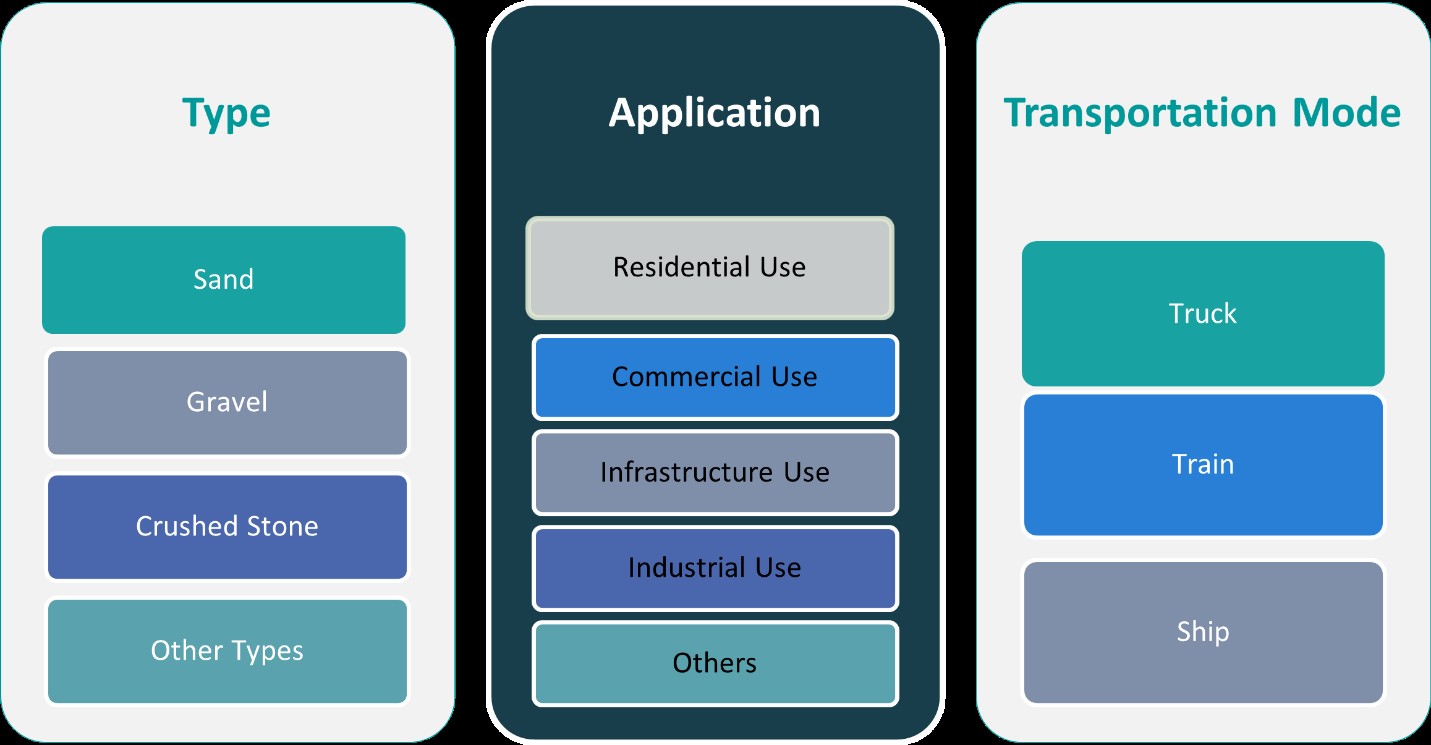

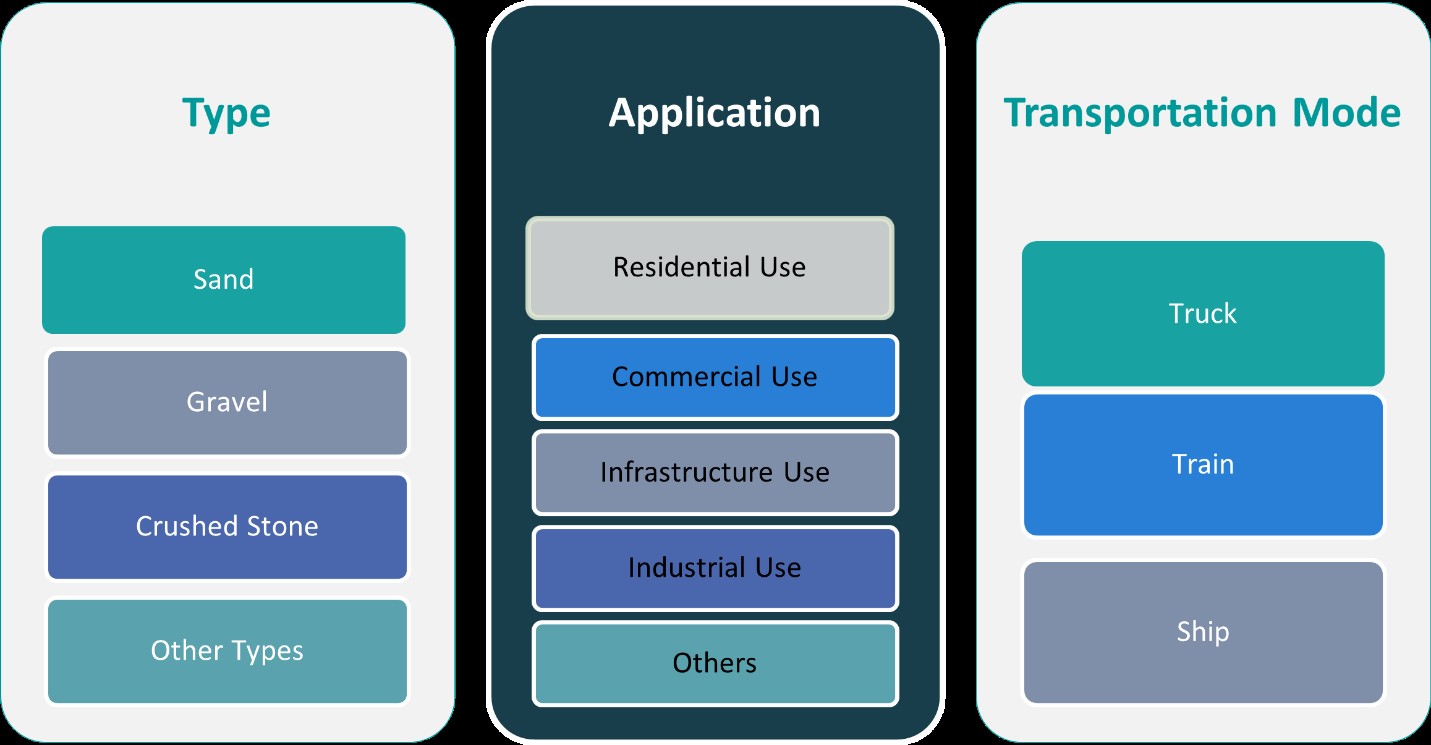

This report segments the Germany Construction Aggregates Market as follows:

Market Drivers

Growing Infrastructure Development and Urbanization

Germany’s construction aggregates market is significantly driven by extensive infrastructure development and rapid urbanization. The government’s investment in transportation networks, including roads, bridges, and railway expansions, has increased the demand for aggregates such as crushed stone, sand, and gravel. For instance, the German Federal Statistical Office reported that new orders in the main construction industry increased by 4.2% in February 2023 compared to the previous month. The rise of smart city projects and modernization of public infrastructure further contribute to market growth. With Germany being a key European economic hub, urban expansion continues at a steady pace, fueling the construction of residential, commercial, and industrial structures that heavily rely on construction aggregates. Additionally, increasing migration to urban centers has led to higher housing demands, prompting continuous construction activities that further stimulate aggregate consumption.

Sustainable Construction and Environmental Regulations

The shift towards sustainable construction practices and stringent environmental regulations has significantly influenced the construction aggregates market in Germany. The government’s commitment to reducing carbon emissions and promoting eco-friendly building materials has led to an increased adoption of recycled aggregates. For instance, policies encouraging circular economy initiatives have driven the use of secondary aggregates derived from demolition waste and industrial byproducts. Additionally, the growing preference for sustainable concrete and low-carbon construction materials aligns with Germany’s environmental objectives, further propelling the market. As regulatory bodies enforce stricter sustainability standards, construction companies are increasingly turning to environmentally friendly aggregate solutions.

Technological Advancements in Aggregate Processing

Innovation in aggregate processing and material handling technologies has enhanced the efficiency and cost-effectiveness of construction projects in Germany. Advanced machinery, such as automated crushers and screeners, improves production output while minimizing material wastage. Additionally, modern transportation and logistics solutions ensure the timely delivery of aggregates to construction sites, optimizing supply chain operations. The integration of digital technologies, including artificial intelligence (AI) and Internet of Things (IoT) solutions, enables real-time monitoring of aggregate quality and production efficiency. These technological advancements have streamlined operations, reducing costs and improving the overall sustainability of aggregate production.

Rising Investments in Renewable Energy Infrastructure

Germany’s strong focus on renewable energy and sustainability has led to significant investments in wind farms, solar power plants, and hydroelectric projects, all of which require substantial amounts of construction aggregates. The expansion of renewable energy infrastructure demands durable materials for foundation work, access roads, and other supporting structures. Additionally, the transition towards greener energy sources has encouraged the development of energy-efficient buildings, further driving aggregate consumption. Government incentives and private sector investments in sustainable energy projects continue to stimulate demand, reinforcing the market’s long-term growth potential. As Germany aims to achieve its energy transition goals, the construction aggregates sector is expected to benefit from ongoing infrastructure expansion and modernization efforts.

Market Trends

Current Challenges in the German Construction Aggregates Market

The German construction aggregates market is currently facing significant challenges due to a downturn in the broader construction industry. For instance, the Zentralverband Deutsches Baugewerbe (ZDB) has highlighted that construction companies are grappling with reduced demand and rising costs, with many firms reporting difficulties in maintaining profitability. ZDB President Wolfgang Schubert-Raab noted that companies are now navigating the depths of the crisis, suggesting that the industry may be approaching its lowest point.

Pessimistic Outlook Among German Businesses

A survey conducted by the German Economic Institute (IW) reveals a prevailing pessimism among German business associations regarding the economic outlook for 2025. The majority of the 49 associations surveyed reported a deterioration in the current situation compared to 2023, with only a few expecting increased production in the coming year. High costs for energy, labor, and materials, coupled with excessive bureaucracy, are cited as major challenges. Additionally, the uncertain global climate and domestic political instability are impacting exports and investment, further exacerbating the negative sentiment within the construction sector.

Housing Demand and Construction Shortfalls

Despite the current downturn, there remains a substantial demand for housing in Germany. A study by the Federal Institute for Research on Building, Urban Affairs, and Spatial Development (BBSR) indicates that Germany needs to construct 320,000 new apartments annually until 2030 to meet growing housing needs, intensified by immigration from countries such as Ukraine and Syria. However, in 2024, permits were issued for only 216,000 apartments, marking the slowest pace since 2010 amid a significant real estate crisis. This shortfall underscores the gap between housing demand and construction activity, directly impacting the aggregates market.

Potential for Market Stabilization and Growth

While the current outlook appears challenging, there are indications that the construction industry may be approaching the bottom of its downturn. For instance, the ZDB has observed that companies are “orientating themselves along the bottom of the trough,” suggesting potential stabilization. Furthermore, the persistent housing demand presents opportunities for future growth in the construction aggregates market. As economic conditions improve and construction activities resume to address housing shortages, the demand for aggregates is expected to rebound, potentially revitalizing the market in the coming years.

Market Challenges Analysis

Rising Costs and Economic Uncertainty

The German construction aggregates industry is facing significant financial pressures due to rising costs and economic instability. High energy prices, increasing labor expenses, and material cost inflation have placed substantial strain on construction companies, reducing their purchasing power for essential aggregates like sand, gravel, and crushed stone. For instance, the German Aggregates Industry Association (MIRO) reported a decline in aggregates production by 8-10% in 2022, attributed to inflation and geopolitical tensions. Additionally, the broader economic slowdown, driven by high-interest rates and weakened investor confidence, has led to a decline in construction activity. Government initiatives to boost infrastructure development and housing construction have fallen short of expectations, leading to a reduced demand for aggregates. Furthermore, supply chain disruptions and geopolitical tensions have exacerbated raw material shortages, further impacting production and pricing dynamics.

Regulatory Barriers and Labor Shortages

Beyond economic pressures, regulatory challenges and labor shortages are further hindering the growth of Germany’s construction aggregates market. Strict environmental regulations and lengthy approval processes for new quarries and mining sites have slowed down resource extraction, limiting supply and increasing costs. Compliance with sustainability standards, such as reducing carbon emissions in mining and transportation, has added to the financial burden on companies. Additionally, a shortage of skilled labor, particularly in the mining and construction sectors, has led to operational inefficiencies. Many companies struggle to find qualified workers for quarry operations and transportation logistics, resulting in project delays and higher labor costs. Without structural reforms to address these issues, the construction aggregates sector will continue to face significant growth limitations.

Market Opportunities

Germany’s construction aggregates market presents promising opportunities despite recent economic challenges. The country’s ongoing housing shortage and infrastructure modernization plans are key drivers for aggregate demand. With an estimated need for 320,000 new housing units annually until 2030, the construction sector is expected to gradually recover, increasing the demand for essential materials such as sand, gravel, and crushed stone. Additionally, the German government’s commitment to green infrastructure, including railway expansion and renewable energy projects, is set to boost aggregate consumption. Investments in road rehabilitation, bridge maintenance, and urban development further enhance market prospects, providing a steady pipeline of construction activity that will sustain aggregate production in the long term.

Sustainability trends and technological advancements are also opening new growth avenues in the German aggregates industry. The push for circular economy practices has increased the demand for recycled aggregates, presenting opportunities for companies specializing in sustainable material processing. Advancements in mining and quarrying technologies, including automation and digitalization, are improving operational efficiency and cost-effectiveness, making aggregate production more competitive. Furthermore, Germany’s focus on reducing carbon emissions is driving the adoption of eco-friendly aggregates and innovative construction materials, creating a niche market for low-carbon and alternative aggregates. As regulatory frameworks evolve to support sustainable building practices, businesses that align with environmental standards will gain a competitive edge in the growing market.

Market Segmentation Analysis:

By Type:

The German construction aggregates market is categorized into sand, gravel, crushed stone, and other types, each serving distinct applications across the construction sector. Sand remains a crucial component in concrete production, brick manufacturing, and mortar applications, making it essential for both residential and commercial projects. However, environmental concerns over excessive sand extraction have led to increased demand for sustainable alternatives, such as recycled sand. Gravel is widely used in road construction, railway ballast, and drainage systems due to its durability and stability. With Germany’s ongoing infrastructure development, the demand for high-quality gravel is expected to rise. Crushed stone, another major segment, is extensively utilized in concrete production, foundation work, and asphalt applications. Its strength and versatility make it indispensable for large-scale infrastructure projects. The “Other Types” category includes specialized aggregates such as slag and recycled materials, which are gaining traction as industries shift toward circular economy practices. The increasing adoption of eco-friendly aggregates is expected to shape market dynamics in the coming years.

By Application:

Germany’s construction aggregates market is further segmented based on application into residential, commercial, infrastructure, and industrial uses. The residential segment remains a key driver, fueled by the country’s urgent need for affordable housing and urban expansion. Government initiatives to address the housing crisis will continue to drive demand for aggregates in concrete and masonry applications. Commercial construction, including office buildings, shopping centers, and mixed-use developments, also contributes to market growth, particularly in major cities experiencing economic revitalization. Infrastructure projects, such as road and bridge construction, railway expansion, and public utility development, represent a substantial portion of aggregate consumption. With Germany prioritizing green infrastructure and transport modernization, demand for aggregates in this segment is expected to remain strong. The industrial segment, which includes aggregates used in manufacturing facilities, energy projects, and heavy engineering, is also growing as industries upgrade and expand. These diverse applications highlight the essential role of construction aggregates in supporting Germany’s economic and structural development.

Segments:

Based on Type:

- Sand

- Gravel

- Crushed Stone

- Other Types

Based on Application:

- Residential Use

- Commercial Use

- Infrastructure Use

- Industrial Use

Based on End- User:

Based on the Geography:

- Berlin

- Munich

- Hamburg

- Bremen

Regional Analysis

Berlin

Berlin holds a significant share of Germany’s construction aggregates market, accounting for approximately 18% of the total demand. As the capital and one of the most densely populated cities, Berlin’s infrastructure and residential development projects continuously drive aggregate consumption. The city’s focus on sustainable urban development, including green buildings and smart city initiatives, further propels the demand for aggregates. Additionally, the ongoing expansion of transportation networks, including metro lines and road rehabilitation projects, strengthens Berlin’s position as a key market for construction aggregates.

Munich

Munich, with a market share of 22%, leads as a major hub for high-end real estate and infrastructure projects in southern Germany. The city’s booming construction sector, driven by corporate expansions, commercial centers, and residential developments, significantly contributes to the demand for aggregates. Munich’s emphasis on modernizing transportation infrastructure, including airport expansions and railway upgrades, has increased the need for high-quality aggregates. Furthermore, the city’s strong regulatory focus on sustainable construction and recycled aggregates fosters innovation in the sector while maintaining consistent demand.

Hamburg

Hamburg accounts for 16% of the construction aggregates market, supported by its strategic role as Germany’s largest port city and a key logistics center. The city’s extensive waterfront development projects, including commercial and residential spaces, contribute substantially to aggregate consumption. Hamburg’s commitment to climate-resilient infrastructure, such as flood protection and sustainable urban planning, further stimulates aggregate demand. Additionally, large-scale industrial projects, including warehouse expansions and port-related construction, play a crucial role in sustaining the city’s aggregate market.

Bremen

Bremen, though smaller in comparison, holds 10% of the market share, driven by its growing commercial and industrial development. The city’s focus on enhancing its maritime infrastructure, including port expansions and logistics hubs, has resulted in steady demand for construction aggregates. Moreover, Bremen’s increasing urban redevelopment projects and modernization of public facilities contribute to its market share. The city’s efforts to integrate eco-friendly construction practices, including recycled aggregates, demonstrate its commitment to sustainable growth while ensuring consistent market activity in the construction sector.

Key Player Analysis

- CRH plc

- Colas Group

- CEMEX S.A.B. de C.V.

- Heidelberg Materials AG

- EUROVIA Kamenolomy AS

- Sika AG

- Tarmac

- Buzzi S.p.A.

- Boral Limited

- Carmeuse

- CEMROS

- Holcim Group

Competitive Analysis

The Germany construction aggregates market is highly competitive, with key players such as Heidelberg Materials AG, Holcim Group, CRH plc, CEMEX S.A.B. de C.V., EUROVIA Kamenolomy AS, Colas Group, Sika AG, Tarmac, Buzzi S.p.A., Boral Limited, Carmeuse, and CEMROS dominating the industry. These companies leverage advanced mining technologies, strategic acquisitions, and sustainable production practices to maintain their market position. The market is characterized by strong competition in infrastructure, residential, and commercial construction sectors, with a focus on high-quality and eco-friendly aggregates. Sustainability is a key differentiator, as companies increasingly adopt recycled aggregates and environmentally friendly production processes to comply with stringent regulations. Investments in digitalized quarry operations, automated processing, and smart logistics systems are further enhancing efficiency and cost-effectiveness. Additionally, firms are expanding their market presence through mergers, acquisitions, and collaborations, strengthening their foothold in regional and international markets. Despite growth opportunities, the industry faces challenges such as rising raw material costs, regulatory restrictions on mining activities, and increasing demand for alternative building materials. To stay competitive, companies are diversifying their product portfolios, focusing on high-performance aggregates for specialized construction applications. With urbanization, infrastructure development, and sustainability trends shaping the market, competition remains intense, pushing firms to innovate and optimize operations for long-term success in Germany’s evolving construction sector.

Recent Developments

- In September 2024, Holcim started the Holcim Sustainable Construction Academy. This is a free online training program that teaches about eco-friendly building methods. It helps people who work in construction learn new skills. The program offers both online classes and face-to-face training.

- In October 2024, CRH Ventures launched the Sustainable Building Materials accelerator to scale up creative climate and build technology firms that specialize in CO2-mineralized materials and sustainable binder solutions.

- In July 2024, Heidelberg Materials launched a recycling plant in Katowice, Poland, using a patented ReConcrete process to recycle demolition concrete and replace virgin material.

- In July 2024, Cemex USA formed a joint venture with Couch Aggregates and Premier Holdings for the production and distribution of aggregates in the Mid-South region. Cemex USA already had a strategic partnership with Couch Aggregates. The company stated that this vertical integration, combined with Premier Holdings’ Gulf Coast marine terminals, would accelerate its regional growth.

- In April 2024, Rogers Group joined The Road Forward initiative to advance sustainable asphalt production and paving practices.

- In January 2024, Heidelberg Materials launched Evo Build, its new global brand for low-carbon and circular products. This initiative aims to provide sustainable solutions for the construction industry, focusing on reducing carbon emissions and promoting circular economy principles.

Market Concentration & Characteristics

The Germany construction aggregates market exhibits a moderate to high level of concentration, with a few dominant players controlling a significant share of the industry. Large multinational corporations and well-established domestic firms lead the market, leveraging advanced production technologies, extensive distribution networks, and strategic partnerships. The industry is characterized by high entry barriers, including stringent environmental regulations, capital-intensive operations, and the need for well-established supply chains. Companies focus on sustainable practices, such as recycled aggregates and eco-friendly mining, to align with Germany’s strict environmental policies. Additionally, regional demand variations influence market dynamics, with urban centers driving consumption through infrastructure and commercial development projects. Despite market consolidation, smaller regional players and independent quarry operators continue to serve niche segments. Competitive pricing, innovation in material quality, and efficiency in logistics are key factors shaping market success. As sustainability trends grow, businesses are increasingly adopting digitalized processes and circular economy models to maintain their competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The construction aggregates market in Germany will continue to grow due to increasing infrastructure and residential development projects.

- Sustainable and recycled aggregates will gain more prominence as environmental regulations become stricter.

- Advanced digital technologies and automation will enhance efficiency in quarry operations and material processing.

- Rising investments in smart cities and green building initiatives will drive aggregate demand.

- Market players will expand through mergers, acquisitions, and strategic collaborations to strengthen their presence.

- Transportation infrastructure upgrades, including roads, railways, and airports, will boost aggregate consumption.

- The demand for high-performance aggregates will rise for specialized applications in commercial and industrial construction.

- Fluctuating raw material costs and regulatory challenges may impact market growth and pricing strategies.

- Companies will focus on improving supply chain efficiency and adopting sustainable extraction methods.

- Germany’s shift toward carbon-neutral construction materials will reshape market trends and production practices.