Market Overview:

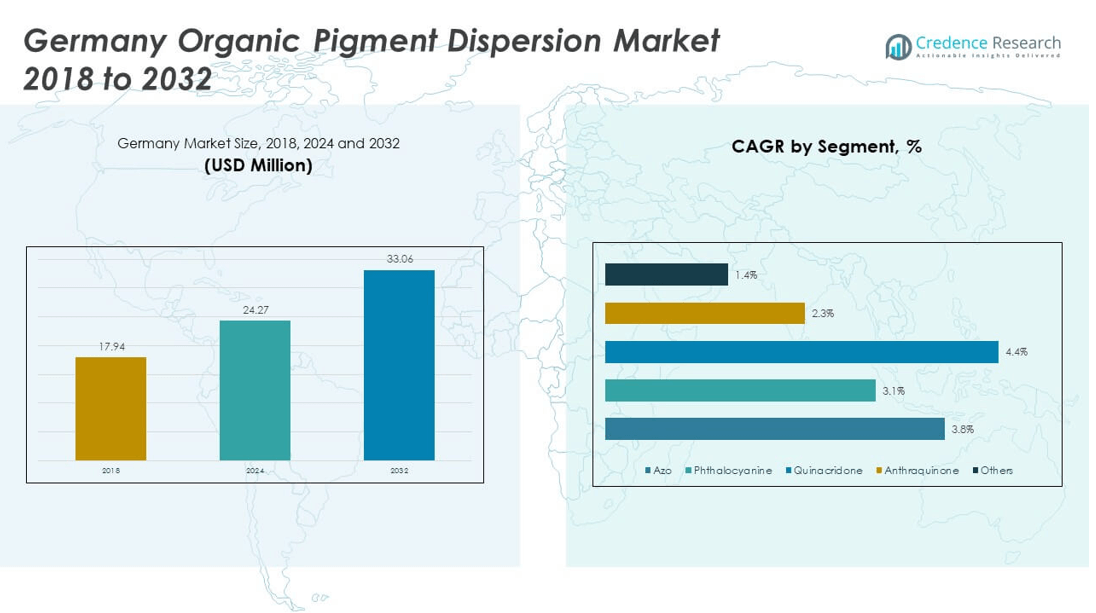

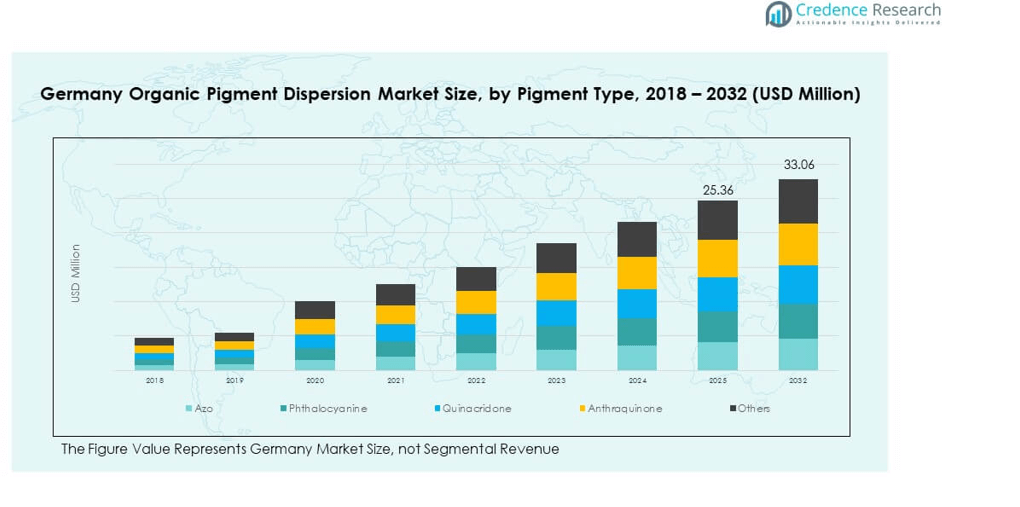

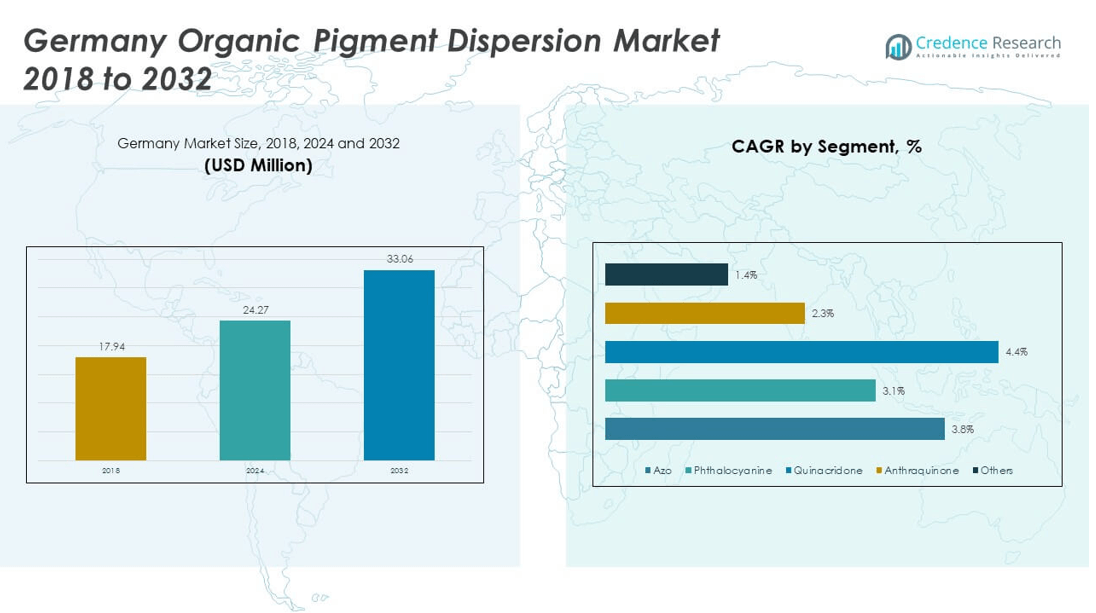

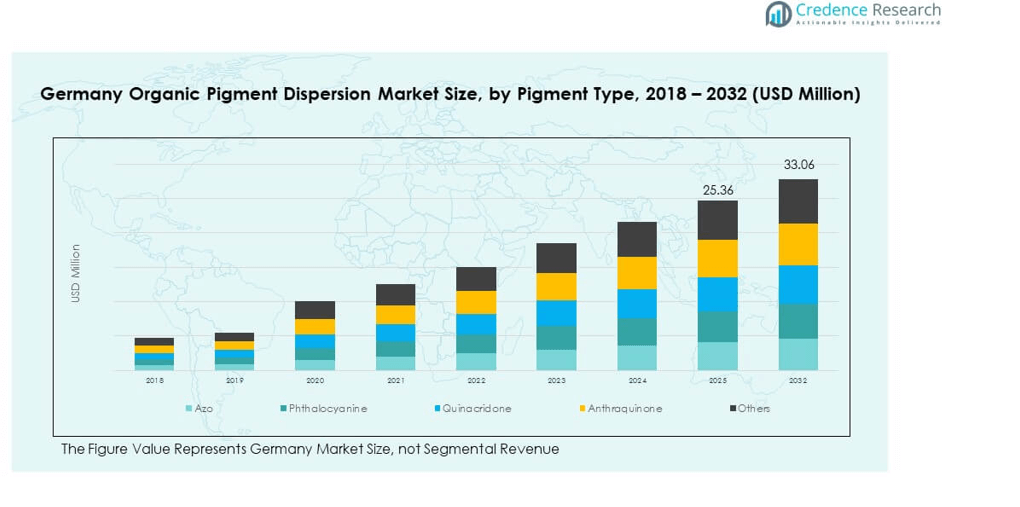

The Germany Organic Pigment Dispersion Market size was valued at USD 17.94 million in 2018 to USD 24.27 million in 2024 and is anticipated to reach USD 33.06 million by 2032, at a CAGR of 3.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Organic Pigment Dispersion Market Size 2024 |

USD 24.27 million |

| Germany Organic Pigment Dispersion Market, CAGR |

3.86% |

| Germany Organic Pigment Dispersion Market Size 2032 |

USD 33.06 million |

Growth in the market is supported by strong demand from packaging, automotive, coatings, and textile industries. Companies respond to strict EU sustainability regulations by developing eco-friendly, water-based dispersions. The market expands as industries seek durable, high-performance pigments that meet regulatory compliance while reducing environmental impact. Rising investments in research and product customization strengthen adoption across diverse applications. It benefits from advanced chemical manufacturing infrastructure and strong collaborations between industry players and research institutes.

Regional analysis highlights Southern Germany as the leading subregion due to its automotive base and industrial manufacturing strength. Western Germany follows, driven by chemical clusters and significant demand from construction-related coatings. Northern and Eastern Germany emerge as growing contributors, supported by packaging, textiles, and digital printing applications. Strong logistics and proximity to export hubs enhance the competitive position of these regions. It demonstrates a balanced market structure where industrial hubs and innovation clusters drive overall growth.

Market Insights

- The Germany Organic Pigment Dispersion Market was valued at USD 17.94 million in 2018, reached USD 24.27 million in 2024, and is anticipated to attain USD 33.06 million by 2032, registering a CAGR of 3.86%.

- The Global Organic Pigment Dispersion Market size was valued at USD 397.20 million in 2018 to USD 549.81 million in 2024 and is anticipated to reach USD 768.02 million by 2032, at a CAGR of 4.18% during the forecast period.

- Southern Germany held 42% share, driven by its strong automotive and industrial base; Western Germany followed with 33% due to its chemical clusters; Northern and Eastern Germany accounted for 25%, led by packaging and textile industries.

- Northern and Eastern Germany emerged as the fastest-growing region with 25% share, supported by rising digital printing, textile production, and eco-friendly packaging demand.

- Azo pigments contributed the largest share of the market in 2024, accounting for nearly 36% of total pigment type demand due to their cost efficiency and versatility.

- Phthalocyanine pigments followed with 28% share, driven by their durability and stability in automotive and industrial coatings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly and Compliant Pigments Across Key Industries

The Germany Organic Pigment Dispersion Market benefits from strict EU environmental regulations and rising consumer demand for safer products. Industries such as packaging, automotive, textiles, and coatings require eco-friendly solutions. Regulatory shifts encourage companies to move away from heavy-metal pigments toward sustainable alternatives. Strong environmental awareness among German consumers creates further pressure on manufacturers. It helps companies develop dispersions with compliance to REACH and other EU standards. Global brands also rely on compliant pigments to meet cross-border trade rules. The German market leverages its advanced R&D to create safer, sustainable pigment solutions. It strengthens its global leadership in high-performance eco-friendly colorants.

- For example, Clariant’s Dispersogen™ Flex 100 is a universal dispersing agent for water- and solvent-based pigment preparations. It is suitable for organic and inorganic pigments, including carbon blacks and titanium dioxide, and is APEO- and NPEO-free with <1% VOC and <0.1% SVOC content, offering a label-free, REACH-compliant solution for European manufacturers.

Growing Investments in High-Performance Pigment Technology by Local Producers

Local players in Germany continue investing in advanced production methods to meet evolving needs. The country is known for its innovation in pigments with strong focus on durability and performance. Companies develop dispersions that ensure high lightfastness and stability in coatings and plastics. It supports industries such as automotive and construction where product life cycle matters. Pigments with enhanced performance reduce maintenance and replacement costs for end-users. The Germany Organic Pigment Dispersion Market aligns with industrial sectors seeking reliable, long-lasting color solutions. Producers also expand laboratory capabilities to speed up product testing. It reinforces Germany’s reputation for precision and quality in pigment manufacturing.

- For example, in October 2024, Sudarshan Chemical Industries entered a definitive agreement to acquire Heubach Group, including its global pigment business. The deal expands Sudarshan’s technological strengths, R&D capabilities, and manufacturing footprint across Europe and other regions, with a focus on customer-centricity and product quality.

Strong Adoption in Automotive and Construction Industries Supporting Growth

Germany’s automotive and construction sectors drive demand for organic pigment dispersions with proven performance. Vehicle manufacturers require high-strength dispersions for coatings that withstand harsh weather. Construction paints and coatings also demand stability against UV exposure and environmental factors. The market responds with dispersions that meet durability and sustainability requirements. It enables manufacturers to address both quality expectations and regulatory guidelines. Growth in housing projects and infrastructure investments further stimulates pigment demand. Automotive exports strengthen global reach for German pigment producers. It helps the country maintain a steady market base for organic dispersions.

Expanding Role of Digital Printing and Packaging Applications in Market Growth

Digital printing technologies are advancing rapidly in Germany, supporting strong pigment dispersion demand. Packaging converters rely on high-quality dispersions for vivid, durable prints. It improves brand visibility and consumer appeal across multiple sectors. The Germany Organic Pigment Dispersion Market supports packaging with solutions meeting food-contact safety norms. Rising e-commerce adds pressure for more appealing, durable packaging designs. Pigments with improved dispersion stability deliver better printing results. Local suppliers continue innovating dispersions for diverse substrates including plastics and paper. It ensures Germany maintains competitiveness in advanced packaging applications worldwide.

Market Trends

Shift Toward Water-Based and Solvent-Free Pigment Dispersions in Key Segments

A notable trend in Germany is the strong move toward water-based pigment dispersions. Regulatory frameworks encourage lower VOC emissions across printing, coatings, and packaging. The Germany Organic Pigment Dispersion Market reflects this change through increased product launches. Manufacturers redesign formulations to replace traditional solvent-heavy dispersions. It helps industries reduce environmental footprint while ensuring performance. Demand for solvent-free systems grows in packaging with food-contact requirements. Water-based dispersions also align with rising consumer expectations for green products. This shift positions Germany as a leader in sustainable pigment technologies.

Integration of Smart Color Solutions Through Digital and Functional Printing

Smart pigments and functional printing are emerging as growing trends in Germany. Companies integrate pigment dispersions with responsive or functional features. The Germany Organic Pigment Dispersion Market incorporates solutions for security, brand authentication, and QR-based packaging. Functional pigments add value through light reflection, temperature resistance, and protective properties. It creates new revenue opportunities for producers targeting high-value industries. Digital and 3D printing further expand dispersion applications beyond conventional markets. Color solutions tailored for electronic and interactive packaging become attractive to brands. Germany’s strong printing sector accelerates adoption of these advanced pigment technologies.

- For example, Sun Chemical’s Sicopal® Yellow L 1130 is a bismuth vanadate-based pigment. It offers high color strength, excellent durability, and strong weather resistance. It finds use in silicate, silicone, stucco, exterior façade, and architectural interior coatings. It also provides solar heat management properties in certain formulations.

Growing Emphasis on Circular Economy and Recycling-Oriented Pigments

Sustainability trends in Germany highlight the importance of recyclable pigment solutions. Industries demand dispersions that maintain recyclability of packaging and plastics. The Germany Organic Pigment Dispersion Market supports these initiatives with bio-based raw materials. It aligns with circular economy strategies across the EU. Demand rises for dispersions that do not interfere with polymer recovery processes. Colorants that support mechanical and chemical recycling processes are gaining traction. German producers partner with recyclers to improve pigment compatibility with reclaimed plastics. This trend strengthens the role of pigments in sustainable value chains.

Rising Customization and Application-Specific Pigment Dispersions for End-Users

End-users in Germany seek highly customized pigment dispersions tailored for sector-specific needs. Automotive and construction firms demand high-performance dispersions with exacting specifications. The Germany Organic Pigment Dispersion Market adapts by offering personalized formulations. It allows manufacturers to deliver precise shades, durability, and processing efficiency. Niche sectors such as cosmetics and textiles also drive demand for specialized colors. Customized dispersions improve efficiency by reducing waste during production. Producers benefit from higher margins through value-added customization services. This trend reflects the German market’s strong orientation toward precision and quality solutions.

- For instance, Merck’s Xirallic® NXT pigment series is officially documented as being specially developed for automotive coatings, providing exceptional sparkle, color depth, and strong flop behavior enabling German automotive manufacturers to achieve highly customized effects and high durability in their OEM finish designs.

Market Challenges Analysis

Regulatory Pressure and Compliance Costs Creating Strain for Local Producers

The Germany Organic Pigment Dispersion Market faces intense pressure due to strict EU chemical regulations. Compliance with REACH, CLP, and waste management laws increases production costs. Small and medium enterprises struggle with resource allocation for continuous testing and certification. It raises entry barriers for new players in the pigment dispersion sector. Non-compliance risks result in penalties and product recalls, impacting profitability. Regulatory updates demand ongoing R&D investments, which challenge smaller firms with limited budgets. Global competitors with lower compliance requirements often undercut prices in international markets. These dynamics make regulatory adherence one of the most significant challenges for the market.

Rising Raw Material Costs and Supply Chain Disruptions Affecting Market Stability

The pigment industry in Germany struggles with volatility in raw material availability and prices. Bio-based feedstocks, solvents, and additives face demand fluctuations, creating uncertainty. The Germany Organic Pigment Dispersion Market depends heavily on reliable input supply. It experiences pressure from disruptions in global supply chains due to geopolitical issues. Rising energy costs in Germany further compound the challenge for producers. Import dependency on certain chemicals makes the market sensitive to external shocks. Manufacturers face difficulty in maintaining price stability for customers. These challenges reduce margins and limit investment capacity for innovation.

Market Opportunities

Growing Demand for Sustainable Pigments in Packaging and Consumer Goods

The Germany Organic Pigment Dispersion Market offers significant opportunities in sustainable packaging. Industries shift toward recyclable and food-safe pigments to meet consumer and regulatory needs. It creates strong demand from FMCG and e-commerce packaging converters. Cosmetic and textile sectors also expand adoption of eco-friendly dispersions. Producers can capture share by developing bio-based and low-VOC products. Global brands sourcing from Germany rely on pigments that enhance sustainability credentials. It positions local manufacturers as preferred suppliers for premium eco-conscious markets.

Expansion into High-Value Segments Through Advanced and Functional Pigments

High-value applications offer growth opportunities for German pigment producers. The Germany Organic Pigment Dispersion Market gains traction through dispersions for electronics, coatings, and smart packaging. It enables innovations such as conductive inks, anti-counterfeit labels, and heat-resistant coatings. Functional pigments provide competitive advantage in industries seeking performance beyond aesthetics. Producers can increase margins by supplying tailored dispersions with advanced features. Partnerships with end-users accelerate adoption of such innovations. These opportunities create pathways for German manufacturers to expand globally with value-driven products.

Market Segmentation Analysis

By pigment type, the Germany Organic Pigment Dispersion Market is led by the azo segment due to its wide use in printing inks, plastics, and coatings. Azo pigments offer strong color strength and cost efficiency, making them the preferred choice across industries. Phthalocyanine pigments follow with significant demand for their excellent stability and high-performance features in automotive and industrial coatings. Quinacridone pigments gain traction in premium coatings and plastics requiring vibrant, long-lasting shades. Anthraquinone pigments maintain presence in specialty applications such as textiles and cosmetics. The others category, including high-performance pigments, shows steady growth supported by niche industrial uses. It reflects the diverse role pigment types play in meeting specific performance and regulatory requirements.

- For example, Hostaperm® Pink E, a quinacridone pigment (PR 122) from Heubach, is valued for excellent color fastness and strong performance in plastics, packaging inks, and coatings. Anthraquinone pigments continue to serve niche applications in textiles and cosmetics, where durability and shade stability are essential.

By application, printing inks hold the largest share of the Germany Organic Pigment Dispersion Market, driven by packaging and publishing industries. Paints and coatings represent another key segment, supported by demand from construction and automotive sectors requiring durability and environmental compliance. Plastics and polymers continue to expand usage due to rising demand for colored packaging and consumer goods. Textiles use pigment dispersions to achieve stable and sustainable coloring solutions. Cosmetics rely on organic dispersions for safe, vibrant shades across product categories. The others category includes applications in specialty chemicals and emerging end-use industries. It demonstrates the wide adoption of pigment dispersions across both traditional and evolving markets.

- For example, Flint Group has advanced its ink portfolio in Europe by introducing NC-free flexographic and gravure solutions, such as VertixCode and MatrixCode. These technologies enhance recyclability in flexible packaging while ensuring pigment compliance and meeting strict European regulatory standards.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Southern Germany – Industrial Manufacturing and Automotive Stronghold

Southern Germany holds the largest share of the market with 42%, driven by its dense industrial base and global automotive hub. The region benefits from high demand in automotive coatings, plastics, and specialty packaging sectors. It serves as a key production and export center for pigment dispersions, supported by advanced R&D clusters in Munich and Stuttgart. The Germany Organic Pigment Dispersion Market gains strong momentum here due to the presence of leading chemical manufacturers and automotive suppliers. Strong collaboration between research institutes and industry accelerates innovation in eco-friendly pigment technologies. It strengthens the region’s dominance by meeting regulatory and performance standards effectively.

Western Germany – Chemical and Construction Sector Growth Base

Western Germany accounts for 33% of the market, with a focus on chemical manufacturing and construction applications. The Ruhr area and North Rhine-Westphalia are central to pigment production and distribution. Strong demand arises from paints and coatings for construction and infrastructure projects. The Germany Organic Pigment Dispersion Market benefits from chemical clusters in Cologne and Leverkusen. Producers in this region emphasize water-based and high-performance dispersions that meet EU sustainability goals. It contributes significantly to export growth through efficient logistics and trade routes. Close proximity to Benelux countries also supports cross-border trade opportunities.

Northern and Eastern Germany – Expanding Packaging and Textile Applications

Northern and Eastern Germany represent 25% of the market share, driven by packaging, textiles, and rising digital printing applications. Hamburg and Berlin act as distribution hubs for exports to Northern Europe. The Germany Organic Pigment Dispersion Market sees demand growth in eco-friendly pigments for food and cosmetic packaging. Textile industries in Saxony and Thuringia increasingly adopt sustainable dispersions for apparel and specialty fabrics. Regional policies promoting circular economy practices fuel further pigment adoption. It strengthens the region’s role as a growing but competitive contributor within the national market. Emerging players also expand reach through partnerships with packaging converters and textile producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Heubach Group

Competitive Analysis

The Germany Organic Pigment Dispersion Market is highly competitive with strong participation from global and domestic firms. BASF SE and Clariant AG maintain leading positions through extensive product portfolios and sustainable innovations. Heubach GmbH and Lanxess AG hold significant shares by leveraging expertise in specialty pigments and performance dispersions. Venator Materials PLC, Cabot Corporation, and Ferro Corporation expand presence through targeted solutions in coatings, plastics, and inks. DIC Corporation and Sudarshan Chemical Industries strengthen competitiveness with global supply chains and diverse pigment offerings. The market also benefits from Heubach Group’s strong regional roots and advanced production technologies. It remains defined by continuous innovation, regulatory compliance, and customer-specific customization that set the foundation for long-term leadership.

Recent Developments

- In March 2025, BASF SE announced the expansion of its portfolio with three new natural-based product launches, including Verdessence® Maize (a natural styling polymer), Lamesoft® OP Plus (a wax-based opacifier dispersion), and Dehyton® PK45 GA/RA (a betaine derived from Rainforest Alliance Certified coconut oil).

- In March 2025, Sudarshan Chemical Industries completed the acquisition of Germany-based Heubach Group through its EU subsidiary. The acquisition, structured as both asset and share deal, is set to create a global pigment company, strengthening Sudarshan’s and Heubach’s combined product portfolio and presence across Europe—particularly targeting the pigment dispersion and specialty chemicals sectors.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

- In November 2023, Heubach GmbH expanded its cooperation with TER Chemicals to include inorganic colored pigments, anti-corrosion pigments, and pigment preparations in Germany and Austria. This partnership aims to enhance product availability for coatings and related applications.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany Organic Pigment Dispersion Market will advance through stronger adoption of eco-friendly pigment formulations.

- Water-based dispersions will gain wider acceptance across packaging, coatings, and printing sectors.

- Automotive demand will sustain growth with dispersions designed for durability and weather resistance.

- The construction sector will create opportunities for dispersions meeting long-term stability standards.

- Packaging innovation will strengthen demand for pigments with food-safe and recyclable properties.

- Customized pigment solutions will grow in importance for cosmetics, textiles, and specialty uses.

- Investments in R&D will expand product portfolios, focusing on bio-based and solvent-free dispersions.

- Export growth will be driven by Western Germany’s chemical hubs and Northern ports.

- Regulatory compliance will remain central, shaping product development and manufacturing priorities.

- Market consolidation through mergers and strategic partnerships will reshape the competitive landscape.