| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Pea Proteins Market Size 2024 |

USD 147.69 Million |

| Germany Pea Proteins Market, CAGR |

12.86% |

| Germany Pea Proteins Market Size 2032 |

USD 388.83 Million |

Market Overview:

The Germany Pea Proteins Market is projected to grow from USD 147.69 million in 2024 to an estimated USD 388.83 million by 2032, with a compound annual growth rate (CAGR) of 12.86% from 2024 to 2032.

The growth of the Germany pea protein market is driven by several factors. A significant driver is the increasing consumer demand for plant-based diets due to rising health concerns. As more individuals turn to plant-based alternatives to reduce their intake of animal proteins, pea protein has gained popularity for its rich nutritional profile and its suitability for various dietary preferences, including vegan, vegetarian, and gluten-free diets. Additionally, the growing awareness of the environmental impact of traditional animal farming has pushed consumers towards more sustainable food sources. Pea protein, requiring fewer resources such as water and land compared to animal-based proteins, aligns well with this trend. Moreover, innovations in processing techniques have enhanced the functionality and versatility of pea protein, allowing it to be incorporated into a wide range of food and beverage products, such as meat substitutes, dairy alternatives, and nutritional supplements. These factors, combined with a growing awareness of the health benefits of plant-based proteins, are significantly propelling the market forward.

Germany is a leading market for pea protein in Europe, driven by a combination of consumer trends, government support, and industry investments. The country has seen a noticeable shift towards plant-based diets, with a large portion of the population adopting vegan and vegetarian lifestyles. This shift is propelled by growing health consciousness and an increasing desire for sustainable and eco-friendly food sources. Furthermore, the German government has actively supported the plant-based protein sector through various initiatives, including funding and research into alternative protein sources. This has encouraged both local and international manufacturers to invest in the German market, expanding production facilities and developing innovative pea protein products. The combination of consumer demand for healthier, more sustainable options and strong industry backing ensures that Germany will continue to play a pivotal role in the European pea protein market in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Pea Proteins Market is projected to grow from USD 147.69 million in 2024 to USD 388.83 million by 2032, at a CAGR of 12.86%, driven by the increasing demand for plant-based alternatives.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Rising health consciousness is contributing to the popularity of pea protein, particularly among vegan, vegetarian, and gluten-free consumers who are seeking natural, nutrient-dense protein sources.

- Pea protein’s low environmental impact, requiring fewer resources than animal proteins, aligns with growing consumer interest in sustainability, further fueling its adoption in Germany.

- The popularity of plant-based meat alternatives, such as pea protein-based sausages and burgers, is expanding the market for pea protein in the food industry.

- The shift towards clean-label products is pushing food manufacturers to incorporate pea protein, which is considered a natural, minimally processed ingredient.

- The demand for functional foods, such as protein-enriched snacks and beverages, is growing in Germany, with pea protein playing a central role due to its nutritional benefits.

- Limited consumer awareness of pea protein’s benefits presents a challenge, requiring education and marketing to boost recognition and adoption of this alternative protein source.

Market Drivers:

Growing Popularity of Plant-Based Meat Alternatives

The German market is witnessing a rapid surge in demand for plant-based meat alternatives, significantly driving the growth of pea protein. As consumers become more conscious of the environmental and ethical implications of animal agriculture, they are increasingly turning to plant-based proteins as substitutes for meat. Pea protein, with its rich amino acid profile and functional properties, is a key ingredient in these alternatives. Its ability to mimic the texture and mouthfeel of meat makes it highly suitable for use in plant-based sausages, burgers, and other meat substitutes. The rising popularity of plant-based diets, along with innovations in meat alternatives, is contributing to the expanding presence of pea protein in the German food industry.

Expansion of Clean-Label Products

One of the significant trends in the German pea protein market is the shift toward clean-label products. Consumers are becoming more aware of the ingredients in their food, demanding products with fewer additives, preservatives, and artificial ingredients. Pea protein, being a natural and minimally processed ingredient, aligns with this trend. For instance, GoodMills Innovation, based in Hamburg, has developed VITATEX Pea Flakes M SVP/SVP Pro-pea-based texturants designed for use in vegetable nuggets, chunks, and tuna alternatives, catering to the demand for minimally processed, clean-label ingredients in functional foods and bakery applications. The increasing preference for clean-label, transparency-driven products has led food manufacturers to adopt pea protein as a key ingredient in their formulations. This trend is particularly strong among health-conscious consumers who seek foods that are free from allergens, chemicals, and other synthetic substances, further accelerating the demand for pea protein-based products in Germany.

Innovation in Functional Foods

The German market is also seeing a growing trend towards functional foods that offer additional health benefits beyond basic nutrition. This includes food products fortified with pea protein to enhance their nutritional profile, such as protein-enriched snacks, beverages, and breakfast cereals. Pea protein, with its high protein content and excellent digestibility, is being increasingly incorporated into these products to cater to health-conscious consumers, athletes, and fitness enthusiasts. For instance, the Empro® E 86 F30 from Emsland Group is a fine particle pea protein isolate tailored for dairy alternatives and sports nutrition, highlighting the focus on protein fortification in functional food. The demand for functional foods is expected to continue rising as more consumers look for ways to improve their health through their diet. As the trend towards functional nutrition gains momentum, pea protein is expected to play a central role in this segment.

Sustainability as a Key Market Focus

Sustainability remains a major trend driving the growth of pea protein in Germany. The increasing concern over environmental issues, such as climate change and resource depletion, has pushed both consumers and manufacturers to prioritize sustainable ingredients. Pea protein is considered more sustainable than animal-based proteins, as it requires less water and land to produce and generates fewer greenhouse gas emissions. As Germany continues to strengthen its commitment to sustainability, consumers are increasingly seeking environmentally friendly food options, including plant-based proteins like pea protein. This growing emphasis on sustainability is influencing product development and marketing strategies, making pea protein an integral part of the country’s green food movement.

Market Trends:

Rise of Vegan and Flexitarian Diets

The increasing adoption of vegan and flexitarian diets in Germany is one of the prominent trends driving the demand for pea protein. Consumers are becoming more conscious of their health, with many seeking to reduce their meat consumption for both ethical and health reasons. The vegan and flexitarian movements, in particular, have gained significant traction, with consumers looking for plant-based protein sources that can meet their nutritional needs. Pea protein has positioned itself as an essential ingredient in various meat alternatives, such as plant-based burgers, sausages, and ready-to-eat meals. This shift towards plant-based eating has accelerated the use of pea protein in the German market, especially among those transitioning to a more plant-centric diet.

Growing Demand for Sustainable Ingredients

Sustainability continues to be a key driver for the growth of pea protein in Germany. With the increasing awareness of the environmental impact of food production, consumers are seeking more sustainable food choices. For instance, DLG Group’s subsidiary HaGe has invested in a new facility in northern Germany dedicated to producing highly processed pea proteins, with a planned annual capacity of up to 50,000 tons. This investment is part of DLG’s broader goal to achieve climate neutrality by 2050 and signals a commitment to local, sustainable raw material production. Animal agriculture is associated with higher carbon emissions, land use, and water consumption, prompting consumers to opt for plant-based proteins, which have a lower environmental footprint. Pea protein, known for its sustainability, requires fewer resources to grow and produce compared to animal proteins. As sustainability becomes a major consideration in food purchasing decisions, the demand for pea protein in Germany is expected to rise, driven by both consumer preference and industry efforts to reduce the environmental impact of food production.

Advances in Food Technology and Product Development

The innovation in food technology has greatly influenced the growth of the pea protein market in Germany. Recent advancements in processing technologies have enhanced the texture, flavor, and solubility of pea protein, making it more versatile and easier to incorporate into various food products. This includes improvements in the development of plant-based meats, dairy substitutes, and protein-enriched snacks. German brand Endori, for example, launched a vegan tuna made from pea protein in September 2023, demonstrating the ingredient’s versatility and ability to deliver on taste and texture without additives or allergens. As food manufacturers continue to innovate and create new applications for pea protein, the ingredient’s presence in everyday food products is expected to expand. The German market is seeing an increase in the availability of functional foods containing pea protein, driven by growing consumer demand for nutrient-dense, healthy products.

Consumer Focus on Clean and Transparent Labels

Another significant trend in the German pea protein market is the growing demand for clean-label products. Consumers are increasingly seeking transparency in the food products they purchase, opting for those with fewer artificial ingredients, preservatives, and additives. Pea protein, being a natural, allergen-free, and minimally processed ingredient, fits perfectly with this trend. Food brands are responding to this demand by using pea protein in their formulations to meet the needs of consumers who prefer food products that are both nutritious and free from unnecessary additives. This clean-label movement has contributed to the rising popularity of pea protein in Germany, as it aligns with the growing consumer preference for whole, minimally processed foods.

Market Challenges Analysis:

Limited Consumer Awareness

One of the key restraints in the Germany pea protein market is the limited consumer awareness surrounding the benefits and applications of pea protein. While the market for plant-based proteins is growing, many consumers are still unfamiliar with pea protein as a viable alternative to animal-based proteins. This lack of awareness can slow adoption, particularly in regions where plant-based diets have not yet gained significant traction. Educating consumers about the nutritional benefits, sustainability, and versatility of pea protein is essential to overcoming this challenge. Without widespread recognition, pea protein may face competition from more established plant-based proteins such as soy or almond.

Price Sensitivity

Another challenge impacting the growth of the pea protein market in Germany is price sensitivity. While the demand for plant-based protein products is increasing, many pea protein-based foods remain relatively expensive compared to their animal-based counterparts. This price disparity can hinder market penetration, especially among budget-conscious consumers. The higher production costs of plant-based proteins, including pea protein, often result in premium pricing for consumers. As the market continues to grow, efforts to scale production and reduce costs will be essential to make pea protein more accessible to a wider demographic, particularly in price-sensitive segments.

Supply Chain and Production Constraints

The pea protein market in Germany also faces challenges related to the supply chain and production processes. While pea protein is increasingly in demand, the production of peas can be influenced by factors such as climate conditions and agricultural yields, which are subject to fluctuations. For example, rising temperatures and reduced crop yields have caused the cost of pulses, including peas, to increase by over 15% in some years. Additionally, the current infrastructure for pea protein extraction and processing may not be sufficient to meet the rapidly growing demand. These constraints in supply chain capacity and processing technologies can result in shortages or delays, impacting product availability and limiting market growth.

Competition from Other Plant-Based Proteins

The growing competition from other plant-based proteins, such as soy, rice, and hemp, is another challenge for the pea protein market in Germany. Each of these alternatives has its own set of benefits, including lower production costs or established market presence. As consumers become more discerning about the sources of their plant-based proteins, they may choose these alternatives over pea protein, which could limit the market share of pea protein products in the long term.

Market Opportunities:

The Germany pea protein market presents significant opportunities driven by the increasing consumer shift towards plant-based diets. As health-conscious consumers seek to reduce their meat consumption and adopt sustainable alternatives, pea protein’s appeal continues to grow. With its high nutritional value, hypoallergenic properties, and environmental sustainability, pea protein offers a strong value proposition for food manufacturers. The rising demand for plant-based meat substitutes, dairy alternatives, and functional foods presents a prime opportunity for companies to expand their product portfolios. As more consumers embrace vegan, vegetarian, and flexitarian diets, there is a growing market for pea protein-enriched products, which opens up new avenues for growth in various segments such as snacks, beverages, and meal replacements.

Additionally, the German market is experiencing a rising trend in clean-label products, with consumers demanding transparency and fewer artificial additives. Pea protein, being a natural and minimally processed ingredient, aligns well with this demand. This presents an opportunity for brands to develop clean-label products that cater to the increasing preference for healthier, allergen-free, and environmentally friendly options. Furthermore, as production technologies advance, it is expected that the cost of pea protein will decrease over time, making it more accessible to a broader consumer base. This cost reduction, coupled with growing consumer interest in sustainable food sources, positions the Germany pea protein market for continued expansion, offering businesses a lucrative opportunity to capitalize on the rising demand for plant-based proteins.

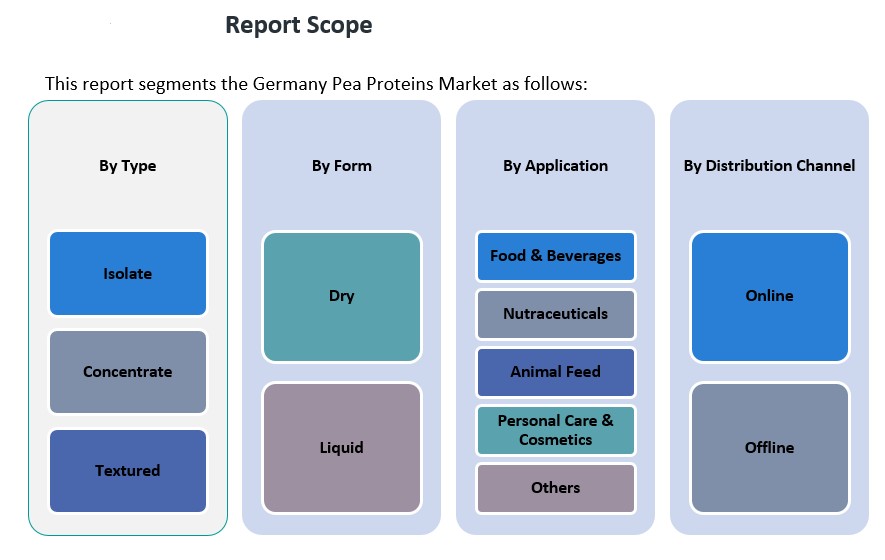

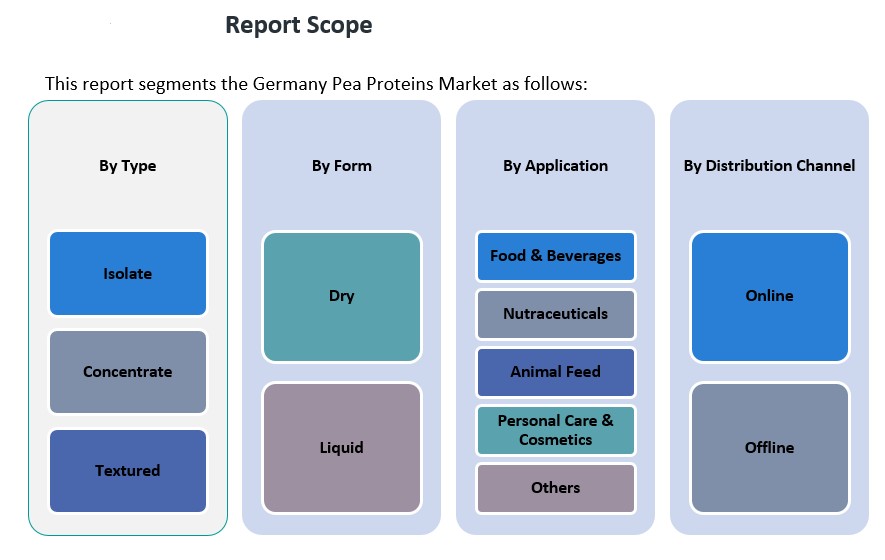

Market Segmentation Analysis:

The Germany pea protein market is segmented into several categories, each offering distinct growth opportunities.

By type, the market is divided into Isolate, Concentrate, and Textured pea protein. Isolate pea protein dominates the market due to its high protein content and versatility in a range of applications, particularly in food and beverages. Concentrate is also widely used, especially in nutraceuticals and animal feed, while Textured pea protein is gaining popularity for its meat-like texture in plant-based meat alternatives.

By application, the market is categorized into Food & Beverages, Nutraceuticals, Animal Feed, Personal Care & Cosmetics, and Others. The Food & Beverages segment leads the market, driven by the growing demand for plant-based proteins in meat substitutes, dairy alternatives, and protein-enriched products. The Nutraceuticals segment is also expanding rapidly, as pea protein is used in dietary supplements due to its health benefits. Animal Feed is a significant application as pea protein serves as a sustainable and nutritious alternative to traditional animal feed ingredients.

By form, the market is divided into Dry and Liquid pea protein. Dry pea protein holds a larger share, owing to its ease of storage and use in various food products. The Liquid segment is growing, particularly in the beverage industry, where it is used in plant-based milk and protein shakes.

By distribution channels, Online sales are expanding rapidly, driven by the growing trend of e-commerce, while Offline sales continue to be important, especially in retail and supermarkets. Both channels are contributing to the overall growth of the market in Germany.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The Germany pea protein market exhibits strong regional dynamics, with significant demand across various parts of the country. As a key player in the European food and beverage industry, Germany’s market is heavily influenced by urbanization, consumer preferences for plant-based products, and sustainability initiatives. The growth of the pea protein market is notably concentrated in urban regions, where there is a higher concentration of health-conscious consumers and plant-based food manufacturers. Major cities such as Berlin, Munich, and Hamburg play a critical role in driving market trends, with an increasing number of consumers seeking plant-based alternatives to traditional animal proteins.

The Southern Germany region holds a significant share of the market, accounting for approximately 35% of total market revenue. This region’s dominance is primarily attributed to its higher adoption of plant-based diets and a strong presence of food and beverage manufacturers that are embracing pea protein in their formulations. Additionally, the southern part of Germany is home to several large-scale food production facilities, which helps in the wider distribution and availability of pea protein products.

The Western Germany region, including cities like Düsseldorf and Cologne, also contributes significantly to the market, with a market share of around 30%. The trend toward healthier eating habits and the increasing popularity of veganism in this region are driving the demand for plant-based proteins. Western Germany’s advanced infrastructure and strong retail network facilitate the widespread availability of pea protein-based products in both online and offline channels.

The Northern Germany market, which includes areas such as Hamburg, represents about 20% of the market share. The region has witnessed steady growth, largely driven by consumer interest in sustainable, allergen-free alternatives. The Eastern Germany market, though smaller, is gaining traction, contributing approximately 15% to the total market share. Eastern Germany is characterized by growing health awareness and the expanding presence of plant-based food options.

Key Player Analysis:

- Roquette Frères

- Cosucra Groupe Warcoing

- Burcon NutraScience Corporation

- Emsland Group

- Shandong Jianyuan Group

- Naturz Organics

- Fenchem Biotek Ltd.

- Kerry Group

- Sotexpro

- Meelunie B.V.

Competitive Analysis:

The Germany pea protein market is highly competitive, with numerous players vying for market share. Key global and regional companies are focusing on product innovation, sustainability, and expanding their distribution networks to maintain a competitive edge. Leading companies such as Roquette Frères, Cargill, and Ingredion Incorporated are actively involved in research and development to enhance the quality and functionality of pea protein, catering to the growing demand for plant-based proteins. These companies are also forming strategic partnerships and collaborations with food manufacturers to expand the application of pea protein in various food and beverage products, particularly in plant-based meat and dairy alternatives. In addition, regional players such as The Green Protein Company and Wageningen University & Research are contributing to the market’s growth by focusing on the extraction and processing of high-quality pea protein. The competitive landscape is marked by continuous advancements in processing technologies and efforts to lower production costs, making pea protein more accessible to a broader consumer base.

Recent Developments:

- In February 2024, Roquette Frères expanded its NUTRALYS® plant protein range by launching four new multi-functional pea protein ingredients: NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured). These innovations are designed to improve taste, texture, and application versatility in plant-based foods and high-protein nutritional products, targeting the growing demand for meat and dairy alternatives in Germany and across Europe.

- In December 2024, Burcon NutraScience Corporation launched its next-generation Peazazz®C pea protein, which boasts over 90% protein purity and low sodium content. This new product, made from North American non-GMO field peas, is intended for a wide array of applications, including beverages, dairy alternatives, baked goods, and nutrition products. The accelerated launch timeline reflects Burcon’s commitment to rapid innovation and market responsiveness in the competitive German pea protein sector.

Market Concentration & Characteristics:

The Germany pea protein market is characterized by a moderate to high concentration, with a few key players holding substantial market shares. In 2024, Germany accounted for approximately 25% of the European pea protein market, reflecting its dominant position in the region. The market is primarily driven by large-scale manufacturers such as Roquette Frères, Cosucra Groupe Warcoing, and Emsland Group, which contribute significantly to production capacities and technological advancements. These leading companies focus on producing high-quality pea protein isolates, which are in high demand due to their nutritional profile and functional properties. The production of pea protein isolates involves advanced processing technologies to ensure purity and functionality, catering to the growing demand in food and beverage applications. Additionally, the market is witnessing increased investments in research and development to enhance product offerings and expand applications in various industries, including nutraceuticals and personal care. The competitive landscape is also marked by the presence of regional players and new entrants who focus on niche markets and specialized products. These companies often emphasize sustainability, clean-label products, and local sourcing to differentiate themselves in the market. Overall, the Germany pea protein market exhibits a dynamic competitive environment with opportunities for both established and emerging players to capitalize on the growing demand for plant-based protein alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany pea protein market is expected to grow at a robust CAGR, driven by increasing consumer demand for plant-based protein alternatives.

- Technological advancements in protein extraction and processing will enhance product quality, broadening pea protein’s applications in food and beverages.

- Growing awareness of sustainability and environmental impact will further boost the demand for plant-based proteins, with pea protein being a key player.

- Expanding vegan and flexitarian diets will continue to drive consumption, especially in urban areas with higher concentrations of health-conscious consumers.

- The rise of clean-label products will lead to increased usage of pea protein as an allergen-free, natural ingredient in food and nutraceuticals.

- Investment in research and development by key players will lead to innovations in pea protein formulations, improving texture, taste, and solubility.

- Online retail channels will gain a larger share of the market, facilitating direct consumer access to pea protein-based products.

- The pet food industry is expected to increasingly incorporate pea protein, capitalizing on the growing demand for sustainable animal feed.

- Regional players will continue to expand their market presence by focusing on locally sourced ingredients and eco-friendly production methods.

- As production capacities increase, the cost of pea protein is expected to decrease, making it more accessible to a wider range of consumers and industries.