Market Overview:

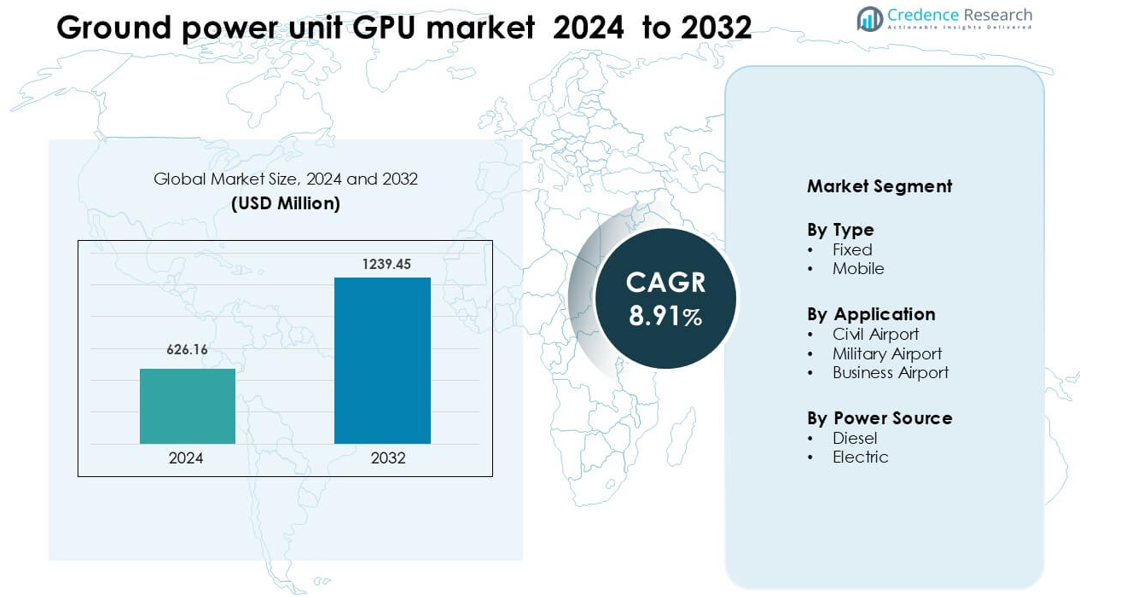

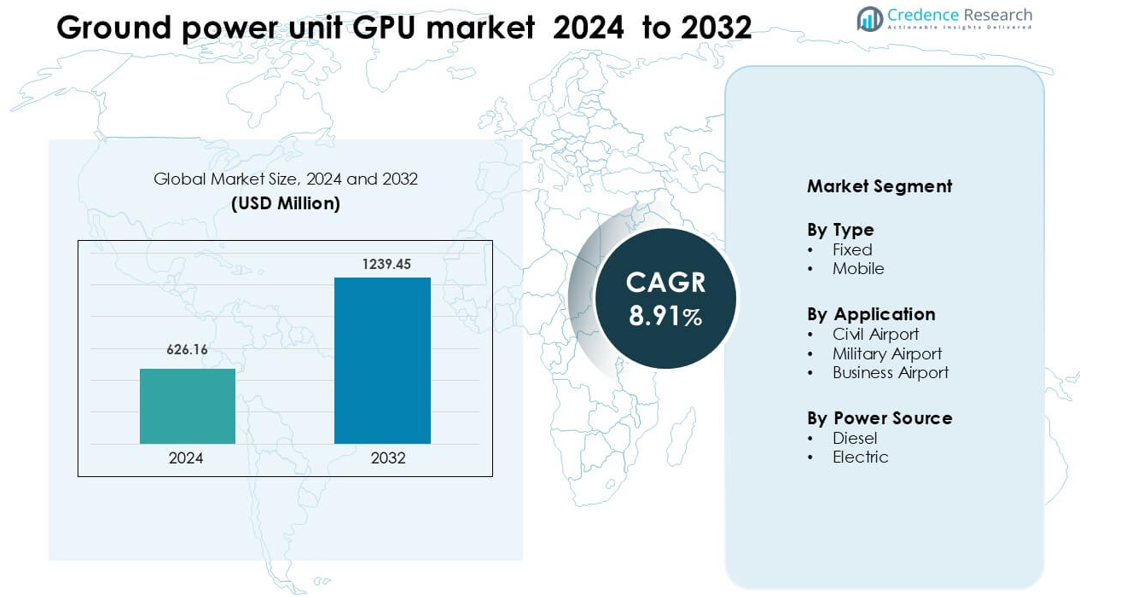

Ground Power Unit (GPU) Market was valued at USD 626.16 million in 2024 and is anticipated to reach USD 1239.45 million by 2032, growing at a CAGR of 8.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ground Power Unit (GPU) Market Size 2024 |

USD 626.16 million |

| Ground Power Unit (GPU) Market, CAGR |

8.91% |

| Ground Power Unit (GPU) Market Size 2032 |

USD 1239.45 million |

The Ground Power Unit (GPU) market is shaped by major players including Air+Mak, Ross, ITW GSE, Tyler Inc, AeromaxGSE, BEAK, Habenchtraiet, GB BARBERI, Red Box Aviation, and JBT, each competing through advanced mobile and fixed GPU solutions tailored for civil, military, and business aviation needs. These companies focus on energy-efficient designs, multi-voltage compatibility, and reliable power delivery to support fast aircraft turnaround. North America leads the market with about 34% share in 2024, driven by strong airport modernization programs, higher aircraft traffic, and rapid adoption of electric and hybrid GPU technologies across major commercial hubs.

Market Insights

- Ground power unit GPU market was valued at USD 626.16 million in 2024 and is anticipated to reach USD 1239.45 million by 2032, growing at a CAGR of 8.91% during the forecast period.

- Growth is driven by rising commercial air traffic, expanding airport infrastructure and upgrades, and increasing demand for mobile and fixed GPUs across applications such as civil airports, business airports, and military operations.

- Current trends include accelerated adoption of electric and hybrid power source GPUs over diesel, increasing demand for mobile units (mobile type holds approximately 62% of type share) and growing integration of smart monitoring in GPU equipment.

- Competitive intensity remains high with major players (e.g., JBT, ITW GSE, Red Box Aviation) expanding technology portfolios and aftermarket services; however, high initial costs and maintenance burdens act as significant restraints.

- Regionally, North America leads the market with more than one-third share in 2022 (approx. > 33 %), while Asia-Pacific and Europe contribute approximately 2 % and 29 % respectively; the fixed segment and civil-airport application dominate the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The mobile category leads the Ground Power Unit (GPU) market with about 62% share in 2024 due to its strong use across civil and military ramps that require flexible positioning around diverse aircraft types. Mobile GPUs support fast towing, quicker gate turns, and smoother power delivery during remote stand operations. Demand rises as airports focus on higher apron mobility and wider fleet compatibility. Fixed GPUs maintain steady adoption in major hubs where operators prefer integrated gate power systems, but growth remains slower due to higher installation cost and limited layout flexibility.

- For instance, ITW GSE, a leading GSE manufacturer, reported delivering over 90,000 ground support units (including both mobile and fixed GPUs) across more than 100 countries.

By Application

Civil airports dominate this segment with nearly 68% share in 2024, driven by rising commercial passenger traffic, wider use of contact and remote stands, and strong investment in aircraft turnaround efficiency. Airport operators prefer reliable GPU systems that reduce auxiliary power unit use and support sustainability goals by cutting ramp emissions. Military airports show stable demand for rugged units that meet harsh-environment requirements, while business airports adopt GPUs at a gradual pace as private aviation ramps expand and operators seek quieter, low-maintenance ground power support.

- For instance, dnata, a major ground-handling provider at Dubai International Airport (DXB), added 14 electric 180 kVA GPUs—from ITW GSE—to its ramp operations. These now account for 33% of all GPU utilization at DXB, replacing diesel units and reducing fuel use by 550,000 litres annually.

By Power Source

Diesel-based GPUs lead this category with around 57% share in 2024 because operators rely on their high power output, long-duration operation, and suitability for varied ramp conditions. Diesel units support wide-body aircraft and remote stands where charging access remains limited. Electric GPUs gain strong momentum as airports adopt low-emission systems to meet environmental targets and reduce noise across passenger zones. Growth intensifies in hubs deploying fixed electric GPUs at gates, but overall market share remains lower as full electrification requires large-scale charging and infrastructure upgrades.

Key Growth Drivers

Rising Commercial Air Traffic and Airport Expansion

Growing global passenger volume drives strong demand for Ground Power Units (GPUs) as airports expand terminals, add remote stands, and upgrade gate infrastructure. Airport authorities aim to improve aircraft turnaround speed and reduce delays, which increases reliance on high-capacity mobile and fixed GPUs. Airlines push for efficient ground operations that minimize auxiliary power unit use and cut fuel burn during gate handling. Expansion projects in Asia-Pacific, the Middle East, and North America integrate modern GPU systems into new aprons and contact gates. This broad infrastructure growth strengthens long-term procurement of advanced, reliable GPU units.

- For instance, ITW GSE supplied 72 GPUs to Bangkok Suvarnabhumi Airport’s satellite terminal alongside 36 PCA units and 72 hose retrievers to support the expansion enabling fixed electric power at newly constructed gate infrastructure.

Shift Toward Low-Emission and Energy-Efficient Operations

Airports and airlines focus on sustainability goals that target reduced emissions and noise on the ramp. GPUs help replace onboard APU operations, lowering fuel consumption and improving local air-quality compliance. Regulatory bodies promote cleaner ground operations through emission caps and green-airport programs. Electric GPU adoption grows as operators reduce dependence on diesel systems, especially in large hubs with strong charging infrastructure. Investment in hybrid and fully electric alternatives supports energy-efficient gate systems. This environmental transition drives steady market growth for GPUs aligned with global decarbonization initiatives.

- For instance, Dnata added 14 new, 180kVA electric ground power units (eGPUs) from ITW GSE to its fleet at Dubai International Airport (DXB).

Fleet Modernization and Advanced Ground Handling Automation

Modern aircraft fleets require stable and precise ground power to support larger avionics loads, cabin systems, and real-time diagnostics. Airports respond by adopting advanced GPU systems with higher efficiency, smart monitoring, and remote control features. Integration with automated ground handling platforms boosts operational predictability and minimizes ramp downtime. Increased demand for digital connectivity during aircraft maintenance also raises the need for reliable GPU performance. As airlines digitize workflows, airports invest in GPUs with telemetry, load-management tools, and predictive maintenance capabilities. This modernization trend strengthens long-term equipment upgrades.

Key Trend & Opportunity

Rapid Growth of Electric and Hybrid GPU Solutions

Electric GPUs gain wide traction as airports prioritize decarbonization. Operators seek quieter units with lower operating costs and minimal maintenance. Government incentives for clean-energy adoption encourage airport authorities to replace diesel units with electric alternatives, especially in Europe and Asia. Hybrid models also rise as transitional solutions for airports lacking full charging infrastructure. Manufacturers respond with modular systems, fast-charging capability, and intelligent power management. The shift creates strong opportunities for suppliers offering flexible, scalable, and environmentally aligned GPU technologies.

- For instance, ITW GSE’s 7400 eGPU, a fully battery-driven ground power unit, supports 8–12 turnarounds of a narrow-body aircraft on a single charge. The unit is rated for 90 kVA, 140 kVA, and 180 kVA models.

Integration of Smart Monitoring and Predictive Maintenance

GPU manufacturers introduce digital features such as telemetry, remote diagnostics, real-time power tracking, and cloud-based analytics. These capabilities help airport teams monitor fleet health, reduce unexpected failures, and optimize ground operations. Data-driven maintenance lowers lifecycle cost and improves equipment reliability. Smart dashboards support load balancing and boost electrical efficiency when multiple aircraft require ground power. This technology shift offers major opportunities for companies developing software-integrated GPU systems that align with broader smart-airport initiatives.

- For instance, proveo, an aviation-telemetry provider, offers a platform used by over 100 GSE clients, giving live data on run hours, battery state of charge, location, and fault codes to predict maintenance cycles.

Increasing Demand for Modular and Mobile GPU Platforms

Airports seek modular, customizable GPU units that adapt to different aircraft classes and ramp layouts. Flexible mobile platforms support fast towing, quick deployment, and efficient use across remote aprons. This trend grows in regions with rising low-cost carrier activity, where fast gate rotation is essential. Modular systems also reduce maintenance downtime and simplify upgrades. Manufacturers focusing on lightweight frames, compact footprints, and multi-voltage compatibility gain strong opportunities in expanding regional and secondary airports.

Key Challenge

High Installation and Infrastructure Costs

Fixed electric GPU systems require significant investment in electrical upgrades, charging infrastructure, and gate-level integration. Smaller airports struggle to fund these large-scale improvements, slowing adoption. Diesel units remain dominant in many regions because they need lower upfront spending, even though they have higher long-term operating costs. Infrastructure limitations create operational bottlenecks, especially in older terminals with limited electrical capacity. These financial and structural barriers challenge rapid modernization and restrict wide deployment of next-generation GPU technologies.

Operational Variability and Maintenance Complexity

GPU systems face heavy usage cycles, exposure to harsh ramp environments, and fluctuating power demands. Mobile units require regular mechanical and electrical servicing, while fixed units need precise calibration to ensure compatibility with diverse aircraft platforms. Failures during peak traffic periods disrupt flight schedules and raise downtime costs. Airports with mixed fleets and older equipment struggle to maintain standardized GPU performance. This variability increases operational risk and pressures operators to adopt stronger maintenance programs, raising lifecycle expenses.

Regional Analysis

North America

North America leads the Ground Power Unit (GPU) market with about 34% share in 2024, driven by strong airport modernization programs and high aircraft traffic across major hubs in the United States. Operators invest in low-emission electric GPUs to support sustainability targets and reduce APU usage during gate operations. Expansion of regional airports and rising demand for mobile GPUs also support growth. Major airlines adopt advanced digital ground handling tools, increasing the need for reliable, high-capacity power units. Federal support for green airport initiatives further strengthens long-term GPU deployment across terminals and remote stands.

Europe

Europe holds around 29% share in 2024, supported by strict environmental rules that push airports to shift from diesel GPUs to electric and hybrid systems. Major hubs in Germany, France, the Netherlands, and the UK integrate fixed gate power units to reduce ramp emissions and meet noise-reduction goals. EU-backed green-airport programs accelerate infrastructure upgrades and encourage adoption of energy-efficient units. Growth also comes from rising commercial traffic and broader use of remote stands. European manufacturers benefit from demand for modular, eco-friendly GPUs tailored for both narrow-body and wide-body aircraft operations.

Asia-Pacific

Asia-Pacific accounts for roughly 27% share in 2024, driven by rapid airport expansion across China, India, Indonesia, and Southeast Asia. Growing domestic and regional air travel increases the need for high-capacity GPUs to manage rising aircraft movements. Large greenfield airport projects integrate modern fixed GPU systems, while busy regional airports rely on mobile units for flexible ramp operations. Governments emphasize improved ground handling efficiency and lower emissions, creating strong demand for electric GPU solutions. Fleet growth among low-cost carriers further accelerates procurement of mobile, multi-voltage GPU platforms.

Latin America

Latin America holds nearly 6% share in 2024, supported by steady airport modernization efforts in Brazil, Mexico, and Colombia. Operators focus on improving turnaround performance and reducing fuel consumption, which increases adoption of diesel and hybrid GPU units suitable for varied ramp conditions. Economic constraints slow large-scale electrification, but major international airports gradually introduce electric GPUs to meet regional sustainability targets. Growth is strongest in busy passenger hubs and cargo-focused airports that require dependable ground power for mixed fleets. Mobile GPUs remain widely preferred due to higher flexibility and lower installation cost.

Middle East & Africa

The Middle East & Africa region captures about 4% share in 2024, driven by strong aviation growth in the UAE, Saudi Arabia, and Qatar. Large airports invest in high-capacity GPUs to support wide-body fleets and long-haul operations. Sustainability programs at major Gulf airports encourage the shift toward electric and hybrid units, though diesel GPUs remain dominant in secondary airports due to infrastructure limitations. In Africa, investments focus on mobile GPU units that serve diverse aircraft types in developing aviation markets. Expansion of new terminals and cargo hubs supports steady long-term demand across the region.

Market Segmentations:

By Type

By Application

- Civil Airport

- Military Airport

- Business Airport

By Power Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ground Power Unit (GPU) market features active competition driven by product innovation, global fleet growth, and airport modernization needs. Leading companies such as Air+Mak, Ross, ITW GSE, Tyler Inc, AeromaxGSE, BEAK, Habenchtraiet, GB BARBERI, Red Box Aviation, and JBT shape the landscape by offering mobile, fixed, diesel, and electric GPU solutions. Manufacturers focus on energy-efficient designs, smart monitoring, and higher reliability to support rapid turnaround operations at civil and military airports. Many suppliers expand portfolios with hybrid and fully electric units to meet growing environmental targets. Partnerships with airport authorities and ground handling firms enhance market presence, while digital maintenance tools strengthen long-term service value. Continuous investment in compact frames, multi-voltage systems, and modular power platforms helps companies stay competitive in a market driven by sustainability and operational efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Air+Mak

- Ross

- ITW GSE

- Tyler Inc

- AeromaxGSE

- BEAK

- Habenchtraiet

- GB BARBERI

- Red Box Aviation

- JBT

Recent Developments

- In October 2025, ITW GSE exhibited at inter airport Europe 2025 in Munich, presenting EcoGate with its 7400 eGPU, DC charger and Power Share solutions to show how integrated GPUs, PCAs and chargers can cut gate power use and support airside electrification.

- In 2023, the Air Force Research Laboratory collaborated with the Air Force Life Cycle Management Center, Air Force Materiel Command headquarters, and General Motors Defense to successfully power a KC-135 tanker aircraft at Edwards Air Force Base using GM Defense’s Electric Ground Power Unit. The system uses GM’s commercial battery electric technology and an electric drive system. The Electric Ground Power Unit and cart support both military and commercial aircraft.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift strongly toward electric and hybrid GPUs as airports pursue lower emissions.

- Mobile GPU demand will rise as airlines expand remote stand operations and mixed-fleet handling.

- Fixed GPUs at major hubs will gain adoption as terminals modernize and integrate smart gate systems.

- Digital monitoring and predictive maintenance features will become standard across new GPU models.

- Adoption will accelerate in Asia-Pacific as new airports and rapid fleet growth drive higher ground power needs.

- Manufacturers will focus on compact, modular designs to support faster deployment and easier servicing.

- Sustainability regulations will push operators to replace older diesel units with cleaner alternatives.

- GPU fleets will see increased integration with automated ground handling equipment and apron management systems.

- Long-term service contracts and aftermarket support will grow as operators seek lower lifecycle costs.

- Investments in high-capacity GPUs will rise to support advanced avionics and wider aircraft electrification trends.