Market Overview

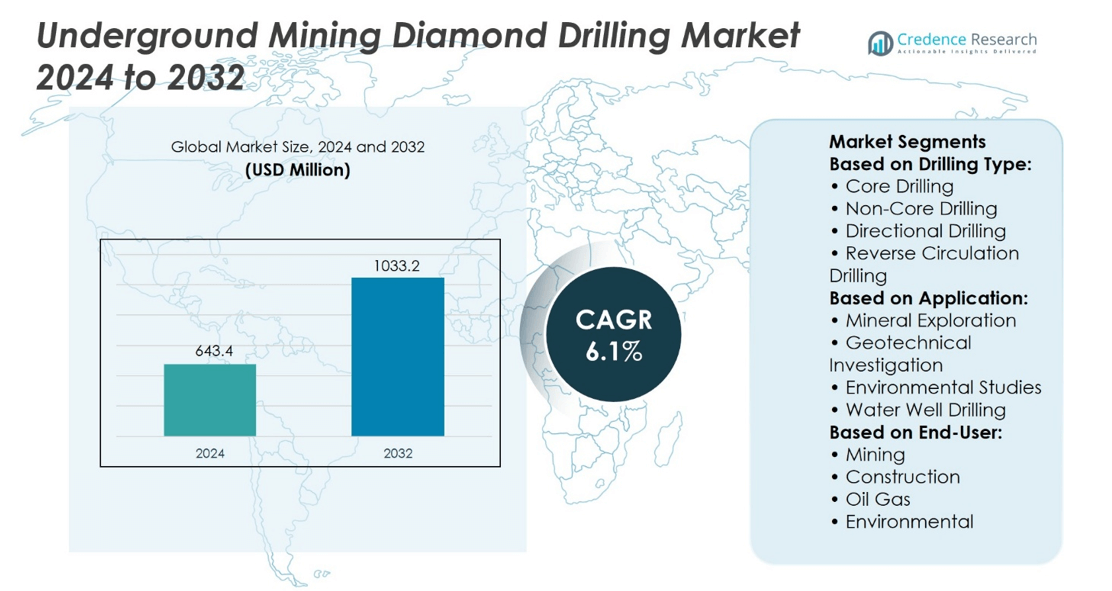

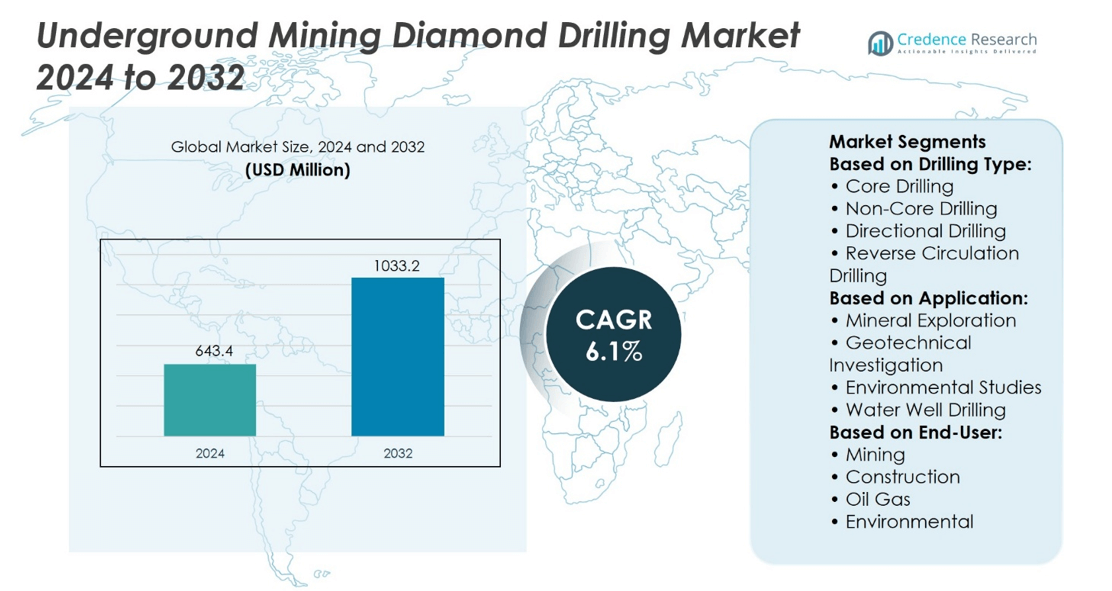

Underground Mining Diamond Drilling Market size was valued at USD 643.4 million in 2024 and is anticipated to reach USD 1033.2 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Underground Mining Diamond Drilling Market Size 2024 |

USD 643.4 million |

| Underground Mining Diamond Drilling Market, CAGR |

6.1% |

| Underground Mining Diamond Drilling Market Size 2032 |

USD 1033.2 million |

The Underground Mining Diamond Drilling Market grows on strong drivers such as expanding mineral exploration, rising demand for critical resources, and the need for precise core sampling to support feasibility studies. It benefits from regulatory emphasis on safety and sustainability, which encourages adoption of advanced rigs and energy-efficient systems. Key trends include the integration of automation, digital monitoring, and predictive maintenance technologies that improve reliability and reduce downtime. It also reflects increasing investments in emerging regions with rich mineral reserves, where operators seek high-performance drilling solutions to unlock complex ore bodies and strengthen long-term resource security.

The Underground Mining Diamond Drilling Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America and Asia-Pacific holding significant shares due to extensive exploration projects and technological adoption. It benefits from rising mineral demand in emerging economies and sustained investments in resource-rich regions. Key players driving the market include Schlumberger, De Beers Group, BHP Billiton, Caterpillar, Rio Tinto, Barrick Gold Corporation, Anglo American, Epiroc, and Noble Corporation.

Market Insights

- The Underground Mining Diamond Drilling Market size was valued at USD 643.4 million in 2024 and is anticipated to reach USD 1033.2 million by 2032, at a CAGR of 6.1% during the forecast period.

- Expanding mineral exploration and rising demand for critical resources drive adoption of diamond drilling technologies.

- Integration of automation, digital monitoring, and predictive maintenance strengthens efficiency and reduces downtime in drilling operations.

- The market features competition among global mining firms and equipment suppliers that focus on innovation, safety, and cost efficiency.

- High operational costs, equipment maintenance requirements, and strict regulatory compliance act as restraints for smaller operators.

- North America and Asia-Pacific hold major shares due to extensive exploration programs, while Latin America, Europe, and the Middle East & Africa show steady growth through mineral-rich projects.

- Key players such as Schlumberger, De Beers Group, BHP Billiton, Caterpillar, Rio Tinto, Barrick Gold Corporation, Anglo American, Epiroc, and Noble Corporation shape the competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Exploration Activities and Expanding Mineral Resource Identification

The Underground Mining Diamond Drilling Market gains momentum from growing exploration projects aimed at discovering new mineral reserves. Governments and private operators invest heavily in identifying high-grade deposits to meet rising global demand for metals. It supports detailed core sampling that allows accurate assessment of ore quality and structure. Companies adopt advanced drilling systems to shorten project timelines and improve resource mapping. The push for securing reliable raw material supplies drives demand for precision drilling. Expansion of exploration zones in Africa, Latin America, and Asia further strengthens the use of diamond drilling technologies.

- For instance, BHP reported in its 2023 exploration update that it drilled over 285,000 meters across copper and nickel targets in Australia and South America, resulting in the identification of 2.1 million tonnes of additional copper-equivalent resources, demonstrating the scale at which diamond drilling supports new resource discoveries.

Strong Demand for Cost-Efficient and High-Precision Drilling Methods

The Underground Mining Diamond Drilling Market benefits from the ability of diamond drill systems to deliver cost-effective and accurate outcomes. Operators focus on reducing material loss and minimizing downtime during drilling operations. It ensures better control over operational costs while maintaining consistent output quality. High precision in core recovery allows mining firms to plan extraction activities with greater efficiency. Contractors seek equipment that extends tool life and reduces the frequency of bit replacement. Rising competition in mineral extraction encourages faster adoption of reliable and durable drilling solutions.

- For instance, Boart Longyear announced in its 2023 performance report that its LM™ series diamond drilling rigs completed over 3.6 million meters of core drilling globally, with automation upgrades cutting operational downtime by more than 1.2 million hours, directly improving cost-efficiency and precision across underground mining projects.

Integration of Technological Advancements and Digital Monitoring Systems

The Underground Mining Diamond Drilling Market advances with rapid integration of automation, sensor technology, and digital monitoring platforms. Real-time performance tracking allows operators to detect faults and improve drilling accuracy. It enables predictive maintenance that reduces risks of unplanned equipment failures. Advanced rigs deliver higher penetration rates while maintaining stability in difficult geological conditions. Mining firms invest in systems that combine data analytics with drilling operations to enhance safety and productivity. Integration of technology ensures stronger compliance with safety standards and efficiency targets.

Increasing Investments in Infrastructure and Strategic Mining Projects

The Underground Mining Diamond Drilling Market is reinforced by global infrastructure expansion and rising investments in strategic mining projects. Demand for copper, gold, lithium, and other critical minerals fuels drilling activity across underground mines. It drives governments and private companies to secure long-term access to essential resources. Major mining corporations allocate large budgets for underground exploration to support energy transition and industrial growth. Infrastructure development in emerging markets increases the requirement for mineral extraction projects. The steady flow of investments sustains continuous adoption of diamond drilling systems across underground operations.

Market Trends

Growing Shift Toward Automation and Smart Drilling Rigs

The Underground Mining Diamond Drilling Market reflects a strong shift toward automation and adoption of smart rigs. Mining operators focus on deploying equipment with remote operation features to reduce workforce risks in hazardous environments. It enhances drilling efficiency by minimizing manual intervention and ensuring consistent performance in deep underground zones. Automated rigs also deliver higher penetration rates and improved core recovery. Companies integrate advanced software platforms to control drilling parameters with precision. This trend underscores the industry’s move toward safer and more productive underground operations.

- For instance, Epiroc reported that its Simba E7 automated drilling rigs collectively executed more than 2.4 million meters of autonomous drilling across underground sites, with remote operation systems enabling operators to control rigs from control rooms located over 1.1 million meters away from the drilling face, significantly enhancing both safety and productivity.

Rising Use of Digital Monitoring and Data-Driven Optimization

The Underground Mining Diamond Drilling Market shows rapid adoption of digital monitoring platforms to optimize core sampling processes. Mining firms apply real-time data collection systems to track drill performance and predict equipment wear. It enables operators to extend rig lifespan while reducing maintenance costs. Integration of data analytics supports faster decision-making on ore quality and extraction feasibility. Advanced sensors improve accuracy in difficult rock formations and help maintain operational continuity. This trend reflects the industry’s commitment to efficient resource management and enhanced drilling reliability.

- For instance, Hexagon Mining confirmed that its MineOperate digital monitoring suite processed over 1.8 million data points per day across underground drilling operations.

Increased Preference for Energy-Efficient and Sustainable Operations

The Underground Mining Diamond Drilling Market highlights a growing preference for rigs designed with energy-efficient systems and reduced environmental impact. Mining companies prioritize equipment that lowers fuel use and emissions during drilling. It aligns with stricter sustainability targets set by governments and global mining regulators. Energy-efficient rigs also lower operational costs and strengthen long-term project viability. Manufacturers focus on delivering lightweight designs and advanced bit materials that reduce waste. This trend illustrates the market’s transition toward greener and more responsible drilling practices.

Expansion of Underground Exploration in Emerging Mineral-Rich Regions

The Underground Mining Diamond Drilling Market is witnessing expansion in exploration projects across mineral-rich regions in Africa, Asia-Pacific, and Latin America. Rising demand for critical minerals such as copper, lithium, and gold drives new underground projects. It increases the requirement for high-performance drilling solutions capable of handling deep and complex geology. Global mining companies direct large-scale investments to unlock resources in unexplored zones. Local governments support foreign partnerships to boost resource development and trade opportunities. This trend reinforces the demand for advanced underground drilling systems across emerging economies.

Market Challenges Analysis

High Operational Costs and Equipment Maintenance Constraints

The Underground Mining Diamond Drilling Market faces significant challenges related to high operational costs and complex maintenance demands. Drilling rigs, bits, and associated systems require regular servicing to sustain performance under extreme underground conditions. It increases the financial burden on mining operators, particularly in projects with lower-grade ore deposits. Unplanned equipment failures often lead to extended downtime and disrupt production schedules. The high cost of specialized diamond bits and replacement parts adds further strain on project economics. Smaller operators struggle to maintain profitability when faced with rising expenses for spare parts and skilled technical services.

Safety Risks and Regulatory Compliance Pressures in Underground Operations

The Underground Mining Diamond Drilling Market is challenged by persistent safety concerns and stringent regulatory frameworks. Underground conditions expose workers to risks such as equipment malfunctions, rock falls, and limited ventilation. It demands advanced safety features in drilling systems, which increase the cost of procurement and deployment. Mining firms also face strict compliance requirements from local and international authorities, adding pressure to upgrade equipment and adopt safer practices. Failure to meet safety standards leads to penalties and reputational risks for operators. These constraints create hurdles for both established companies and new entrants aiming to expand in underground drilling.

Market Opportunities

Expansion of Critical Mineral Exploration and Global Resource Demand

The Underground Mining Diamond Drilling Market presents strong opportunities through rising demand for critical minerals such as copper, lithium, and cobalt. Growing adoption of renewable energy technologies and electric vehicles increases the need for these resources, creating large-scale exploration programs. It strengthens the requirement for precision drilling solutions capable of reaching deep and complex ore bodies. Governments and private companies allocate greater budgets to unlock new reserves and secure long-term supply. Mining operators seek advanced drilling systems that deliver accurate core samples to support feasibility studies. Expanding exploration initiatives in mineral-rich regions open profitable avenues for technology providers.

Advancements in Drilling Technology and Adoption of Digital Solutions

The Underground Mining Diamond Drilling Market is positioned to benefit from advancements in automation, digital monitoring, and predictive maintenance. Innovative rigs with integrated data platforms allow operators to track performance in real time and improve drilling efficiency. It creates opportunities for suppliers that offer solutions combining cost reduction with safety improvements. Increased interest in sustainable operations also accelerates demand for energy-efficient rigs and advanced bit materials. Mining companies invest in technology partnerships to enhance resource recovery and minimize operational risks. The push for digital transformation across the mining sector provides a favorable environment for wider adoption of modern drilling systems.

Market Segmentation Analysis:

By Drilling Type

The Underground Mining Diamond Drilling Market is segmented by drilling type into core drilling, non-core drilling, and directional drilling. Core drilling holds strong relevance due to its ability to deliver intact cylindrical samples that provide precise geological information. It supports detailed analysis of ore quality, structure, and mineral content, which is vital for mining feasibility studies. Non-core drilling is valued for faster operations when continuous sampling is not required, making it effective in large-scale reconnaissance programs. Directional drilling demonstrates increasing importance for reaching targeted ore zones with minimal disruption, particularly in deep and complex deposits. Each type addresses distinct operational needs, ensuring flexibility across exploration and production activities.

- For instance, Major Drilling Group International disclosed in its operations report that it completed over 2.9 million meters of core drilling worldwide.

By Application

Segmentation by application covers mineral exploration, geotechnical investigation, environmental studies, and water well drilling. Mineral exploration remains the dominant application as mining companies intensify efforts to identify new deposits of copper, gold, and critical minerals. It relies heavily on diamond drilling for accurate resource estimation and long-term planning. Geotechnical investigation represents a vital segment, supporting construction of underground infrastructure by providing stability assessments. Environmental studies gain traction as regulators demand detailed monitoring of soil and groundwater conditions near mining sites. Water well drilling also contributes to the segment, especially in regions where mining projects require reliable groundwater access for operations.

- For instance, Barrick Gold reported that it undertook more than 3.2 million meters of drilling across its global portfolio, with underground diamond drilling.

By End User

The Underground Mining Diamond Drilling Market is divided into mining, construction, oil and gas, and environmental sectors. Mining continues to lead the segment due to extensive use of drilling in resource identification and evaluation. It emphasizes accurate core sampling that helps operators secure investment and optimize extraction strategies. Construction firms use diamond drilling for assessing subsurface conditions before tunnel or foundation projects. Oil and gas operators apply similar drilling methods for exploration and structural analysis in challenging geological settings. Environmental applications focus on subsurface testing for contamination, groundwater mapping, and reclamation projects. Each end-use sector broadens the adoption of diamond drilling systems and underscores its role in critical industrial activities.

Segments:

Based on Drilling Type:

- Core Drilling

- Non-Core Drilling

- Directional Drilling

- Reverse Circulation Drilling

Based on Application:

- Mineral Exploration

- Geotechnical Investigation

- Environmental Studies

- Water Well Drilling

Based on End-User:

- Mining

- Construction

- Oil Gas

- Environmental

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 34% of the Underground Mining Diamond Drilling Market, driven by extensive exploration projects in Canada and the United States. Canada’s mining sector plays a central role, with significant activities in diamond, gold, and copper exploration requiring high-precision core drilling methods. It benefits from advanced technologies, strong regulatory support, and a concentration of global mining companies headquartered in the region. The U.S. mining industry contributes through large-scale copper, lithium, and rare-earth exploration that strengthens demand for drilling services. North America’s emphasis on adopting automated and energy-efficient drilling systems further consolidates its leadership position. Continuous investment in digital monitoring tools ensures that operators achieve higher productivity and reduced downtime across deep underground projects.

Europe

Europe holds 18% of the Underground Mining Diamond Drilling Market, supported by mature mining industries in Nordic countries and Eastern Europe. Sweden, Finland, and Poland maintain strong exploration programs targeting iron ore, copper, and rare minerals essential for industrial and renewable applications. It benefits from advanced research collaborations between mining firms and technology providers that promote innovation in drilling practices. Western European nations focus on environmental monitoring and geotechnical investigations, expanding drilling demand beyond mineral exploration. Strict EU sustainability and safety regulations accelerate the adoption of modern rigs with lower emissions and improved safety features. Europe’s steady market presence reflects a balance between established mining operations and growth in critical mineral exploration to support the energy transition.

Asia-Pacific

Asia-Pacific represents 28% of the Underground Mining Diamond Drilling Market, fueled by large-scale mineral exploration in China, Australia, and India. China’s push for domestic resource security encourages heavy drilling activity in coal, rare earths, and base metals. It strengthens overall market adoption by expanding underground projects that require advanced core drilling solutions. Australia leads with strong investments in gold, copper, and lithium exploration, driving innovation in drilling equipment and digital monitoring platforms. India contributes with rising coal and iron ore projects that create opportunities for service providers. Rapid industrial growth and increasing infrastructure projects across Southeast Asia support geotechnical investigations and environmental drilling applications. Asia-Pacific’s large resource base and fast-growing economies reinforce its role as a key high-growth region.

Latin America

Latin America accounts for 12% of the Underground Mining Diamond Drilling Market, with strong contributions from Chile, Peru, and Brazil. Chile and Peru remain global leaders in copper production, creating sustained demand for advanced drilling technologies. It benefits from foreign investments and government-backed exploration programs aimed at expanding mineral reserves. Brazil adds momentum with extensive gold and iron ore exploration activities. Smaller markets in Argentina and Mexico expand opportunities for drilling services as infrastructure and mining projects gain pace. Rising adoption of digital solutions in Latin America also improves drilling efficiency and operational transparency. The region continues to attract global mining companies due to its resource richness and favorable investment climate.

Middle East & Africa

The Middle East & Africa region secures 8% of the Underground Mining Diamond Drilling Market, driven by growing exploration in South Africa and resource development projects across Sub-Saharan Africa. South Africa maintains a leading role with extensive underground gold, platinum, and diamond mining projects requiring precision drilling. It supports the regional market by hosting multinational mining companies with advanced operational standards. Other African nations, including Ghana, Zambia, and the Democratic Republic of Congo, expand drilling demand with copper, cobalt, and gold exploration. The Middle East contributes through geotechnical and environmental drilling linked to construction and infrastructure expansion. Investments in modern rigs and safety-focused technologies improve market penetration across challenging underground environments. Africa’s abundant resource base ensures long-term opportunities for drilling service providers despite operational risks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schlumberger

- De Beers Group

- BHP Billiton

- Caterpillar

- Rio Tinto

- Barrick Gold Corporation

- Anglo American

- Epiroc

- Noble Corporation

- Barrick Gold

Competitive Analysis

The Underground Mining Diamond Drilling Market players such as Schlumberger, De Beers Group, BHP Billiton, Caterpillar, Rio Tinto, Barrick Gold Corporation, Anglo American, Epiroc, Noble Corporation, and Barrick Gold. The Underground Mining Diamond Drilling Market remains highly competitive, driven by continuous innovation in drilling technology, strategic expansion of exploration projects, and the integration of digital platforms. Leading companies focus on automation, data analytics, and predictive maintenance to improve operational reliability and reduce downtime. The market is characterized by strong investment in high-performance rigs, advanced core recovery tools, and energy-efficient systems that align with sustainability requirements. Large mining operators strengthen competition by allocating significant budgets to underground exploration, while equipment manufacturers and service providers compete through product differentiation and global service networks. The competitive landscape is further defined by partnerships between mining firms and technology developers, aimed at improving drilling efficiency and ensuring compliance with safety and environmental standards. This combination of technological advancement, investment intensity, and service innovation establishes a dynamic environment where performance, precision, and cost efficiency determine market leadership.

Recent Developments

- In May 2025, Schlumberger launched a first-of-its-kind at-bit imaging tool called Retina, which produces high-resolution borehole images directly at the drill bit, enhancing drilling accuracy and geological understanding critical for underground mining operations.

- In January 2025, Schlumberger announced a multi-region deepwater drilling contract with Shell to provide AI-enabled digital directional drilling, logging while drilling (LWD), surface logging, and advanced drilling services for offshore projects.

- In December 2023, Southwest Pinnacle Exploration Limited has received an order of 45 million USD for surface exploratory diamond core drilling in Rajasthan, India.

- In October 2023, Boart Longyear launched ‘Surface roller latch head assembly’ which will enhance safety, durability, and productivity. It is a 360-degree joint for improved handling.

Market Concentration & Characteristics

The Underground Mining Diamond Drilling Market displays a moderately concentrated structure, shaped by a mix of global mining corporations, specialized drilling contractors, and equipment manufacturers that compete on technology, service quality, and operational scale. It features high entry barriers due to capital-intensive equipment, technical expertise requirements, and strict safety standards in underground environments. Leading firms emphasize advanced core drilling solutions, integration of digital monitoring platforms, and automation technologies to strengthen efficiency and safety. The market demonstrates strong dependence on mineral exploration projects, where precision and reliability in core recovery remain critical. It also shows cyclical characteristics influenced by commodity prices, global resource demand, and regional exploration budgets. Service providers focus on long-term contracts with mining operators to secure recurring revenue streams, while equipment suppliers differentiate through innovation in energy-efficient rigs and extended tool life. The industry reflects a balance between established players with global reach and smaller regional firms that compete through cost advantages and niche expertise.

Report Coverage

The research report offers an in-depth analysis based on Drilling Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of automation and smart drilling rigs to improve accuracy and reduce workforce risks.

- Demand for diamond drilling will rise with expanding global exploration programs targeting critical minerals.

- Operators will integrate digital monitoring systems to optimize performance and extend equipment life.

- Energy-efficient rigs and sustainable drilling practices will gain priority under stricter environmental regulations.

- Investments in deep underground projects will increase the requirement for high-performance drilling solutions.

- Data-driven decision-making will become central as analytics platforms support faster resource evaluation.

- Remote-controlled drilling operations will expand in hazardous underground environments to enhance safety.

- Equipment suppliers will focus on longer tool life and advanced bit materials to reduce operational costs.

- Emerging markets in Africa, Asia, and Latin America will attract higher investments in underground exploration.

- Strategic partnerships between mining firms and technology providers will accelerate innovation and market growth.