Market Overview:

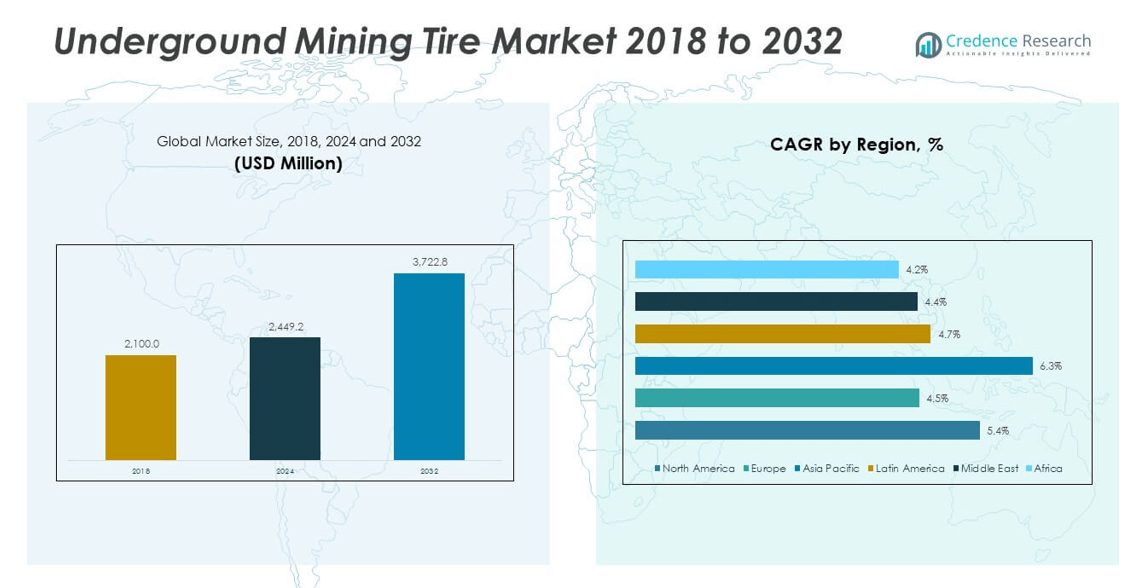

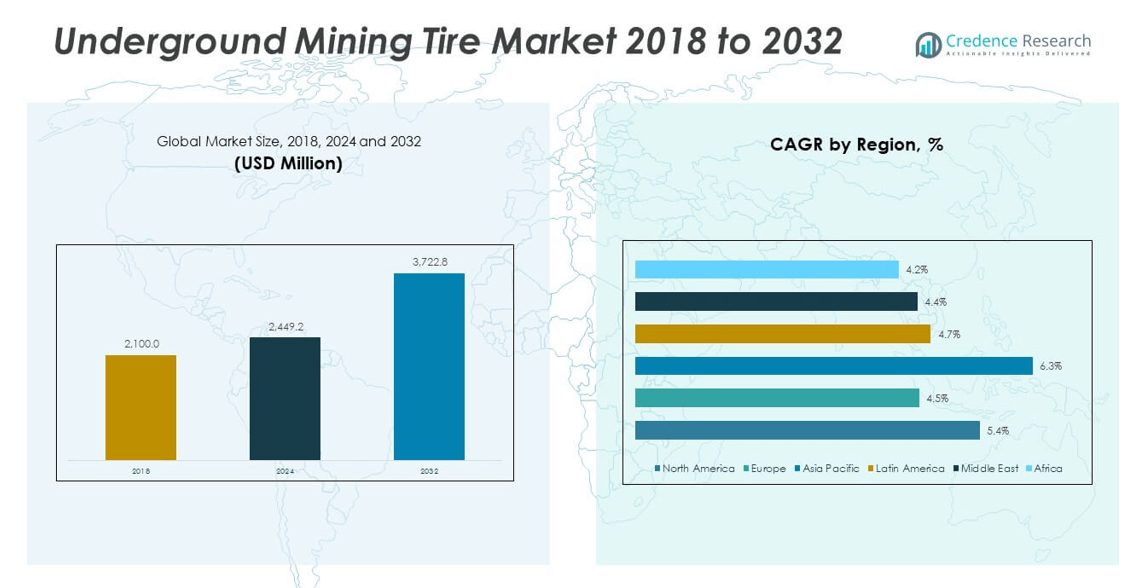

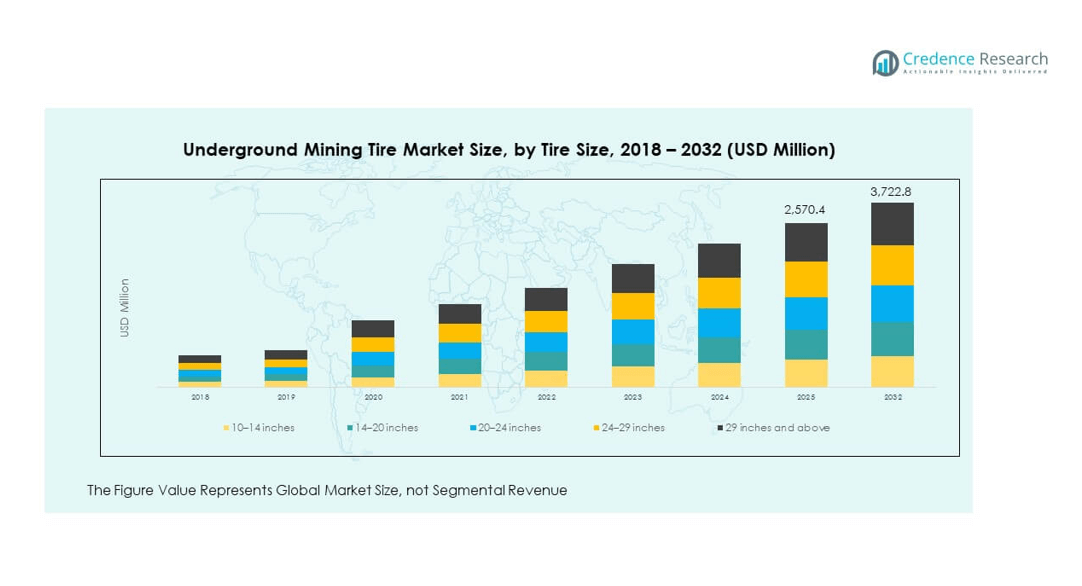

The Global Underground Mining Tire Market size was valued at USD 2,100.0 million in 2018 to USD 2,449.2 million in 2024 and is anticipated to reach USD 3,722.8 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Underground Mining Tire Market Size 2024 |

USD 2,449.2 million |

| Underground Mining Tire Market, CAGR |

5.40% |

| Underground Mining Tire Market Size 2032 |

USD 3,722.8 million |

The market is driven by expansion in underground mining activities, increasing demand for durable and specialized tires, and growing investments in mineral extraction projects. Rising consumption of metals, coal, and industrial minerals worldwide drives the requirement for heavy-duty vehicles equipped with advanced tire technologies. Tire innovations such as cut-resistant treads, heat tolerance, and improved load-bearing capacity support productivity while reducing downtime in harsh underground conditions.

Regional growth is led by Asia Pacific, supported by large-scale mining operations in China, Australia, and India. North America and Europe remain significant due to established mining infrastructure and technology adoption. Latin America is emerging with increased mineral exploration, while Middle East and Africa display gradual uptake due to rising mining investments in precious metals and industrial minerals.

Market Insights:

- The Global Underground Mining Tire Market size was valued at USD 2,100.0 million in 2018 to USD 2,449.2 million in 2024 and is expected to reach USD 3,722.8 million by 2032 at a CAGR of 5.40%.

- Drivers include mining expansion, equipment efficiency, safety focus, and technology adoption.

- Restraints involve high costs, raw material volatility, and maintenance requirements.

- Asia Pacific leads growth due to expanding mining activities and investments.

- North America and Europe remain strong due to established mining sectors and technology use.

- Latin America shows gradual adoption with resource exploration projects.

- Middle East and Africa present future opportunities with rising mineral extraction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of Global Mining Operations Creating Tire Demand:

The Global Underground Mining Tire Market is fueled by expanding mining operations across developing and developed economies. Rising demand for base metals, coal, and rare earth elements has pushed companies to extend underground mining capacity. This creates higher consumption of durable tires capable of handling heavy loads and extreme environments. It benefits tire manufacturers offering reinforced designs that sustain long hours of operation without compromising performance.

- For instance, In Vale underground nickel mines in Canada, Michelin X Mine D2 tires are used on loaders handling loads exceeding 80 tons, consistently lasting beyond 4,500 operating hours due to reinforced carcass designs suitable for abrasive conditions.

Increasing Focus on Equipment Efficiency and Productivity:

The Global Underground Mining Tire Market gains traction from the need to enhance productivity and reduce operational costs in underground mines. Tires play a critical role in vehicle efficiency, influencing load capacity, maneuverability, and safety. Companies are investing in high-performance radial and specialty tires that extend life cycles and reduce downtime. By lowering replacement frequency, such tires provide long-term cost savings, making them attractive for mining operators.

Rising Demand for Safety and Durability Standards:

Underground mining environments present risks such as rock cuts, abrasive surfaces, and high temperatures. The Global Underground Mining Tire Market grows with the push for safety compliance and higher durability standards. Manufacturers are developing heat-resistant, puncture-proof, and foam-filled tire variants to reduce accidents and improve worker safety. These innovations support stringent mining safety regulations, encouraging adoption of advanced tire technologies across regions.

Technological Advancements in Tire Design and Materials:

The Global Underground Mining Tire Market benefits from continuous improvements in tire compounds, tread designs, and pressure-monitoring systems. Integration of digital tire management solutions enables predictive maintenance and reduces failures. Smart tire technologies enhance operational efficiency by monitoring wear and performance in real time. Companies focusing on sustainable raw materials also gain competitive advantage, aligning with environmental standards while ensuring durability in demanding applications.

Market Trends:

Integration of Smart Tire Monitoring Systems:

The Global Underground Mining Tire Market is experiencing increased adoption of sensor-enabled monitoring systems. Real-time pressure and temperature tracking allows predictive maintenance and prevents operational breakdowns. Mining operators are integrating IoT-enabled solutions to improve fleet management and extend tire life cycles, making digitalization a defining trend.

- For instance, Goodyear’s SightLine® smart tire monitoring system was implemented at Antofagasta’s underground copper mine in Chile, which monitors tire pressure and temperature with an accuracy of ±3 psi.

Shift Toward Radial Tire Adoption in Mining Vehicles:

Radial tires are becoming a preferred choice in the Global Underground Mining Tire Market due to their superior heat dissipation, reduced rolling resistance, and longer life. Mining companies are gradually replacing bias tires with radial variants to achieve efficiency gains. This trend aligns with the broader move toward sustainability and operational cost reduction.

Emphasis on Eco-Friendly and Recyclable Tire Solutions:

Sustainability is reshaping the Global Underground Mining Tire Market, with manufacturers focusing on recyclable materials and eco-friendly tire formulations. Green initiatives encourage the development of low-emission production techniques and materials that reduce environmental impact. This aligns with global environmental standards and enhances brand reputation.

Increasing Customization for Machine-Specific Applications:

Mining companies demand tires tailored to specific equipment types such as trucks, drills, bolters, and shearers. The Global Underground Mining Tire Market reflects this trend with machine-specific tire designs delivering optimized traction, stability, and load distribution. This customization improves efficiency while meeting diverse operational requirements.

Market Challenges Analysis:

High Operational Costs and Maintenance Requirements:

The Global Underground Mining Tire Market faces challenges from the high costs of advanced tires and frequent maintenance in harsh mining conditions. Large investments are needed to equip fleets with premium tires, making affordability a barrier for small operators. Frequent exposure to abrasive surfaces and heavy loads accelerates wear, driving up replacement expenses and reducing overall profitability.

Supply Chain Volatility and Raw Material Dependence:

The Global Underground Mining Tire Market is constrained by supply chain disruptions and dependence on raw materials like natural rubber and synthetic compounds. Fluctuations in raw material costs affect pricing stability, while geopolitical tensions impact sourcing. These factors hinder consistent availability, making mining operators vulnerable to sudden cost escalations.

Market Opportunities

Growth in Emerging Economies with Expanding Mining Investments:

The Global Underground Mining Tire Market holds strong opportunities in emerging economies such as India, Brazil, and African nations. Rising demand for precious and industrial minerals encourages new underground mining projects. Companies entering these regions with affordable, durable tire solutions can gain significant market share.

Rising Adoption of Automation and Smart Mining Vehicles:

The adoption of automated underground mining vehicles creates opportunities for advanced tire solutions. The Global Underground Mining Tire Market is evolving to support automation with sensor-integrated and high-durability tires. These developments enhance safety, optimize fleet management, and align with the shift toward digitalized mining operations.

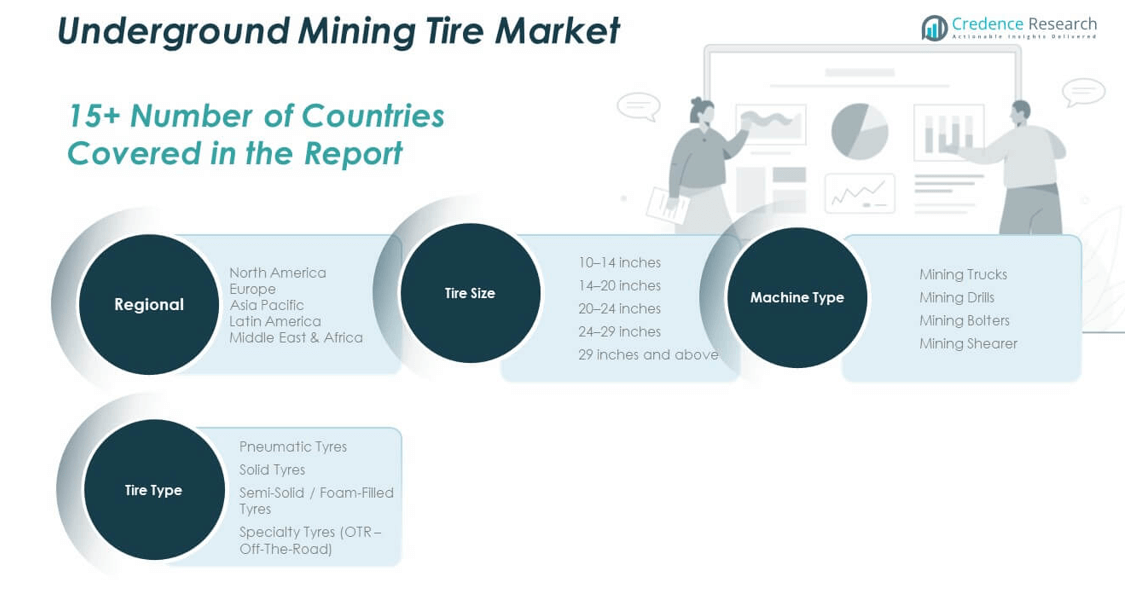

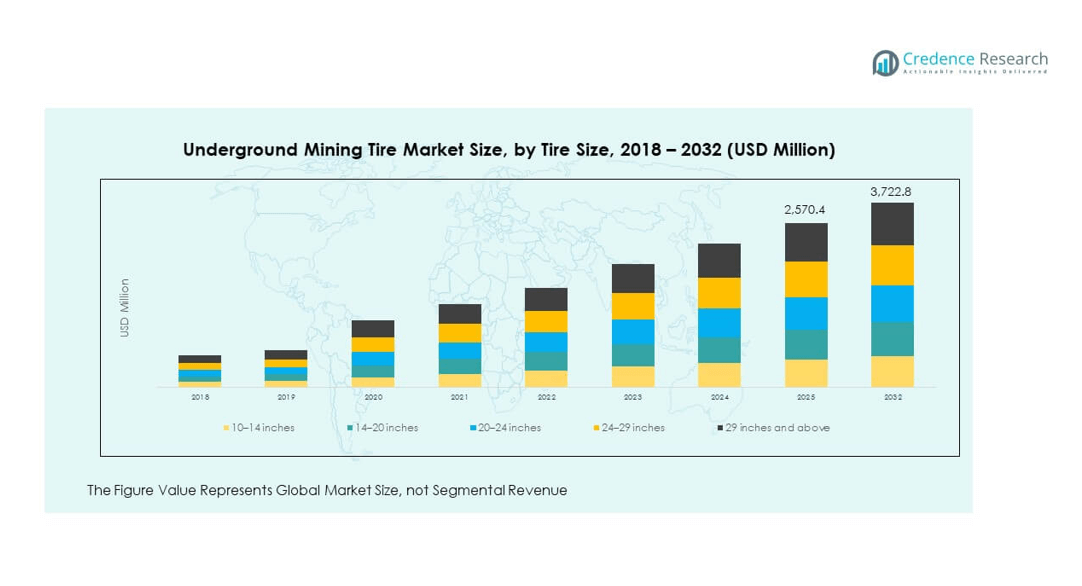

Market Segmentation Analysis:

Tire Size

The Global Underground Mining Tire Market by tire size is dominated by the 24–29 inches category, widely used in heavy-duty mining trucks and loaders. The 29 inches and above segment is expanding with large-scale mining projects requiring higher load-bearing capacity. Mid-range segments such as 14–20 inches and 20–24 inches are essential for drills and bolters, providing durability and stability under abrasive conditions. Smaller 10–14 inches tires serve compact mining machinery operating in confined spaces, ensuring operational flexibility.

- For instance, Titan International supplies large-size underground mining tires such as the 28-inch diameter tires used in coal mining loaders, with these tires routinely handling operational loads in the range of 170 kN pressure, supporting stable operations in extreme underground conditions.

Machine Type

By machine type, mining trucks represent the largest demand share, driven by their critical role in underground material transport. Mining drills generate steady demand for tires that deliver resilience and traction in harsh terrains. Mining bolters depend on specialized tires to provide stability and safety in roof support operations. Mining shearers require strong and durable tires to maintain consistent productivity during rock-cutting activities, reinforcing their importance in underground mining operations.

- For instance, Caterpillar underground mining trucks equipped with Continental OTR mining tires report operational tire lifespan averaging 5,500 hours, contributing to machine uptime in iron ore mines in Australia.

Tire Type

In terms of tire type, pneumatic tyres lead the market due to their balance of cost-effectiveness, durability, and adaptability. Solid tyres are preferred in operations where puncture resistance and extended service life are essential. Semi-solid or foam-filled tyres provide added stability and reduce downtime in high-risk areas. Specialty tires (OTR – Off-The-Road) are tailored for specific applications, offering advanced tread patterns and high-performance compounds. The Global Underground Mining Tire Market reflects a direct alignment between tire types, operational needs, and equipment efficiency.

Segmentation:

Tire Size

- 10–14 inches

- 14–20 inches

- 20–24 inches

- 24–29 inches

- 29 inches and above

Machine Type

- Mining Trucks

- Mining Drills

- Mining Bolters

- Mining Shearer

Tire Type

- Pneumatic Tyres

- Solid Tyres

- Semi-Solid / Foam-Filled Tyres

- Specialty Tyres (OTR – Off-The-Road)

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Underground Mining Tire Market size was valued at USD 541.4 million in 2018 to USD 620.6 million in 2024 and is anticipated to reach USD 941.2 million by 2032, at a CAGR of 5.4% during the forecast period. North America held 25.3% of the global market share in 2024, supported by strong mining activity in the U.S. and Canada. It benefits from mature infrastructure and rising investments in underground coal and metal mining projects. Companies prioritize advanced radial and specialty tires that improve safety, productivity, and efficiency. Tire manufacturers focus on digital monitoring solutions that enable predictive maintenance, ensuring operational continuity. Growing environmental and safety regulations also push operators toward high-quality, durable tires. The region remains a hub for technological advancements, making it a leading contributor to global demand.

Europe

The Europe Global Underground Mining Tire Market size was valued at USD 433.7 million in 2018 to USD 480.7 million in 2024 and is anticipated to reach USD 678.5 million by 2032, at a CAGR of 4.5% during the forecast period. Europe represented 19.6% of the market in 2024, with demand driven by resource-rich countries like Russia, Germany, and Poland. The region focuses on improving mining efficiency and sustainability through innovative tire solutions. Companies adopt heat-resistant and cut-resistant tires to meet harsh operational conditions. Regulatory pressure on safety and emissions encourages miners to invest in advanced tire technologies. Partnerships between European tire manufacturers and mining operators strengthen regional supply chains. The adoption of automation in underground mines further accelerates demand for specialized, high-performance tires.

Asia Pacific

The Asia Pacific Global Underground Mining Tire Market size was valued at USD 787.1 million in 2018 to USD 944.5 million in 2024 and is anticipated to reach USD 1,530.9 million by 2032, at a CAGR of 6.3% during the forecast period. Asia Pacific accounted for 38.5% of the global share in 2024, making it the largest regional market. China, India, and Australia drive demand due to extensive mining of coal, iron ore, and other industrial minerals. Rising investments in mining infrastructure and expansion of underground operations contribute significantly. Manufacturers cater to this high-growth region by introducing cost-efficient yet durable tire solutions. Increased urbanization and industrialization continue to boost mineral demand. Governments in Asia Pacific actively support resource extraction projects, further strengthening tire requirements. It remains the fastest-growing region for underground mining tires globally.

Latin America

The Latin America Global Underground Mining Tire Market size was valued at USD 163.4 million in 2018 to USD 189.1 million in 2024 and is anticipated to reach USD 270.6 million by 2032, at a CAGR of 4.7% during the forecast period. Latin America held 7.7% of the global market in 2024, led by countries such as Brazil, Chile, and Argentina. Mining of copper, gold, and lithium creates consistent tire demand in the region. Companies adopt specialty tires to handle rugged terrains and extreme operational conditions. Regional growth is supported by rising foreign investments in exploration projects. Mining operators focus on efficiency, requiring durable tires that reduce downtime. Government initiatives to expand mineral exports also stimulate market demand. The region shows steady growth potential despite economic fluctuations.

Middle East

The Middle East Global Underground Mining Tire Market size was valued at USD 104.6 million in 2018 to USD 116.1 million in 2024 and is anticipated to reach USD 163.4 million by 2032, at a CAGR of 4.4% during the forecast period. The Middle East represented 4.7% of the global share in 2024, with demand led by Turkey and GCC nations. Industrial mineral extraction and expansion of underground operations drive adoption of specialized mining tires. Companies seek durable, heat-tolerant tires to withstand regional climatic challenges. Partnerships between global tire manufacturers and local mining operators strengthen market presence. Adoption of modern underground mining technologies improves operational efficiency, further supporting tire demand. Growth remains moderate but steady, supported by ongoing diversification efforts in the region’s economy.

Africa

The Africa Global Underground Mining Tire Market size was valued at USD 69.9 million in 2018 to USD 98.2 million in 2024 and is anticipated to reach USD 138.1 million by 2032, at a CAGR of 4.2% during the forecast period. Africa accounted for 4.0% of the global share in 2024, with South Africa and Egypt being key contributors. Expansion in gold, platinum, and diamond mining sustains demand for heavy-duty tires. Operators in Africa focus on cost-effective yet durable solutions due to budget constraints. International players are entering the region to capture opportunities from ongoing resource exploration projects. Harsh mining conditions make durability and cut resistance critical features for tire adoption. Despite infrastructure challenges, Africa presents long-term potential as mining projects expand across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Underground Mining Tire Market is moderately consolidated with major players such as Michelin, Bridgestone, Goodyear, and Continental dominating. These companies invest in R&D to develop durable, heat-resistant, and sensor-integrated tires. Regional players like Magna Tyres, Nokian Tyres, and Forlander Tires compete through cost-effective solutions. The market favors innovation, reliability, and long-term partnerships with mining operators. It remains competitive with emphasis on safety standards, tire life cycles, and sustainability practices.

Recent Developments:

- In February 2025, Bridgestone formed a strategic partnership with Komatsu to enhance underground mining operations by integrating real-time vehicle and tire data. This initiative combines Komatsu’s Komtrax Plus machinery management system with Bridgestone’s iTrack tire monitoring, aiming to improve fuel efficiency, extend tire life, and minimize operational downtime for mining operators.

- In February 2025, Goodyear Tire & Rubber Company completed the sale of its worldwide off-the-road (OTR) tire business—including underground mining tire assets—to Yokohama Rubber Company for $905 million.

- As of August 2025, recent public sources do not report major new product launches, acquisitions, or partnerships for Continental, Magna Tyres, Forlander Tires, or Nokian Tyres specific to the global underground mining tire market.

Market Concentration & Characteristics:

The Global Underground Mining Tire Market shows moderate concentration with global giants and regional suppliers competing. It is characterized by technology-driven product differentiation, safety-focused regulations, and high capital intensity. Strong competition among leading firms drives continuous product innovation, while smaller players fill niche demands. Growth patterns vary by region, with Asia Pacific dominating and Africa emerging gradually.

Report Coverage:

The research report offers an in-depth analysis based on tire size, machine type, and tire type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for radial and specialty tires.

- Growth in Asia Pacific driven by large-scale mining projects.

- Expanding adoption of smart tire monitoring systems.

- Increased investment in sustainable and recyclable tire designs.

- Strong demand for safety-enhanced tire solutions.

- Regional opportunities in Africa and Latin America.

- Partnerships between tire manufacturers and mining operators.

- Digitalization shaping predictive maintenance strategies.

- Premiumization of tires with advanced materials.

- Long-term alignment with global mining automation trends.