Market Overview:

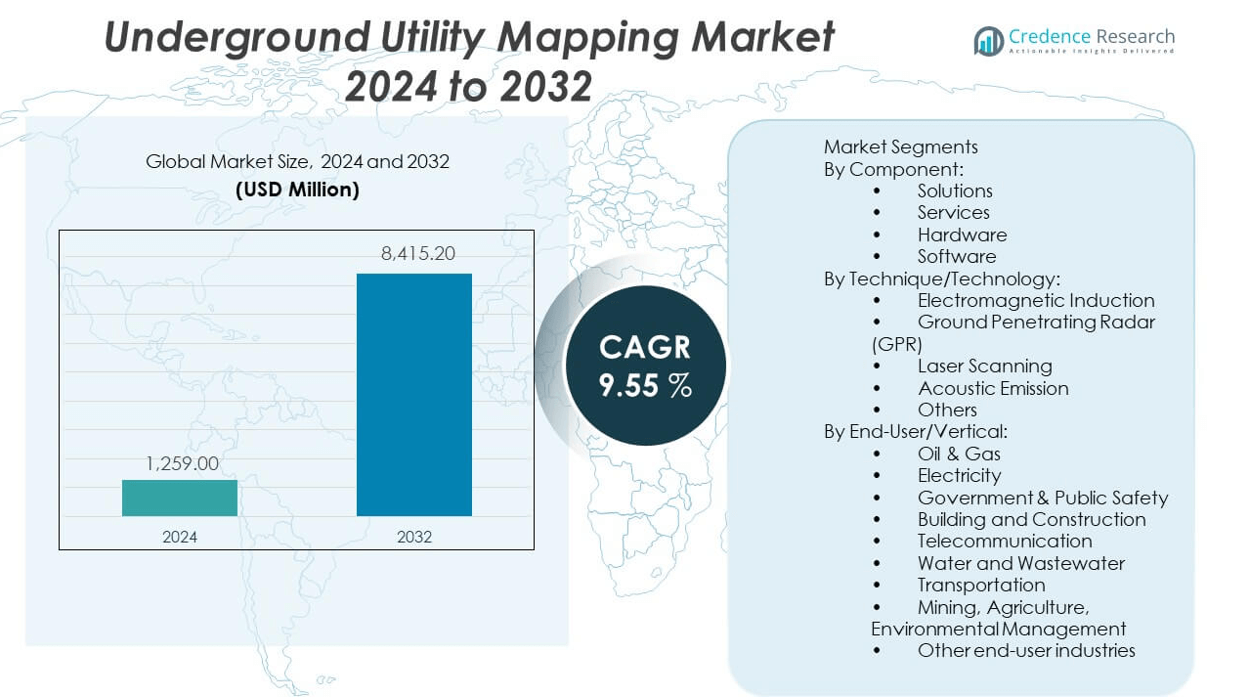

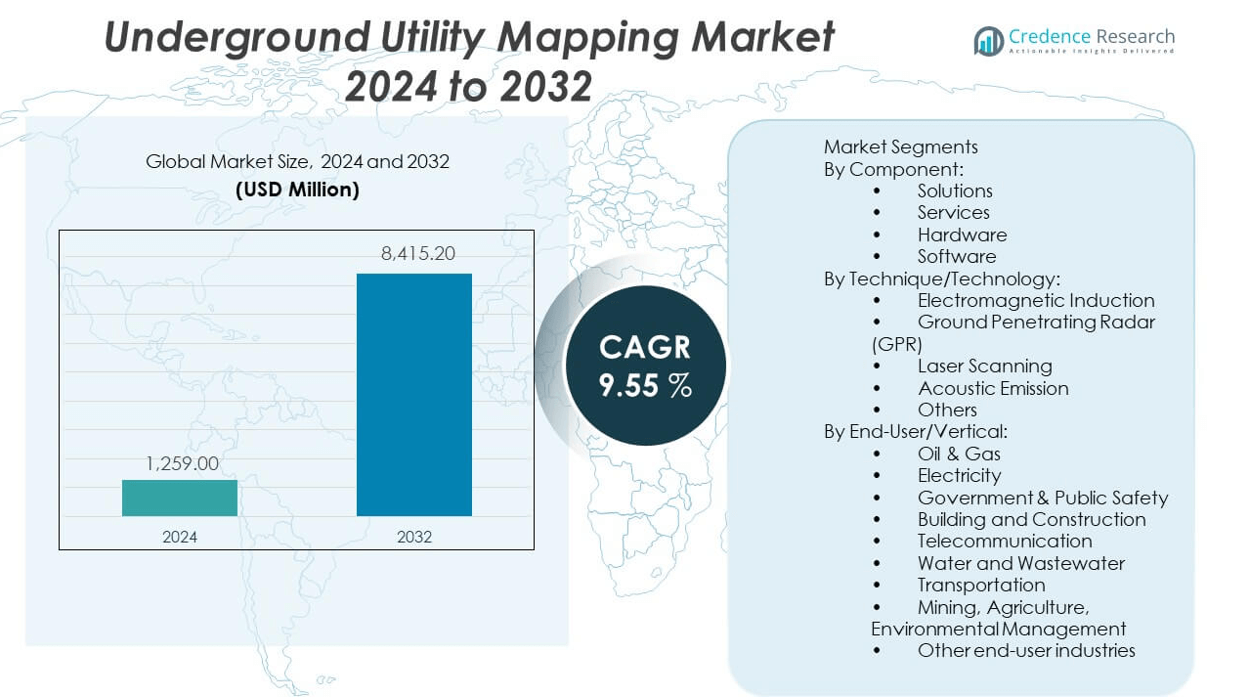

The Underground Utility Mapping market is projected to grow from USD 1,259 million in 2024 to an estimated USD 2,611.7 million by 2032, with a compound annual growth rate (CAGR) of 9.55% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Underground Utility Mapping market Size 2024 |

USD 1,259 million |

| Underground Utility Mapping market, CAGR |

9.55% |

| Underground Utility Mapping market Size 2032 |

USD 2,611.7 million |

This market is gaining momentum as governments and utility providers prioritize accurate subsurface data to prevent infrastructure damage during excavation and construction projects. Increasing urbanization and smart city initiatives have raised the demand for advanced mapping solutions that integrate geographic information systems (GIS), ground-penetrating radar (GPR), and remote sensing technologies. Construction companies and municipalities rely on these tools to enhance safety, reduce project delays, and minimize financial losses from accidental utility strikes.

North America dominates the underground utility mapping market, supported by strong regulatory standards, high infrastructure investment, and widespread adoption of digital utility management systems. Europe follows with steady growth due to urban infrastructure renewal and energy grid upgrades. Asia-Pacific is emerging as a high-potential region, fueled by rapid urban development and increasing infrastructure projects in countries like China, India, and Southeast Asia, where digital transformation of utility services is gaining momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Underground Utility Mapping market is projected to grow from USD 1,259 million in 2024 to USD 2,611.7 million by 2032, registering a CAGR of 9.55% during the forecast period.

- Increasing demand for accurate subsurface data to prevent utility damage during excavation drives market expansion across construction and public infrastructure sectors.

- Rapid urbanization and smart city initiatives are prompting adoption of advanced mapping technologies like GPR, GIS, and electromagnetic locators.

- High equipment costs and the need for skilled operators limit adoption in developing regions and among small-scale contractors.

- Inconsistent regulatory standards across countries create compliance challenges and restrict uniform growth.

- North America leads the market due to mature infrastructure, mandatory utility locating laws, and investment in digital utility systems.

- Asia-Pacific shows strong potential, driven by infrastructure development in India, China, and Southeast Asia, where governments are emphasizing digital transformation and urban planning.

Market Drivers:

Rising Infrastructure Development Projects Across Urban and Rural Areas:

Urbanization and industrial expansion are fueling demand for accurate utility mapping. Governments and private stakeholders are investing heavily in smart city development, which requires precise underground data. The underground utility mapping market is benefitting from this large-scale urban planning. It plays a vital role in reducing delays and avoiding damage to critical underground networks. Construction companies rely on detailed maps to minimize excavation risks. High-voltage cables, gas pipelines, and water networks must be precisely located to avoid service disruption. Regulatory bodies are mandating the use of advanced mapping systems to improve public safety. These factors jointly enhance the market’s long-term prospects.

- For instance, Hexagon AB provided its Leica DSX Ground Penetrating Radar to urban rail projects in Europe, enabling the detection of underground utilities with an accuracy of up to 4cm in depth estimation. In the United States, GSSI Geophysical Survey Systems, Inc. has supported large-scale smart city projects with its StructureScan Mini XT GPR, allowing field teams to complete up to 40 scans per day with immediate data visualization, reducing average utility strike incidents by 30% year-over-year at partnered construction sites.

Government Regulations and Safety Mandates for Subsurface Asset Identification:

Governments are implementing stringent policies regarding subsurface utility detection and management. These mandates require construction and maintenance firms to deploy ground-penetrating radar (GPR) and electromagnetic locating methods. The underground utility mapping market gains momentum due to enforcement of safety standards across developed and developing regions. It ensures compliance with local and national excavation codes. Regulatory penalties for utility strikes have further driven demand for advanced mapping solutions. Stakeholders view proactive mapping as cost-effective and legally sound. Authorities promote standardized utility records and GIS integration to support long-term asset tracking. Mandatory utility identification before digging enhances public safety and protects investment.

- For example, Utility mapping services in the UK, such as those compliant with PAS 128 standards, deliver precise underground utility information using GPR and electromagnetic locators, reducing risks during construction. Adherence to PAS 128 ensures consistent, high-quality mapping, minimizing intrusive investigations and complying with regulatory requirements.

Adoption of Smart Technologies and Digital Twin Integration:

Smart infrastructure systems are integrating real-time data with underground asset records. Technologies like IoT sensors, AI-powered analytics, and 3D visualization tools enhance mapping accuracy. The underground utility mapping market is evolving through the adoption of digital twin technology. It enables a virtual representation of physical utility networks, helping detect faults early. Stakeholders use predictive analytics to monitor the structural health of buried assets. Integration with BIM platforms further improves collaboration between project teams. Construction timelines are shortened and operational risks are reduced. The synergy between advanced technologies and mapping tools is transforming utility asset management.

Growing Demand for Damage Prevention and Cost Optimization in Construction:

Construction delays and utility strikes cause massive financial losses. Utility damage repair and compensation claims have increased operating costs for contractors. The underground utility mapping market addresses this by offering precise location intelligence. It supports pre-construction planning and reduces the likelihood of hitting underground assets. Accurate mapping eliminates redundant excavation and minimizes rework. This directly impacts project efficiency and safety. Insurance companies also favor firms using advanced mapping systems, leading to reduced premiums. Companies aim to enhance their bottom line while adhering to risk management protocols.

Market Trends:

Increased Use of AI-Powered Data Interpretation and Automation Tools:

Artificial intelligence is reshaping how subsurface data is processed and analyzed. Machine learning algorithms quickly identify utility lines and classify asset types. The underground utility mapping market is witnessing a shift toward AI-enhanced workflows. Automated interpretation reduces human error and accelerates mapping accuracy. Software tools now feature predictive models that learn from historic utility layouts. This trend supports real-time decision-making during excavation. AI-driven platforms also offer layered visualization of utility networks. Companies are deploying these solutions to improve speed and cost-efficiency of underground assessments.

- For instance, ProStar Geocorp’s PointMan software integrates with Leica Geosystems’ precision GPS/GNSS receivers for comprehensive data collection and management of critical underground infrastructure. Its advanced digital workflow enhances accuracy and reliability in utility mapping, and is being adopted by global energy companies for maintenance and safety improvements

Integration of Cloud-Based Platforms for Seamless Data Access and Sharing:

Field data collection and remote access are becoming seamless through cloud-based utility mapping platforms. Project stakeholders demand real-time access to geospatial records and excavation plans. The underground utility mapping market is growing through adoption of scalable cloud infrastructure. It allows integration with GPS, LiDAR, and mobile data collection units. Teams can collaborate remotely and share updates instantly. Cloud storage ensures centralized management of large datasets. Security protocols are being enhanced to protect sensitive infrastructure records. This digital shift improves data transparency and stakeholder coordination.

- For example, Red Laser Scanning’s adoption of cloud-enabled Trimble Connect facilitated real-time collaboration among up to 50 remote engineering teams on a single infrastructure mapping project, reducing design change turnaround from a week to less than a day. Cardno Limited uses Esri’s ArcGIS Online platform, enabling seamless integration of mobile LiDAR, GPS, and GPR data, resulting in reports delivered to stakeholders within 24 hours post-survey—50% faster than previous local server workflows.

Expansion of Ground Penetrating Radar (GPR) Use in Non-Invasive Mapping:

Ground-penetrating radar continues to dominate the mapping toolset due to its precision and non-destructive capability. GPR devices are evolving with better depth resolution and signal clarity. The underground utility mapping market is leveraging this tool for high-resolution subsurface imaging. New GPR models feature real-time data processing and wireless connectivity. They can detect plastic pipes and fiber cables, which were historically difficult to locate. Contractors value GPR’s ability to cover diverse terrain without disrupting the environment. This trend aligns with increasing demand for environmentally responsible and accurate utility surveys.

Increased Integration of GIS and Utility Mapping for Infrastructure Planning:

Geographic Information Systems (GIS) are being integrated with utility mapping tools for comprehensive asset visualization. Planners and engineers use GIS overlays to manage utility lifecycles. The underground utility mapping market benefits from this trend by offering detailed geospatial insights. It helps align construction phases with utility positioning. GIS integration aids in route optimization and regulatory compliance. Engineers rely on GIS-linked mapping systems for network expansion and maintenance planning. This trend is strengthening cross-functional collaboration across public works, telecom, and energy sectors.

Market Challenges Analysis:

Inconsistent Data Standards and Fragmented Utility Records Across Regions:

Lack of uniformity in utility data collection and recordkeeping creates substantial challenges. Multiple stakeholders, such as municipalities, utility companies, and contractors, use different data formats and storage methods. The underground utility mapping market faces obstacles in consolidating and interpreting inconsistent datasets. It leads to errors in mapping accuracy and delays in decision-making. Older cities with outdated infrastructure records struggle with digital mapping transformation. Fragmented data sharing protocols reduce efficiency in multi-agency projects. Standardization efforts remain limited in many emerging regions. Without a common framework, achieving mapping interoperability across platforms becomes difficult.

High Cost of Equipment, Skilled Labor, and Technology Deployment:

Adopting advanced mapping technologies involves significant capital investment. Tools such as LiDAR, GPR, and 3D scanners come with high initial and maintenance costs. The underground utility mapping market faces resistance from small and medium enterprises due to these financial constraints. Skilled operators are required to interpret subsurface imaging results accurately. Labor shortages and specialized training add to operational expenses. Budget limitations in municipal departments slow down adoption of modern utility mapping solutions. High costs create a gap between advanced capabilities and actual on-ground deployment, limiting market penetration in resource-constrained areas.

Market Opportunities:

Emerging Demand from Developing Economies and Expanding Urban Infrastructure:

Rapid urbanization in Asia-Pacific, Africa, and Latin America presents a significant opportunity. These regions are investing in transportation, telecom, and water infrastructure. The underground utility mapping market is poised to grow through demand from smart city projects and utility expansion. Governments seek to reduce infrastructure-related risks and delays through better planning. Mapping firms have the chance to collaborate with public agencies for large-scale deployments. Localization of mapping standards and affordable solutions can support this expansion.

Opportunity to Offer Subscription-Based and Modular Mapping Services:

Vendors are exploring recurring revenue models by offering mapping-as-a-service platforms. Companies want flexible solutions that scale with project size and duration. The underground utility mapping market can tap into demand for modular service plans that reduce upfront investment. Subscription models appeal to smaller contractors and municipal bodies. This shift enables technology providers to expand their customer base and generate long-term business value.

Market Segmentation Analysis:

By Component:

The Underground Utility Mapping Market segments by component into solutions, services, hardware, and software. Solutions, such as ground penetrating radar and electromagnetic locators, lead adoption due to their accuracy and non-destructive capabilities. Hardware forms a critical base for utility detection systems, while software enables advanced data visualization and integration with GIS platforms. Services—both managed and professional—continue to see growth, especially in large-scale infrastructure development and urban planning projects.

- For instance, ArcGIS Online by Esri is a leading web-based platform for managing, sharing, and analyzing geographical information. It integrates data from GPS, LiDAR, and GPR systems, serving as a central repository for spatial data and providing stakeholders with real-time information to enhance project transparency and coordination.

By Technique/Technology:

Electromagnetic induction and ground penetrating radar (GPR) dominate usage due to their ability to detect various buried assets across soil conditions. GPR remains a preferred choice for its depth accuracy and resolution. Laser scanning and acoustic emission techniques gain traction in complex urban terrains, while other methods like magnetic locators and vacuum excavators serve niche needs. The underground utility mapping market benefits from ongoing innovation across these technologies, which enhances reliability and detection speed.

- For instance, Leica DSX and similar GPR systems maximize productivity by automating data analysis and instantly creating 2D/3D utility maps, which can be exported into CAD or BIM formats for further project use. These systems offer high-resolution results, survey-grade accuracy, and compatibility across various subsurface conditions, supporting both fast and reliable underground mapping for urban and rural projects

By End-User/Vertical:

The oil & gas and electricity sectors remain major end users, requiring precise mapping to avoid operational hazards. Government and public safety bodies increasingly mandate subsurface mapping to minimize utility strikes. Building and construction applications drive demand due to stricter compliance regulations. The telecommunications and water & wastewater sectors also invest in mapping to support infrastructure upgrades. Emerging use cases in transportation, agriculture, mining, and environmental management further diversify the market’s end-user base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Component:

- Solutions

- Services

- Hardware

- Software

By Technique/Technology:

- Electromagnetic Induction

- Ground Penetrating Radar (GPR)

- Laser Scanning

- Acoustic Emission

- Others

By End-User/Vertical:

- Oil & Gas

- Electricity

- Government & Public Safety

- Building and Construction

- Telecommunication

- Water and Wastewater

- Transportation

- Mining, Agriculture, Environmental Management

- Other end-user industries

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads Due to Regulatory Enforcement and Technological Advancement

North America dominates the underground utility mapping market with a market share of 35.8%, driven by stringent excavation laws and early adoption of subsurface detection technologies. The United States has implemented robust “call-before-you-dig” regulations, which require utility mapping before any ground disturbance. Canada also invests in utility safety and smart infrastructure development. Major companies based in this region offer advanced GPR and electromagnetic solutions. High capital expenditure in transportation, telecom, and energy infrastructure supports steady demand. The region’s focus on digital transformation and GIS integration further accelerates growth. It benefits from a mature utility network requiring ongoing upgrades and accurate mapping.

Europe Maintains Strong Presence Supported by Urban Renewal Projects

Europe accounts for 29.6% of the underground utility mapping market, backed by ongoing infrastructure modernization across Germany, the UK, France, and the Nordics. Governments are investing in underground power grids, smart mobility corridors, and fiber optic deployments. The European Union mandates risk reduction in public works through pre-excavation utility detection. It encourages the use of 3D mapping and BIM-integrated platforms across infrastructure projects. Regional emphasis on environmental safety and sustainable construction promotes non-invasive utility mapping tools. The market continues to grow with the region’s focus on digital utility archives and cross-border infrastructure planning. The presence of multiple international vendors enhances competition and innovation.

Asia-Pacific Emerges as a High-Growth Region Due to Rapid Urban Expansion

Asia-Pacific holds a 23.4% share of the underground utility mapping market and shows the fastest growth trajectory. Countries like China, India, Japan, and South Korea are investing heavily in smart cities, metro rail networks, and urban development. Population growth and accelerated urbanization increase the need for efficient underground asset management. Governments are adopting modern utility mapping tools to prevent service interruptions and reduce construction risk. The market in this region benefits from rising public-private infrastructure partnerships and regulatory reforms. Local service providers and global players are expanding operations to tap into emerging demand. High construction volume and infrastructure density drive the region’s long-term potential.

Other Regions

Latin America, the Middle East & Africa collectively contribute 11.2% to the underground utility mapping market. These regions are gradually adopting mapping technologies amid urban development and regulatory modernization. Increasing investment in energy, water, and broadband networks offers room for growth.

Key Player Analysis:

- Hexagon AB

- GSSI Geophysical Survey Systems, Inc.

- LandScope Engineering Ltd

- Plowman Craven Limited

- Geospatial Corporation

- Vivax-Metrotech Corp.

- Maverick Inspection Ltd.

- Red Laser Scanning

- Technics Group

- multiVIEW Locates Inc.

- Cardno Limited

- Enviroscan

- Sensors & Software Inc.

- US Radar

- Guideline Geo AB

- IDS GeoRadar (part of Hexagon)

- ProStar Geocorp

- Global Detection Solution Sdn. Bhd.

- Ground Penetrating Radar Systems, LLC

- SECON Private Limited

- MultiView, Inc.

Competitive Analysis:

The Underground Utility Mapping Market features intense rivalry among advanced-technology providers. Hexagon AB (via IDS GeoRadar) and GSSI Geophysical Survey Systems dominate with high-performance ground penetrating radar and electromagnetic induction tools. Sensors & Software Inc. and Vivax‑Metrotech Corp. follow closely, offering detection hardware and integrated software solutions. Companies differentiate through accuracy, deployment speed, and data visualization quality. Hexagon it positions by merging hardware and software under a unified platform. GSSI emphasises reliability and flexibility across sectors. Mid‑sized firms like Plowman Craven and LandScope Engineering leverage specialized services and regional focus to compete. The competitive landscape rewards continuous innovation, strong customer support, and integration with GIS and AI-driven analytics.

Recent Developments:

- In June 2025, Hexagon AB launched the Leica DS4000, a next-generation ground penetrating radar system capable of identifying underground utility assets up to 60% deeper than traditional systems. This innovation enhances the detection of previously undetectable assets, representing a significant technological leap for utility mapping professionals.

- In May 2025, Geophysical Survey Systems, Inc. (GSSI) announced a leadership change, appointing Chris Green as President and Chief Operating Officer, marking a strategic transition to further drive innovation in ground penetrating radar solutions for subsurface mapping.

- In February 2025, LandScope Engineering Ltd officially joined Celnor Group, strengthening its capabilities in above-ground and underground surveying through new synergies and expanded technology offerings. This acquisition positions LandScope to deliver broader geospatial and marine survey solutions with enhanced service quality.

- In June 2025, Vivax-Metrotech Corp. validated Swift Navigation’s Skylark Precise Positioning Service for its vLoc3 RTK-Pro receiver, enabling mapping of underground utilities with centimeter-level GNSS accuracy. This partnership streamlines field workflows and raises the precision standard for utility locating.

- In February 2025, Red Laser Scanning utilized advanced FARO® 3D laser scanning technology for a major ROCKWOOL factory upgrade, allowing completion substantially faster and at a lower cost, and demonstrating the company’s commitment to long-term technology partnerships and efficient project delivery.

Market Concentration & Characteristics:

The Underground Utility Mapping Market maintains moderate concentration, with top players including Hexagon AB, GSSI, Sensors & Software, Vivax‑Metrotech, LandScope Engineering, and Plowman Craven leading share. It features a balance between global hardware/software vendors and regional service providers. Customers expect high precision, rapid deployment, and integration with mapping platforms. It faces rising demand from infrastructure investment and regulatory mandates. Mid‑tiers differentiate via localized service delivery and custom solutions. Overall, the market combines global innovation with regional specialization while threshold entry requires capital in R&D and client credibility.

Report Coverage:

The research report offers an in-depth analysis based on Component, Technique/Technology, and End-User/Vertical. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of AI-driven mapping platforms will enhance real-time detection accuracy and reduce interpretation errors.

- Government mandates for pre-excavation utility detection will strengthen compliance and drive demand across public infrastructure projects.

- Integration of GIS with GPR and remote sensing technologies will create unified platforms for utility asset management.

- Cloud-based data storage and visualization tools will support scalable, multi-site utility mapping operations.

- Smart city development will accelerate adoption of underground utility mapping in urban infrastructure planning.

- Investment in non-destructive testing technologies will expand the utility mapping toolkit across diverse terrains.

- Partnerships between technology vendors and construction firms will foster custom-built solutions for project-specific needs.

- Rising telecom and broadband expansion will require accurate mapping to avoid service disruptions.

- The Asia-Pacific region will emerge as a major growth hub due to rapid infrastructure development.

- Competition will intensify as mid-sized firms adopt automation and analytics to challenge incumbents.