Market Overview

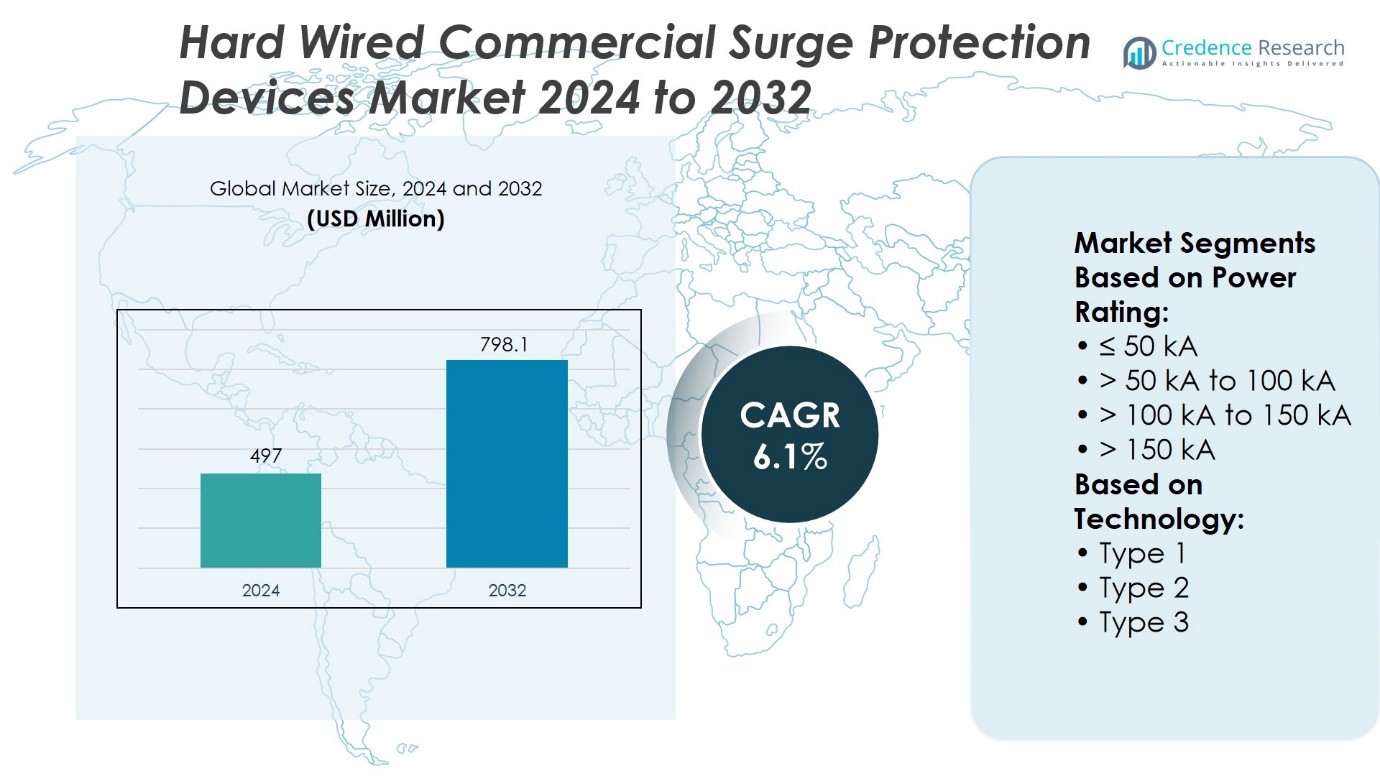

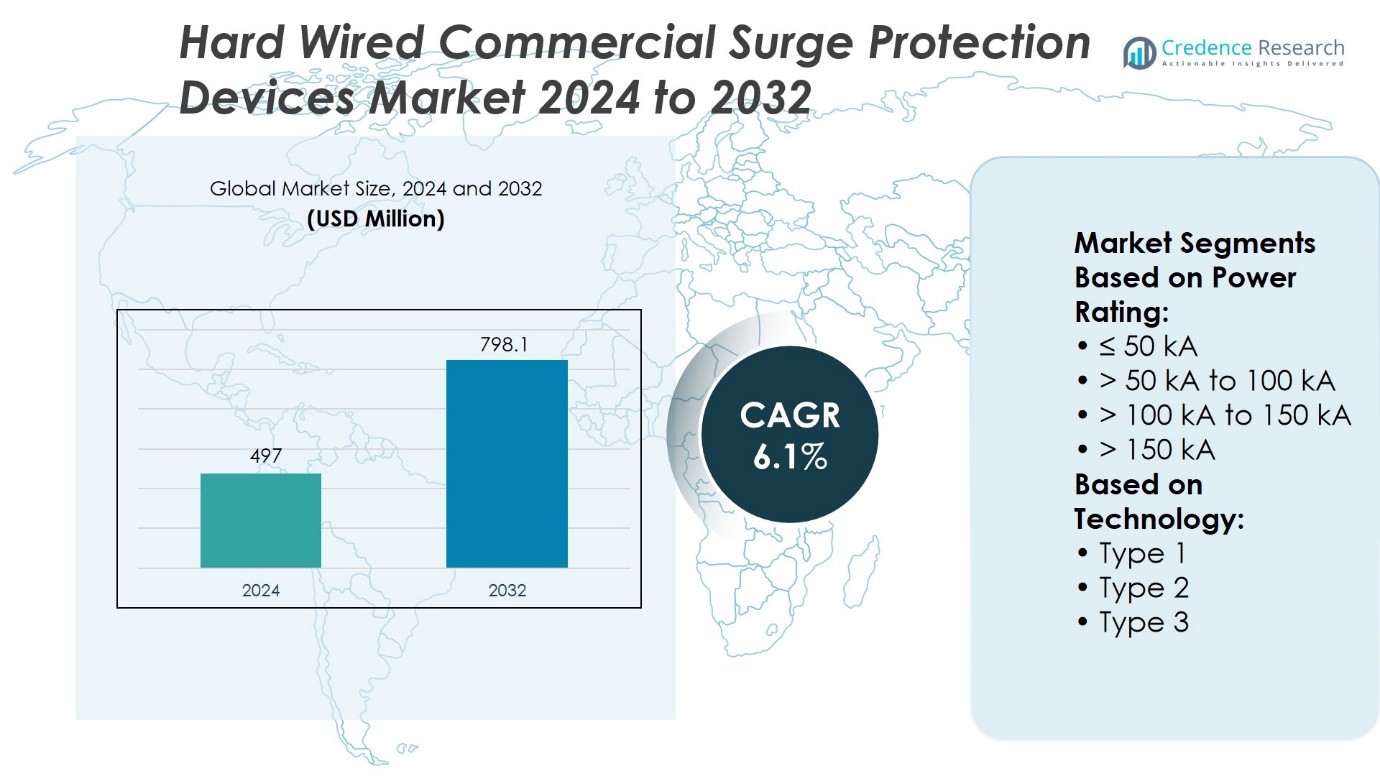

Hard-Wired Commercial Surge Protection Devices Market size was valued at USD 497 million in 2024 and is anticipated to reach USD 798.1 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hard-Wired Commercial Surge Protection Devices Market Size 2024 |

USD 497 Million |

| Hard-Wired Commercial Surge Protection Devices Market, CAGR |

6.1% |

| Hard-Wired Commercial Surge Protection Devices Market Size 2032 |

USD 798.1 Million |

The Hard-Wired Commercial Surge Protection Devices Market grows through strong drivers such as rising demand for reliable power infrastructure in commercial buildings, stricter regulatory standards, and the increasing vulnerability of sensitive equipment to power quality issues. It benefits from expansion in sectors like healthcare, data centers, and financial services where uninterrupted operations remain critical. The market also reflects trends including the integration of smart monitoring features, adoption of compact and modular product designs, and alignment with sustainability goals through eco-friendly materials. Continuous innovation in predictive maintenance and real-time surge detection further accelerates long-term adoption across global commercial infrastructure.

The Hard-Wired Commercial Surge Protection Devices Market shows strong geographical presence, with North America and Europe leading through advanced infrastructure and strict regulatory frameworks, while Asia-Pacific emerges as the fastest-growing region driven by rapid urbanization and commercial expansion. Latin America and the Middle East & Africa record steady adoption supported by infrastructure upgrades and smart city initiatives. Key players such as Eaton, ABB, Emerson Electric, Legrand, Littelfuse, Hubbell, Belkin, Infineon Technologies, Intermatic, and JMV strengthen competition with innovation and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Hard-Wired Commercial Surge Protection Devices Market size was valued at USD 497 million in 2024 and is anticipated to reach USD 798.1 million by 2032, at a CAGR of 6.1% during the forecast period.

- Rising demand for reliable power infrastructure and stricter regulatory standards drive adoption across commercial buildings and critical facilities.

- Integration of smart monitoring, compact modular designs, and eco-friendly materials reflects major market trends.

- Intense competition shapes the landscape, with global players focusing on innovation, distribution strength, and compliance with international standards.

- High installation costs and limited awareness in emerging markets remain key restraints to wider adoption.

- North America and Europe lead with advanced infrastructure, while Asia-Pacific emerges as the fastest-growing region supported by rapid urbanization.

- Latin America and the Middle East & Africa record steady growth through infrastructure upgrades and smart city initiatives, supported by leading manufacturers expanding their regional presence.

Market Drivers

Rising Demand for Reliable Electrical Infrastructure in Commercial Buildings

The Hard-Wired Commercial Surge Protection Devices Market grows steadily with the expansion of commercial complexes that require uninterrupted operations. Electrical systems in offices, hospitals, and data centers face increasing exposure to power fluctuations. Businesses prioritize secure power delivery to protect equipment worth millions. It reduces downtime, strengthens system reliability, and safeguards sensitive assets. The demand aligns with stricter building safety codes that push facility managers to adopt certified surge protection. This momentum reinforces installation across newly constructed and retrofitted buildings.

- For instance, Eaton Corporation deployed more than 12,000 surge protection devices rated up to 200 kA in commercial data centers across North America.

Strengthening Regulatory Standards and Compliance Requirements

Governments and industry regulators enforce standards that mandate effective surge protection in commercial facilities. The Hard-Wired Commercial Surge Protection Devices Market benefits from compliance obligations linked to workplace safety and energy efficiency. It creates a stable demand curve for tested devices in regional and global markets. Regulatory frameworks such as UL 1449 in North America set strict performance benchmarks. Vendors align their products with these certifications to gain credibility. The enforcement of mandatory codes drives faster adoption and reduces risks tied to non-compliance.

- For instance, ABB reported in 2023 that it supplied more than 8,500 Type 1 surge protective devices compliant with IEC 61643-11 and UL 1449 standards to newly commissioned hospital and airport projects across Europe and Asia, ensuring protection for over 420 MW of connected electrical infrastructure.

Growing Vulnerability of Commercial Equipment to Power Quality Issues

Power surges remain a primary cause of equipment failure in commercial infrastructure. The Hard-Wired Commercial Surge Protection Devices Market gains traction as organizations face higher costs from system outages and equipment replacements. It provides proven protection against voltage spikes that compromise IT hardware, medical instruments, and industrial automation systems. Increased reliance on sensitive electronics magnifies the risk of disruption. Businesses recognize the cost advantage of preventive investment compared to expensive downtime. This awareness accelerates integration of Hard-Wired devices into facility-wide electrical networks.

Technological Advancements Enhancing Product Efficiency and Safety

Manufacturers introduce advanced designs that extend protection life cycles and improve monitoring accuracy. The Hard-Wired Commercial Surge Protection Devices Market reflects innovation in smart units capable of real-time surge detection. It supports predictive maintenance and reduces risks from hidden electrical faults. Advanced thermal disconnect technology strengthens operational safety. The focus on compact designs simplifies installation and supports higher power ratings. Product improvements align with the commercial sector’s demand for dependable and efficient protective solutions.

Market Trends

Integration of Smart Monitoring Features for Real-Time Protection

The Hard-Wired Commercial Surge Protection Devices Market reflects a strong move toward smart monitoring capabilities. Manufacturers equip devices with sensors that track surge events and provide instant feedback to facility managers. It enables real-time assessment of electrical risks and ensures timely interventions. Digital dashboards allow remote supervision across multiple sites, improving operational control. Businesses value predictive insights that reduce the likelihood of costly equipment downtime. This trend accelerates the shift toward intelligent surge protection systems in commercial buildings.

- For instance, Schneider Electric integrated its PowerLogic™ smart surge protection modules into more than 6,200 commercial installations.

Rising Preference for Compact and Modular Product Designs

Architects and contractors demand space-efficient solutions that align with modern electrical panel configurations. The Hard-Wired Commercial Surge Protection Devices Market benefits from compact and modular designs that simplify installation. It allows easy integration into existing infrastructure without extensive retrofitting. Modular formats enable replacement of individual components, extending device life and lowering maintenance costs. Contractors prefer flexible units that reduce labor hours and support quicker deployment. This design-driven trend strengthens product acceptance across diverse commercial facilities.

- For instance, Siemens delivered 2.3 million compact and modular surge protection devices under its SENTRON series.

Expanding Role of Surge Protection in Data-Centric Industries

Digitalization drives reliance on high-value servers, storage networks, and communication equipment. The Hard-Wired Commercial Surge Protection Devices Market grows as data centers, healthcare providers, and financial institutions invest in advanced surge protection. It ensures the safety of critical assets where power disruption translates directly into revenue loss. Businesses adopt higher-rated devices that guard against repeated surges. This trend underscores the direct link between reliable surge protection and business continuity. Industry leaders prioritize integration to secure uninterrupted digital operations.

Increasing Focus on Sustainability and Compliance with Green Standards

Corporate sustainability goals influence the selection of protective devices that align with eco-friendly practices. The Hard-Wired Commercial Surge Protection Devices Market adapts through designs that reduce energy waste and extend product longevity. It supports compliance with green building certifications and environmental regulations. Manufacturers highlight recyclable materials and low-maintenance systems in their portfolios. Energy-efficient designs resonate with commercial buyers seeking long-term operational savings. This sustainability-focused trend reshapes procurement priorities across global commercial infrastructure.

Market Challenges Analysis

High Installation Costs and Limited Awareness in Emerging Regions

The Hard-Wired Commercial Surge Protection Devices Market faces barriers linked to high upfront installation costs and limited knowledge of long-term benefits. Many small and mid-sized enterprises hesitate to invest in advanced surge protection due to budget constraints. It creates slower adoption in regions where cost-sensitive buyers prioritize immediate savings over reliability. Lack of awareness about equipment protection further reduces penetration, especially in developing markets. Limited technical expertise among contractors adds to the challenge by discouraging proper installation. These factors collectively restrict wider acceptance despite growing demand for secure electrical systems.

Rapid Technological Change and Need for Skilled Maintenance

Frequent advancements in surge protection technology create challenges for consistent adoption across commercial facilities. The Hard-Wired Commercial Surge Protection Devices Market requires regular product updates to match evolving electrical standards. It places pressure on facility managers who must ensure compatibility with existing infrastructure. Skilled labor shortages complicate the maintenance of advanced systems, particularly smart units that require technical knowledge. Businesses risk operational inefficiencies when they fail to adapt to rapid product cycles. The gap between product innovation and workforce readiness continues to limit broader market utilization.

Market Opportunities

Expanding Infrastructure Development and Smart Building Adoption

The Hard-Wired Commercial Surge Protection Devices Market holds strong opportunities in regions undergoing rapid urbanization and infrastructure upgrades. Commercial projects in Asia-Pacific, the Middle East, and Africa continue to demand reliable surge protection to safeguard high-value electrical systems. It benefits from the rising integration of smart building technologies that require stable and secure power distribution. Developers prioritize energy management systems that incorporate advanced surge protection as a critical safeguard. Governments invest heavily in commercial zones and public facilities, reinforcing consistent demand. These infrastructure-driven initiatives create long-term opportunities for manufacturers and suppliers.

Growing Adoption of Digital Solutions and Predictive Maintenance Tools

The Hard-Wired Commercial Surge Protection Devices Market gains new opportunities through the adoption of digital monitoring and predictive maintenance platforms. It enables real-time detection of surge events and predictive analysis that reduces unplanned downtime. Businesses in sectors such as healthcare, data centers, and finance view advanced protection as essential for continuous operations. Vendors offering connected devices with IoT compatibility position themselves strongly in this evolving landscape. Predictive maintenance solutions reduce lifecycle costs and extend equipment reliability, making them highly attractive for commercial users. This shift toward digital solutions expands revenue potential and strengthens long-term client relationships.

Market Segmentation Analysis:

By Power Rating

The Hard-Wired Commercial Surge Protection Devices Market segments by power rating into ≤ 50 kA, > 50 kA to 100 kA, > 100 kA to 150 kA, and > 150 kA categories. Devices rated at ≤ 50 kA find widespread use in small and mid-sized commercial facilities where moderate protection is sufficient. It supports everyday operations in retail outlets, offices, and small healthcare centers. The > 50 kA to 100 kA range gains demand in larger commercial buildings that face higher surge exposure due to complex electrical infrastructure. Systems rated > 100 kA to 150 kA address more demanding environments such as data centers, industrial complexes, and large hospitals where critical equipment requires advanced protection. Surge protection devices with ratings above 150 kA remain vital in high-risk zones, including airports, logistics hubs, and smart cities with extensive grid connections. This segmentation highlights diverse demand patterns across varying facility sizes and operational needs.

- For instance, Eaton manufactured and supplied 3.6 million hard-wired surge protection devices rated above 100 kA.

By Technology

The Hard-Wired Commercial Surge Protection Devices Market also divides by technology type into Type 1, Type 2, and Type 3 devices. Type 1 devices mount at the service entrance and safeguard electrical systems against external surges caused by lightning or utility grid switching. It delivers the highest protection levels, ensuring resilience for large commercial sites. Type 2 devices install at distribution panels within facilities, protecting internal circuits and sensitive equipment from residual surges. Their versatility makes them the most widely adopted across commercial infrastructure. Type 3 devices focus on point-of-use applications, protecting critical electronics such as communication systems, IT equipment, and medical devices. This layered technology segmentation reflects a structured approach to surge management that strengthens electrical security across all levels of commercial operations.

- For instance, ABB recorded the delivery of 2.8 million Type 2 surge protection devices under its OVR series.

Segments:

Based on Power Rating:

- ≤ 50 kA

- > 50 kA to 100 kA

- > 100 kA to 150 kA

- > 150 kA

Based on Technology:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a commanding position in the Hard-Wired Commercial Surge Protection Devices Market with a market share of 36%. The region benefits from a strong concentration of data centers, healthcare institutions, and corporate complexes that require continuous power security. It shows consistent demand driven by strict enforcement of building codes, particularly UL 1449, which defines performance standards for surge protection devices. Investments in advanced electrical infrastructure, along with widespread integration of IoT-enabled commercial buildings, further boost adoption. The presence of global leaders in surge protection manufacturing strengthens regional supply reliability and innovation. North American businesses also prioritize predictive maintenance features, driving steady acceptance of high-end smart devices across large-scale facilities.

Europe

Europe accounts for 28% of the Hard-Wired Commercial Surge Protection Devices Market, supported by its mature commercial infrastructure and emphasis on safety regulations. Countries such as Germany, the United Kingdom, and France lead adoption due to strong industrial bases and technology-driven building modernization projects. It benefits from strict energy efficiency and workplace safety directives across the European Union, which mandate reliable electrical protection. The integration of surge protection devices aligns with the region’s focus on sustainable smart building practices. Commercial sectors such as banking, retail, and healthcare demonstrate rising investment in power security to prevent costly disruptions. Europe’s advanced grid networks and frequent upgrades ensure that demand for higher-rated devices continues to expand steadily.

Asia-Pacific

Asia-Pacific represents 22% of the Hard-Wired Commercial Surge Protection Devices Market, marking it as the fastest-growing regional segment. It experiences rapid urbanization, industrial expansion, and large-scale infrastructure development, especially in China, India, and Southeast Asia. Commercial complexes, high-rise buildings, and technology parks drive adoption due to rising demand for uninterrupted operations. Governments in the region invest heavily in digital infrastructure, making reliable surge protection vital for IT and communication sectors. It also reflects strong momentum from expanding healthcare facilities and new airports, which require high-rated surge protection devices. Local manufacturers play a key role in cost-effective supply, while global vendors expand presence to capture emerging opportunities. The region’s growth trajectory underscores its rising importance in shaping the market’s future outlook.

Latin America

Latin America contributes 8% to the Hard-Wired Commercial Surge Protection Devices Market, with gradual adoption supported by urban development and rising commercial activity. Brazil and Mexico lead demand, driven by modernization of retail, healthcare, and logistics facilities. It faces challenges from limited awareness and cost sensitivity, yet increasing investments in industrial parks and public infrastructure stimulate demand. Surge protection in commercial sectors aligns with regional efforts to improve power reliability amid grid instability. Businesses begin to adopt higher-rated devices to safeguard IT equipment and automation systems. Latin America’s market remains smaller compared to advanced regions, but steady progress supports long-term expansion.

Middle East and Africa

The Middle East and Africa account for 6% of the Hard-Wired Commercial Surge Protection Devices Market, with growing interest in surge protection linked to infrastructure development. Gulf countries, including Saudi Arabia and the United Arab Emirates, prioritize electrical security in commercial megaprojects, airports, and business districts. It reflects demand generated by large-scale investments in tourism, financial services, and smart city initiatives. Africa records slower adoption due to cost barriers, yet increasing urbanization fosters incremental uptake. Regional governments emphasize power reliability to support economic diversification, encouraging the use of advanced surge protection systems. Market share remains smaller but provides significant potential for future growth as infrastructure investments expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Hard-Wired Commercial Surge Protection Devices Market include Littelfuse, Intermatic, ABB, Legrand, JMV, Belkin, Hubbell, Emerson Electric, Eaton, and Infineon Technologies. The Hard-Wired Commercial Surge Protection Devices Market features intense competition driven by technological innovation, compliance with global safety standards, and expanding regional presence. Leading manufacturers focus on developing devices with advanced monitoring features, higher power ratings, and improved thermal disconnect technologies to meet the needs of modern commercial infrastructure. Companies strengthen their positions through strategic partnerships, acquisitions, and investments in smart building integration. Continuous emphasis on predictive maintenance, eco-friendly designs, and compact modular formats differentiates offerings and enhances customer value. Competition remains centered on balancing high performance with cost efficiency to serve both advanced markets with stringent regulatory frameworks and emerging regions with growing commercial infrastructure demand.

Recent Developments

- In April 2025, Littelfuse launched the Pxxx0S3G-A SIDACtor® Protection Thyristor Series, which is the industry’s first 2 kA thyristor in a compact DO-214AB package. This new product provides high surge current protection in a space-saving design, suitable for harsh environments such as automotive on-board chargers, EV charging stations, and industrial power supplies.

- In June 2024, Schneider Electric unveiled its PowerLogic P7 digital power-protection and control platform, designed for complex industrial and commercial installations with enhanced surge protection functionality integrated into the system.

- In May 2024, Phoenix consolidated its position in North America by creating Phoenix Contact Production S.A. de C.V in Mexico.

- In February 2024, ABB announced the strategic acquisition of SEAM Group to expand its Electrification portfolio. This move enhances ABB’s capabilities in renewables, electrical safety, and asset management advisory services.

Market Concentration & Characteristics

The Hard-Wired Commercial Surge Protection Devices Market demonstrates moderate to high concentration, with a mix of global leaders and regional specialists shaping competitive dynamics. It reflects strong dominance from multinational corporations that leverage broad product portfolios, global distribution channels, and compliance with international standards to secure large-scale commercial projects. Regional players maintain relevance by offering cost-effective solutions tailored to local infrastructure needs and regulatory frameworks. The market features characteristics such as high entry barriers due to certification requirements, continuous technological innovation, and growing integration of smart monitoring features. It also emphasizes durability, reliability, and scalability as core attributes influencing buyer decisions. Demand patterns highlight a balance between advanced markets driven by regulatory enforcement and emerging regions where rising infrastructure investment drives adoption.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing demand for secure electrical infrastructure in commercial buildings.

- It will benefit from stricter regulatory enforcement that pushes adoption across developed economies.

- Smart monitoring features will gain wider acceptance in predictive maintenance applications.

- Compact and modular designs will drive faster deployment in modern electrical systems.

- Data centers and healthcare facilities will remain key growth drivers due to reliance on sensitive equipment.

- Manufacturers will focus on eco-friendly materials and energy-efficient designs to meet sustainability goals.

- Emerging economies will present strong opportunities through rising investments in urban infrastructure.

- Strategic partnerships and acquisitions will accelerate innovation and regional expansion.

- Integration with smart building management systems will strengthen long-term market adoption.

- Continuous product upgrades will enhance device safety, reliability, and lifecycle performance.