Market Overview

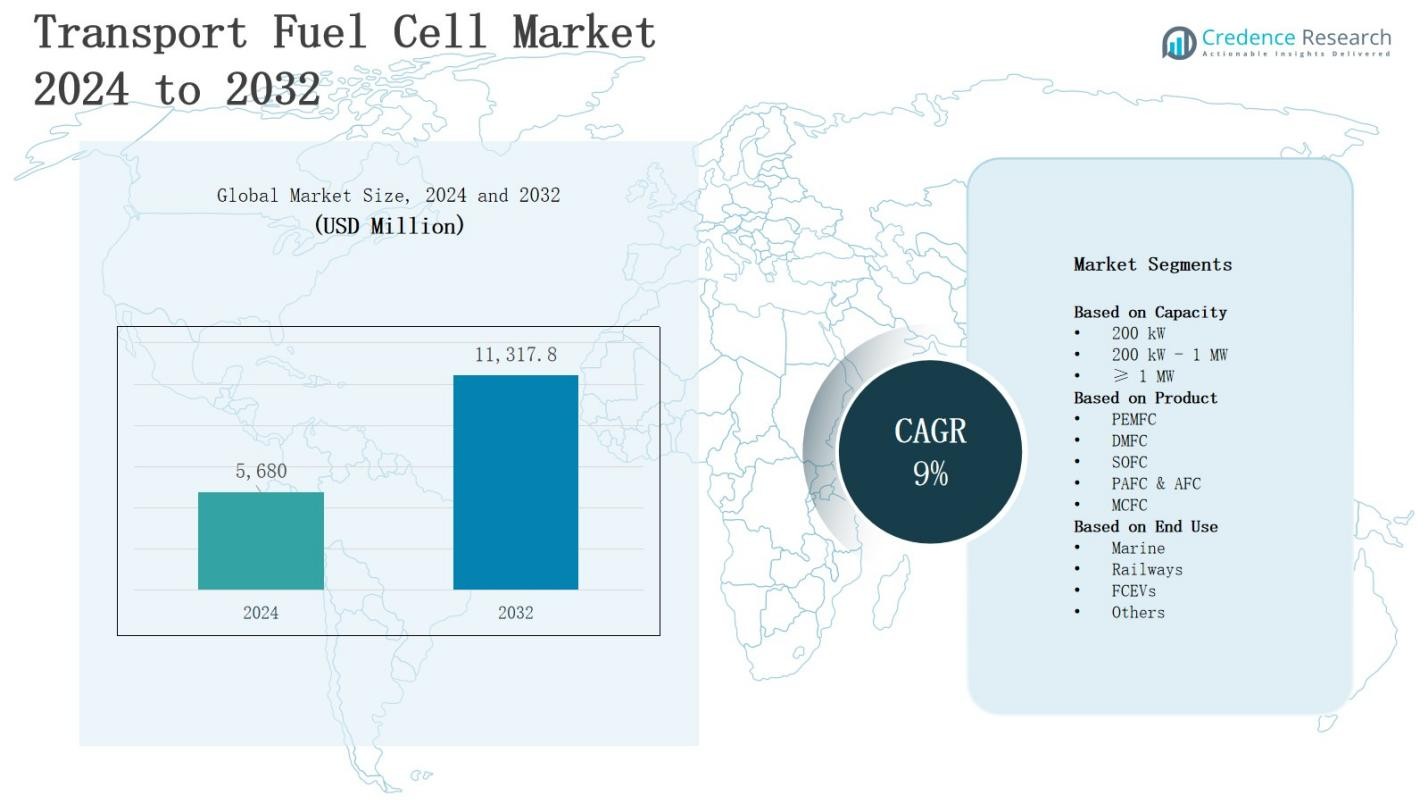

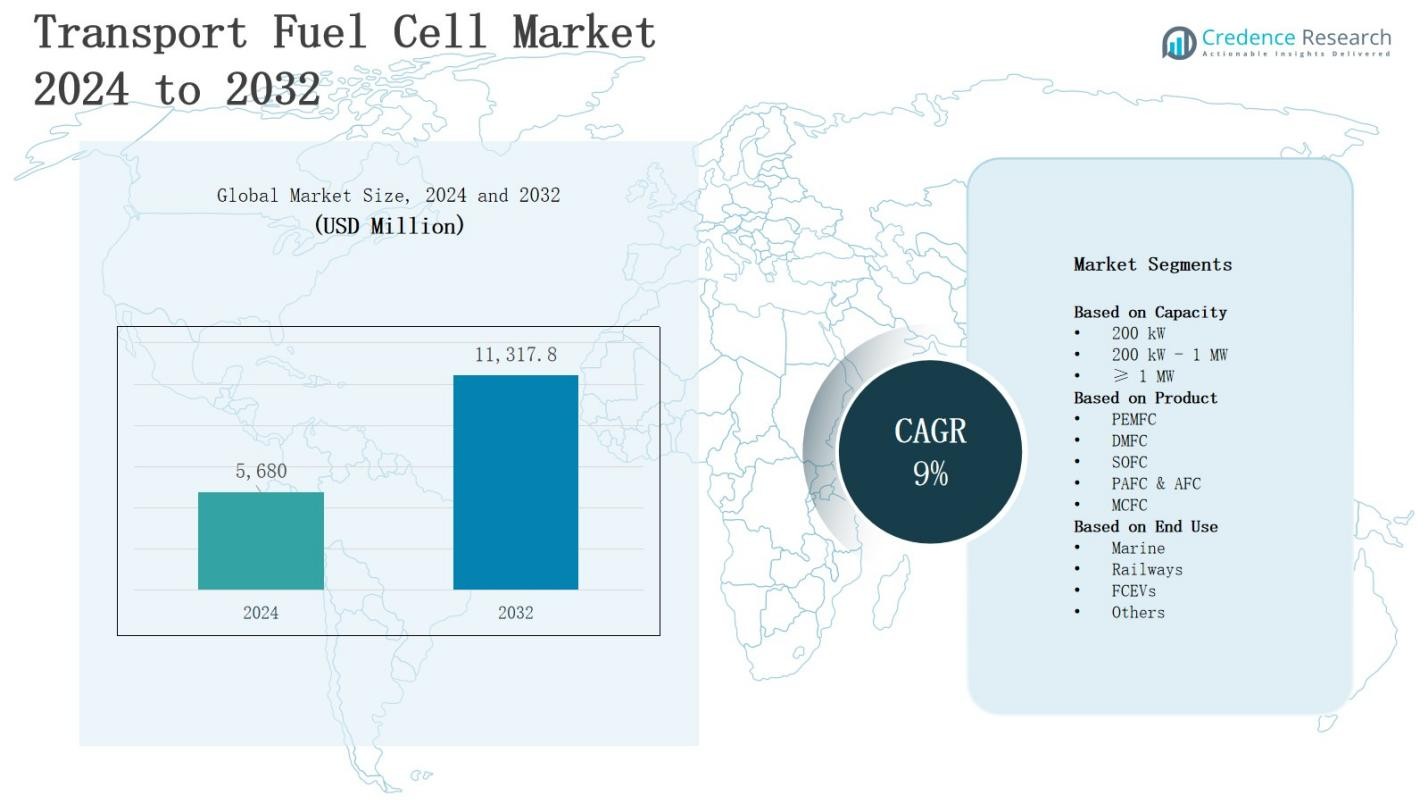

The transport fuel cell market is projected to grow from USD 5,680 million in 2024 to USD 11,317.8 million by 2032, registering a robust 9% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transport Fuel Cell Market Size 2024 |

USD 5,680 Million |

| Transport Fuel Cell Market, CAGR |

9% |

| Transport Fuel Cell Market Size 2032 |

USD 11,317.8 Million |

The transport fuel cell market is driven by rising demand for zero-emission mobility, government incentives for clean transportation, and increasing investment in hydrogen infrastructure. Automakers are adopting fuel cell technology to meet stringent emission regulations and extend vehicle range compared to battery-electric alternatives. Growth in commercial fleets, buses, and heavy-duty trucks further supports adoption due to high efficiency and quick refueling advantages. Key trends include collaborations between automotive manufacturers and energy companies, declining fuel cell costs through economies of scale, and technological advancements enhancing durability, performance, and integration across passenger vehicles, public transport, and logistics applications.

The transport fuel cell market shows diverse geographical growth across Asia Pacific, Europe, North America, Latin America, and the Middle East & Africa. Asia Pacific leads with large-scale adoption in Japan, China, and South Korea, while Europe advances with strong infrastructure investments and regulatory support. North America focuses on heavy-duty applications, whereas Latin America explores renewable hydrogen for buses and fleets. The Middle East & Africa leverage abundant resources for hydrogen hubs. Key players include Toyota Motors, Honda Motors, General Motors, Volvo Group, Nikola Corporation, Stellantis, Hyzon Motors, Quantron, PowerCell Sweden, and ElringKlinger.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The transport fuel cell market is projected to grow from USD 5,680 million in 2024 to USD 11,317.8 million by 2032, registering a 9% CAGR during the forecast period.

- Rising demand for zero-emission mobility and strict government emission norms drive adoption across passenger vehicles, buses, and heavy-duty trucks.

- Policy support, subsidies, and international collaboration on green hydrogen projects accelerate commercialization and infrastructure expansion.

- High infrastructure costs, limited refueling networks, and reliance on expensive materials such as platinum remain key challenges.

- Asia Pacific leads with 34% share, followed by Europe at 29% and North America at 26%, while Latin America and Middle East & Africa hold 5% and 6% shares.

- Technological advancements such as improved stack durability, cost reduction strategies, and hydrogen corridor expansion enhance market potential.

- Key players include Toyota Motors, Honda Motors, General Motors, Volvo Group, Nikola Corporation, Stellantis, Hyzon Motors, Quantron, PowerCell Sweden, and ElringKlinger.

Market Drivers

Rising Demand for Zero-Emission Mobility

The transport fuel cell market benefits from accelerating global adoption of zero-emission mobility solutions. Governments set stricter emission norms, pushing automakers and logistics operators to integrate fuel cell technologies. It offers extended driving range and shorter refueling times compared to battery-electric alternatives, which enhances consumer acceptance. Growth in urban pollution concerns drives large-scale deployment in buses and public fleets. Hydrogen-powered transport systems align with international carbon neutrality targets. This rising preference strengthens industry penetration.

- For instance, Wrightbus plans to supply up to 1,000 zero-emission hydrogen fuel cell buses across the UK, addressing urban pollution with quick refueling and high capacity.

Government Incentives and Policy Support

The transport fuel cell market gains strong momentum from favorable government policies and financial incentives. Subsidies for hydrogen production, infrastructure deployment, and vehicle adoption reduce entry barriers for manufacturers and consumers. It secures long-term growth through emission-free transportation mandates across major economies. Tax rebates and grants encourage automotive firms to scale commercialization faster. International collaboration for green hydrogen projects supports resource availability. This policy-driven ecosystem accelerates adoption and industry competitiveness.

- For instance, Ballard Power Systems secured an order in 2025 for a 1.5 MW fuel cell engine to power Sierra Northern Railway’s hybrid locomotive, demonstrating government-backed support for clean rail transport without compromising performance.

Expanding Infrastructure and Commercial Fleet Adoption

The transport fuel cell market advances through increasing investment in hydrogen refueling infrastructure. It ensures operational reliability for long-haul trucks, buses, and heavy-duty fleets requiring rapid turnaround times. Logistics operators favor fuel cell vehicles for efficiency, durability, and reduced carbon emissions. Expansion of hydrogen corridors in Europe, North America, and Asia enables cross-border transportation. Infrastructure scalability reassures fleet managers on supply security. These developments significantly accelerate adoption across commercial mobility applications.

Technological Advancements and Cost Reduction

The transport fuel cell market experiences growth from technological progress enhancing efficiency, durability, and affordability. Continuous research focuses on extending stack lifespan and reducing platinum catalyst dependency. It lowers manufacturing costs and broadens adoption across diverse transport categories. Automakers collaborate with energy firms to integrate advanced storage and distribution solutions. Improved performance metrics boost confidence in large-scale commercialization. The industry moves closer to parity with conventional propulsion technologies, strengthening future competitiveness.

Market Trends

Integration of Fuel Cells in Heavy-Duty and Commercial Vehicles

The transport fuel cell market shows a clear trend toward adoption in heavy-duty trucks, buses, and commercial fleets. Operators value fast refueling and extended range compared to battery-powered alternatives. It supports uninterrupted logistics operations while reducing greenhouse gas emissions. Hydrogen corridors across Europe, Asia, and North America facilitate cross-border transport. Fleet operators invest in scalable solutions to meet emission targets. This transition strengthens the role of fuel cells in freight and mass mobility.

- For instance, FlixBus’s HyFleet project aims to launch hydrogen long-distance buses with a minimum range of 450 km per refueling on the European network by 2024.

Collaborations Between Automakers and Energy Companies

The transport fuel cell market witnesses increasing collaborations between automakers, hydrogen producers, and energy companies. These alliances accelerate infrastructure expansion, technology integration, and cost optimization. It enables faster rollout of vehicles supported by reliable refueling networks. Joint ventures provide access to renewable hydrogen and sustainable production methods. Partnerships improve supply chain resilience and global competitiveness. Such cross-industry cooperation plays a vital role in creating a cohesive ecosystem for long-term growth.

- For instance, Toyota and BMW are jointly developing a third-generation fuel cell system and collaborating on establishing sustainable hydrogen supply networks to ensure stable refueling and cost reduction.

Declining Costs and Manufacturing Advancements

The transport fuel cell market benefits from continuous cost reductions achieved through economies of scale and innovation. Research initiatives aim to reduce platinum content, improve stack durability, and streamline production. It supports affordability for both commercial and passenger vehicles. Automation in manufacturing enhances consistency and output. Lower costs stimulate wider adoption among fleet operators and consumers. The ongoing drive for efficiency reinforces the long-term potential of hydrogen-powered mobility solutions.

Emergence of Green Hydrogen as a Fuel Source

The transport fuel cell market aligns with the growing emphasis on green hydrogen as a sustainable fuel. Investments in renewable-powered electrolysis strengthen the availability of clean hydrogen. It enhances environmental benefits while reducing dependency on fossil-based sources. Countries prioritize large-scale projects to meet climate commitments. Energy firms expand capacity to meet rising demand from mobility and industry. This trend creates a strong foundation for expanding hydrogen-powered transport globally.

Market Challenges Analysis

High Infrastructure Costs and Limited Refueling Networks

The transport fuel cell market faces a major challenge in the form of limited hydrogen refueling infrastructure and high associated costs. Establishing hydrogen stations requires significant investment, regulatory approvals, and coordination among stakeholders. It restricts adoption in regions where fueling networks remain underdeveloped. Consumers and fleet operators hesitate to transition without assurance of accessibility and reliability. Slow infrastructure rollout reduces the pace of commercialization. This challenge directly impacts scalability and market penetration.

High Production Costs and Technology Barriers

The transport fuel cell market also struggles with high production costs of fuel cells and limited technological maturity in some applications. Manufacturing requires expensive materials such as platinum, which increases vehicle prices compared to conventional engines. It places a burden on automakers to achieve cost competitiveness through innovation and volume scaling. Limited durability of stacks and complex storage systems add to operational challenges. This cost-performance gap slows mass adoption and creates uncertainty for end users.

Market Opportunities

Rising Demand from Data Centers and Healthcare Facilities

The standby commercial diesel gensets market holds strong opportunities due to the rapid expansion of data centers and critical healthcare facilities. Growing reliance on digital services, cloud computing, and artificial intelligence requires uninterrupted power supply. Hospitals, laboratories, and pharmaceutical units also demand reliable backup to support sensitive equipment and patient safety. It drives procurement of advanced gensets with low emissions and higher efficiency. Investments in resilient power infrastructure enhance adoption. This demand positions gensets as essential assets in critical industries.

Emergence of Hybrid Solutions and Technological Advancements

The standby commercial diesel gensets market benefits from opportunities created by hybrid integration and digital monitoring technologies. Manufacturers focus on combining diesel gensets with renewable energy sources to reduce emissions and improve efficiency. Smart control systems and IoT-enabled monitoring enhance operational reliability and predictive maintenance. It attracts businesses seeking sustainable yet dependable power backup. The shift toward greener solutions opens new markets across commercial and industrial sectors. This evolution strengthens long-term competitiveness and adoption potential.

Market Segmentation Analysis:

By Capacity

The transport fuel cell market is segmented into 200 kW, 200 kW–1 MW, and ≥1 MW categories. The 200 kW segment supports passenger FCEVs and light-duty applications with compact designs and efficient output. It caters to urban mobility where quick refueling and range are priorities. The 200 kW–1 MW category dominates buses, trucks, and rail-based transport, offering higher power density. The ≥1 MW segment addresses marine vessels and large-scale freight, supporting long-haul operations with durable, high-capacity systems.

- For instance, Toyota deploys around 114 kW fuel cell stacks in its Mirai passenger FCEV, optimizing city driving efficiency. The 200 kW–1 MW category dominates buses, trucks, and rail-based transport by offering higher power density.

By Product

The market includes PEMFC, DMFC, SOFC, PAFC & AFC, and MCFC technologies. PEMFC leads adoption due to high efficiency, rapid startup, and suitability for vehicles. It powers passenger cars, buses, and trucks with strong commercial viability. DMFC finds niche use in portable and auxiliary systems. SOFC and MCFC are favored in marine and stationary hybrid applications due to higher efficiency and fuel flexibility. PAFC & AFC remain limited but contribute to specific industrial or demonstration projects.

- For instance, Proton Exchange Membrane Fuel Cells (PEMFC) are widely adopted in the automotive industry, powering vehicles like Hyundai’s NEXO hydrogen fuel cell car, thanks to their high efficiency and fast startup capability.

By End Use

The market is segmented into marine, railways, FCEVs, and others. FCEVs remain the largest contributor, with demand rising for passenger cars, buses, and commercial trucks. It offers long range, fast refueling, and compliance with emission mandates. Railways adopt fuel cells to replace diesel engines on non-electrified routes. Marine applications expand with the adoption of ≥1 MW systems to decarbonize shipping. The others category includes aerospace and defense pilots, showcasing emerging opportunities in specialized mobility segments.

Segments:

Based on Capacity

- 200 kW

- 200 kW – 1 MW

- ≥ 1 MW

Based on Product

- PEMFC

- DMFC

- SOFC

- PAFC & AFC

- MCFC

Based on End Use

- Marine

- Railways

- FCEVs

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The transport fuel cell market in North America holds a 26% share, supported by strong investments in hydrogen infrastructure and government incentives for clean mobility. The United States leads adoption with deployment of FCEVs in California and pilot projects in freight transport. It benefits from collaborations between automakers and energy companies expanding hydrogen corridors. Canada also invests in hydrogen-powered buses and trucks to support decarbonization targets. The region demonstrates strong growth potential, particularly in heavy-duty and long-haul transport segments.

Europe

Europe accounts for 29% of the market share, driven by stringent emission regulations and ambitious climate goals. Countries such as Germany, France, and the United Kingdom invest heavily in hydrogen refueling networks and large-scale fleet programs. It benefits from European Union funding for cross-border hydrogen corridors and innovation in fuel cell technologies. Railways and marine applications advance rapidly with multiple pilot projects. The region positions itself as a leader in integrating fuel cells across multiple mobility platforms.

Asia Pacific

Asia Pacific dominates the transport fuel cell market with a 34% share, led by strong adoption in Japan, South Korea, and China. Governments support large-scale deployment of FCEVs, buses, and hydrogen-powered trucks through subsidies and infrastructure expansion. It gains momentum from advanced R&D investments and domestic automakers driving commercialization. China leads in fuel cell bus fleets, while Japan and South Korea focus on passenger cars and hydrogen supply chains. The region drives global leadership in fuel cell manufacturing capacity.

Latin America

Latin America holds a 5% share, supported by emerging interest in hydrogen mobility projects. Countries such as Brazil and Chile invest in renewable-powered hydrogen production to support transport applications. It creates opportunities for fuel cell buses and pilot fleets in urban centers. Limited infrastructure remains a challenge, but growing partnerships with international energy firms encourage adoption. The market outlook in the region strengthens as governments align with global decarbonization strategies.

Middle East & Africa

The Middle East & Africa region captures a 6% share, driven by investments in hydrogen projects linked to abundant renewable energy resources. Countries like Saudi Arabia and the United Arab Emirates develop large-scale hydrogen hubs to support transport and export markets. It enables pilot projects in buses, trucks, and port logistics. South Africa explores fuel cell applications in mining and heavy transport. The region’s resource strength provides a foundation for future growth in hydrogen-powered mobility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stellantis

- PowerCell Sweden

- Hyzon Motors

- General Motors

- ElringKlinger

- Toyota Motors

- Quantron

- Honda Motors

- Volvo Group

- Nikola Corporation

Competitive Analysis

The transport fuel cell market demonstrates intense competition with global automakers and specialized fuel cell developers expanding their portfolios to capture rising demand. Toyota Motors and Honda Motors lead with established FCEV offerings supported by large-scale hydrogen infrastructure initiatives in Asia. General Motors and Stellantis focus on strategic partnerships to accelerate commercialization across passenger and commercial vehicles. Volvo Group and Nikola Corporation target heavy-duty trucks and logistics applications, emphasizing efficiency and long-haul performance. Hyzon Motors and Quantron drive adoption in commercial fleets with scalable, zero-emission solutions. PowerCell Sweden and ElringKlinger strengthen the market with advanced stack technologies, offering durability and cost efficiency for diverse applications. It reflects a competitive landscape shaped by alliances, joint ventures, and R&D investments aimed at improving performance, reducing costs, and expanding refueling networks. The industry’s rivalry is defined by innovation speed, infrastructure collaboration, and the ability to address multiple end-use segments including marine, railways, and passenger mobility.

Recent Developments

- In December 2024, Hyundai Motor Group Metaplant America (HMGMA), in partnership with Glovis America, began deploying 21 XCIENT heavy-duty hydrogen fuel cell electric trucks in Georgia to strengthen sustainable logistics.

- In April 30, 2025, Savage and Symbio North America announced a strategic collaboration to roll out hydrogen fuel cell vehicles for drayage operations, supporting clean mobility initiatives.

- In January 2025, Plug Power secured a USD 1.66 billion loan guarantee from the U.S. Department of Energy to build six green hydrogen plants, starting with Graham, Texas.

- In October 2024, DHL Supply Chain partnered with Diageo North America to integrate two Nikola hydrogen-powered fuel cell electric trucks into its U.S. fleet, supported by a HYLA modular refueler.

Market Concentration & Characteristics

The transport fuel cell market demonstrates moderate concentration, with a mix of established automakers, specialized technology providers, and emerging startups shaping competition. Toyota Motors, Honda Motors, and General Motors lead commercialization efforts in passenger and commercial vehicles, while Volvo Group, Nikola Corporation, and Hyzon Motors target heavy-duty transport applications. PowerCell Sweden and ElringKlinger strengthen the supply chain with advanced stack technologies, while Stellantis and Quantron focus on expanding fleet adoption. It reflects characteristics of rapid innovation, high capital requirements, and strong dependence on government policies and infrastructure development. Collaboration between automakers, energy firms, and governments defines competitive dynamics, ensuring scale and cost efficiency. The market remains technology-intensive, where advances in stack durability, platinum reduction, and integration of green hydrogen play decisive roles. It offers opportunities for regional leaders to gain influence through infrastructure investment, while global players compete through partnerships, alliances, and continuous product innovation.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of fuel cell electric vehicles will expand across passenger cars, buses, and heavy-duty trucks.

- Governments will strengthen policy frameworks and incentives to accelerate hydrogen mobility.

- Investment in hydrogen corridors and refueling infrastructure will scale across major regions.

- Automakers will increase collaborations with energy companies to secure fuel supply chains.

- Advances in stack technology will improve durability and reduce dependence on platinum catalysts.

- Green hydrogen production will become a central focus for sustainable fuel cell adoption.

- Heavy-duty transport, marine, and railway sectors will drive large-scale commercial applications.

- Manufacturing cost reductions will improve competitiveness against conventional propulsion systems.

- Regional markets in Asia Pacific, Europe, and North America will maintain leadership in adoption.

- Emerging players and startups will intensify competition through innovation and niche applications.