Market Overview:

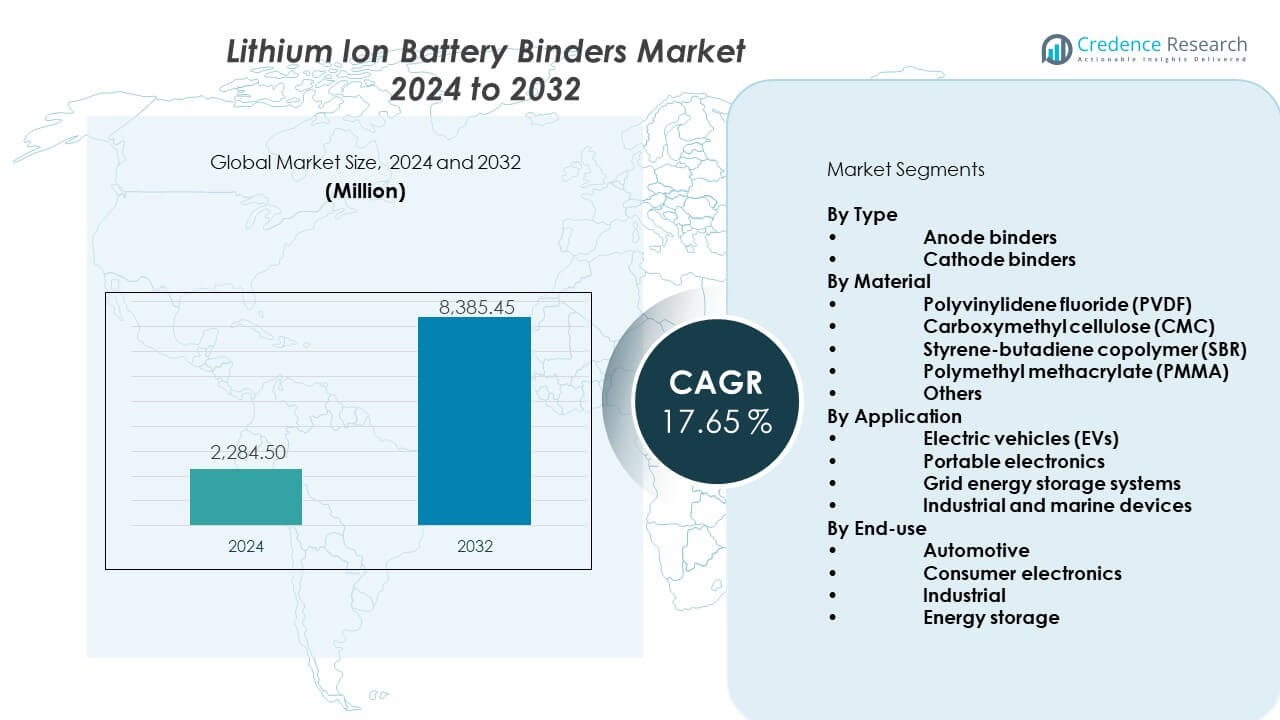

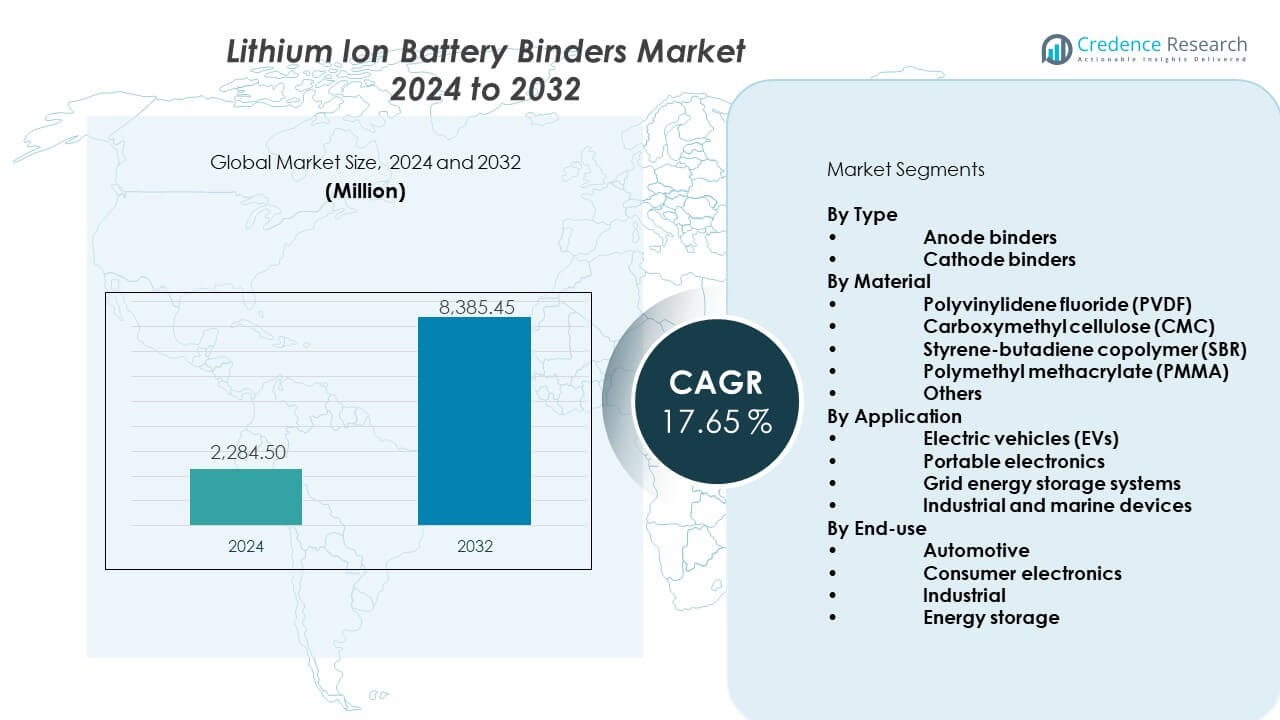

The Lithium ion battery binders market is projected to grow from USD 2,284.5 million in 2024 to an estimated USD 8,385.45 million by 2032, with a compound annual growth rate (CAGR) of 17.65% from 2024 to 2032.

|

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Ion Battery Binders Market Size 2024 |

USD 2,284.5 Million |

| Lithium Ion Battery Binders Market, CAGR |

17.65% |

| Lithium Ion Battery Binders Market Size 2032 |

USD 8,385.45 Million |

Rising demand for cleaner mobility strengthens the use of improved anode and cathode binders in EV batteries. Manufacturers adopt water-based formulations to meet sustainability targets and reduce processing risks. Polymer innovators design materials that maintain adhesion under fast-charging conditions and heavy load cycles. The shift toward silicon-enhanced anodes pushes development of binders with greater elasticity and structural stability. Energy-storage projects expand binder use across utility and commercial systems. Wider adoption in electronics boosts steady baseline demand. The market gains momentum as producers synchronize binder development with next-generation electrode technologies.

Asia-Pacific leads the market due to strong battery-production capacity in China, Japan, and South Korea. These countries hold advanced supply chains and mature cell-manufacturing ecosystems, supporting faster technology deployment. Europe shows fast growth driven by new gigafactory plans, clean-transport policies, and rising regional EV assembly. North America gains traction through expanding EV programs and local material-sourcing initiatives. Emerging markets in Southeast Asia begin building capacity through new cell-component investments. Each region contributes to broader adoption as global electrification accelerates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Lithium ion battery binders market is set to grow from USD 2,284.5 million in 2024 to USD 8,385.45 million by 2032, registering a strong 65% CAGR driven by EV expansion and advanced cell manufacturing.

- Asia-Pacific (40%), North America (28%), and Europe (25%) hold the top regional shares due to strong battery ecosystems, large EV programs, and accelerated gigafactory construction.

- Europe (25%) stands out as the fastest-growing region, supported by clean-transport mandates, local cell production plans, and rapid scale-up of energy-storage systems.

- By Application, electric vehicles account for about 45% share, driven by rising global EV manufacturing and demand for high-performance electrodes.

- By End-use, automotive holds nearly 50% share due to dominant consumption of binders in high-energy, long-cycle EV battery platforms.

Market Drivers:

Rapid Shift Toward High-Energy Battery Production

Growing EV production strengthens demand for advanced binders that support higher electrode stability. Battery makers prefer materials that maintain adhesion under fast-charging loads. Manufacturers scale polymer upgrades that support longer cycle life across major cell formats. The Lithium ion battery binders market gains wider traction due to rising gigafactory investments. Energy-storage developers use binders that maintain consistency across harsh temperature swings. Consumer electronics brands adopt improved systems that allow higher current flow. Producers refine slurry performance to reduce coating defects. Sustainability goals push broader use of water-based binder solutions.

- For instance, LG Energy Solution aims to achieve a global annual production capacity of approximately 540 GWh by the end of 2025 across its facilities in North America, Europe, and Asia. The company is actively developing advanced battery technology, including the use of material innovation like third-generation separators and PFAS-free binder coating to improve performance, durability, and support the development of next-generation fast-charge EV cells.

Rising Emphasis on Long Cycle Life and Improved Safety Compliance

Manufacturers upgrade binder chemistries to reduce swelling during repeated charge cycles. Safety standards guide the shift toward solutions that improve thermal stability. The Lithium ion battery binders market grows due to rising demand for better electrode mechanical strength. EV producers depend on strong adhesion to extend pack durability. Next-generation cathode materials need binders with better oxidative resistance. Energy-storage firms prefer systems that lower fire-propagation risks. Polymer developers redesign molecular structures for predictable structural retention. Industrial users value stable coatings for heavy-duty discharge demands.

- For instance, Panasonic’s cylindrical cells used in Tesla vehicles are engineered for cycle life exceeding 1,000 cycles under controlled conditions, supported by binder formulations designed to reduce swelling and improve thermal endurance.

Large-Scale Expansion of Global Gigafactories and Vertical Integration

Rapid construction of battery plants increases procurement of high-performance binders. Cell producers adopt vertical integration to secure steady material supply. The Lithium ion battery binders market benefits from alignment between electrode design and binder formulation. Large manufacturers standardize binder requirements for mass-production consistency. Energy-storage developers push for materials that minimize electrode cracking. EV players adopt binders that support faster line speeds. Industrial buyers value uniformity in viscosity for smooth coating. Strong investment momentum accelerates technology transfer across major regions.

Growing Demand for Water-Based and Eco-Friendly Binder Systems

Regulations encourage use of safer water-based binder systems in electrode processing. Producers replace solvent-heavy materials to reduce emissions. The Lithium ion battery binders market shifts toward chemistries with lower environmental impact. EV manufacturers support cleaner production models to meet sustainability targets. Energy-storage firms invest in materials that reduce processing hazards. Polymer suppliers scale solutions that cut drying times. Consumer electronics brands push for binder options with improved recyclability. Cleaner chemistries align with global green-manufacturing goals.

Market Trends:

Shift Toward Silicon-Anode Adoption and High-Capacity Battery Designs

Silicon-rich anodes require elastic binders that withstand large volume expansion. Developers test new polymer networks to improve mechanical retention. The Lithium ion battery binders market sees strong alignment between binder elasticity and anode growth. EV makers invest in high-capacity cells that need better stress-absorbing systems. Material scientists refine structures that maintain adhesion during intense cycling. Producers create hybrids that combine strength and flexibility. Cell plants test binders that support extreme charge-rate designs. Demand rises for materials optimized for silicon blending.

- For instance, Sila Nanotechnologies’ silicon-dominant anode material delivers up to a 20% energy-density boost in commercial cells, which relies on elastic binders capable of handling high expansion ratios documented in the company’s technical publications.

Growing Use of Bio-Based and Next-Generation Polymer Solutions

Sustainability goals inspire research into renewable binder solutions. Producers explore natural-origin polymers that match synthetic performance. The Lithium ion battery binders market improves due to interest in low-impact chemistries. EV firms test new formulations designed to cut manufacturing emissions. Energy-storage developers need alternatives that maintain strong adhesion. Material designers test new backbone structures for higher durability. Consumer brands value cleaner supply chains. Growth in green-material R&D accelerates commercial adoption.

- For instance, Arkema’s bio-based Kynar® CTO PVDF grades include up to 100% renewable carbon content based on certified crude tall oil (CTO), confirmed in its sustainability documentation. Arkema’s other product lines, like the Rilsan polyamide 11 range, use castor oil as a bio-feedstock.

Advanced Manufacturing Automation and Smart Electrode Coating

Automation improves binder mixing, coating, and drying precision. Plants adopt inline monitoring tools to achieve tighter thickness control. The Lithium ion battery binders market aligns with upgrades in smart manufacturing systems. AI tools help optimize slurry dispersion. EV battery lines use robotics to stabilize output quality. Producers apply automated diagnostics to reduce defects. Material partners design binders compatible with high-speed coating. Demand rises for solutions that support Industry 4.0 workflows.

Increased Focus on Ultra-Thin Electrodes and High-Efficiency Cell Designs

Manufacturers push toward thinner electrodes to improve energy density. Thin coatings require binders with better adhesion at low loading levels. The Lithium ion battery binders market grows due to precision-driven electrode innovations. Cell makers test formulations that improve flexibility during calendaring. Performance demands guide development of ultra-low-viscosity solutions. High-efficiency cells depend on binders with uniform molecular distribution. Producers adopt systems that reduce internal resistance. Market players push toward next-generation thickness standards.

Market Challenges Analysis:

High Material Costs and Complex Qualification Requirements

Producers face rising costs linked to advanced polymer engineering. Qualification cycles remain long due to strict safety and reliability rules. The Lithium ion battery binders market experiences delays when suppliers must meet varied regional standards. EV makers prefer tested systems, which limits new material entry. Cell producers face compatibility concerns during slurry reformulation. Binder changes can disrupt existing production lines. Manufacturers invest heavily to validate long-term stability. Market adoption slows when testing windows extend across multiple cell formats.

Technical Limitations in Extreme-Performance Applications

High-capacity designs place heavy stress on traditional binder chemistries. Volume expansion in silicon-rich anodes raises risks of electrode cracking. The Lithium ion battery binders market must support better elasticity without losing adhesion strength. Fast-charging pressures increase demands on mechanical properties. Producers face challenges maintaining stability at ultra-high operating currents. Thermal loads test oxidative tolerance. Developers need more predictable behavior across wide temperature bands. Material innovation cycles struggle to keep pace with advanced cell requirements.

Market Opportunities:

Expansion of Next-Generation Battery Chemistries and EV Platforms

Growth in solid-state, sodium-ion, and silicon-dominant systems opens new binder demand. Developers engineer fresh polymer designs to match evolving electrode structures. The Lithium ion battery binders market gains opportunities from large EV platform investments. Energy-storage projects adopt flexible materials for diverse applications. Producers collaborate with battery plants to tailor chemistries for niche uses. New gigafactories increase long-term supply prospects. Material partnerships accelerate product qualification. Innovation pipelines widen global market reach.

Rising Demand for Eco-Friendly and Water-Based Binder Solutions

Sustainability regulations drive interest in cleaner production materials. Water-based systems attract buyers aiming for safer and low-emission environments. The Lithium ion battery binders market benefits from expanding adoption among global manufacturers. EV brands prioritize green supply chains. Industrial users invest in systems that support safer working conditions. Cleaner binders help align with circular-economy goals. Polymer innovators develop solutions with improved drying efficiency. Opportunities rise across regions with strong environmental policies.

Market Segmentation Analysis:

By Type

Anode binders lead demand due to wider adoption in high-capacity anode chemistries used in EV and storage cells. Cathode binders follow with strong consumption in NMC and LFP production lines. The Lithium ion battery binders market benefits from rising focus on stability, adhesion strength, and improved mechanical behavior across both segments. Binder upgrades support higher power output and longer cycle durability. EV platforms depend on balanced anode–cathode binder performance to maintain safety. Industrial battery formats require consistent coating behavior. Growth strengthens as producers scale material compatibility across new cell designs.

- For instance, CATL’s NMC cells deployed in global EV fleets exceed 300 Wh/L in volumetric density, and even their latest LFP cells reach around 220 Wh/L, due in part to optimized binder systems that support high-stress electrode loading.

By Material

PVDF remains the most dominant due to strong chemical resistance and compatibility with high-voltage cathodes. CMC and SBR gain traction in water-based anode systems due to lower environmental impact. PMMA supports advanced electrode formulations requiring greater flexibility. Other specialty polymers address niche high-temperature or high-strain applications. Each material type aligns with performance targets set by EV and energy-storage manufacturers. Producers refine polymer structures to meet cycling and mechanical demands. Material choice shapes overall electrode reliability. Innovation drives faster adoption in newer chemistries.

- For instance, Solvay’s Solef PVDF grades are validated for high-voltage cathodes above 4.4V and are used across major EV battery lines according to Solvay’s technical specifications.

By Application

Electric vehicles hold the largest share due to rapid global EV expansion. Portable electronics provide steady demand across smartphones, laptops, and wearables. Grid energy storage systems use binders that maintain stability under long-duration cycles. Industrial and marine devices require improved strength to handle harsh operating conditions. Application-specific needs guide binder formulation strategies. Performance consistency improves across advanced platforms. Manufacturers refine product lines to meet varied operational loads. Growth aligns with expansion of global battery production.

By End-use

Automotive leads due to strong EV penetration worldwide. Consumer electronics maintain steady consumption linked to device upgrades. Industrial applications require robust performance for heavy-duty cycles. Energy storage grows due to rising deployment of utility and commercial systems. Each end-use sector drives specialized binder performance. Producers adapt solutions to different electrode processing methods. Demand remains tied to global electrification trends. Manufacturers expand portfolios to support broader adoption across regions.

Segmentation:

By Type

- Anode binders

- Cathode binders

By Material

- Polyvinylidene fluoride (PVDF)

- Carboxymethyl cellulose (CMC)

- Styrene-butadiene copolymer (SBR)

- Polymethyl methacrylate (PMMA)

- Others

By Application

- Electric vehicles (EVs)

- Portable electronics

- Grid energy storage systems

- Industrial and marine devices

By End-use

- Automotive

- Consumer electronics

- Industrial

- Energy storage

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds around 28% share of the Lithium ion battery binders market due to strong EV adoption, advanced battery manufacturing clusters, and rapid energy-storage deployment. The United States leads regional consumption with large investments in gigafactory expansion. Canada supports growth with rising cell-component production and clean-energy incentives. The region focuses on high-performance binders that support fast-charging capability. Producers refine polymer systems to meet strict durability and safety requirements. The Lithium ion battery binders market strengthens in North America as EV makers accelerate local sourcing plans. Regional policies encourage wider use of low-emission manufacturing materials.

Europe

Europe accounts for roughly 25% market share driven by strong EV regulations, expanding gigafactory pipelines, and large shifts toward renewable-energy storage. Germany, France, and the Nordic countries support advanced binder use through high-scale battery programs. Regional firms adopt sustainable binder chemistries aligned with stringent environmental standards. EV platform growth strengthens demand for PVDF, SBR, and next-generation water-based systems. Manufacturers invest in improving cathode and anode stability to support long-range mobility. Supply-chain reshoring across Europe pushes higher binder procurement. The Lithium ion battery binders market gains strategic importance due to the region’s clean-transport mandates.

Asia-Pacific

Asia-Pacific dominates with nearly 40% share supported by China, South Korea, and Japan’s leadership in global battery production. China drives the highest binder consumption with massive output of EV cells, portable electronics, and energy-storage units. South Korea and Japan maintain strong positions in advanced polymer innovation and specialty binder design. Regional players focus on enhancing binder elasticity, thermal stability, and compatibility with high-capacity electrode materials. Growth spreads to Southeast Asia as new battery plants scale production. Strong regional supply chains help stabilize raw material availability and reduce production costs. The Lithium ion battery binders market expands rapidly across Asia-Pacific due to integrated manufacturing ecosystems and large-scale technology investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Lithium ion battery binders market features strong competition among global chemical companies, polymer innovators, and specialty material producers. Leading firms invest in advanced binder chemistries that support higher energy density, improved adhesion, and stable cycling. It gains competitive strength through rapid expansion of EV and energy-storage manufacturing. Companies focus on PVDF and water-based systems to meet sustainability and performance targets. Major players build long-term supply partnerships with battery producers to secure market presence. Continuous R&D drives development of binders tailored for silicon-rich anodes and high-voltage cathodes. Competitive activity intensifies as new gigafactories scale procurement across regions.

Recent Developments:

- In March 2025, Zeon Corporation announced an agreement to establish a joint venture specializing in sales of anode binders for lithium-ion batteries in China’s domestic market. Zeon Trading (Shanghai), a fully owned subsidiary of Zeon Corporation, agreed with Zhuhai Chenyu New Materials Technology, an affiliate of Shanghai Energy New Materials Technology (SEMCORP), to set up Shanghai Chenon New Materials Technology, a joint sales venture scheduled to be established at the end of April 2025. The investment ratio is 51% by Chenyu and 49% by Zeon Trading, and the goal of this partnership is to further expand the anode binder business in China’s domestic market by leveraging the sales channels of SEMCORP, which boasts the number one share of the separator market in China, and by integrating the anode binder technology cultivated over the years by Zeon with Chenyu’s competitive manufacturing costs.

- In March 2025, LG Chem showcased groundbreaking battery material innovations at InterBattery 2025, held at COEX in Seoul from March 5-7. The company introduced Korea’s first mass-produced precursor-free cathode materials, called LG Precursor Free (LPF), which are created through direct calcination of specially designed metals without using precursors, enhancing power performance in low-temperature conditions and accelerating the development process. LG Chem also unveiled its eco-friendly water-based latex anode binder technology, which mechanically stabilizes anode active materials to enhance battery lifespan and efficiency by ensuring more stable adhesion of electrode materials, thereby improving battery performance and durability. The company announced plans to commence production of LPF cathode materials in the first half of 2025, with aspirations to broaden the application of LPF technology across new product lines, offering clients unique, tailored solutions in terms of performance, cost, and environmental sustainability.

- In February 2025, Arkema announced a 15% capacity expansion of its PVDF production site in Calvert City, Kentucky, representing an investment of around $20 million. The expansion, with startup planned for mid-2026, will focus on innovative PVDF grades designed to support the manufacture of electric vehicles and energy storage systems with improved sustainability profiles, as well as growth in local manufacturing by customers in other strategic markets. At the Battery Show Europe 2025 in Stuttgart, Germany, held from June 3-5, Arkema showcased its latest portfolio of advanced materials designed for the next generation of semi-solid batteries, including innovative materials for gel electrolyte batteries and electrode binder solutions for dry coating processes.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Material, By Application, and By End-use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- EV growth will strengthen demand for advanced binders with higher adhesion performance.

- Water-based binder adoption will rise due to sustainability requirements and regulatory pressure.

- Silicon-rich anodes will create strong demand for elastic and stress-resistant binders.

- Gigafactory expansion will drive long-term procurement stability for global suppliers.

- Material innovation will focus on higher thermal resistance and improved cycling durability.

- Regional supply chains will expand to reduce import dependency for critical materials.

- Binder formulations will evolve to support ultra-thin electrodes and fast-charging cells.

- Energy-storage deployments will widen adoption across grid and commercial projects.

- Partnerships between chemical firms and battery OEMs will intensify.

- The global shift toward greener manufacturing will push rapid adoption of low-emission binder systems.