Market Overview

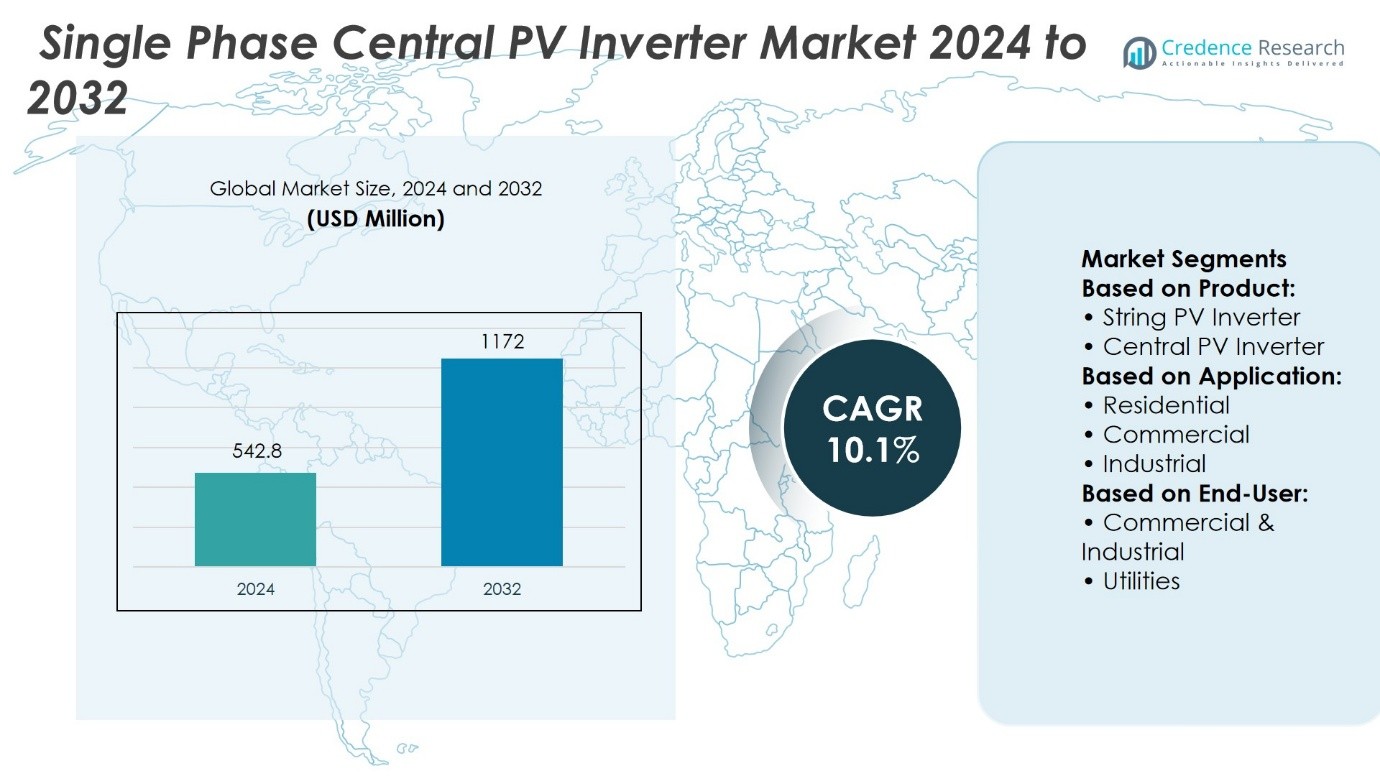

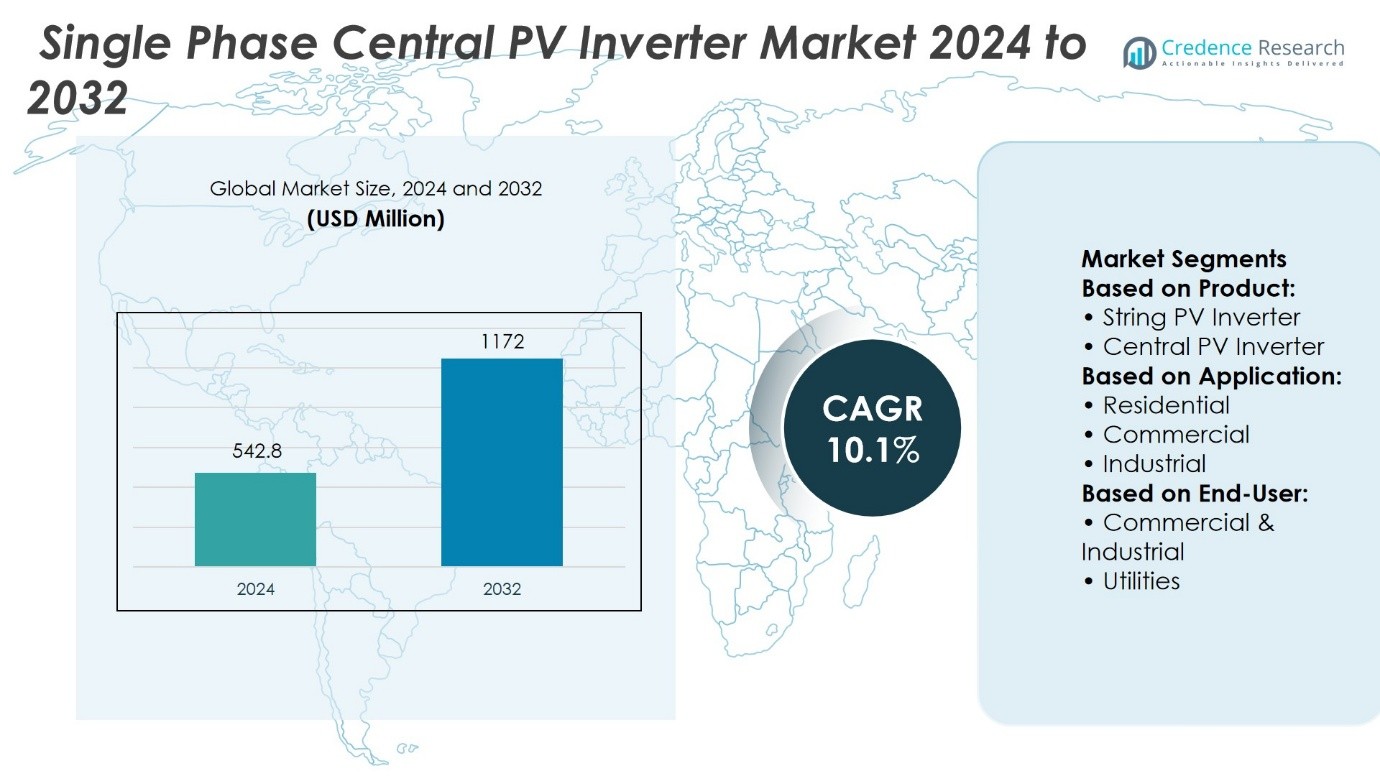

Single-Phase Central PV Inverter Market size was valued at USD 542.8 million in 2024 and is anticipated to reach USD 1172 million by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Phase Central PV Inverter Market Size 2024 |

USD 542.8 Million |

| Single-Phase Central PV Inverter Market, CAGR |

10.1% |

| Single-Phase Central PV Inverter Market Size 2032 |

USD 1172 Million |

The Single-Phase Central PV Inverter Market advances through strong drivers such as rising residential solar adoption, supportive government incentives, and increasing demand for energy independence. It grows with the need for reliable grid integration, cost-efficient power conversion, and compliance with evolving renewable policies. Key trends shaping the market include integration of smart monitoring platforms, development of hybrid-ready systems with storage compatibility, and preference for compact, high-efficiency designs. It also reflects expanding alignment with sustainability standards and grid modernization programs, positioning inverters as essential enablers of decentralized renewable energy systems and long-term clean energy transitions.

The Single-Phase Central PV Inverter Market shows strong geographical presence, with Asia-Pacific holding the largest share, followed by North America and Europe, while Latin America and the Middle East & Africa emerge with steady growth. It benefits from regional policies, renewable targets, and rising solar adoption across residential and utility applications. Key players shaping the market include Siemens Energy, SMA Solar Technology AG, Delta Electronics, SunPower Corporation, Fimer Group, Eaton, Emerson Electric Co., Omron Corporation, Hitachi Hi-Rel Power Electronics, and Power Electronics S.L.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single-Phase Central PV Inverter Market was valued at USD 542.8 million in 2024 and is projected to reach USD 1172 million by 2032 at a CAGR of 10.1%.

- Rising residential solar adoption, supportive government incentives, and growing demand for energy independence drive steady market expansion.

- Integration of smart monitoring platforms, hybrid-ready inverter systems with storage, and compact high-efficiency designs define major market trends.

- Competition centers on product innovation, grid compatibility, and digital solutions, with global players investing in R&D and regional expansion.

- High upfront costs, limited scalability, and grid compliance challenges act as restraints that impact wider adoption.

- Asia-Pacific leads market share, followed by North America and Europe, while Latin America and the Middle East & Africa show steady growth.

- Key players shaping the market landscape include Siemens Energy, SMA Solar Technology AG, Delta Electronics, SunPower Corporation, Fimer Group, Eaton, Emerson Electric Co., Omron Corporation, Hitachi Hi-Rel Power Electronics, and Power Electronics S.L.

Market Drivers

Rising Deployment of Residential Solar Installations Driving Market Growth

The Single-Phase Central PV Inverter Market expands with the surge in residential solar projects that require efficient and compact inverter solutions. Governments encourage rooftop solar adoption through incentives, tax benefits, and net metering policies, which create steady demand. Homeowners focus on reducing dependency on conventional energy sources, improving energy security, and lowering electricity costs. It benefits from the alignment of national renewable energy targets with consumer-level adoption. The market also responds to urban energy transitions, where rooftop integration becomes essential. It strengthens presence by offering solutions tailored for low to medium energy capacities.

- For instance, Siemens has secured an order to domestically manufacture 1,000 string inverters totaling approximately 125 megawatts to be delivered starting in Q1 of 2025 for Summit Ridge Energy ground-mounted solar projects in Illinois and Virginia.

Increasing Grid Modernization Efforts Strengthening Market Demand

The Single-Phase Central PV Inverter Market gains momentum from extensive grid modernization programs across multiple regions. Utilities implement smart grid initiatives that require advanced inverters capable of bidirectional power flow and real-time monitoring. Governments prioritize grid stability and renewable integration, which increases investments in inverter technologies. It supports the transition by enabling smoother solar-to-grid connectivity and maintaining voltage consistency. The market benefits from the requirement for improved load balancing in residential zones. It aligns with long-term infrastructure upgrades that promote decentralized renewable adoption.

- For instance, Fimer Group delivered nine PVS-100 string inverters each rated up to 120 kW for a decentralized 999.18 kWp solar installation at Vegitalia S.p.A. in Calabria, integrating 2,196 photovoltaic modules into a smart grid setup for enhanced power distribution.

Technological Advancements in Inverter Efficiency Supporting Expansion

The Single-Phase Central PV Inverter Market advances through innovation in efficiency, durability, and digital integration. Manufacturers introduce solutions with higher conversion efficiency, improved thermal management, and enhanced grid support functions. IoT-enabled monitoring platforms and AI-driven predictive maintenance expand adoption among residential users. It adapts to evolving customer expectations for smarter and more resilient power systems. Growing preference for compact, lightweight designs also accelerates deployment in limited-space installations. It demonstrates resilience by supporting hybrid applications, including storage integration and demand-side management.

Policy Support and Sustainable Energy Goals Fueling Market Growth

The Single-Phase Central PV Inverter Market thrives under strong regulatory support and global sustainability commitments. Governments implement renewable energy targets, carbon neutrality roadmaps, and green financing schemes that encourage adoption. It gains traction where public and private investments prioritize cleaner alternatives to fossil fuel-based generation. International initiatives promoting distributed energy resources further drive residential inverter deployment. The market grows alongside stricter emission reduction frameworks and renewable energy portfolio standards. It secures relevance by addressing climate goals while meeting rising household energy demand.

Market Trends

Growing Integration of Smart Monitoring and Digital Platforms Enhancing Market Evolution

The Single-Phase Central PV Inverter Market demonstrates a clear trend toward integration of digital tools for monitoring, diagnostics, and remote control. IoT-enabled platforms allow users to track performance, predict faults, and optimize energy output. It improves user experience by delivering real-time insights on energy consumption and inverter health. Manufacturers strengthen portfolios with AI-driven analytics that reduce downtime and extend equipment life. Consumers adopt these solutions to gain greater control over residential solar systems. It reflects the shift toward intelligent energy management across the renewable sector.

- For instance, SunPower Corporation has deployed over 100,000 residential systems in the U.S. equipped with its SunPower Equinox® platform, each integrating microinverters and the EnergyLink™ monitoring software, which processes real-time data from more than million connected solar cells to provide predictive diagnostics and performance optimization.

Rising Preference for Hybrid Systems with Storage Compatibility Driving Adoption

The Single-Phase Central PV Inverter Market advances with the growing interest in hybrid energy systems that integrate storage solutions. Consumers demand uninterrupted energy supply and better control over surplus generation. It aligns with the rising importance of energy independence in residential applications. Manufacturers design inverters compatible with lithium-ion batteries and other storage technologies to expand adoption. Utilities support this trend by promoting self-consumption and distributed storage models. It creates strong momentum for inverters that can balance solar generation with household energy demand.

- For instance, Delta Electronics, Inc. deployed more than 1,500 units of its hybrid E5 inverters, each with a 5 kW power output and 6 kWh lithium-ion battery integration, across residential projects in Japan and Germany.

Shift Toward High-Efficiency and Compact Designs Influencing Consumer Choices

The Single-Phase Central PV Inverter Market evolves with a strong focus on compact, lightweight, and high-efficiency designs. Manufacturers introduce models with improved power density and reduced footprint, catering to residential spaces with limited installation capacity. It addresses consumer expectations for performance without compromising aesthetics or space. The trend also emphasizes improved cooling systems and higher conversion rates that extend system life. Homeowners choose advanced models to lower operational costs while enhancing reliability. It positions innovative designs as a competitive differentiator in the market.

Expanding Role of Policy Alignment and Sustainability Standards Shaping Market Trends

The Single-Phase Central PV Inverter Market responds to evolving policy frameworks and global sustainability commitments that influence technology development. Governments push for compliance with new grid codes, safety standards, and renewable integration policies. It drives manufacturers to upgrade inverter functionalities, ensuring grid stability and regulatory adherence. Sustainability standards highlight low-carbon manufacturing and recyclable components, which impact design strategies. Regional initiatives promoting distributed solar accelerate the adoption of standardized inverter solutions. It underscores the market’s adaptation to regulatory and environmental priorities.

Market Challenges Analysis

High Cost Pressures and Limited Scalability Restricting Wider Adoption

The Single-Phase Central PV Inverter Market faces challenges from high upfront costs and limited scalability in certain applications. Residential users remain sensitive to installation expenses, which often include inverters, mounting systems, and integration services. It struggles to compete in regions where electricity tariffs are low or subsidies are uncertain. Manufacturers must balance the need for advanced features with affordability to maintain competitiveness. The challenge intensifies when larger capacity requirements arise, as single-phase systems cannot easily scale for higher demand. It underscores the difficulty of expanding beyond residential or small commercial use without driving costs further.

Grid Compatibility Issues and Technical Reliability Concerns Slowing Progress

The Single-Phase Central PV Inverter Market encounters barriers linked to grid compatibility and long-term reliability. Different regions enforce distinct grid codes, which complicates product standardization for global manufacturers. It requires continuous design adjustments to meet evolving safety, efficiency, and compliance expectations. Technical concerns such as overheating, reduced lifespan under high loads, and complex maintenance add further pressure. Users seek robust solutions, but failures or inefficiencies can erode trust and slow adoption. It highlights the importance of consistent performance and regulatory adaptability to overcome these limitations.

Market Opportunities

Expanding Residential Solar Installations Creating Strong Growth Potential

The Single-Phase Central PV Inverter Market holds significant opportunity in the growing adoption of residential solar systems worldwide. Rising awareness of clean energy benefits and cost savings drives homeowners to invest in rooftop installations. It benefits from favorable net metering schemes, tax incentives, and renewable integration programs introduced by governments. Increasing energy independence needs in urban and rural settings further boost demand for reliable inverter solutions. Manufacturers can capture growth by offering user-friendly, efficient, and compact models tailored for household use. It positions residential deployment as a primary driver of sustained opportunity.

Integration with Storage and Smart Energy Systems Unlocking New Prospects

The Single-Phase Central PV Inverter Market gains further opportunities through integration with storage solutions and smart energy platforms. Consumers prioritize uninterrupted supply and demand-side control, which strengthens the need for hybrid inverter systems. It supports expansion into smart home ecosystems where digital monitoring and automation enhance energy management. Advances in battery compatibility and grid interaction capabilities broaden adoption across diverse regions. Partnerships between inverter manufacturers and storage providers can accelerate market penetration. It highlights the potential for growth in delivering next-generation solutions that align with evolving energy consumption patterns.

Market Segmentation Analysis:

By Product

The Single-Phase Central PV Inverter Market divides into string PV inverters and central PV inverters, each catering to distinct application requirements. String PV inverters dominate residential and small-scale installations due to their modular design, ease of installation, and ability to manage shading or panel mismatch effectively. It gains adoption in projects where flexibility and scalability are crucial, particularly in distributed solar applications. Central PV inverters, on the other hand, play a critical role in larger solar systems by delivering high-capacity power conversion through a single unit. Their suitability for utility-scale and commercial projects makes them integral to achieving efficiency at scale. It remains an attractive choice in regions emphasizing large centralized solar projects, supported by infrastructure investments and utility-led renewable programs.

- For instance, Omron Corporation has shipped installations exceeding 6.5 GW of string inverters cumulatively across Europe and Japan, demonstrating its large-scale footprint in distributed solar applications.

By Application

The Single-Phase Central PV Inverter Market by application is categorized into residential, commercial, and industrial segments. The residential sector drives strong demand with increasing rooftop solar installations and the need for reliable, compact, and cost-effective energy solutions for households. The commercial segment adopts these inverters to enhance efficiency in small to medium facilities, ensuring compliance with regulatory standards and contributing to cost savings. In the industrial segment, adoption emerges in localized operations and smaller manufacturing units where stable energy conversion supports productivity and aligns with sustainability goals. Together, these applications highlight the versatility of Single-Phase central PV inverters across diverse end-user environments.

By End-user

The Single-Phase Central PV Inverter Market further segments into commercial & industrial and utility applications, reflecting varied energy demand profiles. Commercial and industrial end-users adopt these inverters to meet rising sustainability goals, manage operational costs, and ensure reliable on-site power. It strengthens presence in commercial complexes, manufacturing facilities, and institutions that value efficiency and compliance with green building standards. Utilities represent another significant segment, where demand stems from large-scale distributed energy projects and community solar programs. Grid modernization and renewable integration strategies push utilities to adopt advanced inverter technologies that ensure stability and support bidirectional power flow. It aligns with policy-driven expansion of clean energy portfolios and accelerates adoption across diverse markets.

- For instance, SMA Solar Technology AG reported that in 2020 its sold inverters reached a cumulative installed capacity exceeding 100 gigawatts globally—a concrete milestone confirming its broad deployment across both commercial/industrial and utility-scale applications.

Segments:

Based on Product:

- String PV Inverter

- Central PV Inverter

Based on Application:

- Residential

- Commercial

- Industrial

Based on End-User:

- Commercial & Industrial

- Utilities

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 28% of the Single-Phase Central PV Inverter Market, driven by rapid expansion of residential and community solar projects across the United States and Canada. Federal and state-level incentives, including tax credits, subsidies, and net metering policies, continue to encourage adoption in the residential and small commercial sectors. It benefits from the region’s rising demand for energy independence, especially in areas affected by frequent grid instability and climate-related disruptions. Commercial facilities and utility-led community solar programs add further demand, highlighting the importance of inverter technologies that ensure stable integration with existing grid infrastructure. The U.S. leads adoption with strong regulatory frameworks supporting clean energy transitions, while Canada contributes through government-backed solar programs aimed at meeting national climate goals. It positions the region as a steady growth contributor with increasing investments in hybrid systems that combine storage and advanced monitoring platforms.

Europe

Europe holds 25% of the Single-Phase Central PV Inverter Market, supported by ambitious renewable energy targets set by the European Union and strict compliance requirements on carbon emissions. The region leads with well-developed solar policies, mature infrastructure, and a strong emphasis on sustainable energy systems. It benefits from feed-in tariffs, green financing mechanisms, and stringent grid codes that require advanced inverter technologies to maintain system stability. Countries such as Germany, Spain, and Italy dominate adoption, driven by large residential solar penetration and commercial rooftop projects. Utilities in Europe increasingly integrate centralized solar into national grids, further expanding the scope of inverter deployment. The market also responds to innovation in compact, high-efficiency designs demanded by urban households with limited space. It underscores the region’s commitment to decarbonization and positions inverters as an essential enabler of distributed renewable power.

Asia-Pacific

Asia-Pacific commands the largest share at 32% of the Single-Phase Central PV Inverter Market, fueled by aggressive solar deployment across China, India, Japan, and Southeast Asia. Governments in the region prioritize solar adoption as a core element of energy security and economic growth strategies. It benefits from rapid urbanization, expanding electrification, and large-scale policy initiatives such as China’s solar subsidy schemes and India’s rooftop solar programs. The presence of leading manufacturers further strengthens regional supply capabilities and accelerates cost reductions. Residential adoption in Japan and Australia adds momentum, where consumers seek energy independence and lower reliance on conventional utilities. Utility-scale and community solar projects across Southeast Asia enhance the demand for central inverter solutions. It establishes Asia-Pacific as the global leader in both production and consumption of inverter technologies.

Latin America

Latin America contributes 8% of the Single-Phase Central PV Inverter Market, largely influenced by growing solar deployment in Brazil, Mexico, and Chile. Government initiatives promoting renewable diversification and private sector investment in distributed solar projects support steady growth. It benefits from the rising role of residential and small commercial rooftop installations, particularly in Brazil where net metering drives household adoption. Mexico and Chile add demand through structured renewable auctions and clean energy policies. Utility companies in the region increasingly adopt central inverters to integrate distributed energy into broader grid networks. It signals expanding opportunities for manufacturers targeting price-sensitive markets with durable and cost-effective inverter solutions.

Middle East & Africa

The Middle East & Africa region holds 7% of the Single-Phase Central PV Inverter Market, with growth emerging from renewable diversification strategies in Gulf nations and rising electrification projects in Africa. Governments across the UAE, Saudi Arabia, and South Africa promote solar investments as part of long-term energy diversification agendas. It gains traction through utility-driven programs and large-scale solar farms that require high-capacity inverters for stable grid integration. Rural electrification and off-grid solutions in Africa create additional demand for single-phase inverters that support community and residential projects. The market faces challenges from infrastructure limitations but benefits from increasing international funding for renewable projects. It positions the region as a rising player with long-term opportunities in both residential and utility applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- Fimer Group

- SunPower Corporation

- Delta Electronics, Inc

- Omron Corporation

- SMA Solar Technology AG

- Emerson Electric Co.

- Eaton

- Hitachi Hi-Rel Power Electronics Private Limited

- Power Electronics S.L.

Competitive Analysis

The competitive landscape of the Single-Phase Central PV Inverter Market including Siemens Energy, Fimer Group, SunPower Corporation, Delta Electronics, Inc., Omron Corporation, SMA Solar Technology AG, Emerson Electric Co., Eaton, Hitachi Hi-Rel Power Electronics Private Limited, and Power Electronics S.L. The Single-Phase Central PV Inverter Market shows a highly competitive structure, driven by continuous innovation, regulatory compliance, and regional expansion strategies. Manufacturers focus on delivering high-efficiency designs, compact form factors, and advanced digital monitoring features to meet evolving consumer and utility requirements. Competition intensifies as companies integrate hybrid compatibility and storage-ready solutions, enabling greater energy independence for residential and small-scale applications. Strong emphasis on research and development fosters advancements in thermal management, grid-support functionalities, and AI-enabled predictive maintenance. Global players expand their reach through partnerships, mergers, and localized production to strengthen supply chains and address price-sensitive markets. The landscape highlights a balance between established innovators and emerging regional suppliers, creating an environment defined by technology differentiation, service reliability, and policy-driven adoption.

Recent Developments

- In May 2024, Omron Electronic Components Europe announced a diverse range of innovations at the Smarter E Europe Exhibition 2024 to support efficiency and reduce energy losses for electric vehicle charging, electricity storage systems (ESS), and solar applications.

- In February 2024, Siemens AG announced new products and partnerships to achieve transformation and sustainable infrastructure. Siemens customers get access to flagship technologies in the space, including Xcelerator, an open and innovative digital business platform offering integration with more than 400 sellers in the Siemens global ecosystem.

- In July 2023, LG Energy Solution Ltd., a South Korea-based battery manufacturer, introduced new hybrid inverters tailored for residential applications in the European market. Designed to accommodate both low-voltage and high-voltage configurations, these inverters come equipped with a built-in backup function, specifically crafted to seamlessly integrate with the company’s distinctive line of batteries.

- In April 2023, FIMER showcased its flagship products BESS Converter PVS980-58 BC series and the Central Inverters PVS980-58 series —at multiple events in India and received the ‘Solar+ Storage Project-Inverter Provider of the Year 2023’ award for the Modhera project.

Market Concentration & Characteristics

The Single-Phase Central PV Inverter Market reflects a moderately concentrated structure, with global players maintaining strong influence while regional manufacturers contribute to price competitiveness and localized solutions. It demonstrates a balance between innovation-driven differentiation and cost-focused offerings, creating a dynamic environment shaped by both technology leaders and emerging suppliers. Market characteristics include a steady focus on efficiency improvements, compact designs, and integration with digital monitoring systems that enhance user control and system reliability. It gains momentum from policy-driven renewable adoption, residential solar expansion, and the push toward decentralized energy systems. Competition emphasizes product reliability, grid compatibility, and hybrid readiness to meet growing demand for storage integration and smart energy management. It evolves through strategic partnerships, continuous R&D investments, and geographic expansion, defining a market where technology leadership, regulatory compliance, and service excellence determine long-term positioning.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for residential rooftop solar systems will drive steady adoption of Single-Phase central inverters.

- Integration with energy storage solutions will expand opportunities for hybrid-ready inverter systems.

- Smart monitoring platforms and AI-enabled diagnostics will enhance system efficiency and reliability.

- Policy support and renewable energy targets will continue to accelerate market penetration.

- Compact and high-efficiency designs will gain preference in urban and space-constrained installations.

- Utilities will adopt advanced inverters to strengthen grid stability and manage distributed energy resources.

- Cost reduction through localized manufacturing will improve accessibility in emerging markets.

- Partnerships with battery and smart home solution providers will expand ecosystem integration.

- Growing focus on sustainability will encourage adoption of recyclable components and low-carbon production.

- Continuous R&D investment will drive innovations in thermal management, conversion efficiency, and grid compatibility.