Market Overview

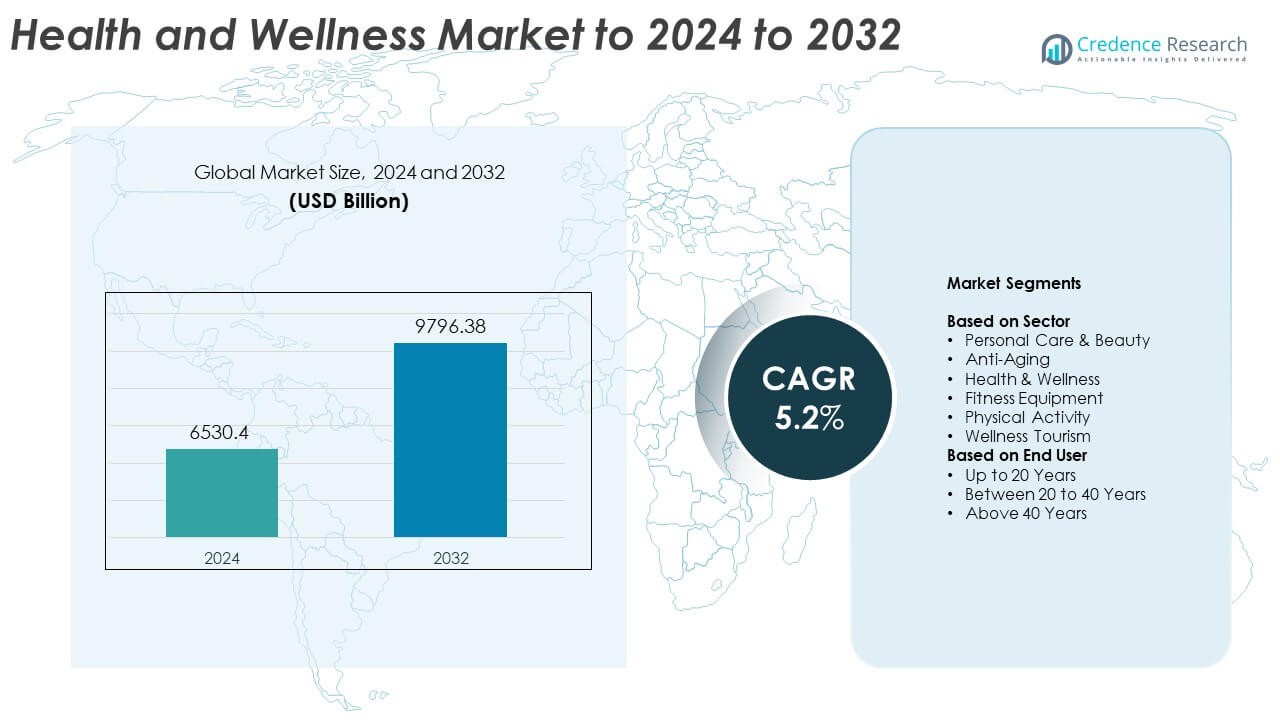

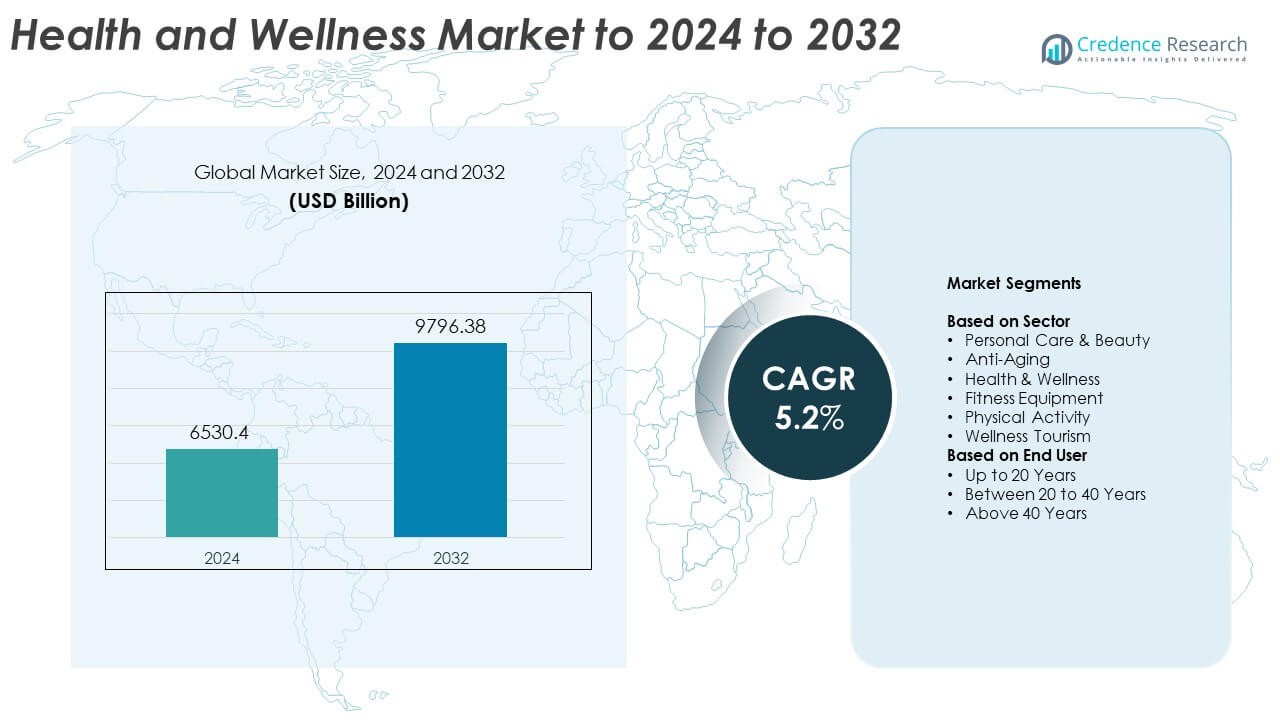

Health And Wellness Market size was valued at USD 6530.4 Billion in 2024 and is anticipated to reach USD 9796.38 Billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Health And Wellness Market Size 2024 |

USD 6530.4 Billion |

| Health And Wellness Market, CAGR |

5.2% |

| Health And Wellness Market Size 2032 |

USD 6530.4 Billion |

The health and wellness market is shaped by major players such as Procter & Gamble, Herbalife Nutrition Ltd., Unilever Plc, Fitness First, Nestlé SA, Vitabiotics Ltd., Bayer AG, L’Oréal SA, Amway Corp., Holland & Barrett Retail Limited, Danone, and David Lloyd Leisure Ltd. These companies strengthened their positions through wider product portfolios, strong retail distribution, and rising investment in digital wellness and clean-label solutions. North America led the global market with about 37% share due to high spending on preventive healthcare and personal wellness products. Europe followed with nearly 29% share, driven by strong demand for natural supplements, fitness services, and regulated health products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The health and wellness market reached USD 6530.4 Billion in 2024 and is projected to reach USD 9796.38 Billion by 2032, growing at a CAGR of 5.2%.

- Rising demand for preventive healthcare, clean-label nutrition, fitness services, and natural personal care products drives steady market expansion across age groups.

- Key trends include rapid adoption of digital wellness tools, growth of personalized nutrition, rising mental wellness spending, and increasing preference for sustainable and chemical-free products.

- Competition remains strong as global brands expand portfolios, enhance online distribution, and invest in research, ingredient transparency, and hybrid wellness experiences to strengthen market presence.

- North America held about 37% share, Europe accounted for nearly 29%, and Asia Pacific captured around 25%, while the leading segment by sector was personal care and beauty with about 32% share due to strong demand for clean and premium products.

Market Segmentation Analysis:

By Sector

Personal Care and Beauty led the sector in 2024 with about 32% share, driven by rising demand for clean-label skincare, premium cosmetics, and self-care routines across urban consumers. Anti-Aging products expanded as aging populations in Asia and Europe increased spending on collagen boosters and advanced dermatology solutions. Health and Wellness services gained traction due to higher focus on immunity, while Fitness Equipment and Physical Activity segments grew with home workouts and digital fitness programs. Wellness Tourism showed steady recovery as travelers sought holistic treatments, but Personal Care and Beauty stayed dominant due to continuous product innovation and mass-market reach.

- For instance, in 2023, Dove achieved its highest underlying sales growth in more than a decade, with turnover reaching €6 billion for Unilever.

By End User

Consumers between 20 to 40 years dominated the end-user segment in 2024 with nearly 46% share, supported by higher spending on gym memberships, organic skincare, supplements, and mental-wellness services. This age group adopted active lifestyles and purchased premium wellness products at faster rates than other groups. Users above 40 years also contributed strong demand for anti-aging and chronic-condition management solutions, while individuals up to 20 years showed rising interest in sports nutrition. The 20 to 40 years segment remained the largest due to strong digital engagement, higher disposable income, and strong adoption of preventive health practices.

- For instance, Planet Fitness reported about 18.7 million members and 2,575 gyms as of 31 December 2023.

Key Growth Drivers

Rising Focus on Preventive Healthcare

Consumers shifted toward preventive care as lifestyle-related disorders increased worldwide. People invested more in nutritional supplements, fitness plans, and wellness services to avoid long-term medical costs. Governments also promoted early diagnosis programs, which boosted demand for monitoring devices and digital health tools. Preventive habits strengthened market growth because buyers preferred sustainable routines over reactive treatments. This shift positioned preventive healthcare as the leading growth driver in the health and wellness market.

- For instance, Abbott stated that more than 6 million people in over 60 countries use its diabetes technology, including FreeStyle Libre systems.

Expansion of Digital and Connected Wellness Solutions

Digital platforms transformed how users track health goals, manage diets, and access remote fitness programs. Wearable devices, telehealth apps, and AI-driven wellness tools gained faster adoption across younger and middle-aged groups. Companies improved personalization features, which increased user engagement and subscription revenues. Hybrid wellness models that combine online and offline services expanded rapidly, making digital wellness a major driver of long-term market expansion.

- For instance, Peloton reported approximately 6.2 million total members and exactly 3.00 million paid connected fitness subscriptions as of December 31, 2023.

Growing Demand for Clean, Natural, and Functional Products

Consumers preferred natural formulations and chemical-free solutions in beauty, nutrition, and personal care. Clean-label supplements, organic skincare, and plant-based foods drew strong demand as shoppers prioritized safety and sustainability. Brands invested in transparent ingredient sourcing and eco-friendly packaging, which strengthened customer trust. Functional products that support immunity, stress reduction, and better sleep generated strong traction. This trend made the clean and functional product shift a key growth driver for the health and wellness market.

Key Trends and Opportunities

Rise of Holistic and Mental Wellness Adoption

Mental well-being emerged as a major focus as stress, sleep issues, and burnout increased across working populations. Consumers adopted meditation apps, mindfulness programs, and stress-management therapies, expanding the wellness ecosystem. Holistic routines that combine mental, physical, and emotional health gained strong acceptance. Companies offering integrated wellness programs found significant growth opportunities as buyers sought balanced and long-term lifestyle solutions.

- For instance, Headspace has been downloaded more than 100 million times globally and has users in over 190 countries and regions.

Growth of Personalized Wellness and Biohacking

Personalized nutrition, DNA-based diet plans, and biomarker-driven wellness gained traction as individuals aimed for tailored outcomes. Users relied on metabolic tests, smart wearables, and real-time health insights to optimize performance. Biohacking practices, such as intermittent fasting tools and micro-dosing supplements, became more mainstream. This shift created strong opportunities for brands offering customized products and data-driven coaching services in the health and wellness market.

- For instance, 23andMe was reported in 2024 to hold genotype and phenotype data for approximately 15 million individuals

Expansion of Wellness-Focused Travel and Experiences

Wellness tourism grew as travelers sought spa therapies, detox programs, and nature-based healing retreats. Demand increased across Asia, Europe, and the Middle East as consumers prioritized restorative journeys. Hotels upgraded wellness facilities, while specialized retreat operators expanded programs focused on mindfulness, fitness, and nutrition. This trend created new opportunities for destinations and businesses offering immersive wellness experiences.

Key Challenges

High Cost of Premium Wellness Products and Services

Premium supplements, organic foods, fitness equipment, and personalized wellness plans remain expensive for price-sensitive users. High costs limit adoption in developing economies where disposable incomes vary widely. The affordability gap restricts mass-market penetration, slowing the expansion of advanced wellness solutions. Companies must balance innovation with cost efficiency to reach broader consumer segments in the health and wellness market.

Regulatory Variations and Quality Control Issues

The wellness sector faces inconsistent regulations across supplements, personal care, digital health tools, and alternative therapies. Variations in labeling rules, testing standards, and ingredient compliance create barriers for global brands. Counterfeit or low-quality products in some regions further reduce consumer trust. Ensuring strict quality control and meeting changing regulatory expectations remain key challenges for companies operating in the health and wellness market.

Regional Analysis

North America

North America held the largest share of the health and wellness market in 2024 with about 37% share. The region benefited from strong spending on fitness services, preventive healthcare, organic nutrition, and digital wellness platforms. High awareness of lifestyle diseases pushed consumers toward supplements, gym memberships, and personalized coaching. The United States led demand due to a mature retail ecosystem and advanced telehealth adoption. Strong presence of global wellness brands and rising preference for clean-label products kept North America ahead in overall market contribution.

Europe

Europe accounted for nearly 29% of the market in 2024, supported by growing interest in functional foods, natural cosmetics, and regulated wellness services. The region saw strong demand for anti-aging solutions and preventive care as aging populations increased adoption. Countries like Germany, France, and the UK drove growth with structured fitness programs and sustainable product choices. Wellness tourism also expanded across Mediterranean destinations. Strong regulatory frameworks and consumer preference for high-quality health products kept Europe a major contributor to market revenue.

Asia Pacific

Asia Pacific captured about 25% share in 2024, driven by expanding middle-class populations and rising awareness of preventive health. Consumers invested more in supplements, home fitness tools, mental wellness apps, and natural personal care products. China, India, Japan, and South Korea showed strong growth due to urbanization and digital platform adoption. K-beauty, Ayurveda, and herbal nutrition gained traction, strengthening regional product diversity. Rapid economic growth, wider e-commerce access, and rising health consciousness positioned Asia Pacific as the fastest-growing region in the market.

Latin America

Latin America held nearly 6% share in 2024, supported by rising demand for fitness programs, natural cosmetics, and affordable wellness solutions. Brazil and Mexico led regional spending as consumers adopted preventive health practices and home exercise routines. Growth remained steady due to increasing focus on organic foods and regional beauty traditions. However, income variations limited adoption of premium services. Expanding retail channels, improved product availability, and rising digital fitness usage helped Latin America strengthen its presence in the market.

Middle East and Africa

Middle East and Africa accounted for around 3% share in 2024, with gradual growth driven by rising interest in wellness resorts, organic skincare, and fitness centers. Gulf countries led adoption as consumers invested more in luxury spa services, nutrition plans, and personalized training. Urbanization and growing health awareness supported moderate expansion across African nations. However, limited access to premium products and varying economic conditions slowed wider penetration. Investments in wellness tourism and expanding retail infrastructure continued to enhance regional market growth.

Market Segmentations:

By Sector

- Personal Care & Beauty

- Anti-Aging

- Health & Wellness

- Fitness Equipment

- Physical Activity

- Wellness Tourism

By End User

- Up to 20 Years

- Between 20 to 40 Years

- Above 40 Years

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the health and wellness market features leading companies such as Procter & Gamble, Herbalife Nutrition Ltd., Unilever Plc, Fitness First, Nestlé SA, Vitabiotics Ltd., Bayer AG, L’Oréal SA, Amway Corp., Holland & Barrett Retail Limited, Danone, and David Lloyd Leisure Ltd. The market remained highly dynamic as brands expanded product portfolios across nutrition, personal care, fitness services, and wellness solutions. Companies focused on clean-label formulations, digital engagement, and personalization to strengthen consumer loyalty. Strategic investments in research, advanced skincare science, dietary innovation, and hybrid fitness models helped players respond to shifting lifestyle needs. Many competitors upgraded online retail capabilities and partnered with wellness platforms to enhance global reach. Strong emphasis on sustainability, natural ingredients, and holistic well-being further shaped competition in both mature and emerging markets.

Key Player Analysis

- Procter & Gamble

- Herbalife Nutrition Ltd.

- Unilever Plc

- Fitness First

- Nestlé SA

- Vitabiotics Ltd.

- Bayer AG

- L’Oréal SA

- Amway Corp.

- Holland & Barrett Retail Limited

- Danone

- David Lloyd Leisure Ltd.

Recent Developments

- In 2025, Amway Corp. launched the Nutrilite™ Begin 30 Holistic Wellness Program , a 30-day guided wellness journey aimed at supporting gut health and adopting healthy habits.

- In 2025, David Lloyd Leisure Ltd. launched several new initiatives and club openings, including a new site with extensive facilities such as a 100+ station gym, heated pools, sports courts, and a luxurious adult-only Spa Retreat.

- In 2025, Holland & Barrett Retail Limited launched the Live Well Programme, a pioneering supply chain wellness initiative in Sri Lanka that educates workers on nutrition, hygiene, mental wellbeing, and disease prevention using a peer-led health champion model.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Sector, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as consumers prioritize long-term preventive health solutions.

- Demand for personalized wellness plans will rise due to wider use of data-driven tools.

- Adoption of digital fitness platforms and remote coaching will expand across all age groups.

- Natural, clean-label, and sustainable products will gain stronger traction in beauty and nutrition.

- Mental wellness services will grow as stress and burnout issues increase in global populations.

- Wellness tourism will recover further and attract higher spending on immersive healing experiences.

- Hybrid fitness models combining online and offline formats will reshape consumer engagement.

- Functional foods and supplements will see rising acceptance for immunity, sleep, and gut health.

- Regulatory frameworks will strengthen to improve product quality and curb counterfeit items.

- Investments in AI-powered health monitoring devices will boost adoption of connected wellness ecosystems.